6 Q

9th - 12th

11 Q

11th - Uni

5 Q

12th

6 Q

9th - 12th

6 Q

11th - 12th

10 Q

9th - 12th

11 Q

9th - 12th

7 Q

11th - 12th

10 Q

12th

13 Q

9th - 12th

16 Q

12th

18 Q

12th

10 Q

12th

10 Q

9th - 12th

12 Q

9th - 12th

20 Q

9th - 12th

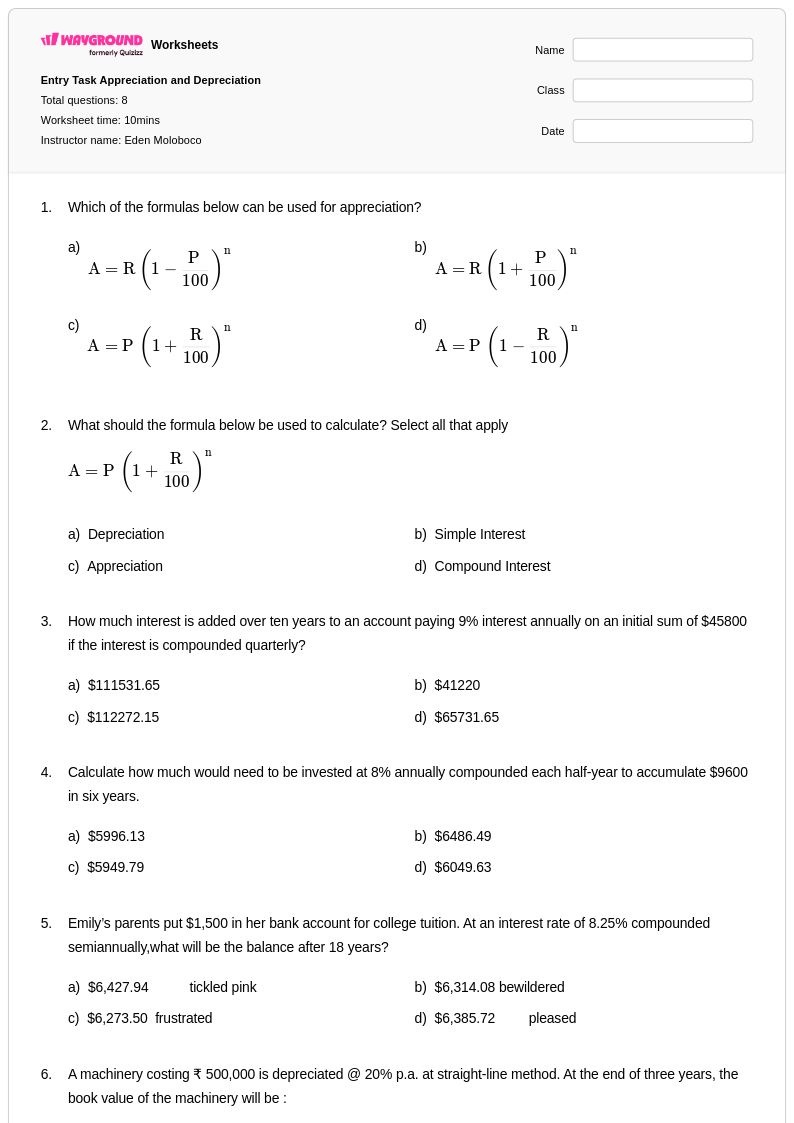

8 Q

9th - 12th

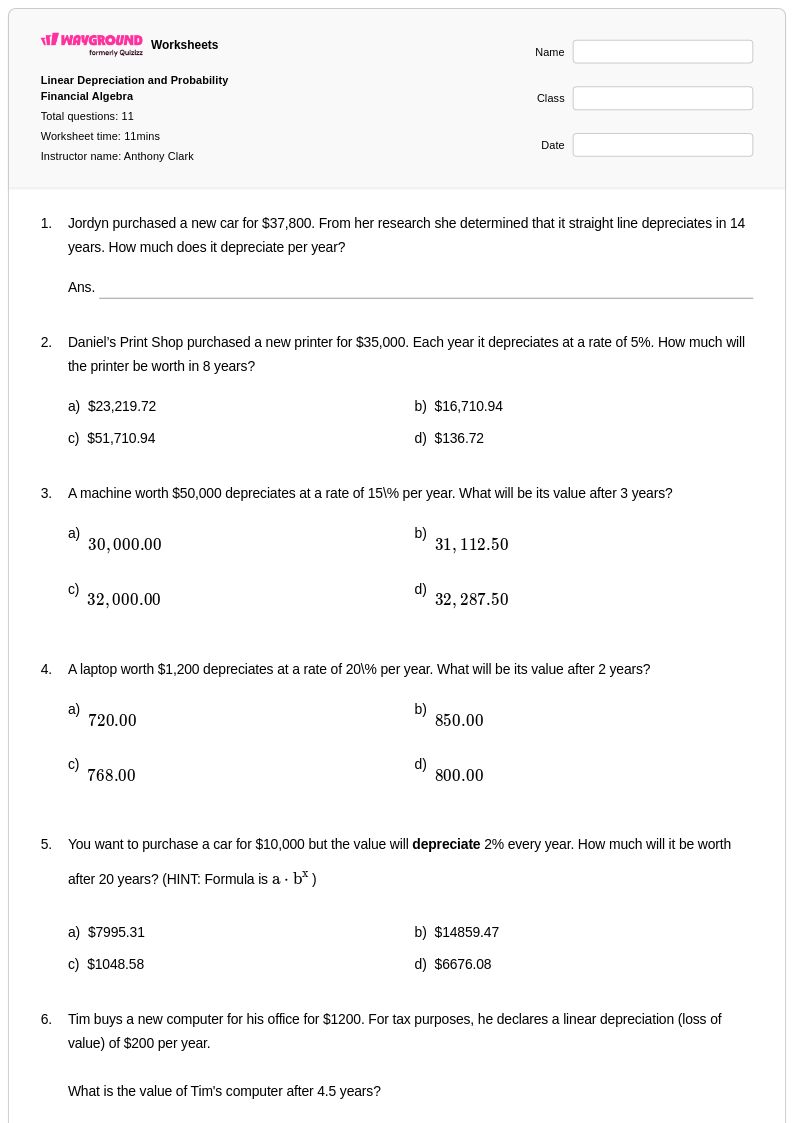

11 Q

9th - Uni

