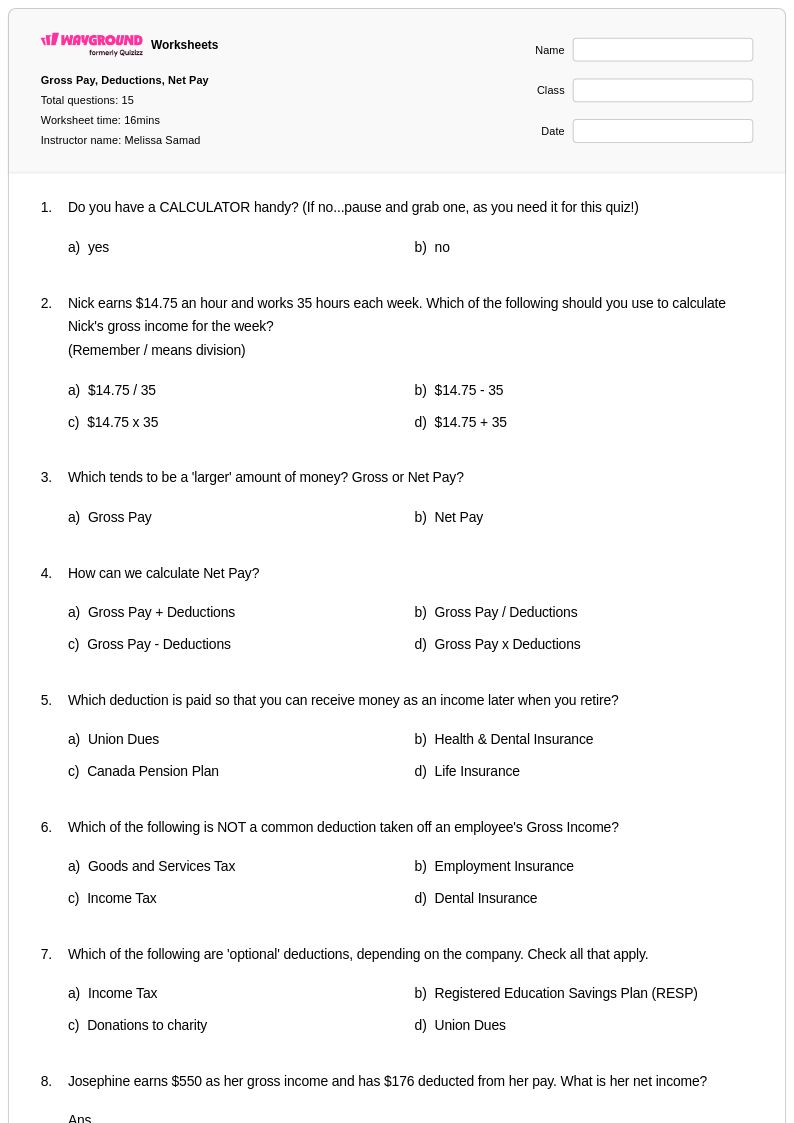

15Q

8th - 12th

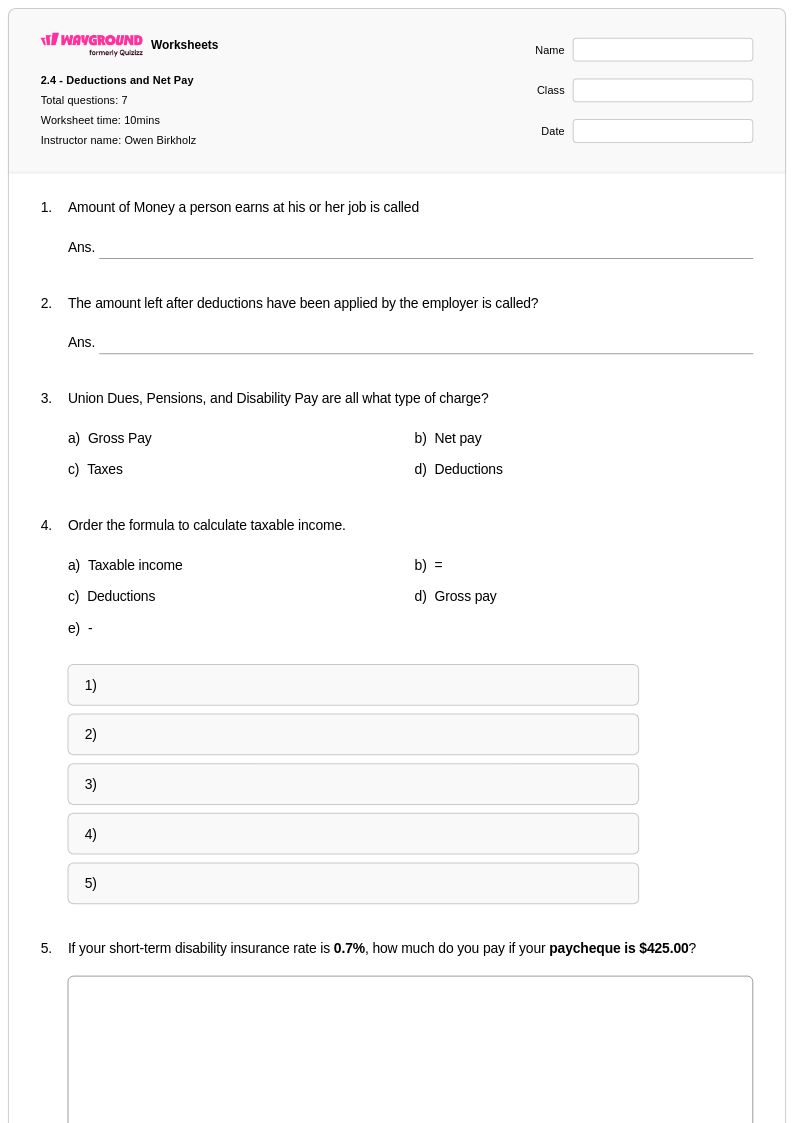

7Q

10th

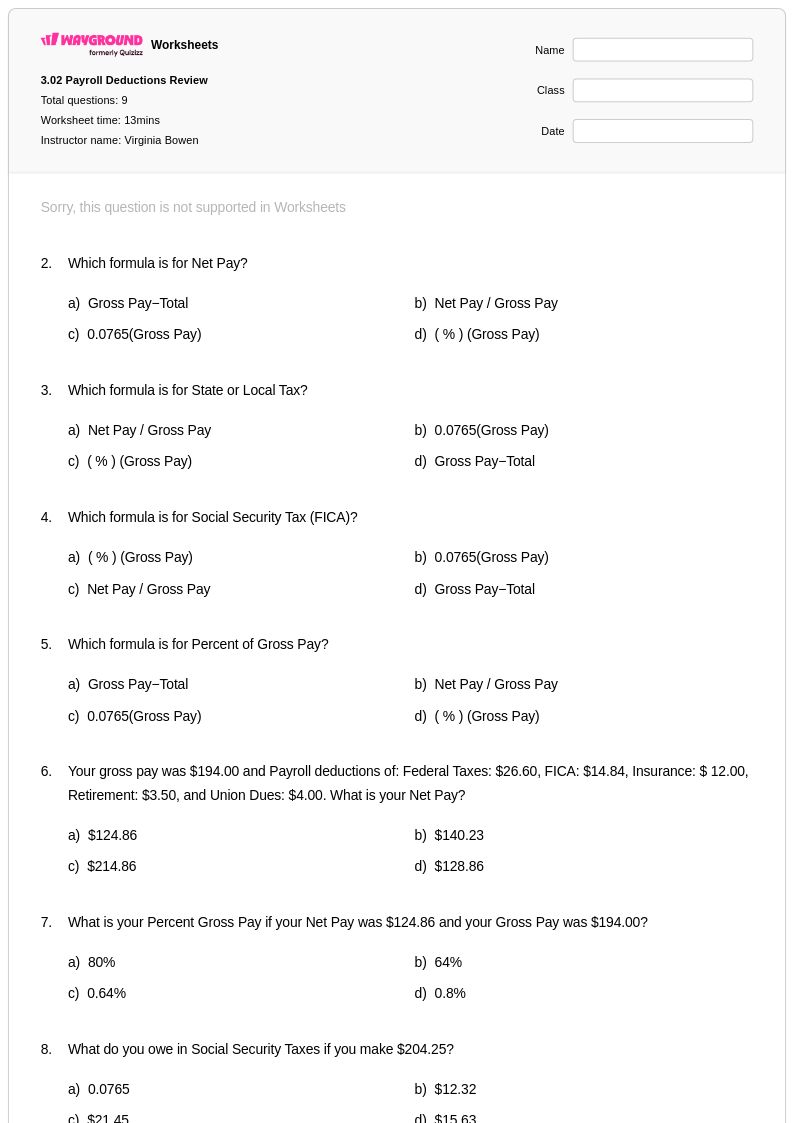

16Q

9th - 12th

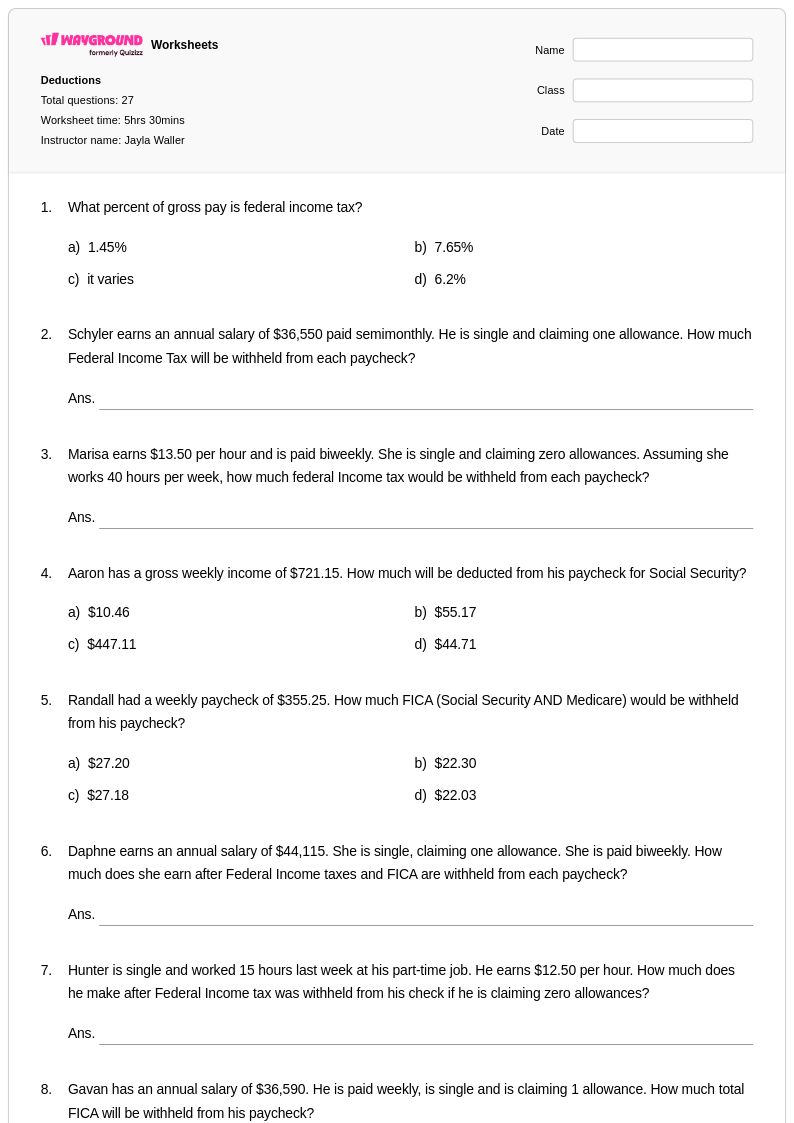

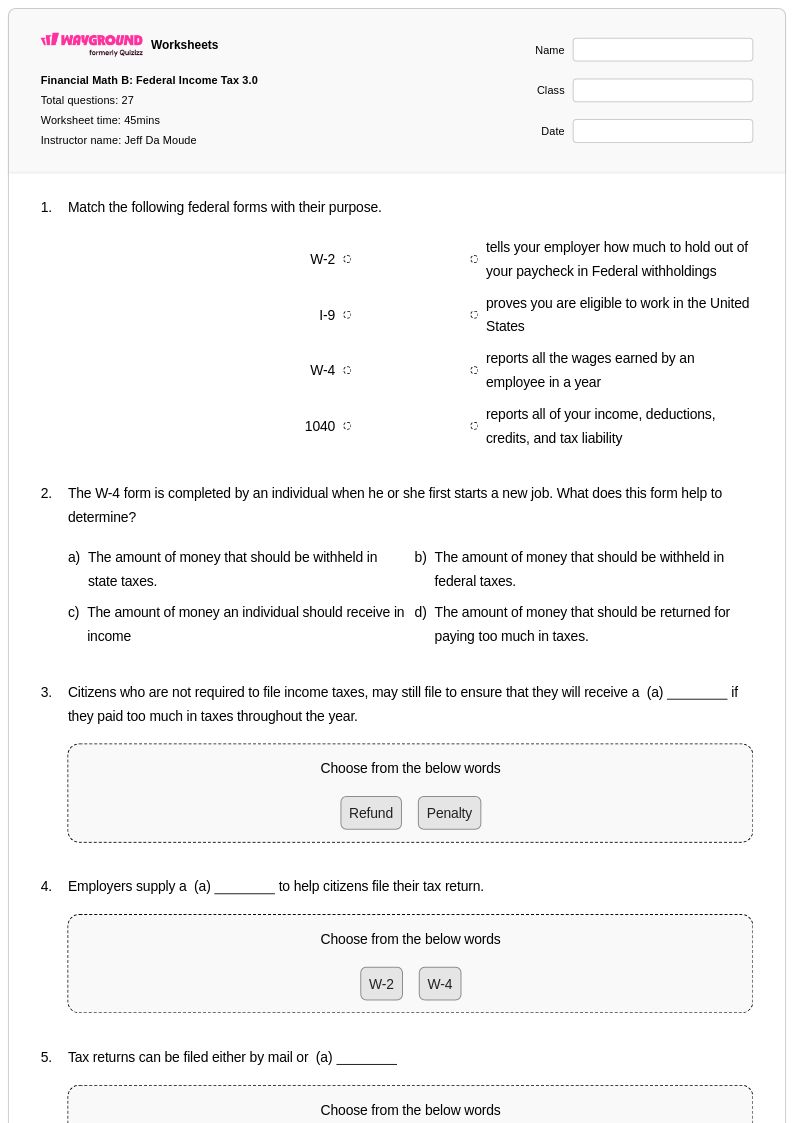

27Q

10th

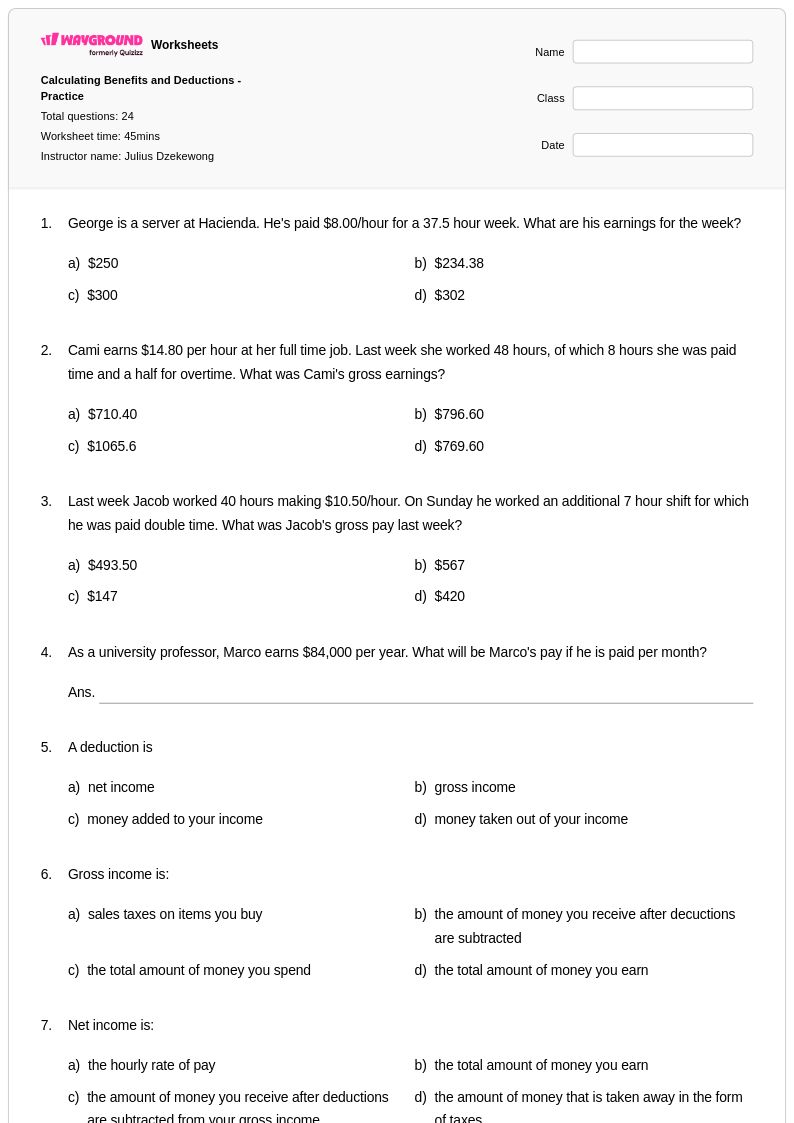

24Q

10th - 12th

37Q

9th - 12th

15Q

9th - 12th

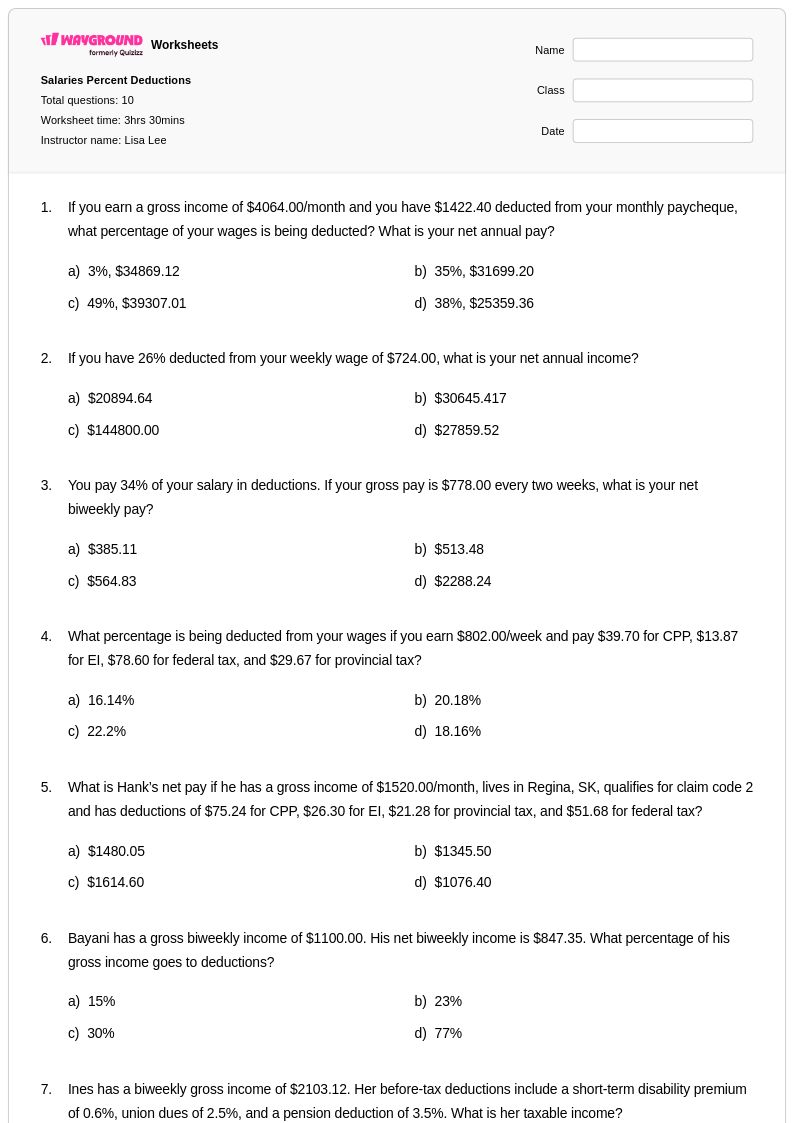

10Q

