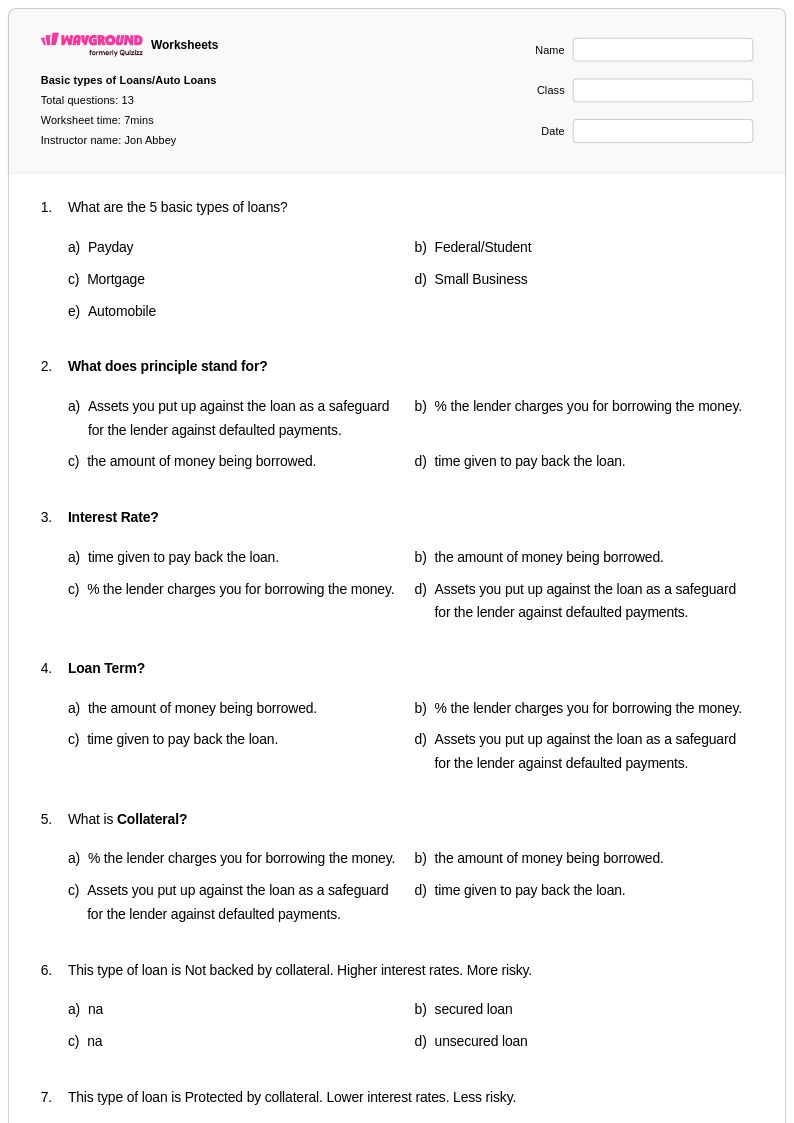

13 Q

10th

16 Q

10th