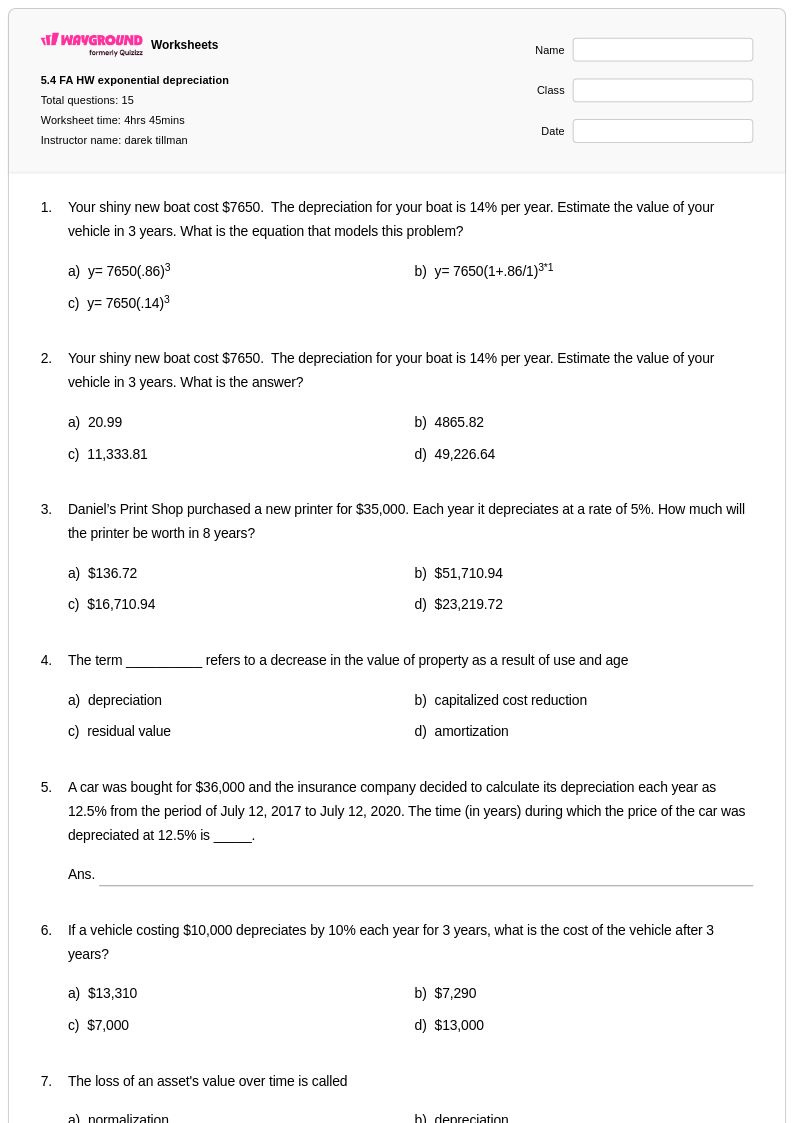

15 Q

12th

120 Q

9th - 12th

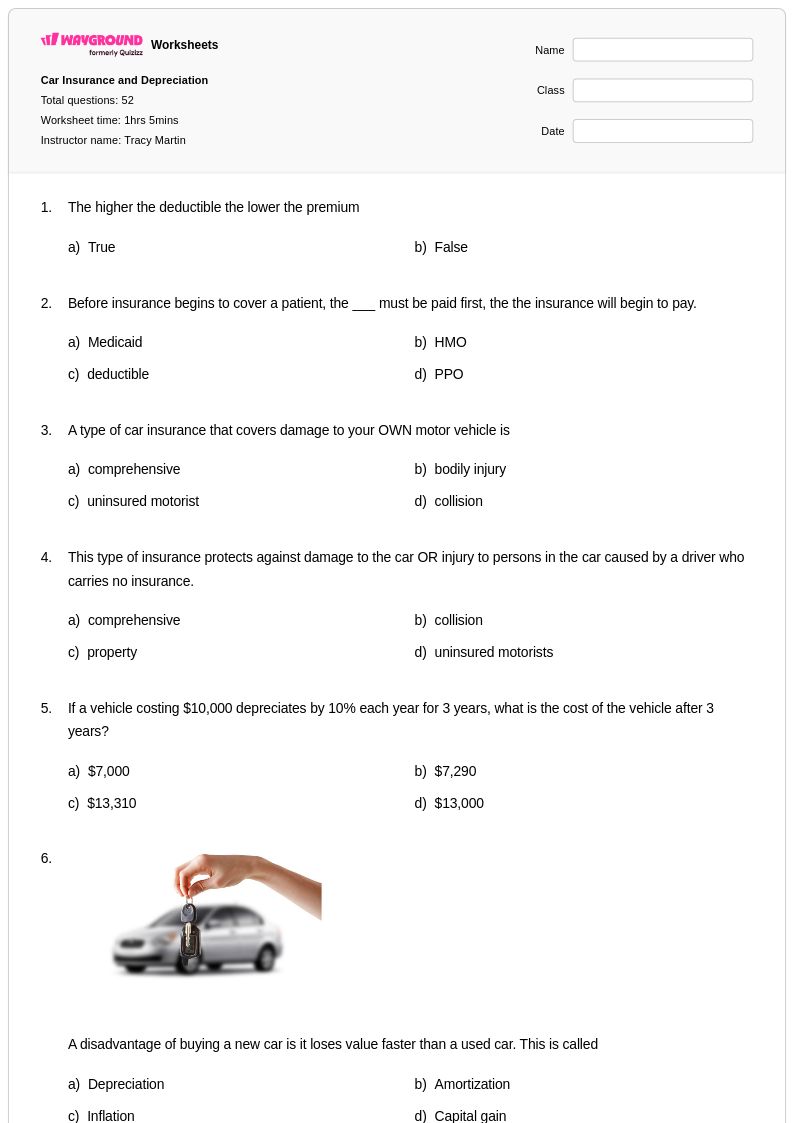

52 Q

11th - 12th

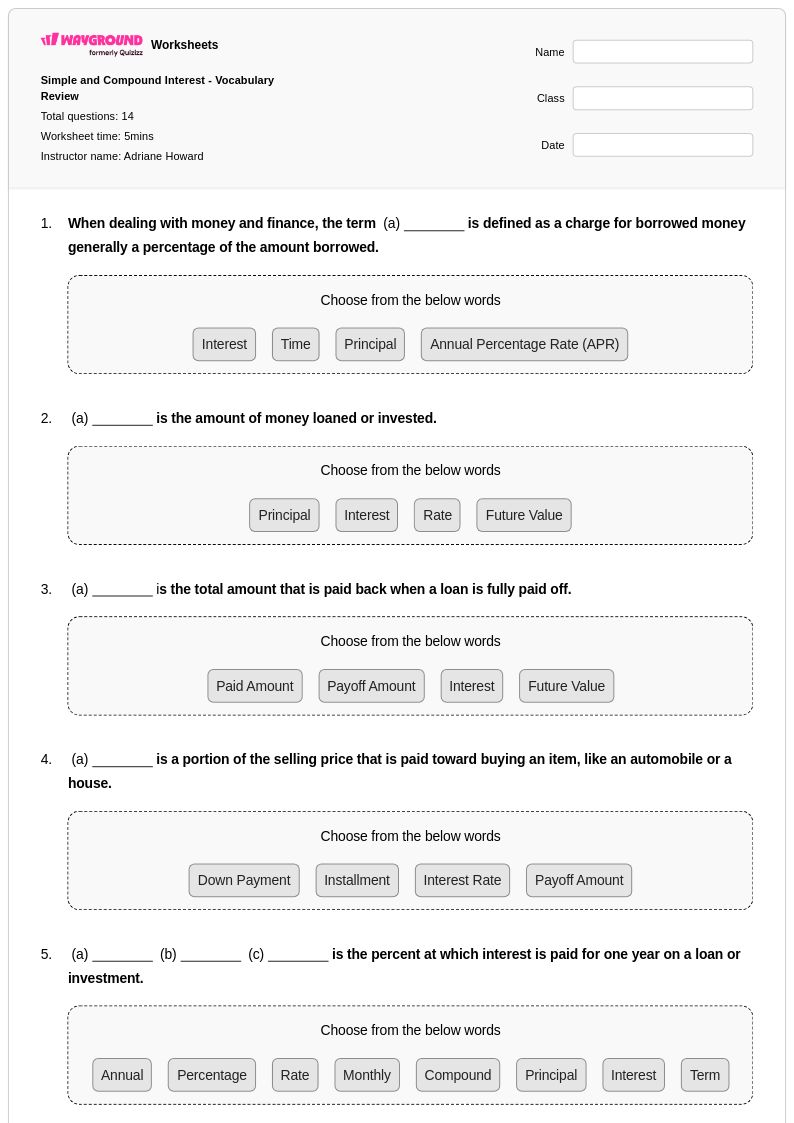

14 Q

12th

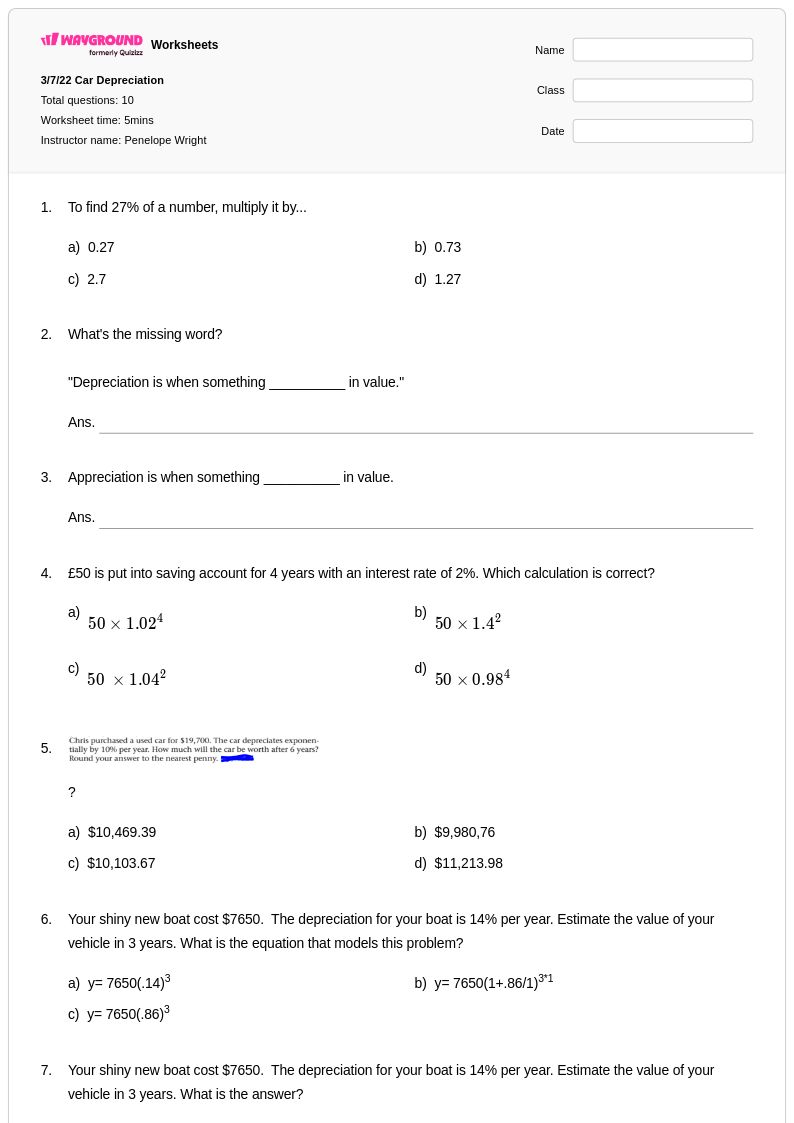

10 Q

12th

10 Q

9th - 12th

Explore Other Subject Worksheets for year 12

Explore printable Depreciation worksheets for Year 12

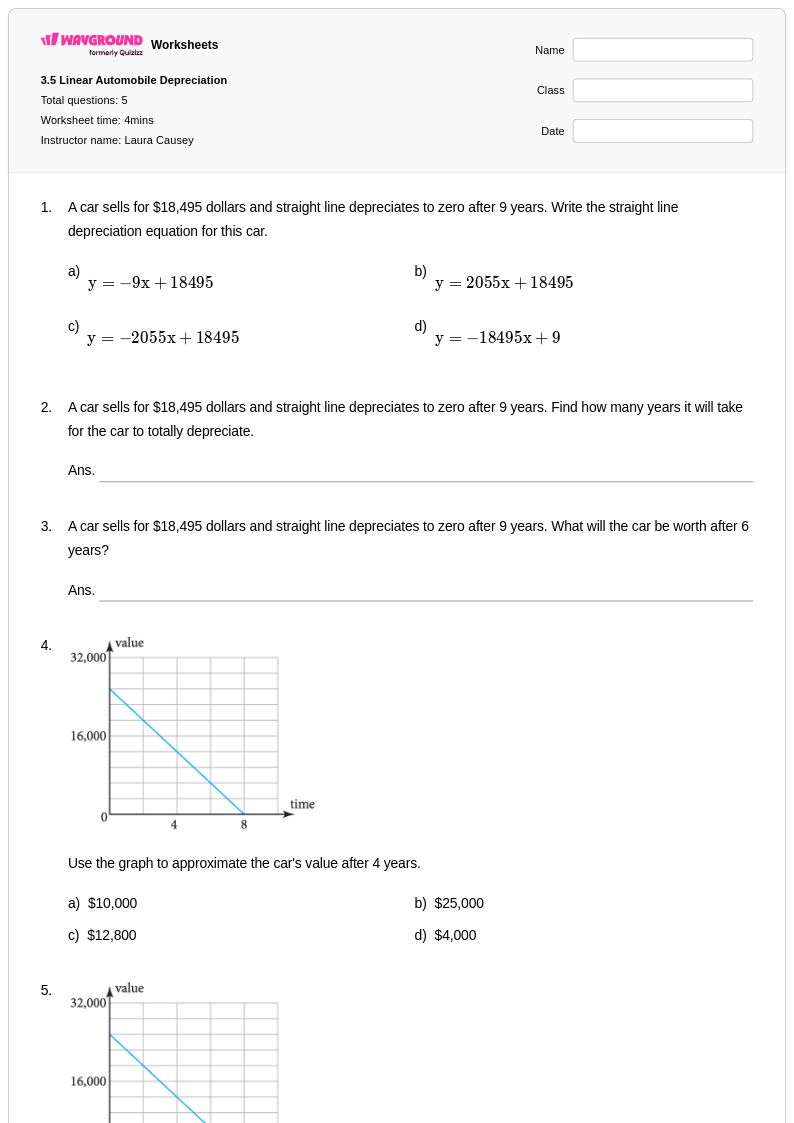

