10 T

9th - 12th

10 T

12th

7 T

12th

18 T

12th

22 T

12th

37 T

9th - 12th

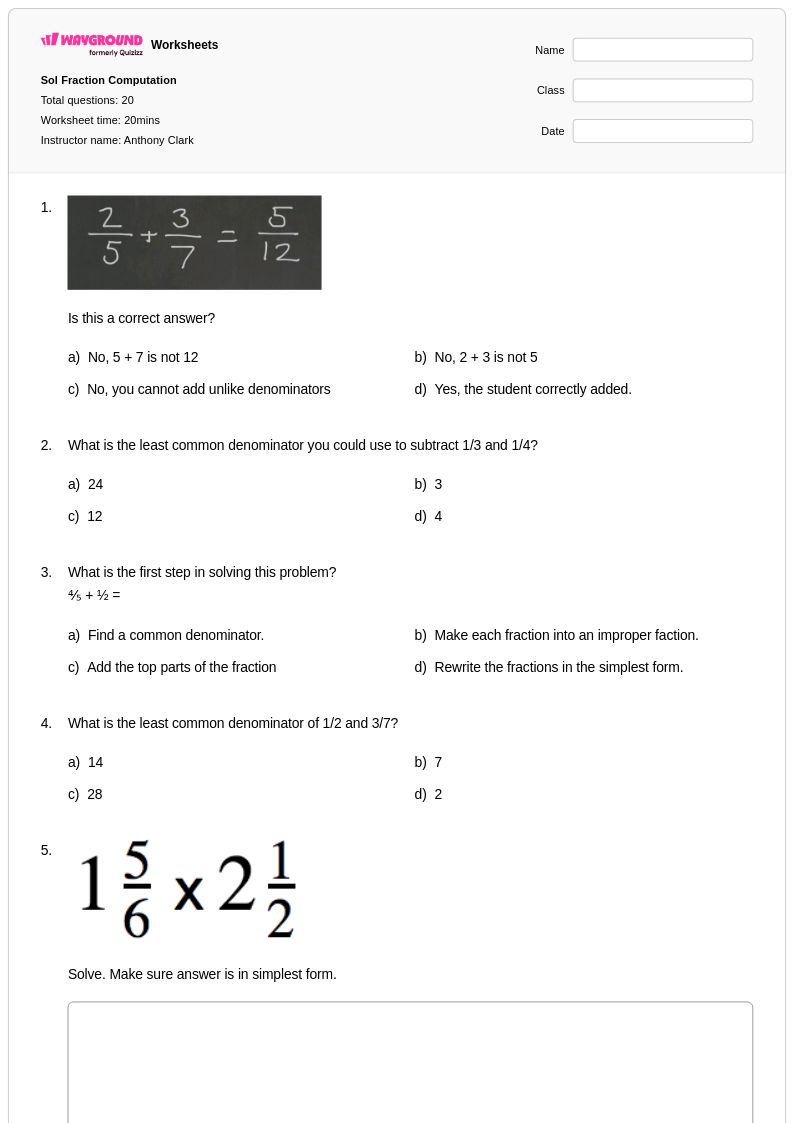

20 T

12th

15 T

12th - Uni

10 T

12th

14 T

12th

18 T

5th - Uni

19 T

4th - Uni

20 T

4th - Uni

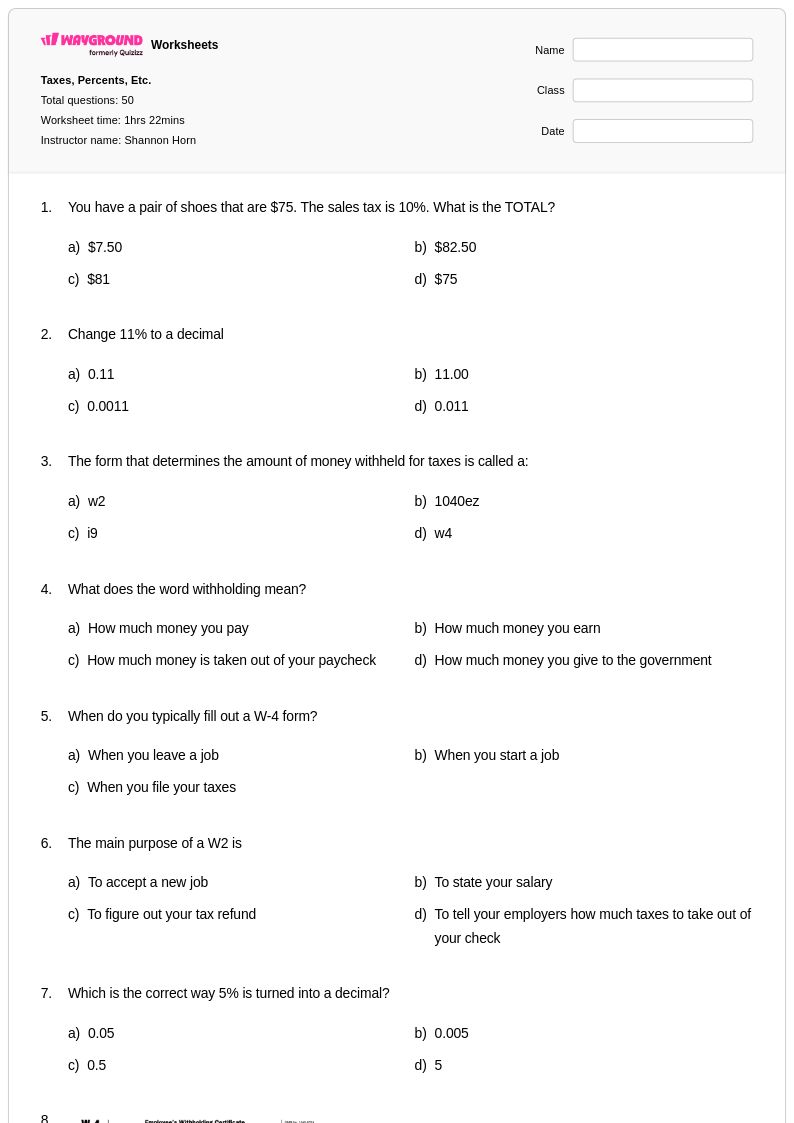

50 T

9th - 12th

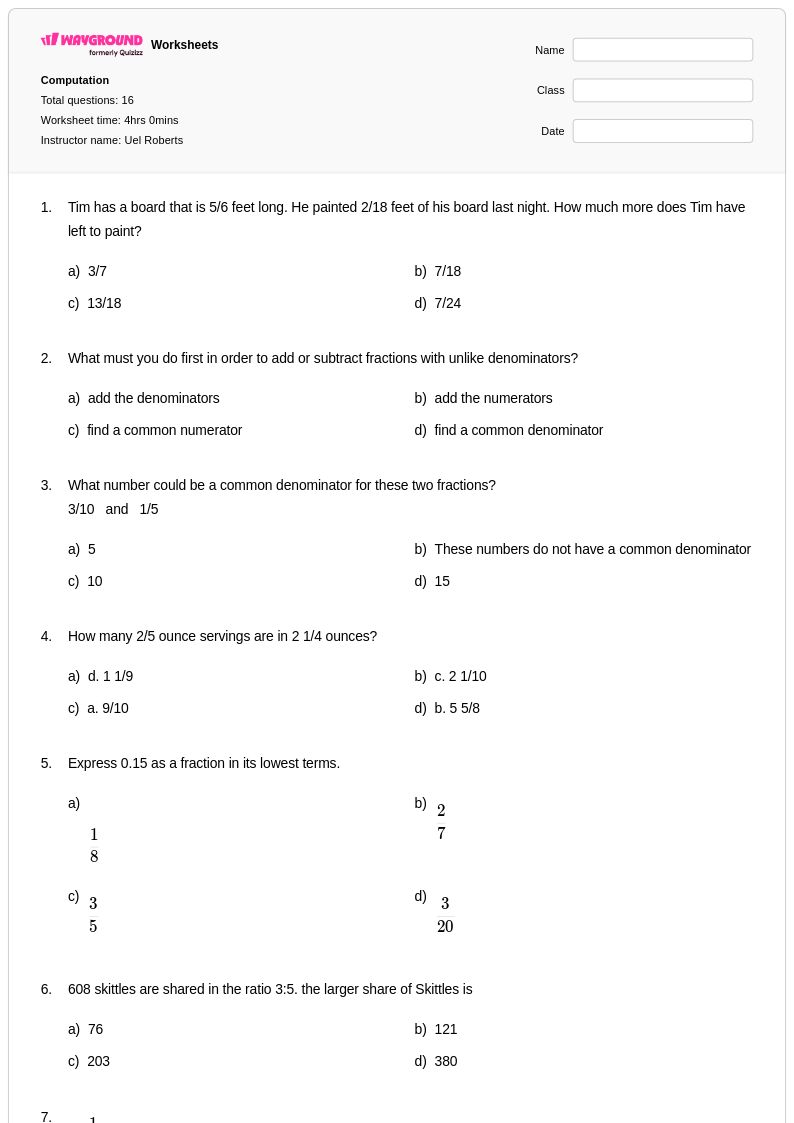

16 T

4th - 12th

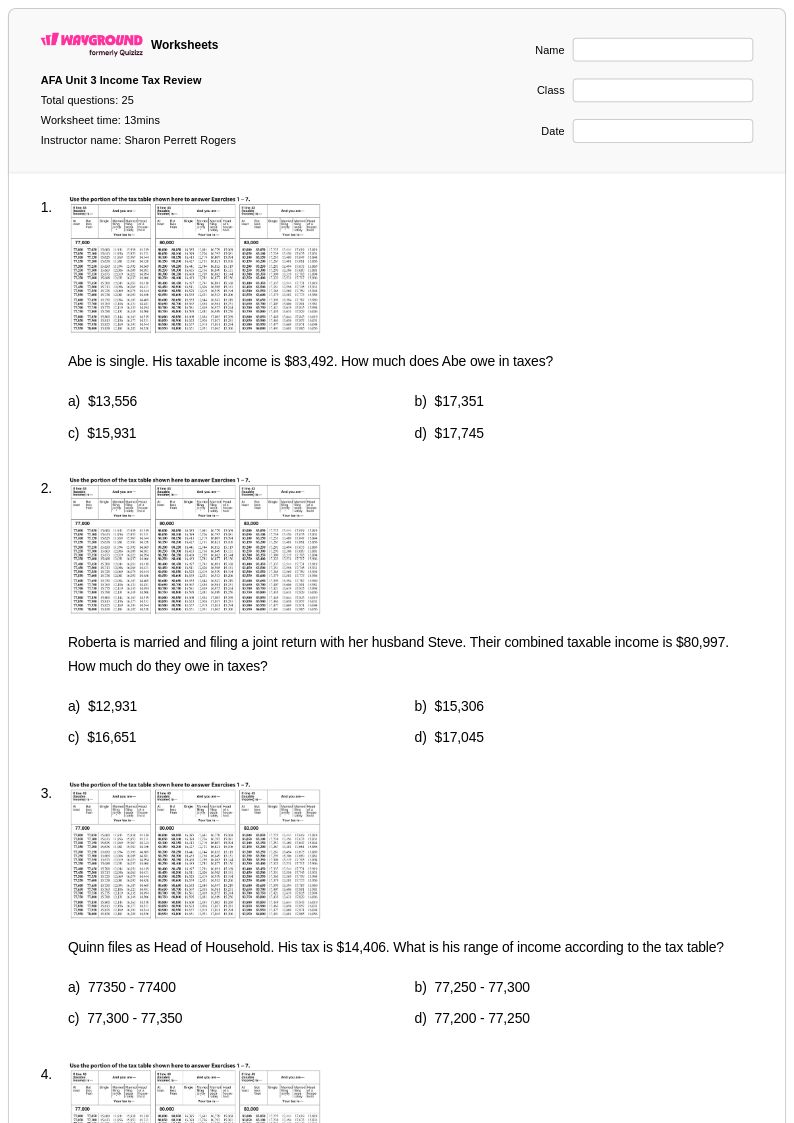

