20 Q

7th - Uni

10 Q

7th - 9th

12 Q

9th

20 Q

7th - Uni

20 Q

6th - 10th

20 Q

9th

20 Q

9th - 12th

10 Q

9th

15 Q

9th - 12th

20 Q

7th - Uni

20 Q

7th - Uni

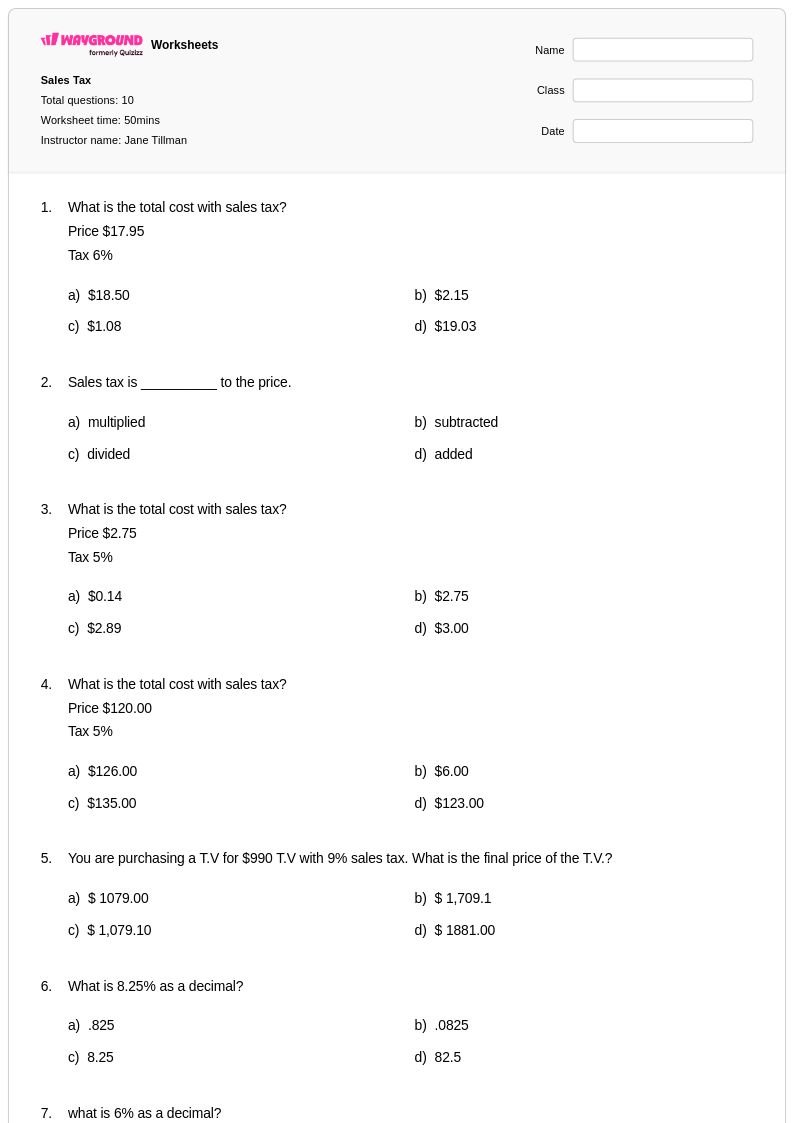

10 Q

9th

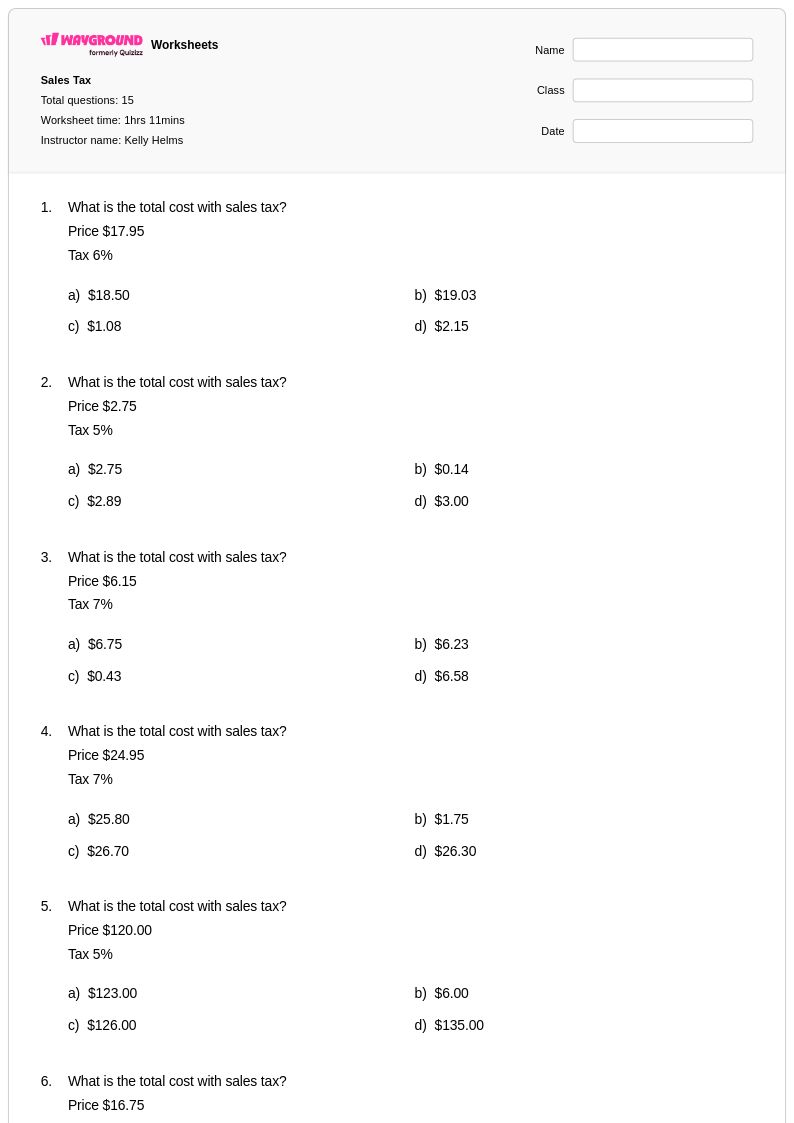

15 Q

7th - Uni

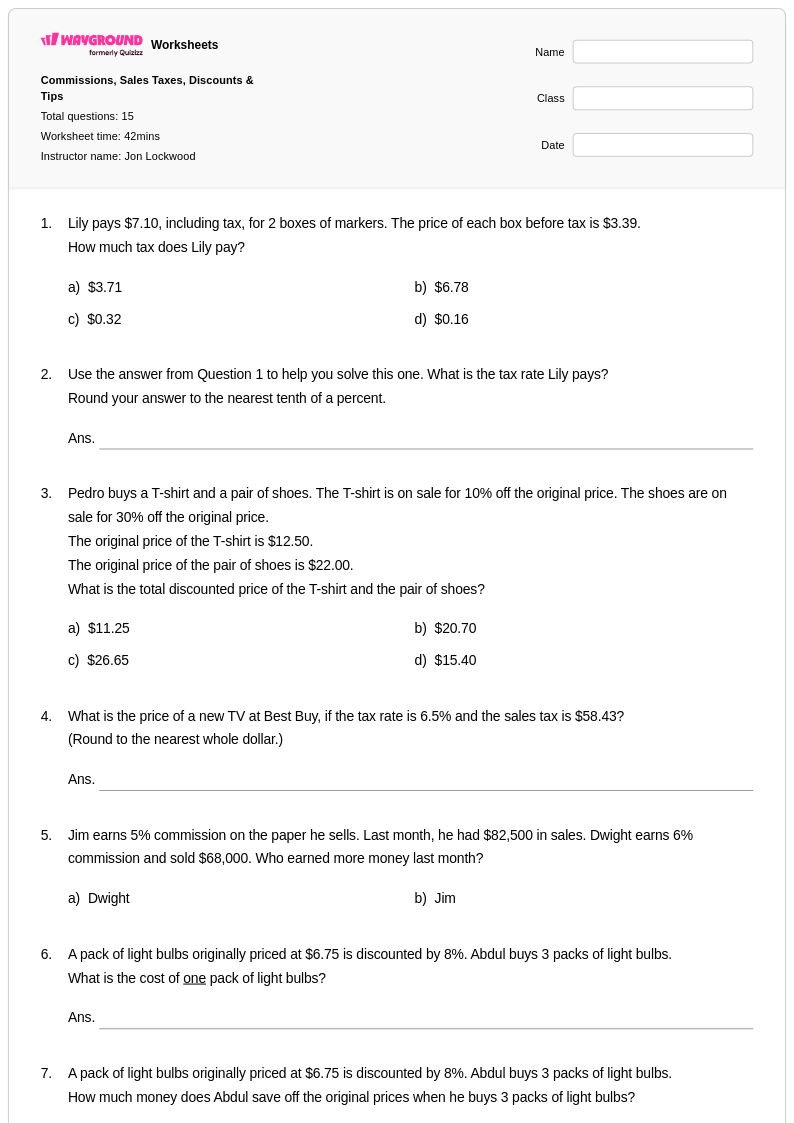

15 Q

4th - 9th

10 Q

9th - 12th

