17Q

7th

10Q

6th - Uni

29Q

7th

21Q

7th

10Q

7th

10Q

6th - 8th

30Q

6th - 8th

15Q

6th - 8th

14Q

7th

10Q

1st - Uni

11Q

6th - 8th

19Q

7th - Uni

11Q

6th - 10th

15Q

7th

21Q

4th - Uni

20Q

4th - Uni

15Q

7th

17Q

7th

20Q

7th

13Q

7th

26Q

7th

8Q

6th - 8th

18Q

7th - Uni

26Q

6th - Uni

Explorar Understanding Paychecks hojas de trabajo por grados

Explore otras hojas de trabajo de materias para class 7

Explore printable Understanding Paychecks worksheets for Class 7

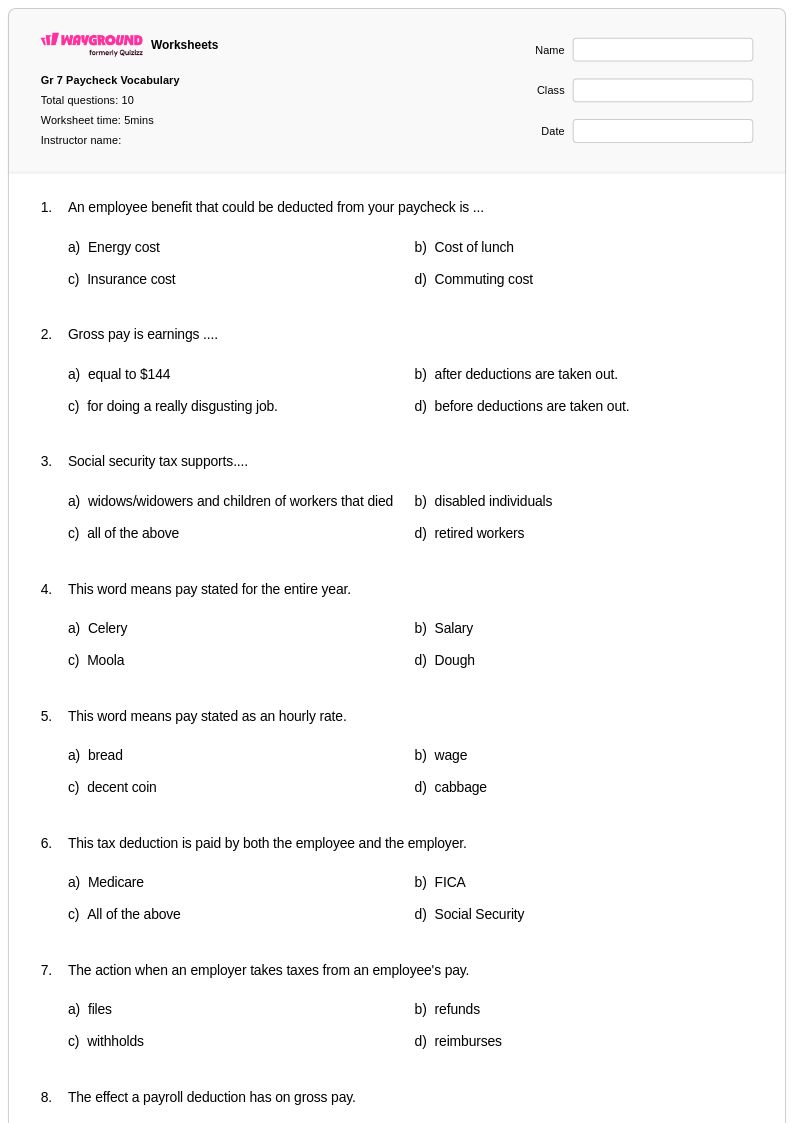

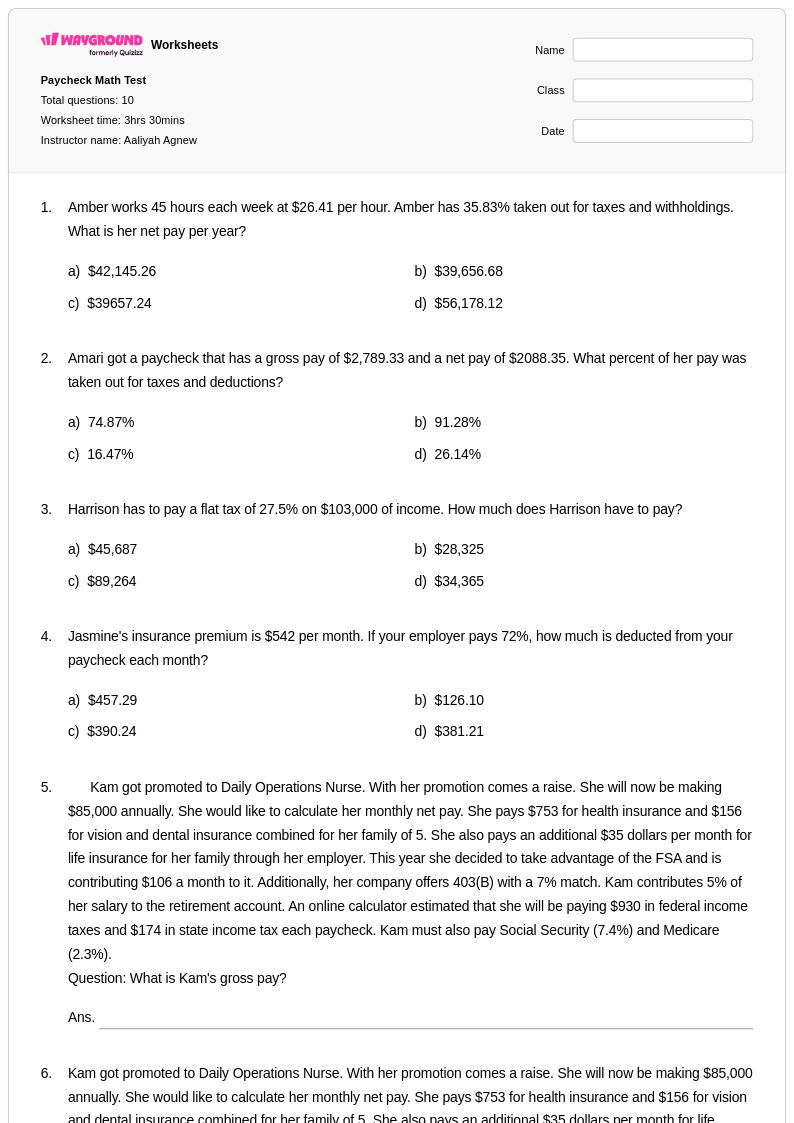

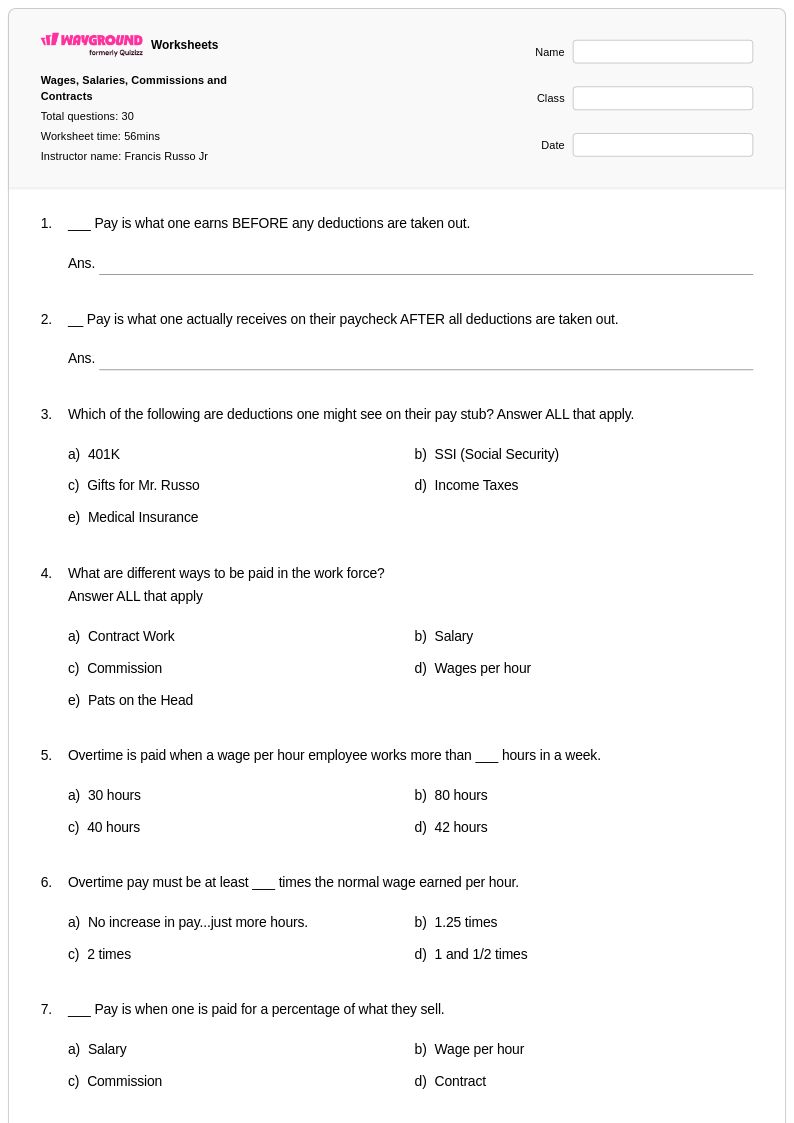

