15 Q

10th

15 Q

9th - 12th

15 Q

8th - 12th

19 Q

9th - Uni

20 Q

9th - 12th

10 Q

1st - Uni

52 Q

9th - 12th

19 Q

10th - 12th

21 Q

4th - Uni

20 Q

4th - Uni

16 Q

9th - 12th

20 Q

9th - 12th

15 Q

9th - 12th

26 Q

9th - 12th

23 Q

9th - 12th

20 Q

8th - 12th

20 Q

9th - 12th

12 Q

9th - 12th

11 Q

9th - 12th

20 Q

8th - 12th

20 Q

8th - 12th

15 Q

8th - Uni

21 Q

9th - Uni

22 Q

9th - Uni

Explore Understanding Paychecks Worksheets by Grades

Explore Other Subject Worksheets for class 10

Explore printable Understanding Paychecks worksheets for Class 10

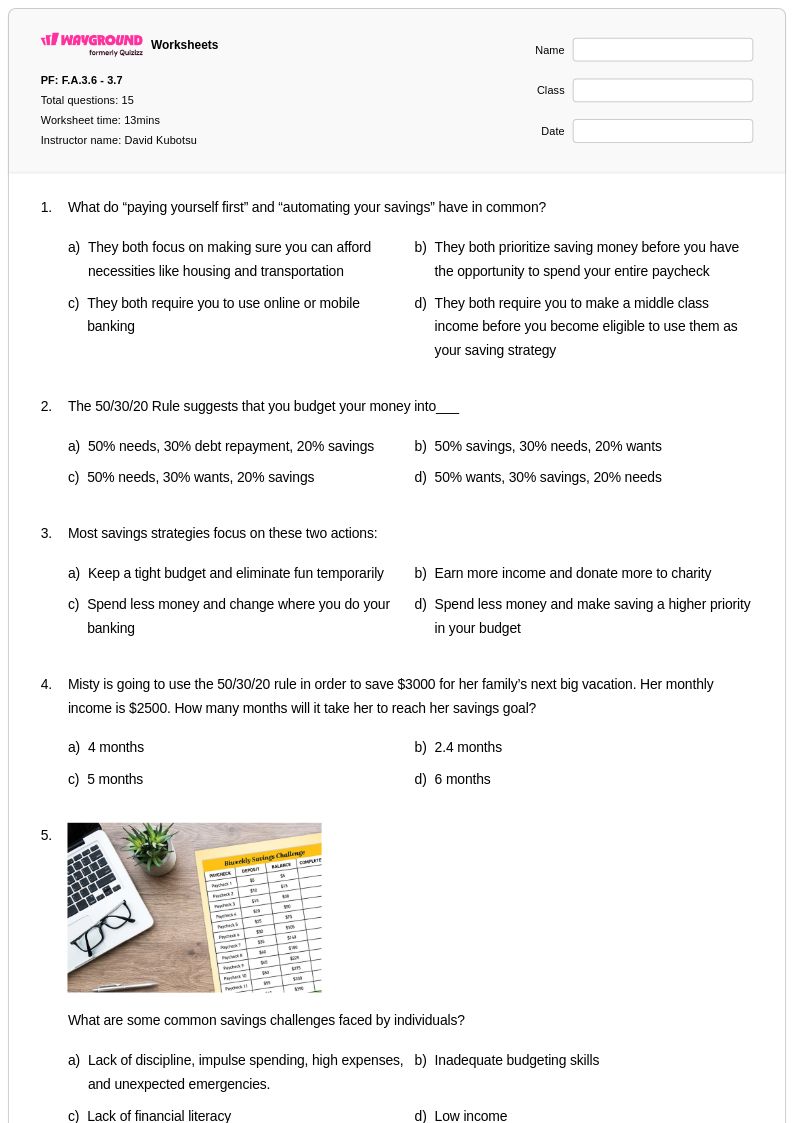

Understanding paychecks represents a critical component of financial literacy education for Class 10 students, requiring comprehensive worksheets that bridge mathematical concepts with real-world financial applications. Wayground's collection of paycheck analysis worksheets enables students to develop essential skills in calculating gross pay, net pay, and various deductions including federal and state taxes, Social Security, Medicare, and voluntary contributions such as health insurance and retirement plans. These practice problems incorporate authentic paycheck scenarios that challenge students to interpret pay stubs, calculate hourly versus salary compensation, understand overtime calculations, and analyze the impact of different deduction amounts on take-home pay. The accompanying answer key supports both independent learning and classroom instruction, while the free printable format ensures accessibility for diverse educational settings and allows students to work through complex financial calculations at their own pace.

Wayground, formerly Quizizz, empowers educators with millions of teacher-created resources specifically designed to strengthen students' understanding of paycheck fundamentals through targeted worksheet collections. The platform's robust search and filtering capabilities allow teachers to locate grade-appropriate materials that align with mathematics and financial literacy standards, while differentiation tools enable customization of worksheet difficulty to meet diverse student needs. Teachers can access these resources in both printable pdf format for traditional classroom use and digital formats for technology-integrated instruction, facilitating seamless lesson planning and implementation. The extensive collection supports various instructional approaches including skill practice sessions, remediation for students struggling with percentage calculations and tax computations, and enrichment activities that explore advanced concepts such as benefits valuation and retirement planning, ensuring comprehensive coverage of paycheck literacy across all learning levels.