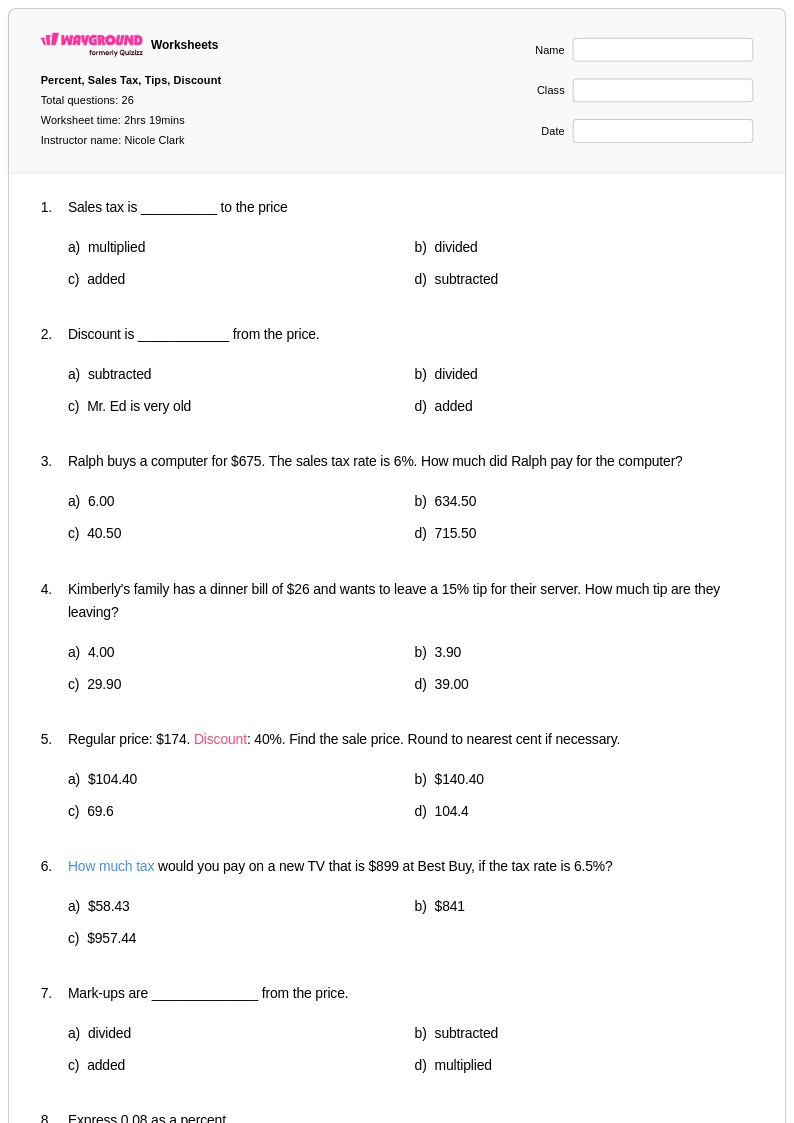

26 Q

9th

20 Q

9th

38 Q

7th - 9th

10 Q

7th - 9th

15 Q

9th - 11th

100 Q

9th

10 Q

7th - 10th

14 Q

9th - 12th

15 Q

9th

Explore Other Subject Worksheets for class 9

Explore printable Sales Tax worksheets for Class 9

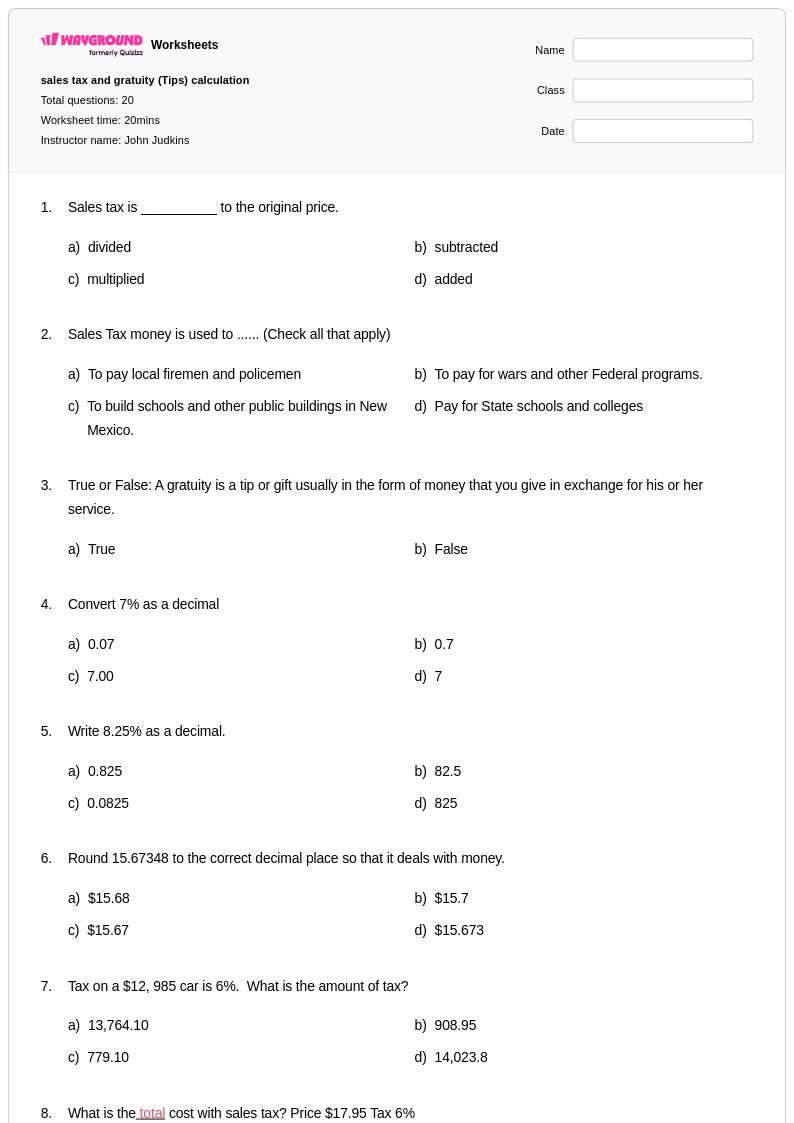

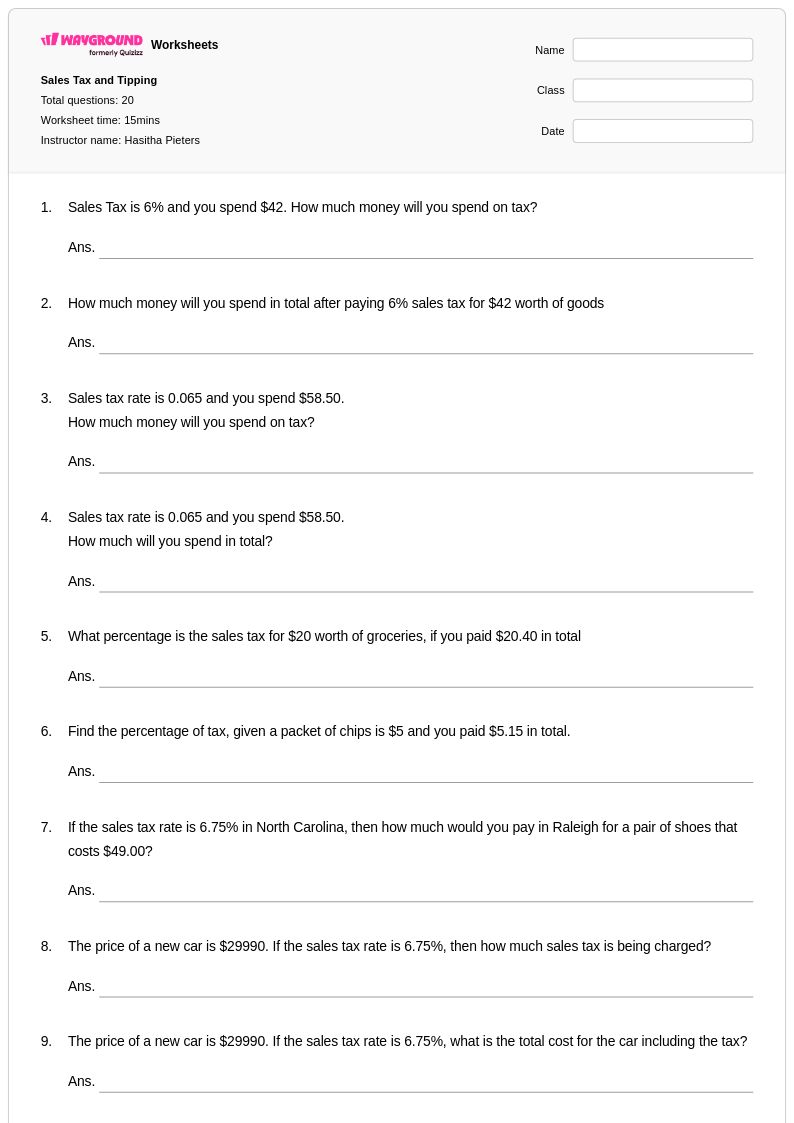

