Recommended Topics for you

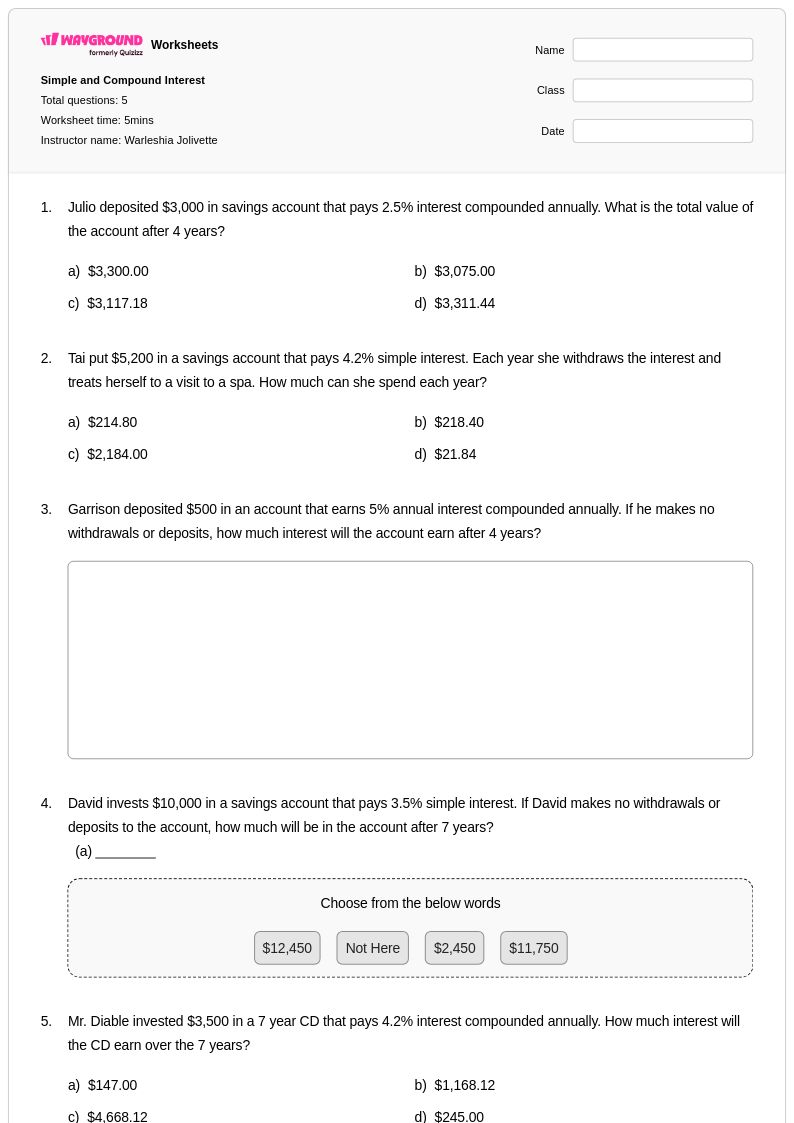

5 Q

8th

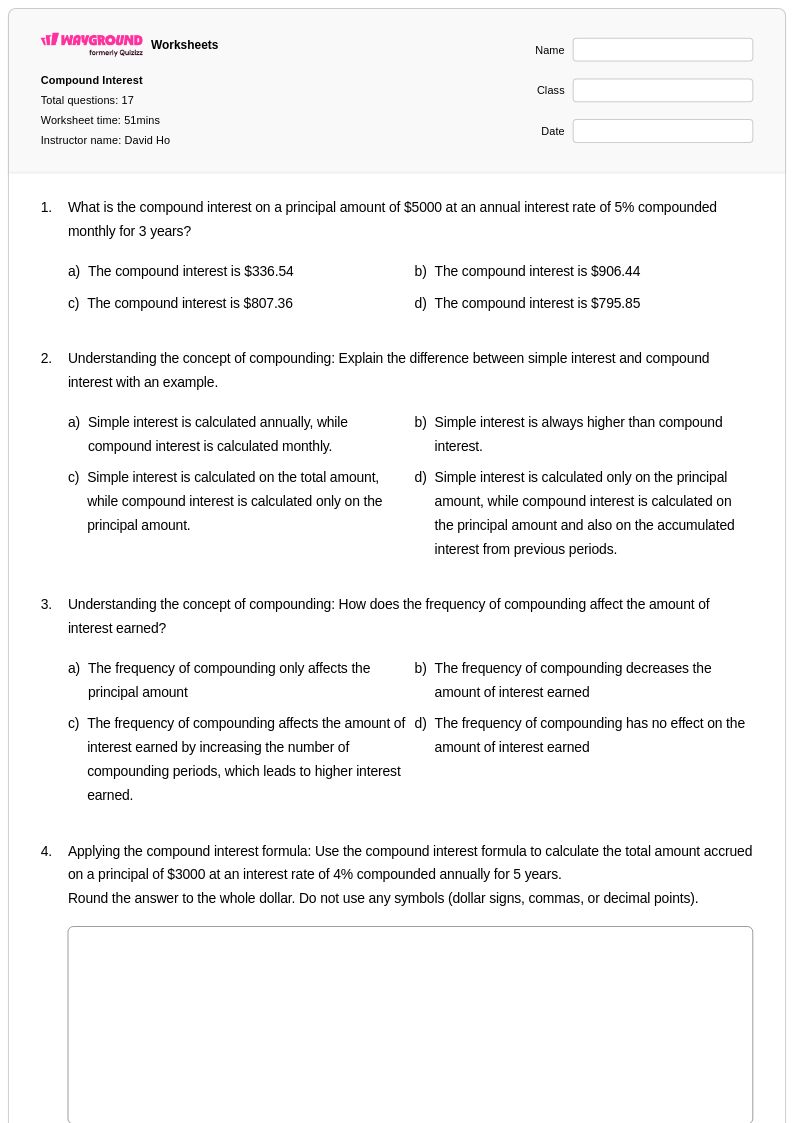

17 Q

12th

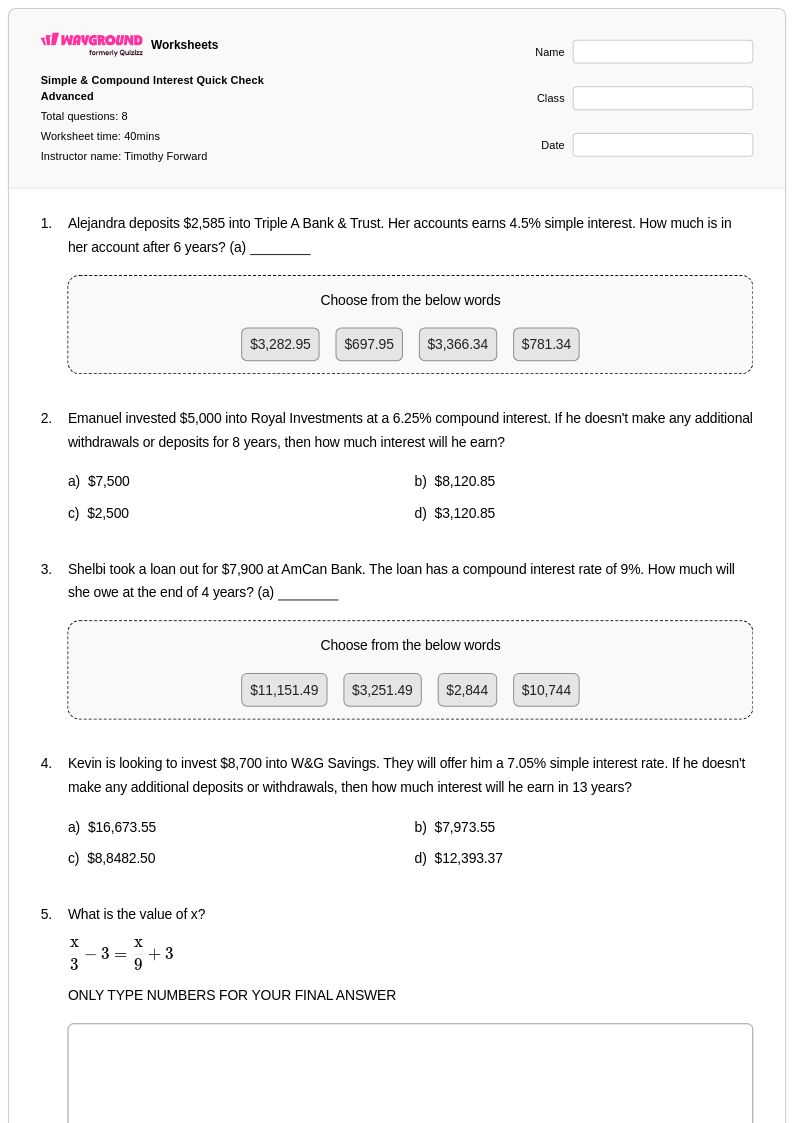

8 Q

8th

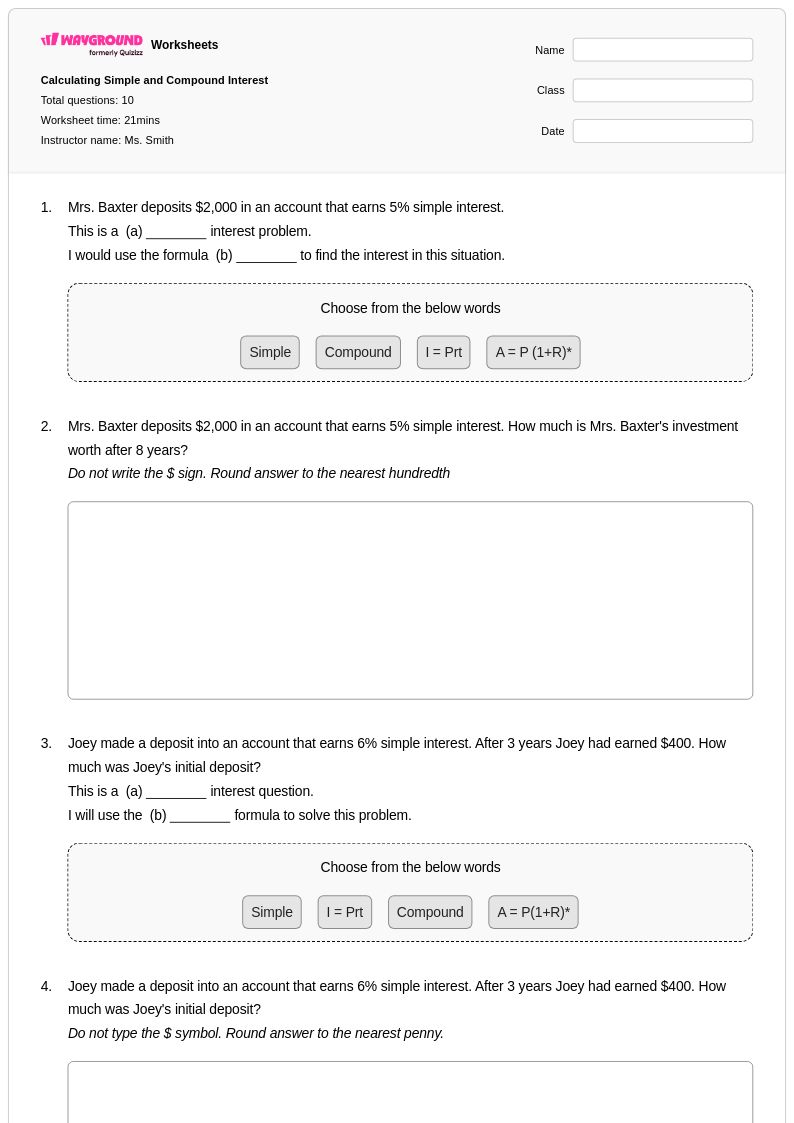

10 Q

7th

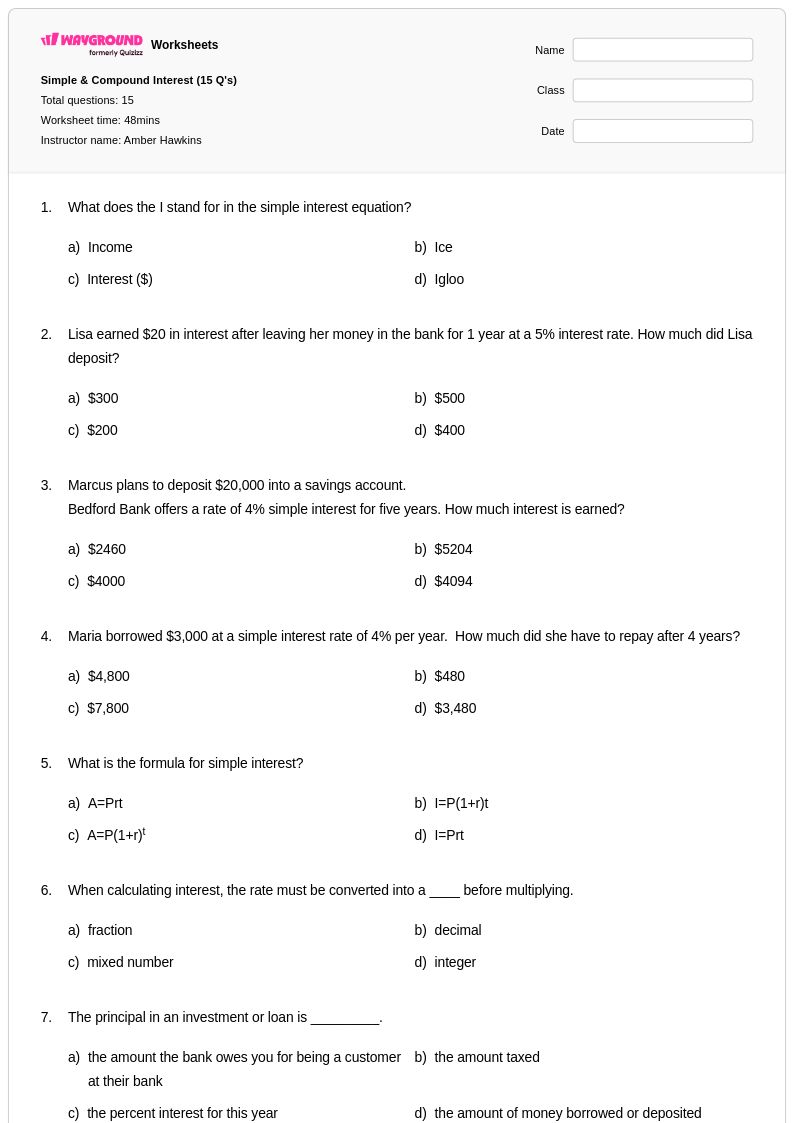

15 Q

8th

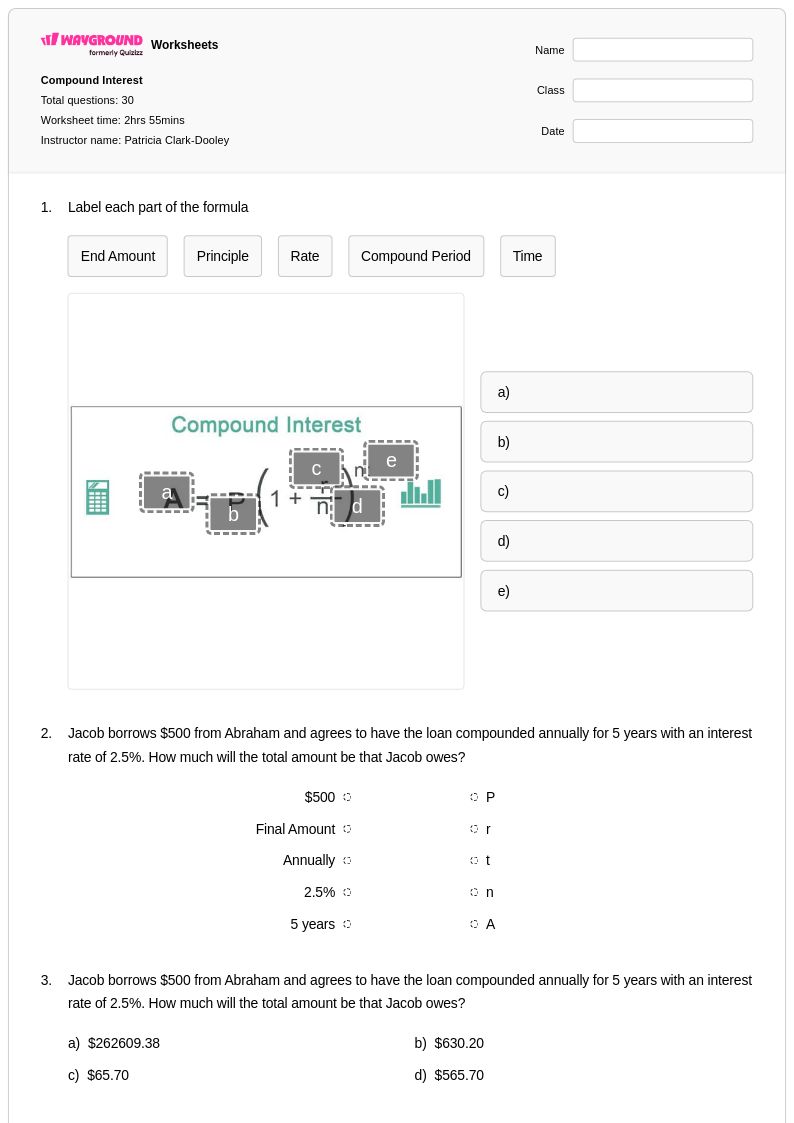

30 Q

9th - 12th

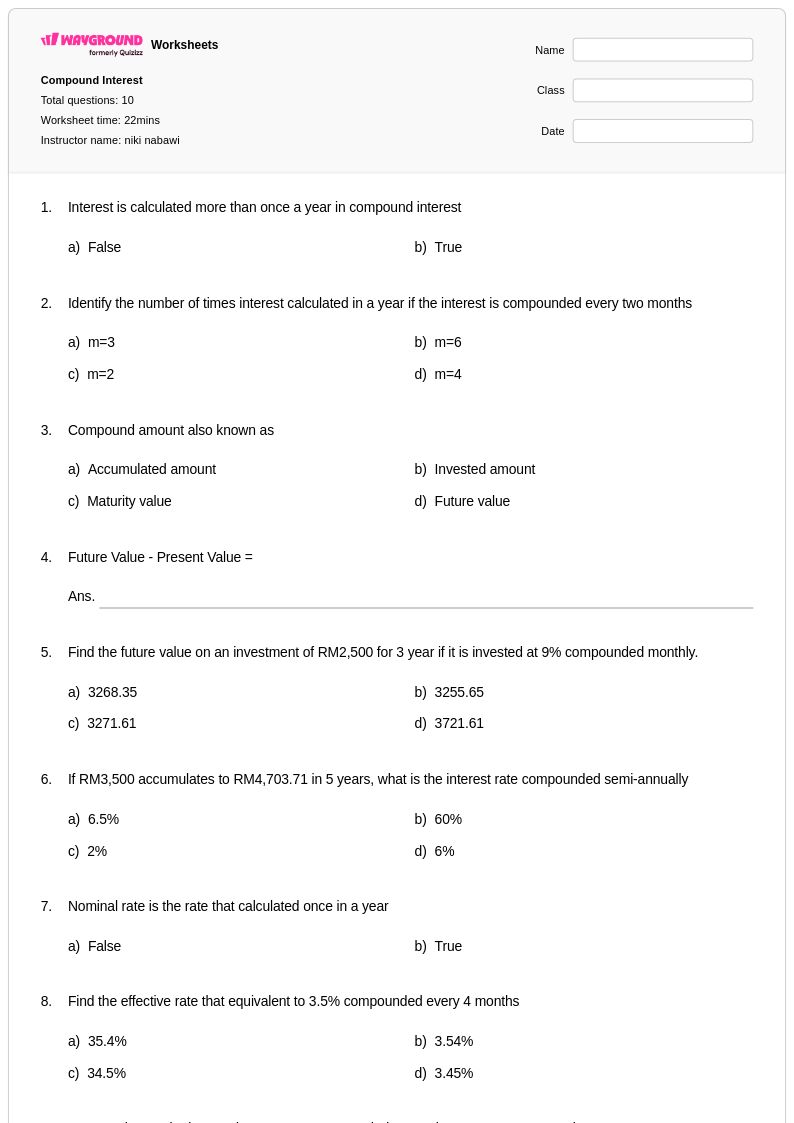

10 Q

Uni

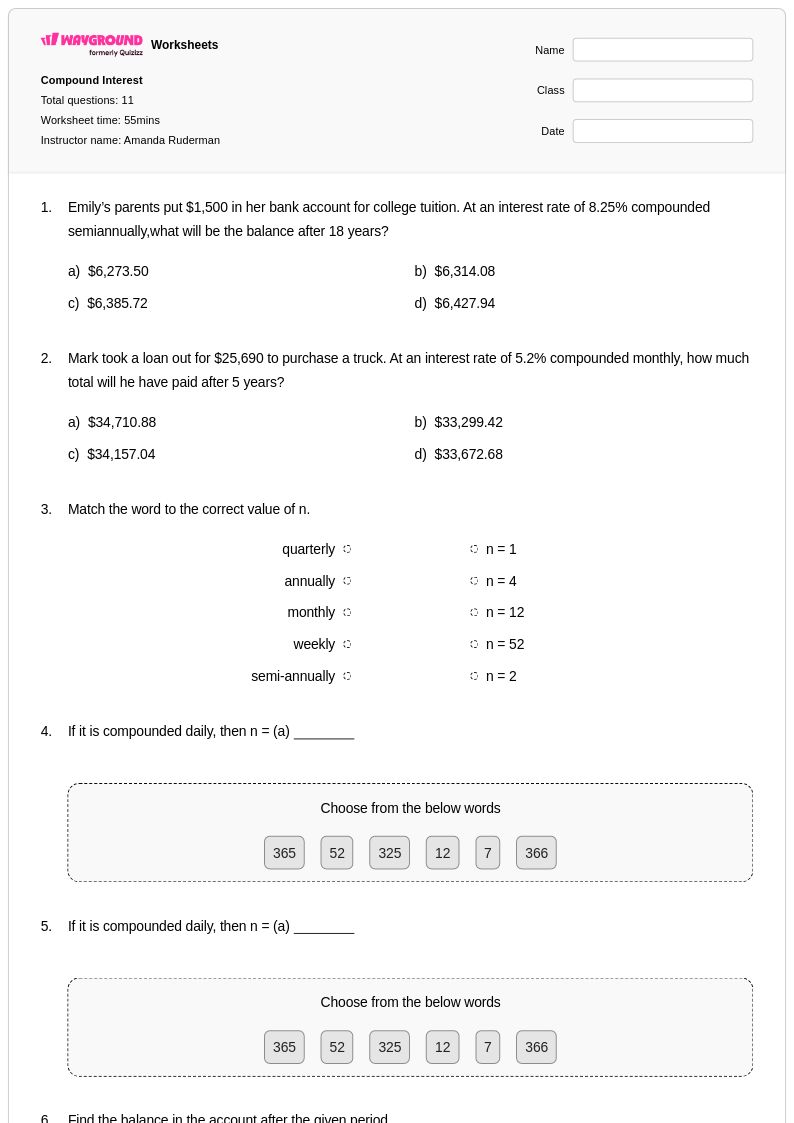