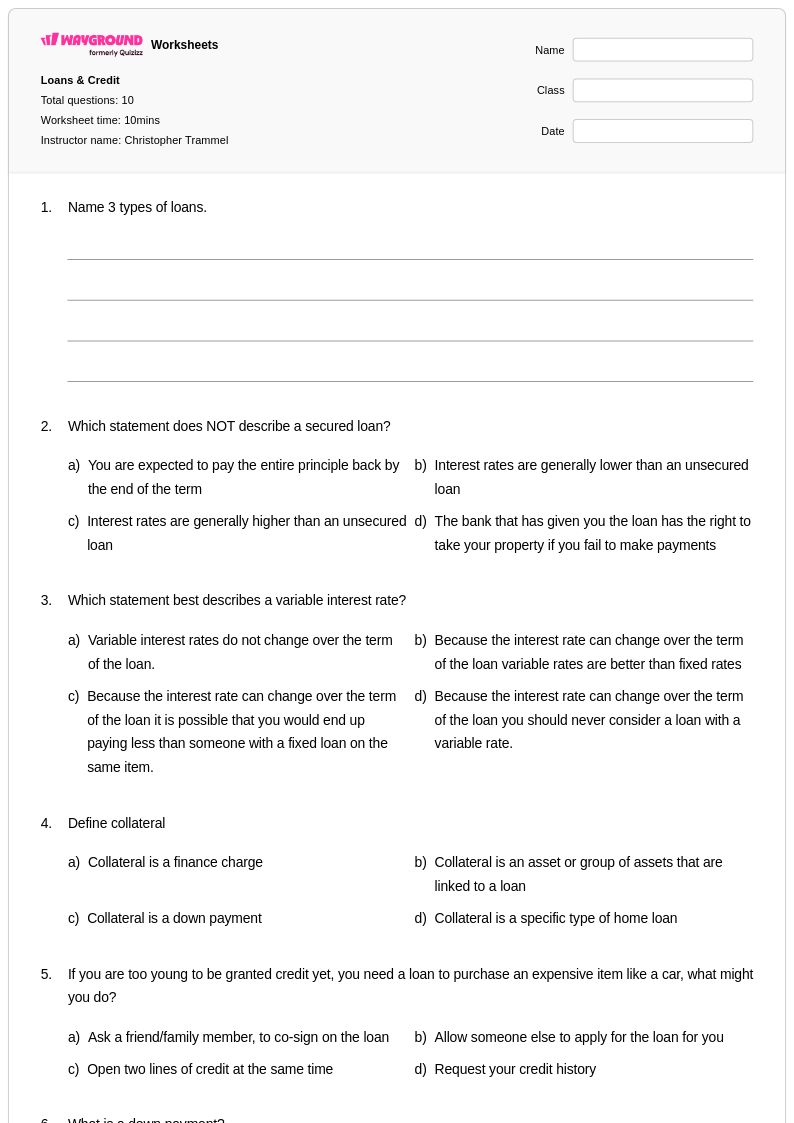

10 Q

10th

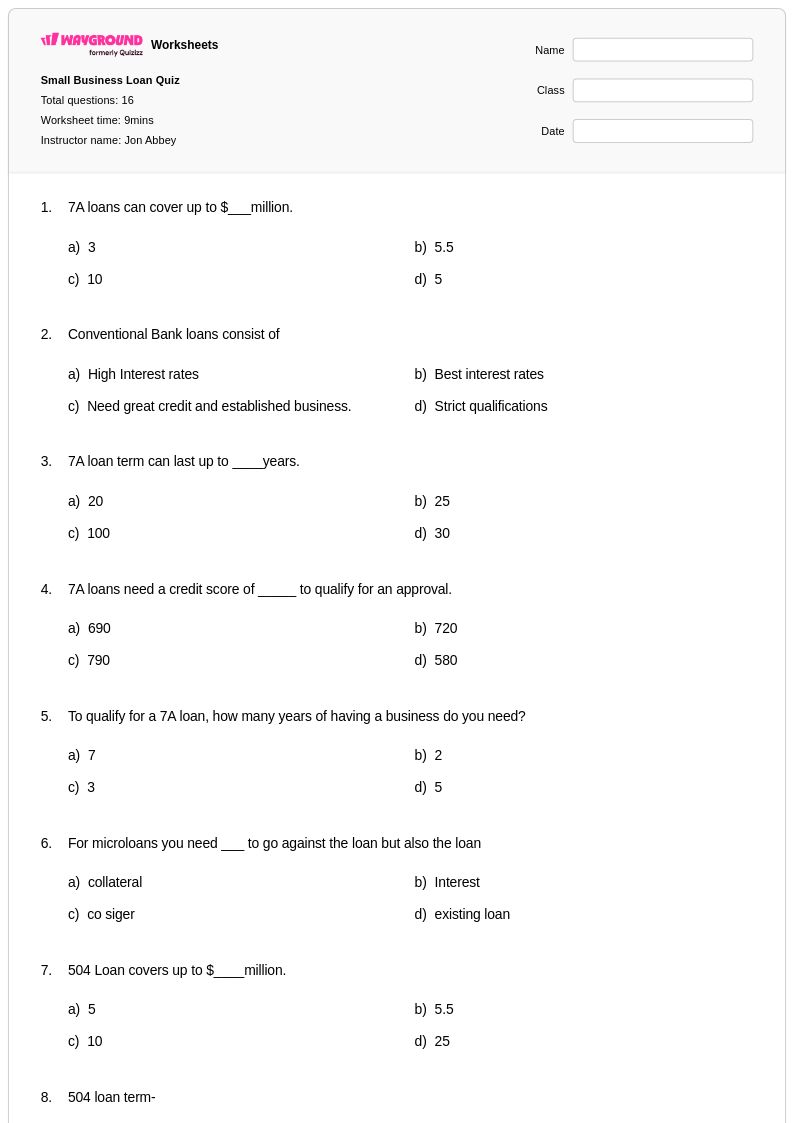