25 T

12th

20 T

12th

20 T

7th - Uni

23 T

12th

20 T

7th - Uni

12 T

5th - Uni

15 T

5th - Uni

15 T

11th - 12th

15 T

9th - 12th

Jelajahi Tax Computation Lembar Kerja berdasarkan Nilai

Jelajahi Lembar Kerja Mata Pelajaran Lainnya untuk year 12

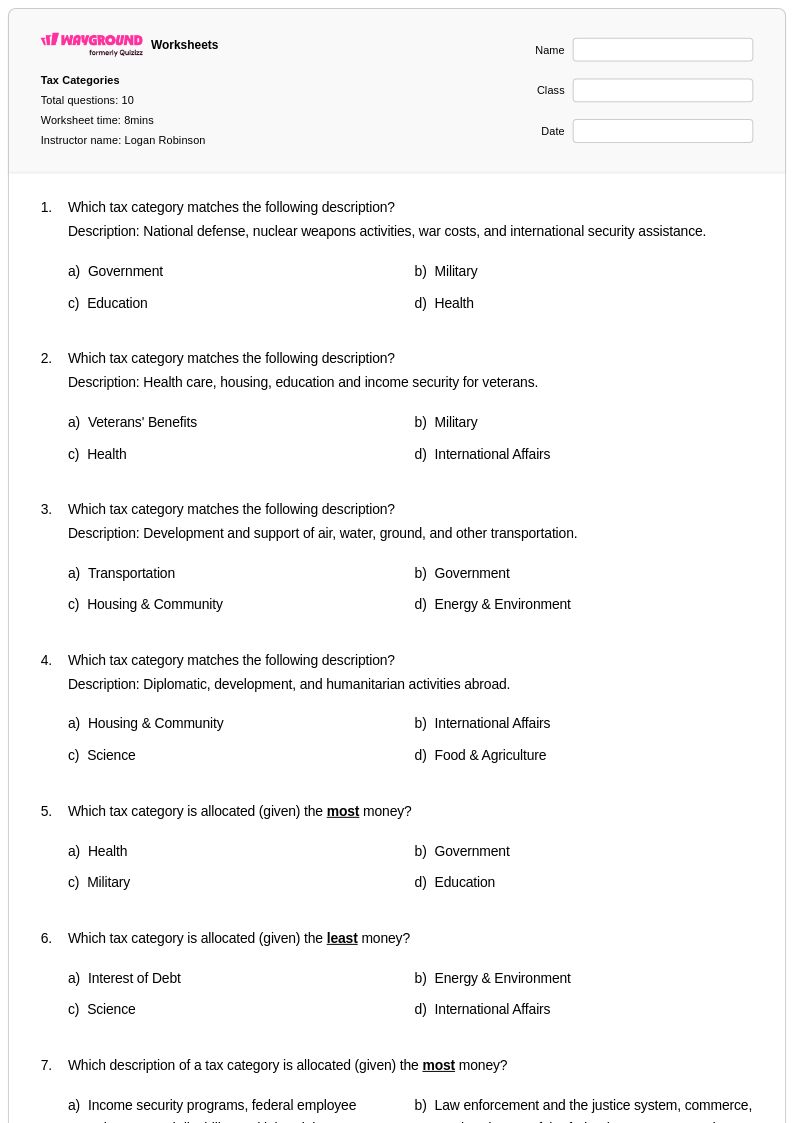

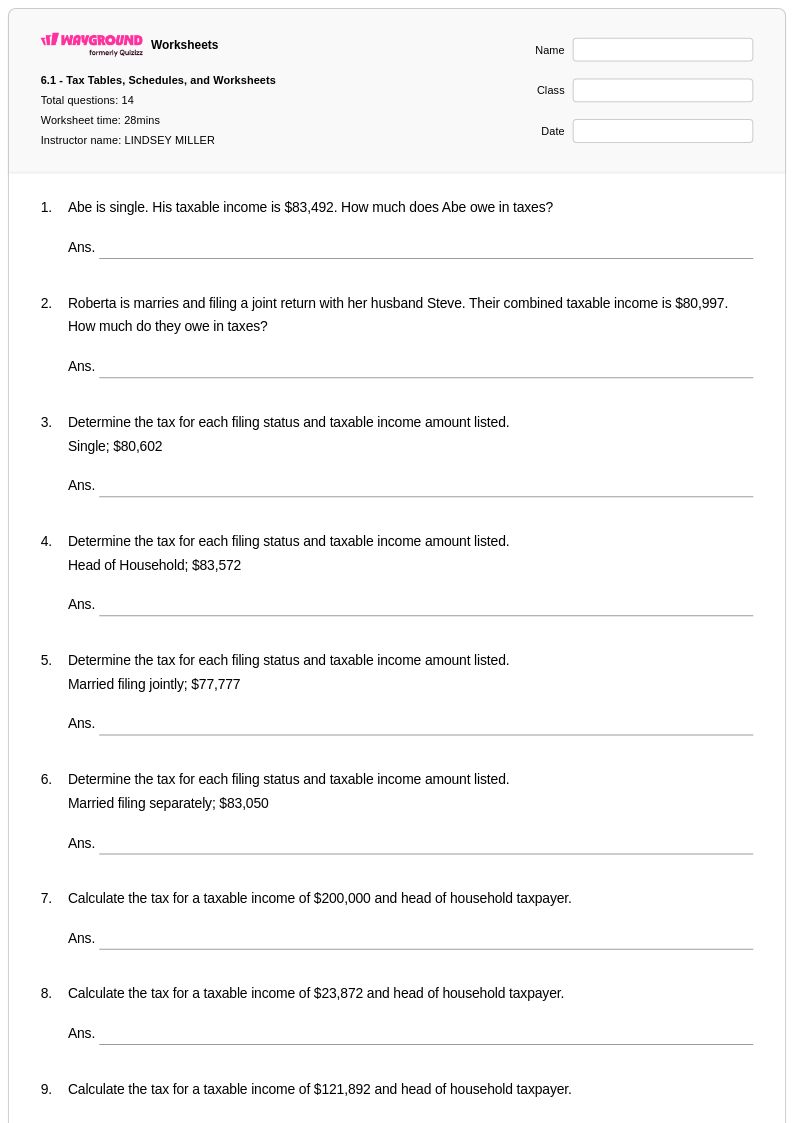

Explore printable Tax Computation worksheets for Year 12

