Evaluating Monetary Policy's Impact During Recessions

Interactive Video

•

Social Studies

•

6th - 10th Grade

•

Practice Problem

•

Hard

Liam Anderson

FREE Resource

Read more

10 questions

Show all answers

1.

MULTIPLE CHOICE QUESTION

30 sec • 1 pt

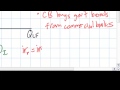

What does the money market diagram primarily illustrate?

The relationship between fiscal policy and aggregate demand

The inverse relationship between nominal interest rates and the quantity of money demanded

The direct relationship between inflation rates and money supply

The impact of government spending on private investment

2.

MULTIPLE CHOICE QUESTION

30 sec • 1 pt

Which of the following is NOT a tool of monetary policy?

Increasing government spending

Lowering the reserve requirement

Lowering the discount rate

Buying government bonds from commercial banks

3.

MULTIPLE CHOICE QUESTION

30 sec • 1 pt

What is the primary goal of expansionary monetary policy during a recession?

To stimulate aggregate demand and move the economy towards full employment

To increase the reserve requirement for banks

To decrease the money supply

To increase government spending

4.

MULTIPLE CHOICE QUESTION

30 sec • 1 pt

Under what condition might a decrease in interest rates fail to stimulate aggregate demand?

When the economy is experiencing high inflation

When there is a strong confidence in future business opportunities

When the government increases its spending

When private sector investment demand is exceedingly low

5.

MULTIPLE CHOICE QUESTION

30 sec • 1 pt

What could cause the demand for private sector investment to be very low?

Low business confidence and expectation of deflation

A significant increase in government spending

Expectation of rising prices for goods in the future

High business confidence

6.

MULTIPLE CHOICE QUESTION

30 sec • 1 pt

How can negative real interest rates occur?

When there is a high demand for loanable funds

When the central bank increases the money supply

When nominal interest rates are very low and inflation is present

When nominal interest rates are below zero

7.

MULTIPLE CHOICE QUESTION

30 sec • 1 pt

What happens to the real interest rate if the nominal interest rate is 1% and inflation is 3%?

It increases to 4%

It increases to 2%

It remains at 1%

It decreases to -2%

Access all questions and much more by creating a free account

Create resources

Host any resource

Get auto-graded reports

Continue with Google

Continue with Email

Continue with Classlink

Continue with Clever

or continue with

Microsoft

%20(1).png)

Apple

Others

Already have an account?

Popular Resources on Wayground

15 questions

Fractions on a Number Line

Quiz

•

3rd Grade

20 questions

Equivalent Fractions

Quiz

•

3rd Grade

25 questions

Multiplication Facts

Quiz

•

5th Grade

22 questions

fractions

Quiz

•

3rd Grade

20 questions

Main Idea and Details

Quiz

•

5th Grade

20 questions

Context Clues

Quiz

•

6th Grade

15 questions

Equivalent Fractions

Quiz

•

4th Grade

20 questions

Figurative Language Review

Quiz

•

6th Grade

Discover more resources for Social Studies

24 questions

Republic of Texas and Early Statehood Test Review

Quiz

•

7th Grade

4 questions

7SS - 35b - Presidential v. Parliamentary Democracies

Quiz

•

6th - 7th Grade

11 questions

Early Statehood Vocabulary Lesson

Lesson

•

6th - 8th Grade

10 questions

Exploring the Executive Branch and Presidential Powers

Interactive video

•

6th - 10th Grade

19 questions

New South

Quiz

•

8th Grade

13 questions

Ancient Egypt

Interactive video

•

6th Grade

25 questions

SW Asia (Middle East) Environmental Issues

Quiz

•

7th Grade

19 questions

Unit 7 CSA Review

Quiz

•

7th Grade