16 Q

10th

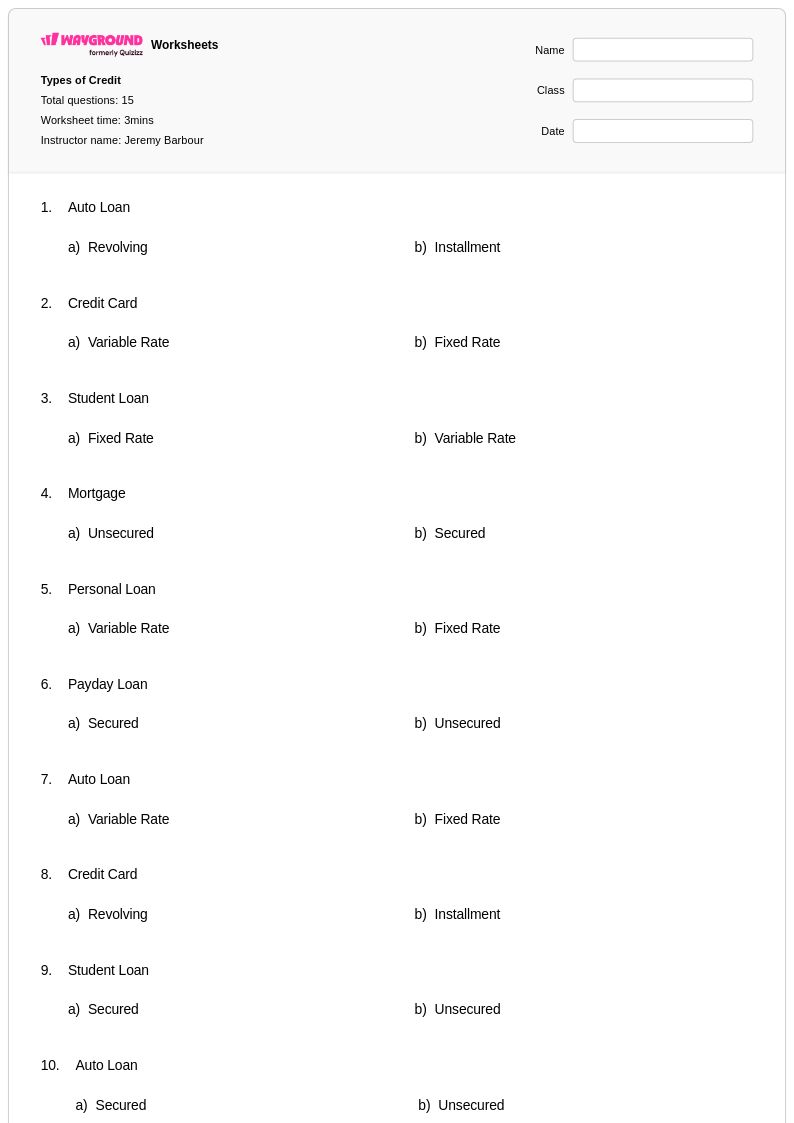