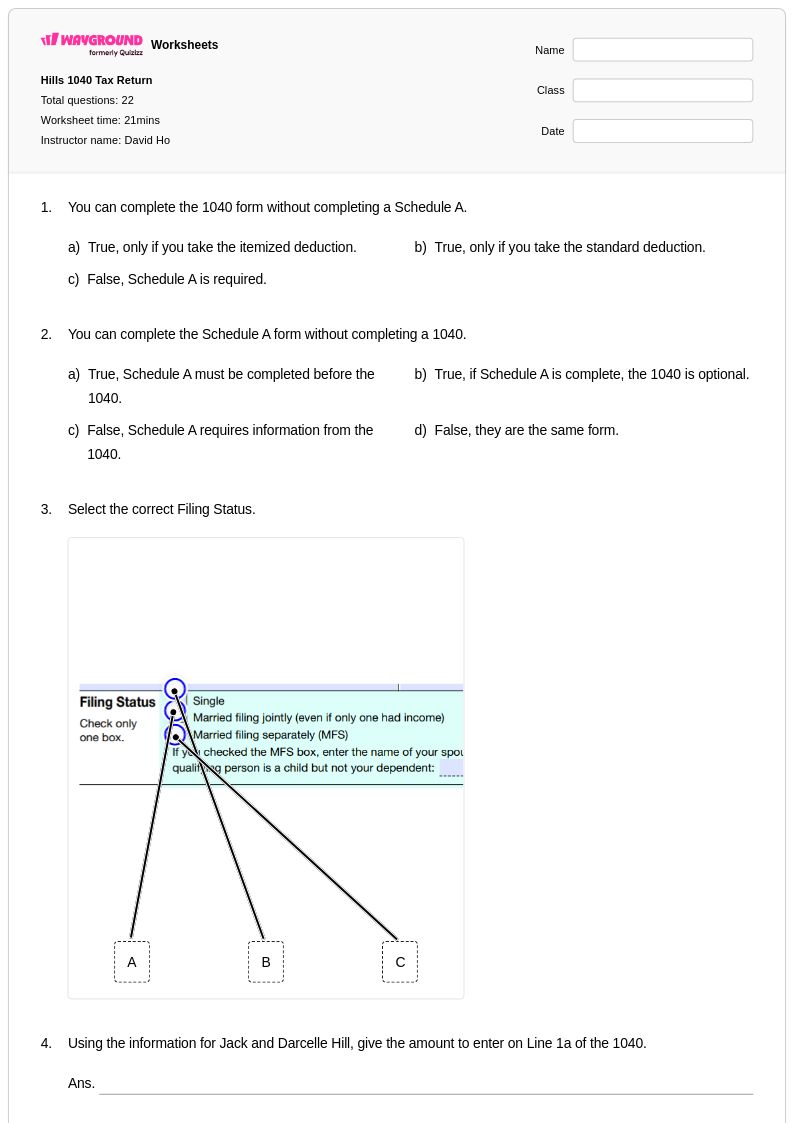

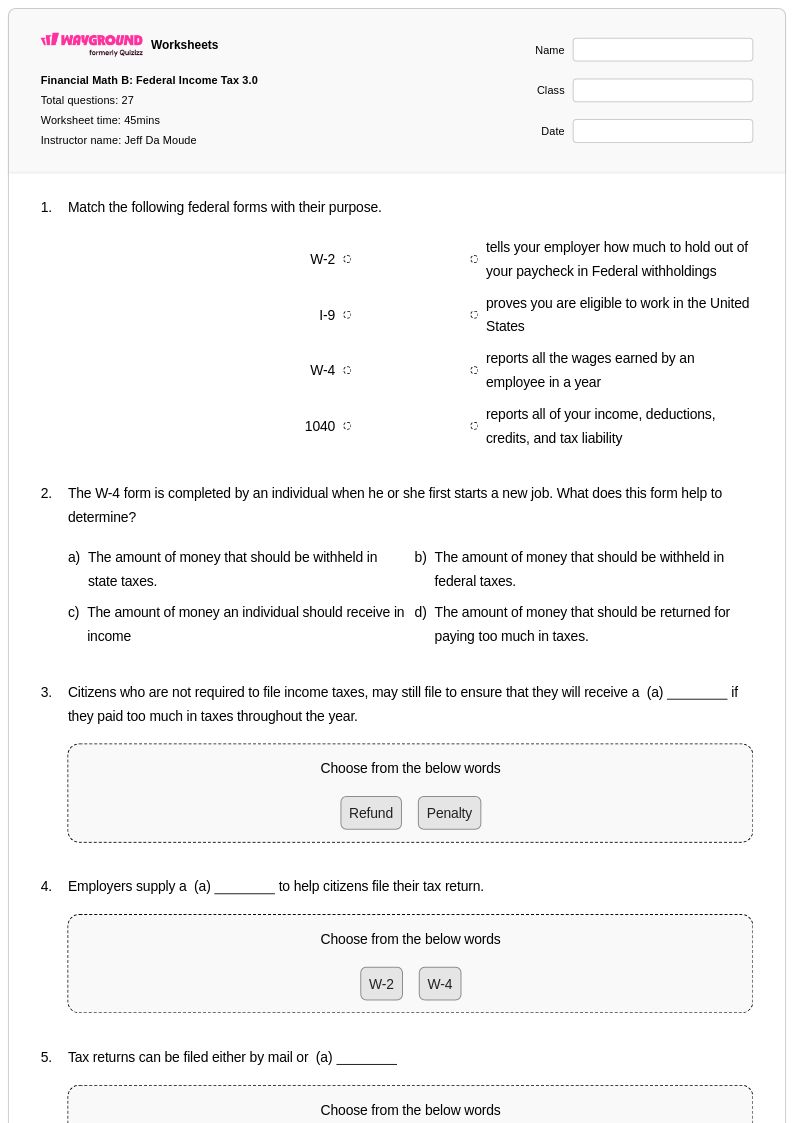

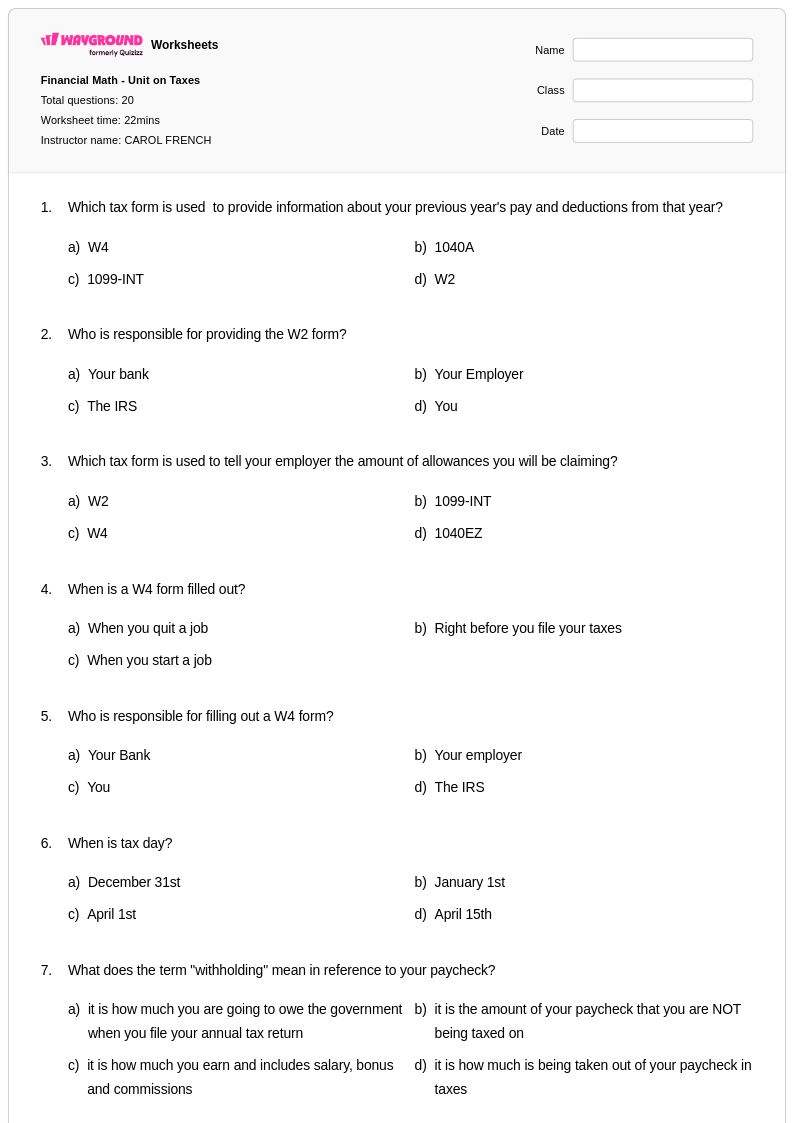

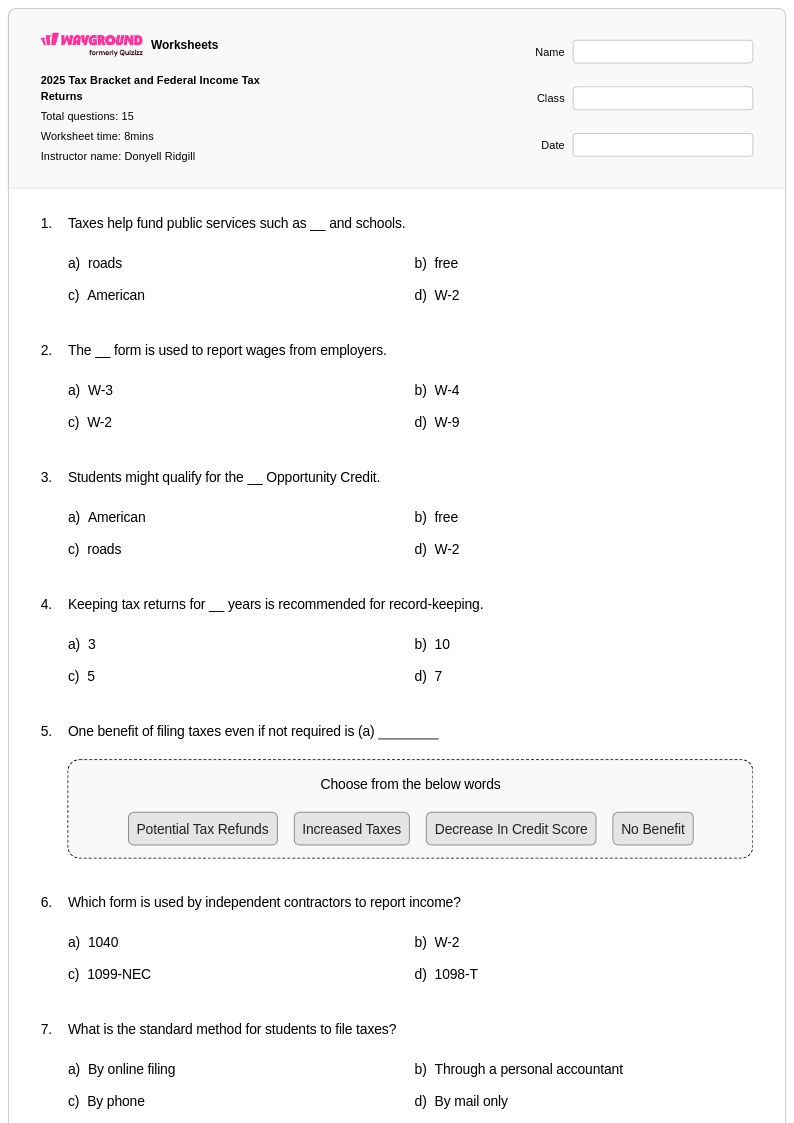

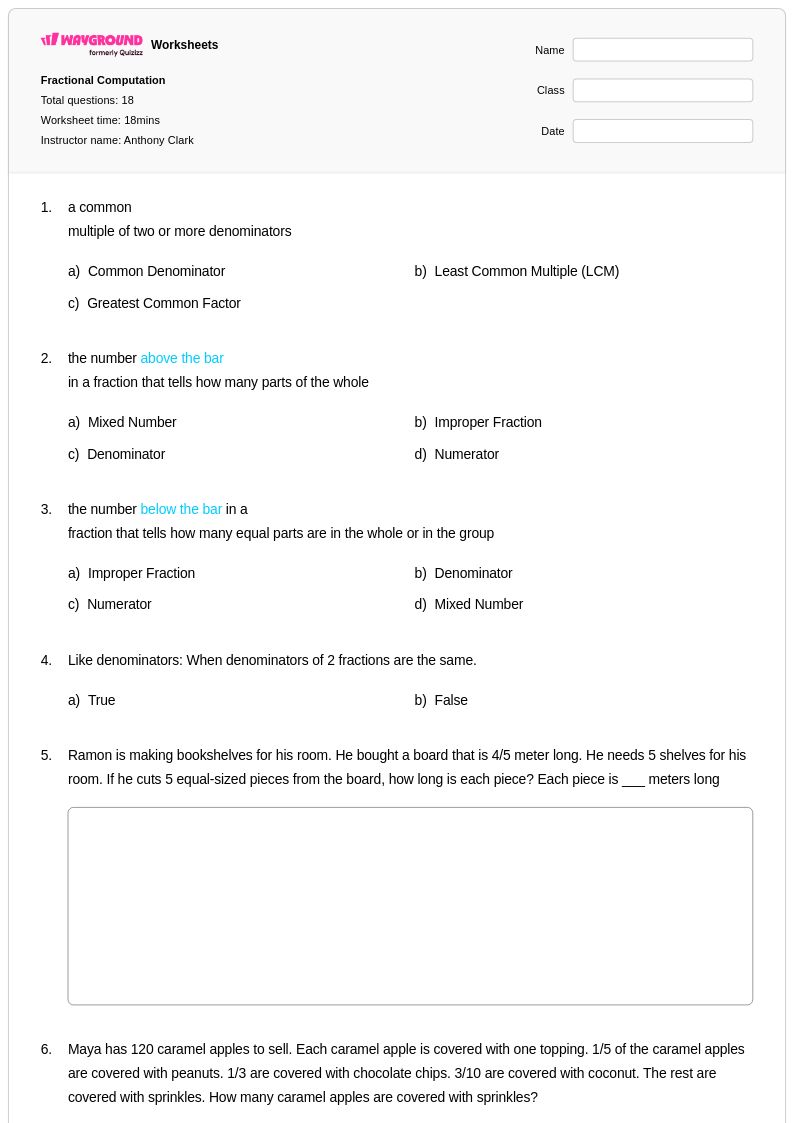

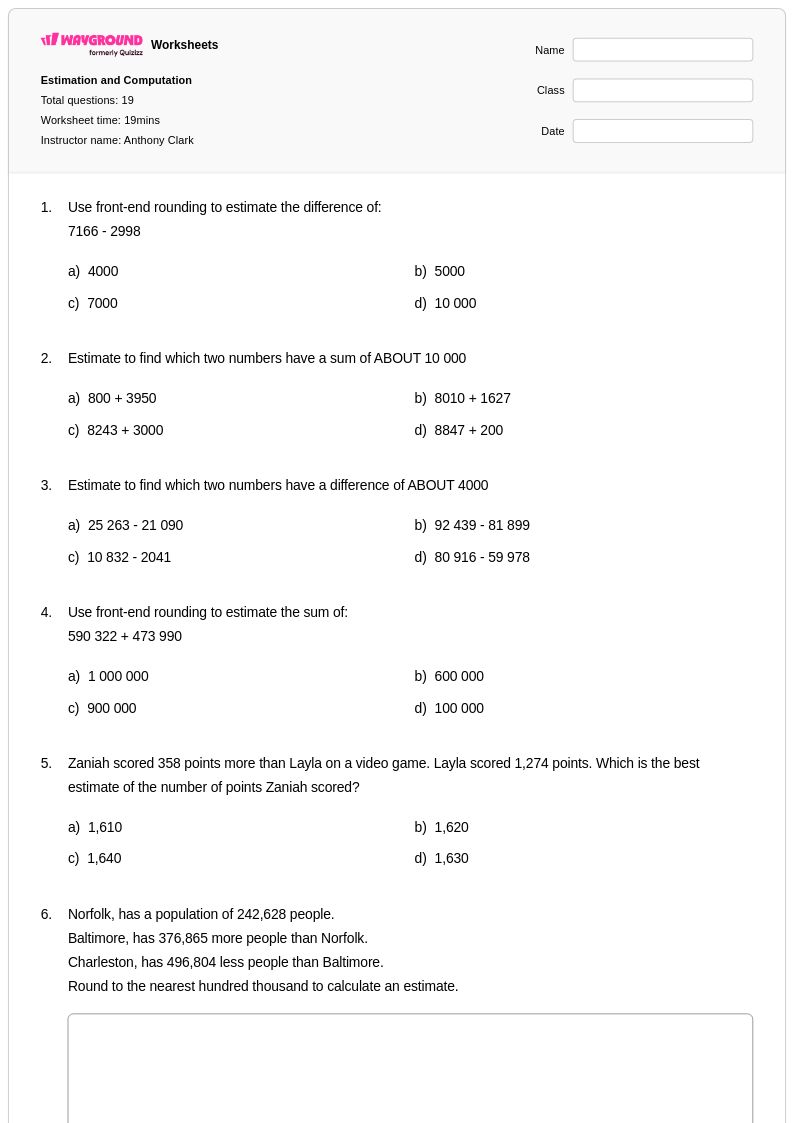

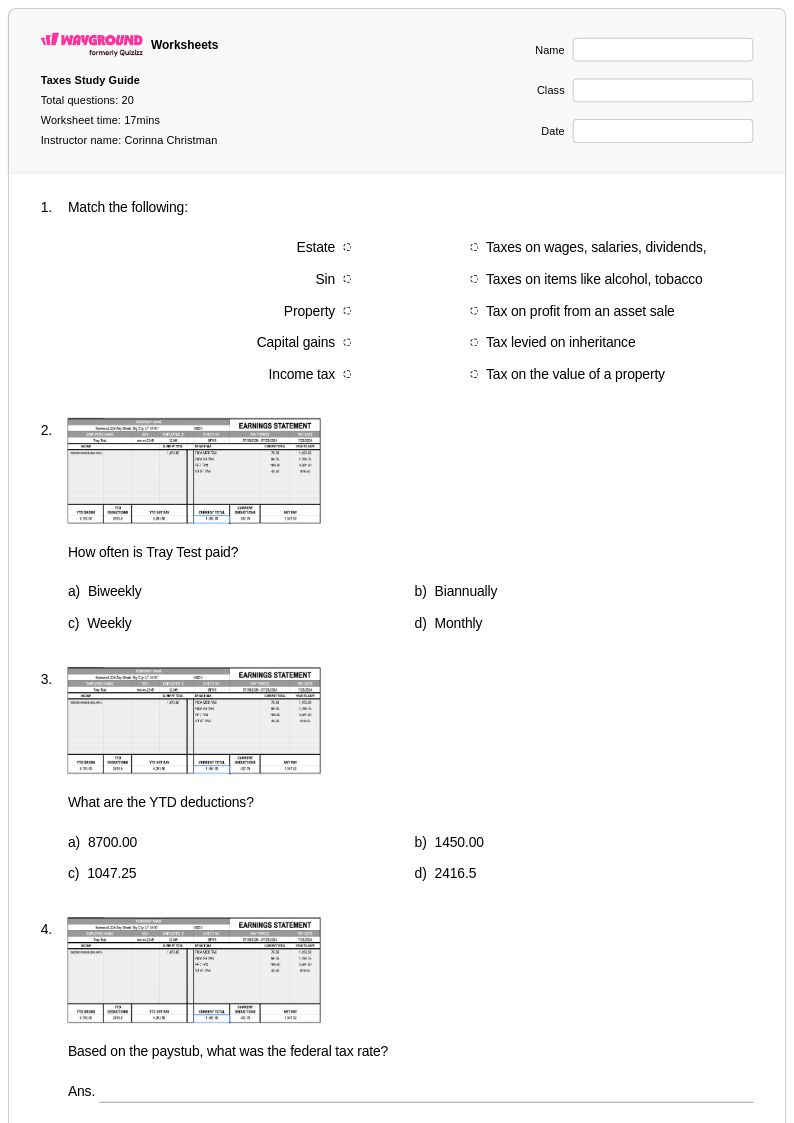

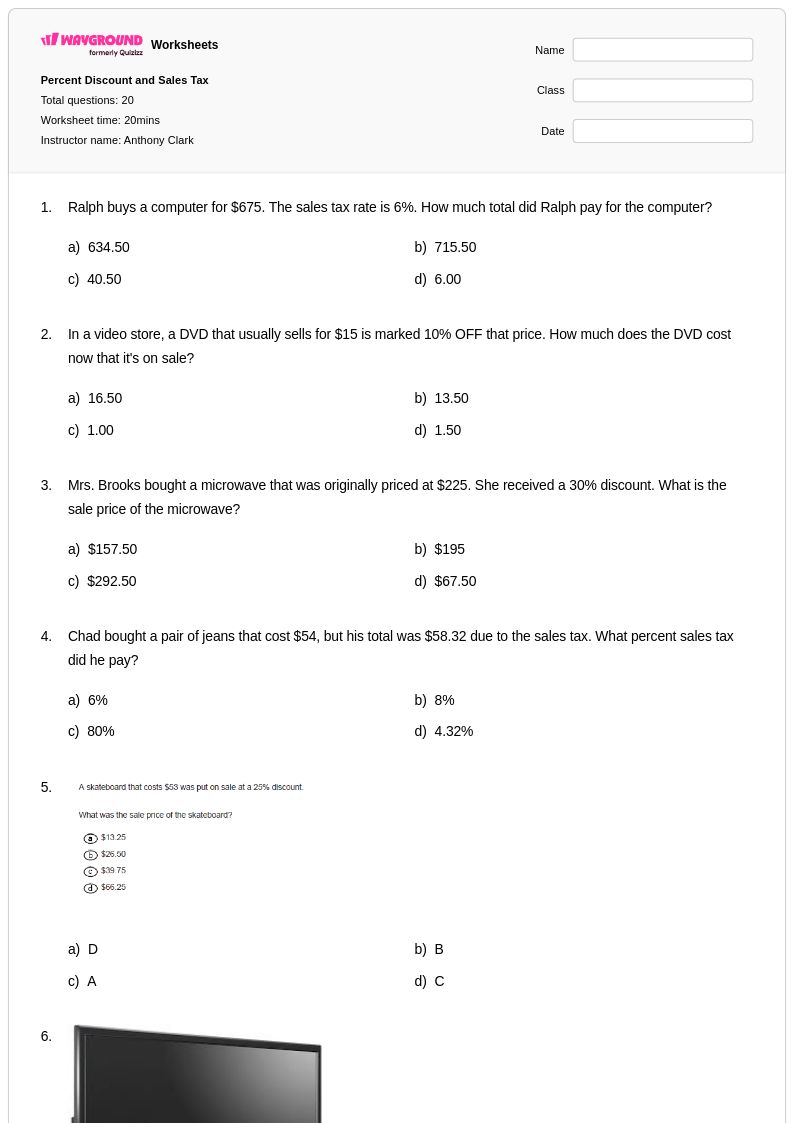

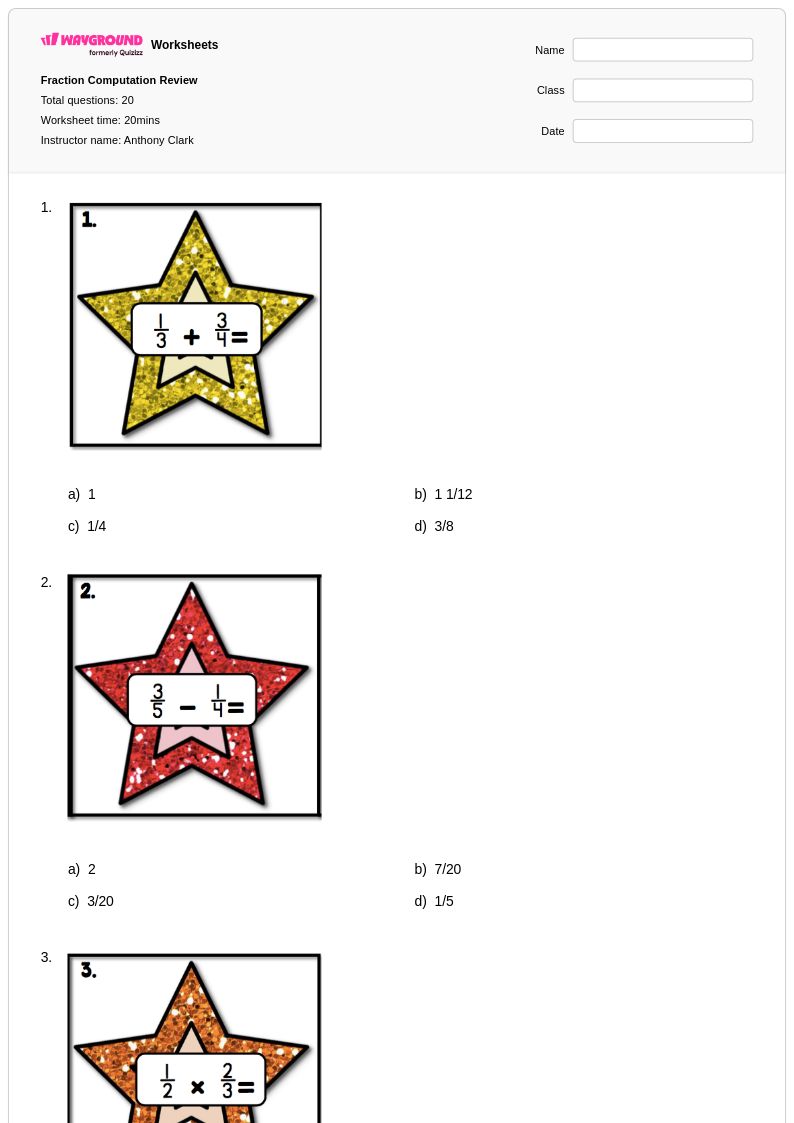

