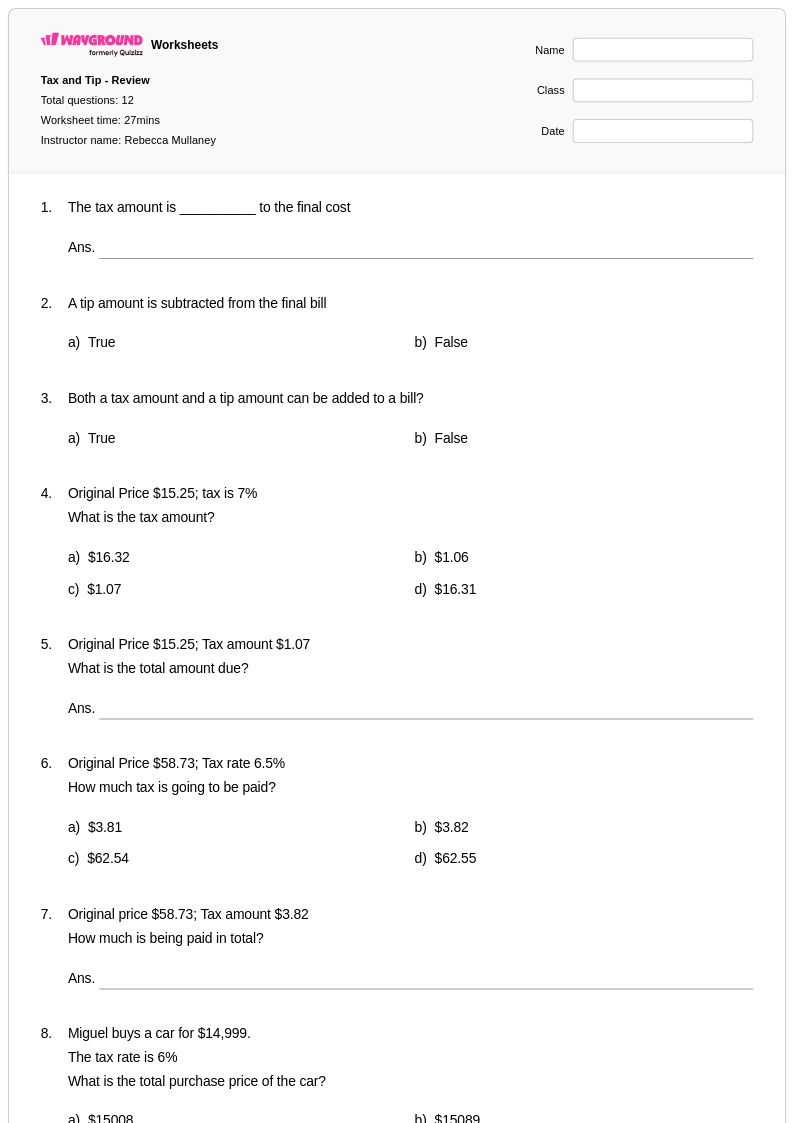

12 Q

6th - 7th

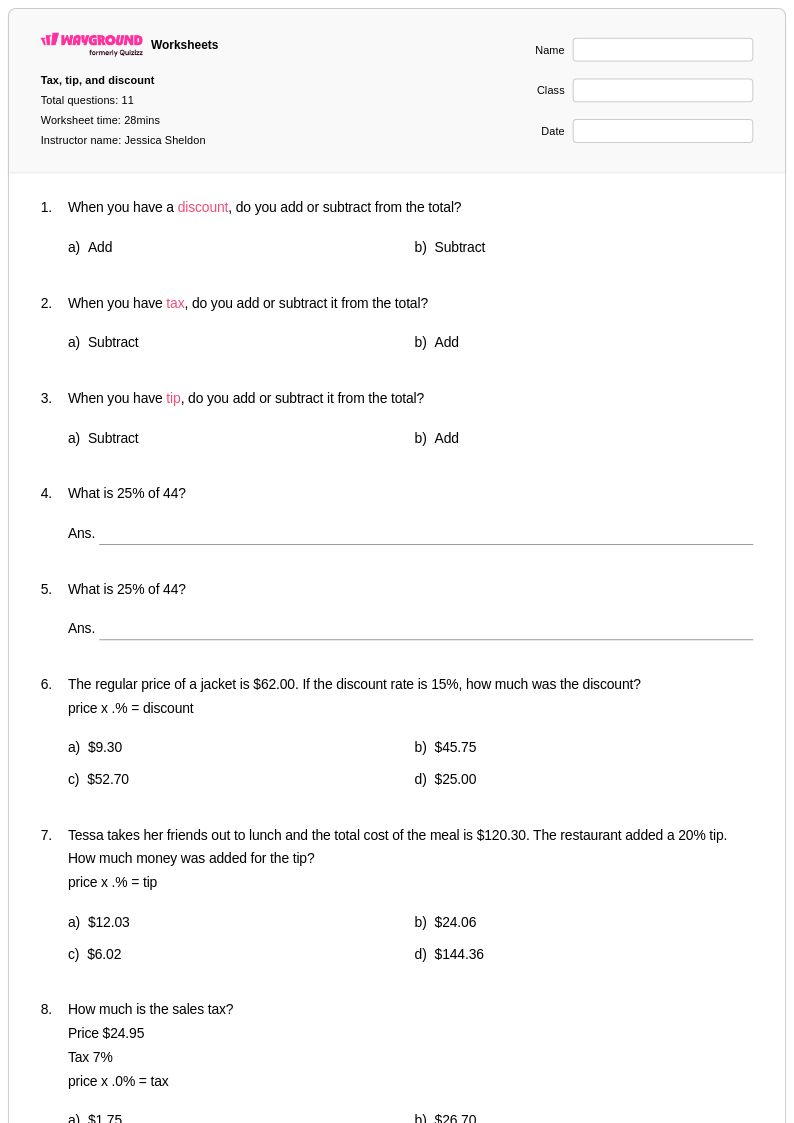

11 Q

6th - 7th

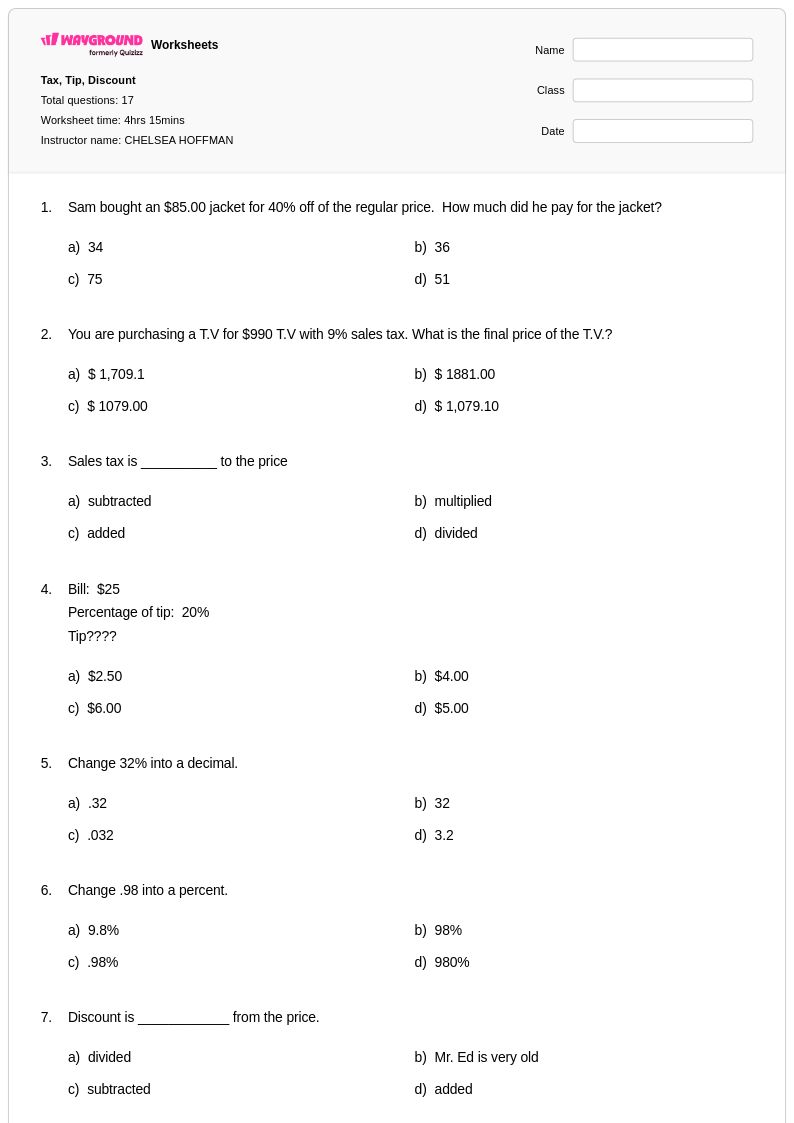

17 Q

6th - 9th

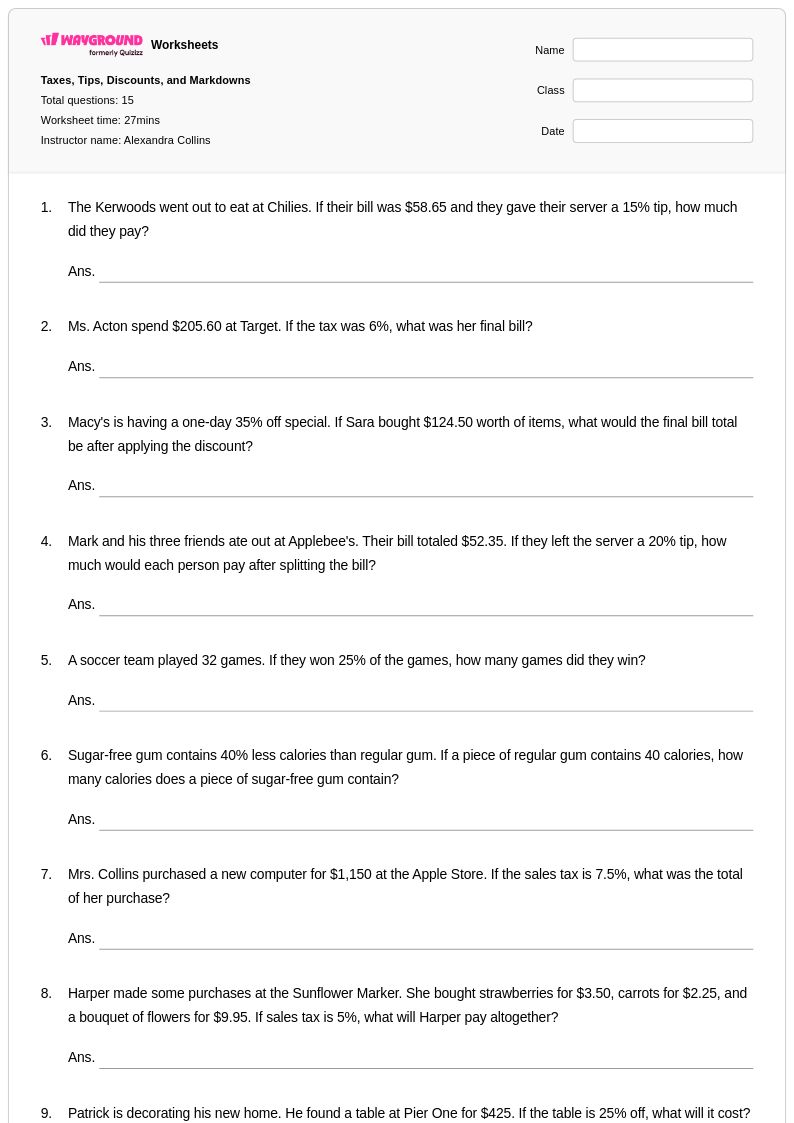

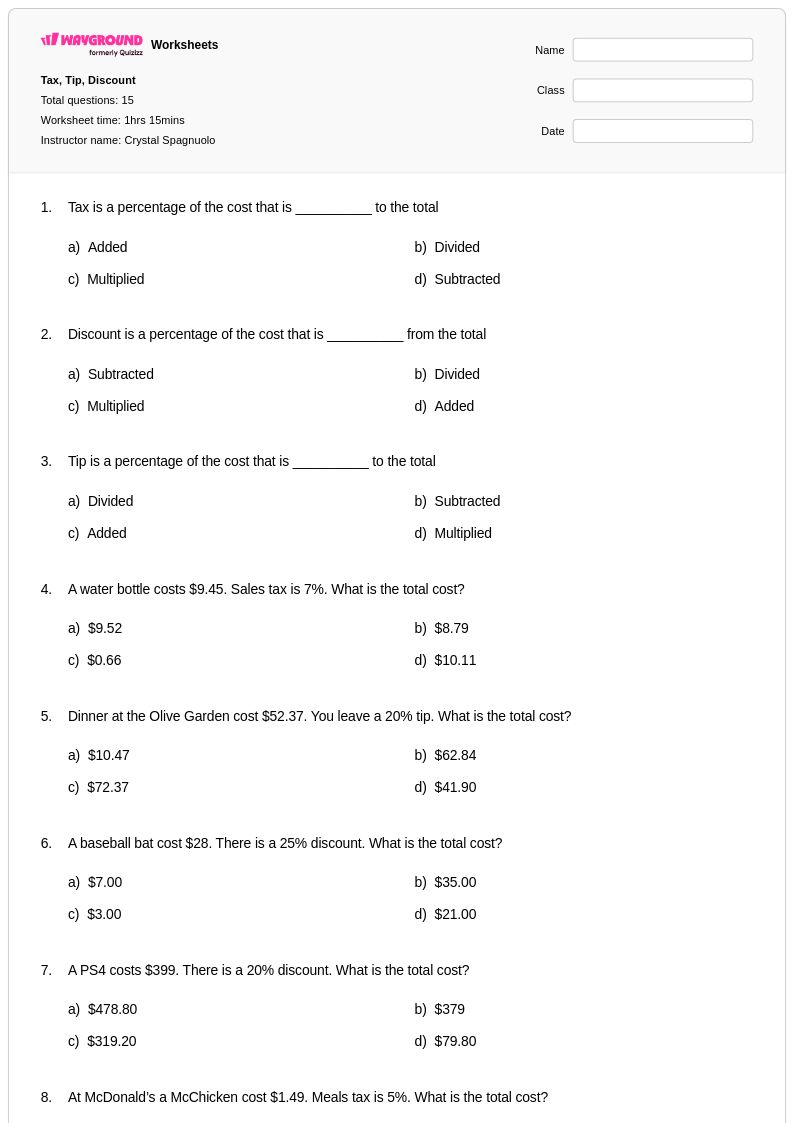

15 Q

6th - 7th

27 Q

6th - 7th

20 Q

6th

16 Q

6th

20 Q

6th - 8th

15 Q

6th - 8th

16 Q

6th

10 Q