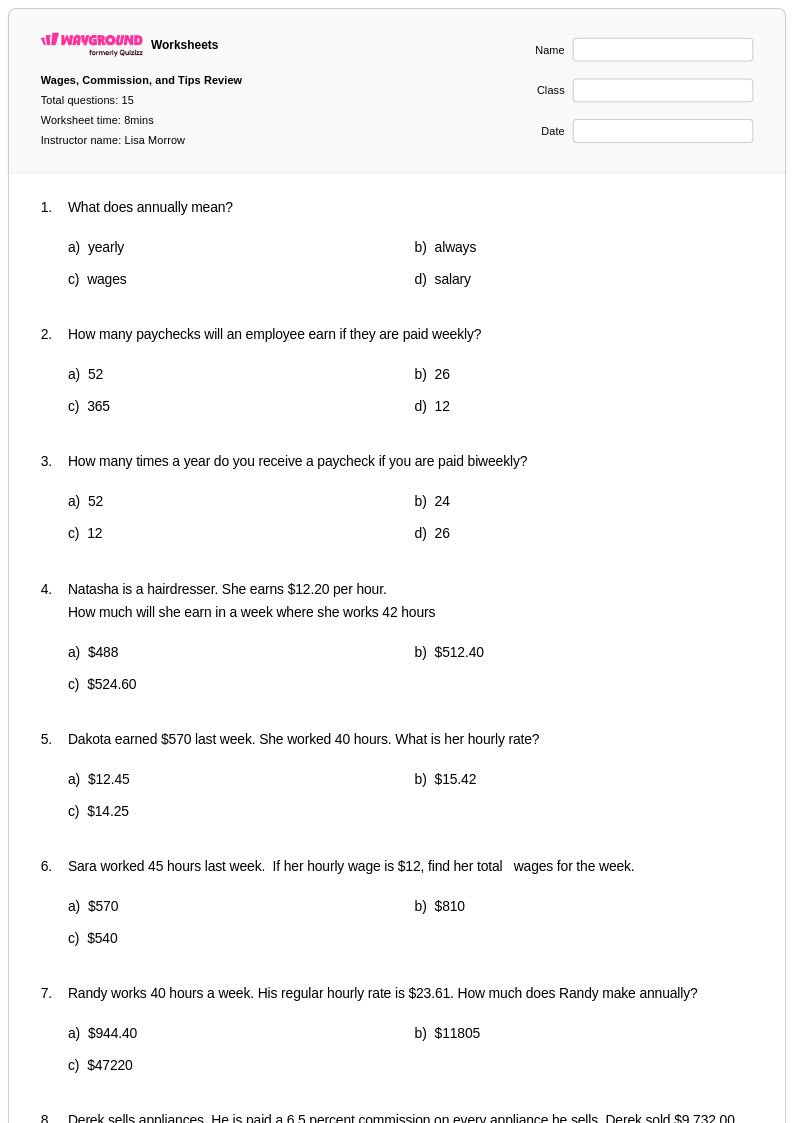

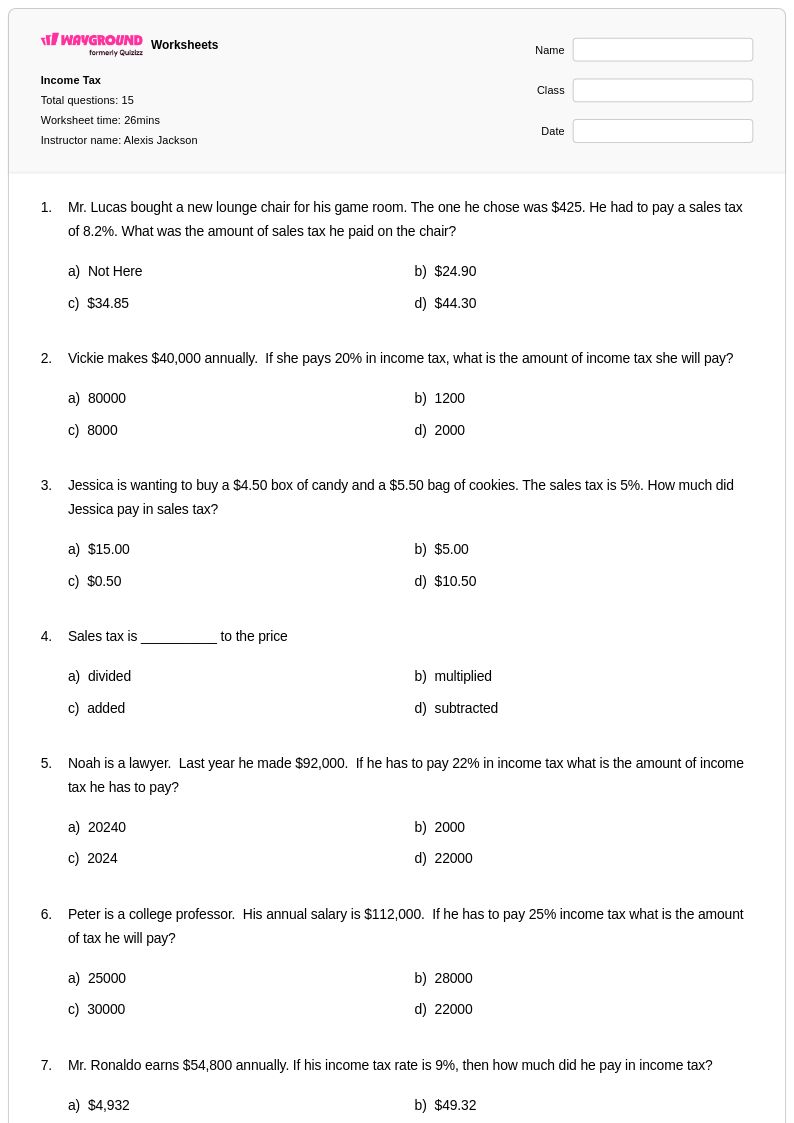

Understanding paychecks represents a fundamental component of financial literacy education for Class 7 students, and Wayground's comprehensive worksheet collection addresses this critical life skill through carefully structured practice problems and real-world scenarios. These worksheets guide seventh-grade students through the essential elements of paycheck analysis, including gross pay calculations, tax deductions, benefit contributions, and net pay determination. Students develop practical mathematical skills while learning to interpret pay stubs, calculate hourly versus salary compensation, and understand the impact of various deductions on take-home pay. Each worksheet includes detailed answer keys that support independent learning and self-assessment, while the free printable format ensures accessibility for diverse classroom environments and home study applications.

Wayground, formerly Quizizz, empowers educators with millions of teacher-created resources specifically designed to enhance financial literacy instruction at the middle school level. The platform's robust search and filtering capabilities allow teachers to quickly locate worksheets that align with specific curriculum standards and learning objectives related to paycheck comprehension and workplace mathematics. These differentiation tools enable educators to customize content complexity, ensuring appropriate challenge levels for students with varying mathematical abilities and prior financial knowledge. Available in both printable PDF format and interactive digital versions, these resources support flexible lesson planning approaches, from targeted remediation sessions for students struggling with decimal operations in payroll contexts to enrichment activities that explore advanced concepts like overtime calculations and commission structures.