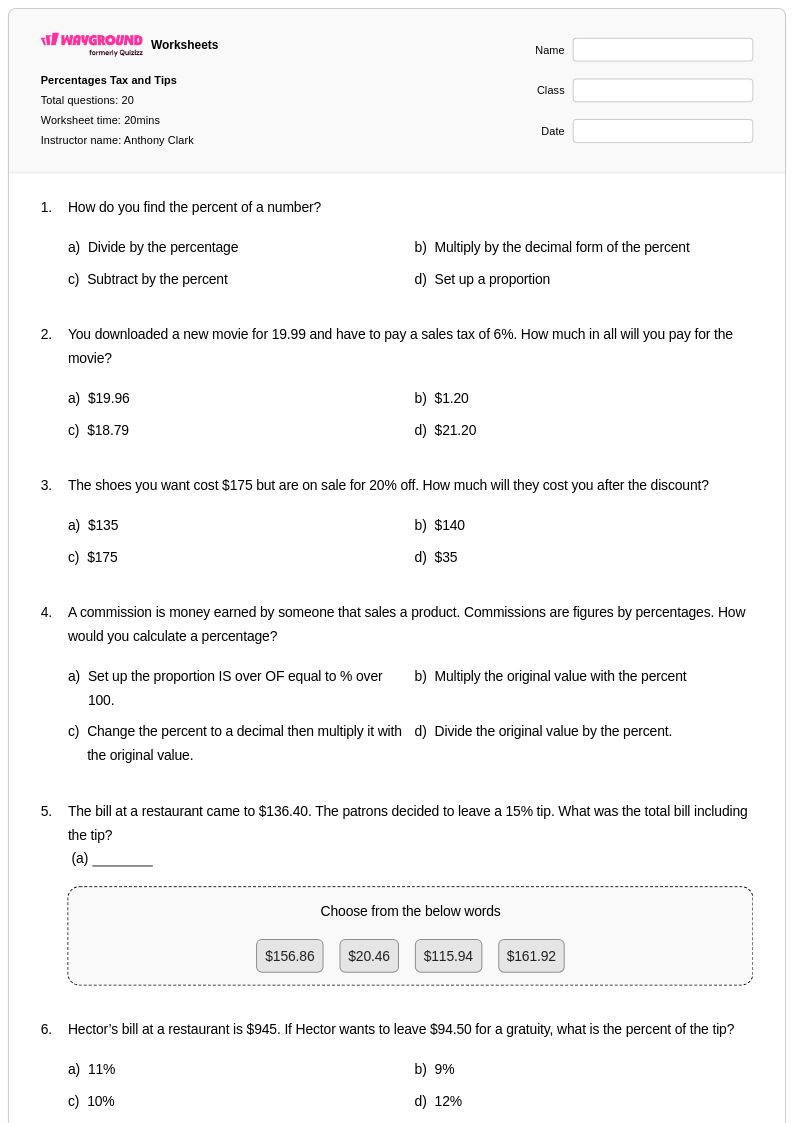

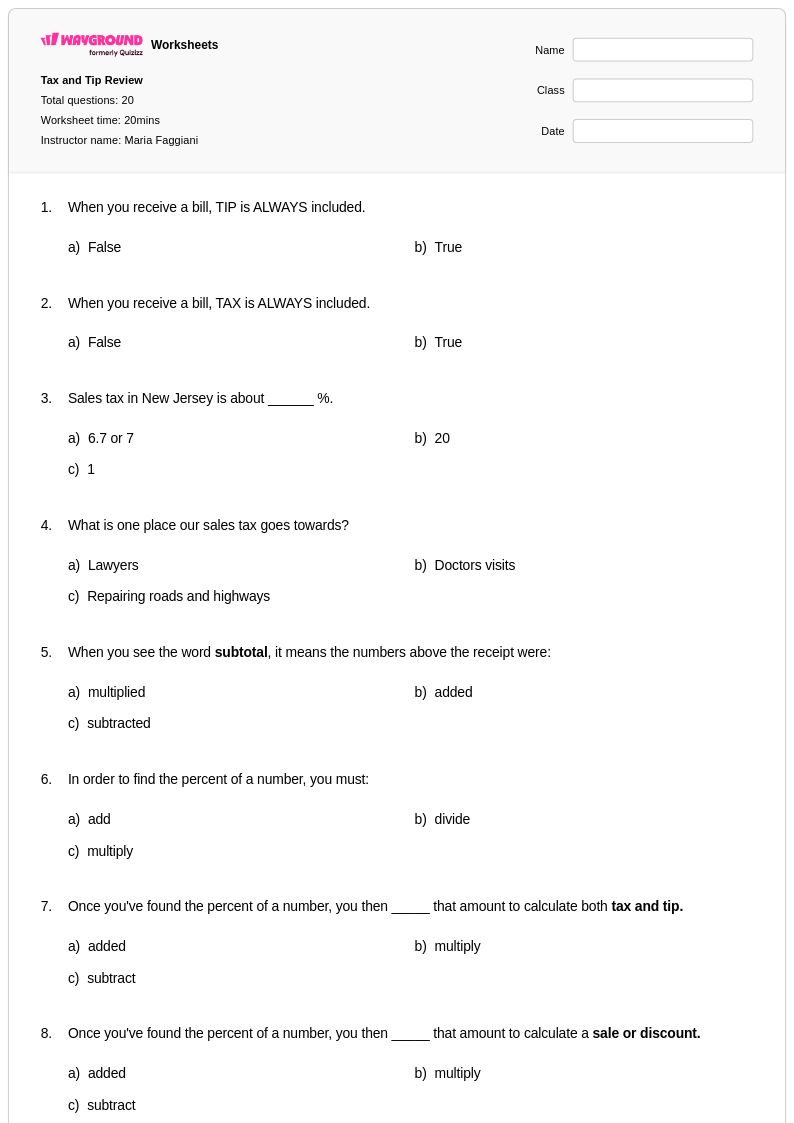

20 Q

7th - Uni

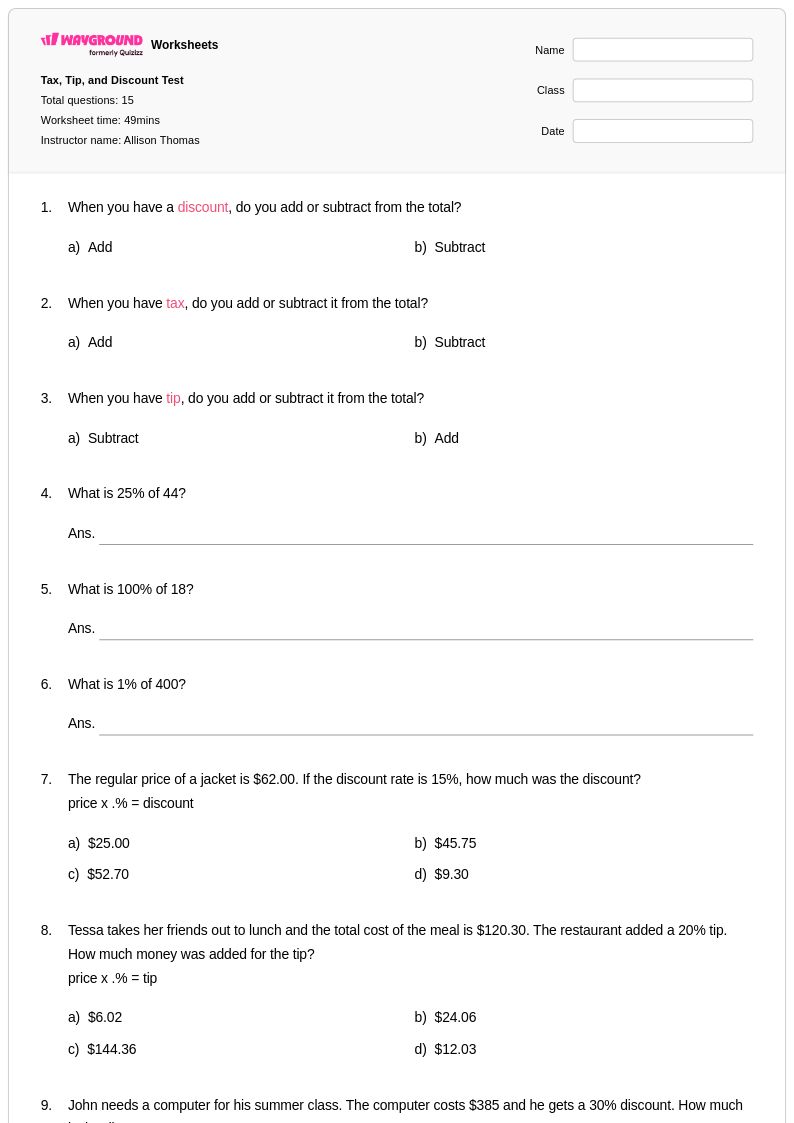

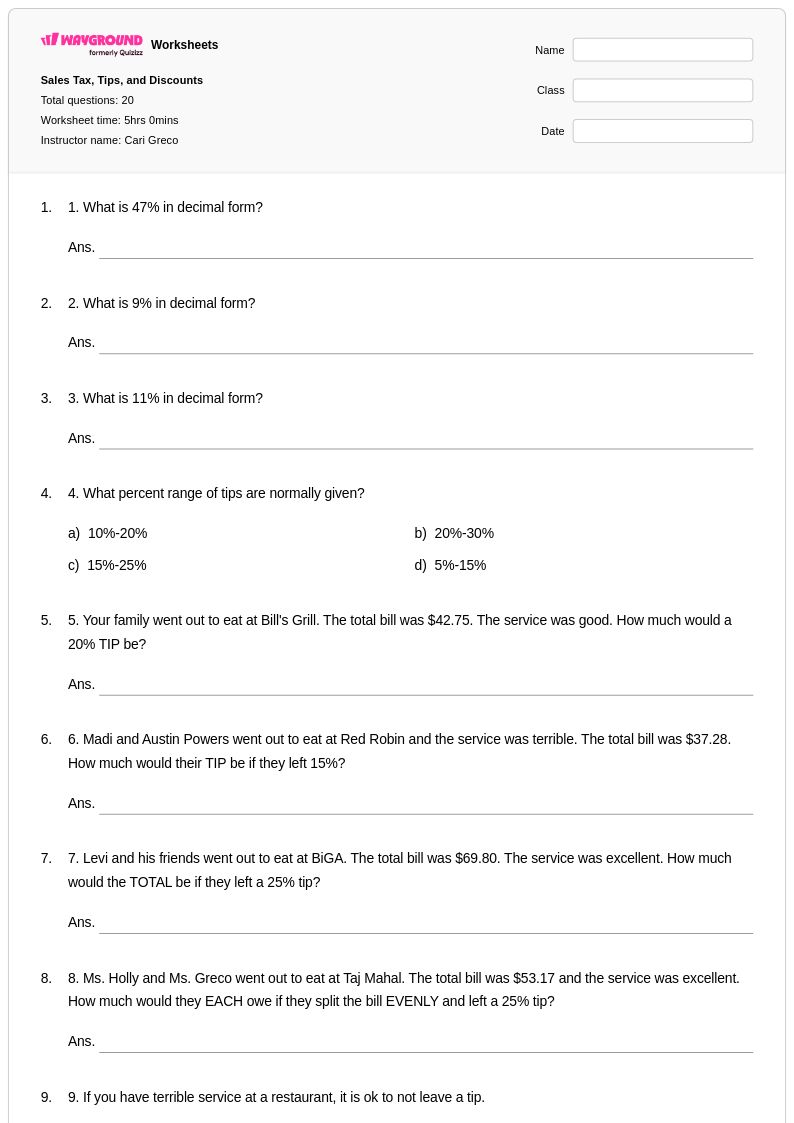

15 Q

6th - 12th

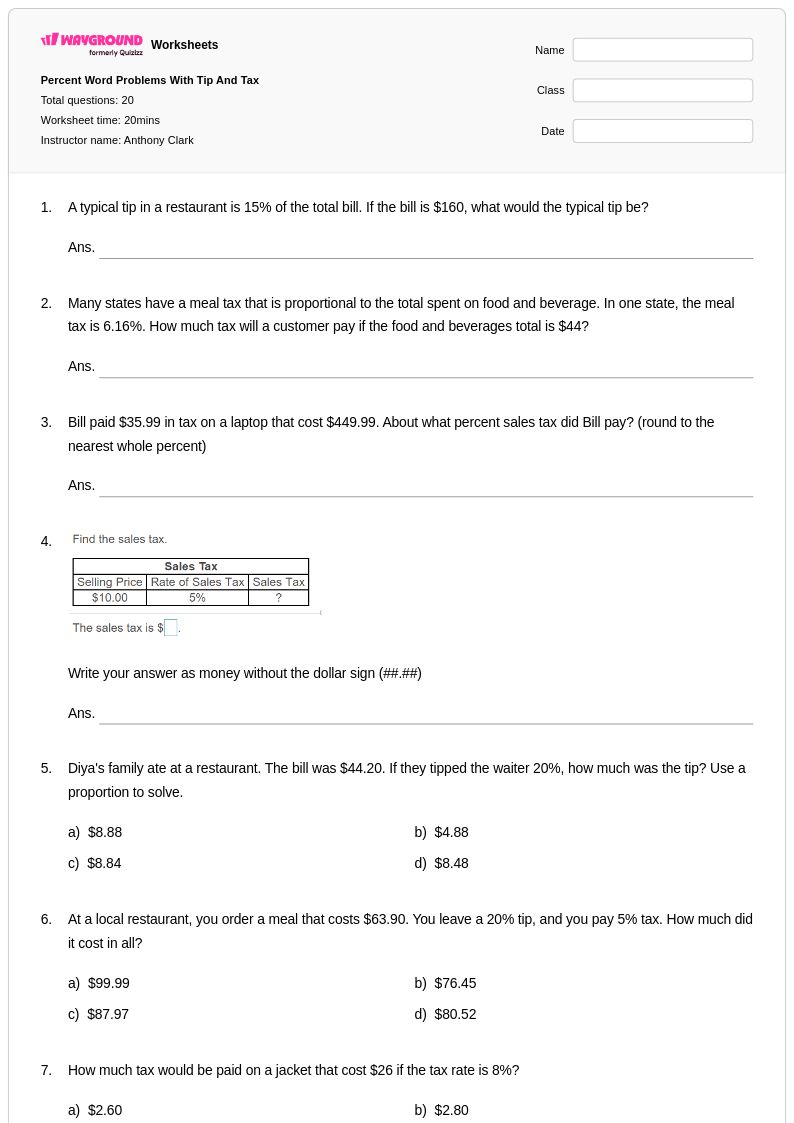

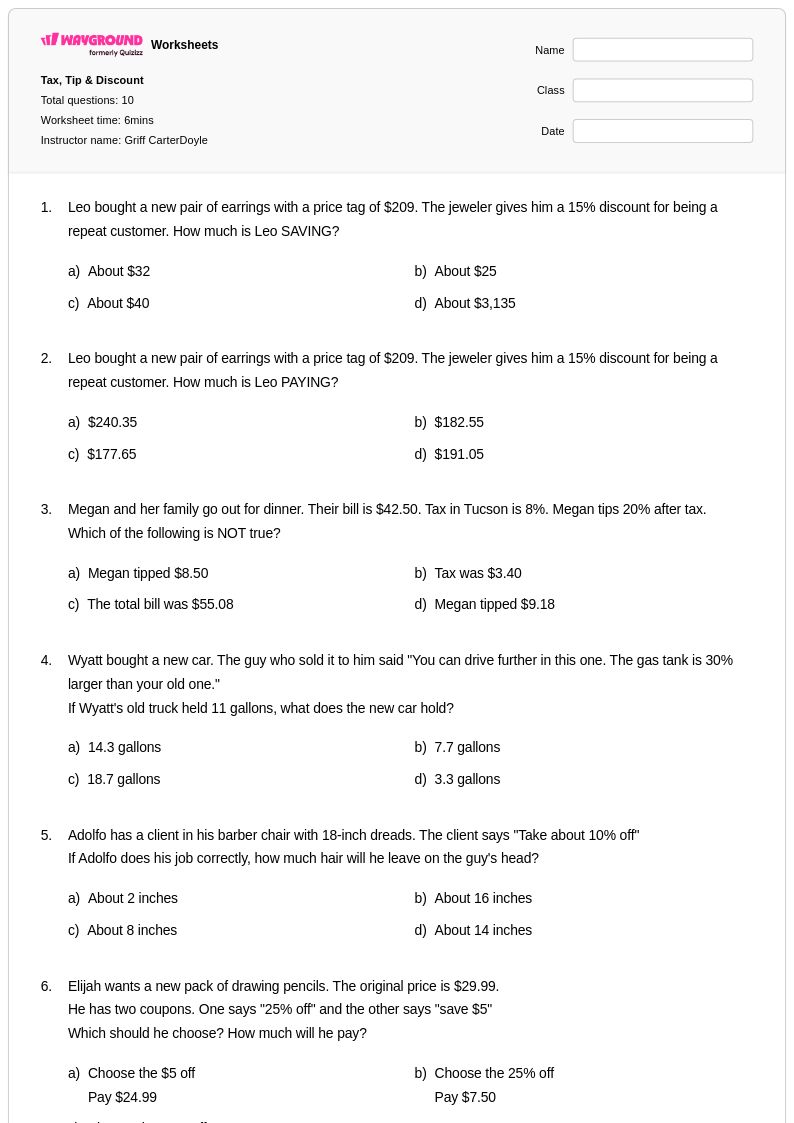

20 Q

7th - Uni

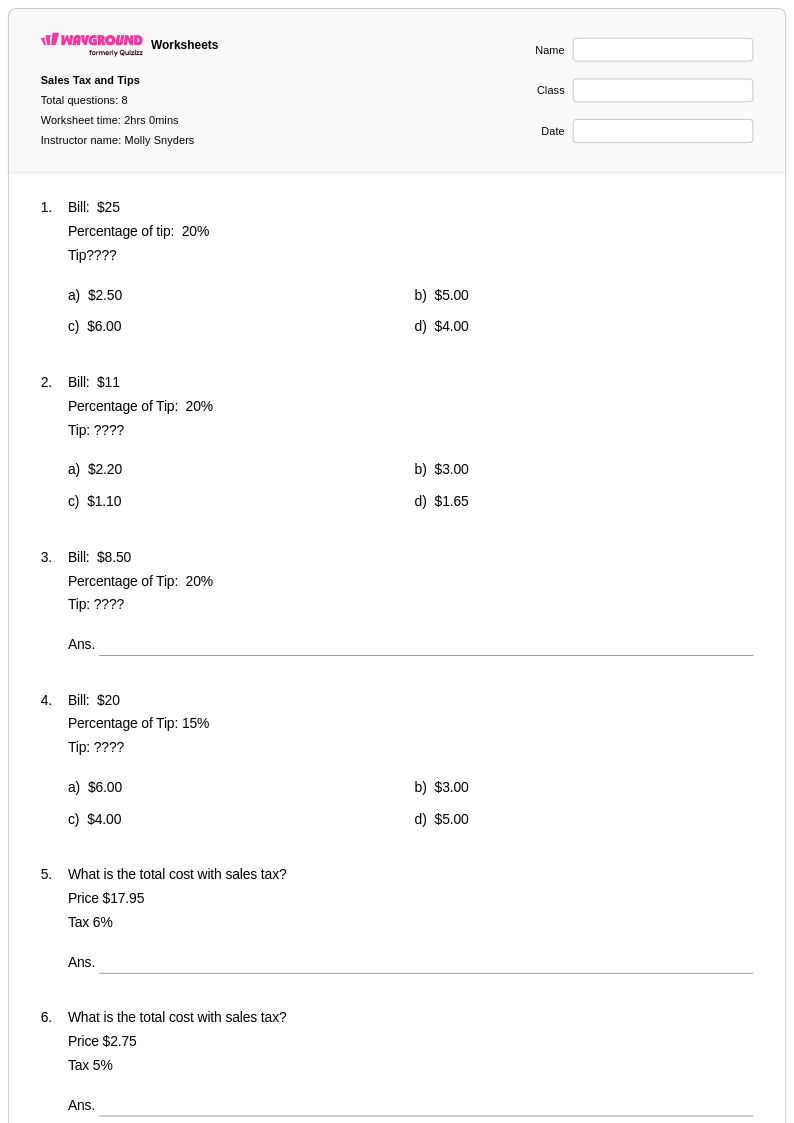

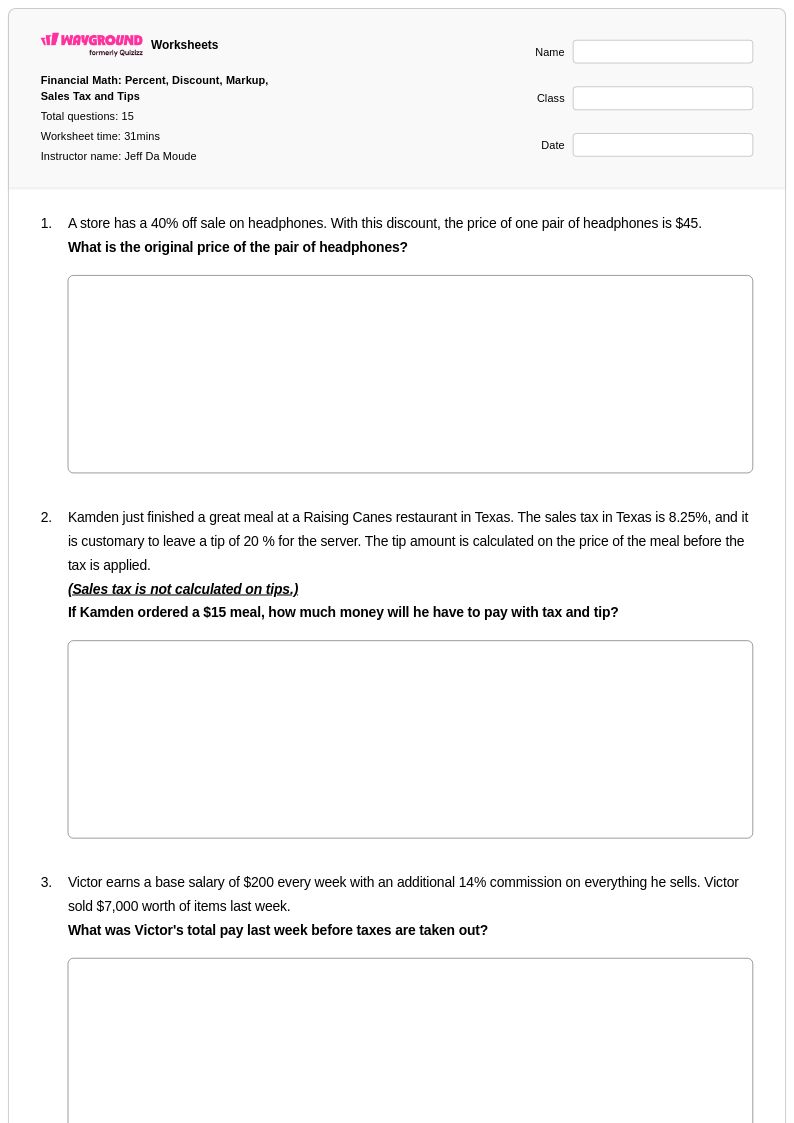

8 Q

9th - 12th