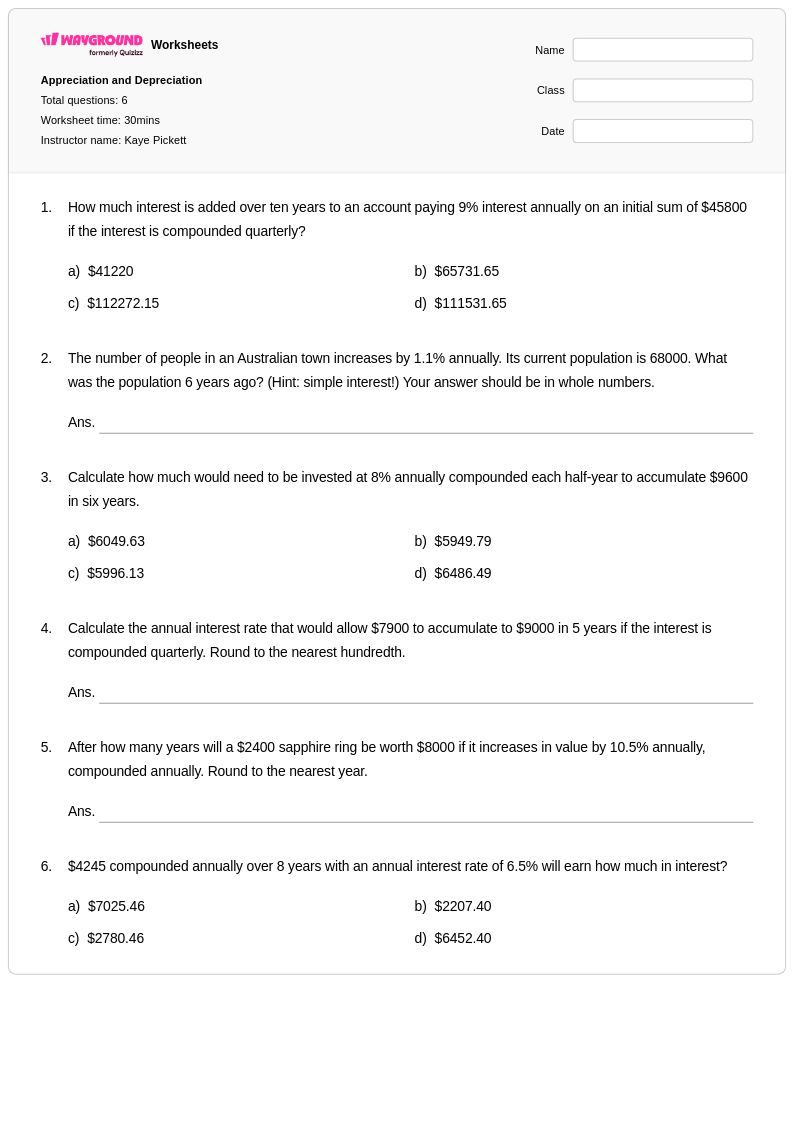

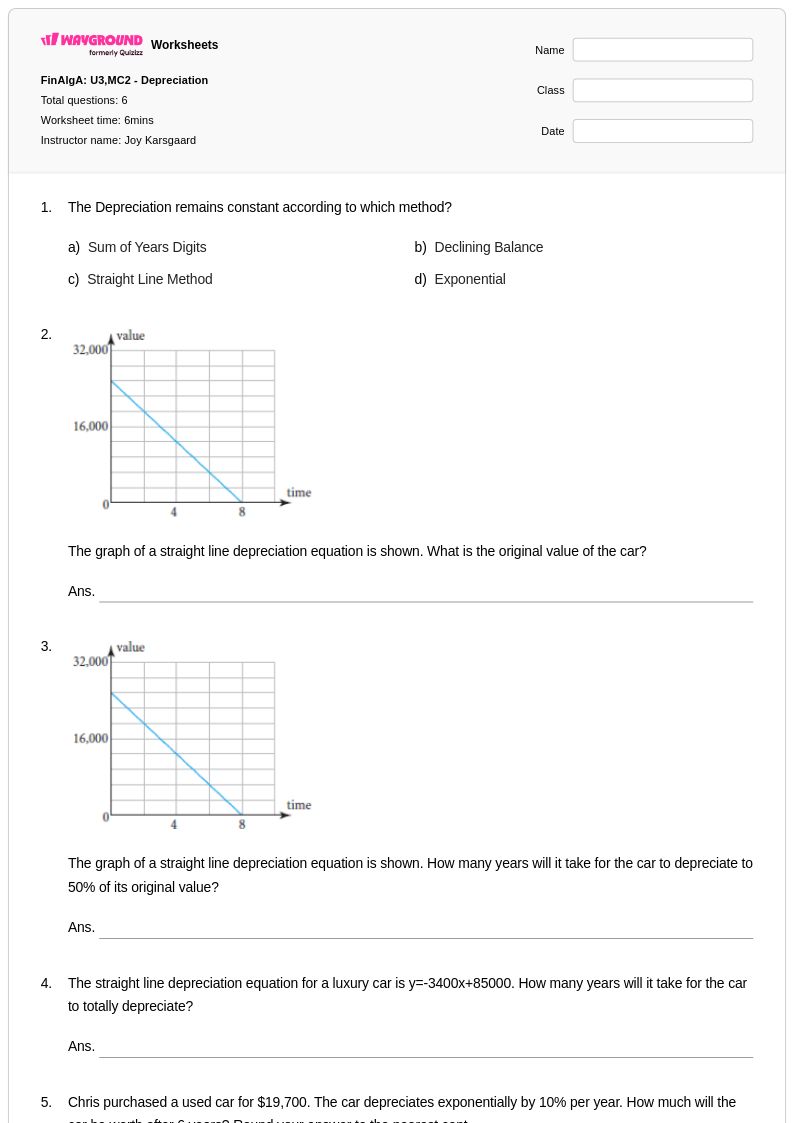

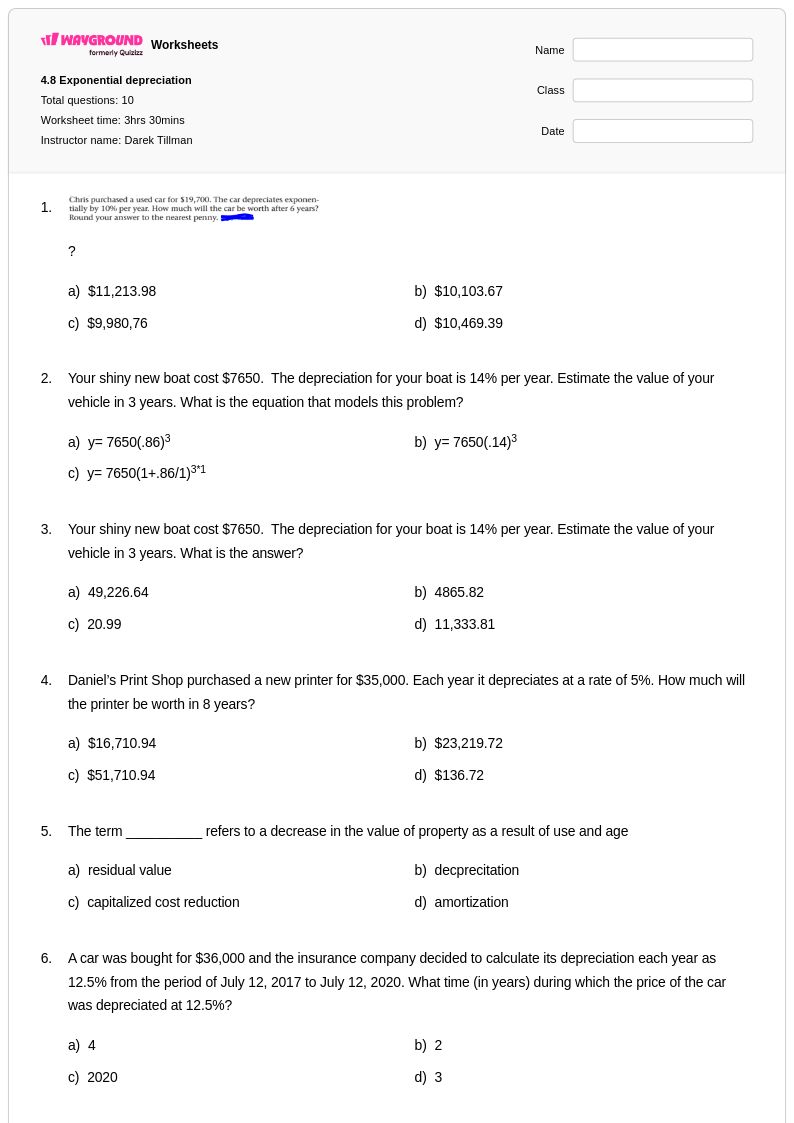

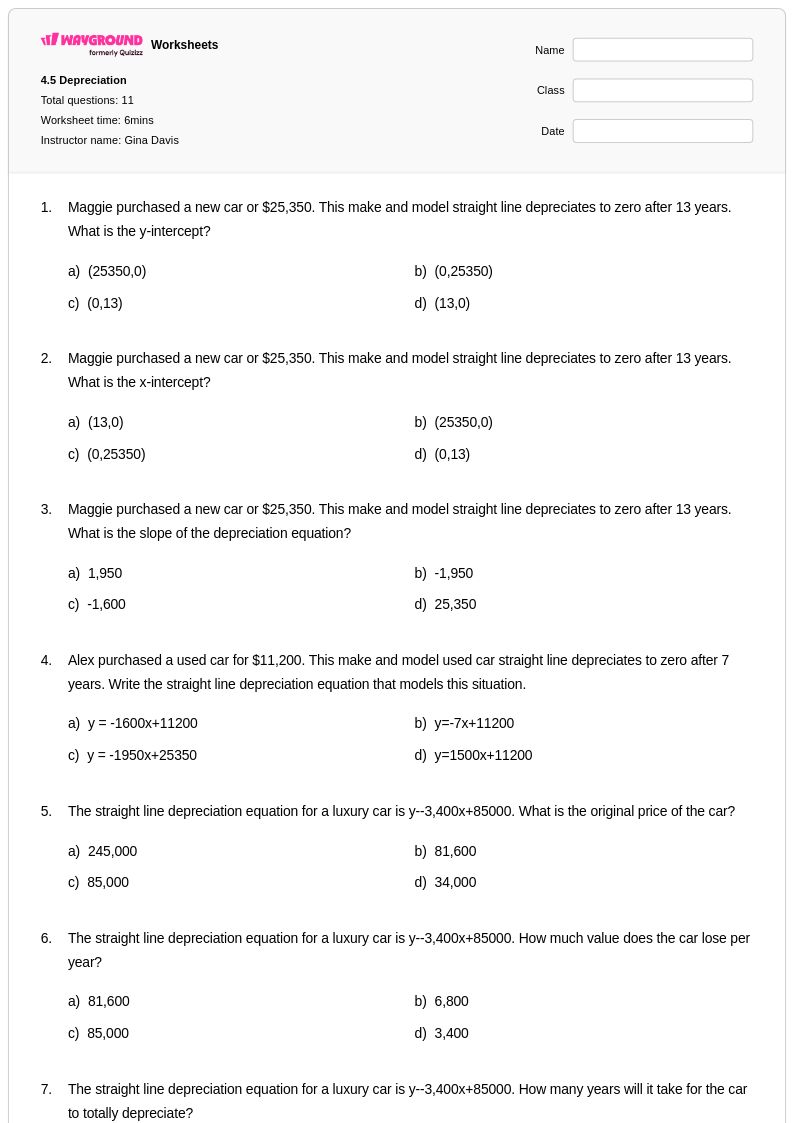

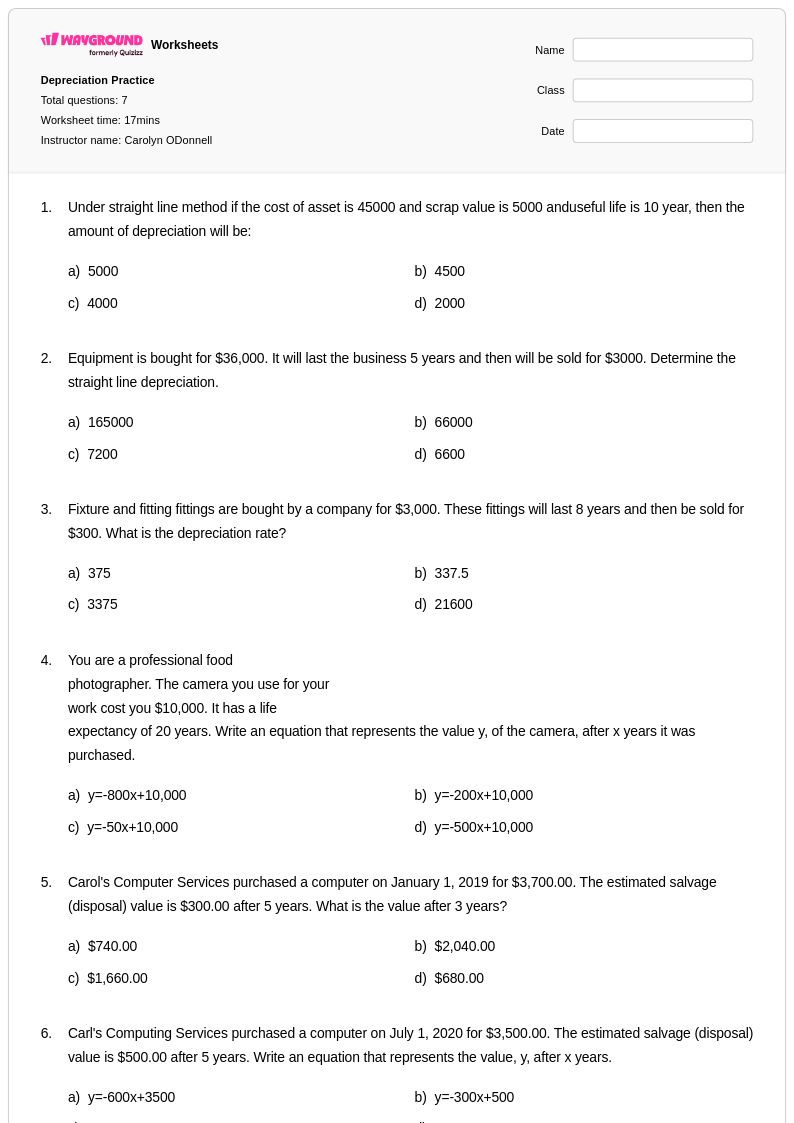

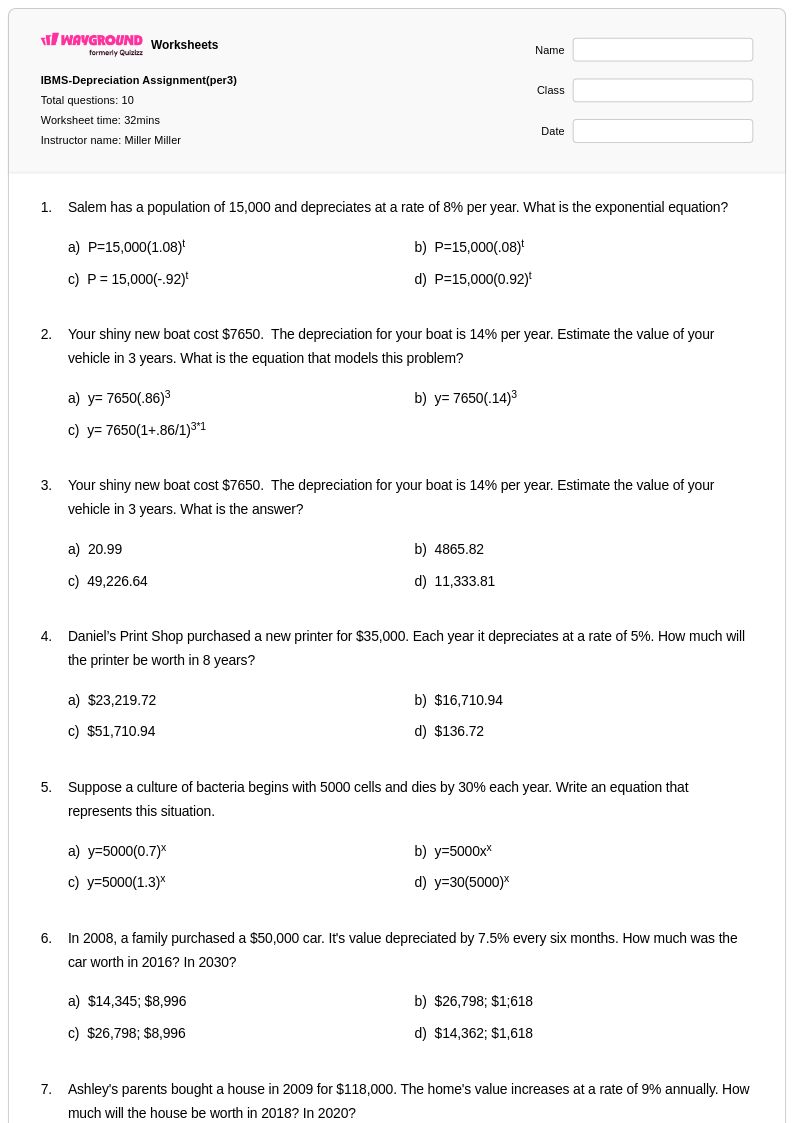

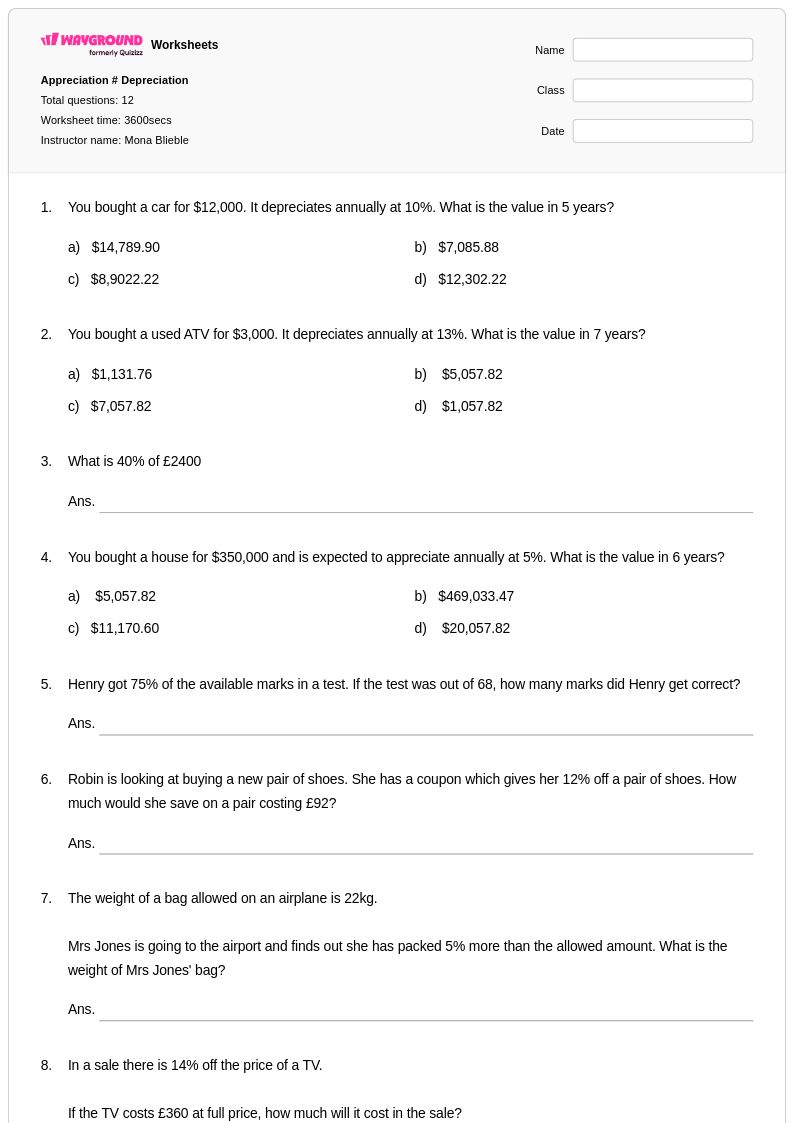

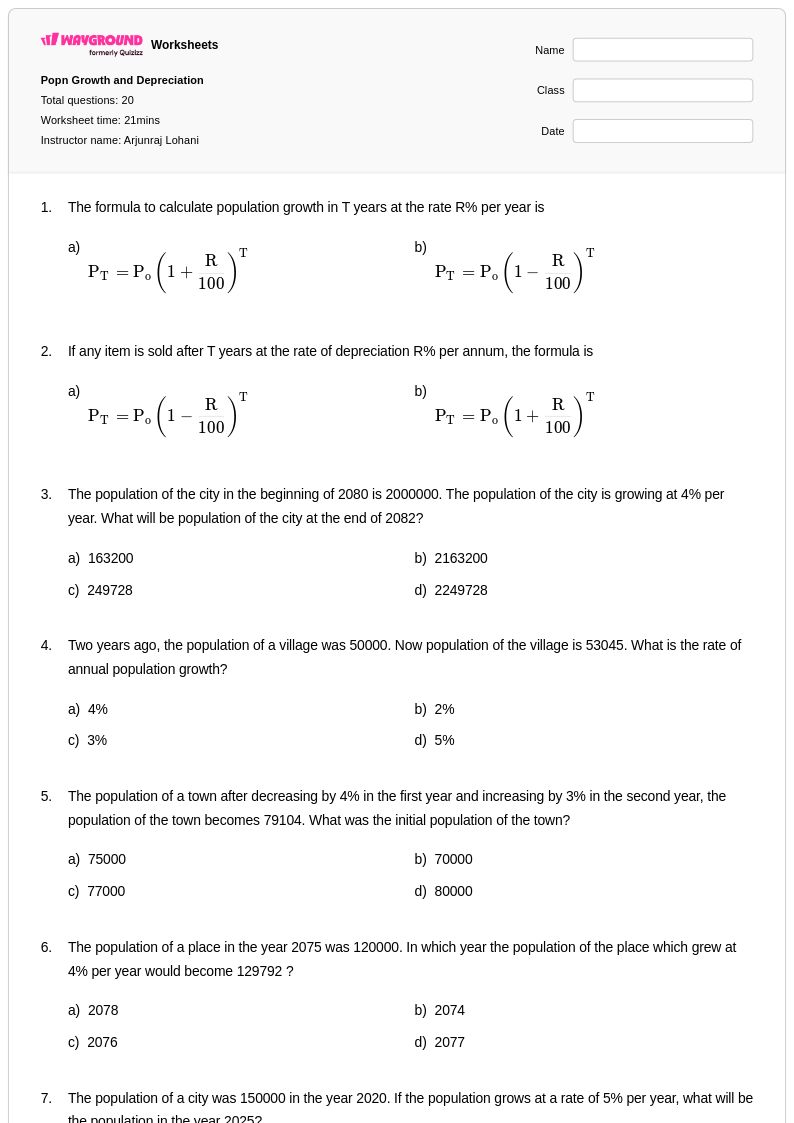

