15 Q

6th - 8th

14 Q

6th - 8th

23 Q

6th

25 Q

5th - Uni

22 Q

6th

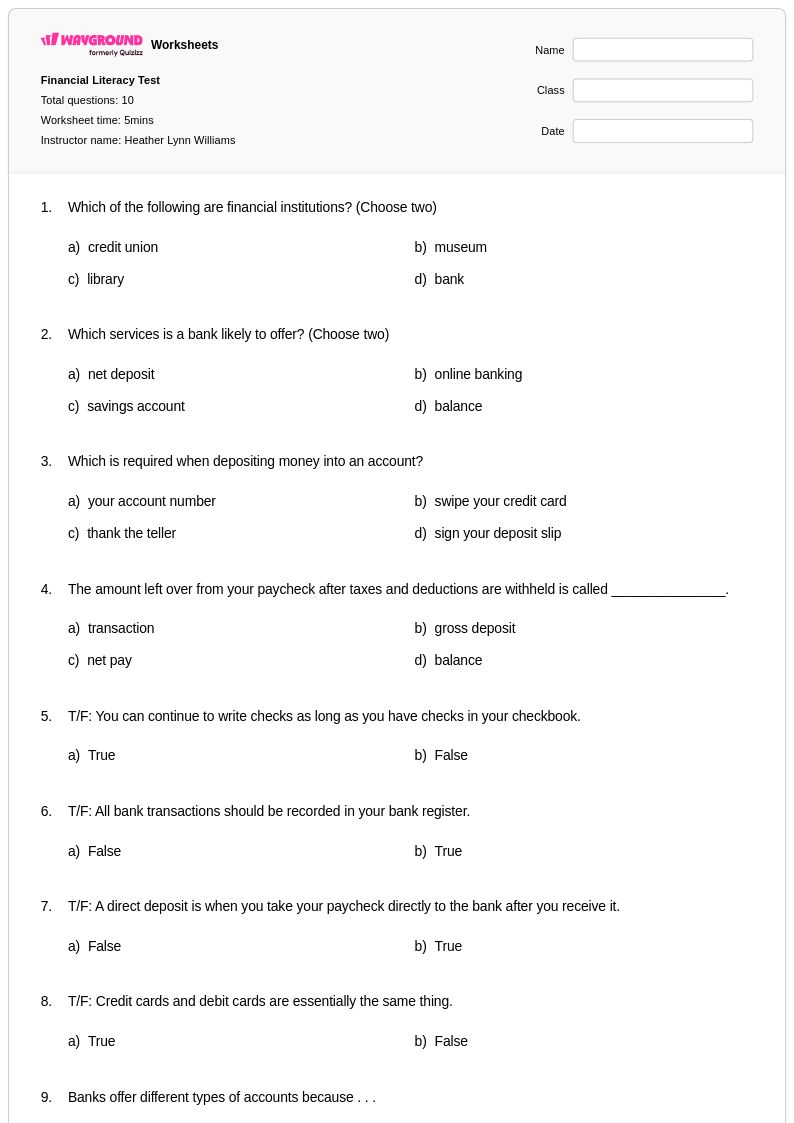

15 Q

5th - Uni

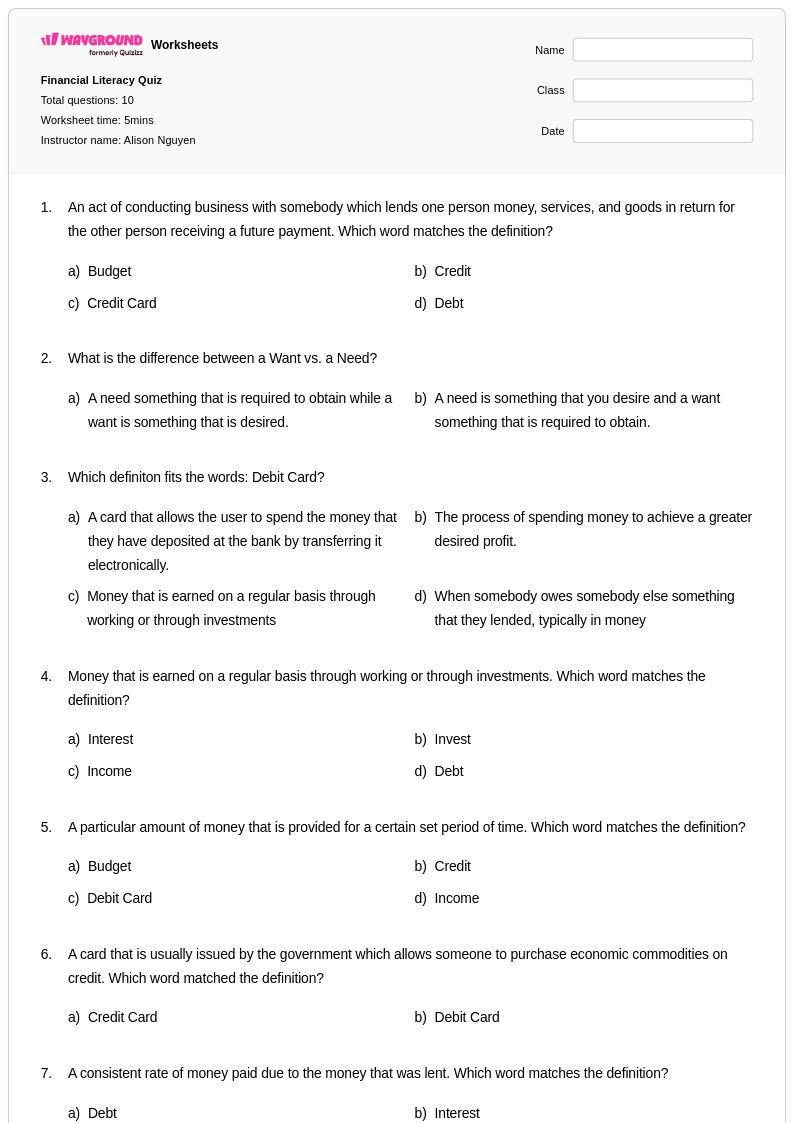

10 Q

6th

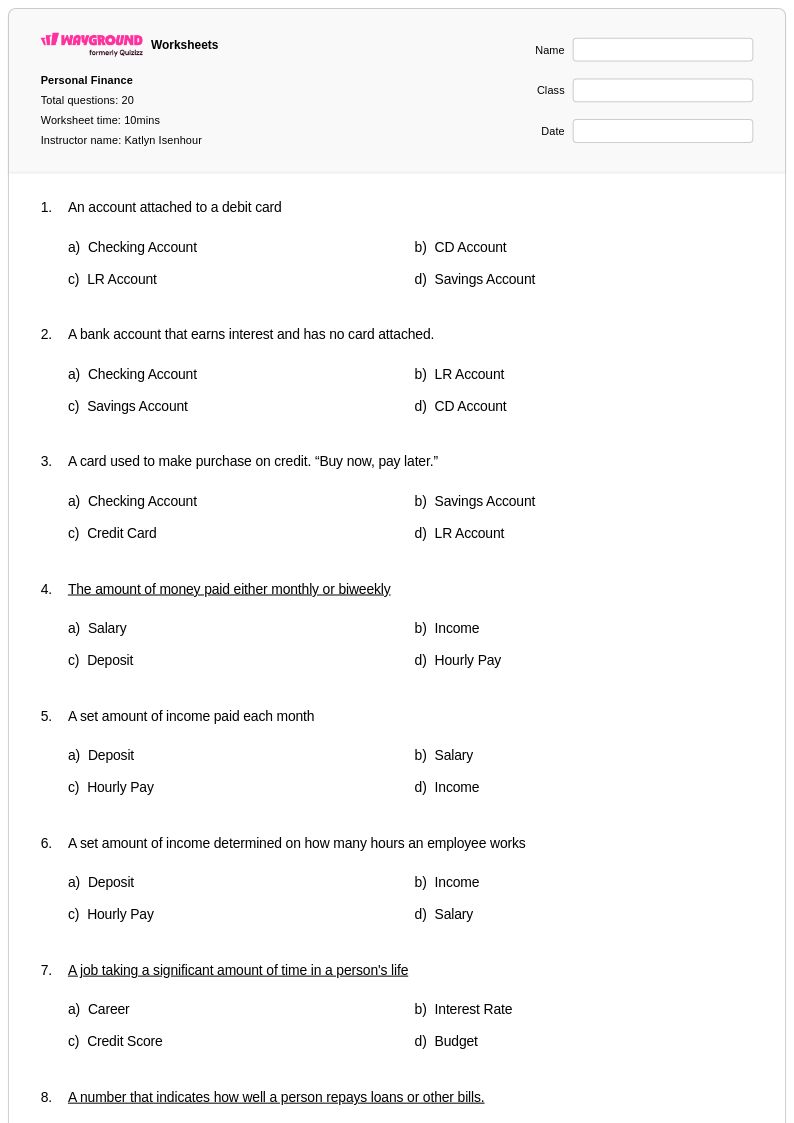

20 Q

6th

10 Q

6th

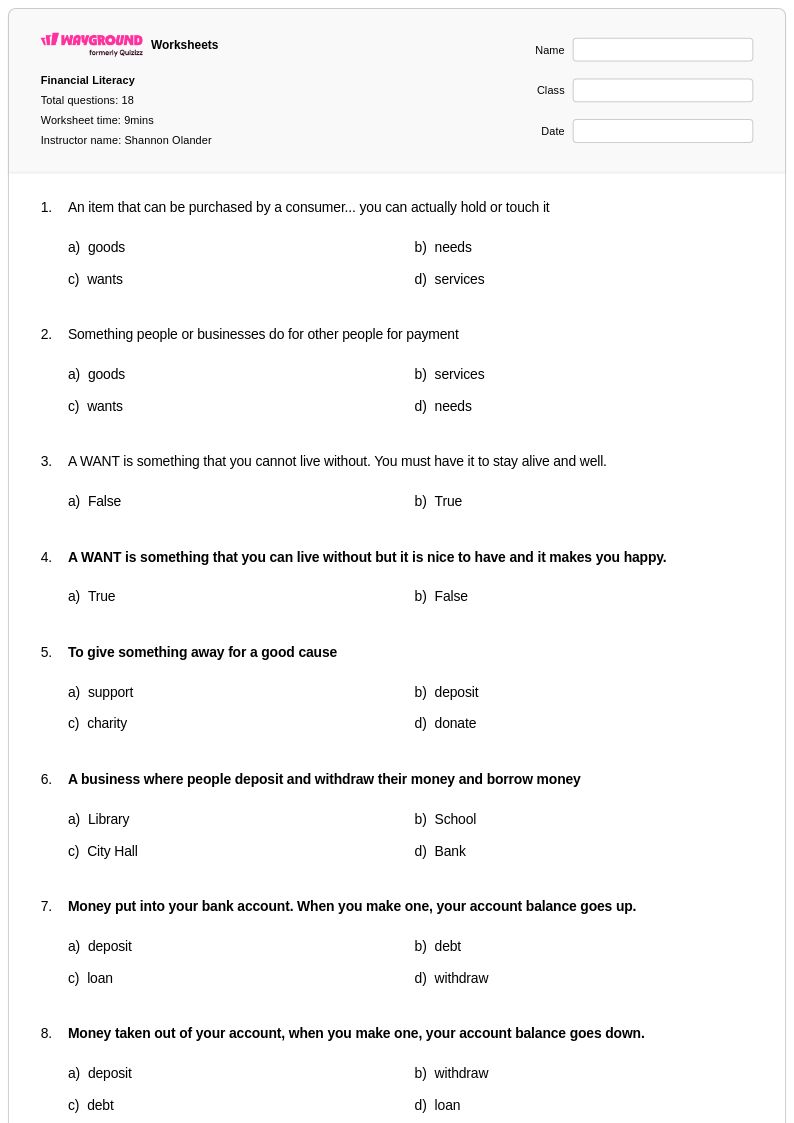

18 Q

3rd - 6th

10 Q

6th

20 Q

6th - 8th

15 Q

5th - 7th

25 Q

6th

14 Q

6th - 7th

23 Q

6th

10 Q

6th - 8th

18 Q

6th - 8th

20 Q

6th

