12 Q

5th - Uni

10 Q

3rd - Uni

21 Q

8th

20 Q

8th - 12th

14 Q

6th - 8th

18 Q

6th - 8th

20 Q

8th

22 Q

6th - 8th

10 Q

8th

44 Q

7th - 12th

11 Q

8th

12 Q

6th - 8th

18 Q

8th

21 Q

6th - 8th

15 Q

7th - Uni

14 Q

8th

10 Q

8th

20 Q

8th

12 Q

8th

17 Q

8th

43 Q

6th - 8th

13 Q

8th

26 Q

8th

39 Q

8th

Explore Reading Paycheck Stubs Worksheets by Grades

Explore Other Subject Worksheets for class 8

Explore printable Reading Paycheck Stubs worksheets for Class 8

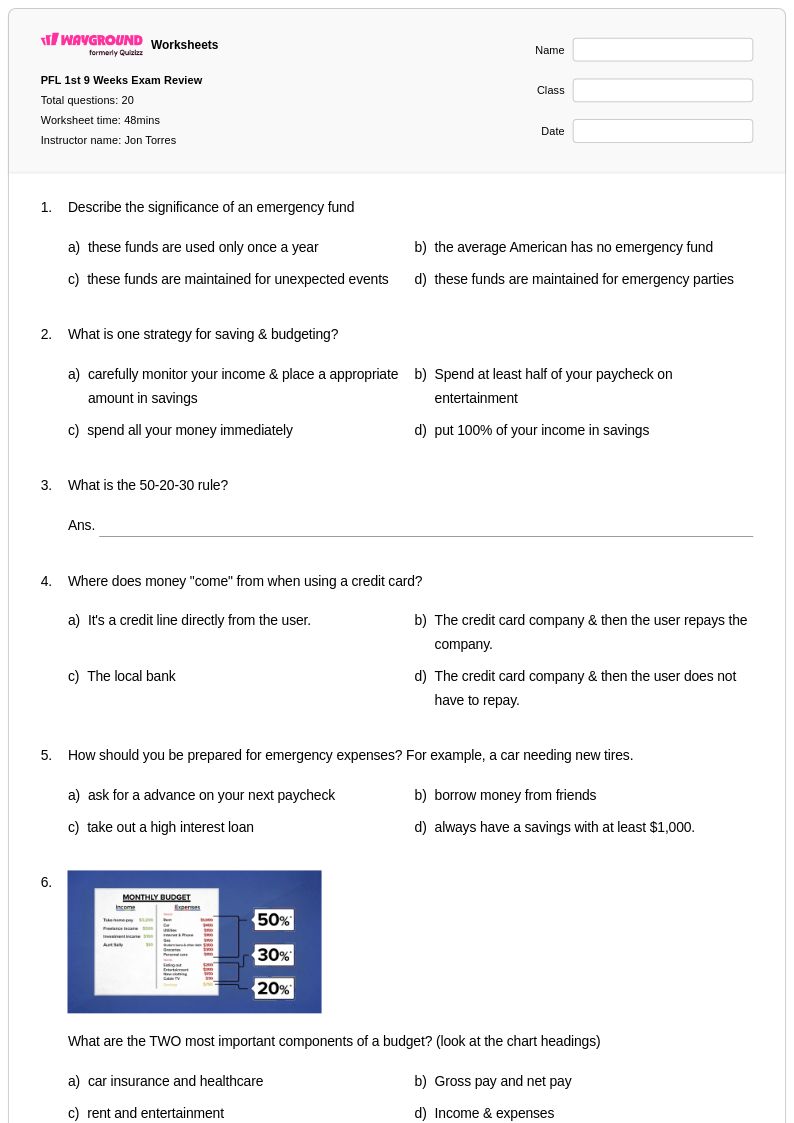

Reading paycheck stubs represents a crucial life skill that Class 8 students must master as they prepare for future financial independence and career readiness. Wayground's comprehensive collection of reading paycheck stubs worksheets provides students with authentic practice interpreting real-world financial documents, helping them understand essential concepts like gross pay, net pay, deductions, taxes, and benefits. These carefully designed worksheets strengthen critical thinking skills as students analyze various paycheck components, calculate take-home pay, and identify different types of deductions including federal and state taxes, Social Security, and voluntary contributions. Each worksheet comes complete with detailed answer keys and is available as free printable PDF resources, allowing students to work through practice problems that mirror actual paycheck scenarios they will encounter in their working lives.

Wayground (formerly Quizizz) empowers educators with millions of teacher-created resources specifically focused on reading paycheck stubs and financial literacy concepts appropriate for Class 8 students. The platform's robust search and filtering capabilities enable teachers to quickly locate worksheets that align with state standards for economics education and career readiness skills. Teachers can easily differentiate instruction by selecting from various difficulty levels and customizing worksheets to meet individual student needs, whether for remediation, enrichment, or regular skill practice. The flexible format options include both printable PDF versions for traditional classroom use and digital formats for online learning environments, making lesson planning seamless while ensuring students receive consistent practice with this fundamental financial literacy skill that bridges academic learning with practical life application.