Depreciation worksheets for Year 12 students provide comprehensive practice with calculating asset value decline over time using various mathematical methods including straight-line, declining balance, and units of production approaches. These carefully structured worksheets help students master essential financial mathematics concepts by working through real-world scenarios involving vehicles, equipment, and property depreciation calculations. Students develop critical analytical skills as they interpret depreciation schedules, calculate book values, and determine salvage values through systematic practice problems that mirror actual business applications. Each worksheet collection includes detailed answer keys and step-by-step solutions, making these free printables invaluable resources for reinforcing complex mathematical concepts that bridge academic learning with practical financial literacy skills.

Wayground (formerly Quizizz) empowers educators with an extensive library of millions of teacher-created depreciation worksheet resources specifically designed for Year 12 mathematics instruction. The platform's robust search and filtering capabilities allow teachers to quickly locate materials aligned with specific curriculum standards while accessing differentiation tools that accommodate diverse learning needs within the classroom. These comprehensive worksheet collections are available in both printable pdf formats and interactive digital versions, providing maximum flexibility for lesson planning and instruction delivery. Teachers can seamlessly customize existing resources or build upon the foundational materials to create targeted remediation activities, enrichment challenges, or focused skill practice sessions that help students master the mathematical principles underlying depreciation calculations and their real-world applications in business and personal finance contexts.