20 Q

9th - 12th

20 Q

9th - 12th

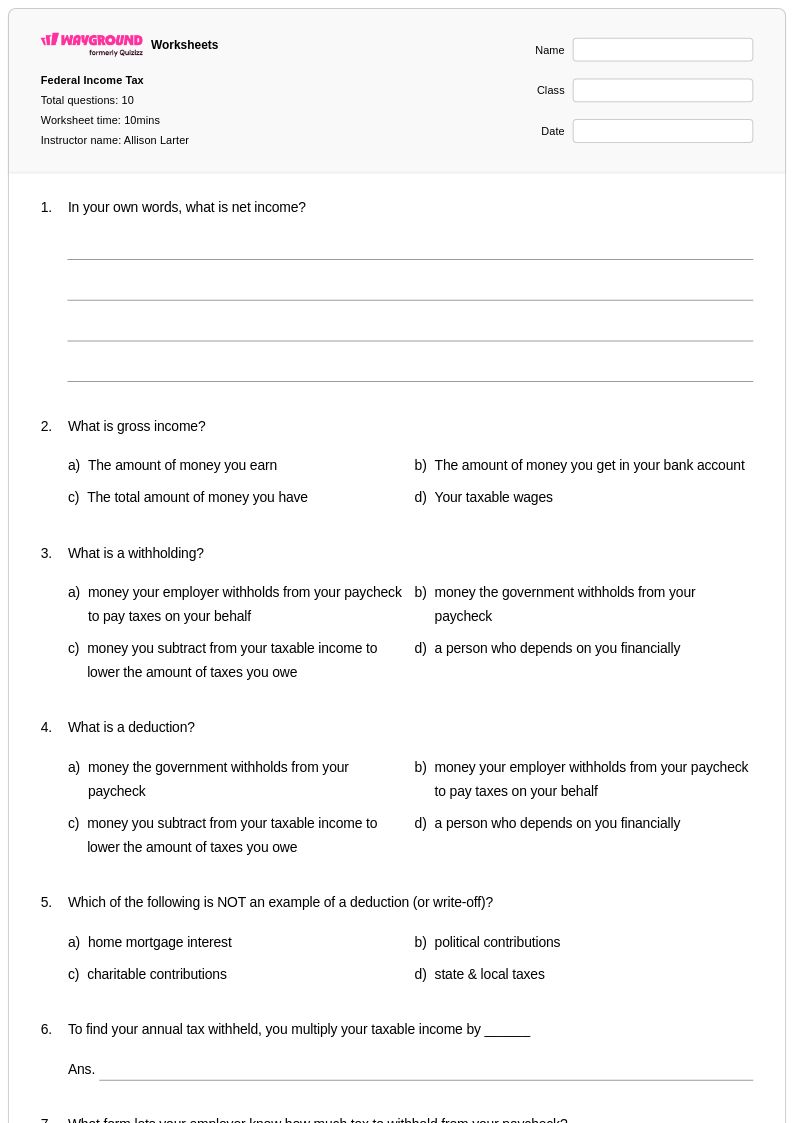

10 Q

9th - 12th

15 Q

9th - 12th

50 Q

9th - 12th

30 Q

12th

10 Q

12th

10 Q

12th

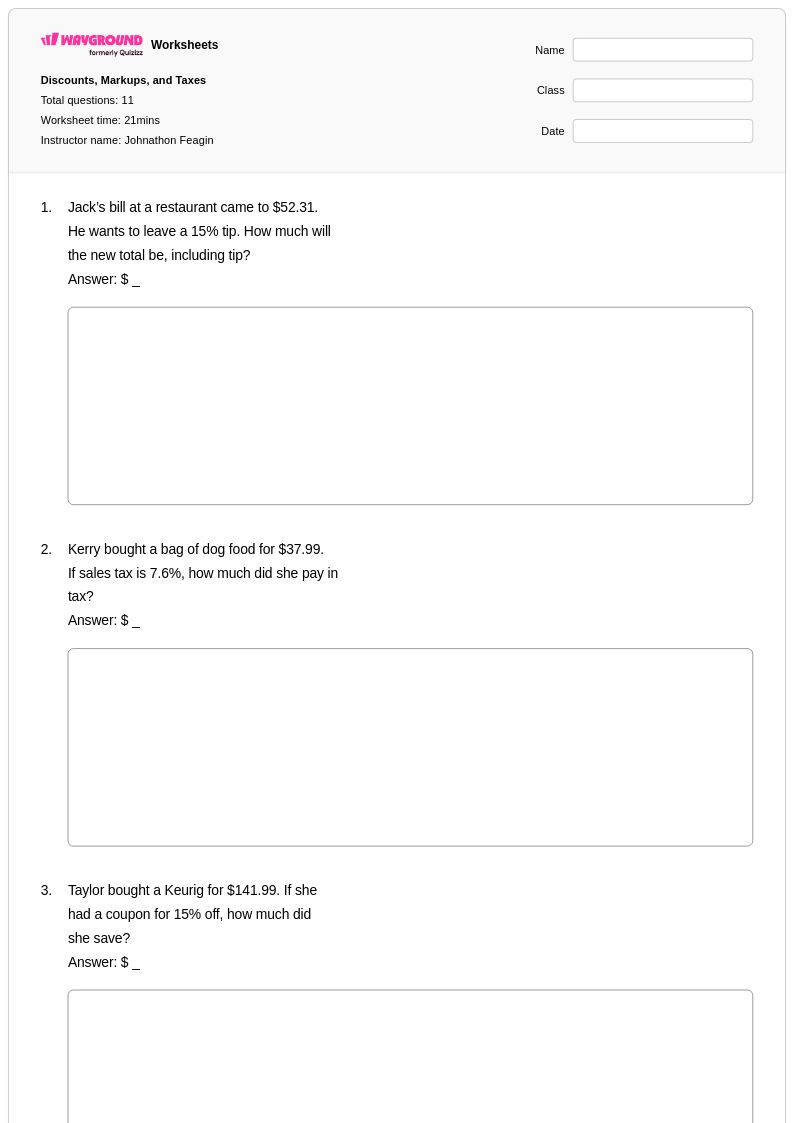

11 Q

9th - 12th

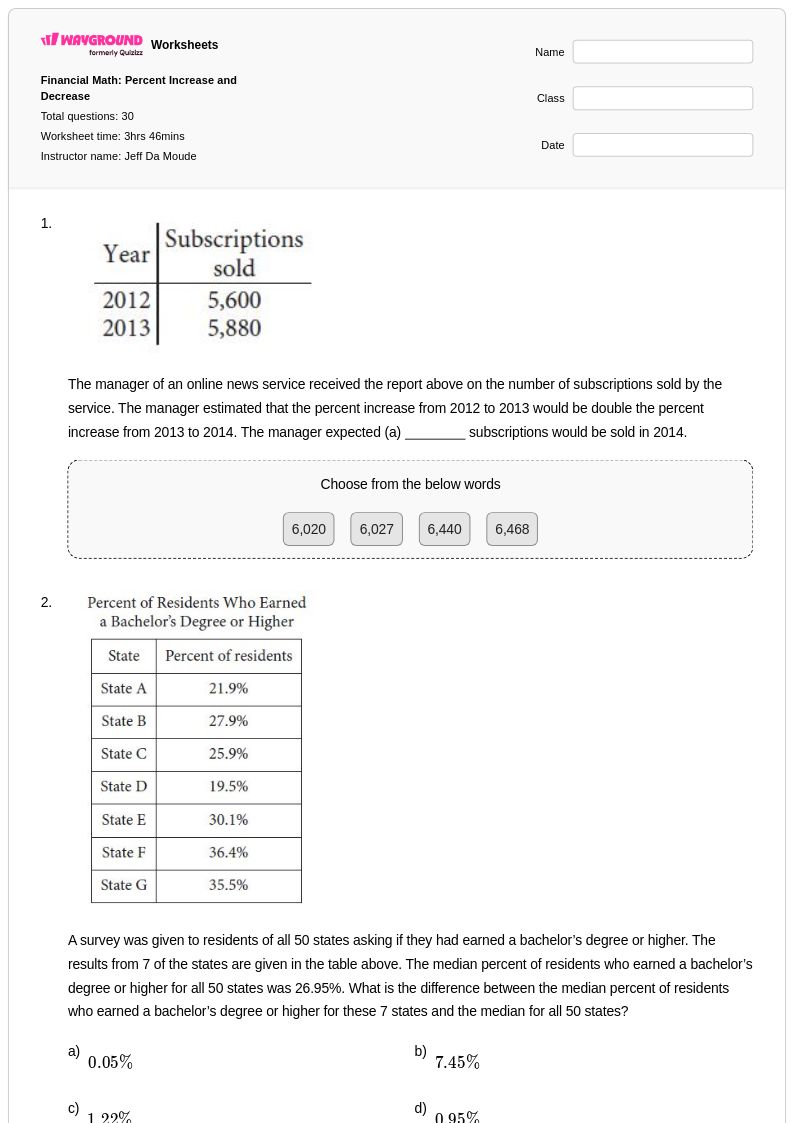

30 Q

12th

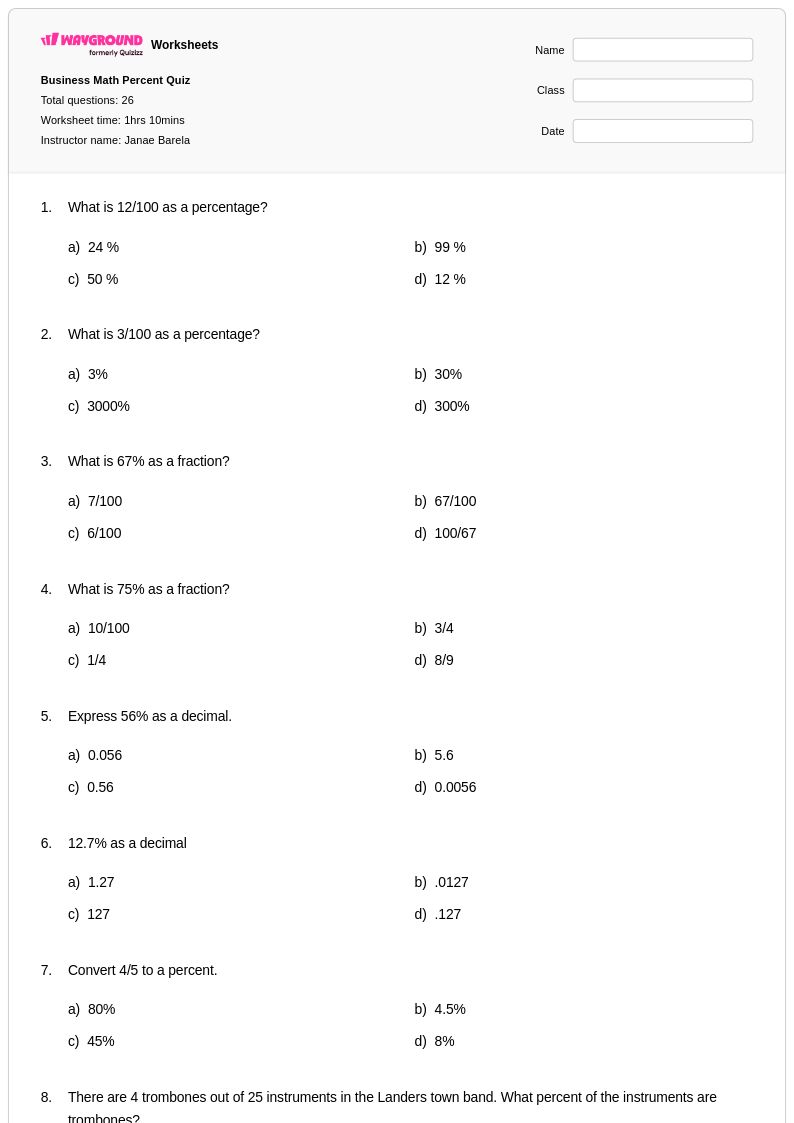

26 Q

9th - 12th

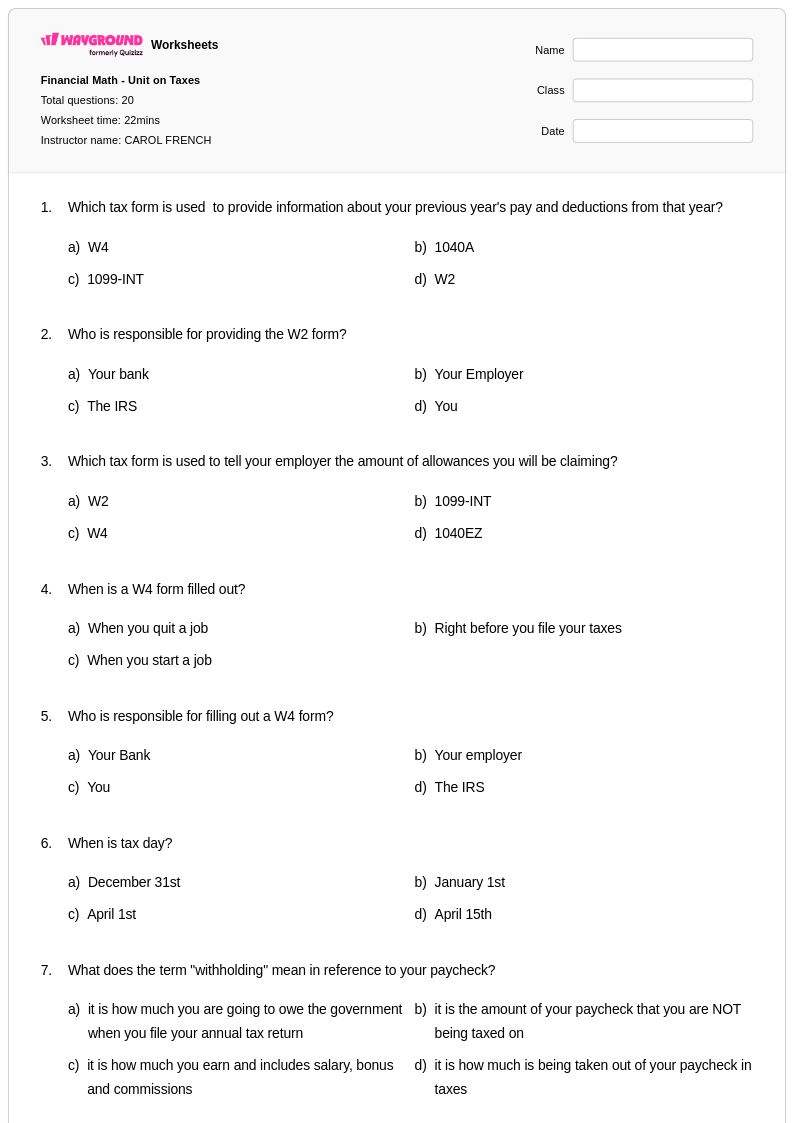

20 Q

12th

