10 Q

9th - 12th

23 Q

6th - 12th

25 Q

6th - 12th

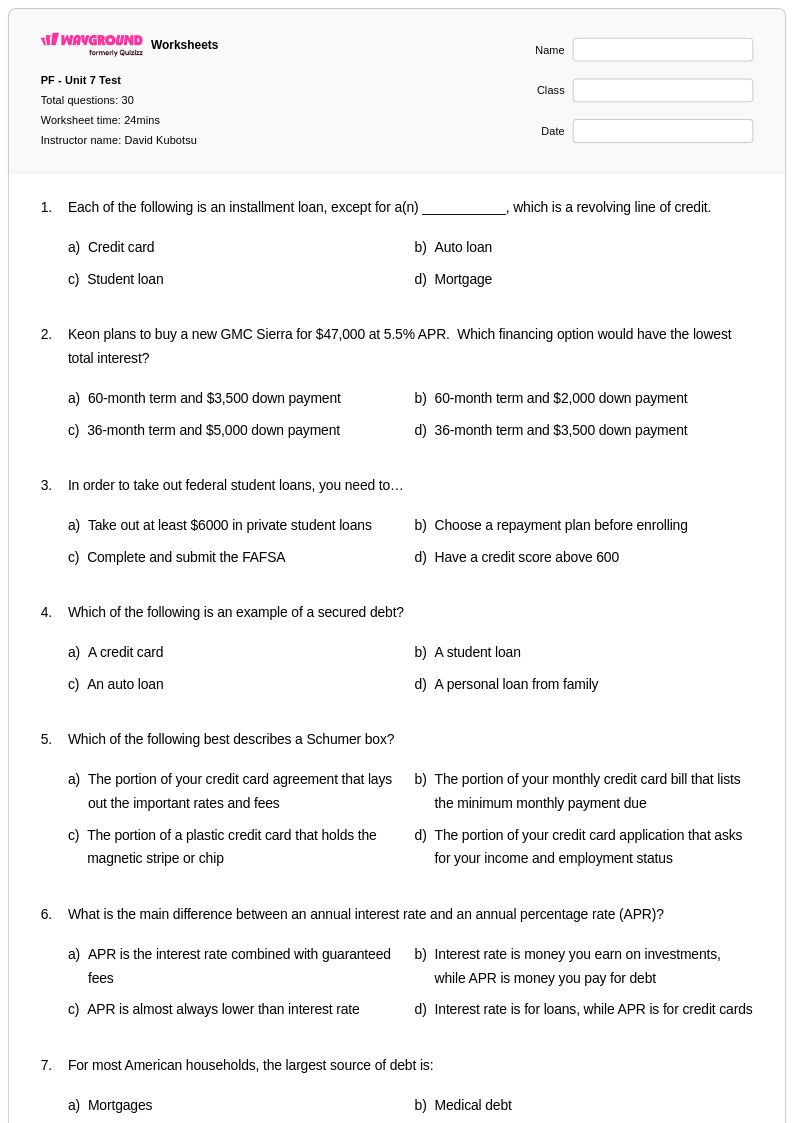

30 Q

9th - 12th

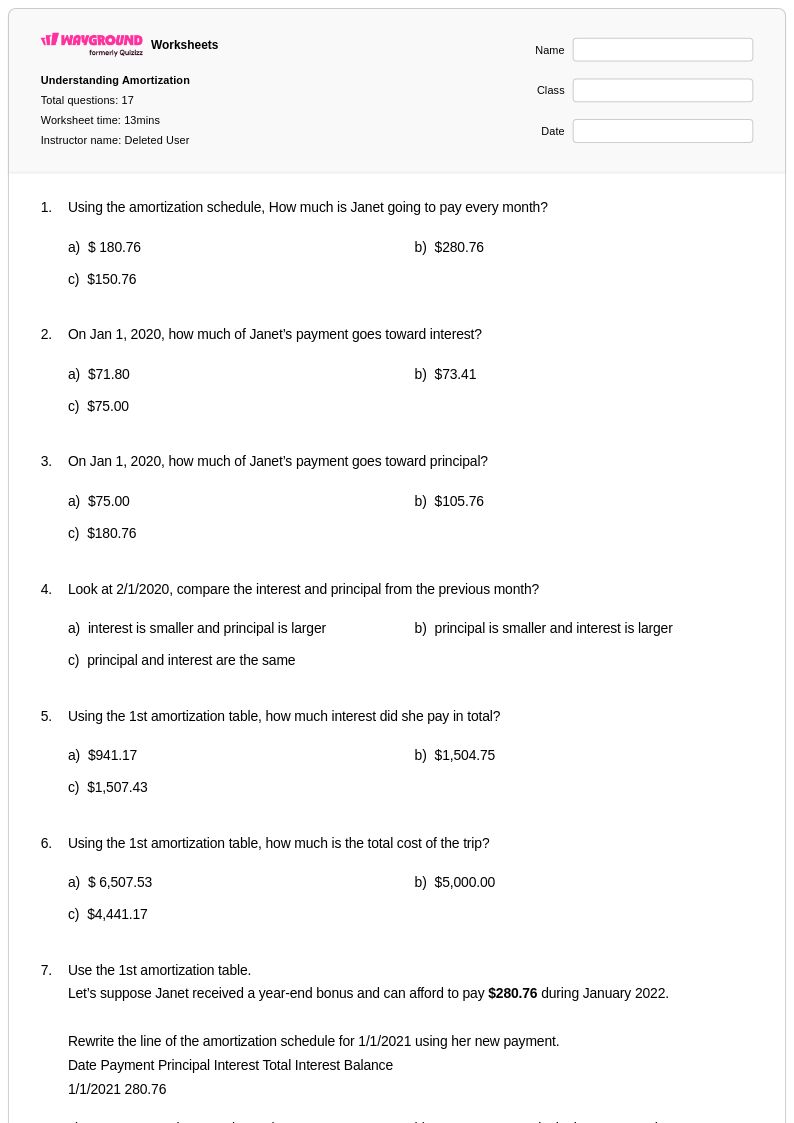

17 Q

9th - 12th

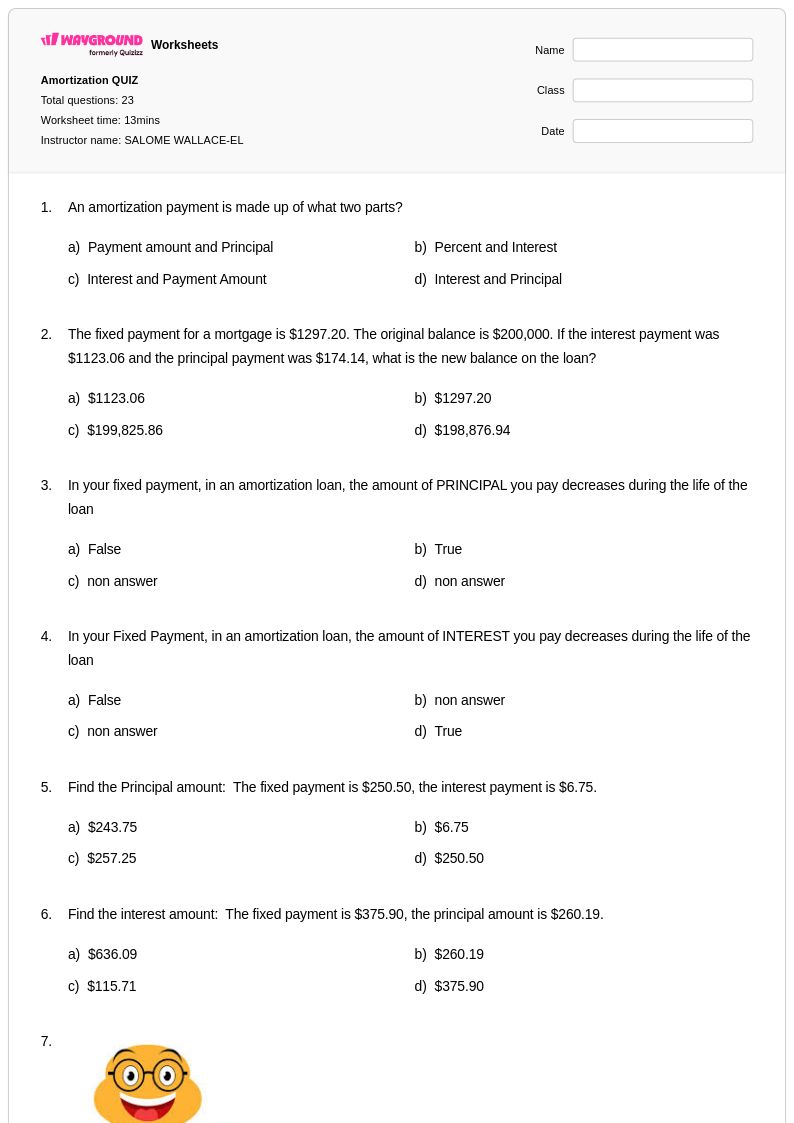

23 Q

6th - 12th

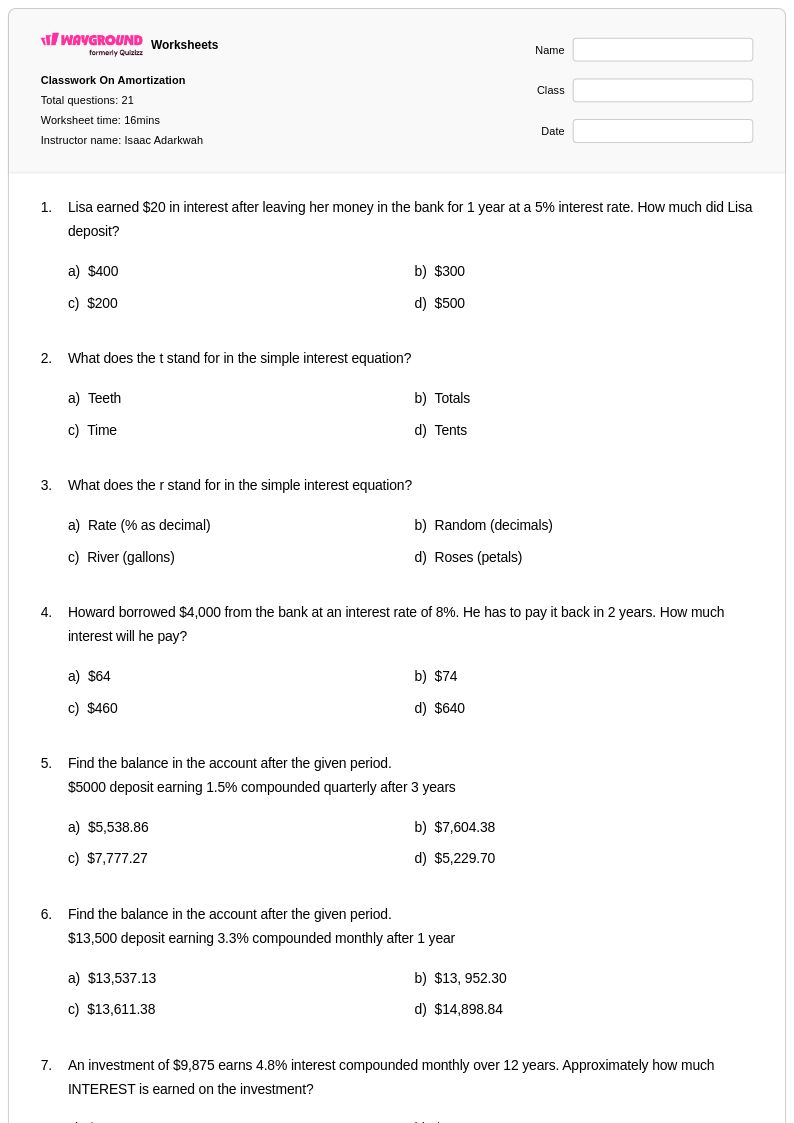

21 Q

9th - 12th

6 Q

9th - 12th

9 Q

KG - Uni

25 Q

9th - 12th

25 Q

6th - 12th

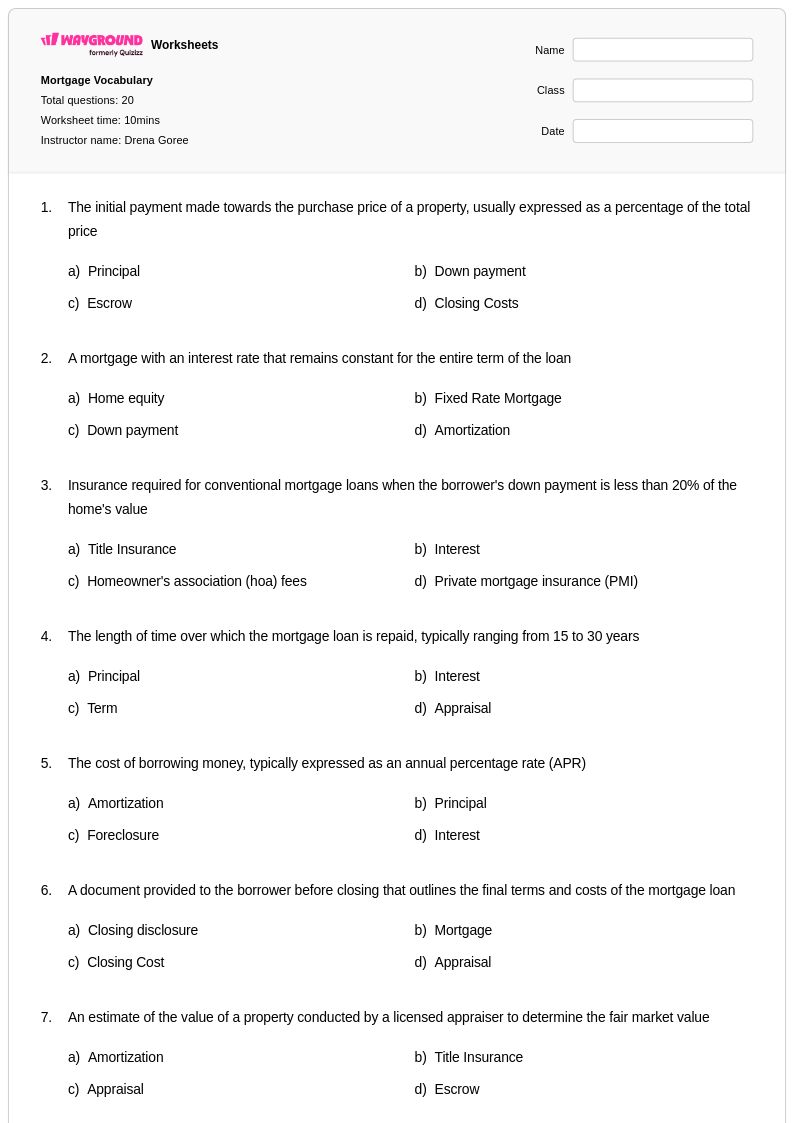

