12 Q

9th - 12th

45 Q

11th

48 Q

9th - 12th

20 Q

11th - 12th

18 Q

9th - 12th

12 Q

9th - 12th

16 Q

9th - 12th

38 Q

9th - 12th

15 Q

11th

18 Q

8th - 12th

10 Q

9th - 12th

20 Q

11th

56 Q

9th - 12th

12 Q

11th

16 Q

9th - 12th

52 Q

11th

24 Q

9th - 12th

55 Q

9th - 12th

15 Q

11th

16 Q

10th - 12th

20 Q

9th - 12th

34 Q

9th - 12th

5 Q

9th - 12th

30 Q

9th - 12th

Explore Other Subject Worksheets for year 11

Explore printable Taxable Income worksheets for Year 11

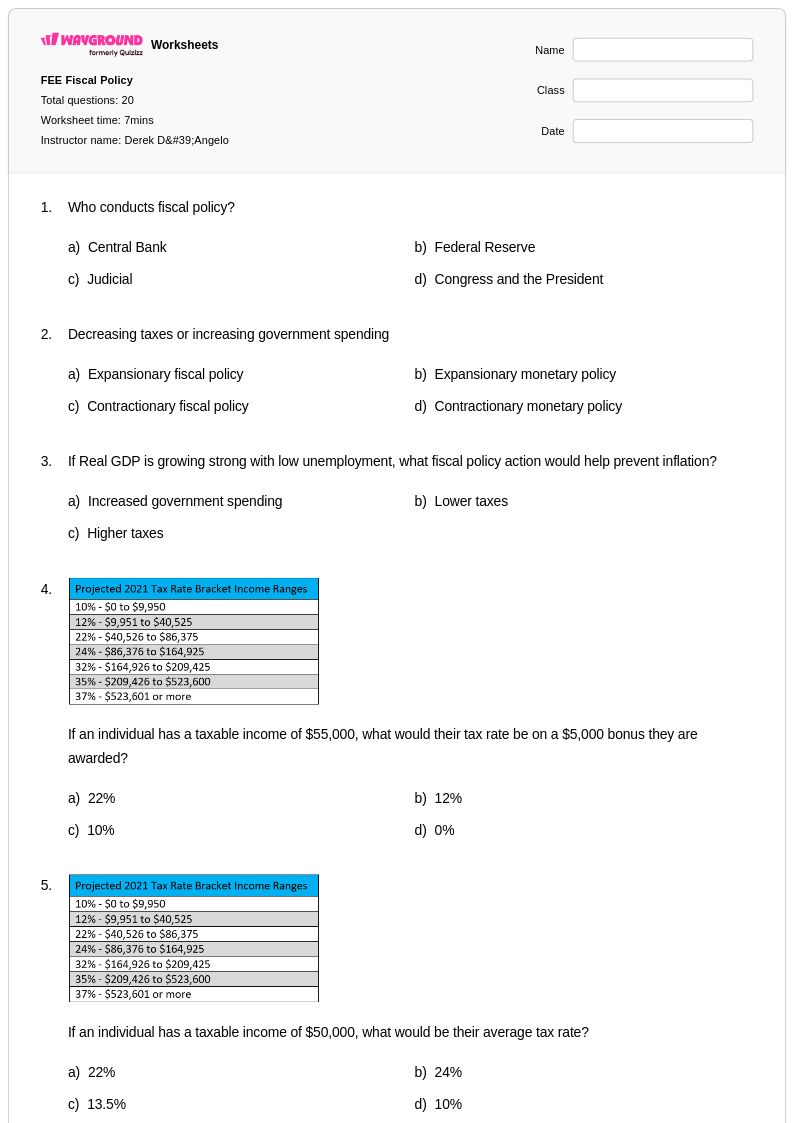

Taxable income worksheets for Year 11 students available through Wayground (formerly Quizizz) provide comprehensive practice in understanding the fundamental concepts of personal taxation and income calculation. These carefully designed resources help students master essential skills including identifying various forms of taxable income, calculating gross and net income, understanding deductions and exemptions, and applying tax brackets to determine tax liability. The worksheets feature realistic scenarios and practice problems that mirror actual tax situations students will encounter as working adults, reinforcing critical financial literacy concepts through hands-on application. Each worksheet collection includes detailed answer keys and is available in convenient pdf format, offering free printables that teachers can easily distribute and customize for classroom use or independent study.

Wayground (formerly Quizizz) supports educators with an extensive library of millions of teacher-created resources specifically focused on taxable income and broader economics education. The platform's robust search and filtering capabilities enable teachers to quickly locate worksheets aligned with Year 11 standards and curriculum requirements, while differentiation tools allow for seamless customization to meet diverse learning needs within the classroom. These resources are available in both printable pdf formats and interactive digital versions, providing maximum flexibility for lesson planning, targeted remediation for struggling students, and enrichment opportunities for advanced learners. The comprehensive collection empowers teachers to deliver focused skill practice that builds students' confidence in understanding tax concepts, preparing them for real-world financial decision-making and civic responsibility.