12 Q

9th - 12th

16 Q

12th

5 Q

12th

17 Q

12th

10 Q

12th

22 Q

12th

15 Q

12th - Uni

15 Q

12th - Uni

10 Q

12th

15 Q

12th - Uni

10 Q

9th - 12th

15 Q

7th - Uni

15 Q

12th

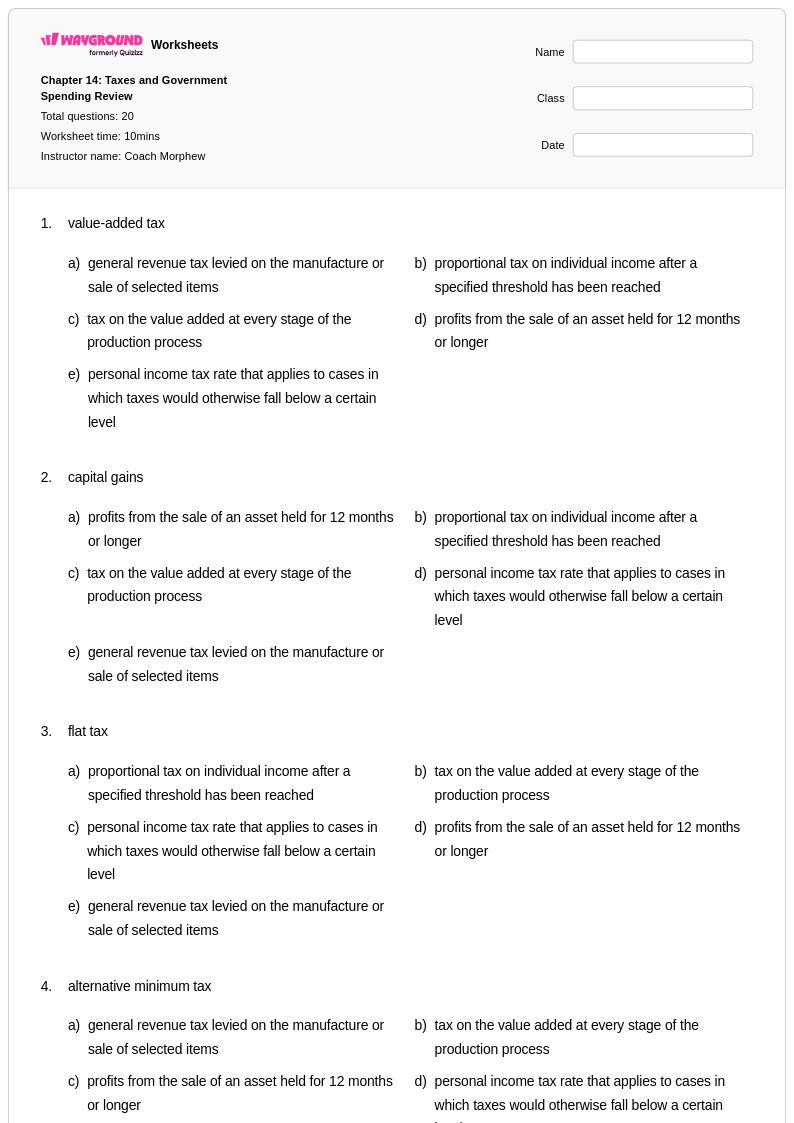

20 Q

12th

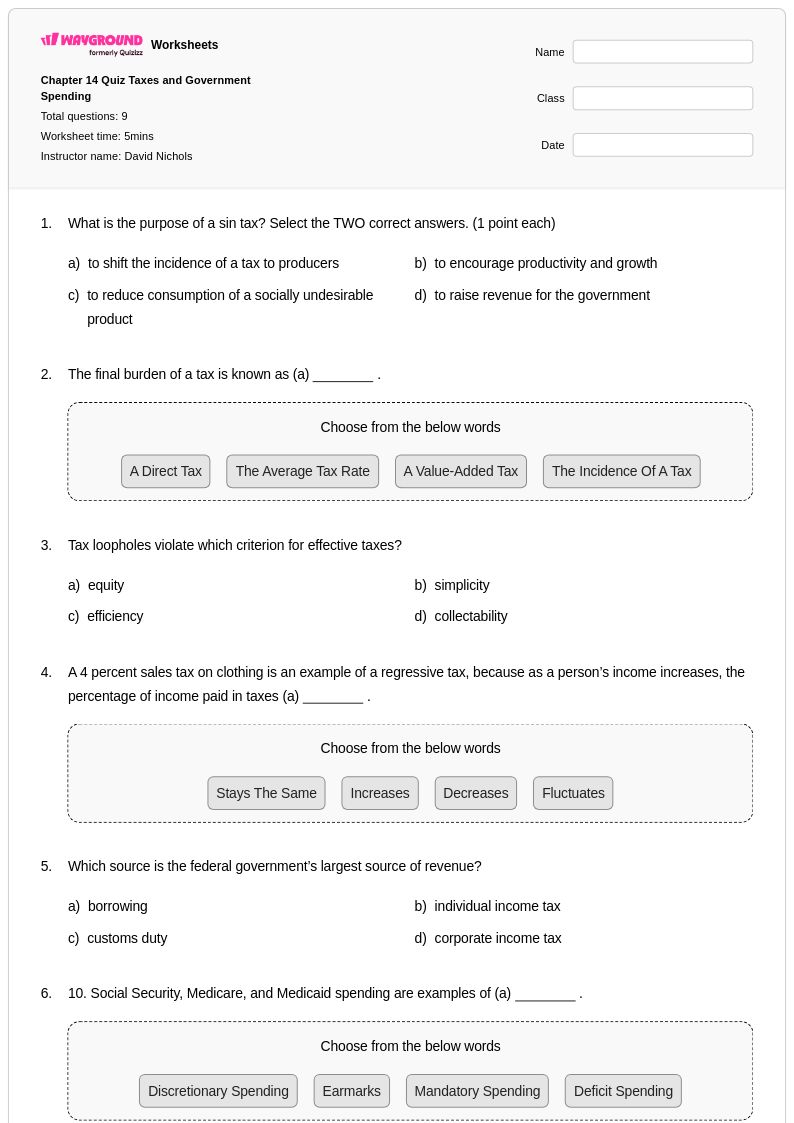

9 Q

12th

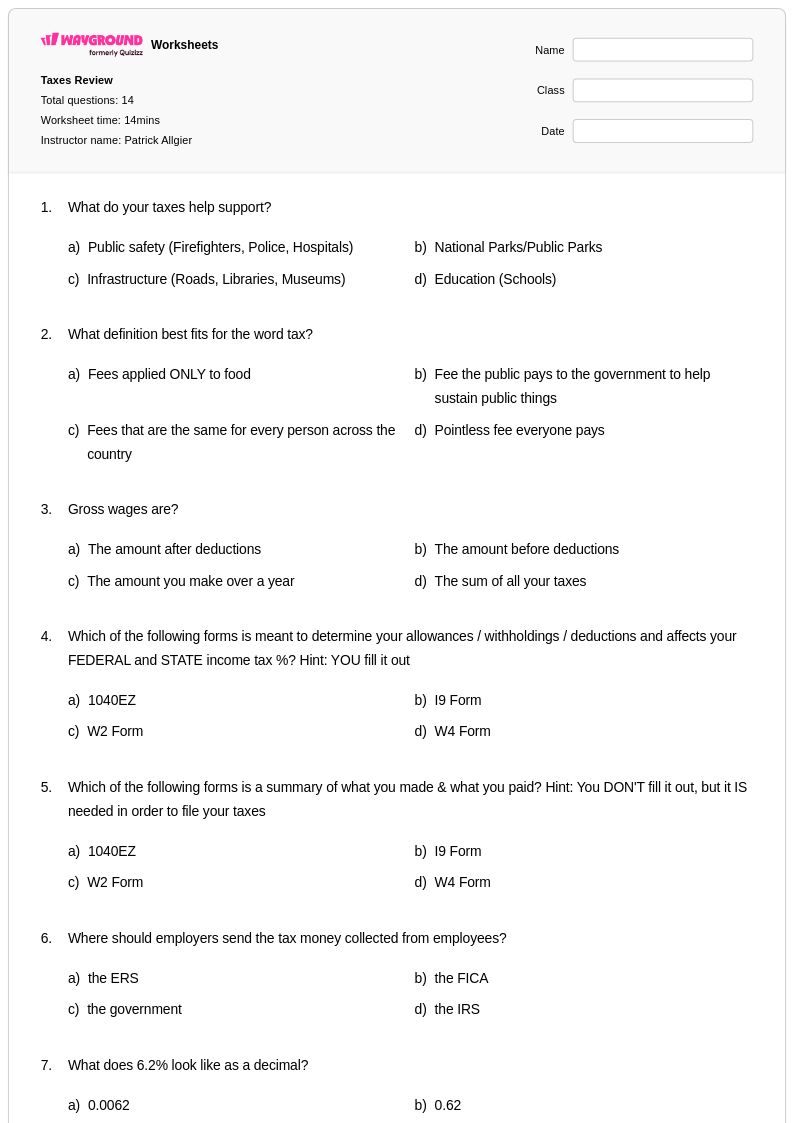

14 Q

12th

25 Q

12th - Uni

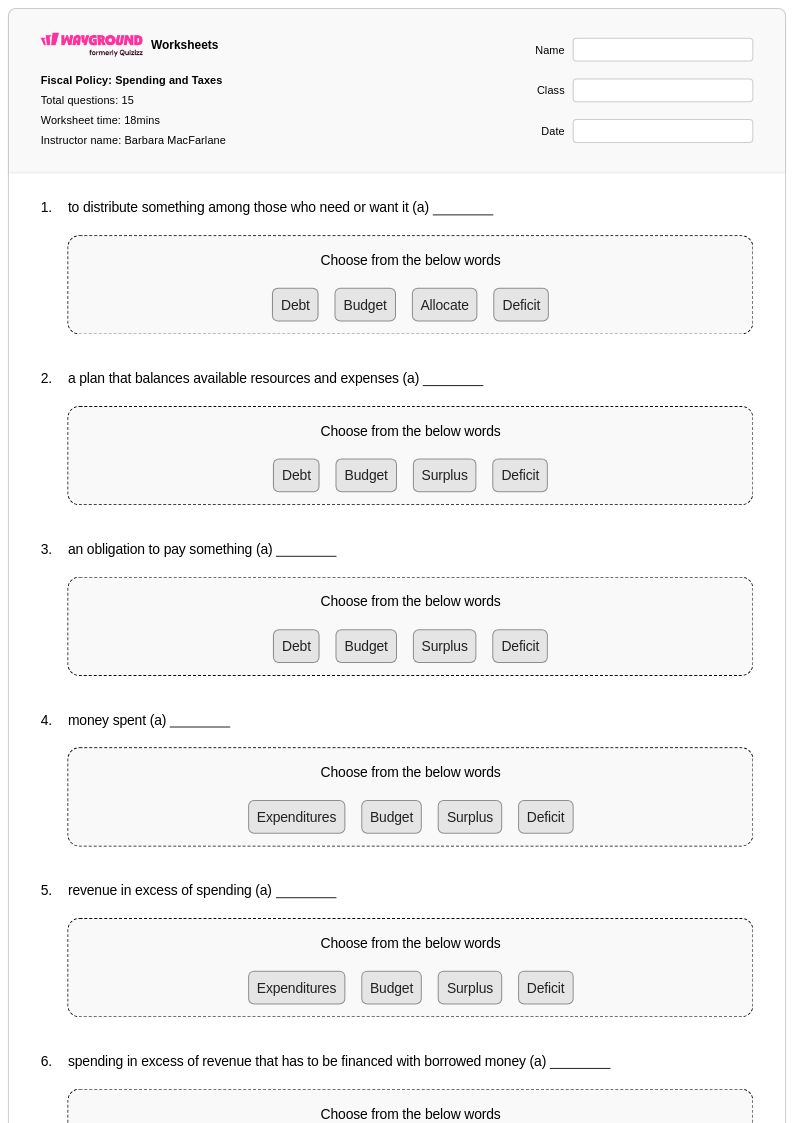

18 Q

9th - 12th

20 Q

12th

110 Q

12th

37 Q

12th - Uni

15 Q

12th - Uni

25 Q

9th - 12th

Explore Other Subject Worksheets for year 12

Explore printable Federal Tax worksheets for Year 12

Federal tax worksheets for Year 12 students available through Wayground (formerly Quizizz) provide comprehensive practice with the complexities of the United States tax system that graduating seniors will soon encounter as independent taxpayers. These carefully designed worksheets strengthen critical skills including calculating federal income tax liability, understanding progressive tax brackets, analyzing deductions and exemptions, and interpreting tax forms such as the 1040. Students engage with realistic practice problems that mirror actual tax scenarios, working through calculations involving standard and itemized deductions, earned income credit, and various filing statuses. Each worksheet includes detailed answer keys that allow students to verify their understanding of federal tax concepts, while the free printable format ensures accessibility for both classroom instruction and independent study.

Wayground (formerly Quizizz) supports educators with an extensive collection of teacher-created federal tax resources that streamline lesson planning and enhance student learning outcomes. The platform's millions of high-quality worksheets offer robust search and filtering capabilities, enabling teachers to quickly locate materials aligned with specific curriculum standards and learning objectives. These differentiation tools allow instructors to customize worksheets based on individual student needs, providing targeted remediation for struggling learners while offering enrichment opportunities for advanced students. Available in both printable PDF format and interactive digital versions, these federal tax worksheets facilitate flexible classroom implementation, whether teachers need structured skill practice during direct instruction, homework assignments that reinforce classroom learning, or assessment tools that measure student mastery of complex tax calculations and concepts.