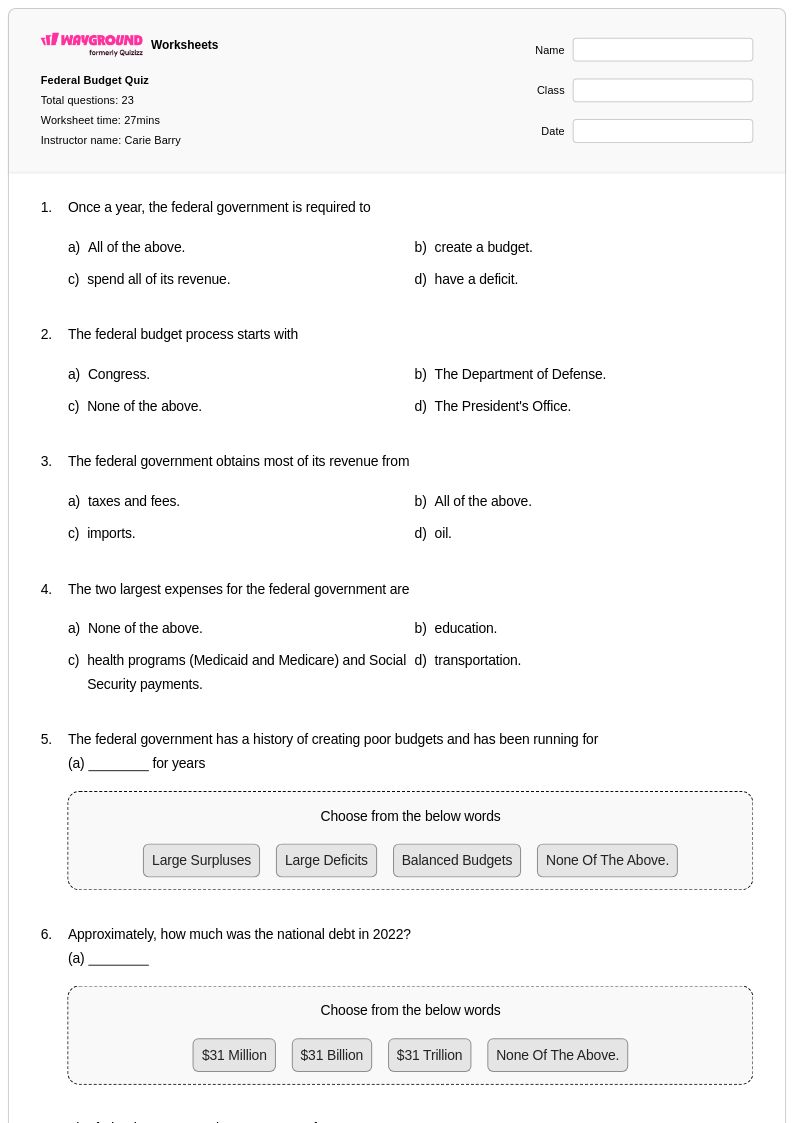

23 Q

9th - 12th

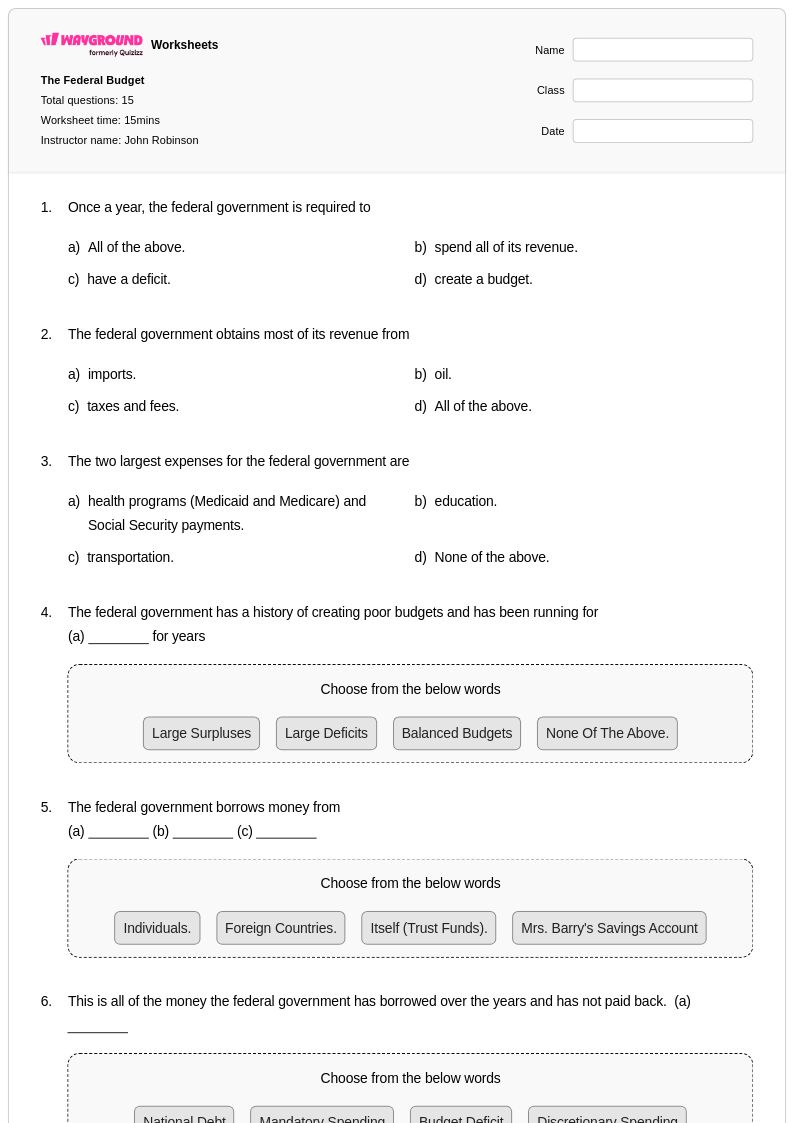

15 Q

12th - Uni

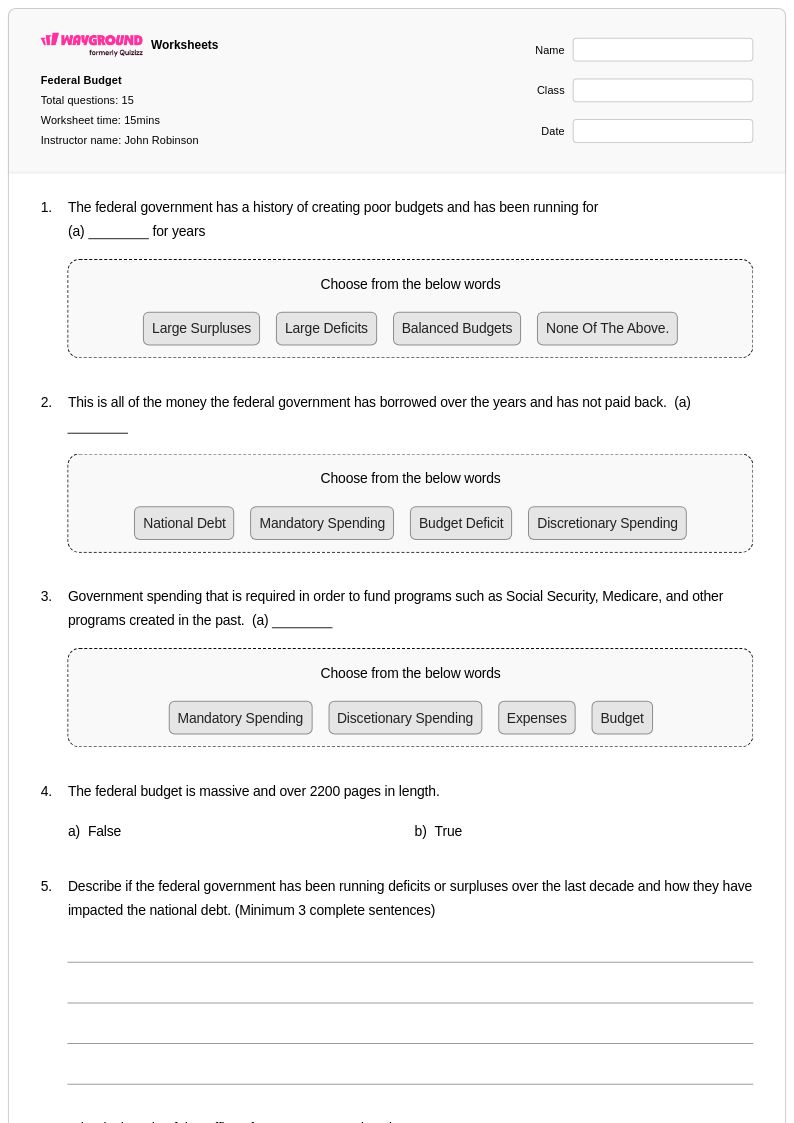

15 Q

12th - Uni

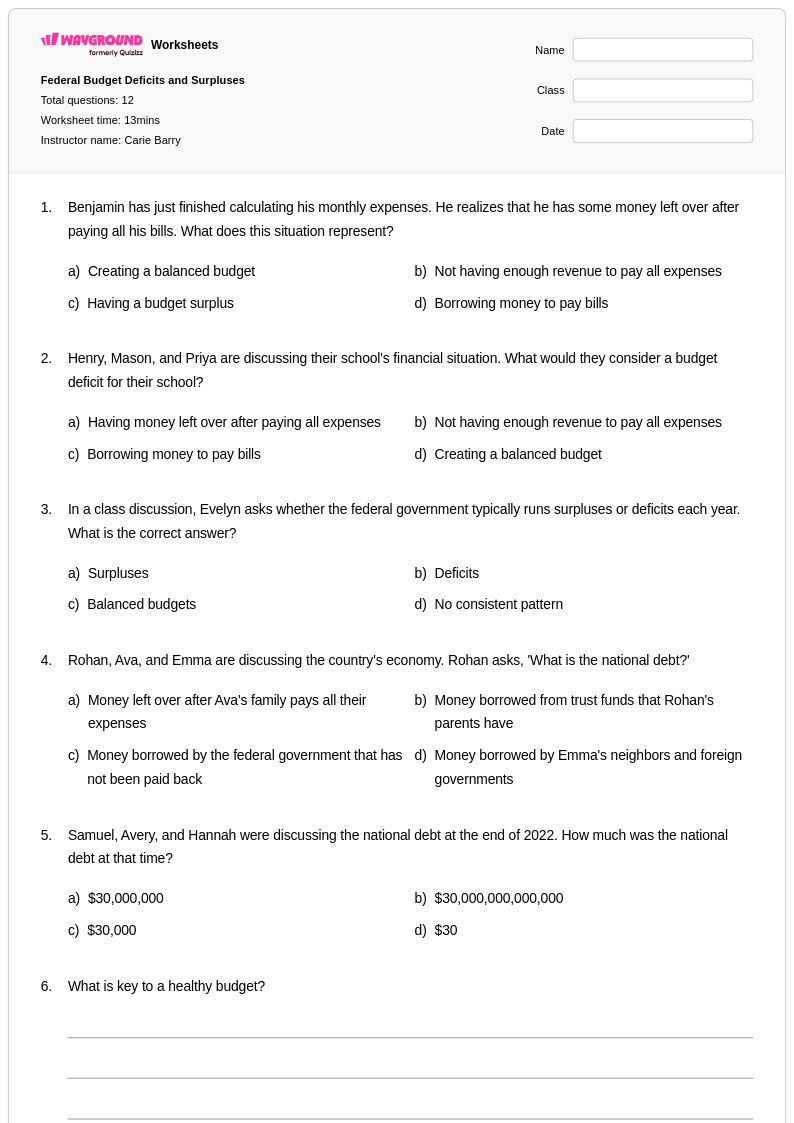

12 Q

12th

20 Q

9th - 12th

46 Q

9th - 12th

10 Q

12th

10 Q

12th

10 Q

12th

8 Q

9th - 12th

25 Q

12th - Uni

13 Q

12th

30 Q

12th

30 Q

12th

7 Q

11th - 12th

20 Q

12th

25 Q

12th - Uni

15 Q

12th - Uni

15 Q

12th - Uni

37 Q

12th

15 Q

12th - Uni

15 Q

12th - Uni

15 Q

12th - Uni

15 Q

12th - Uni

Explore Other Subject Worksheets for grade 12

