12Q

9th

12Q

5th - 12th

10Q

9th - 12th

20Q

7th - Uni

5Q

7th - Uni

8Q

9th - 12th

16Q

9th - 12th

10Q

9th - 12th

22Q

9th - 12th

20Q

9th

20Q

6th - 10th

18Q

9th - 12th

10Q

7th - 9th

16Q

9th

20Q

9th

15Q

9th

37Q

9th - 12th

8Q

9th

9Q

9th - 12th

14Q

9th - 12th

10Q

9th - 12th

22Q

9th - 12th

50Q

9th - 12th

11Q

9th

Explore otras hojas de trabajo de materias para class 9

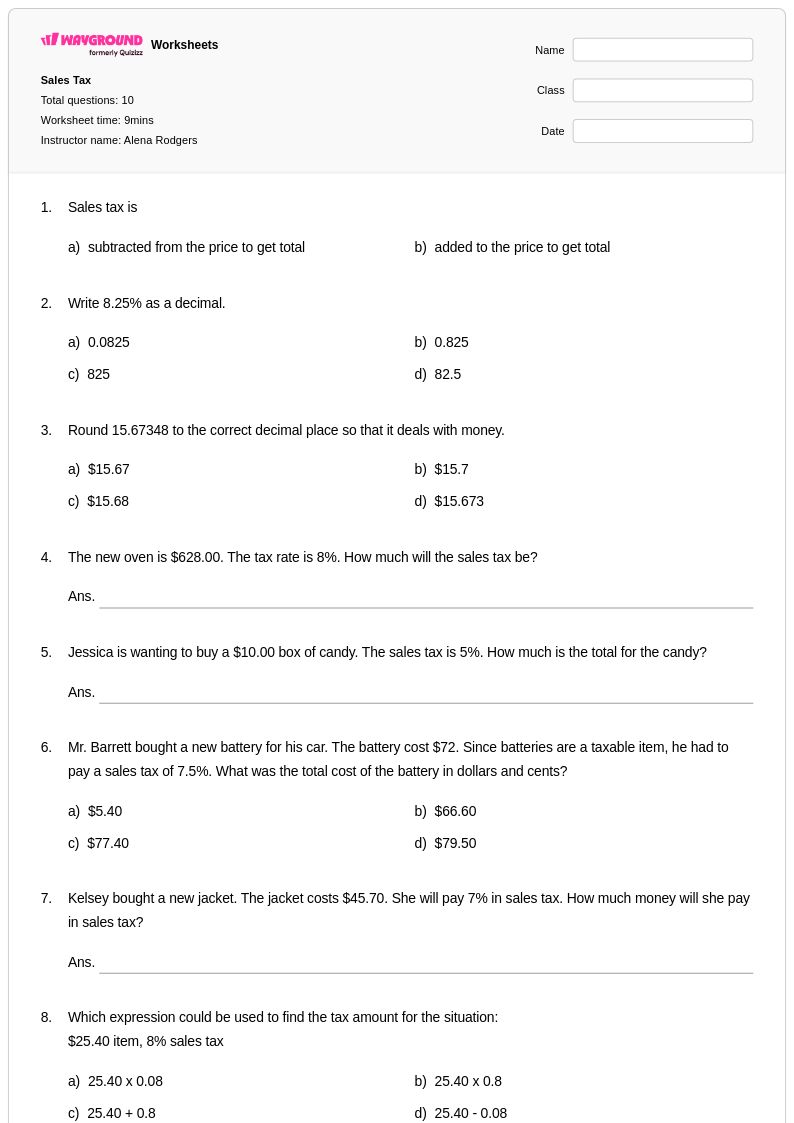

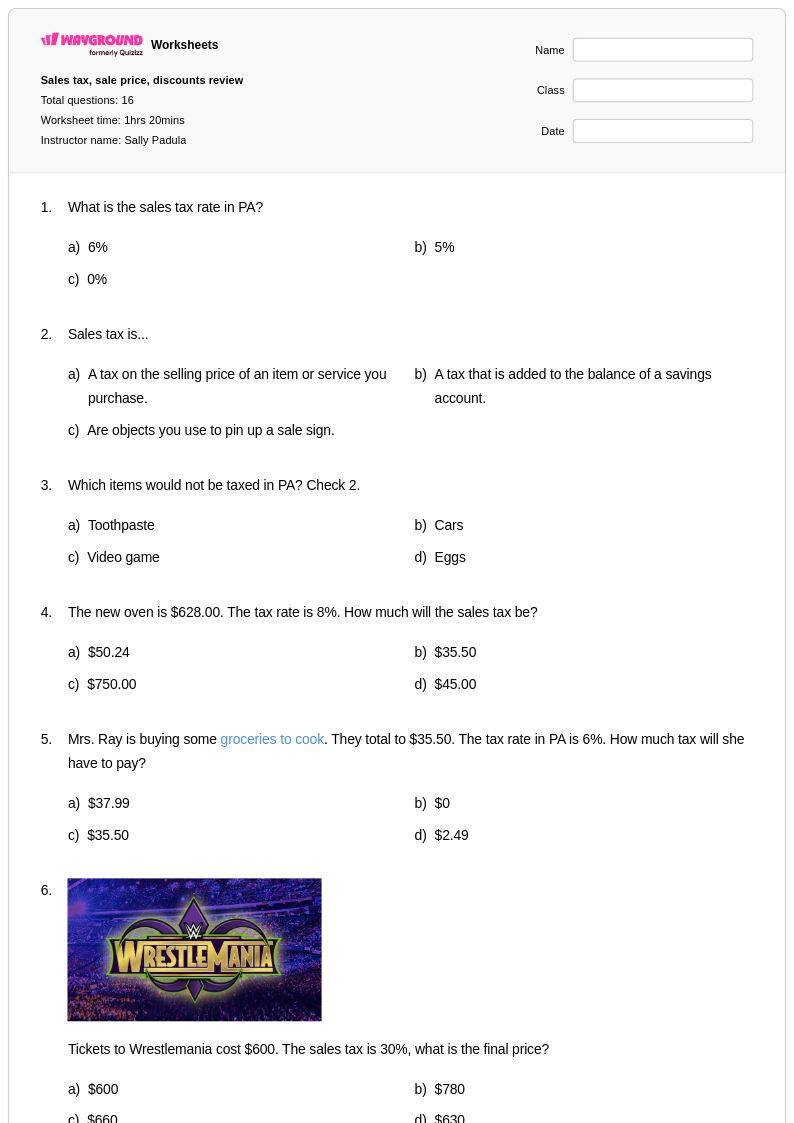

