20 T

7th - Uni

20 T

7th - Uni

20 T

6th - 10th

49 T

10th - Uni

20 T

9th - 12th

15 T

9th - 12th

20 T

7th - Uni

20 T

7th - Uni

15 T

7th - Uni

10 T

9th - 12th

15 T

9th - 11th

10 T

10th

21 T

10th

10 T

7th - 10th

14 T

9th - 12th

20 T

6th - 12th

16 T

9th - 12th

10 T

9th - 12th

10 T

9th - Uni

12 T

7th - Uni

20 T

7th - Uni

13 T

9th - 12th

15 T

7th - Uni

10 T

9th - 12th

Jelajahi Sales Tax Lembar Kerja berdasarkan Nilai

Jelajahi Lembar Kerja Mata Pelajaran Lainnya untuk grade 10

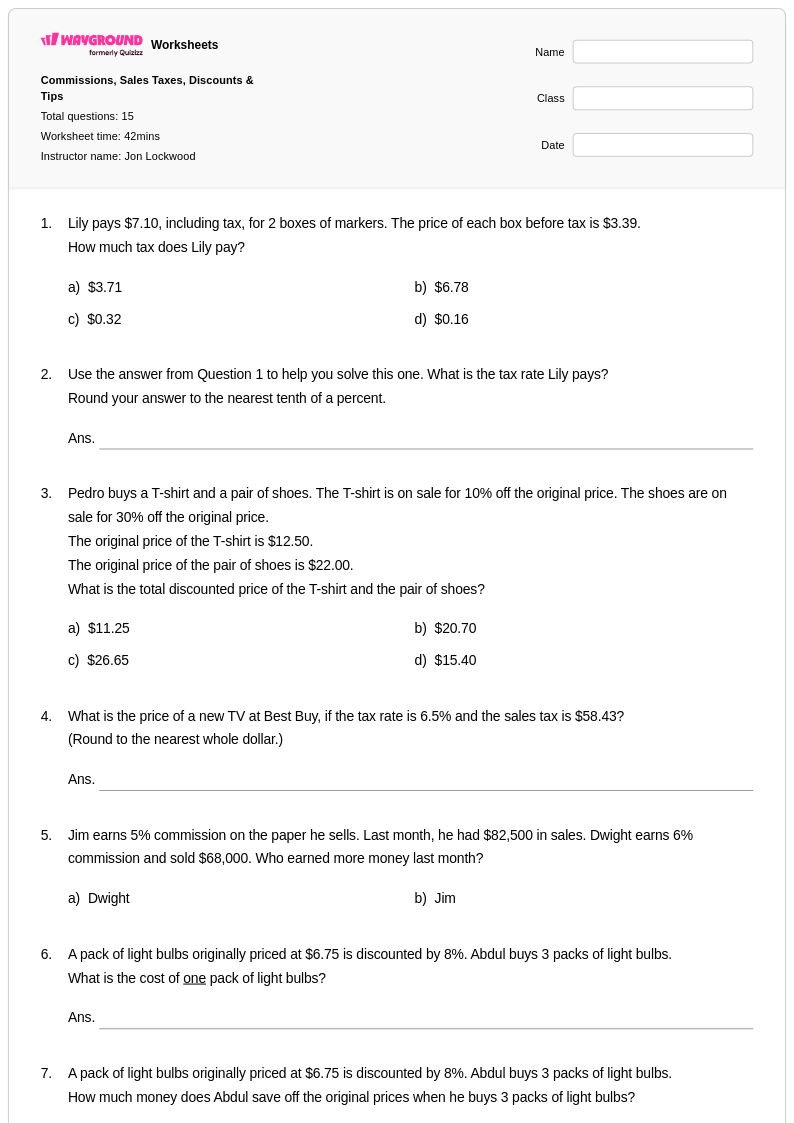

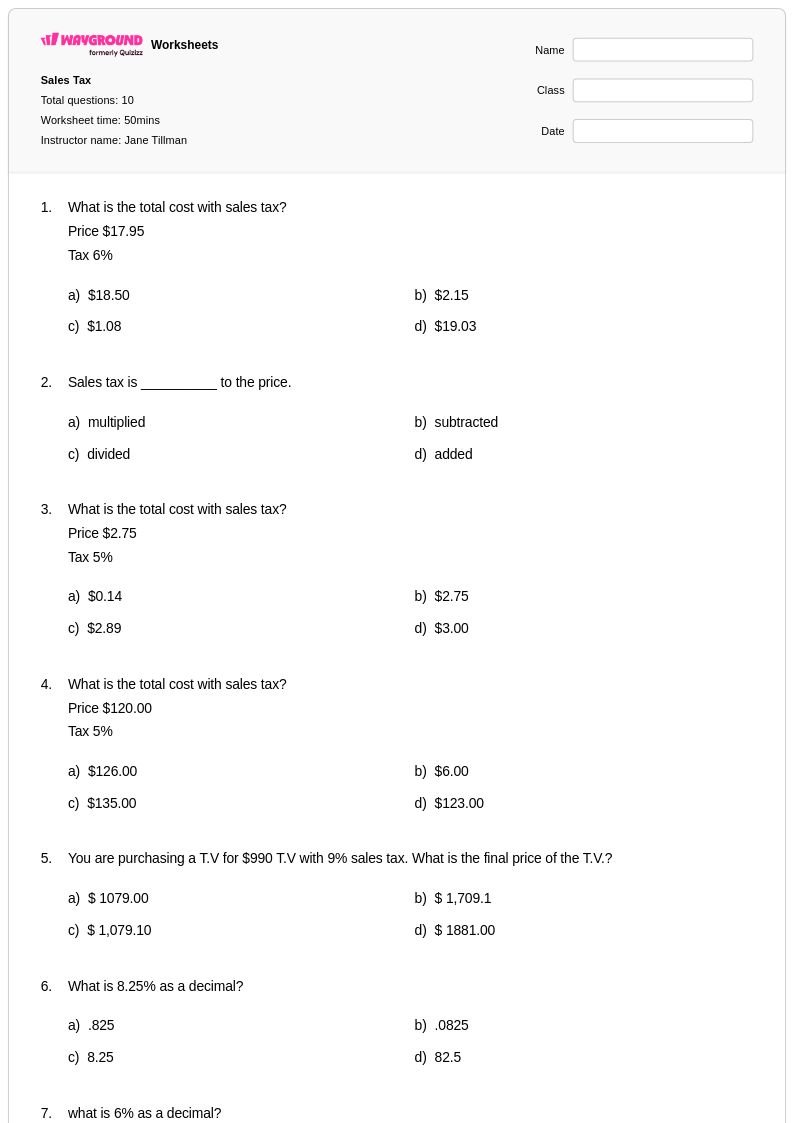

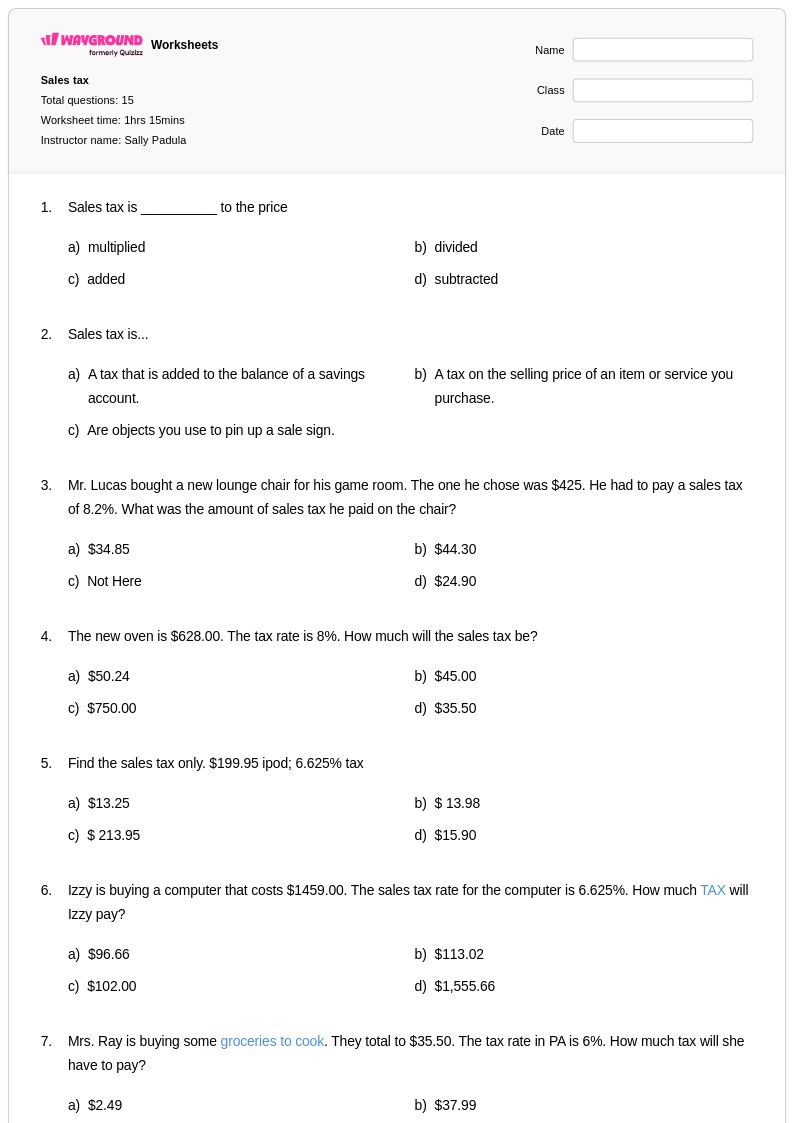

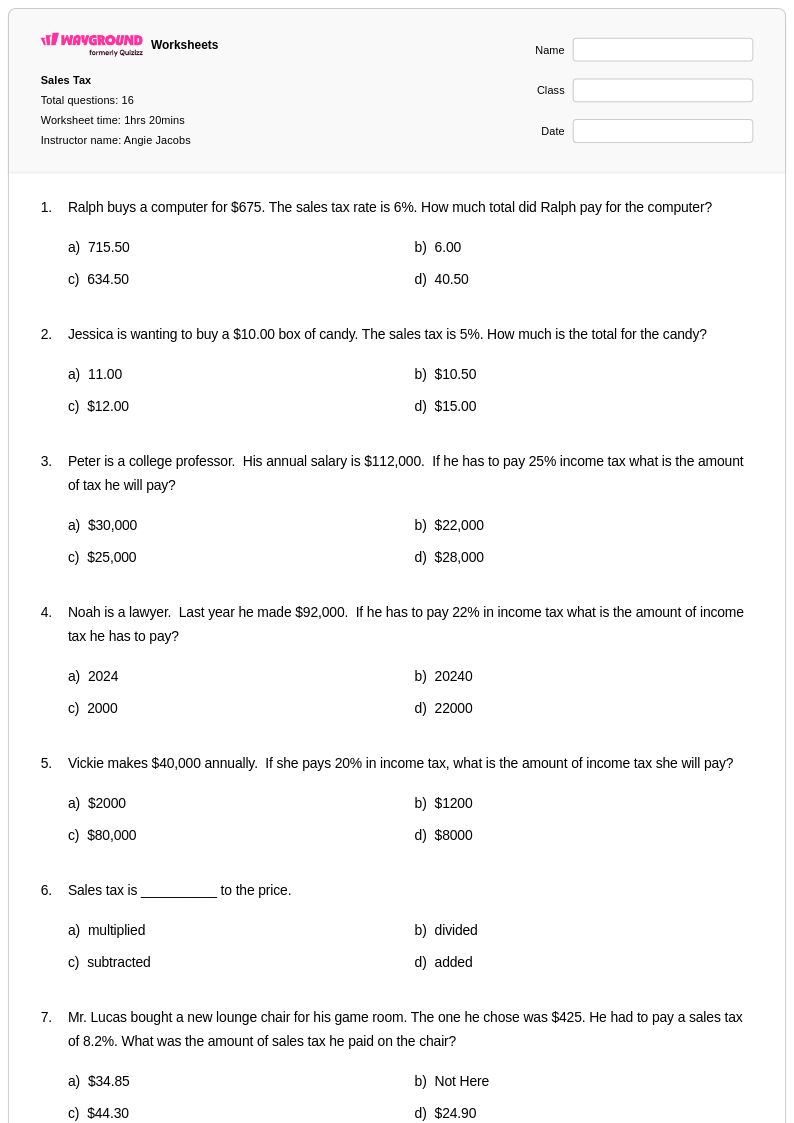

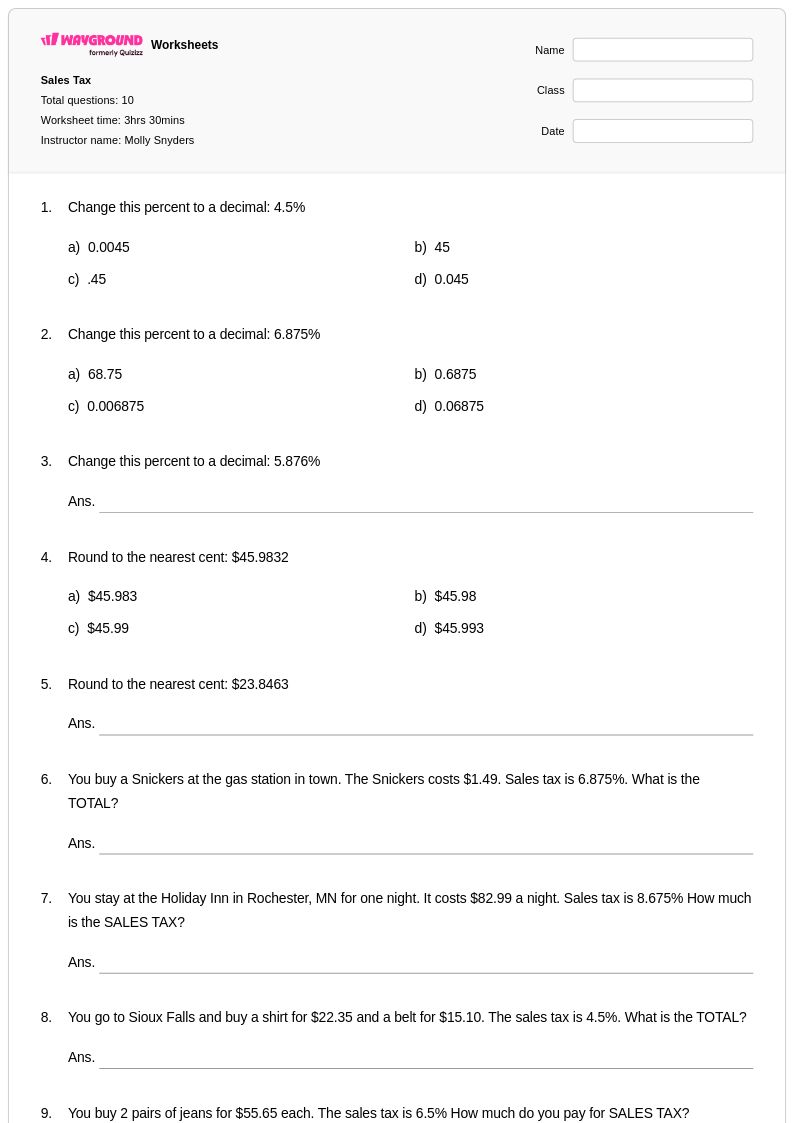

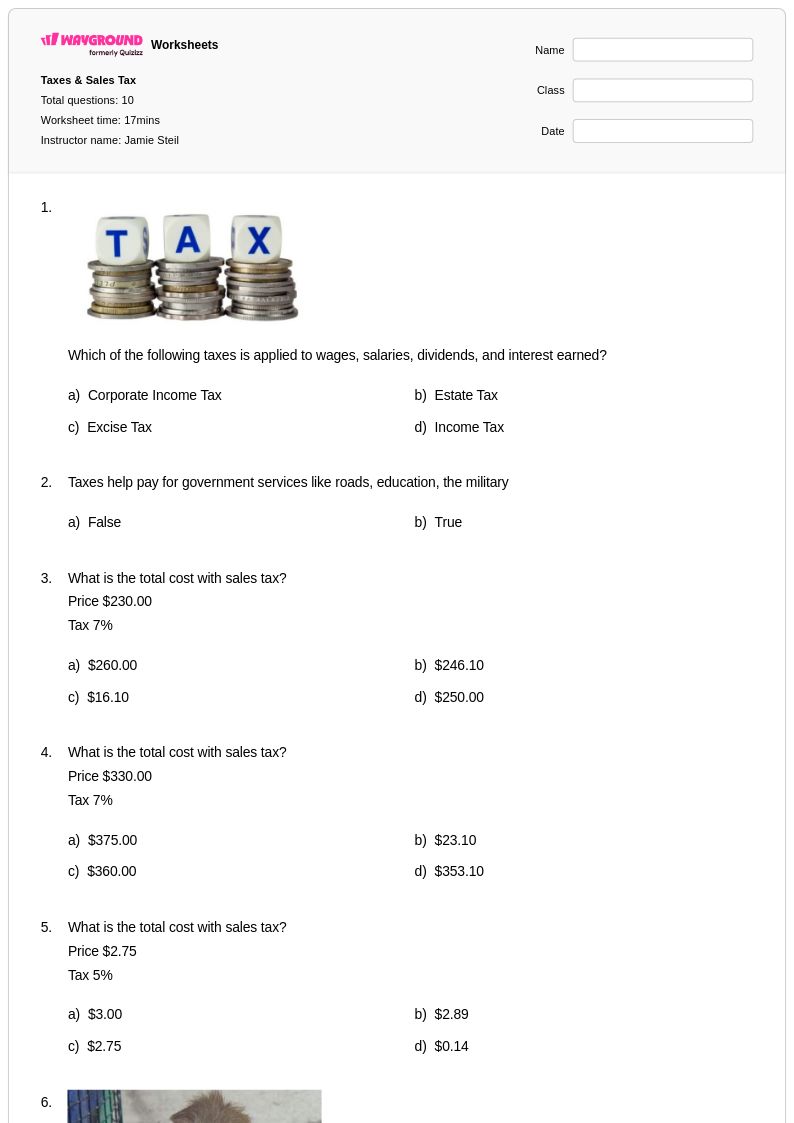

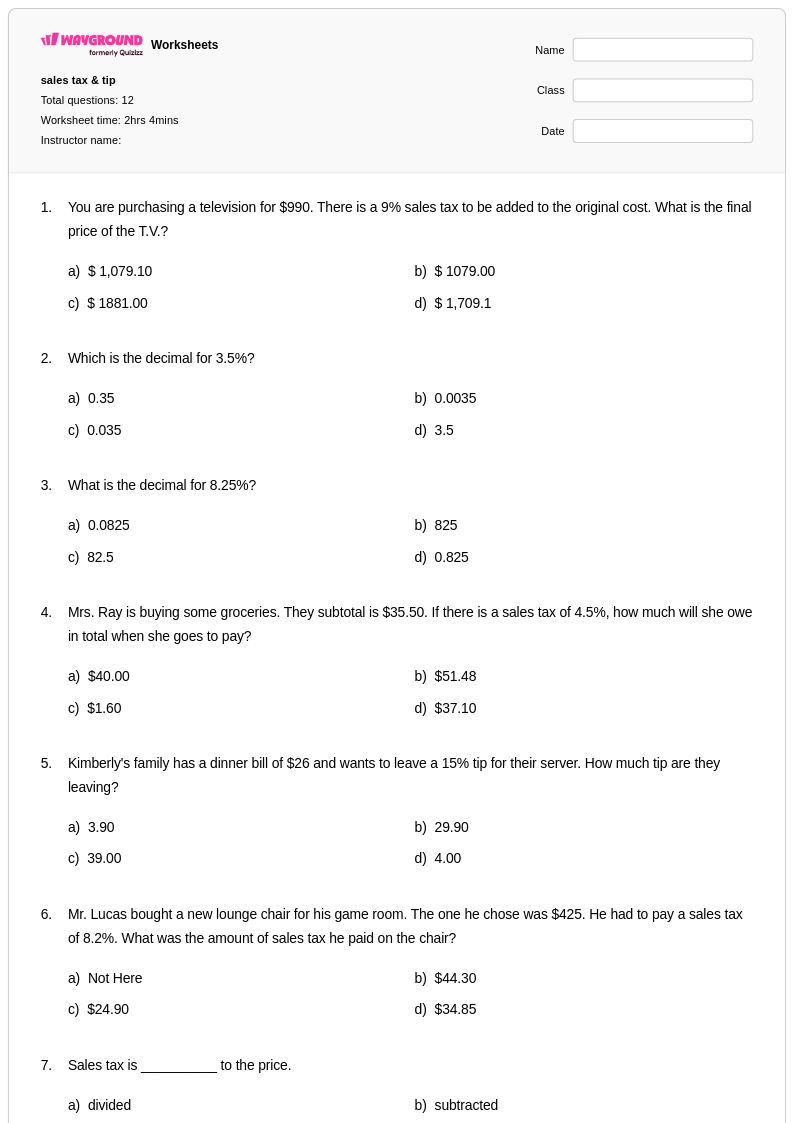

Explore printable Sales Tax worksheets for Grade 10

Sales tax worksheets for Grade 10 students available through Wayground (formerly Quizizz) provide comprehensive practice with calculating, analyzing, and