15 Q

10th

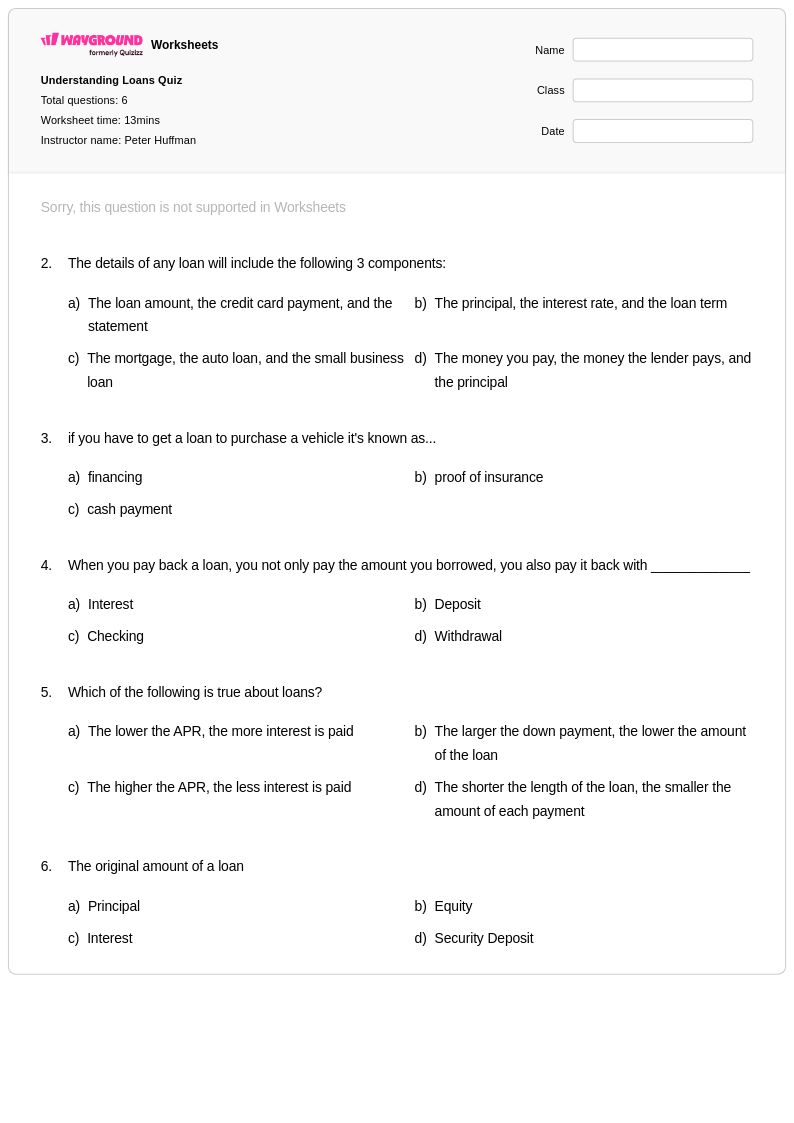

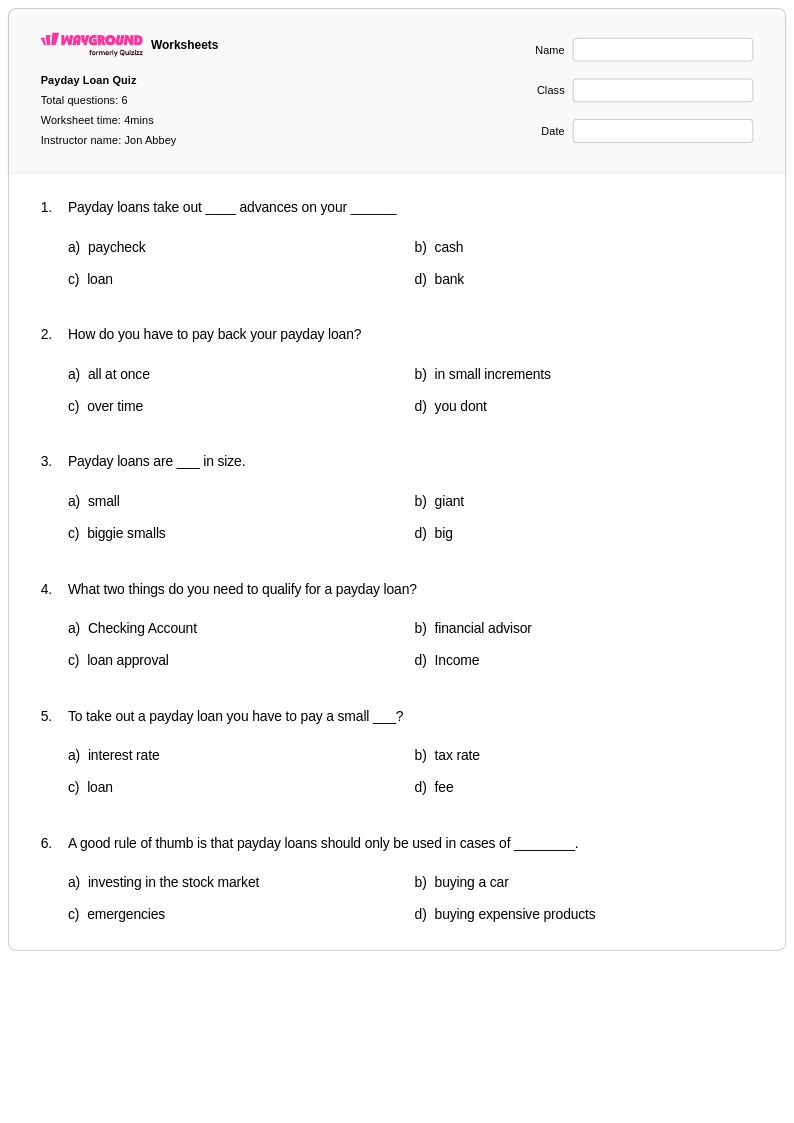