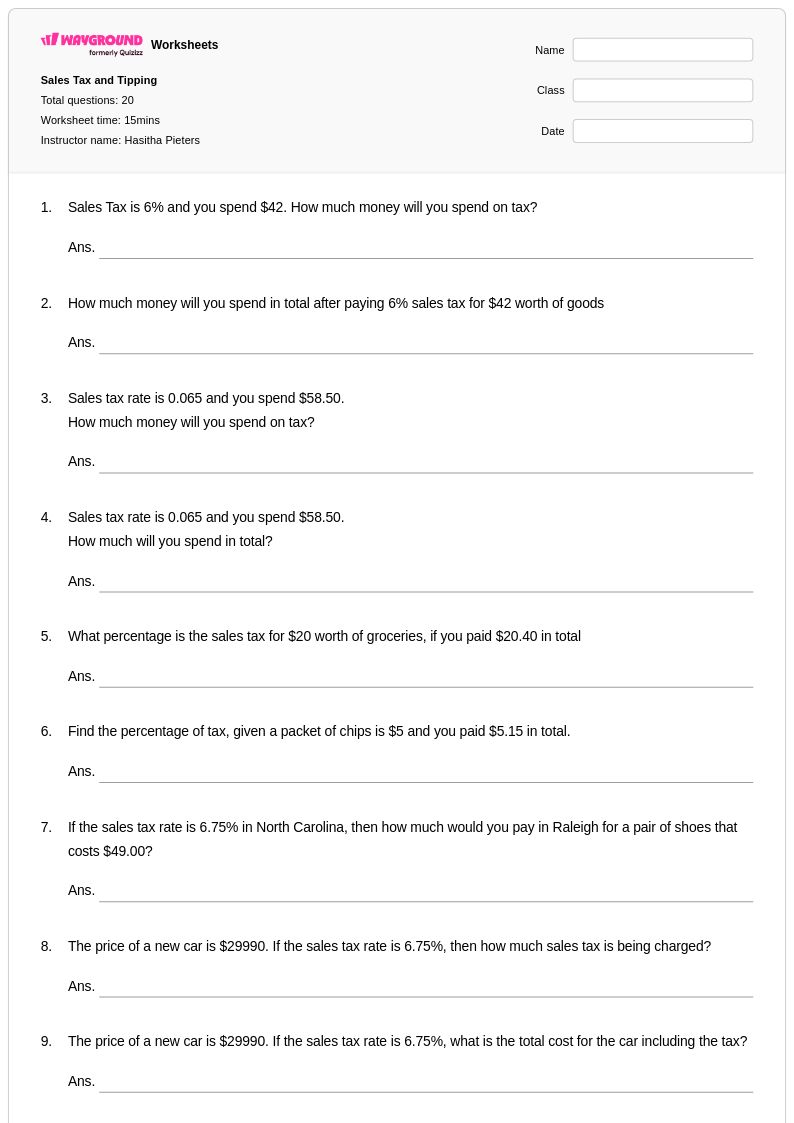

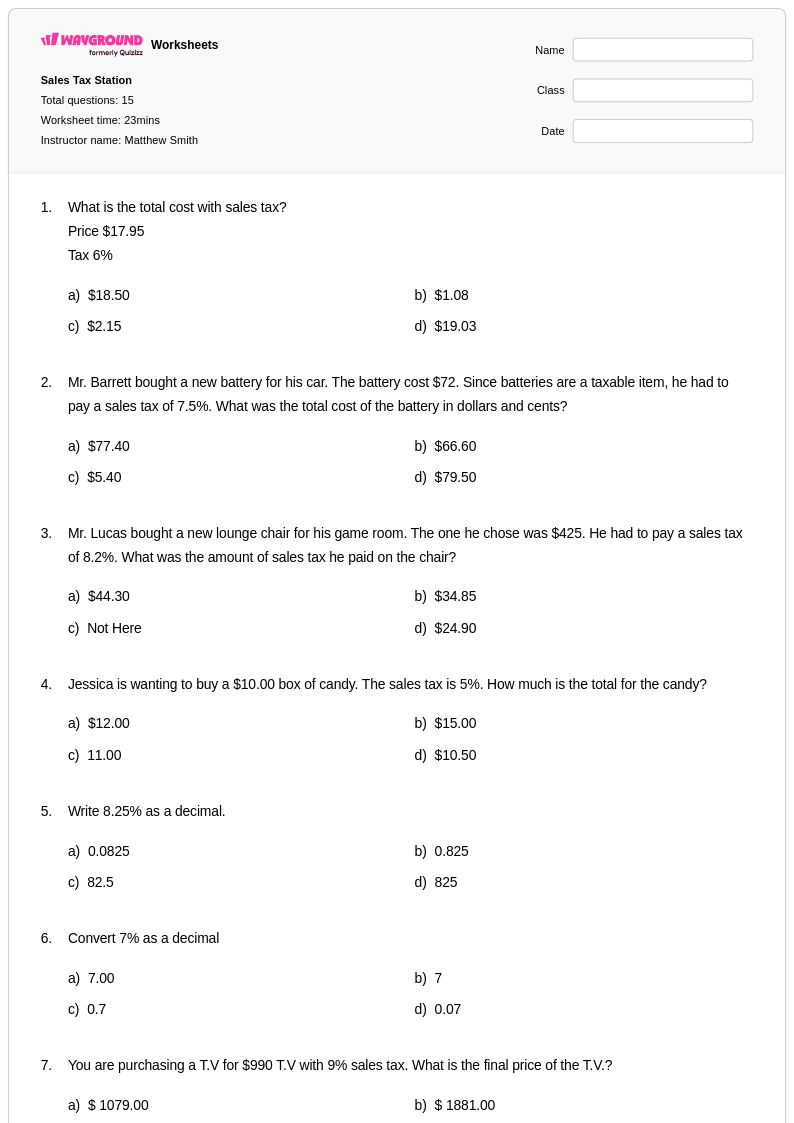

Explore printable Tax Calculation worksheets for Class 9

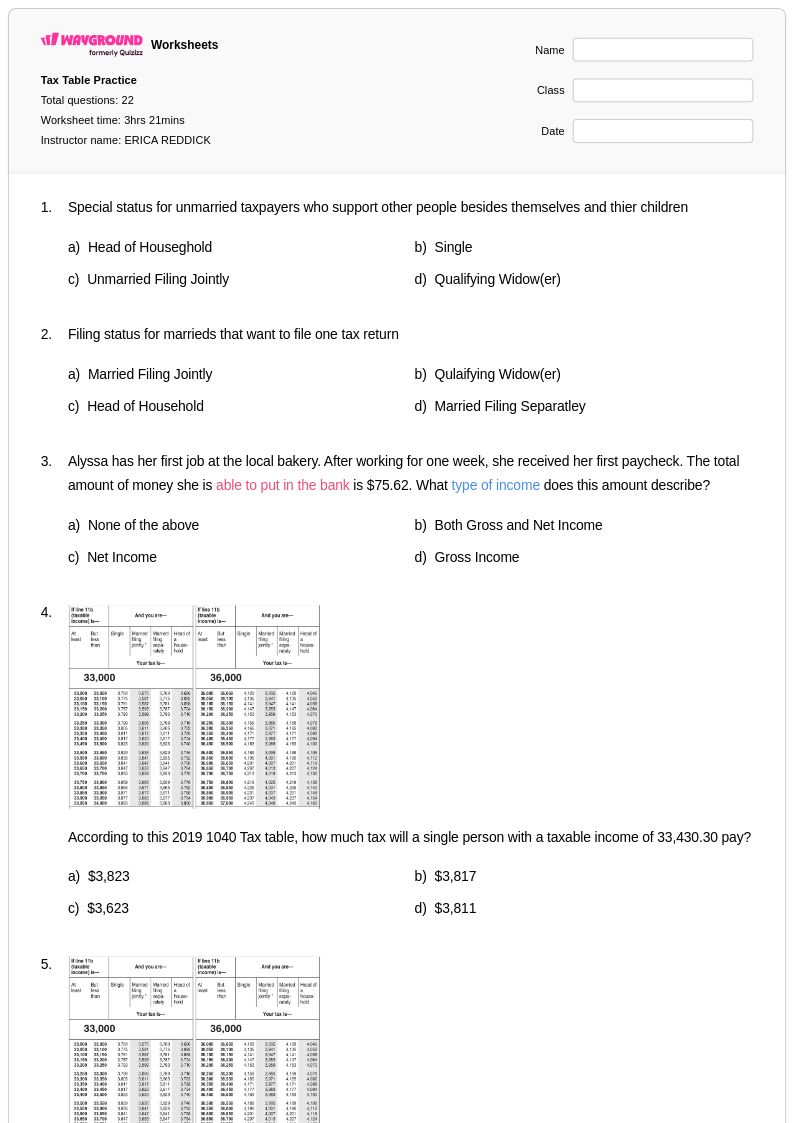

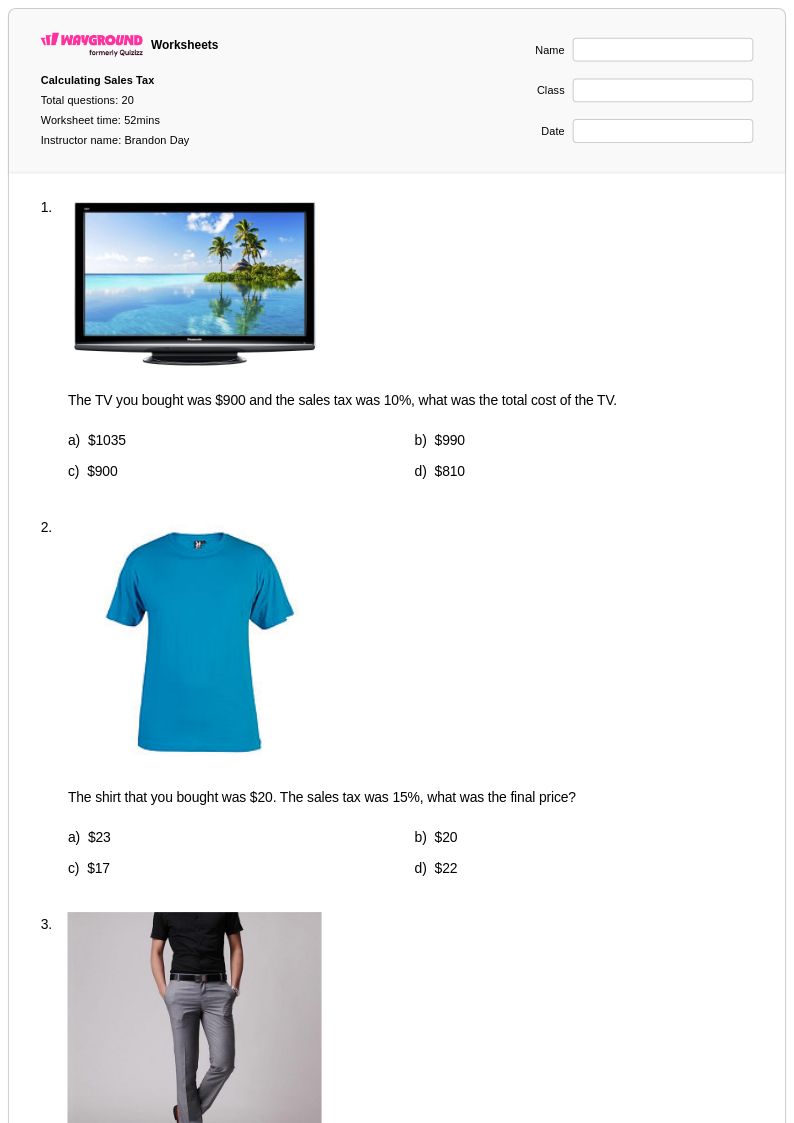

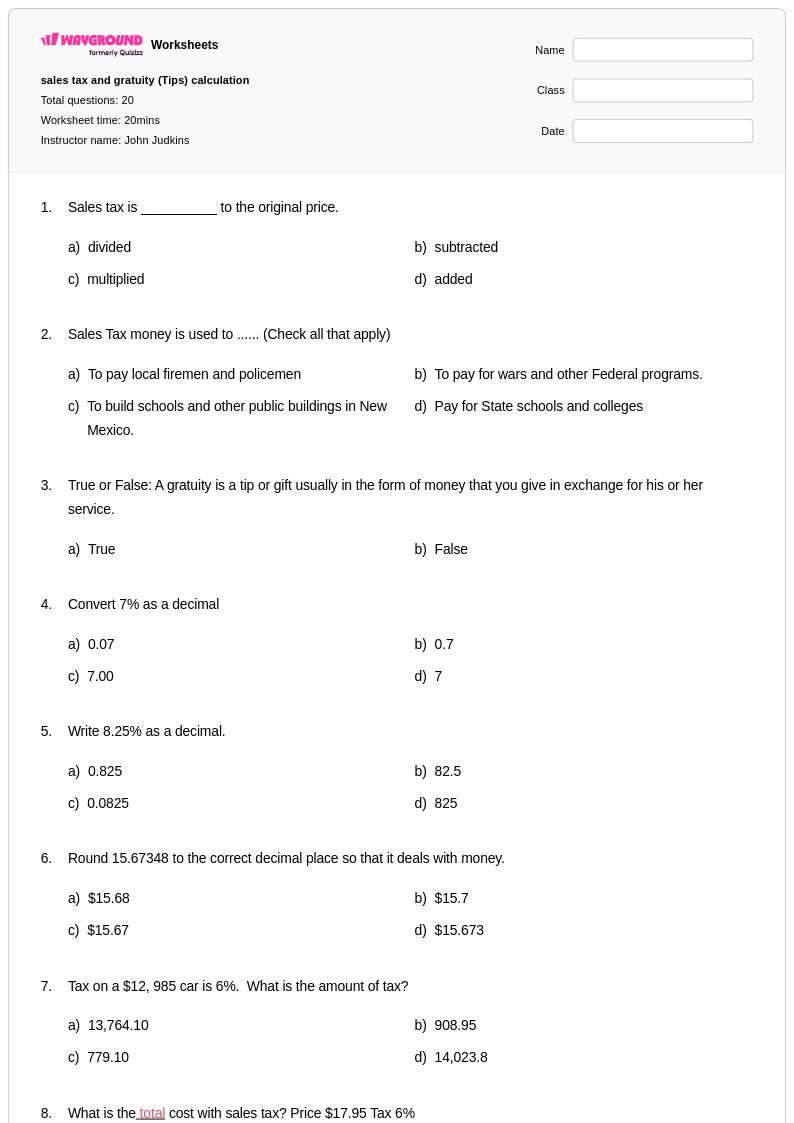

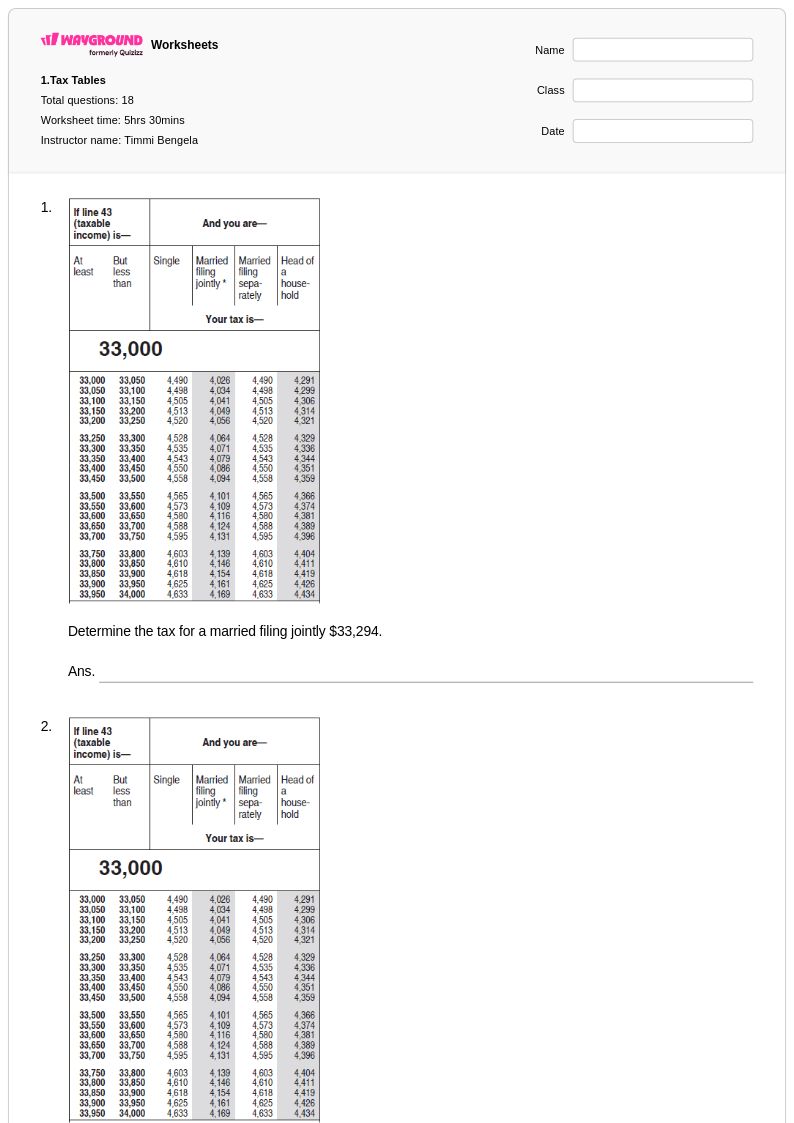

Tax calculation worksheets for Class 9 students available through Wayground (formerly Quizizz) provide comprehensive practice with essential financial