6th - 7th

20 Q

6th - 8th

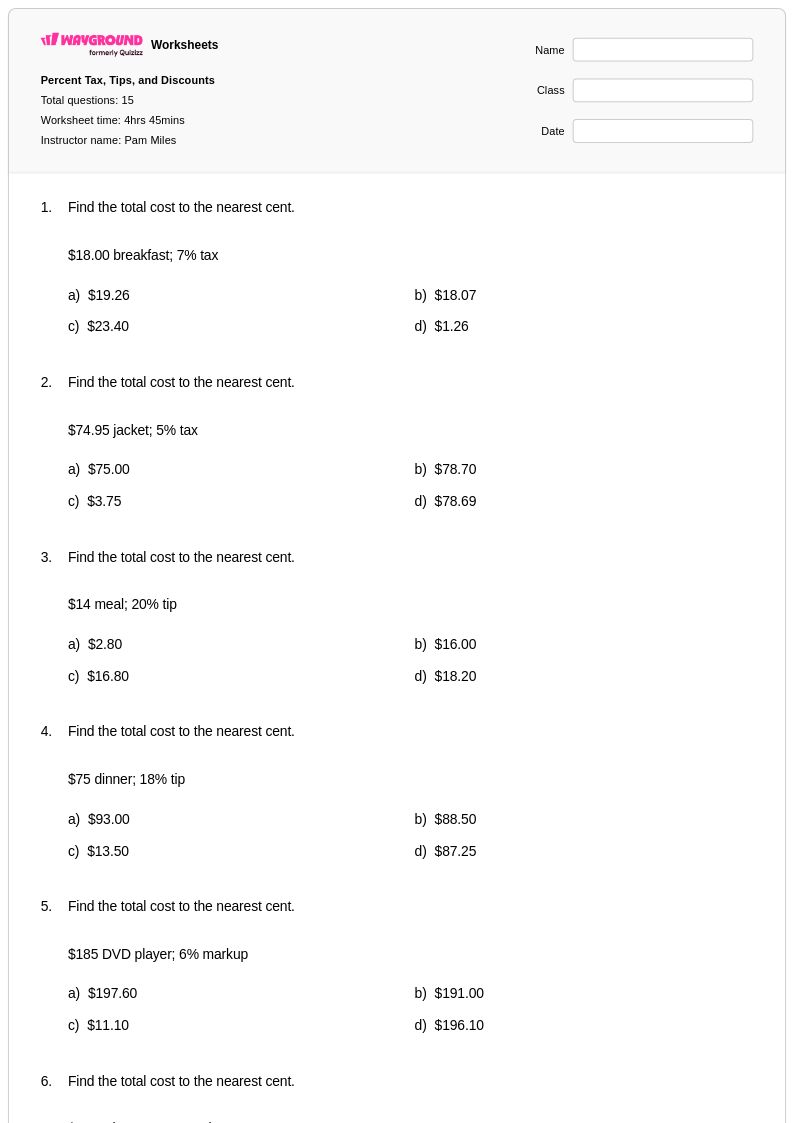

15 Q

6th - 7th

15 Q

6th - 7th

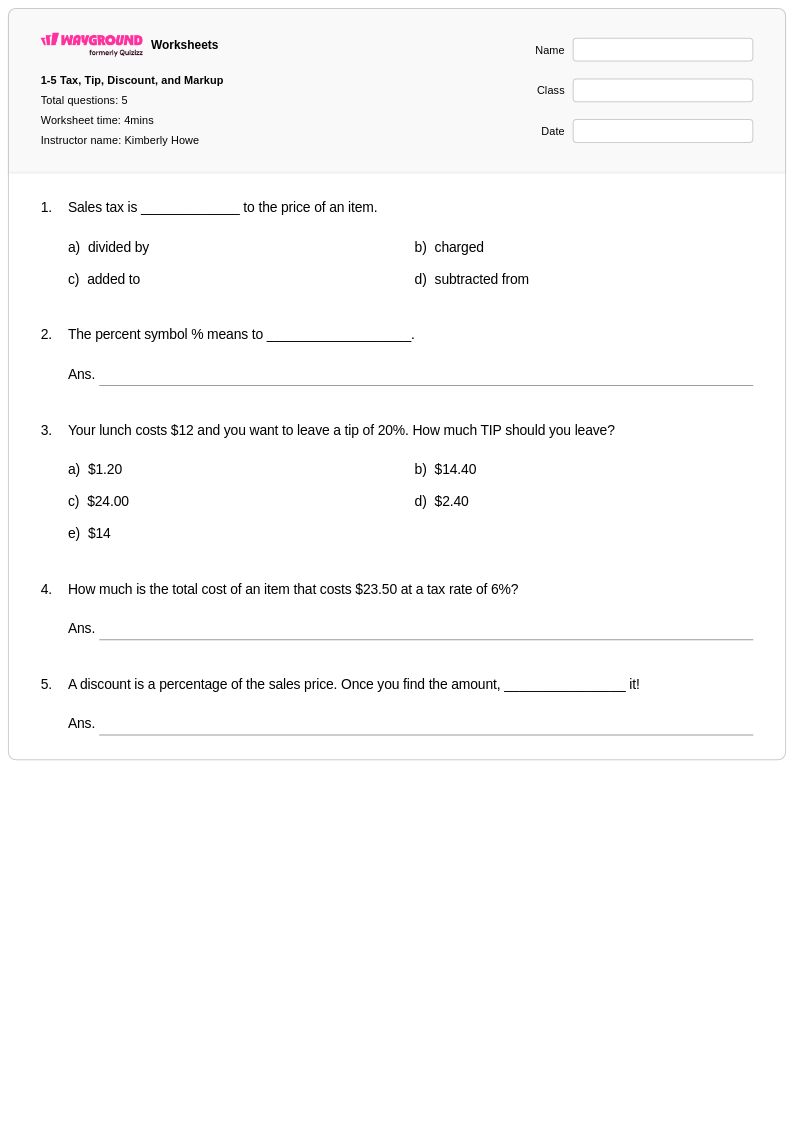

5 Q

6th - 8th

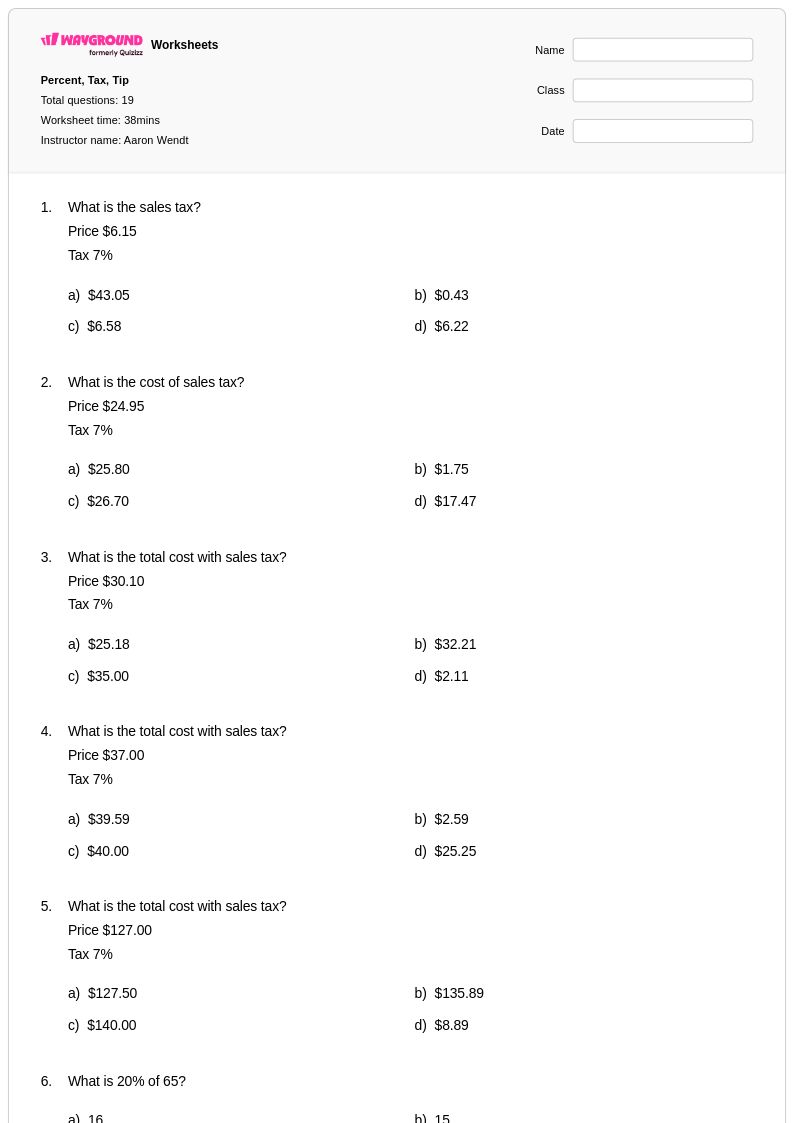

19 Q

5th - 8th

8 Q

6th - 8th

11 Q

6th - 8th

20 Q

6th - 8th

20 Q

6th

20 Q

6th - 8th

9 Q

6th - 8th

13 Q

6th - 8th

20 Q

6th - 10th

Explore Tax and Tip Calculations Worksheets by Grades