6th - 12th

20Q

9th - 12th

35Q

9th - 12th

16Q

9th - 12th

10Q

9th - 12th

21Q

9th - 12th

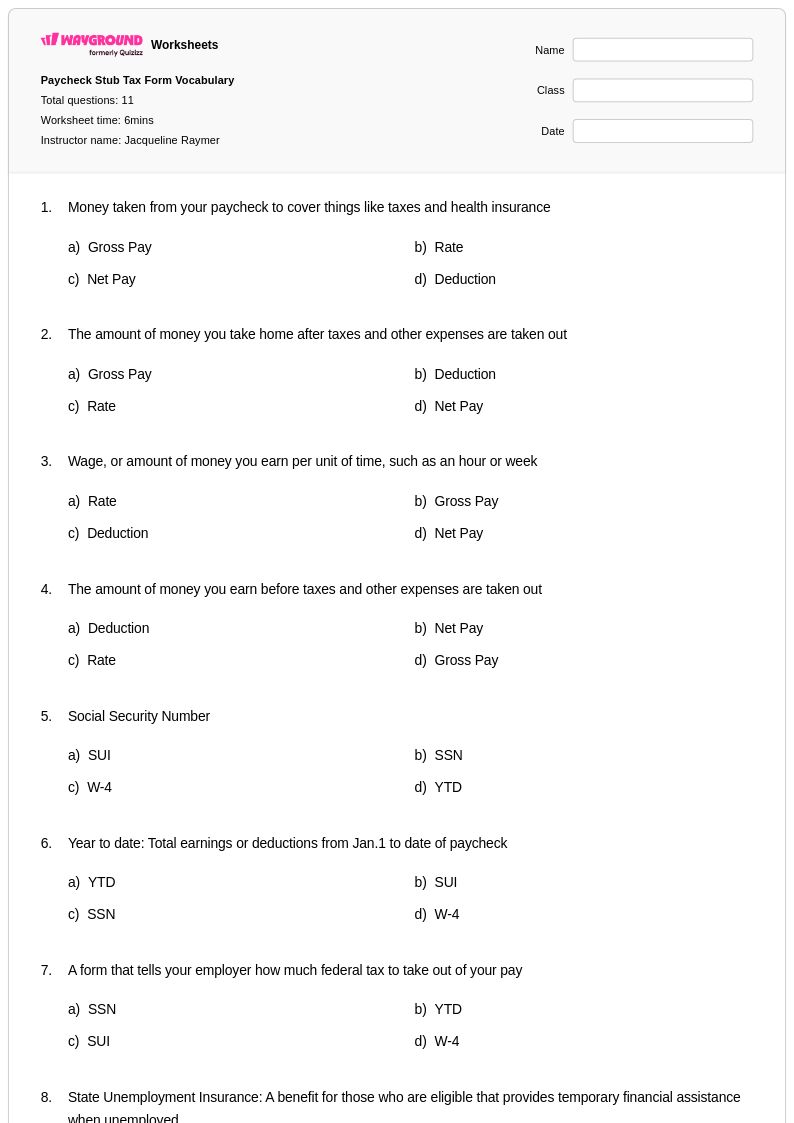

8Q

9th - 10th

20Q

9th - 12th

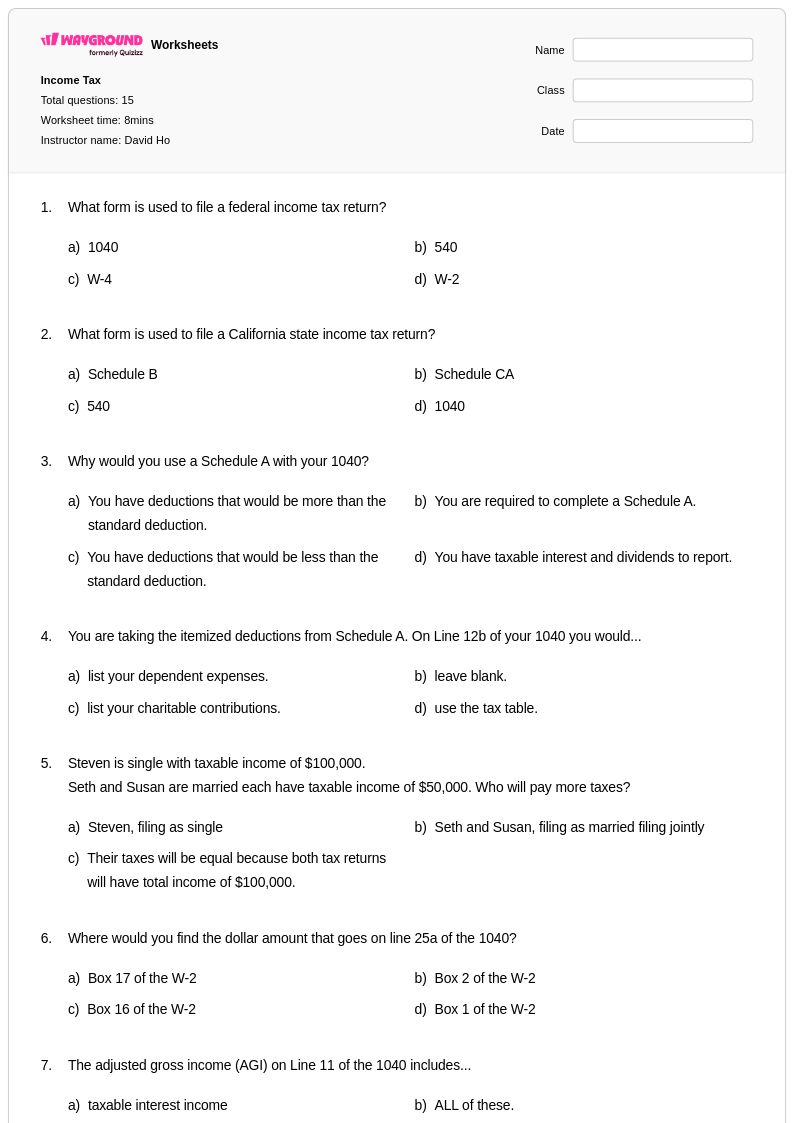

15Q

9th - 12th

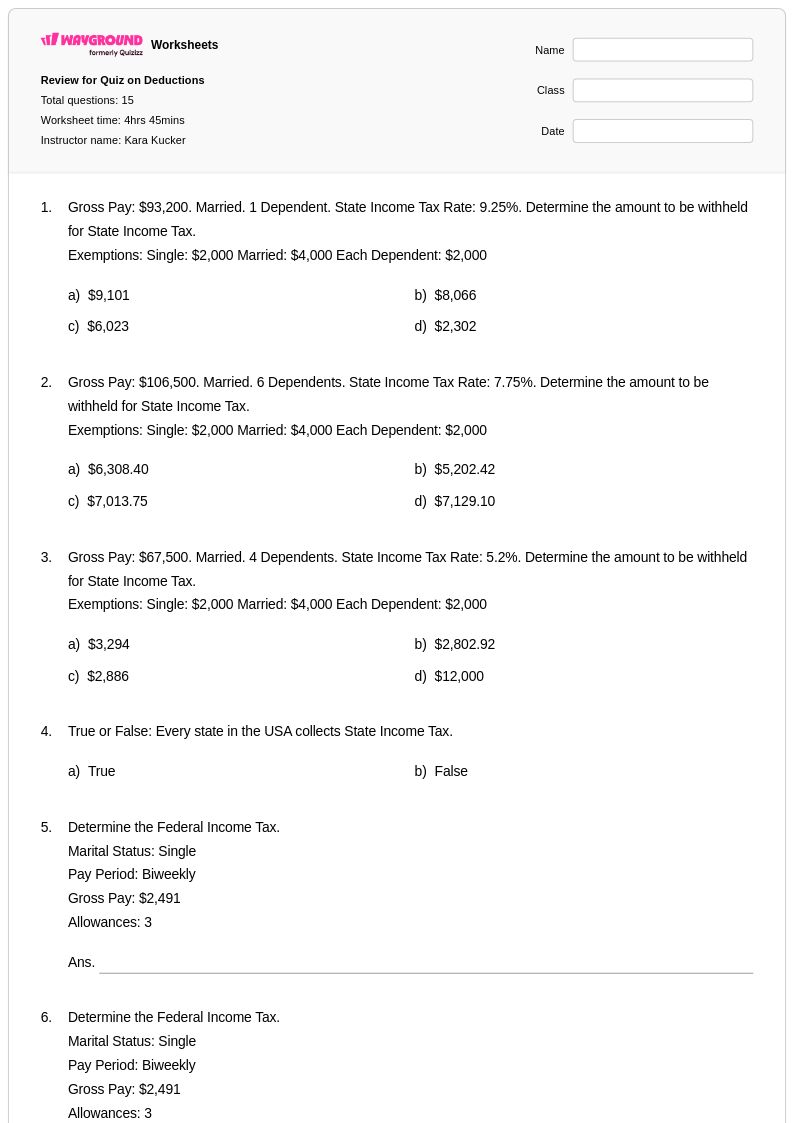

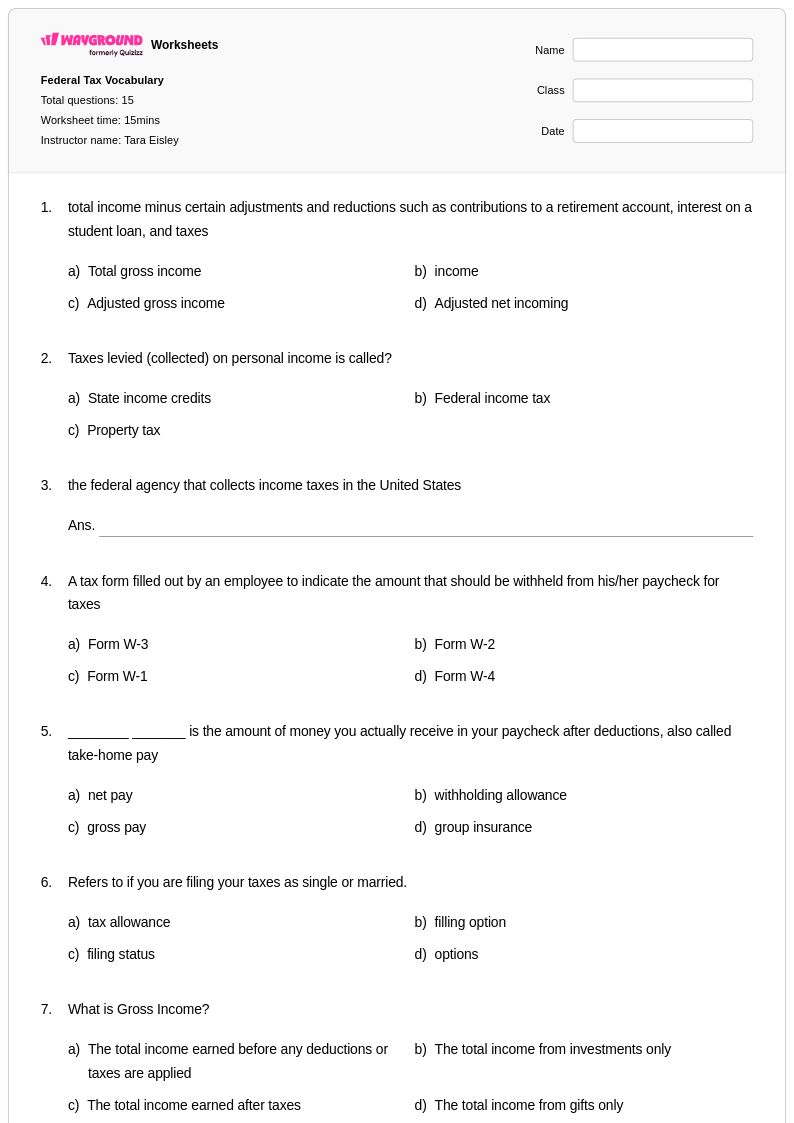

15Q

10th - 12th

11Q

10th

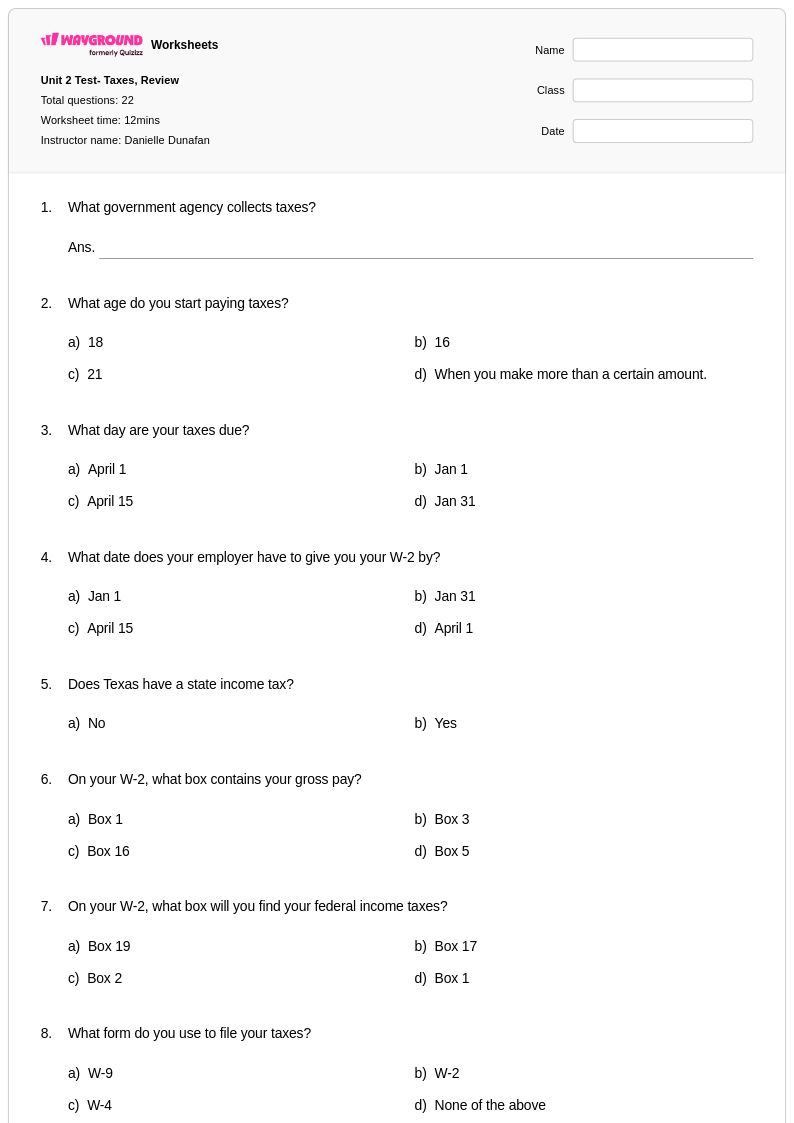

22Q

9th - 12th