applying sales tax concepts in real-world financial scenarios. These educational resources strengthen essential mathematical skills including percentage calculations, decimal operations, and multi-step problem solving while building practical financial literacy competencies that students will use throughout their lives. The collection includes diverse practice problems ranging from basic sales tax computations to complex scenarios involving multiple tax rates, exemptions, and compound calculations, with each worksheet featuring detailed answer keys and step-by-step solutions. Students work through authentic situations such as calculating total purchase costs, determining pre-tax amounts, comparing prices across different tax jurisdictions, and understanding how sales tax impacts budgeting decisions, all presented in printable pdf format for flexible classroom and home use.

Wayground (formerly Quizizz) empowers educators with millions of teacher-created sales tax and financial literacy resources specifically designed for Grade 10 mathematics instruction, featuring robust search and filtering capabilities that allow teachers to quickly locate materials aligned with their curriculum standards and learning objectives. The platform's comprehensive collection supports differentiated instruction through customizable worksheets that can be modified to meet diverse student needs, from remediation activities for struggling learners to enrichment challenges for advanced students. Teachers benefit from seamless integration of printable and digital formats, enabling flexible implementation across various learning environments while maintaining consistent quality and educational rigor. These versatile tools streamline lesson planning by providing ready-to-use materials for skill practice, formative assessment, homework assignments, and test preparation, allowing educators to focus on instruction while ensuring students develop confident mastery of sales tax calculations and broader financial literacy concepts.