14 Q

6th

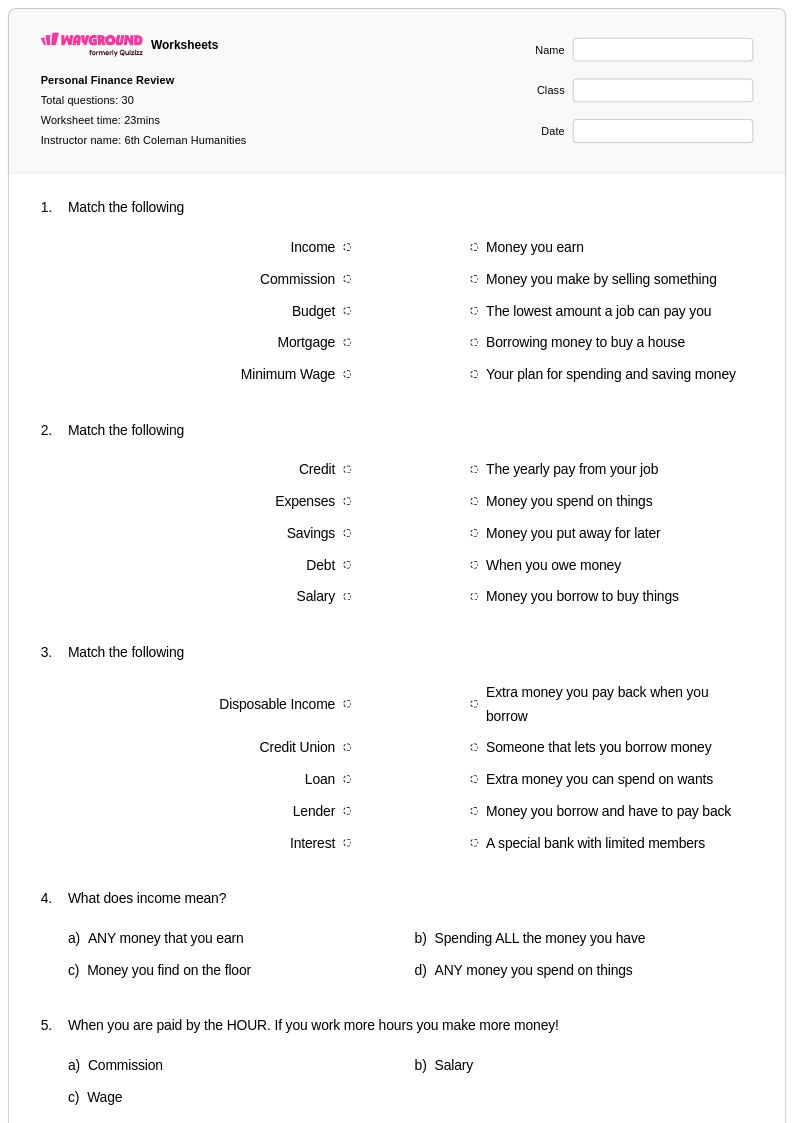

30 Q

6th

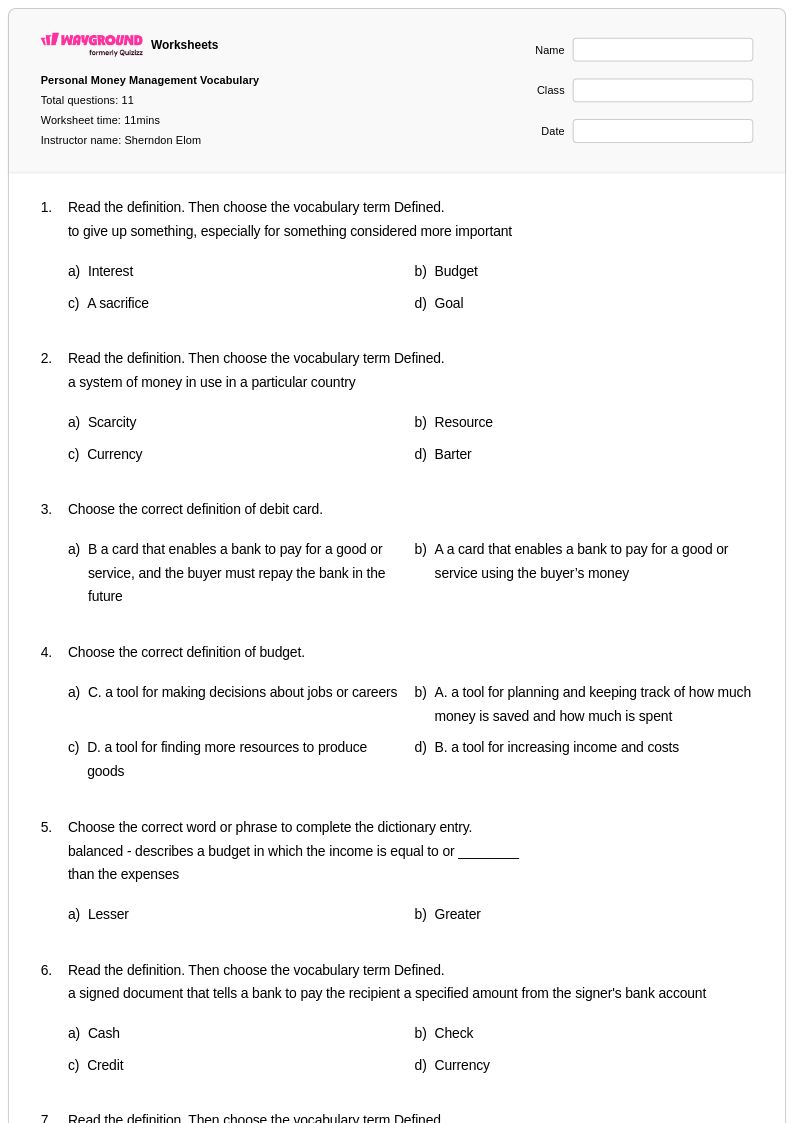

11 Q

6th

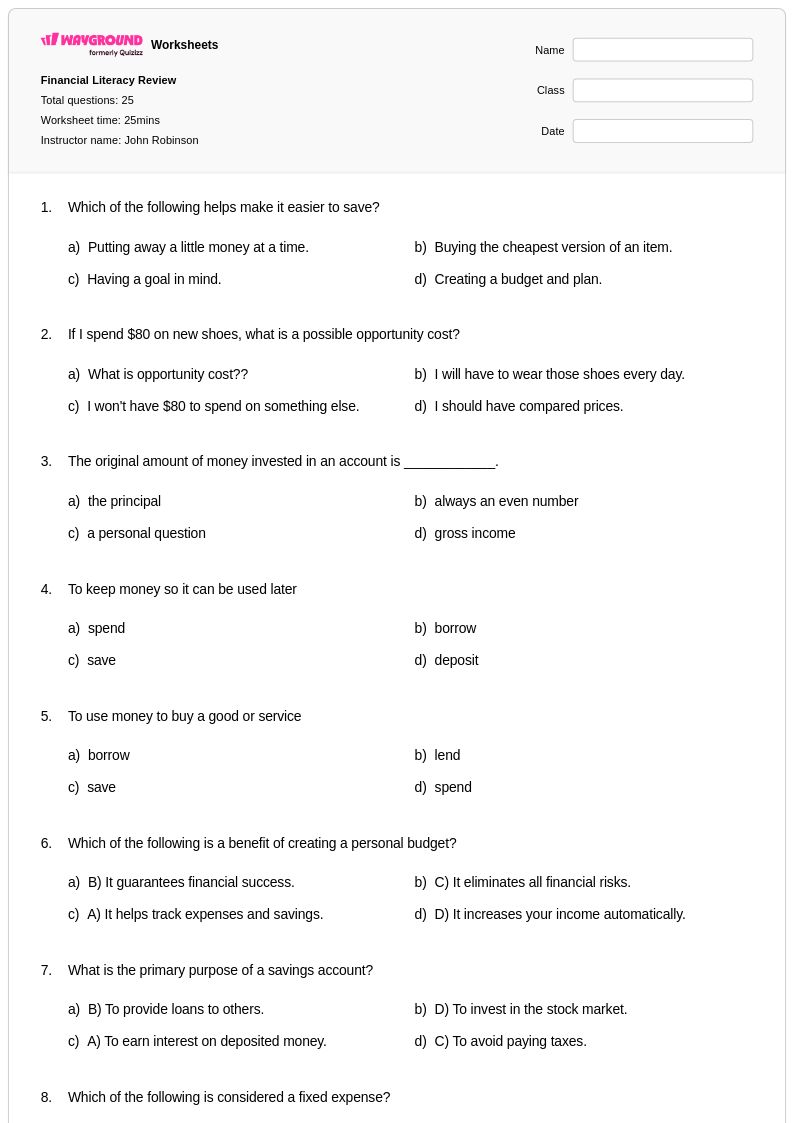

25 Q

4th - Uni

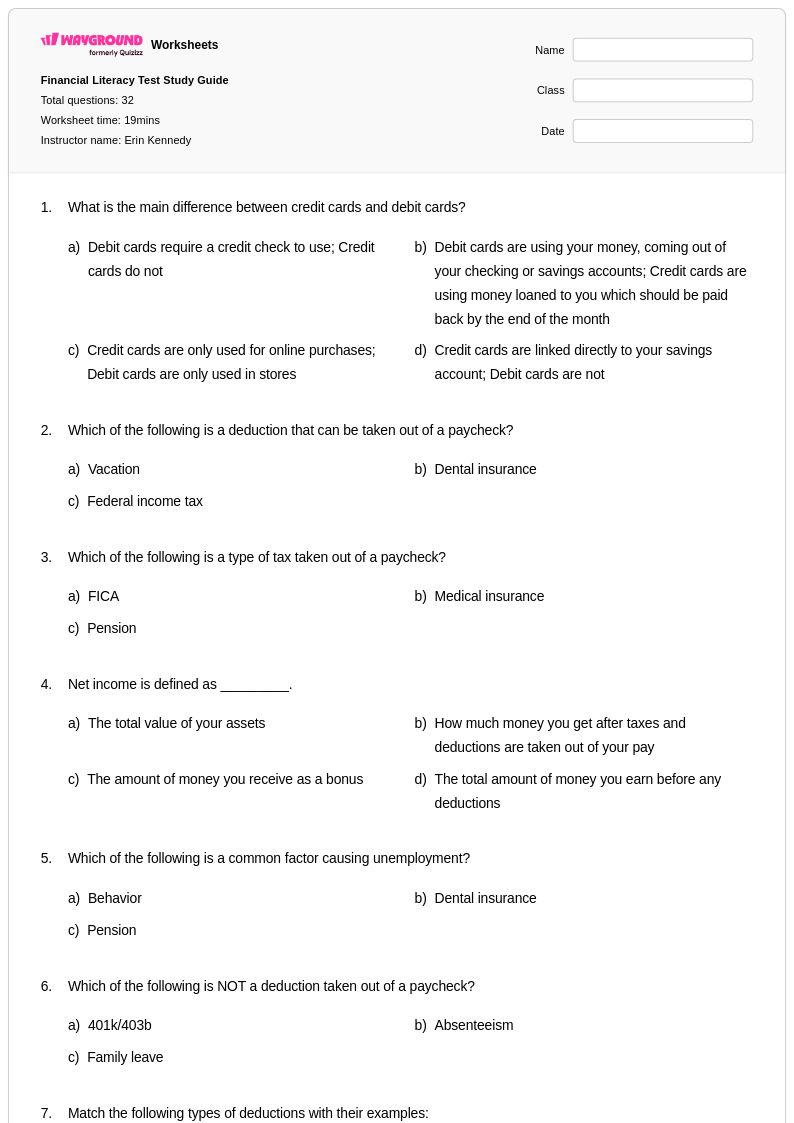

32 Q

6th

Explore Personal Financial Literacy Worksheets by Grades

Explore Other Subject Worksheets for grade 6

Explore printable Personal Financial Literacy worksheets for Grade 6

Personal Financial Literacy worksheets for Grade 6 students available through Wayground (formerly Quizizz) provide comprehensive practice opportunities that build essential money management skills at a foundational level. These educational resources focus on critical concepts including budgeting, saving strategies, understanding income and expenses, making informed spending decisions, and recognizing the difference between needs and wants. Each worksheet collection strengthens students' ability to analyze real-world financial scenarios through engaging practice problems that mirror situations they encounter in daily life. The materials include detailed answer keys that support both independent learning and teacher-guided instruction, with free printables available in convenient pdf format to accommodate various classroom and homework requirements.

Wayground (formerly Quizizz) empowers educators with an extensive library of millions of teacher-created Personal Financial Literacy resources specifically designed for Grade 6 Social Studies curricula. The platform's robust search and filtering capabilities enable teachers to quickly locate worksheets aligned with specific standards and learning objectives, while built-in differentiation tools allow for seamless customization to meet diverse student needs and ability levels. These versatile materials are available in both printable and digital formats, including downloadable pdf versions, making them ideal for lesson planning, targeted remediation sessions, enrichment activities, and structured skill practice. Teachers benefit from the flexibility to modify content, track student progress, and access comprehensive assessment tools that support data-driven instruction in personal finance education.