15Q

9th - 12th

18Q

9th - 12th

7Q

9th - 12th

35Q

9th - 12th

23Q

9th - 12th

Explorar Deductions hojas de trabajo por grados

Explore otras hojas de trabajo de materias para class 10

Explore printable Deductions worksheets for Class 10

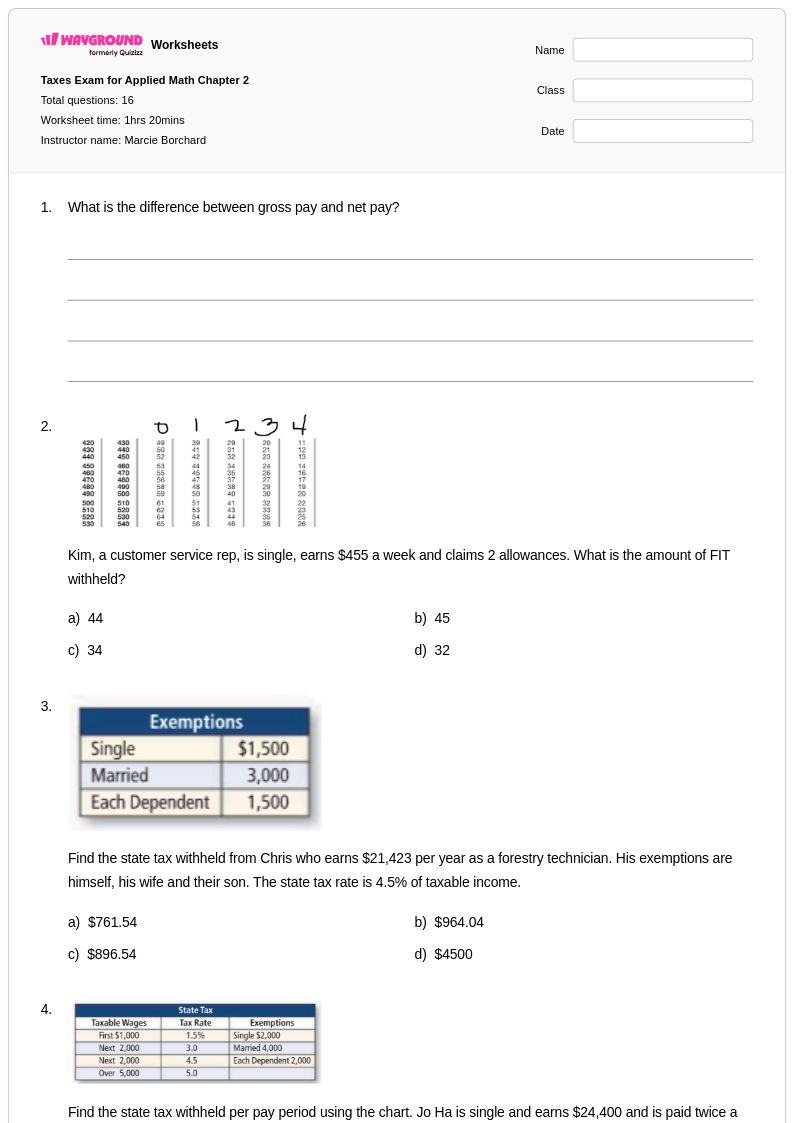

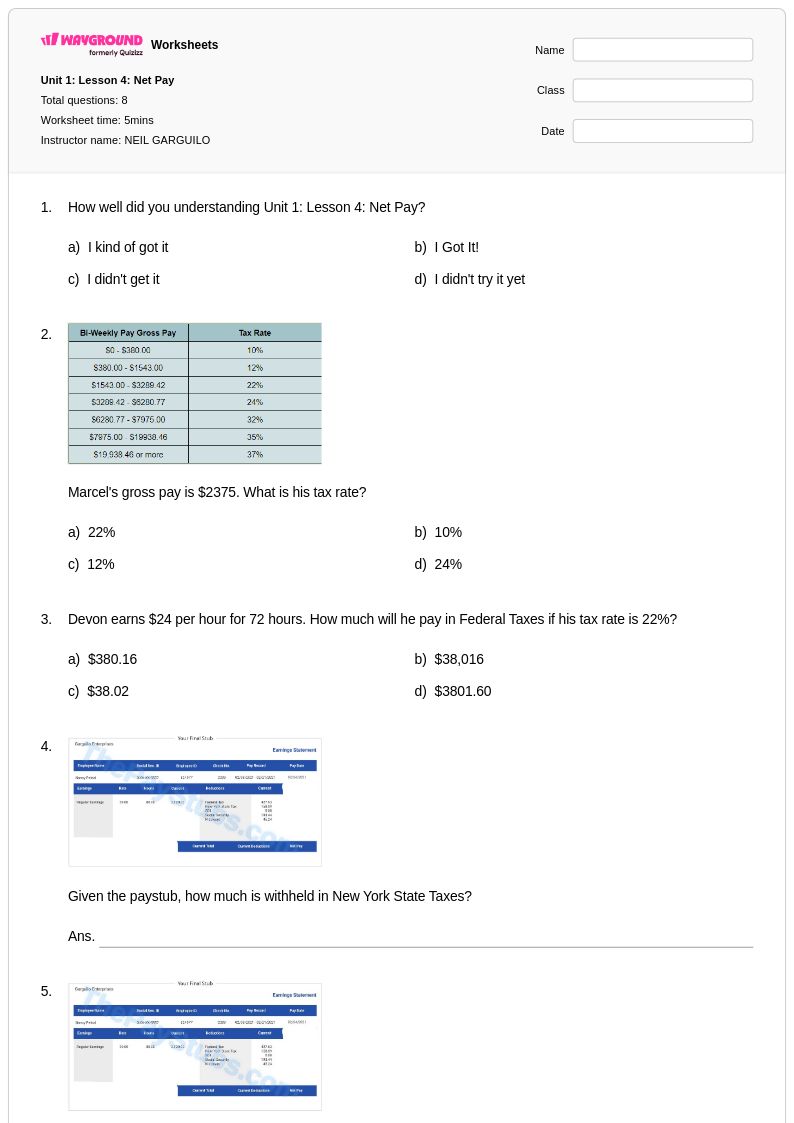

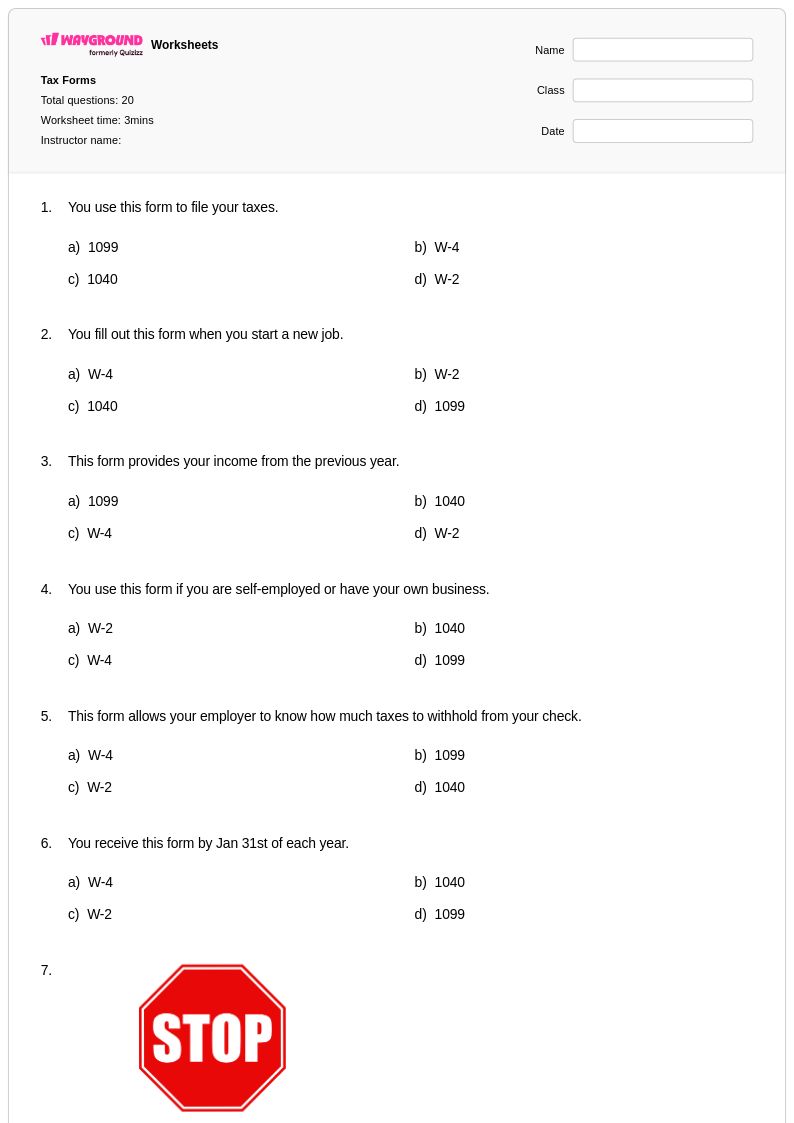