6 Q

10th

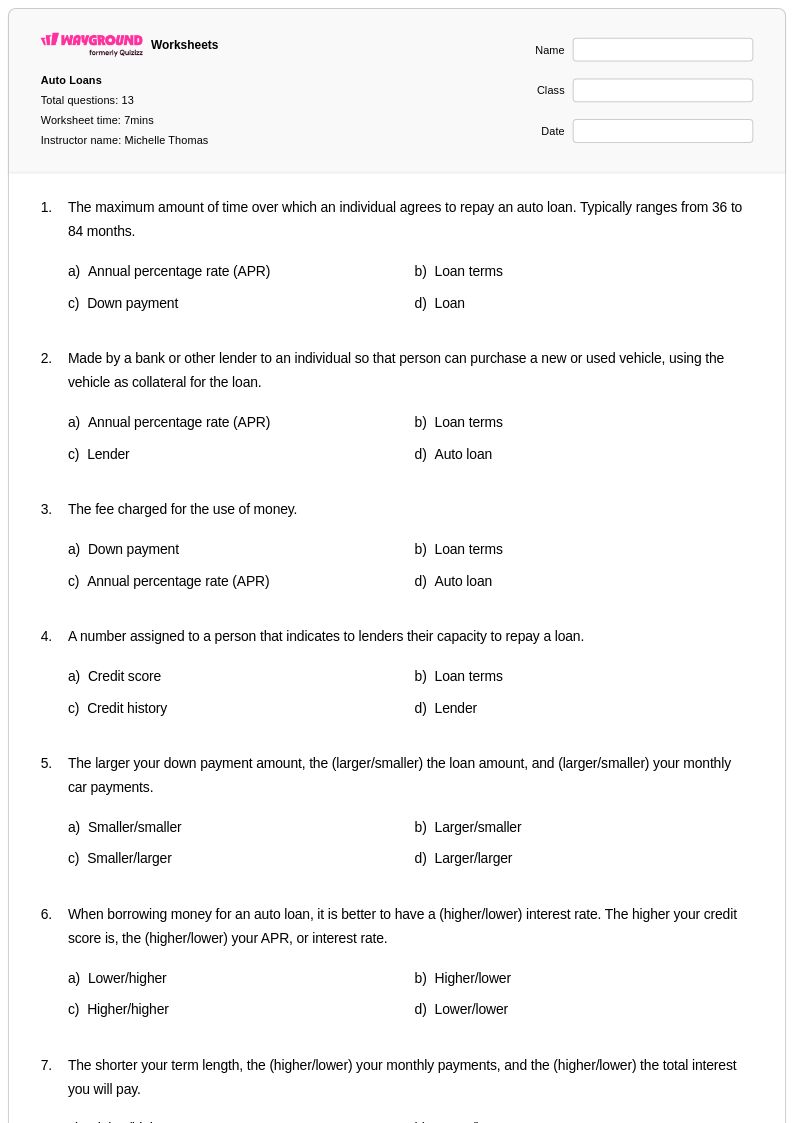