20 Q

9th - 12th

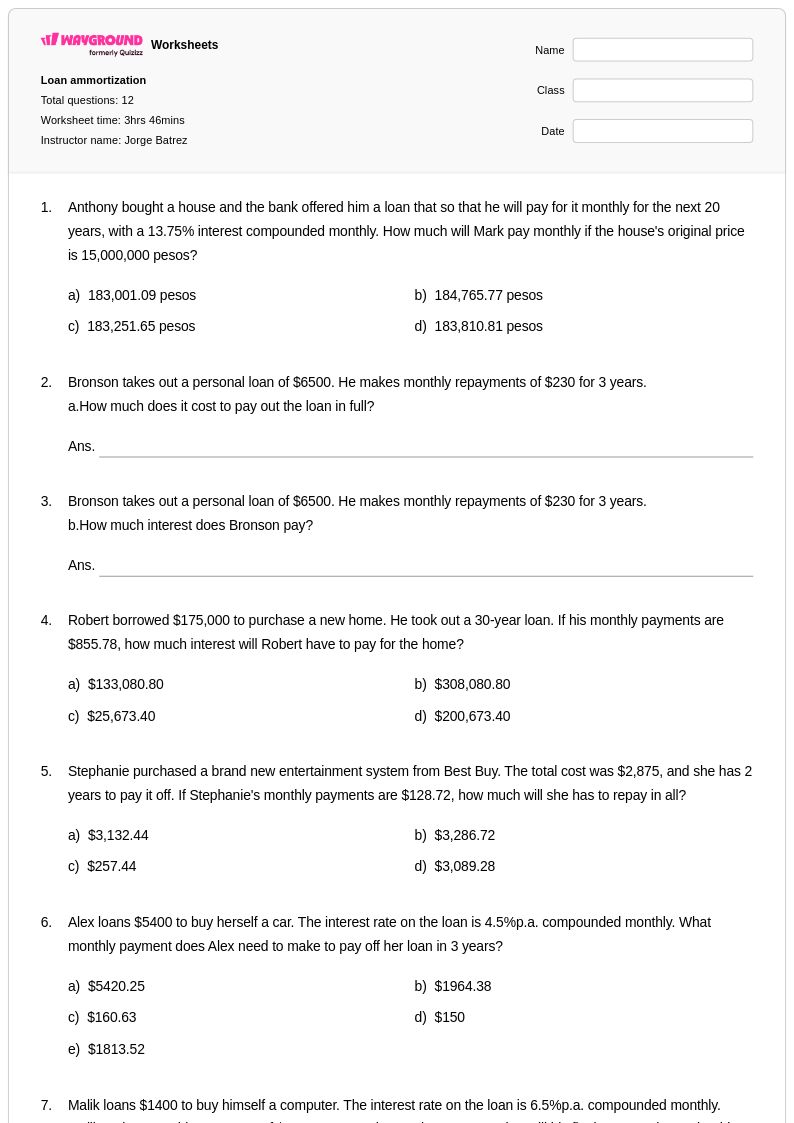

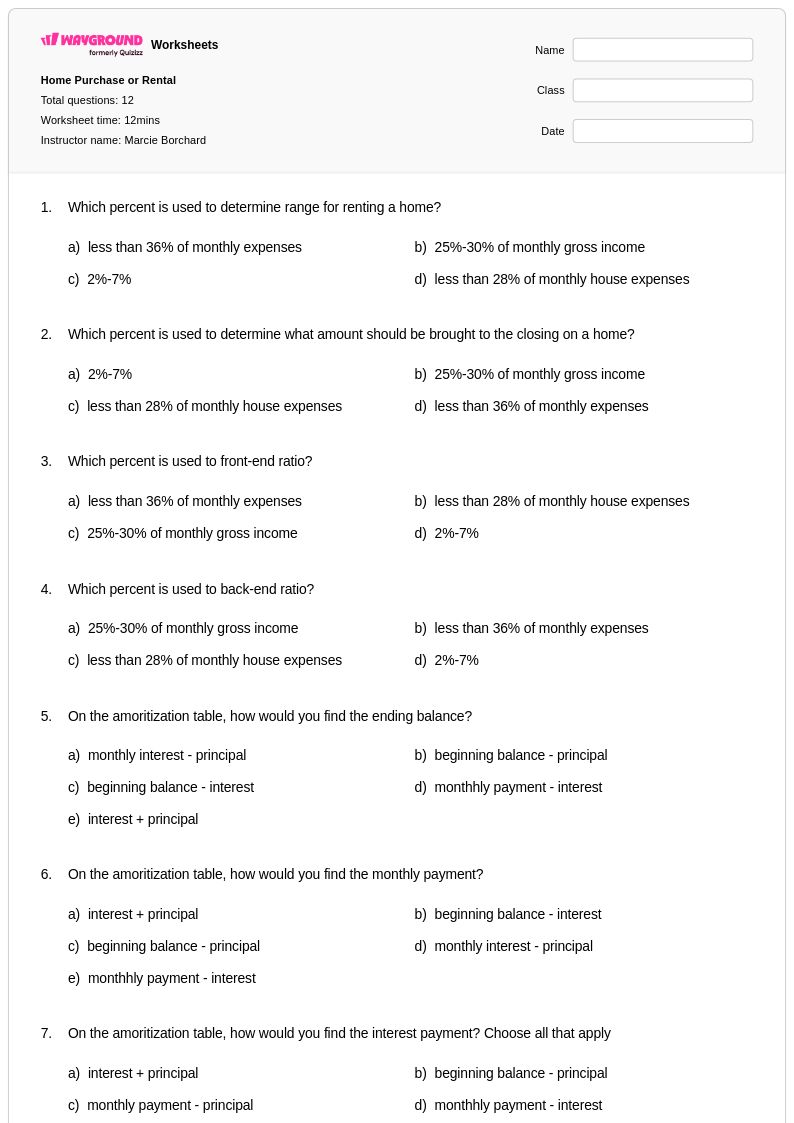

12 Q

9th - 12th

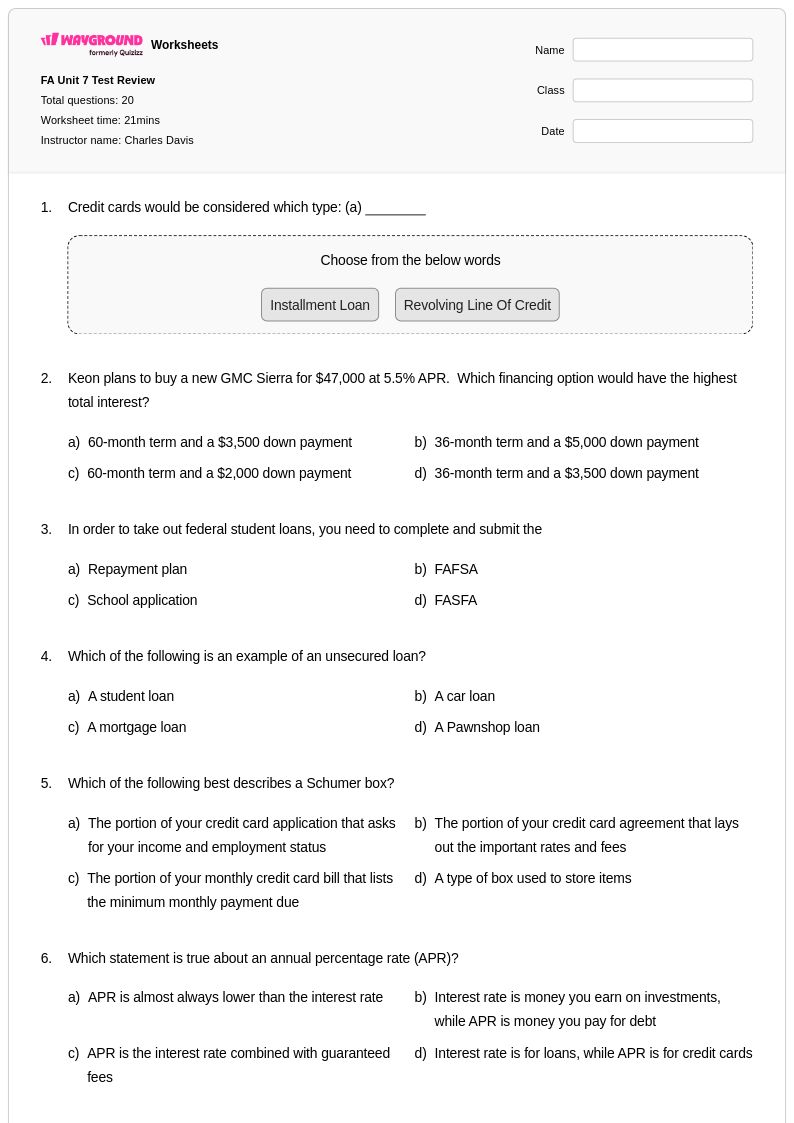

20 Q

9th - 12th

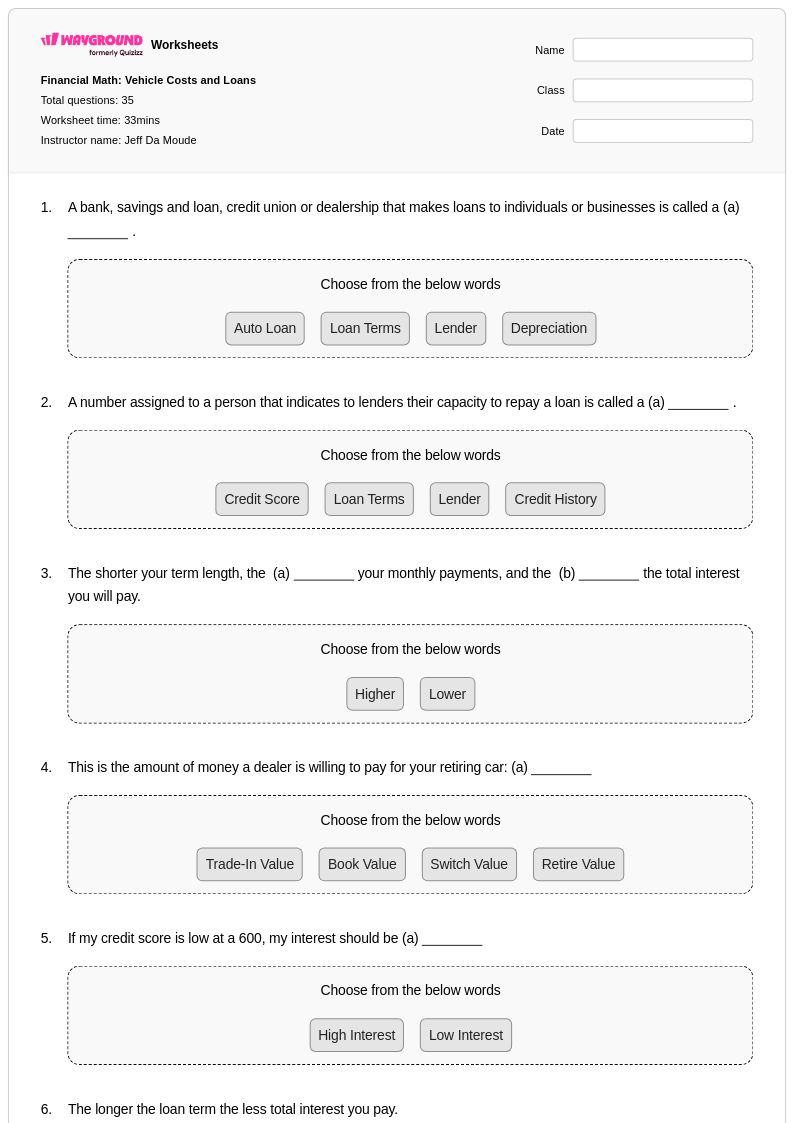

35 Q

9th - 12th

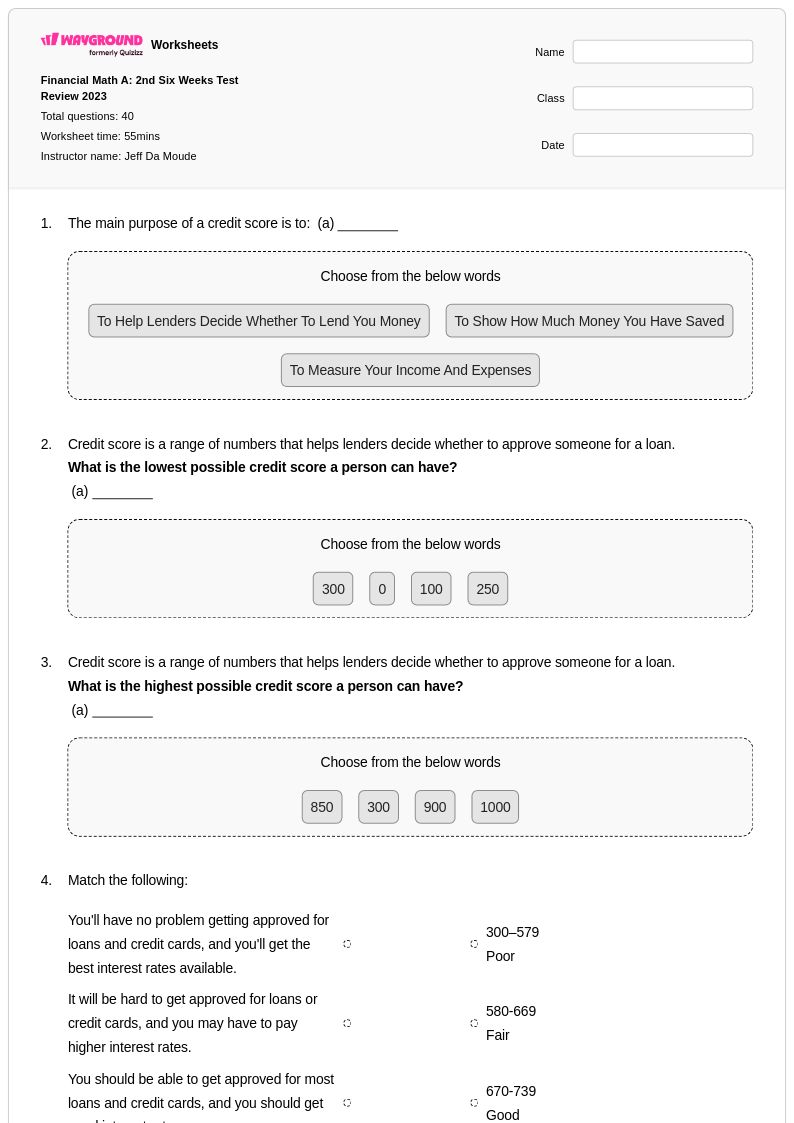

40 Q

9th - 12th

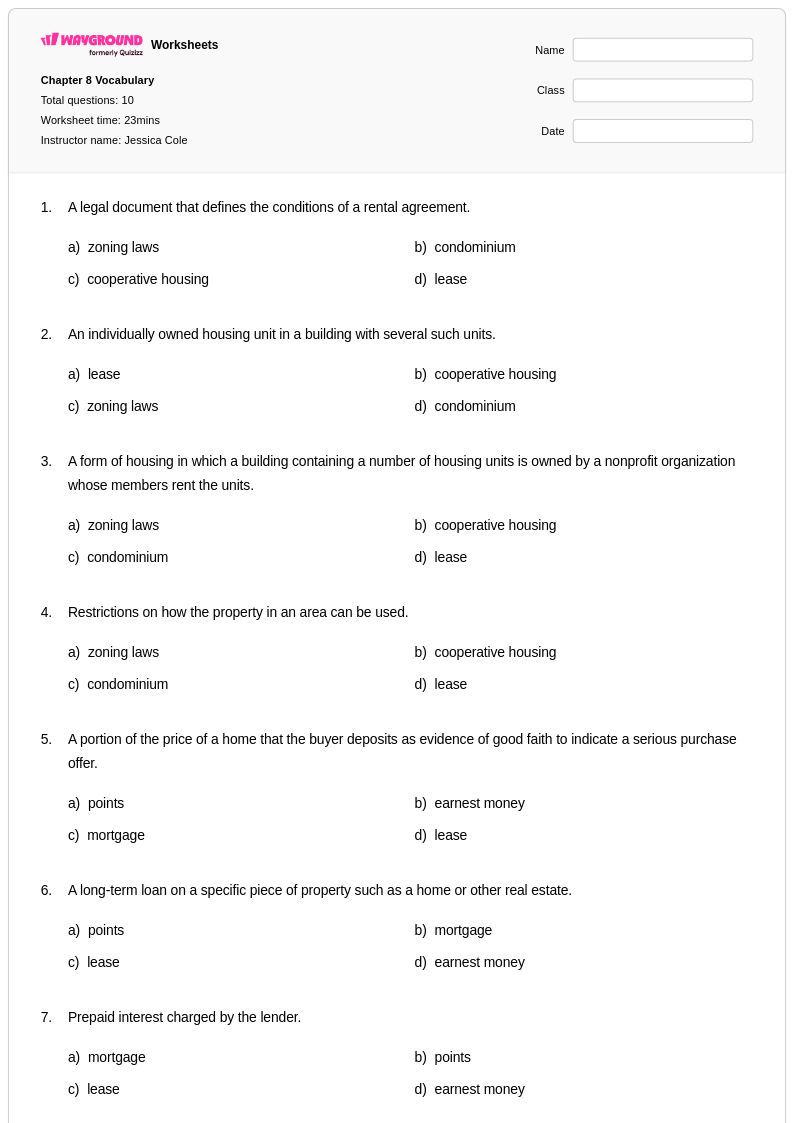

10 Q

9th - 12th

45 Q

9th - 12th