Explore Other Subject Worksheets for class 6

Explore printable Tax and Tip Calculations worksheets for Class 6

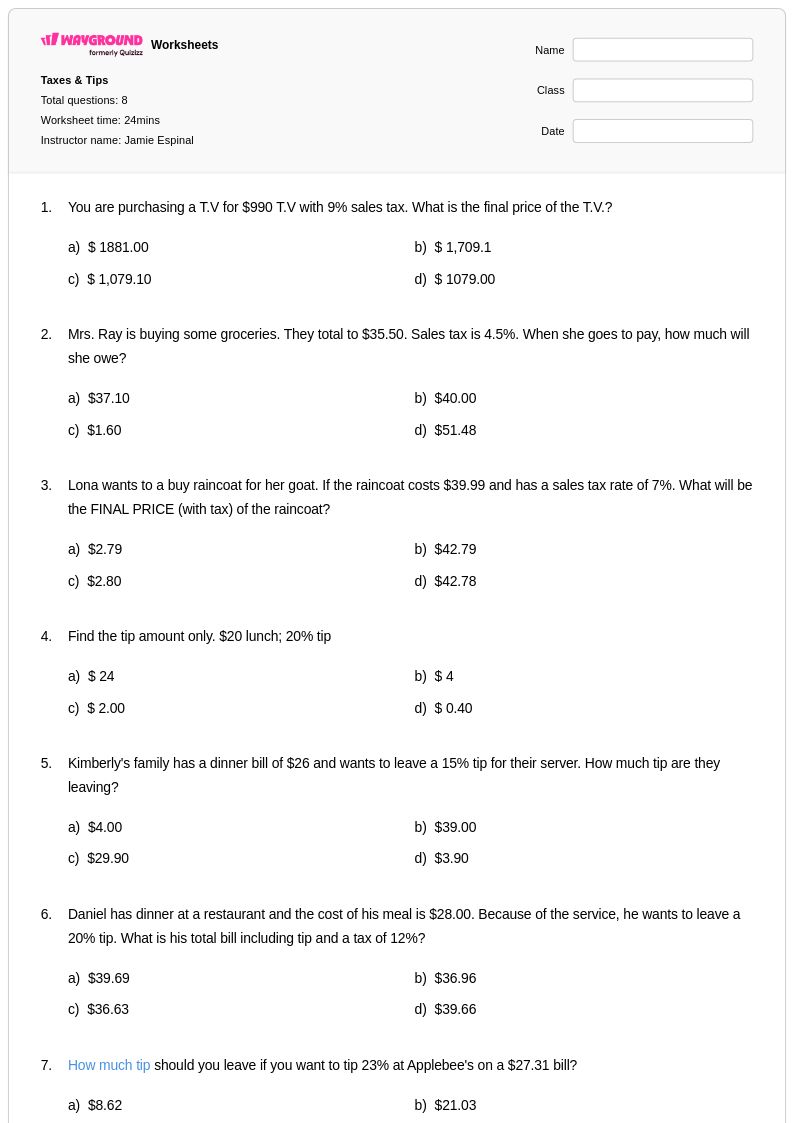

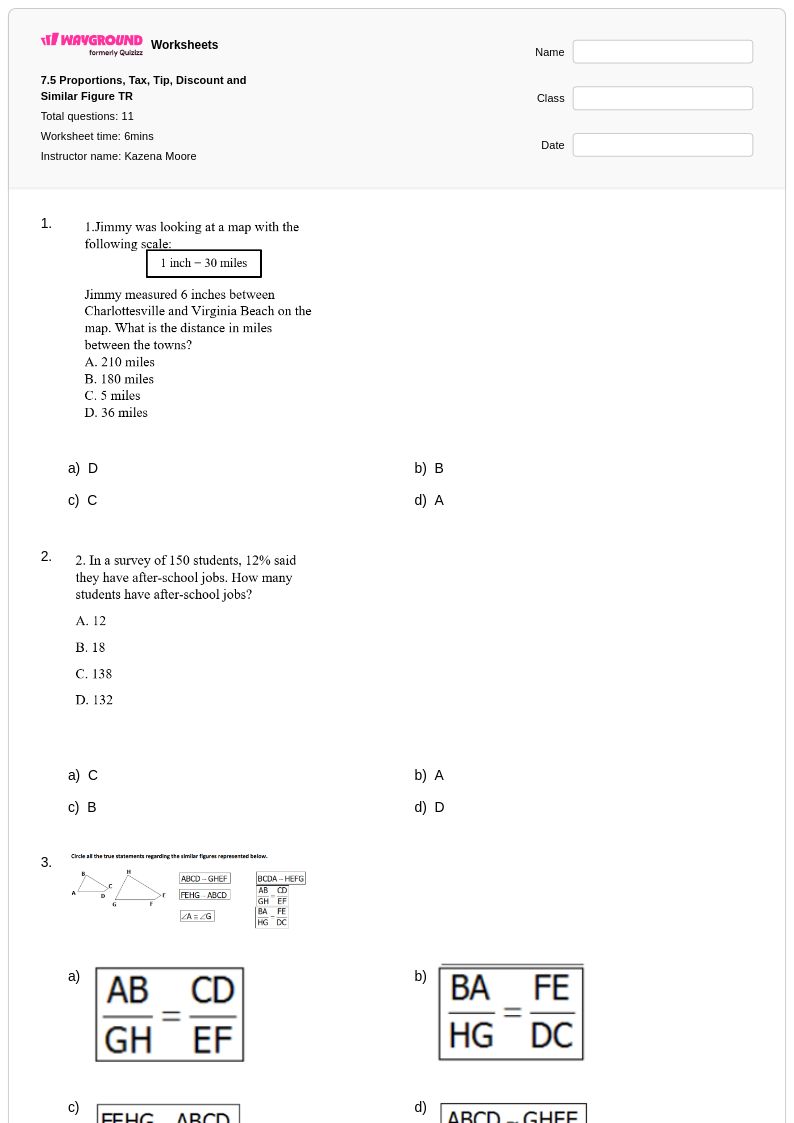

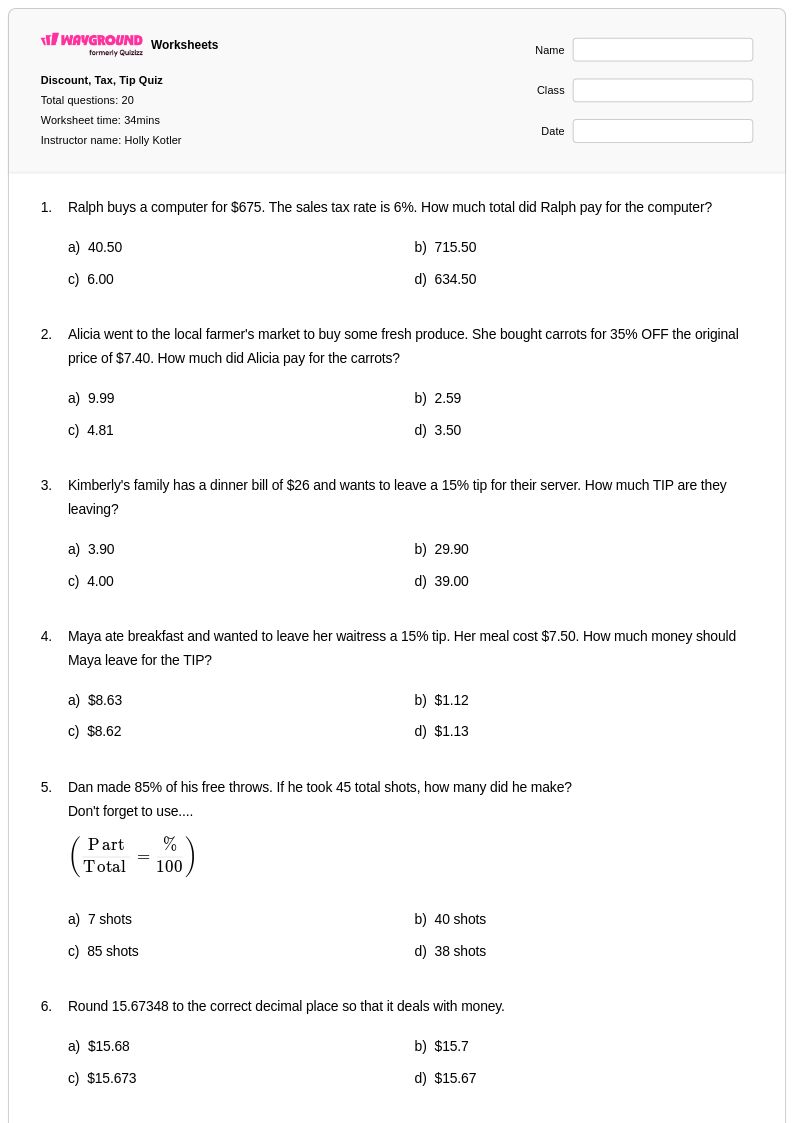

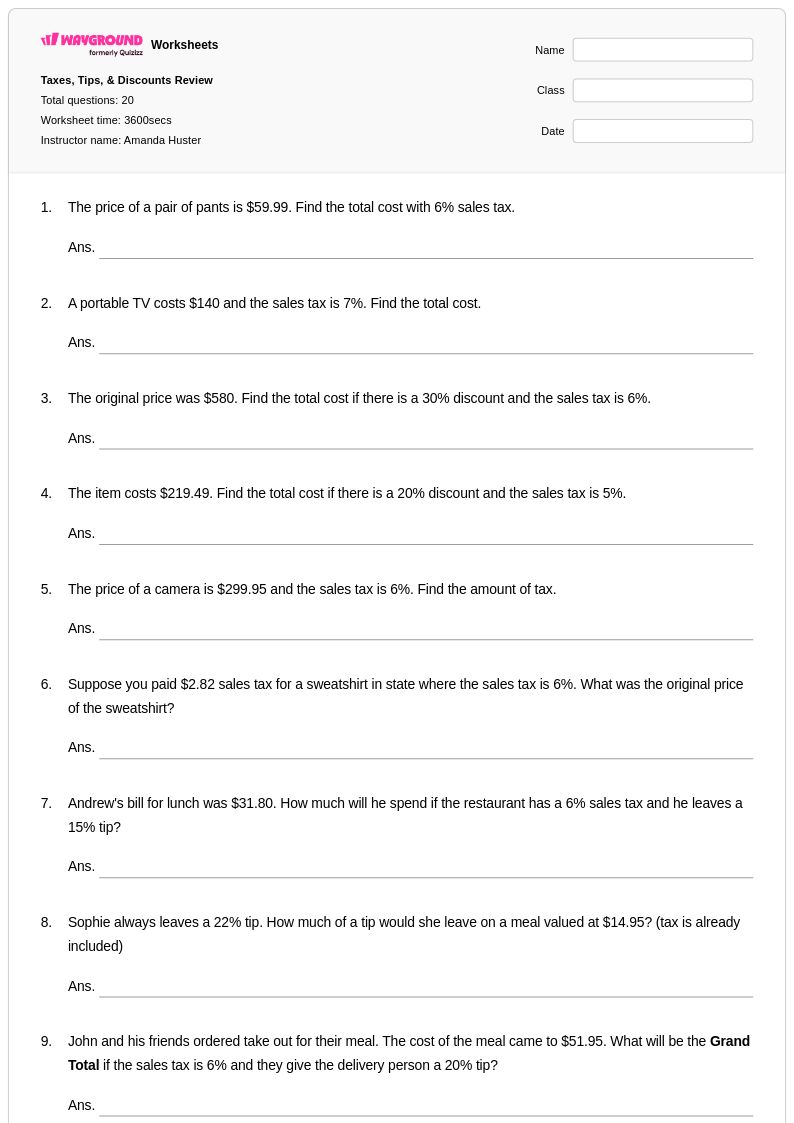

Tax and tip calculations for Class 6 students represent a crucial