50 Q

9th - 12th

40 Q

11th - 12th

15 Q

9th - 12th

7 Q

12th

10 Q

9th - 12th

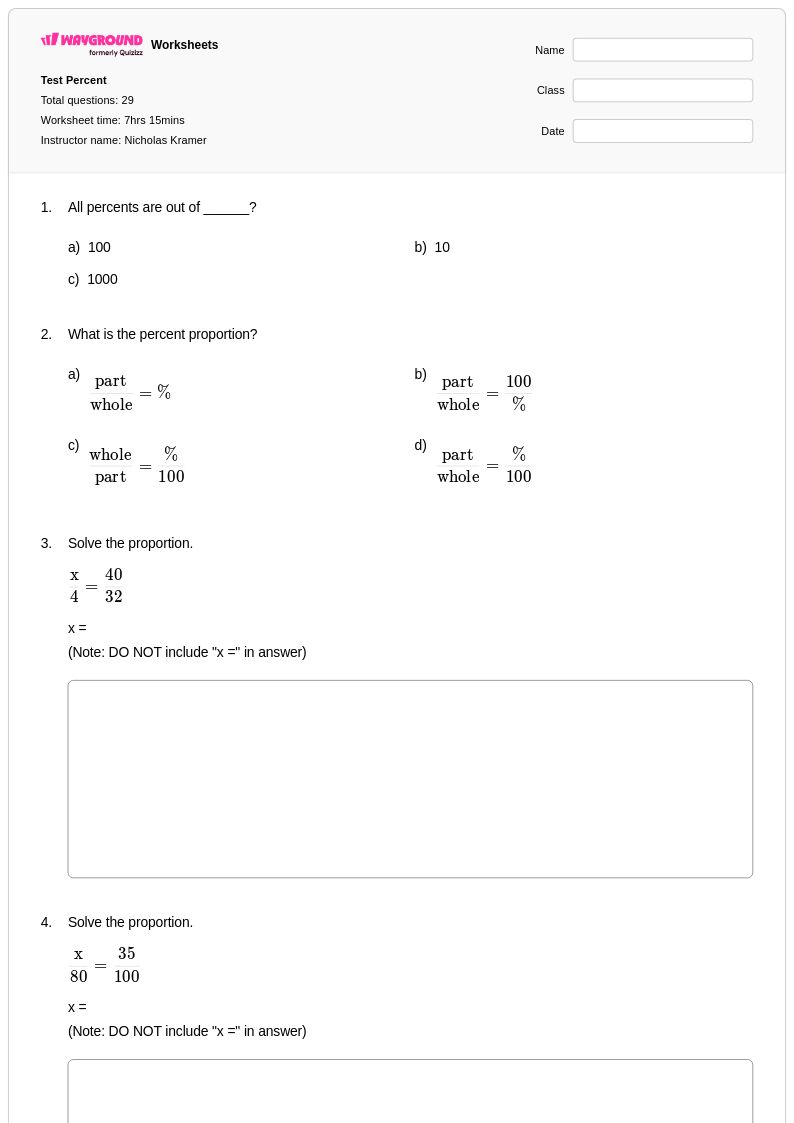

29 Q

9th - 12th

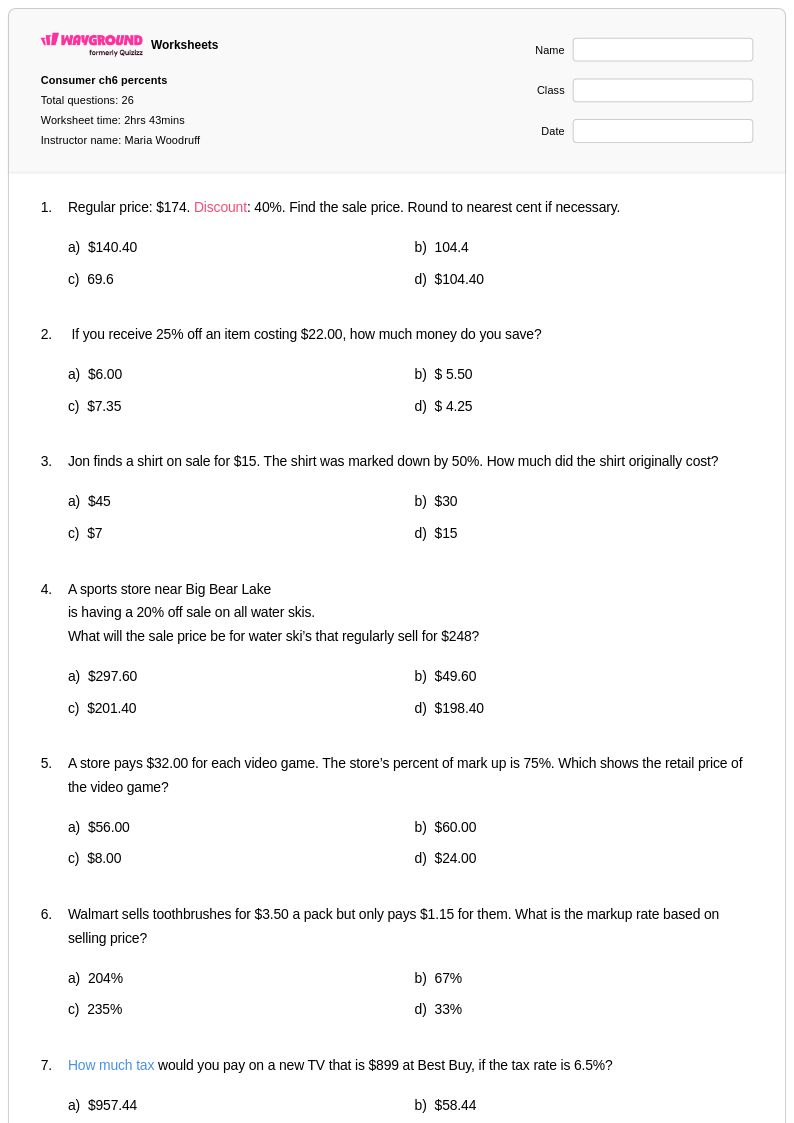

26 Q

9th - 12th

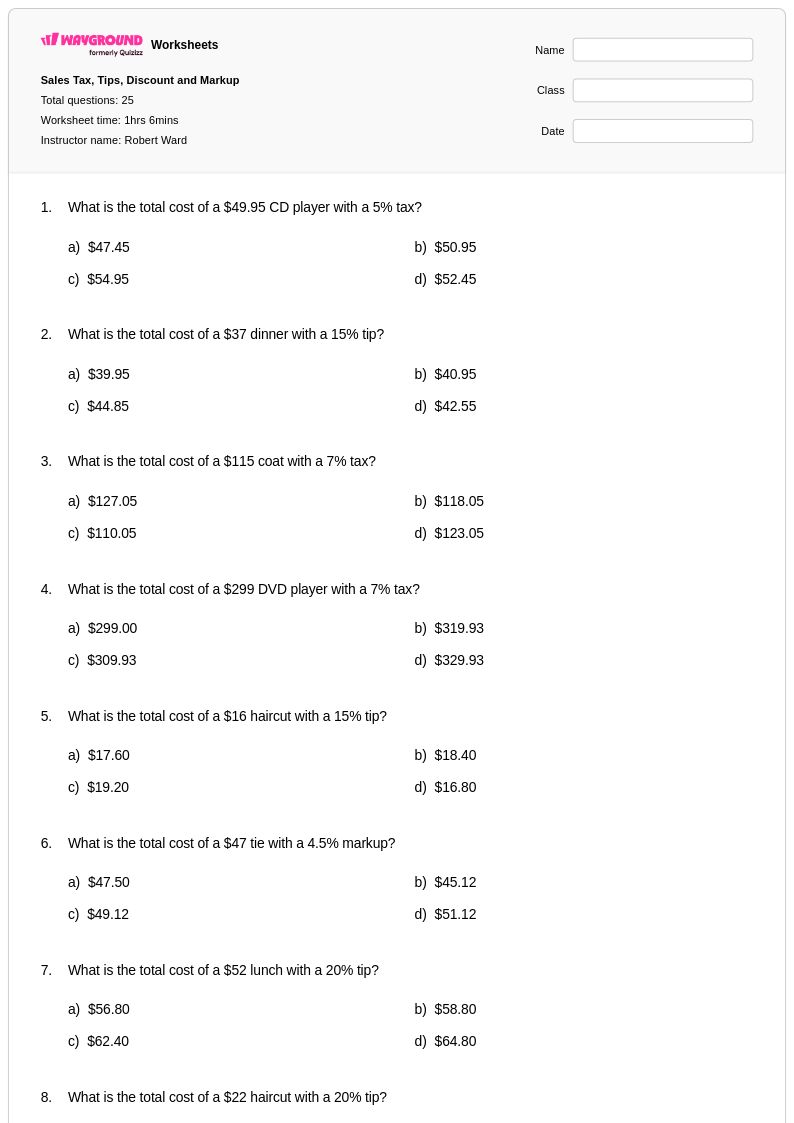

25 Q

12th

Explore Tax and Tip Calculations Worksheets by Grades

Explore Other Subject Worksheets for class 12

Explore printable Tax and Tip Calculations worksheets for Class 12