34 Q

9th - 12th

25 Q

9th - 12th

20 Q

9th - 12th

30 Q

9th - 12th

12 Q

9th - 12th

10 Q

9th - 12th

Explore Other Subject Worksheets for class 9

Explore printable Amortization worksheets for Class 9

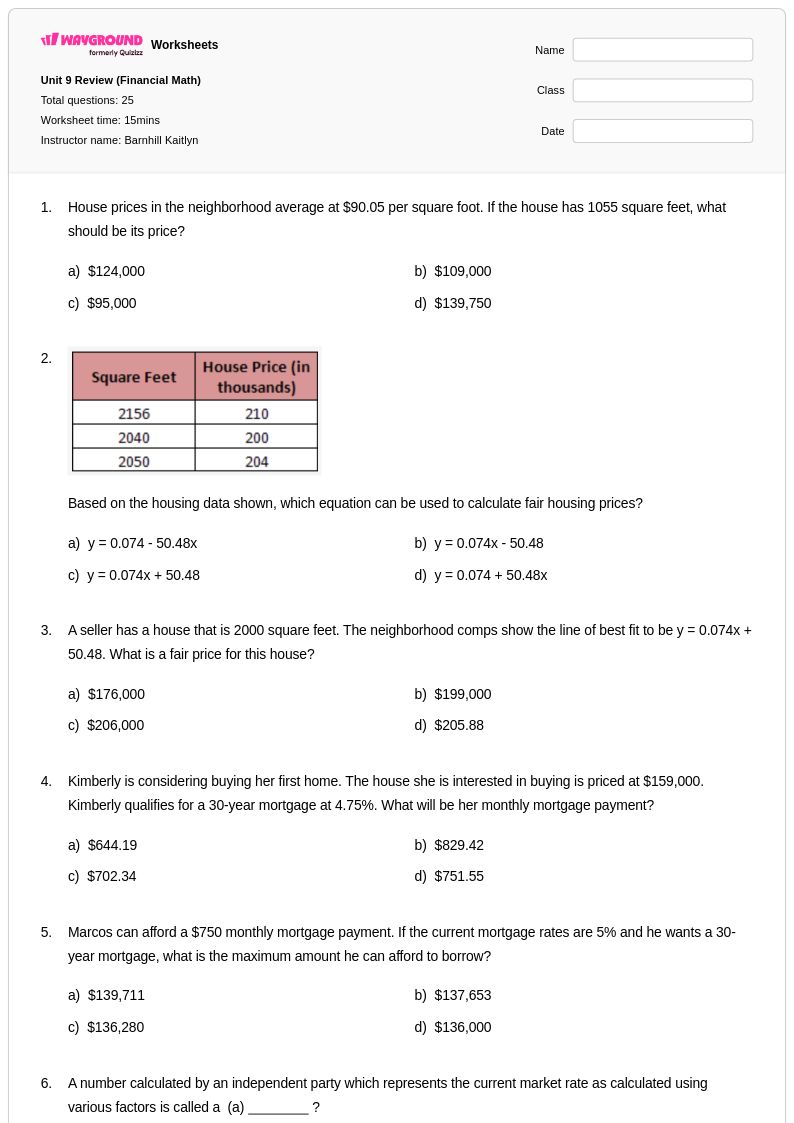

Amortization worksheets for Class 9 students available through Wayground (formerly Quizizz) provide comprehensive practice in understanding