12 Q

5th - 12th

10 Q

6th - 8th

20 Q

7th

12 Q

9th

10 Q

7th

10 Q

12th

12 Q

7th

10 Q

7th

20 Q

7th

10 Q

7th

15 Q

12th

12 Q

12th

10 Q

5th

16 Q

12th

22 Q

12th

14 Q

6th

10 Q

6th

10 Q

6th - 7th

8 Q

9th - 12th

10 Q

7th

20 Q

6th - 8th

16 Q

7th

18 Q

6th

20 Q

6th - 10th

Explore Worksheets by Subjects

Explore printable Tax Calculation worksheets

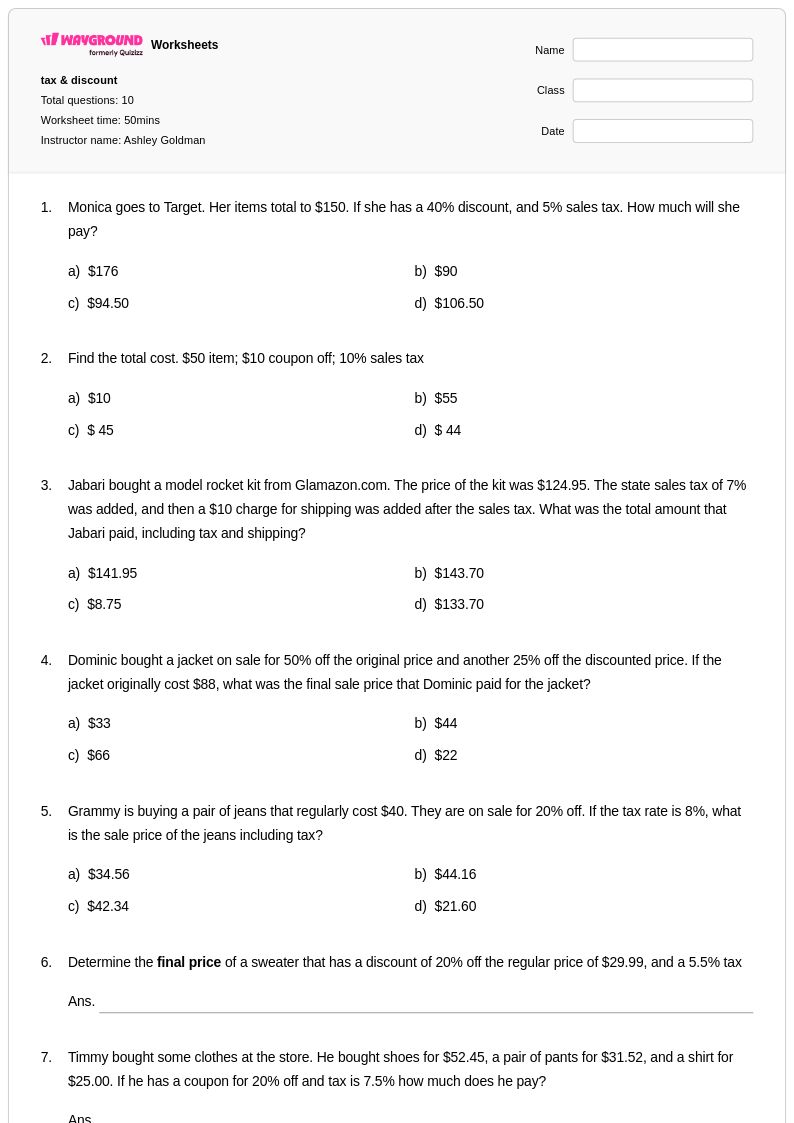

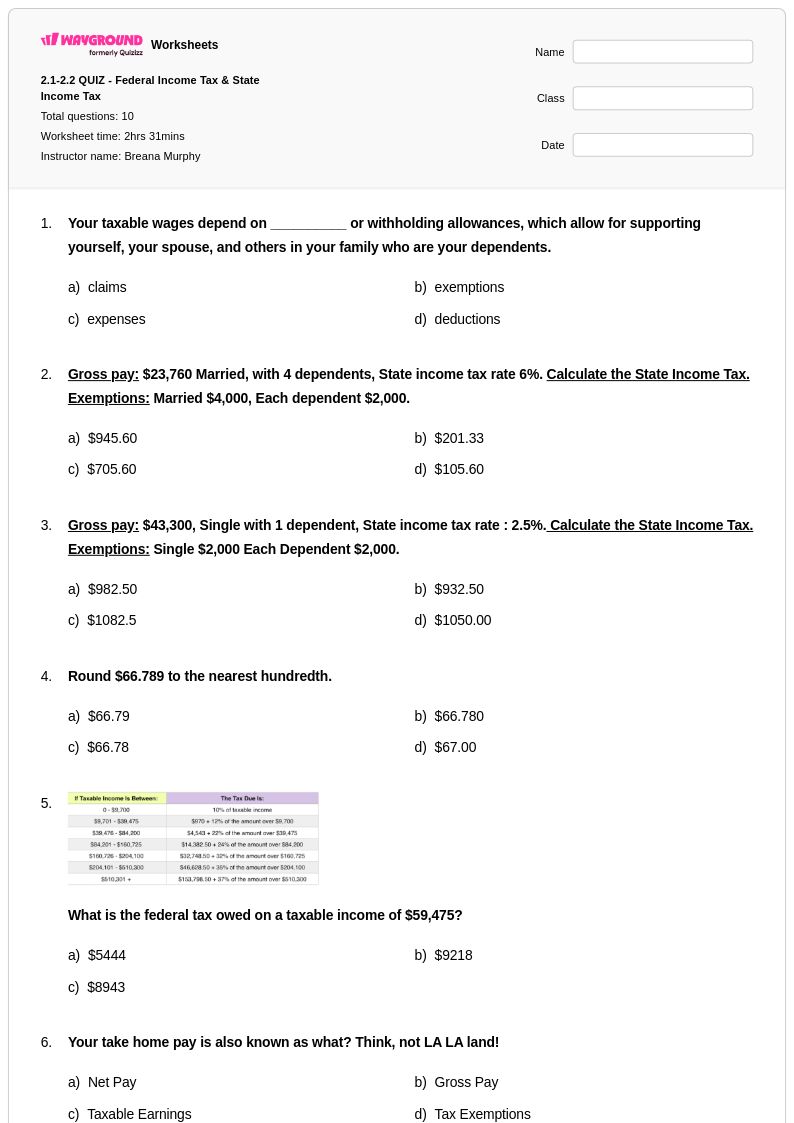