Explore printable Federal Budget worksheets for Grade 12

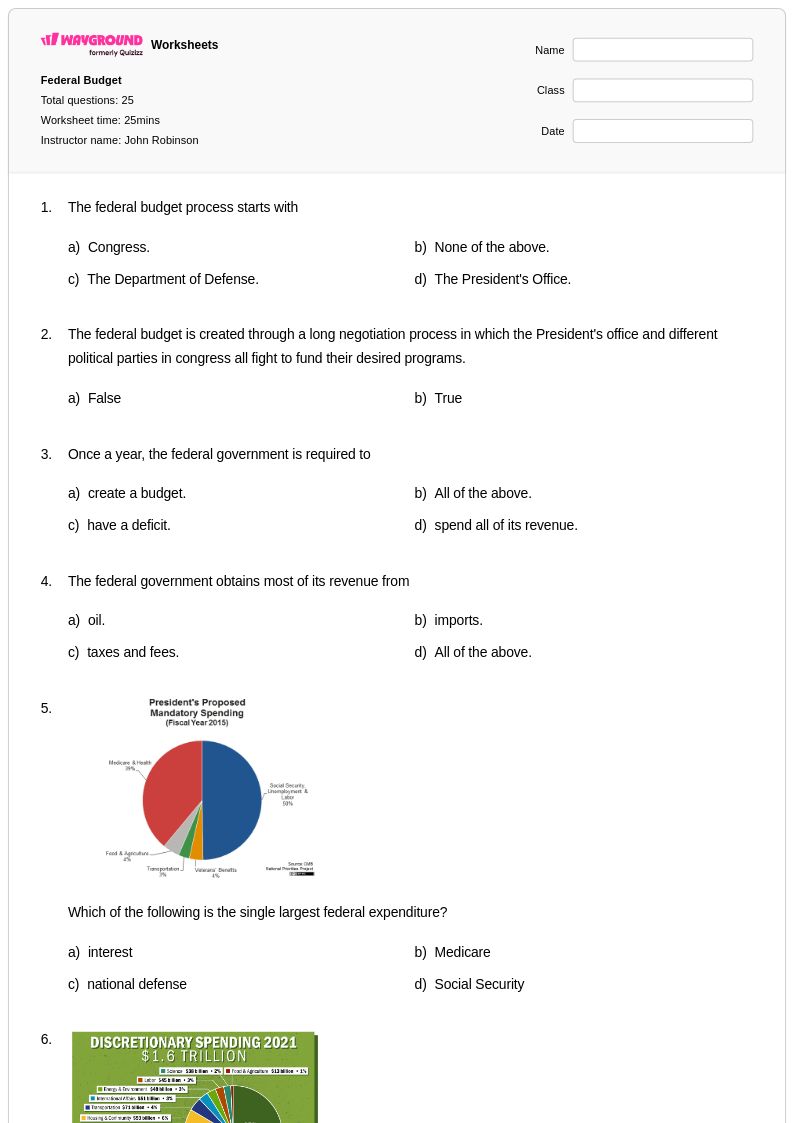

Federal Budget worksheets available through Wayground provide Grade 12 students with comprehensive practice examining the complexities of government fiscal policy and budgetary processes. These expertly designed resources strengthen critical analytical skills as students explore federal revenue sources, expenditure categories, deficit spending, and debt management while developing deep understanding of how budgetary decisions impact national priorities and economic policy. Each worksheet collection includes detailed answer keys and spans various formats from traditional printables to interactive digital exercises, offering free access to practice problems that guide students through budget analysis, interpreting fiscal data, and evaluating the relationship between government spending and constitutional responsibilities.

Wayground's extensive collection supports educators with millions of teacher-created Federal Budget resources that streamline lesson planning and enhance student engagement with complex fiscal concepts. The platform's robust search and filtering capabilities enable teachers to locate standards-aligned materials that match specific curriculum requirements, while differentiation tools allow customization for diverse learning needs and skill levels. Whether accessed as printable pdf worksheets for traditional classroom use or interactive digital formats for technology-enhanced instruction, these flexible resources facilitate targeted remediation for struggling learners, enrichment opportunities for advanced students, and systematic skill practice that builds Grade 12 students' capacity to analyze government financial decision-making and understand the broader implications of federal fiscal policy on American society.