literacy skills that students need to understand their civic responsibilities and personal financial management. These carefully designed worksheets guide students through the fundamentals of calculating income tax, sales tax, property tax, and payroll deductions, helping them develop proficiency in percentage calculations, multi-step problem solving, and real-world mathematical applications. Each worksheet includes detailed practice problems that progress from basic tax calculations to more complex scenarios involving tax brackets, deductions, and credits, with complete answer keys provided to support independent learning and self-assessment. The free printable resources are available in convenient PDF format, making them accessible for both classroom instruction and homework assignments while reinforcing critical mathematical concepts through authentic financial contexts.

Wayground (formerly Quizizz) empowers educators with millions of teacher-created tax calculation worksheets and Class 9 financial literacy resources that can be easily searched, filtered, and customized to meet diverse classroom needs. The platform's robust standards alignment ensures that worksheets correspond to state and national mathematics and financial literacy standards, while built-in differentiation tools allow teachers to modify content complexity for varied skill levels within their classrooms. Teachers can seamlessly integrate these resources into their lesson planning for initial instruction, targeted remediation, or enrichment activities, with the flexibility to use materials in both printable and digital formats depending on their classroom setup and student needs. The extensive collection supports systematic skill practice across multiple tax calculation concepts, enabling educators to provide focused, repeated exposure to these essential life skills while tracking student progress and understanding.