bridge between abstract mathematical concepts and real-world financial applications that young learners will encounter throughout their lives. Wayground's comprehensive collection of tax and tip calculation worksheets provides middle school students with engaging practice problems that develop essential percentage skills while building financial literacy foundations. These carefully designed printables guide students through step-by-step processes for calculating sales tax on purchases, determining appropriate tip amounts at restaurants, and understanding how these calculations impact total costs. Each worksheet includes detailed answer keys that support independent learning and allow students to check their work, while the variety of free pdf resources ensures teachers can provide consistent practice across different scenarios and difficulty levels.

Wayground's extensive library of teacher-created tax and tip calculation resources empowers educators with millions of expertly crafted materials that align with Class 6 mathematics standards and financial literacy objectives. The platform's robust search and filtering capabilities enable teachers to quickly locate worksheets that match specific learning goals, whether focusing on basic percentage calculations or more complex multi-step problems involving combined tax and tip scenarios. These versatile resources support differentiated instruction through customizable difficulty levels and are available in both printable and digital formats, making them ideal for classroom instruction, homework assignments, remediation sessions, and enrichment activities. Teachers can seamlessly integrate these materials into their lesson planning to provide targeted skill practice that helps students master essential financial mathematics while building confidence in real-world problem-solving situations.