how loans and mortgages are systematically paid down over time through regular payments. These educational resources strengthen critical financial literacy skills by teaching students to calculate monthly payment amounts, determine interest versus principal portions of payments, and analyze how different loan terms affect total interest paid over the life of a loan. Students work through practice problems that simulate real-world scenarios involving car loans, student loans, and home mortgages, developing the mathematical reasoning needed to make informed borrowing decisions. Each worksheet includes detailed answer keys that guide students through the step-by-step process of creating amortization schedules, while free printable pdf versions ensure accessibility for diverse learning environments and allow for repeated practice of these essential personal finance calculations.

Wayground (formerly Quizizz) empowers educators with millions of teacher-created amortization worksheet resources that support comprehensive Class 9 financial literacy instruction through robust search and filtering capabilities aligned with mathematical and financial education standards. Teachers can easily differentiate instruction by selecting worksheets that match varying skill levels, from basic loan payment calculations to complex amortization schedule analysis, while flexible customization tools allow for modification of interest rates, loan amounts, and payment frequencies to reflect current market conditions. The platform's availability in both printable and digital pdf formats facilitates seamless integration into classroom instruction, homework assignments, and independent study sessions, enabling educators to provide targeted remediation for struggling learners and enrichment opportunities for advanced students ready to explore sophisticated financial modeling concepts that prepare them for real-world financial decision-making.