9 Q

7th - 12th

15 Q

7th - 10th

10 Q

7th - 12th

10 Q

6th - 12th

9 Q

7th - 12th

10 Q

7th

21 Q

7th

10 Q

6th - 8th

13 Q

7th

10 Q

7th - 9th

21 Q

7th

20 Q

5th - 12th

10 Q

6th - 12th

14 Q

7th

15 Q

7th - Uni

30 Q

6th - 8th

12 Q

7th

23 Q

7th

20 Q

7th

26 Q

7th

18 Q

7th

12 Q

7th

18 Q

7th

20 Q

7th

Explore Other Subject Worksheets for class 7

Explore printable Net Pay worksheets for Class 7

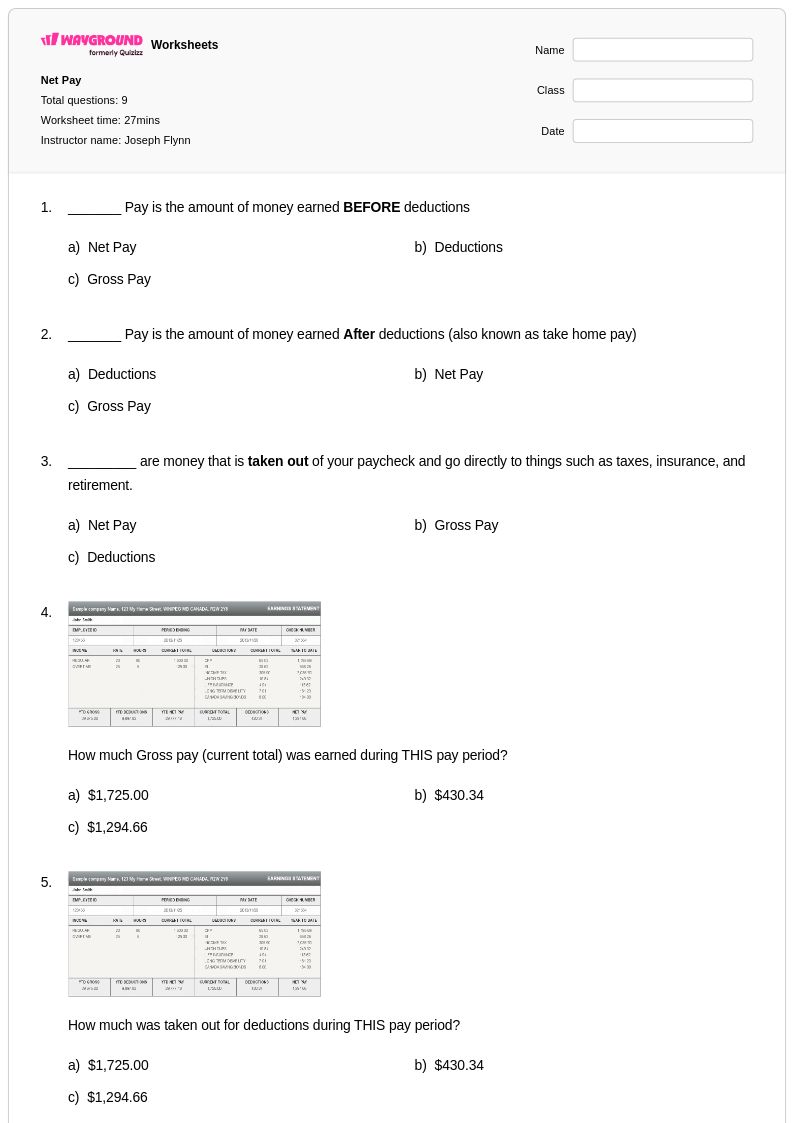

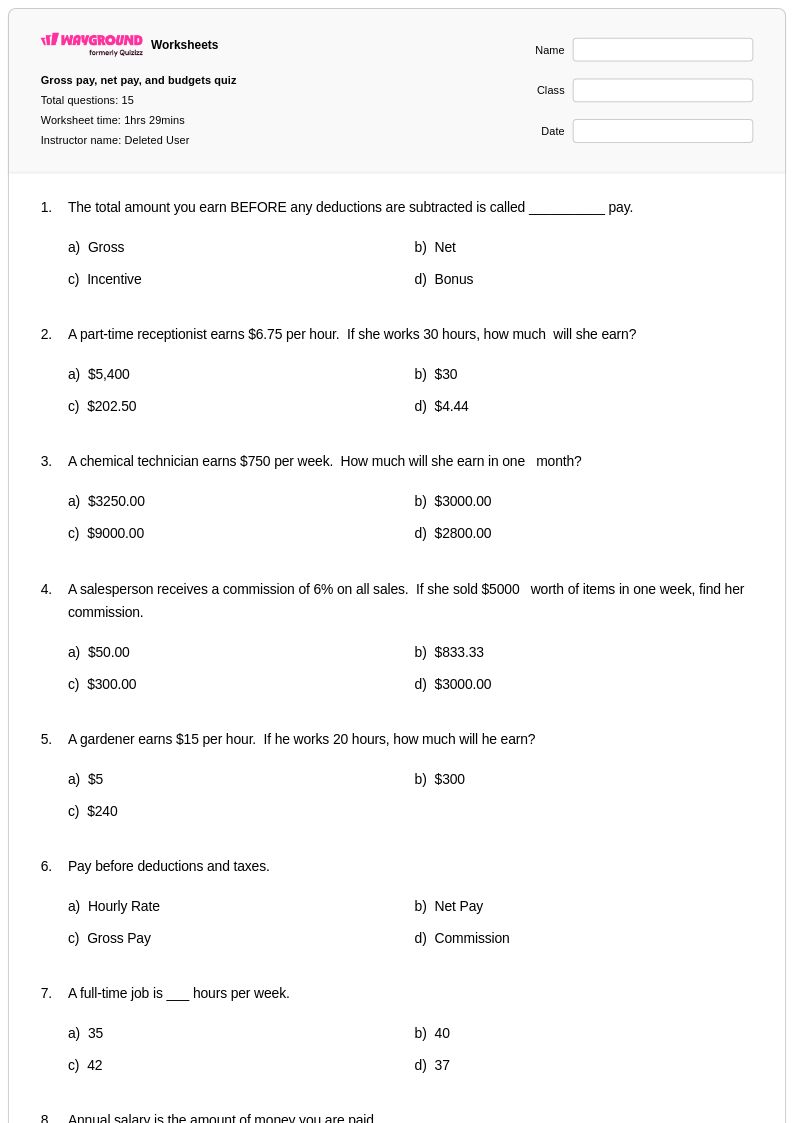

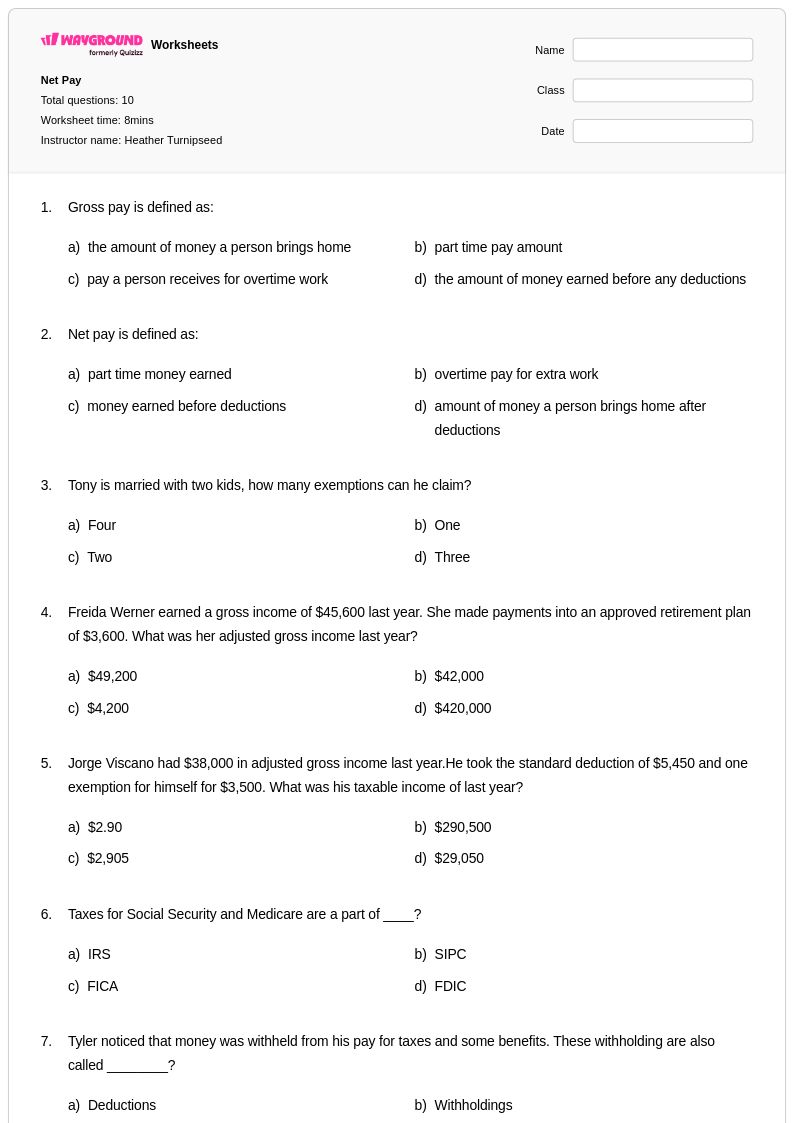

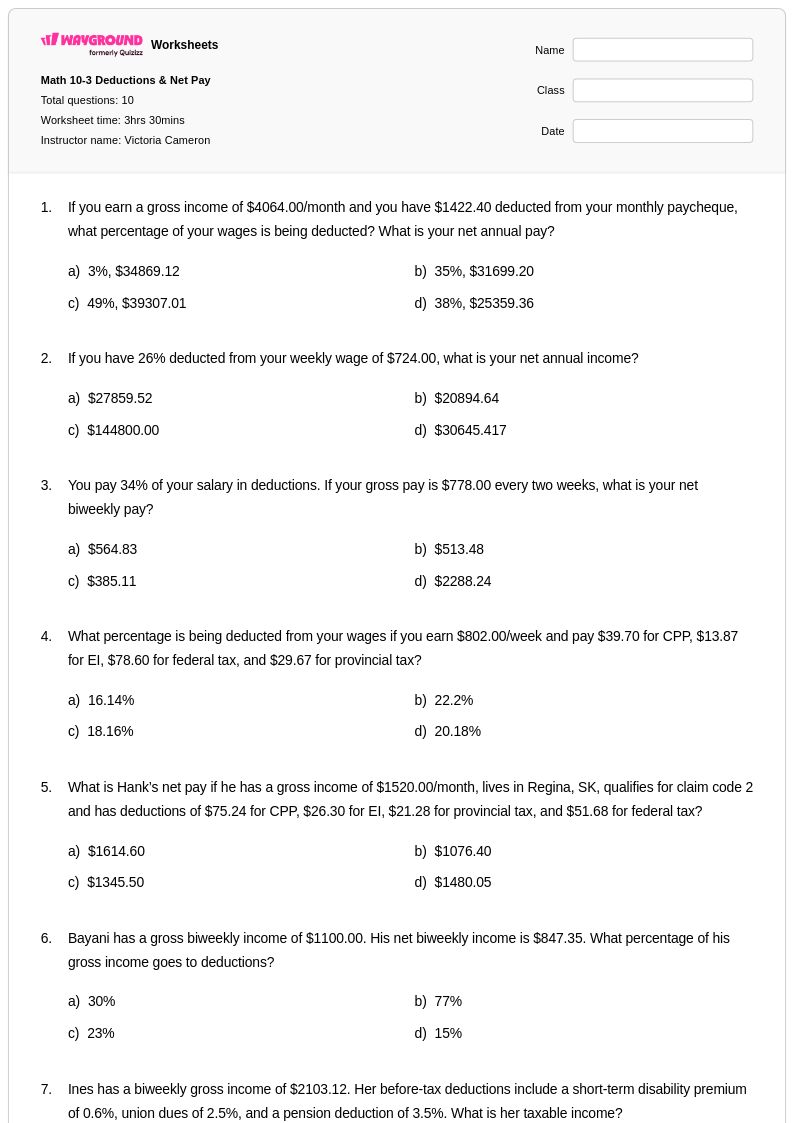

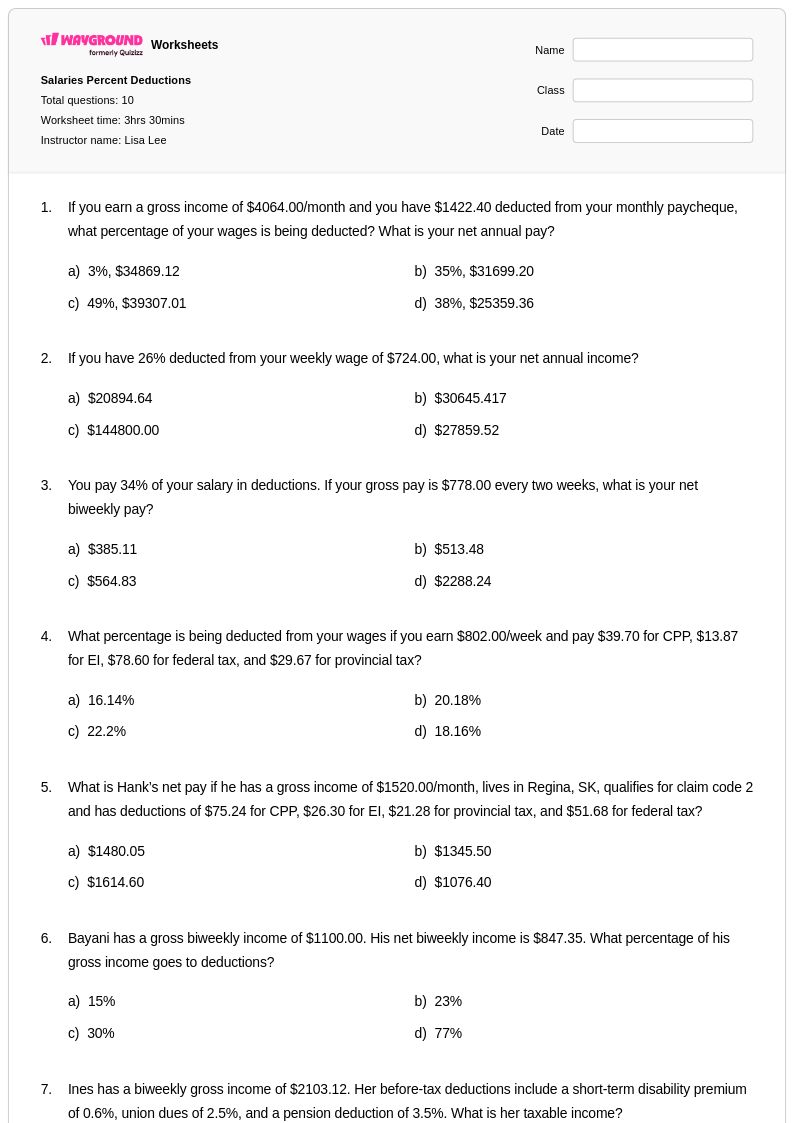

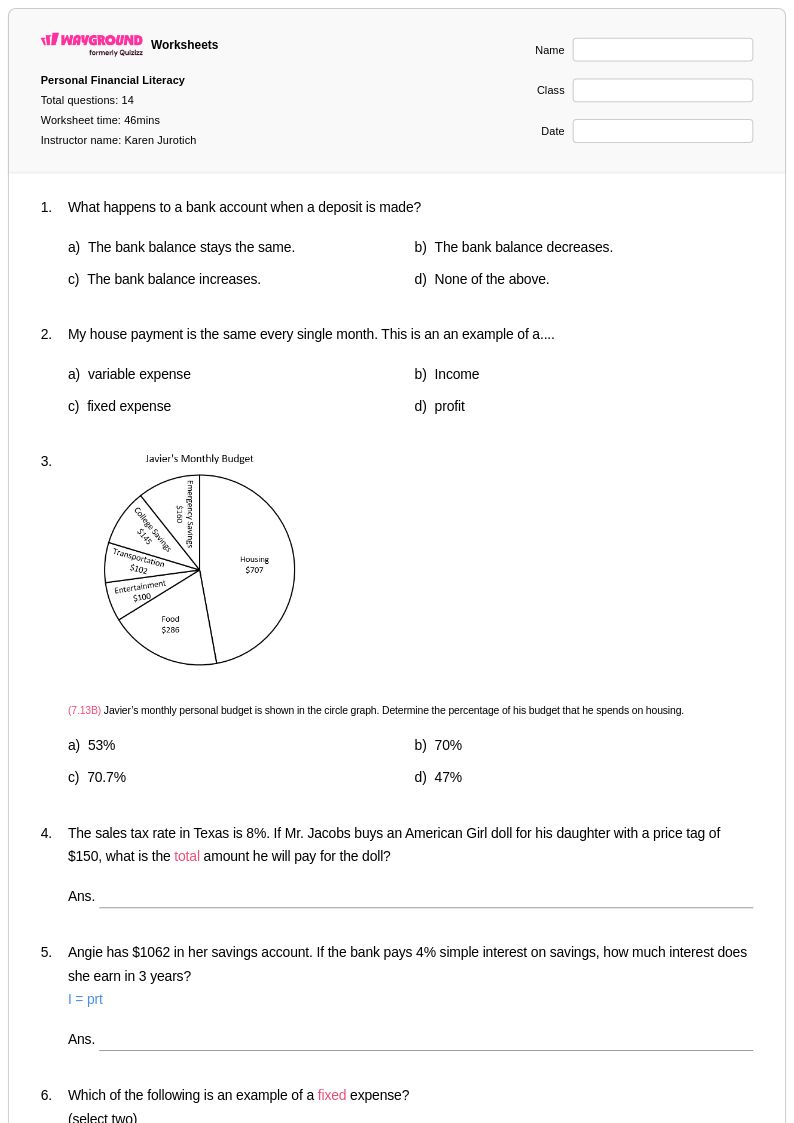

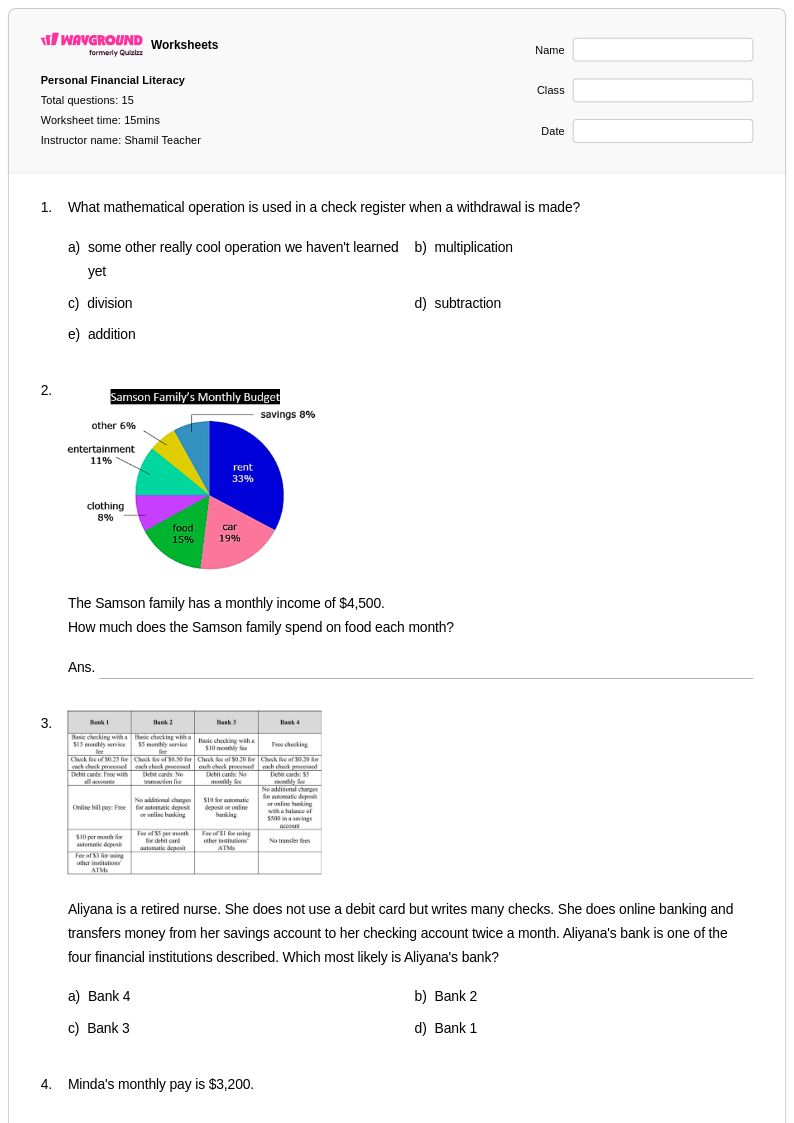

