15 Q

6th - Uni

15 Q

9th

20 Q

9th - 12th

40 Q

6th - Uni

16 Q

9th - 12th

44 Q

6th - Uni

10 Q

9th

16 Q

9th

36 Q

9th

135 Q

9th - 12th

17 Q

9th

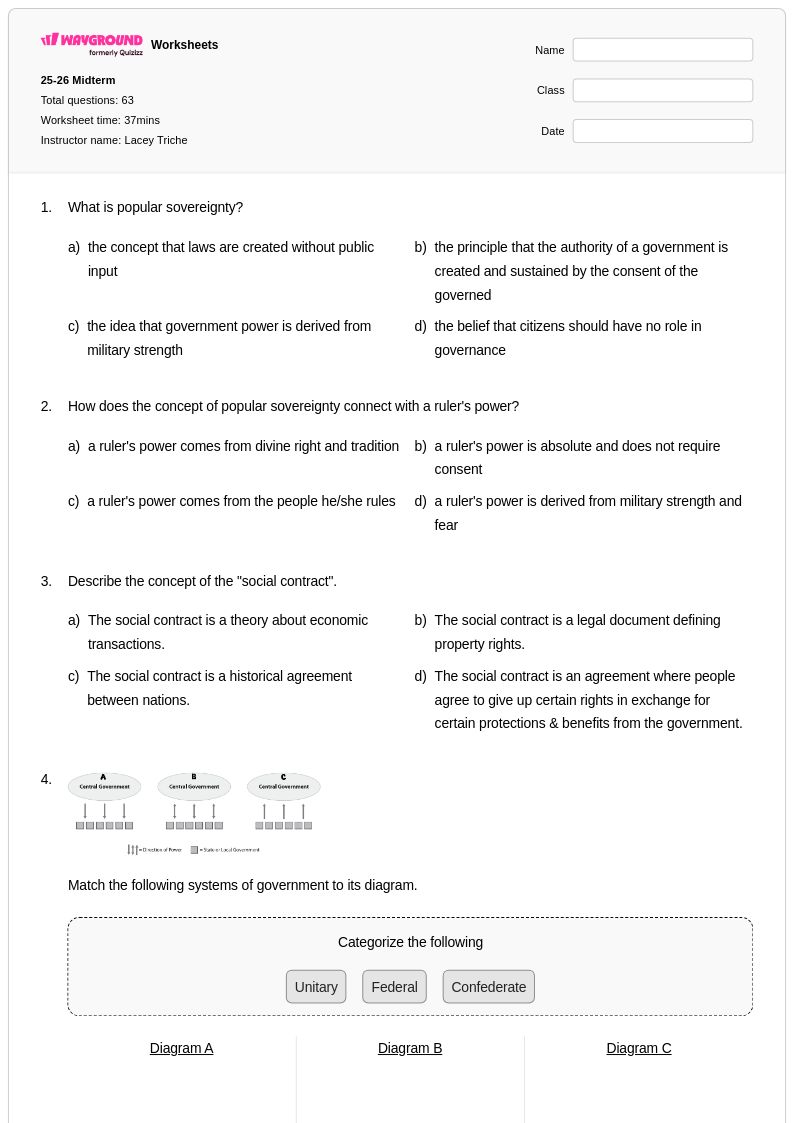

63 Q

9th - 12th

69 Q

9th

25 Q

9th - 12th

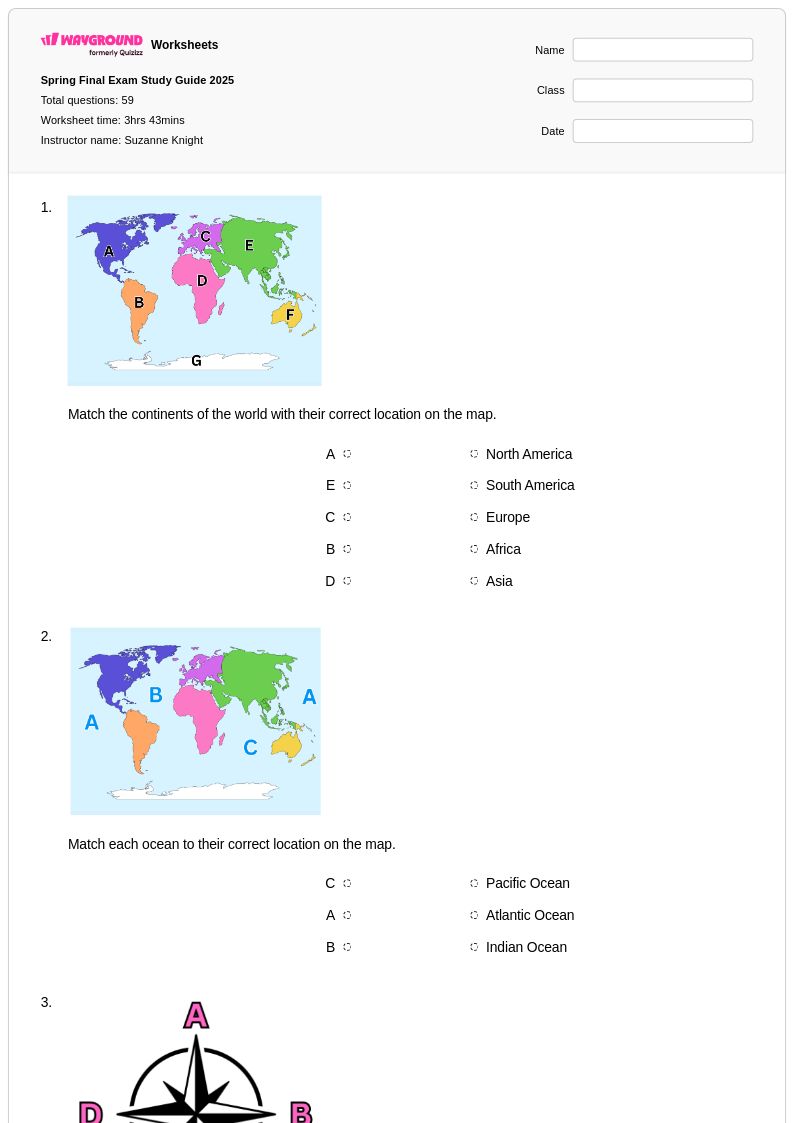

59 Q

6th - Uni

13 Q

9th - 11th

9 Q

9th

9 Q

8th - Uni

49 Q

9th

22 Q

9th

31 Q

9th

16 Q

1st - 12th

15 Q

9th

Explore Other Subject Worksheets for grade 9

Explore printable Government Budget worksheets for Grade 9

Government budget worksheets for Grade 9 students through Wayground (formerly Quizizz) provide comprehensive practice in understanding how governments manage public finances, allocate resources, and make fiscal policy decisions. These carefully designed worksheets strengthen critical thinking skills as students analyze budget components including revenue sources like taxes and fees, expenditure categories such as defense and social programs, and the relationship between government spending and economic outcomes. Students engage with practice problems that require them to interpret budget data, calculate deficit and surplus scenarios, and evaluate the trade-offs inherent in government financial decisions. Each worksheet collection includes detailed answer keys that support independent learning and self-assessment, while the free printables and pdf formats ensure accessibility for diverse classroom environments and homework assignments.

Wayground (formerly Quizizz) empowers educators with millions of teacher-created government budget resources that feature robust search and filtering capabilities, enabling quick identification of materials aligned with specific curriculum standards and learning objectives. The platform's differentiation tools allow teachers to customize worksheets based on individual student needs, whether providing remediation for struggling learners or enrichment challenges for advanced students. These government budget materials are available in both printable and digital formats, including downloadable pdf versions that facilitate seamless integration into lesson planning and classroom instruction. Teachers can efficiently support skill practice through varied question types and assessment formats, while the extensive collection ensures abundant options for reinforcing key concepts about fiscal responsibility, public finance principles, and the economic impact of government budgetary decisions on citizens and society.