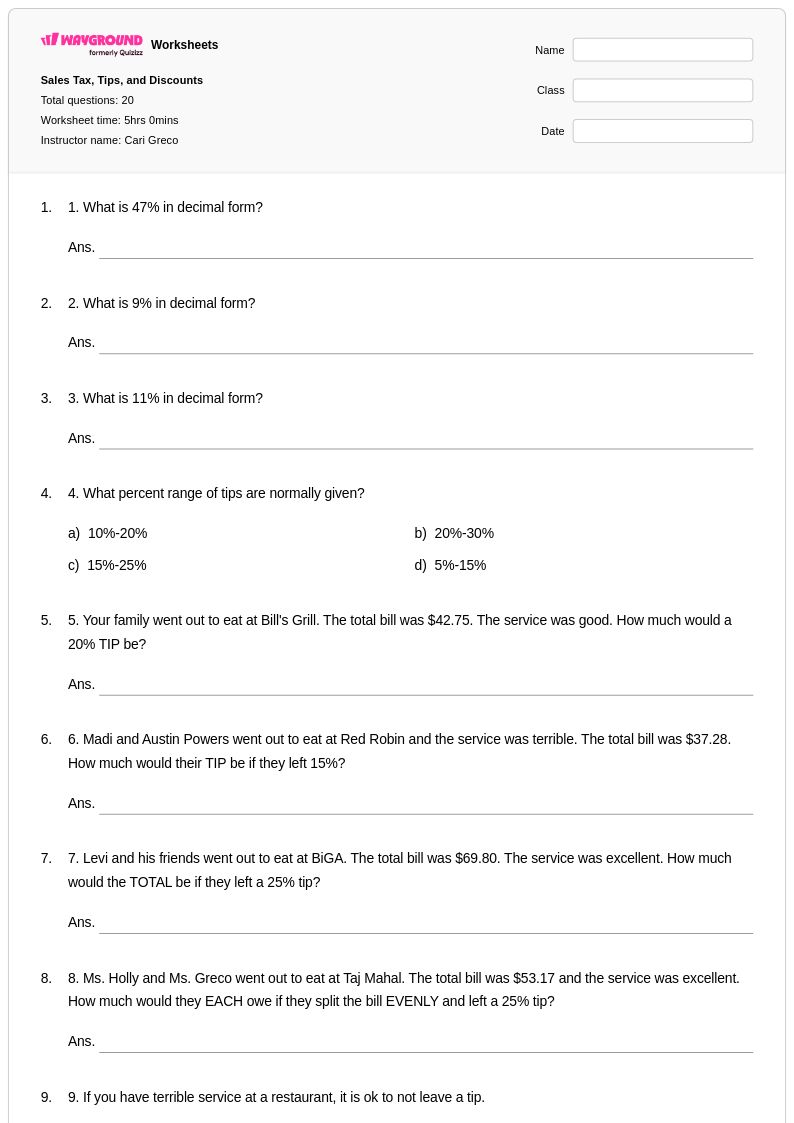

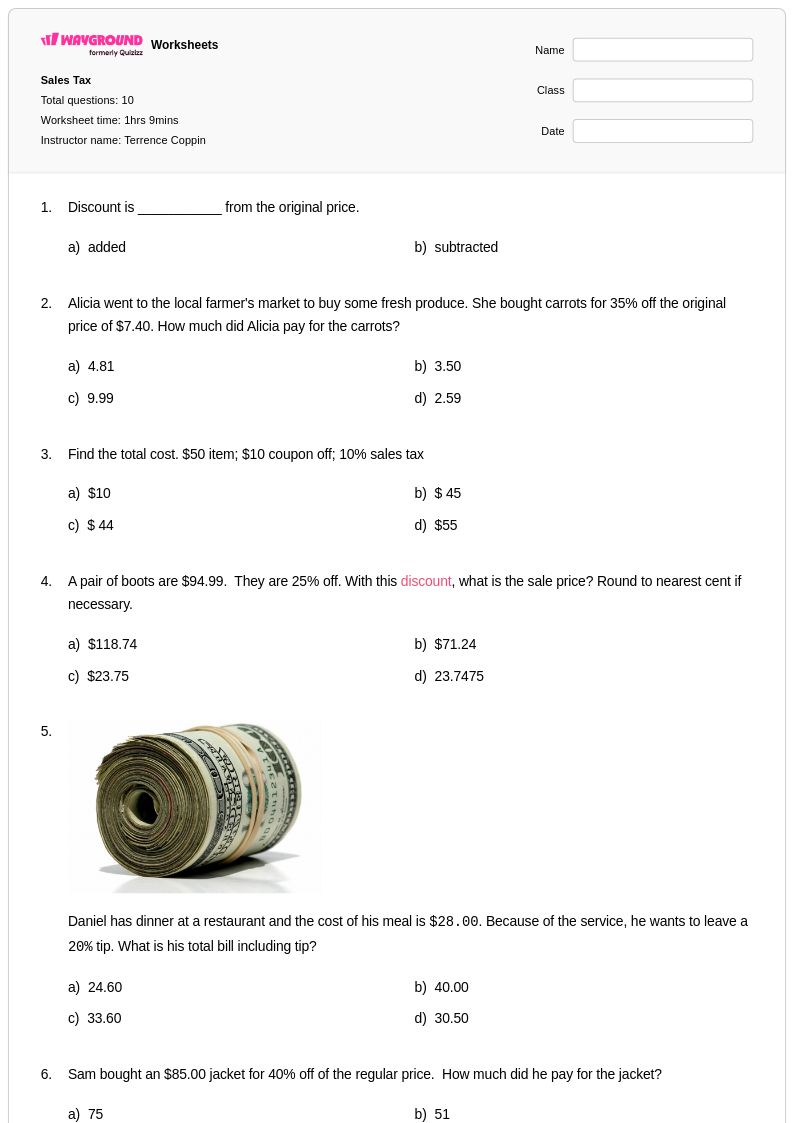

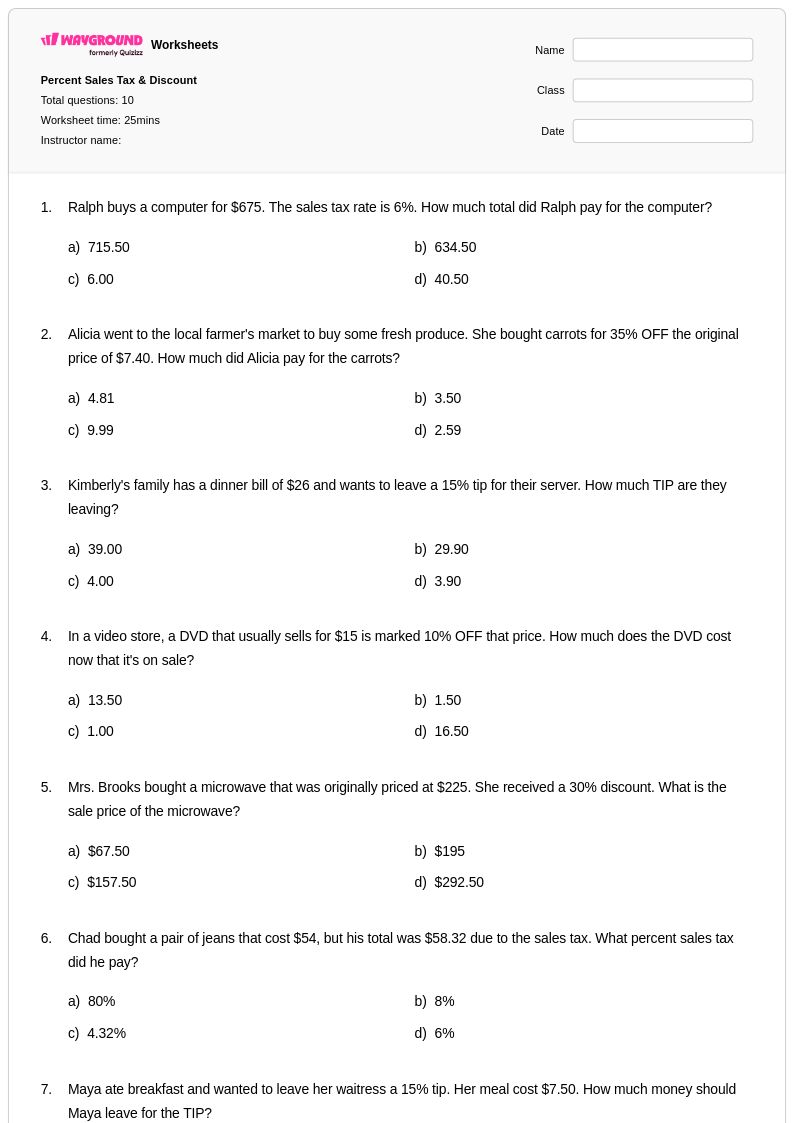

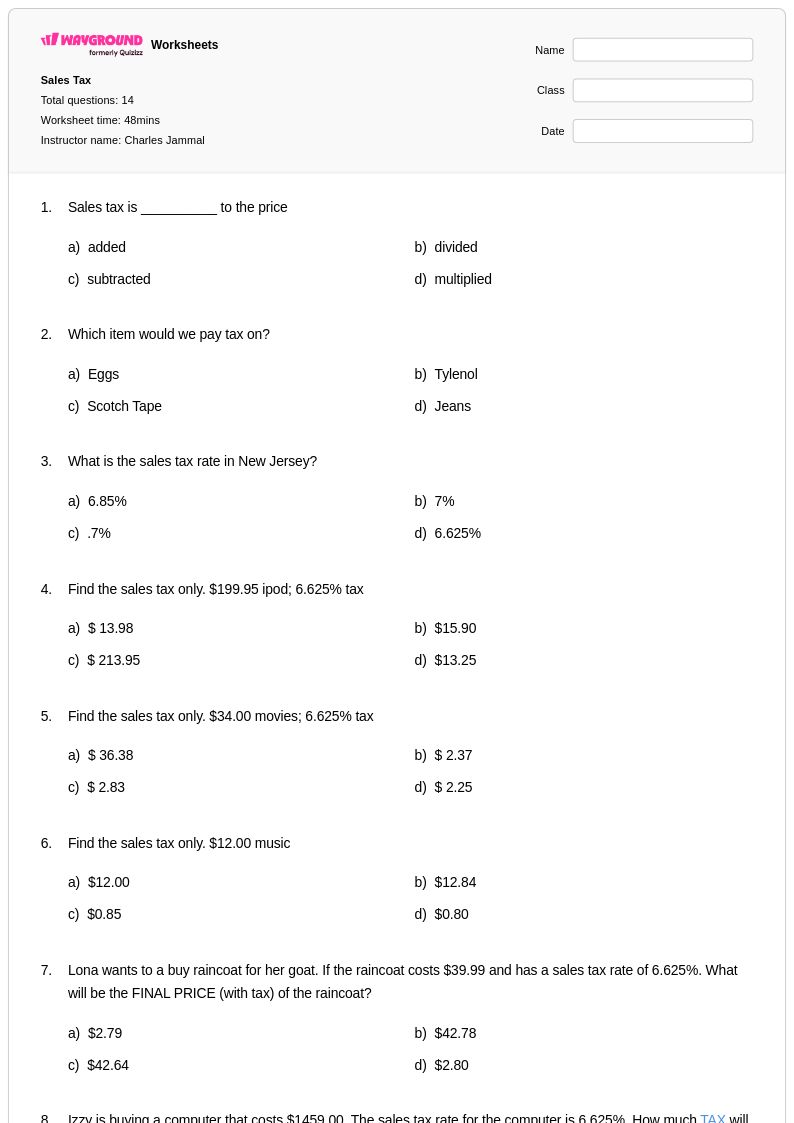

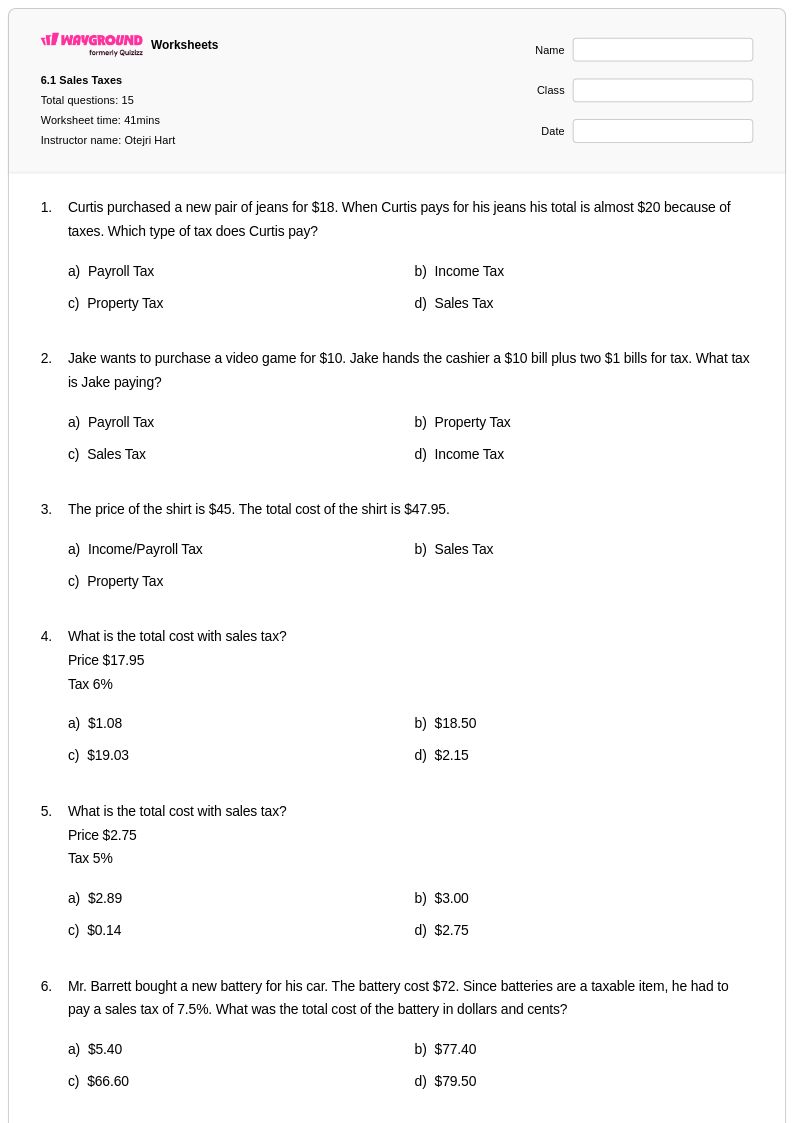

Sales tax worksheets for Class 9 students available through Wayground (formerly Quizizz) provide comprehensive practice with this essential financial literacy concept that