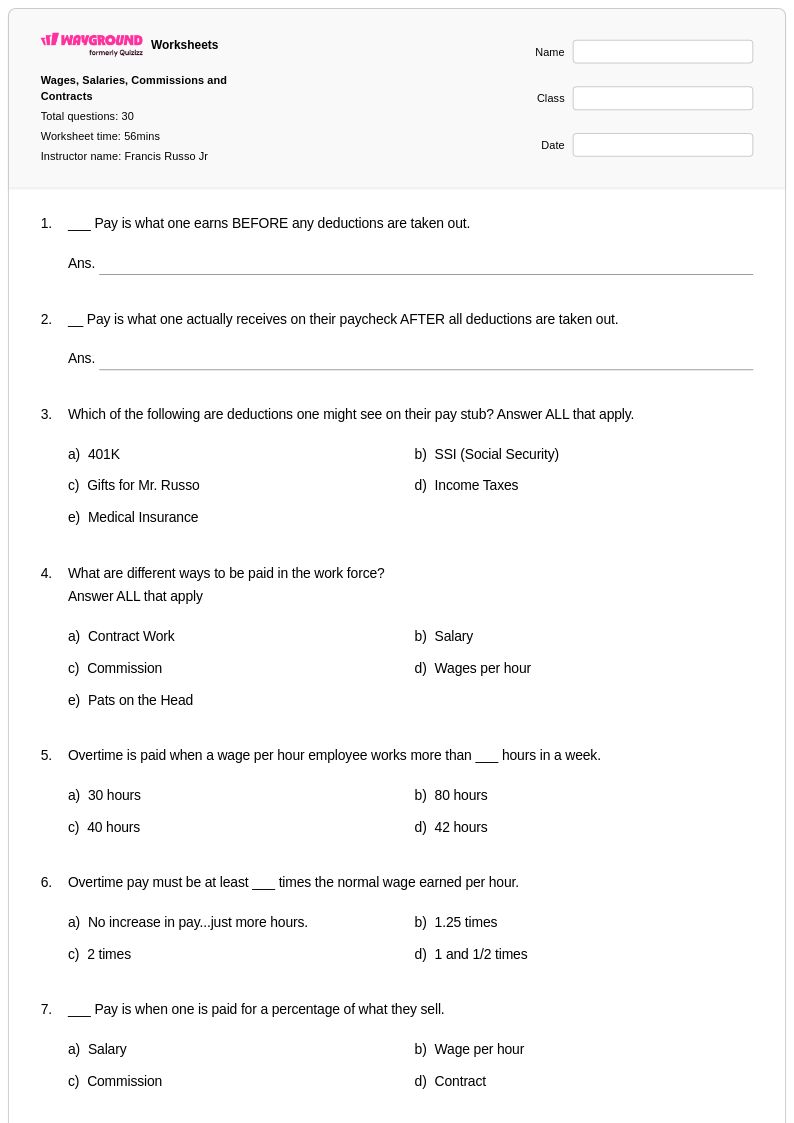

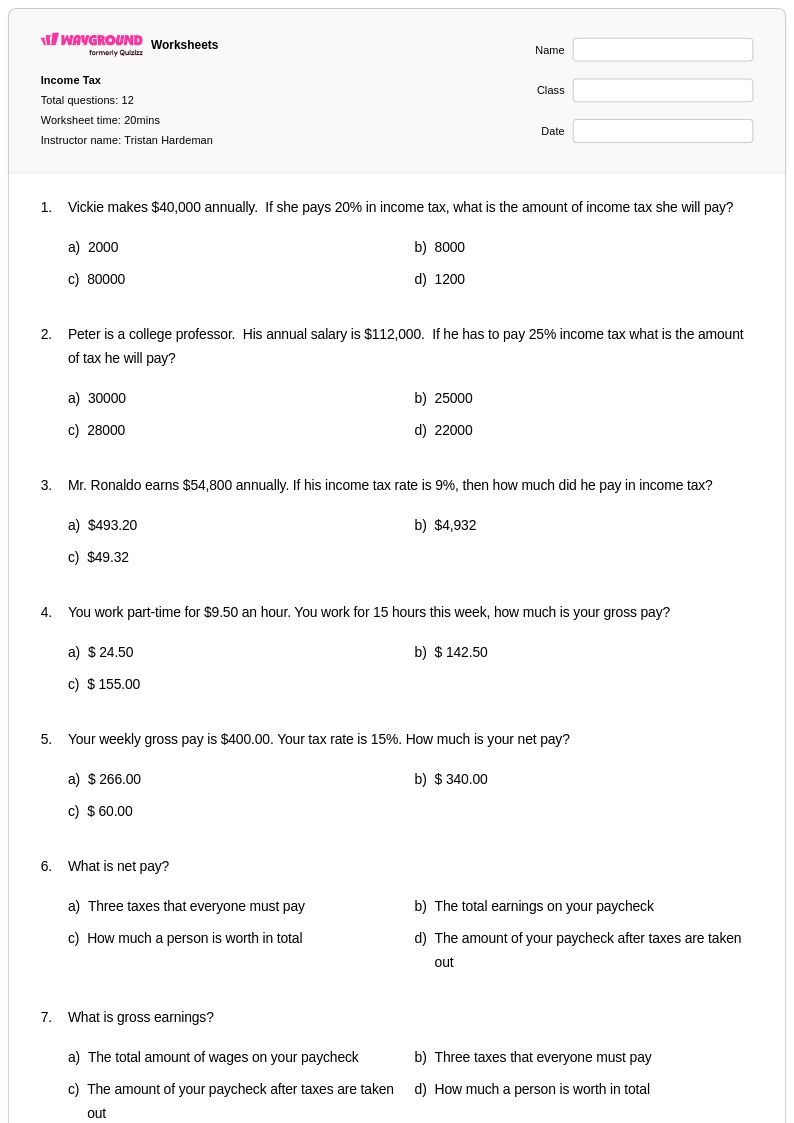

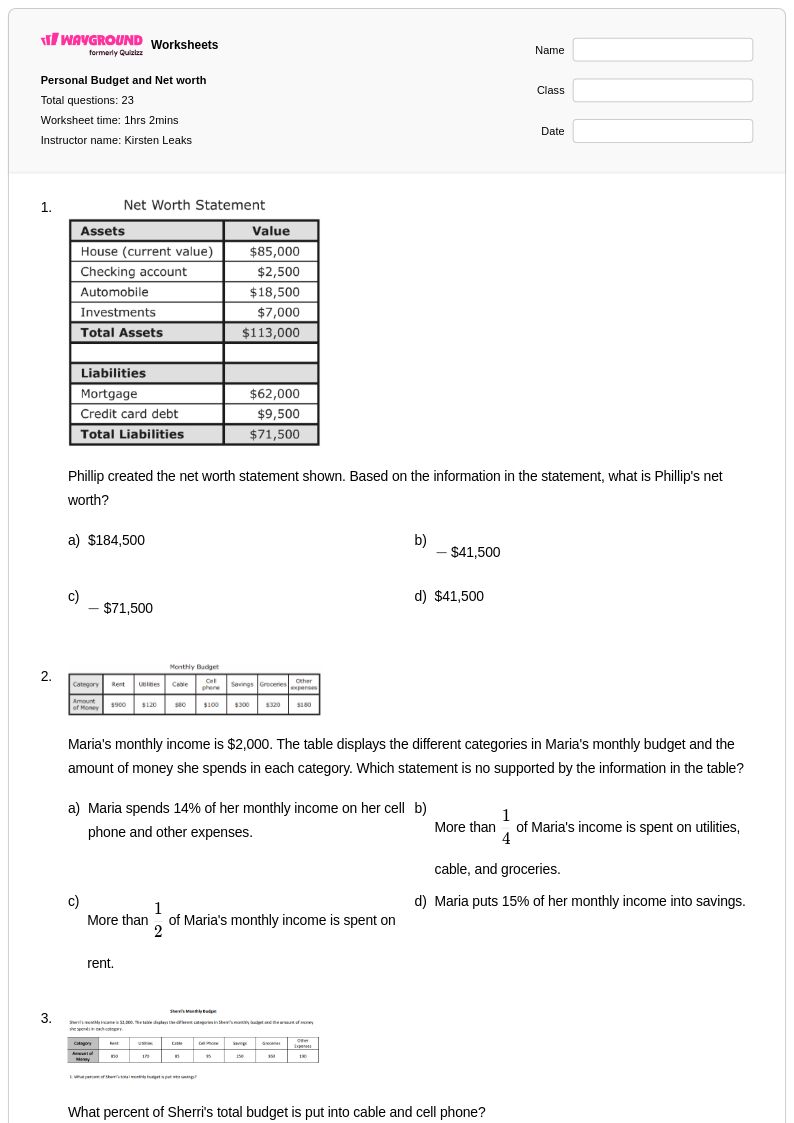

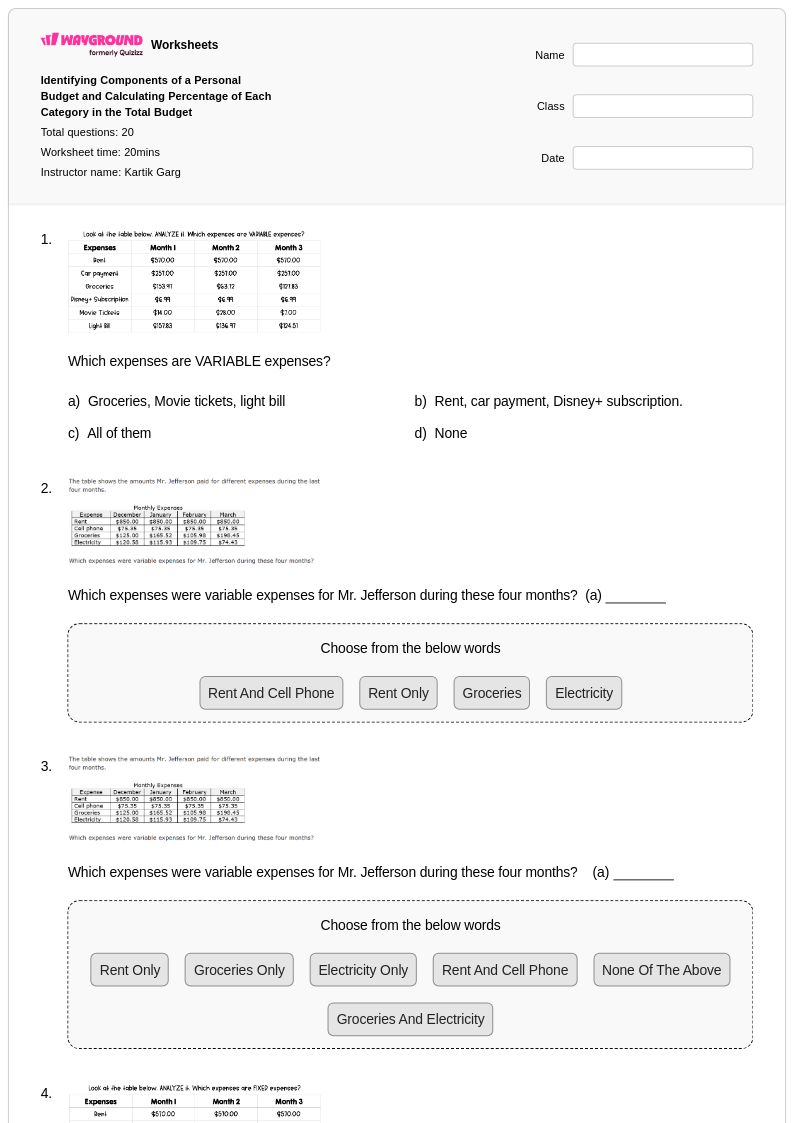

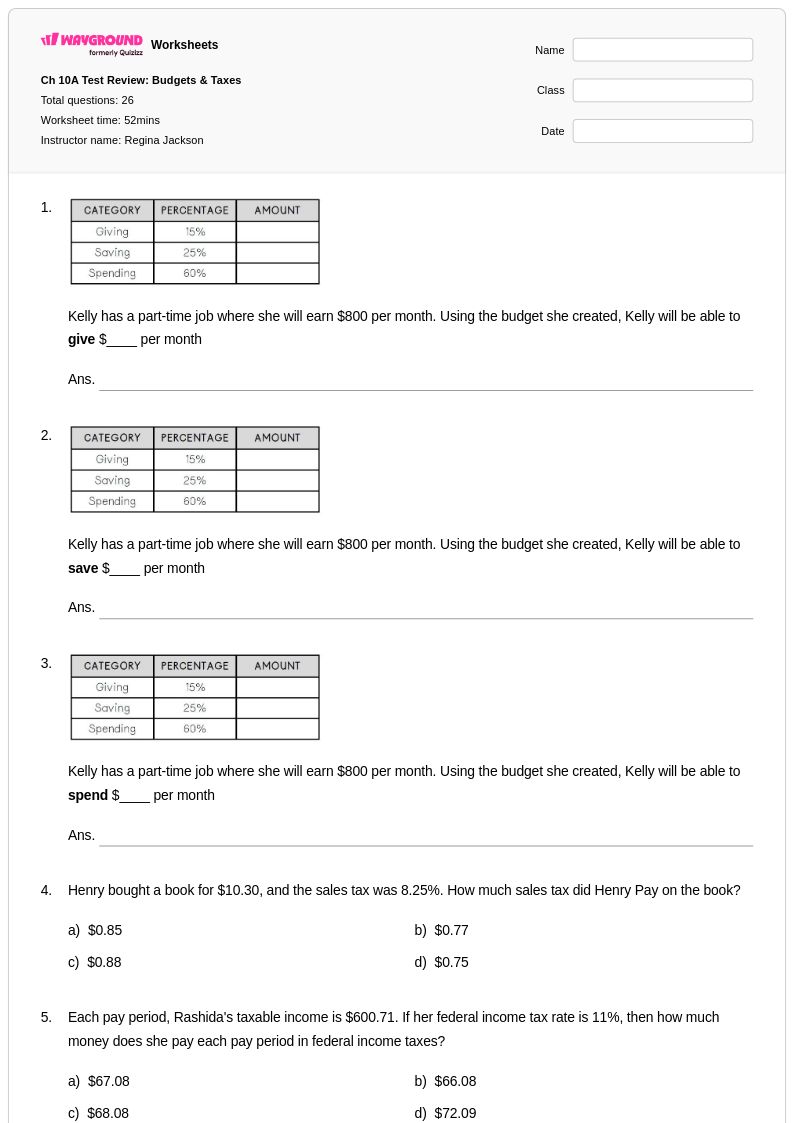

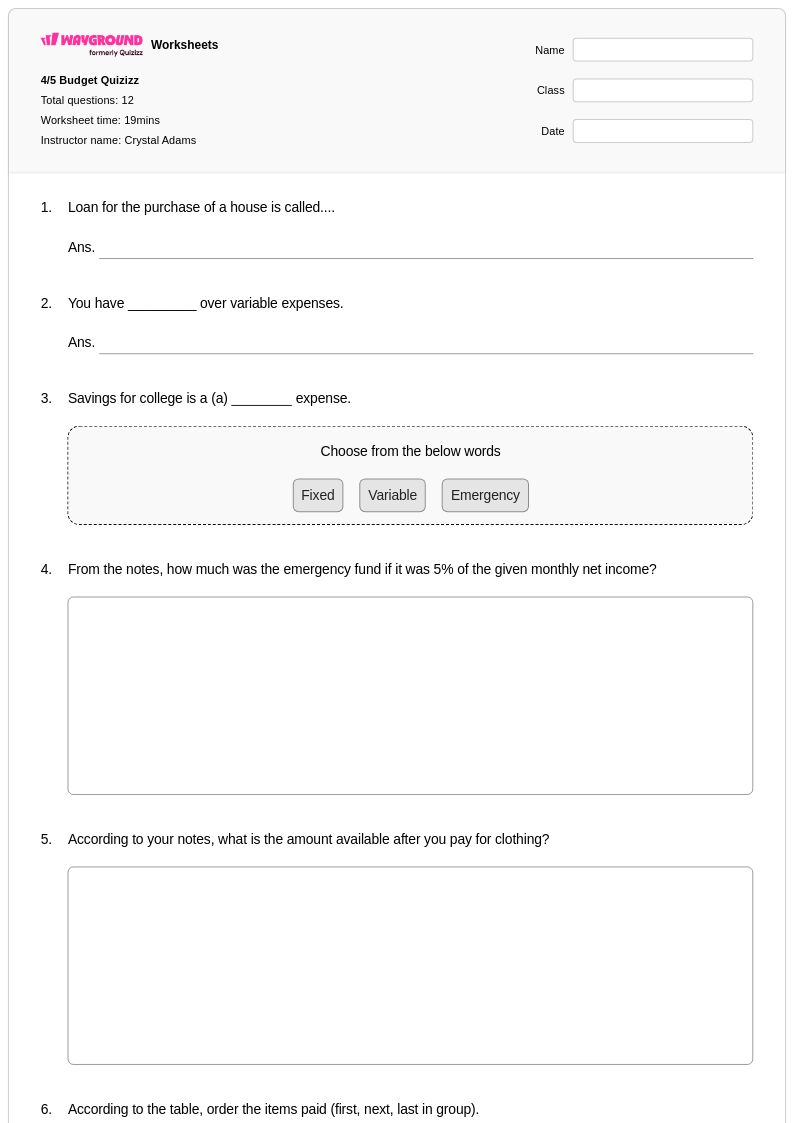

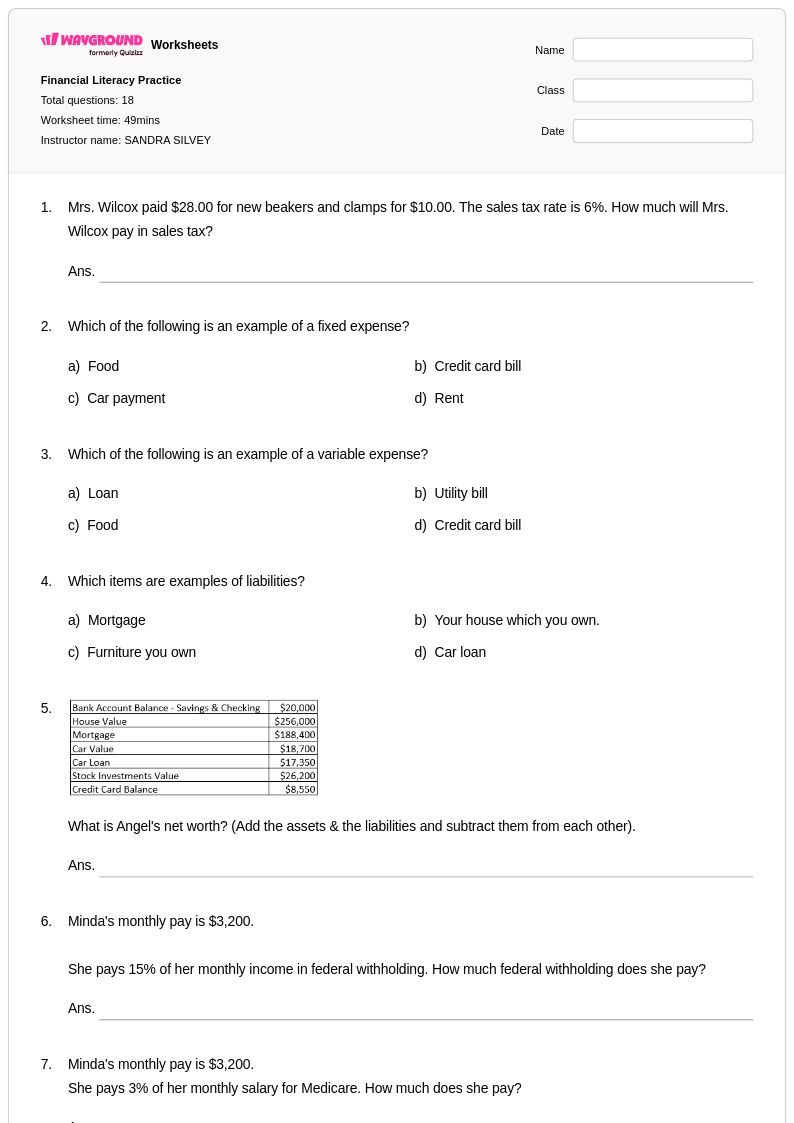

Class 7 net pay worksheets available through Wayground provide students with essential practice in calculating take-home earnings after various deductions have been applied to gross income. These comprehensive printables strengthen critical financial literacy skills by having students work through real-world scenarios involving federal taxes, state taxes, Social Security contributions, Medicare deductions, and other common payroll withholdings. Students engage with practice problems that require them to interpret pay stubs, calculate percentage-based deductions, and determine final net pay amounts using multi-step mathematical processes. Each worksheet includes detailed answer keys that allow for independent learning and self-assessment, while the free pdf format ensures accessibility for both classroom instruction and homework assignments that reinforce these fundamental money management concepts.

Wayground supports educators with an extensive collection of teacher-created net pay resources that streamline lesson planning and provide multiple pathways for student skill development. The platform's millions of educational materials include worksheets aligned to financial literacy standards, with robust search and filtering capabilities that help teachers quickly locate grade-appropriate content for Class 7 mathematics instruction. Teachers can customize existing worksheets to match their specific curriculum needs, create differentiated versions for various learning levels, and access both printable pdf formats for traditional classroom use and digital versions for technology-integrated lessons. These flexible resources enable effective remediation for students struggling with percentage calculations and decimal operations, while also providing enrichment opportunities for advanced learners ready to explore more complex payroll scenarios and financial planning concepts.