11 Q

9th

15 Q

Uni

25 Q

9th - 11th

20 Q

KG - Uni

20 Q

12th - Uni

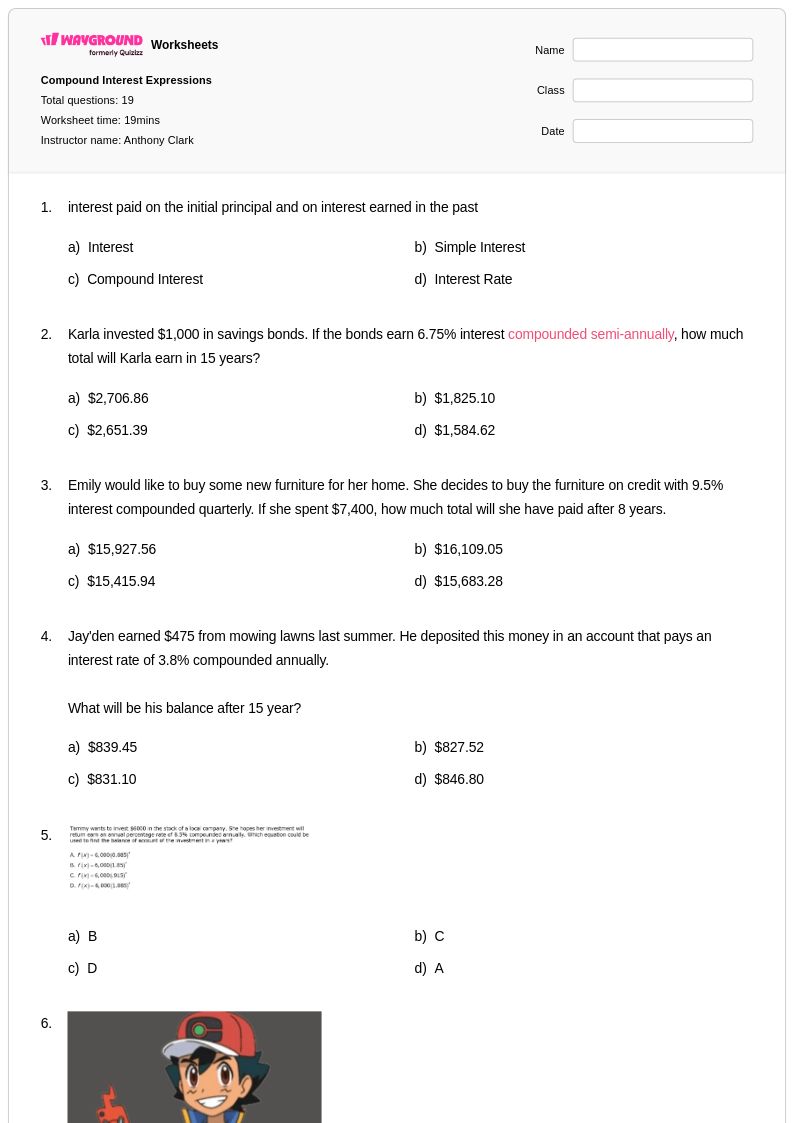

19 Q

8th - Uni

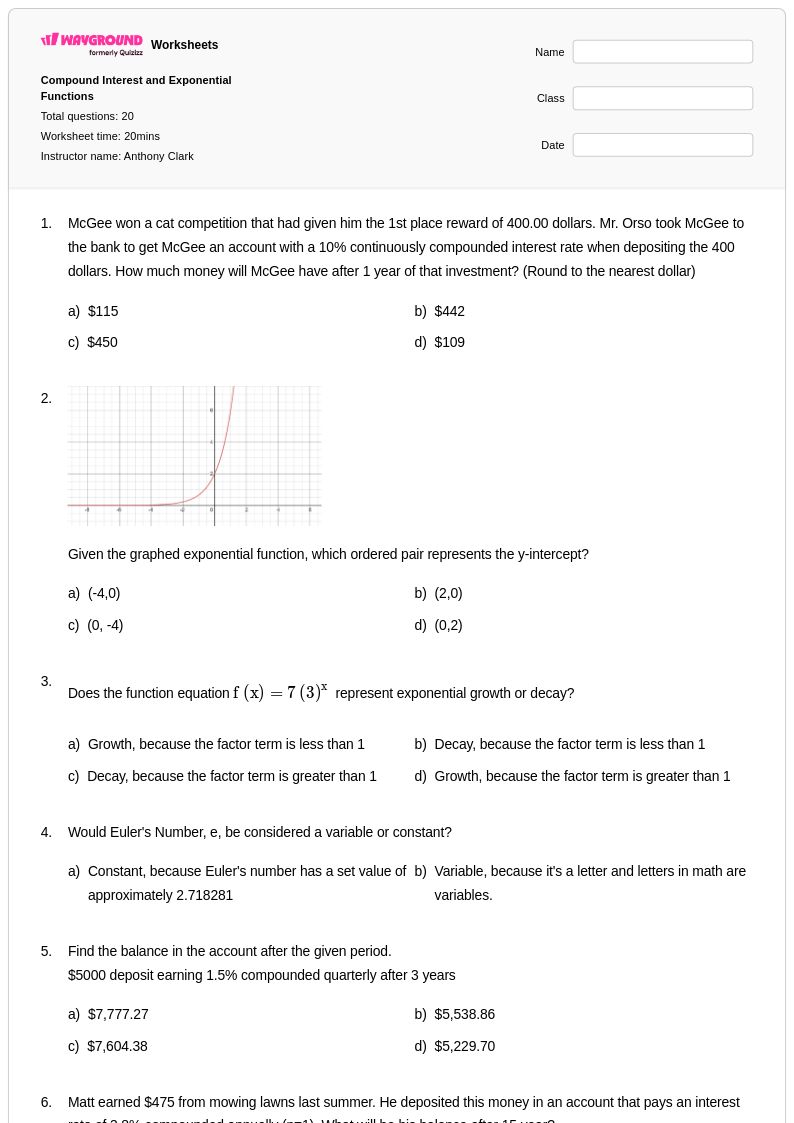

20 Q

9th - Uni

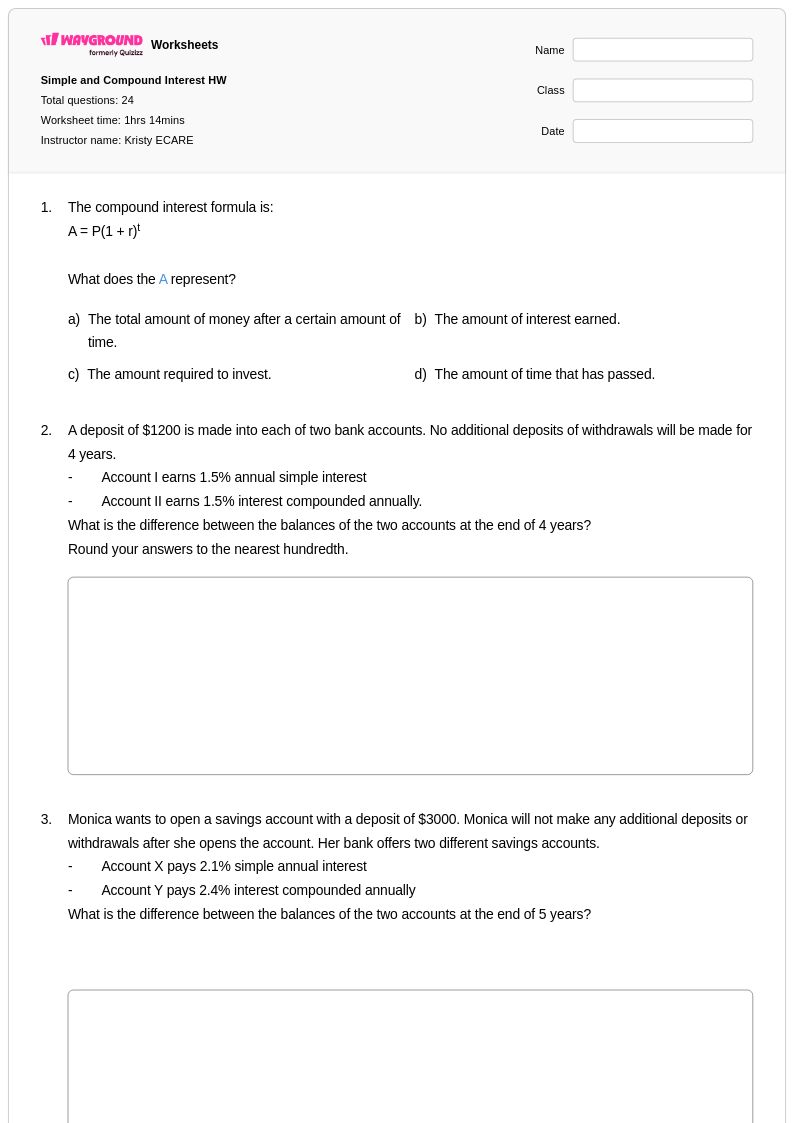

24 Q

8th

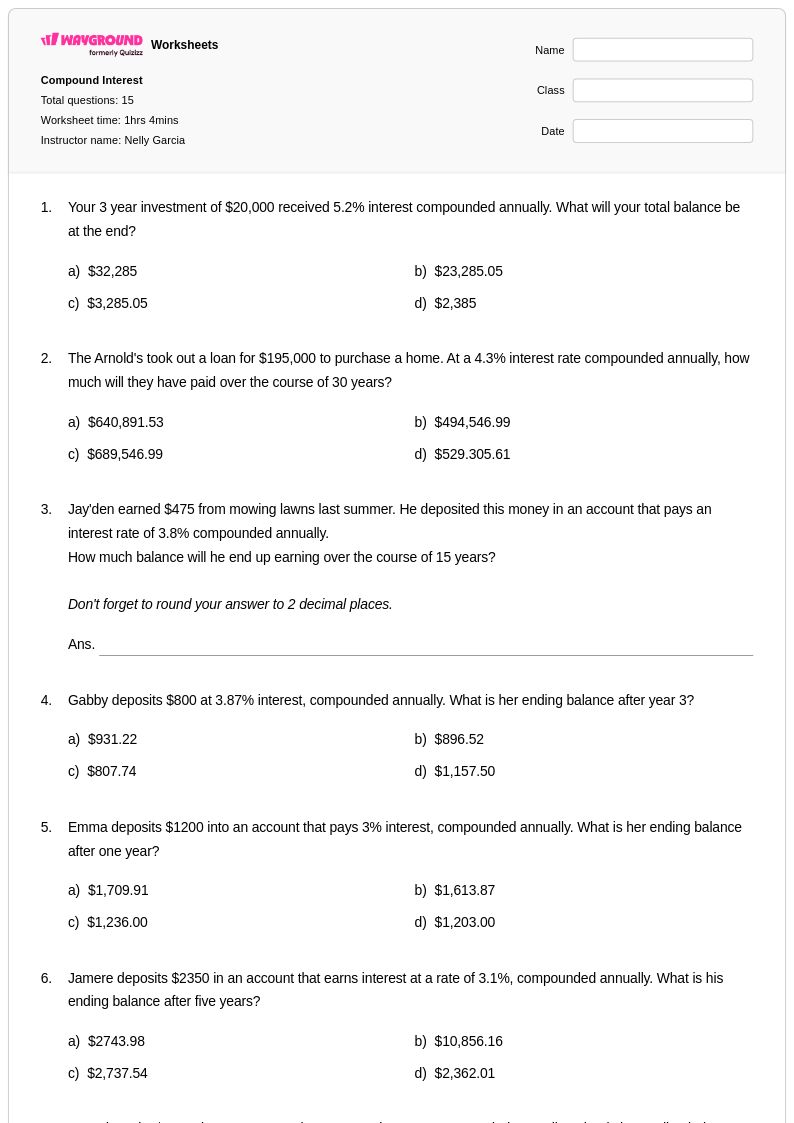

15 Q

8th

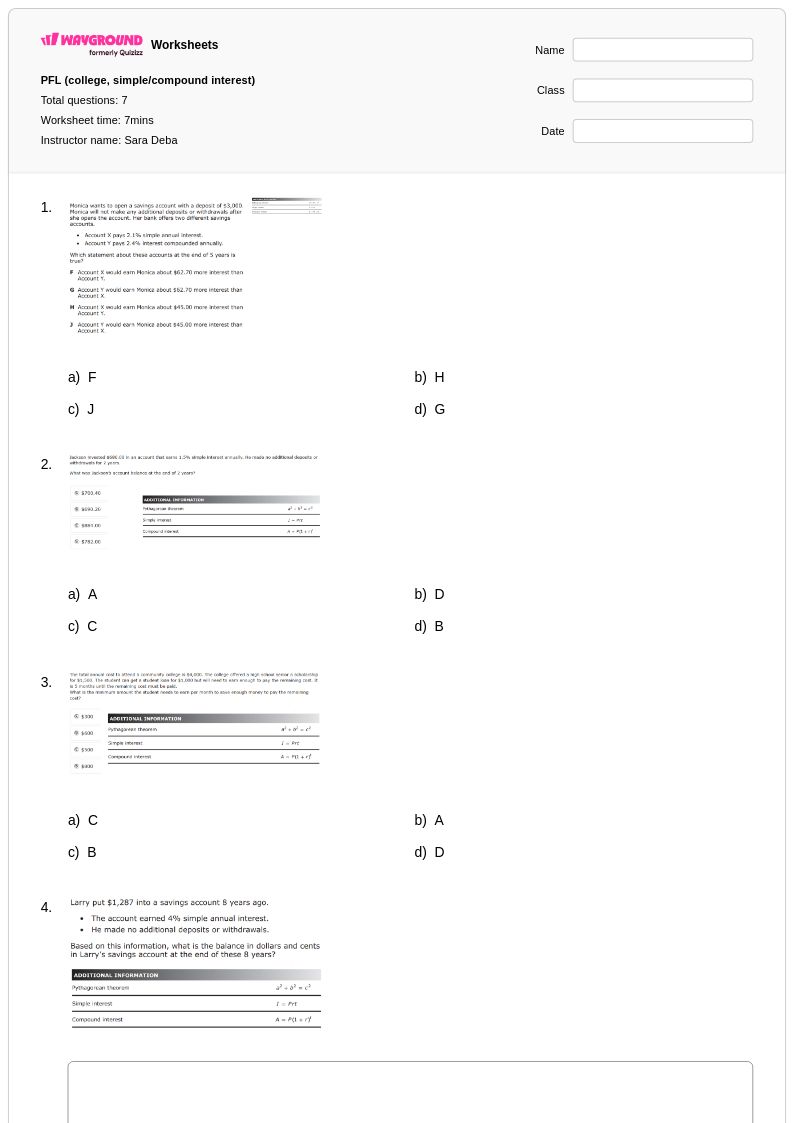

7 Q

9th

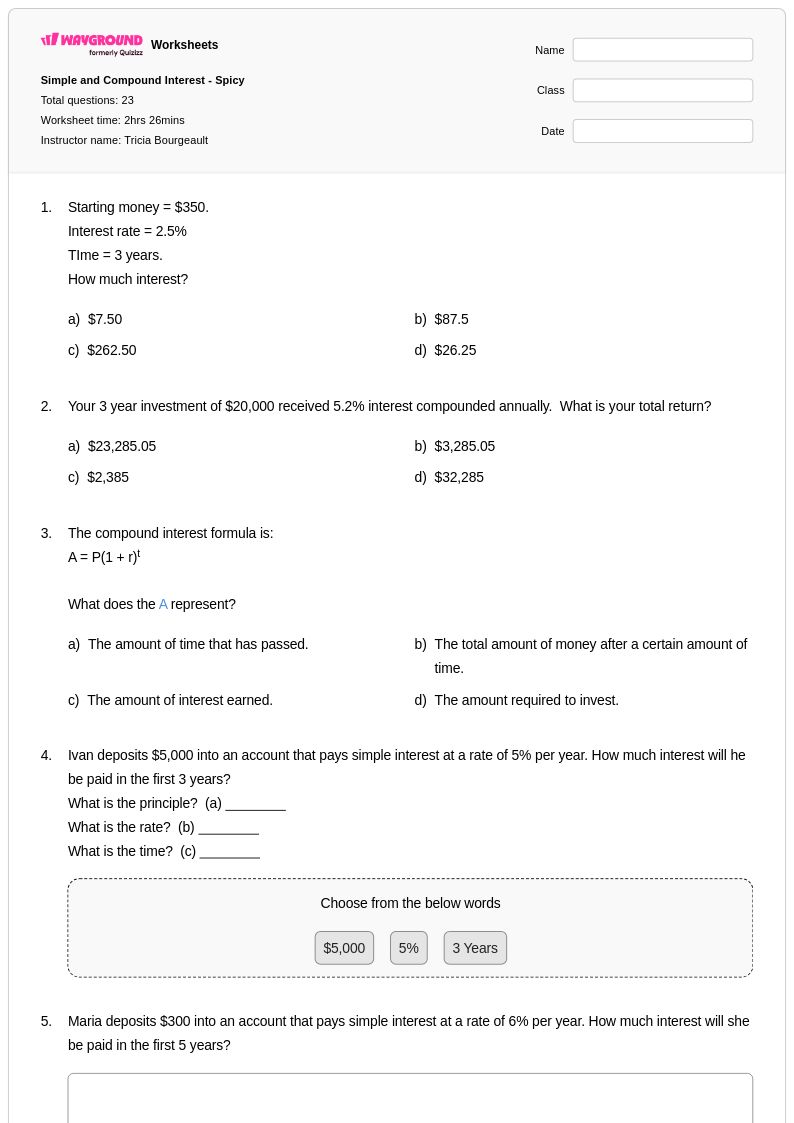

23 Q

12th

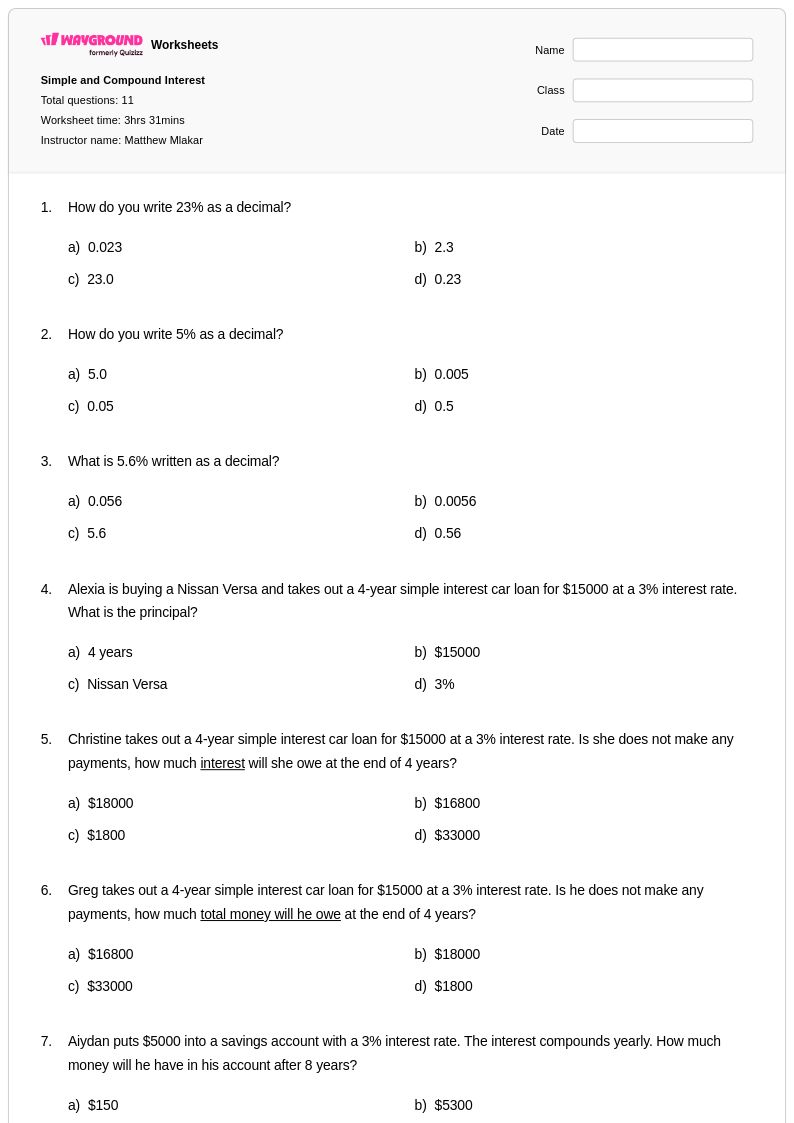