Tax and tip calculations for Class 12 students represent essential real-world mathematical skills that bridge classroom learning with practical financial literacy applications. These comprehensive worksheets available through Wayground (formerly Quizizz) focus on developing students' ability to compute sales tax, income tax deductions, gratuity percentages, and combined tax-tip scenarios using proportional reasoning and percentage calculations. Students strengthen their computational fluency while mastering the mathematical concepts underlying everyday financial transactions, from calculating the total cost of purchases including tax to determining appropriate tip amounts in service situations. The collection includes detailed practice problems with corresponding answer keys, enabling independent study and self-assessment, while pdf formats and free printables ensure accessibility for both classroom instruction and homework assignments.

Wayground (formerly Quizizz) empowers educators with millions of teacher-created resources specifically designed to support Class 12 tax and tip calculation instruction across diverse learning environments. The platform's robust search and filtering capabilities allow teachers to quickly locate worksheets aligned with specific mathematical standards and learning objectives, while built-in differentiation tools enable customization for students with varying skill levels and learning needs. These resources are available in both printable pdf formats and interactive digital versions, providing flexibility for traditional paper-based practice, online assignments, or hybrid learning approaches. Teachers can seamlessly integrate these materials into lesson planning for initial skill introduction, targeted remediation for struggling learners, enrichment opportunities for advanced students, or comprehensive review sessions that prepare students for standardized assessments and real-world financial decision-making.