students encounter daily in real-world purchasing situations. These expertly crafted worksheets strengthen students' abilities to calculate sales tax percentages, determine total costs including tax, and work backwards from final prices to find original amounts or tax rates. The practice problems range from basic single-step calculations to multi-step scenarios involving discounts combined with sales tax, helping ninth graders develop the mathematical reasoning and decimal operations skills necessary for informed consumer decision-making. Each worksheet collection includes detailed answer keys and is available as free printables in convenient pdf format, allowing students to practice independently while building confidence with percentage applications in authentic financial contexts.

Wayground's extensive library supports mathematics teachers with millions of teacher-created sales tax resources specifically designed for Class 9 financial literacy instruction. The platform's robust search and filtering capabilities enable educators to quickly locate worksheets that align with state mathematics standards and match their students' specific skill levels and learning needs. Teachers can easily differentiate instruction by selecting from various difficulty levels, customize existing worksheets to address specific misconceptions or extend learning objectives, and access materials in both printable pdf format for traditional paper-based practice and digital formats for technology-integrated lessons. These flexible tools streamline lesson planning while providing targeted resources for remediation of struggling learners, skill practice for grade-level students, and enrichment opportunities for advanced learners who are ready to tackle complex real-world financial scenarios involving sales tax calculations.