11 Q

9th - 11th

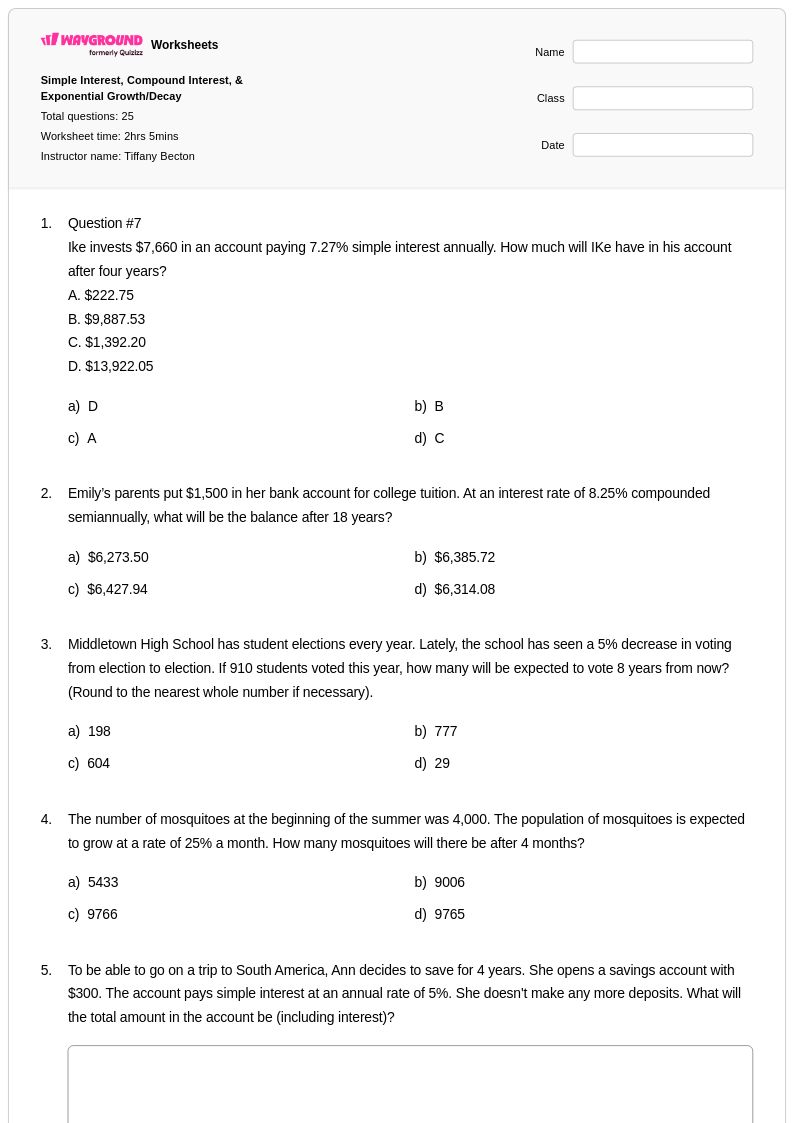

25 Q

9th - 12th

20 Q

11th - Uni

18 Q

11th - Uni

31 Q

8th - Uni

15 Q

6th - 8th

Explore Compound Interest Worksheets by Topics

Explore Worksheets by Subjects

Explore printable Compound Interest worksheets

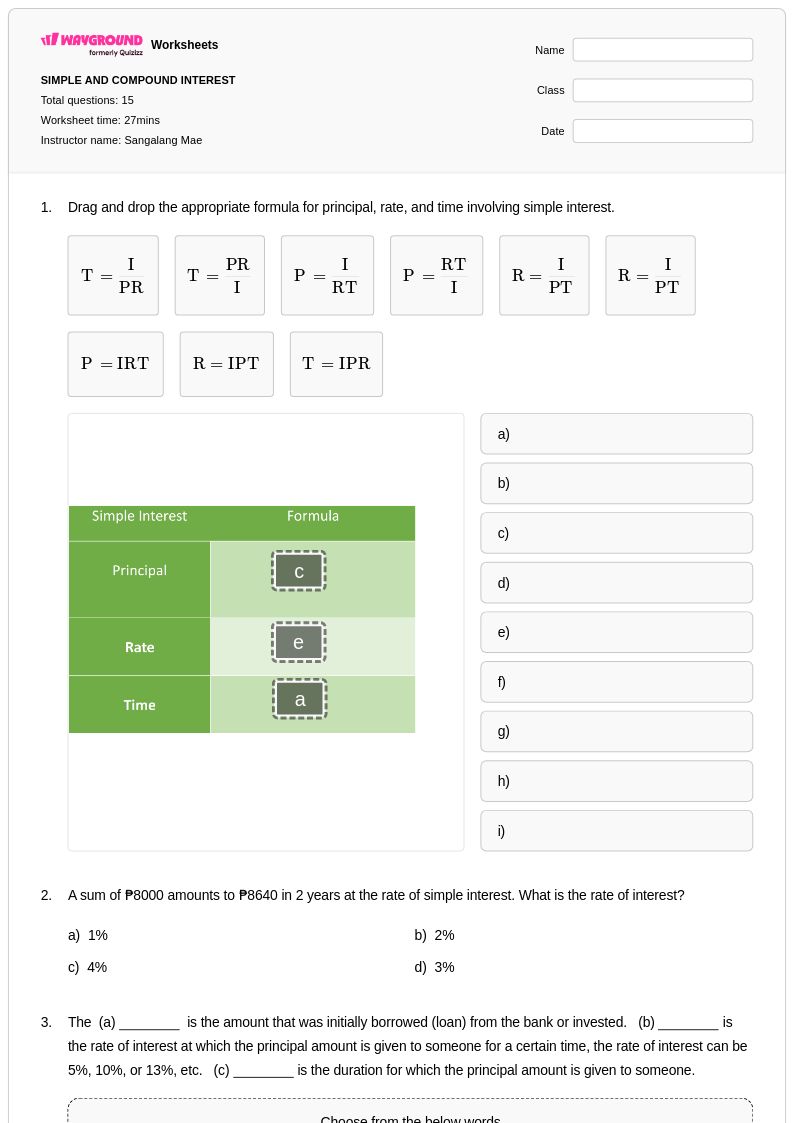

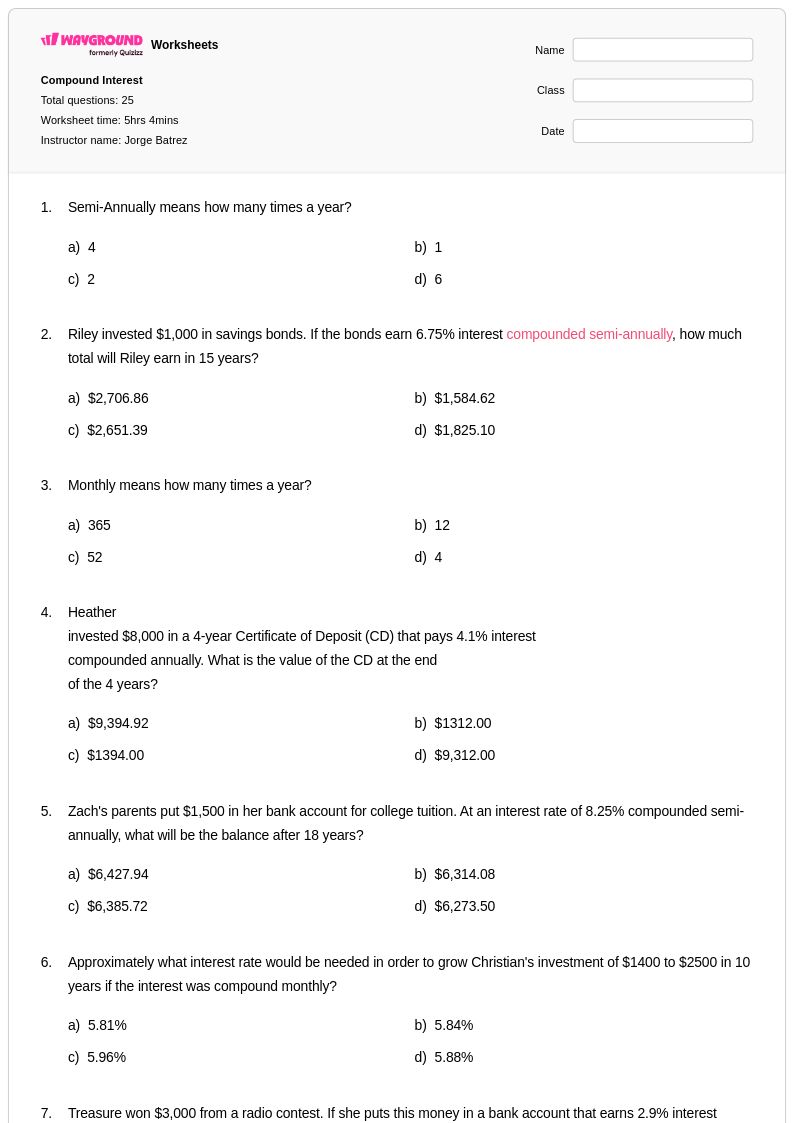

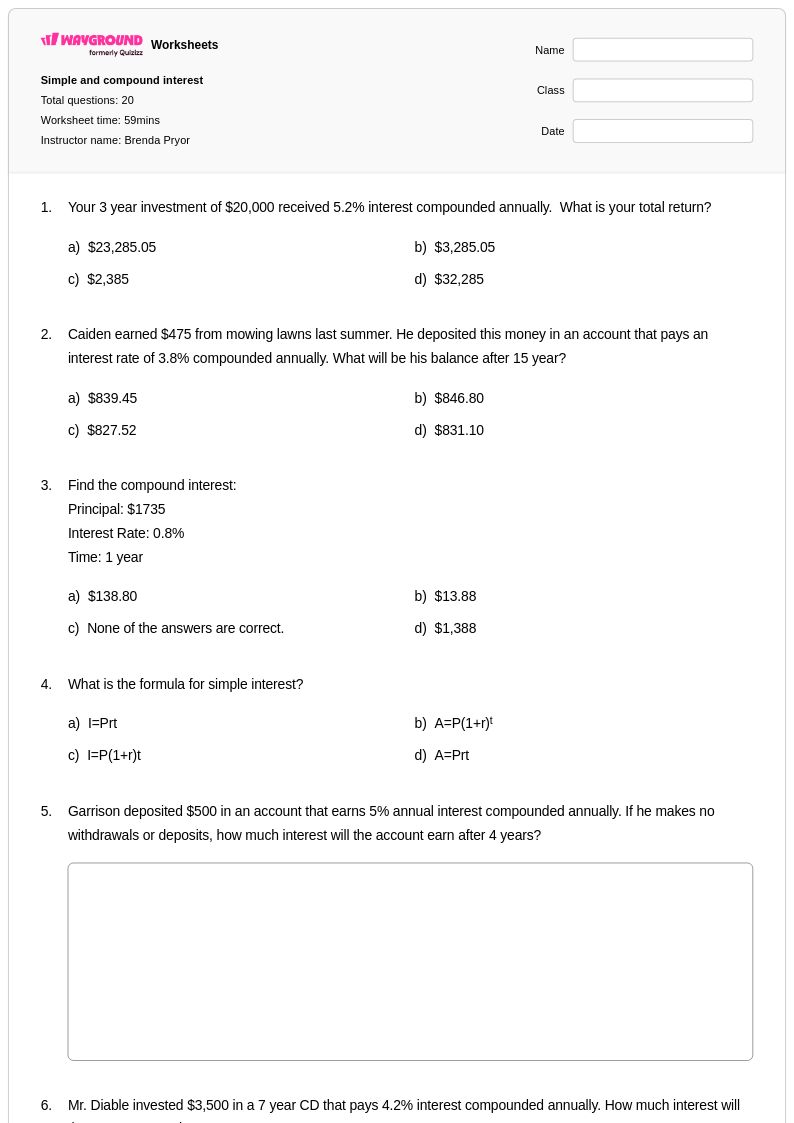

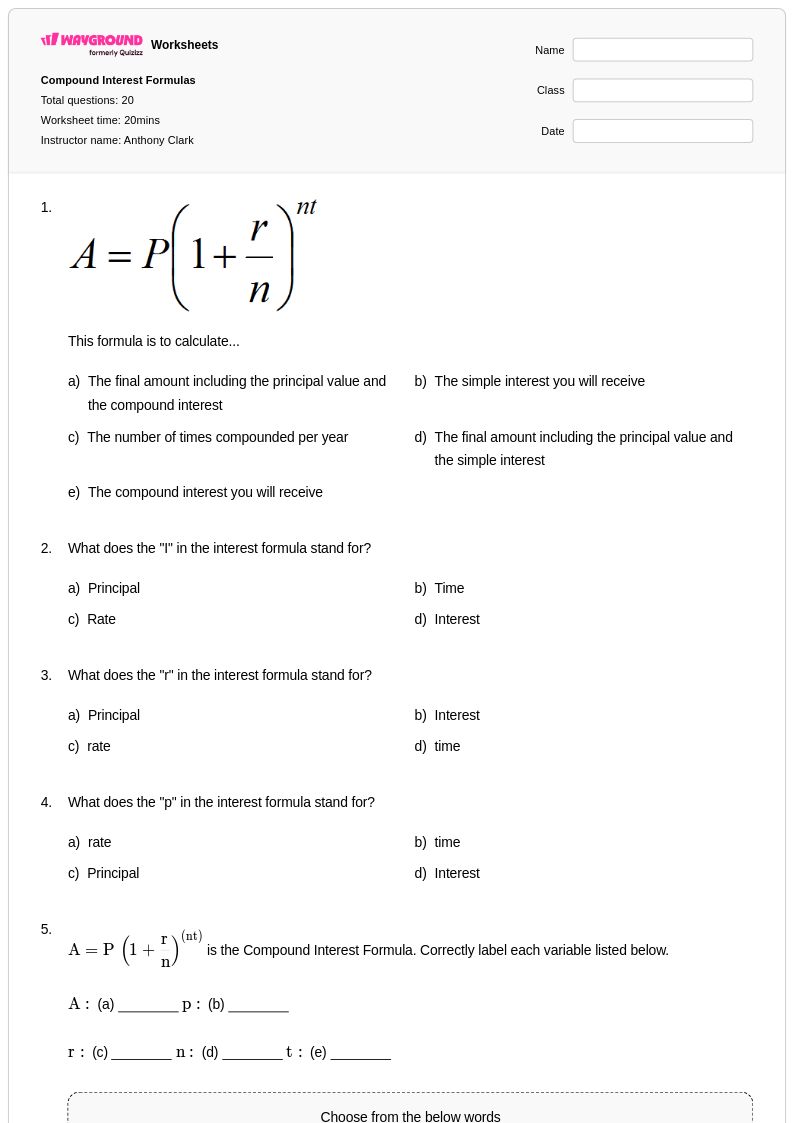