Deductions worksheets for Class 10 students available through Wayground (formerly Quizizz) provide comprehensive practice with understanding how various deductions impact take-home pay and financial planning decisions. These mathematics resources focus on building essential financial literacy skills by helping students calculate federal and state income taxes, Social Security contributions, Medicare deductions, health insurance premiums, retirement plan contributions, and other common payroll deductions. Students work through realistic scenarios involving gross pay calculations, percentage-based deductions, and net pay determinations using practice problems that mirror real-world employment situations. The worksheets include detailed answer keys that allow students to verify their calculations and understand the step-by-step processes involved in payroll mathematics, while printable pdf formats ensure easy access for both classroom instruction and independent study sessions.

Wayground (formerly Quizizz) supports mathematics educators with an extensive collection of teacher-created deductions worksheets that streamline lesson planning and enhance Class 10 financial literacy instruction. The platform's millions of educational resources include standards-aligned materials that can be easily located through robust search and filtering capabilities, allowing teachers to find worksheets that match specific curriculum requirements and student skill levels. Differentiation tools enable educators to customize practice problems based on individual student needs, while flexible formatting options provide both digital and printable versions to accommodate diverse classroom environments and learning preferences. These comprehensive worksheet collections support targeted skill practice, remediation for students struggling with percentage calculations and multi-step problem solving, and enrichment opportunities for advanced learners ready to explore complex deduction scenarios involving multiple income sources and varying tax brackets.