20 Q

9th - 12th

23 Q

9th - 12th

30 Q

9th - 12th

37 Q

9th - 12th

15 Q

9th - 12th

20 Q

9th

21 Q

9th - 12th

22 Q

9th - 12th

23 Q

7th - Uni

22 Q

9th - 12th

40 Q

9th - 12th

23 Q

9th - 12th

26 Q

7th - 9th

30 Q

9th - 12th

56 Q

9th - 12th

19 Q

9th

40 Q

9th - 12th

37 Q

9th - 12th

25 Q

7th - Uni

54 Q

9th - 12th

15 Q

9th - 10th

16 Q

9th

8 Q

7th - 9th

21 Q

9th

Explore Income and Expenses Worksheets by Grades

Explore Other Subject Worksheets for class 9

Explore printable Income and Expenses worksheets for Class 9

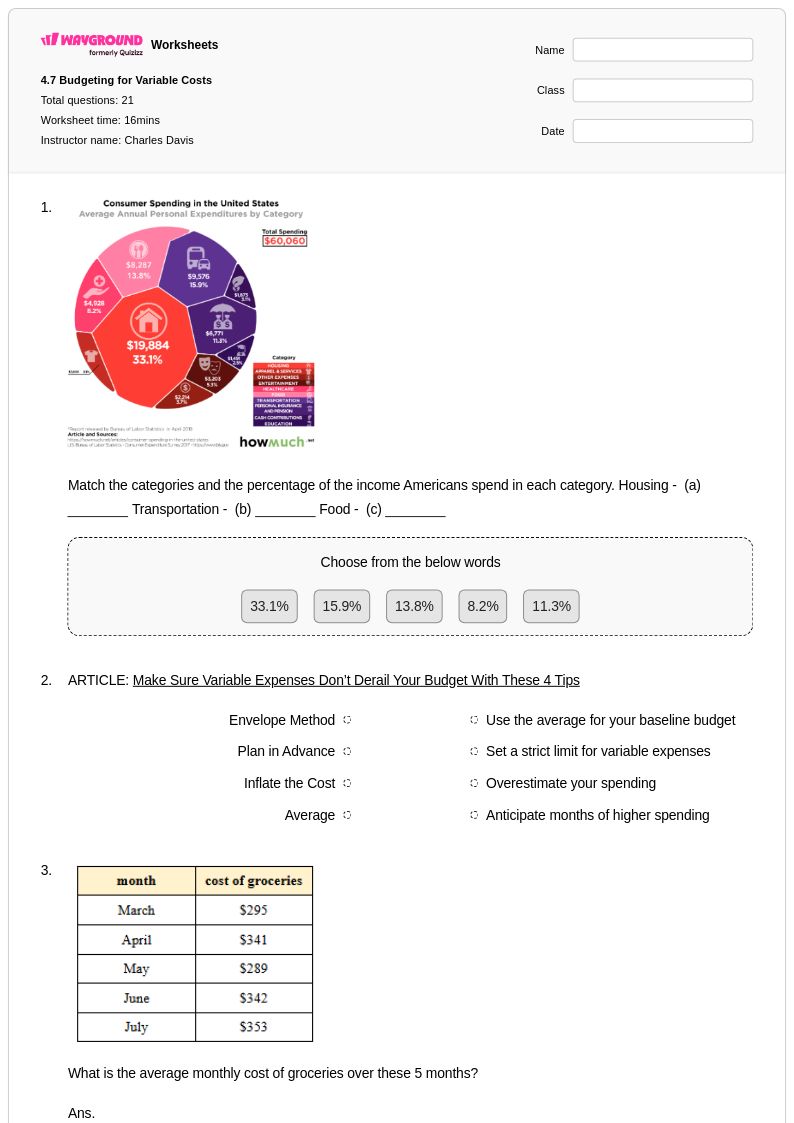

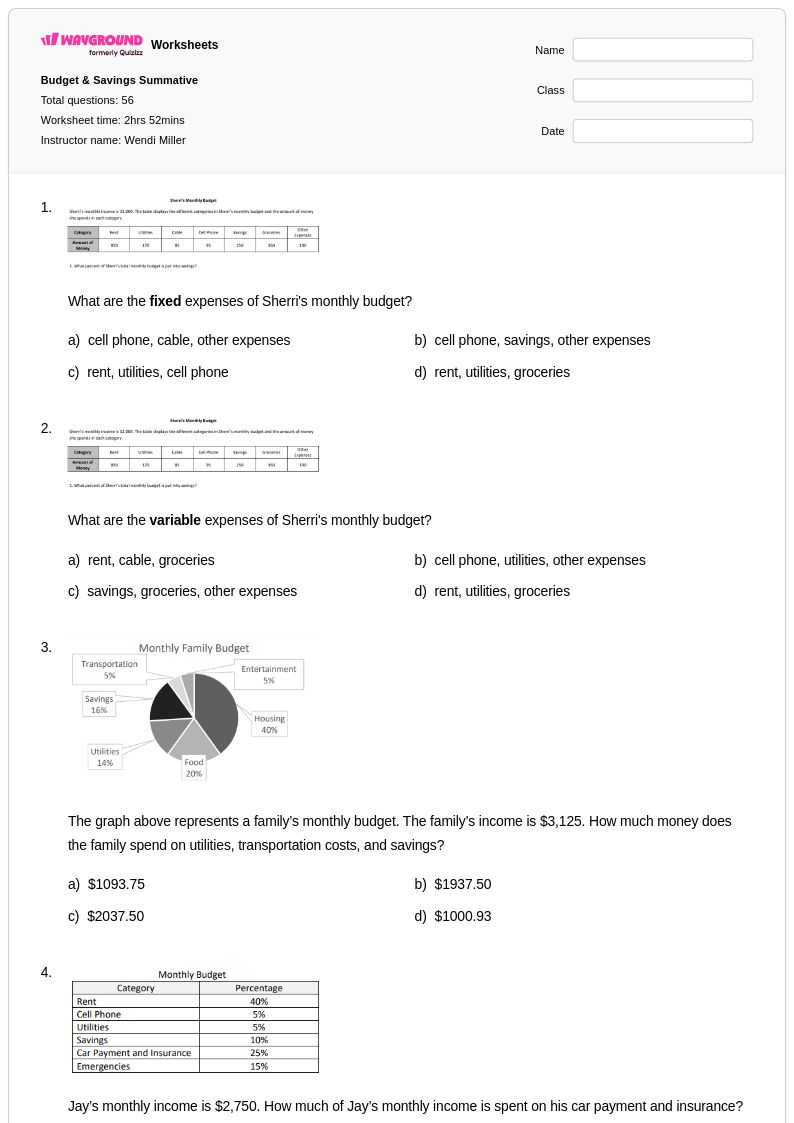

Income and expenses worksheets for Class 9 students available through Wayground (formerly Quizizz) provide comprehensive practice in fundamental personal finance concepts that form the cornerstone of financial literacy education. These expertly designed resources help ninth-grade students develop critical skills in tracking personal income sources, categorizing various types of expenses, and understanding the relationship between earning and spending money. Students work through realistic scenarios involving part-time jobs, allowances, and typical teenage expenses while learning to distinguish between fixed and variable costs, needs versus wants, and essential budgeting principles. Each worksheet collection includes detailed answer keys and is available as free printable pdf resources, allowing students to practice problems that mirror real-world financial situations they will encounter as they gain independence.

Wayground (formerly Quizizz) supports mathematics educators with millions of teacher-created resources specifically designed for Class 9 financial literacy instruction, featuring robust search and filtering capabilities that align with state and national standards for personal finance education. Teachers can easily differentiate instruction by accessing worksheets at varying complexity levels, from basic income and expense tracking to more sophisticated budget analysis and financial decision-making scenarios. The platform's flexible customization tools allow educators to modify existing materials or combine multiple resources to meet specific classroom needs, while both printable and digital formats including downloadable pdfs accommodate diverse learning environments. These comprehensive collections streamline lesson planning and provide targeted materials for remediation, enrichment, and ongoing skill practice, ensuring students build confidence in managing personal finances through structured, progressive learning experiences.