Tax computation worksheets for Year 12 students available through Wayground (formerly Quizizz) provide comprehensive practice with essential tax calculation skills that prepare students for real-world financial responsibilities. These carefully designed resources help students master complex concepts including income tax brackets, deductions, exemptions, tax credits, and various filing scenarios that mirror actual tax preparation processes. Students develop proficiency in calculating gross income, adjusted gross income, taxable income, and final tax liability while working through authentic practice problems that reinforce mathematical precision and financial literacy comprehension. The worksheets include detailed answer keys that enable independent learning and self-assessment, with free printable pdf formats ensuring accessibility for diverse learning environments and study preferences.

Wayground (formerly Quizizz) empowers educators with millions of teacher-created tax computation resources specifically aligned with Year 12 financial literacy standards and curriculum requirements. The platform's robust search and filtering capabilities allow teachers to quickly locate worksheets that match specific learning objectives, whether focusing on federal tax calculations, state tax considerations, or business tax scenarios. Advanced differentiation tools enable instructors to customize complexity levels and problem types to meet individual student needs, supporting both remediation for struggling learners and enrichment opportunities for advanced students. Available in both printable and digital formats, these tax computation materials facilitate flexible lesson planning, targeted skill practice, and comprehensive assessment preparation while ensuring students develop the mathematical competencies and financial understanding necessary for informed citizenship and personal financial management.