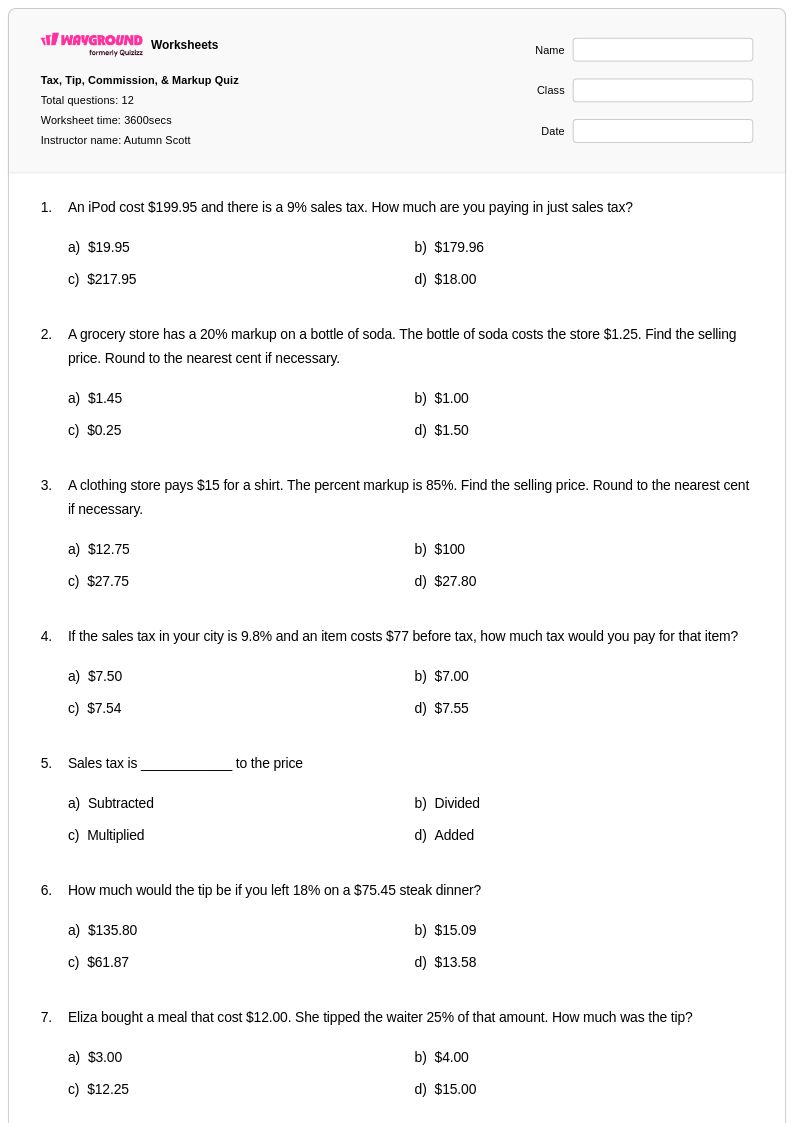

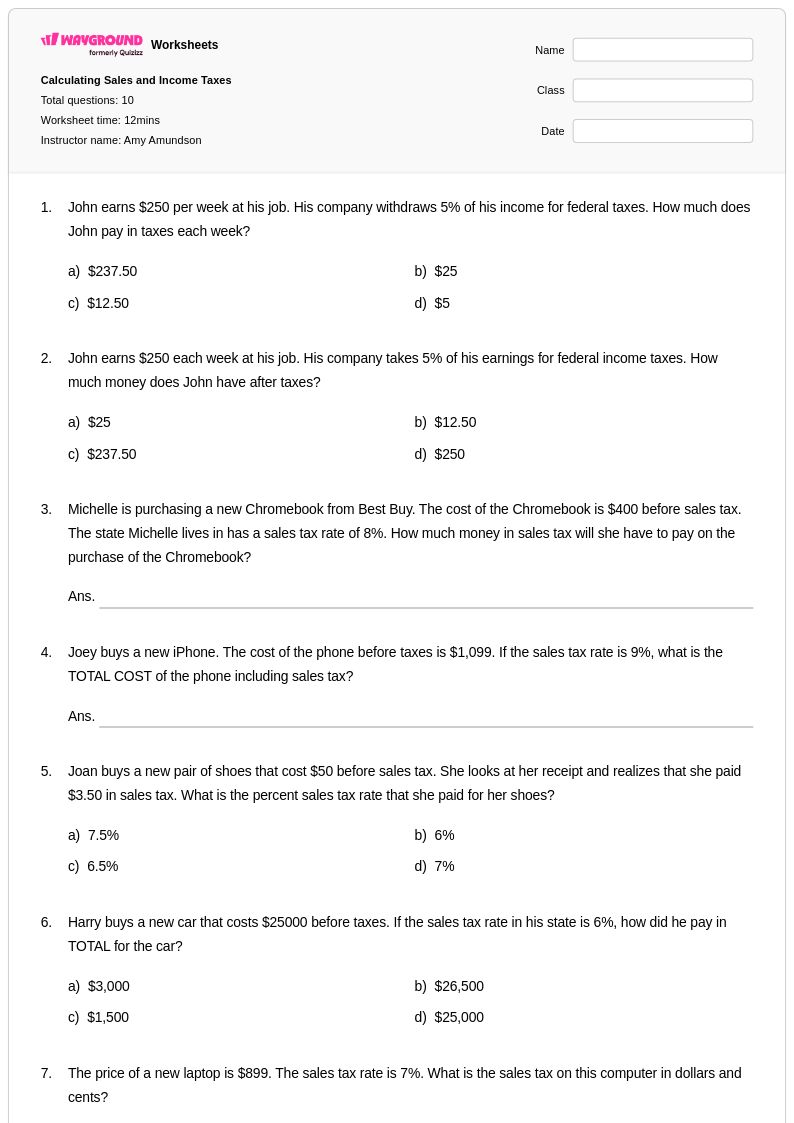

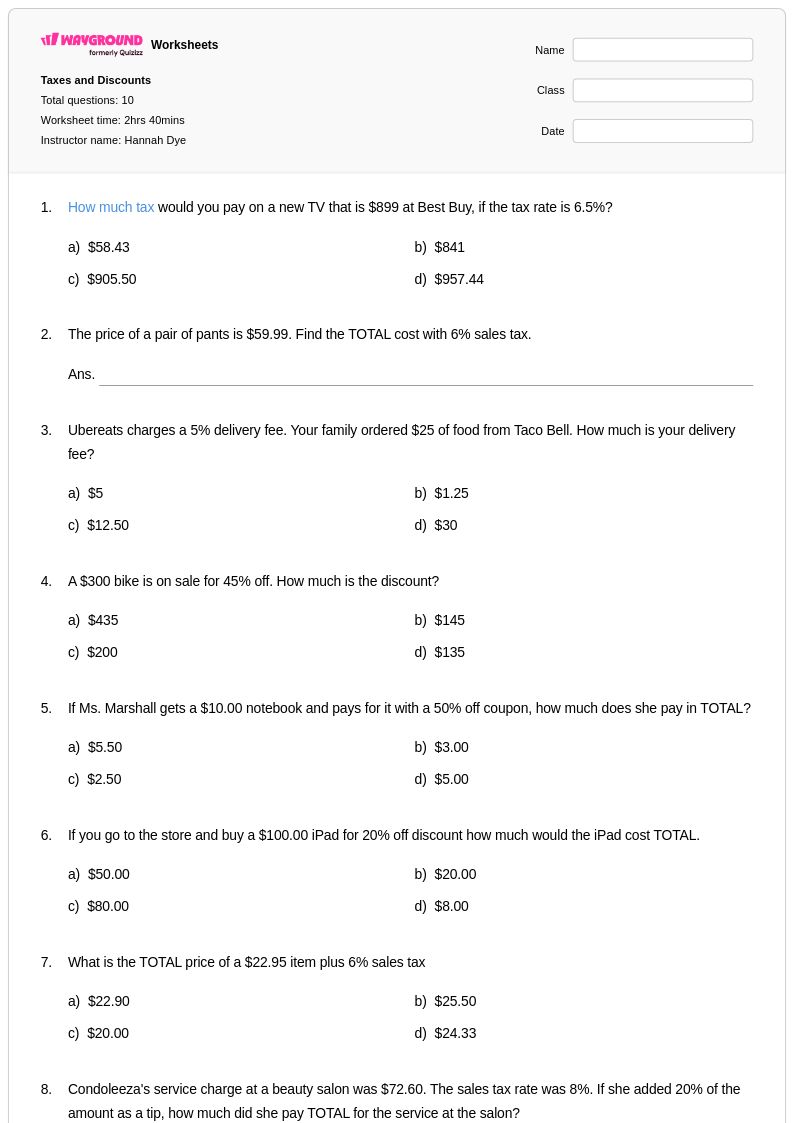

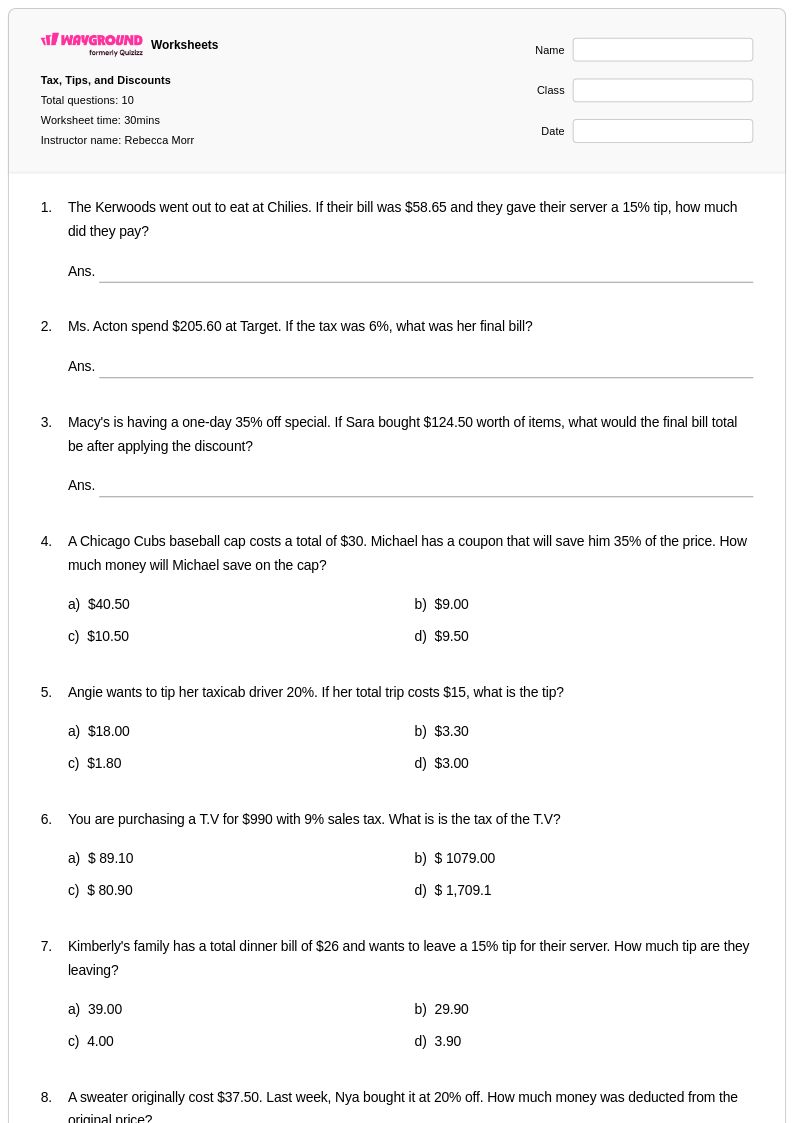

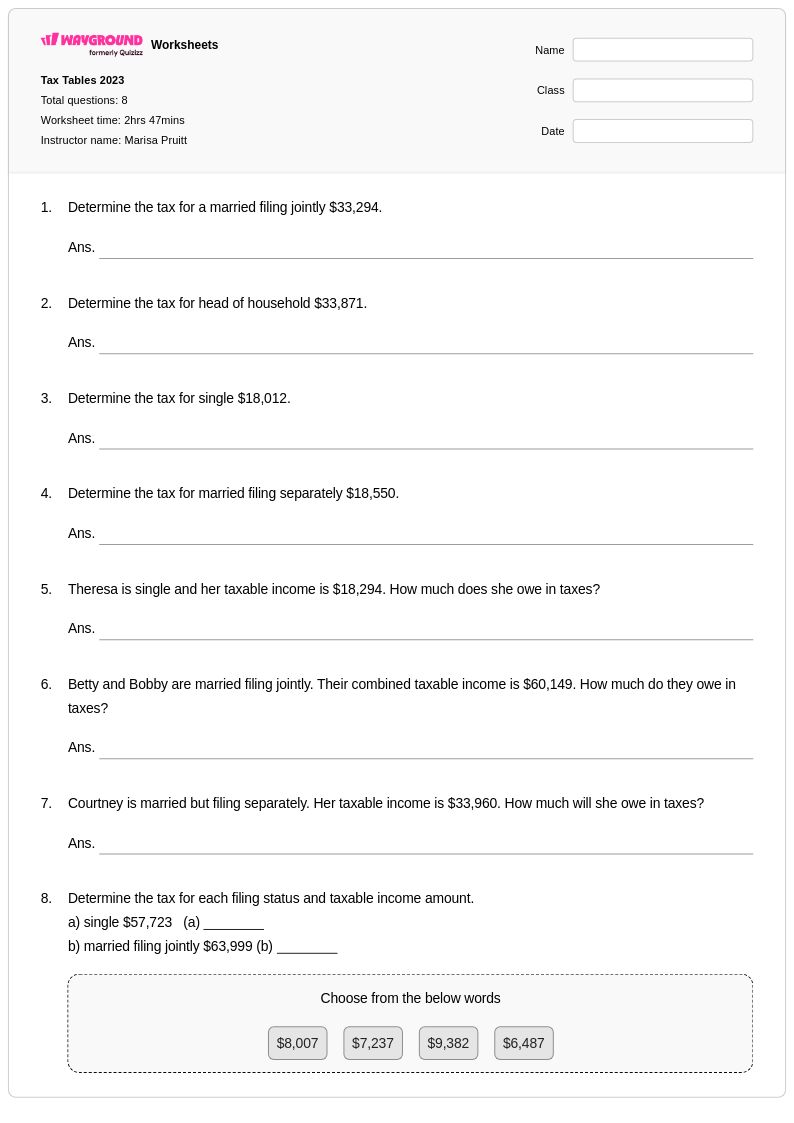

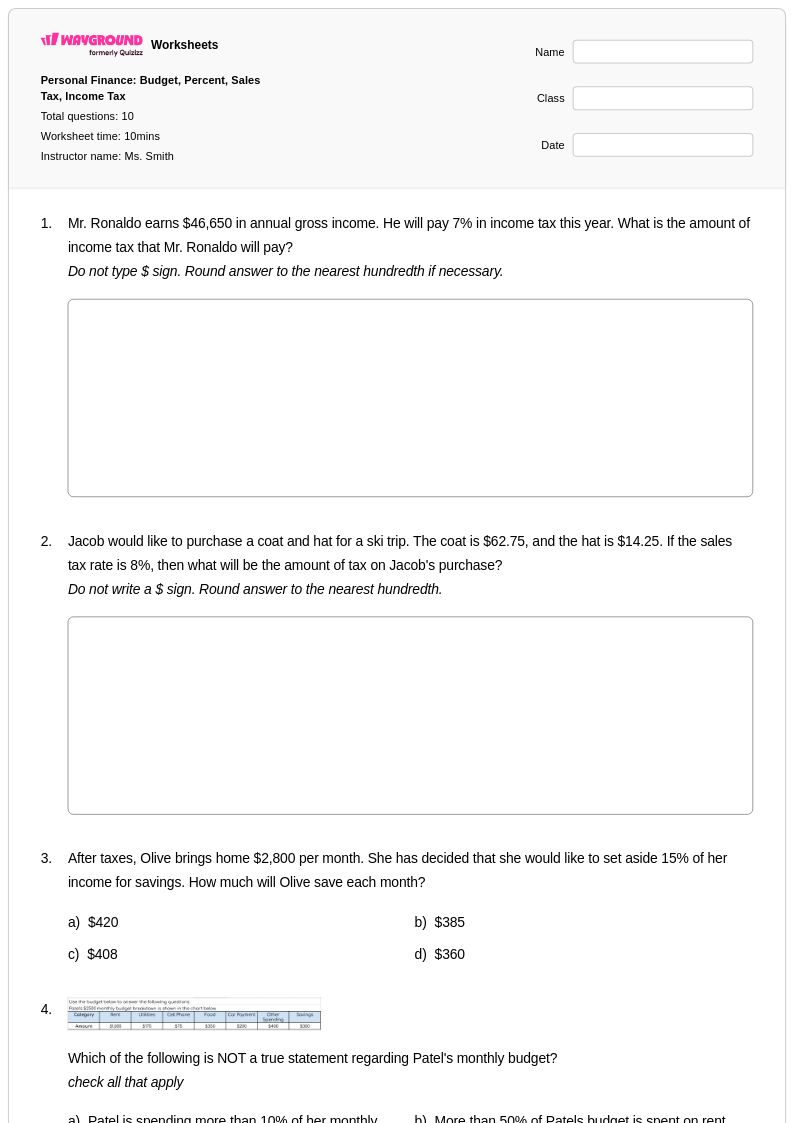

Tax calculation worksheets available through Wayground (formerly Quizizz) provide comprehensive practice with essential financial literacy skills that students need to navigate real-world tax scenarios. These expertly crafted resources help learners master key concepts including calculating gross and net income, determining tax brackets, computing federal and state tax obligations, understanding deductions and exemptions, and working with tax forms like the 1040EZ. Each worksheet collection includes detailed answer keys and step-by-step solutions that guide students through complex tax calculations, while free printable pdf formats ensure accessibility for diverse learning environments. The practice problems range from basic percentage calculations for tax rates to more advanced scenarios involving multiple income sources, itemized deductions, and tax credits, building the mathematical reasoning skills necessary for personal financial management.

Wayground (formerly Quizizz) empowers educators with millions of teacher-created tax calculation resources that streamline lesson planning and support differentiated instruction across all skill levels. The platform's robust search and filtering capabilities allow teachers to quickly locate worksheets aligned with specific standards and learning objectives, while customization tools enable modification of existing materials to meet individual student needs. These digital and printable resources support effective remediation for struggling learners through scaffolded problems and provide enrichment opportunities for advanced students ready to tackle complex tax scenarios. Teachers can seamlessly integrate these materials into their financial literacy curriculum for targeted skill practice, formative assessment, or homework assignments, ensuring students develop the computational fluency and critical thinking abilities essential for understanding tax obligations and making informed financial decisions throughout their lives.