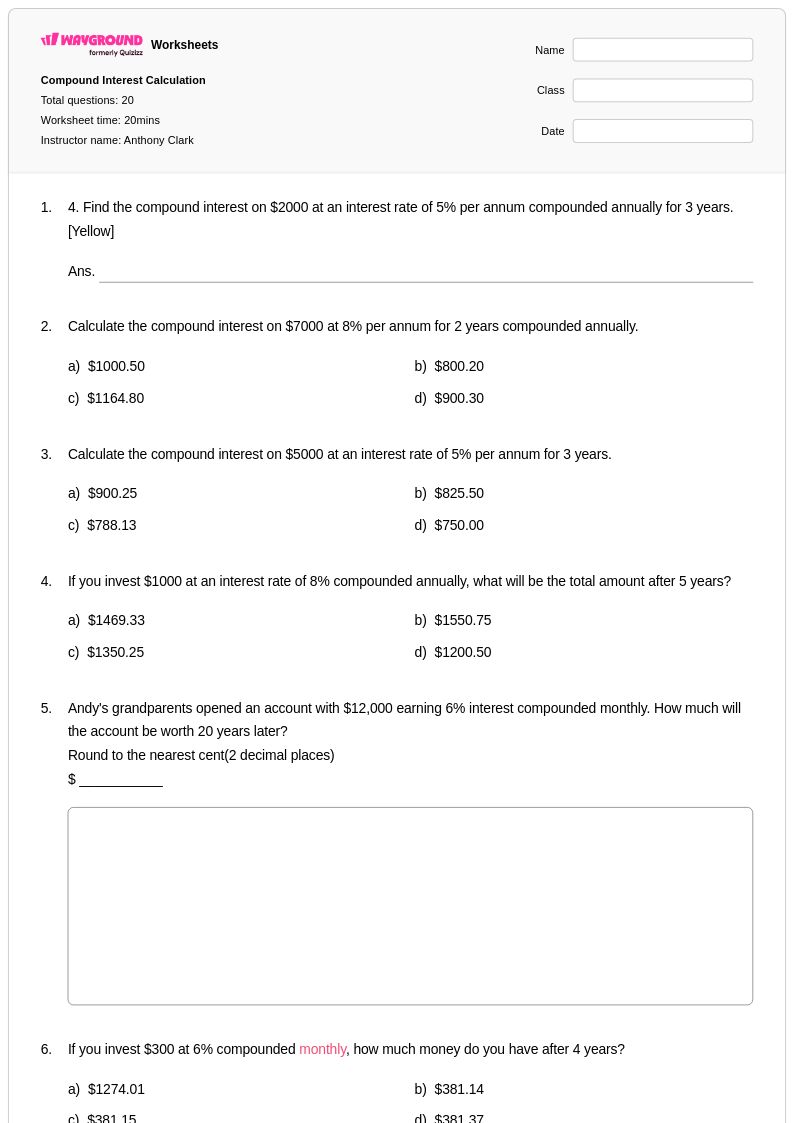

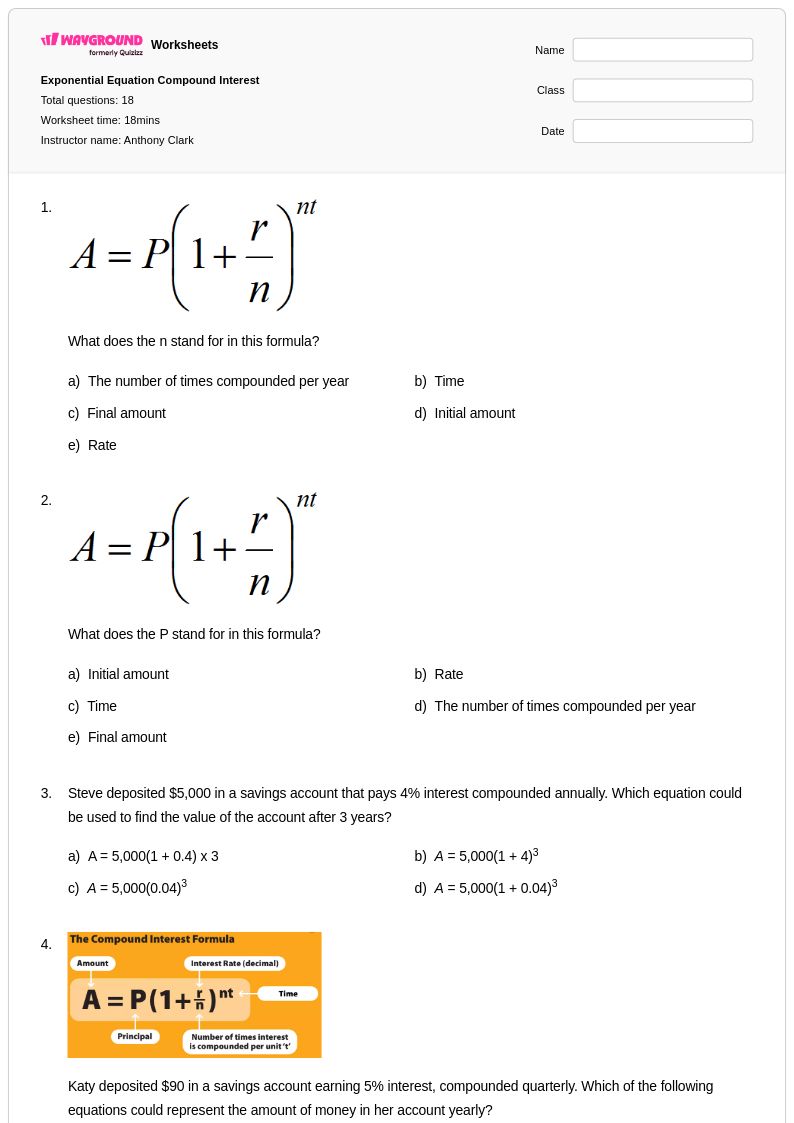

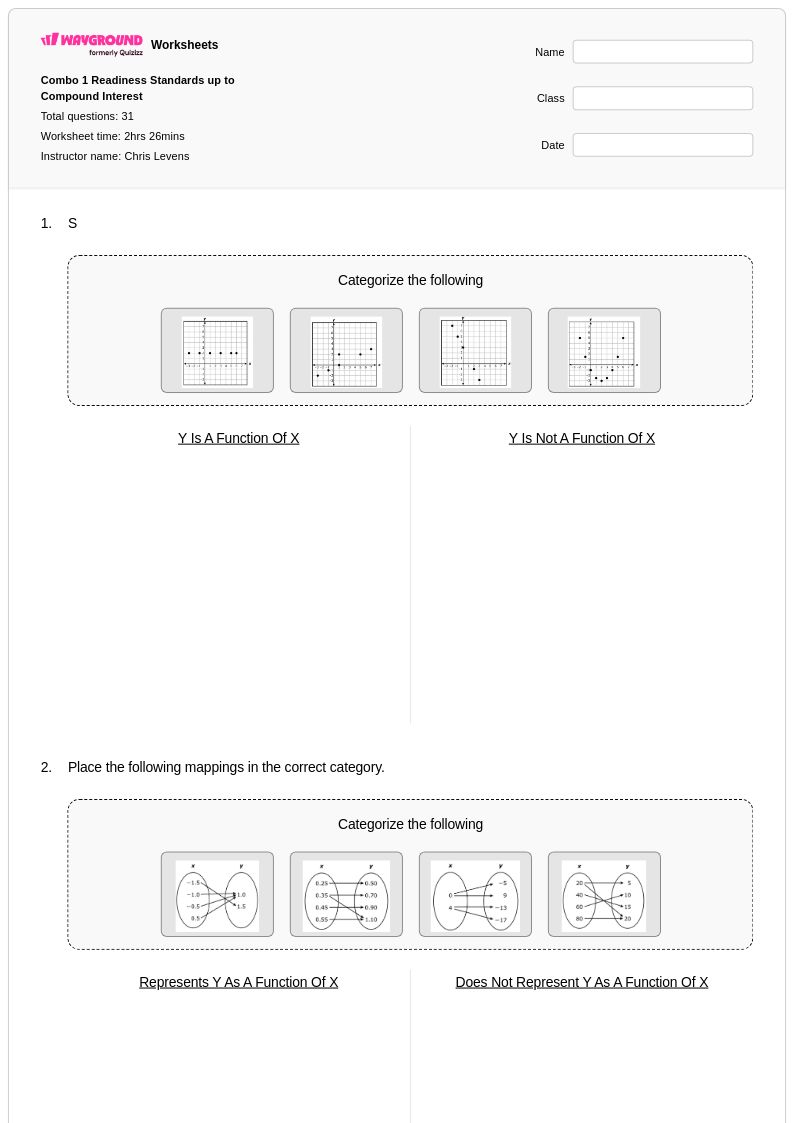

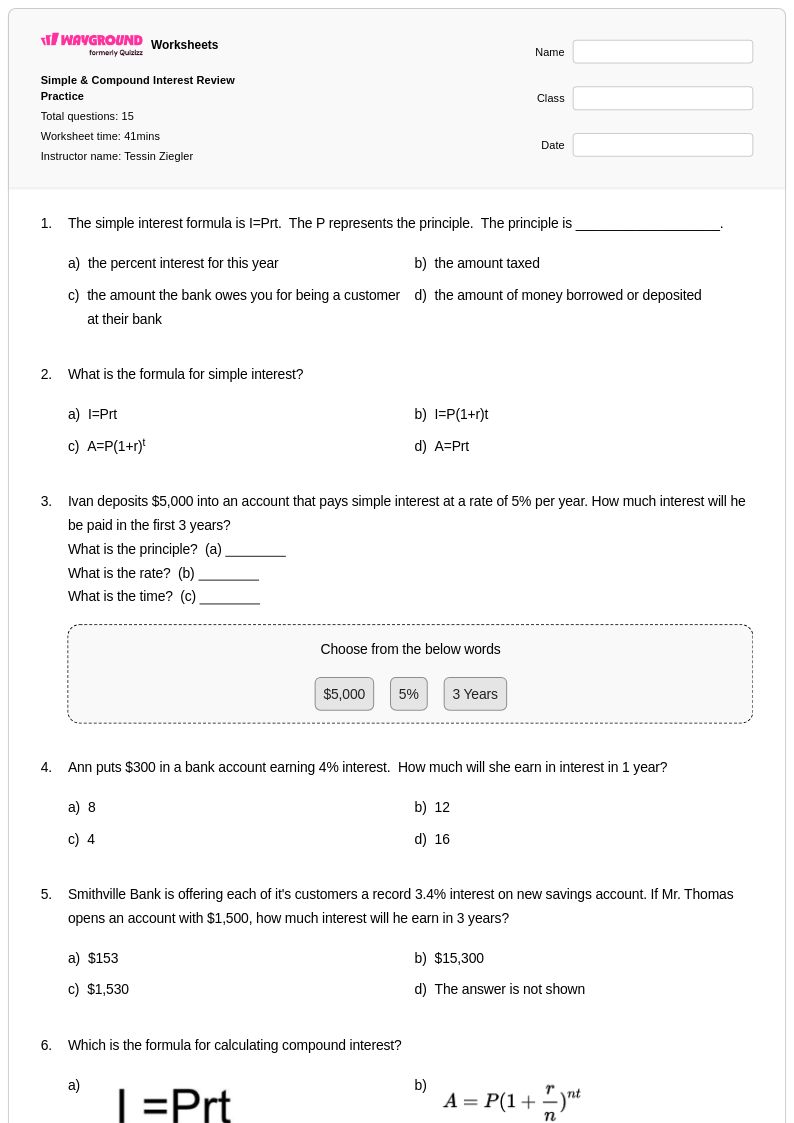

Compound interest worksheets available through Wayground (formerly Quizizz) provide comprehensive mathematics resources designed to build students' understanding of exponential financial growth and time-value of money principles. These expertly crafted worksheets strengthen critical quantitative skills including calculating compound interest using various formulas, comparing simple versus compound interest scenarios, determining investment growth over different time periods, and analyzing the impact of compounding frequency on financial outcomes. Each worksheet collection includes detailed practice problems that progress from basic compound interest calculations to complex real-world applications, complete with answer keys and step-by-step solutions. Teachers can access these free printables in convenient pdf format, making it easy to distribute targeted practice materials that reinforce fundamental financial literacy concepts through hands-on problem solving.

Wayground (formerly Quizizz) empowers educators with millions of teacher-created compound interest resources that feature robust search and filtering capabilities, standards alignment to mathematics curricula, and comprehensive differentiation tools for diverse learning needs. The platform's flexible customization options allow teachers to modify existing worksheets or create personalized versions that match specific lesson objectives, assessment requirements, and student skill levels. Available in both printable and digital formats including downloadable pdfs, these worksheet collections support effective instructional planning by providing ready-to-use materials for classroom practice, homework assignments, remediation activities, and enrichment challenges. Teachers can efficiently locate age-appropriate compound interest problems, track student progress through integrated assessment features, and seamlessly integrate these mathematical resources into comprehensive financial literacy instruction that prepares students for real-world financial decision making.