13 Q

9th - 12th

14 Q

10th

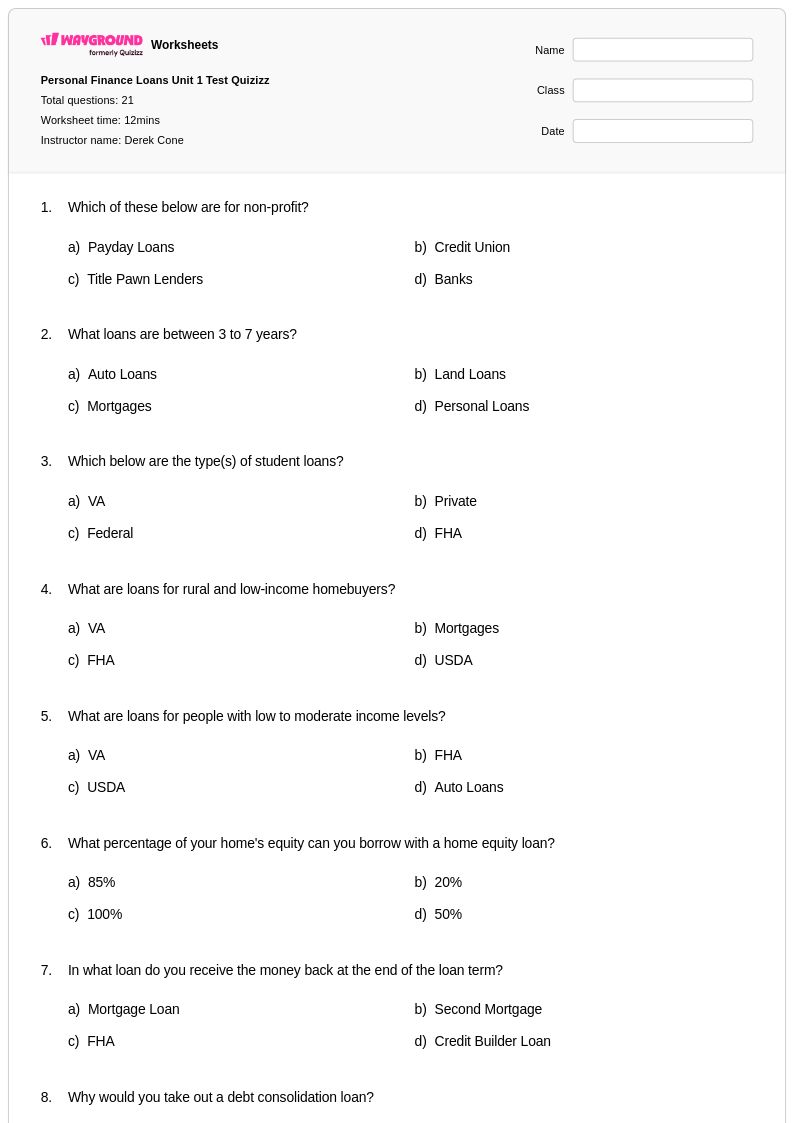

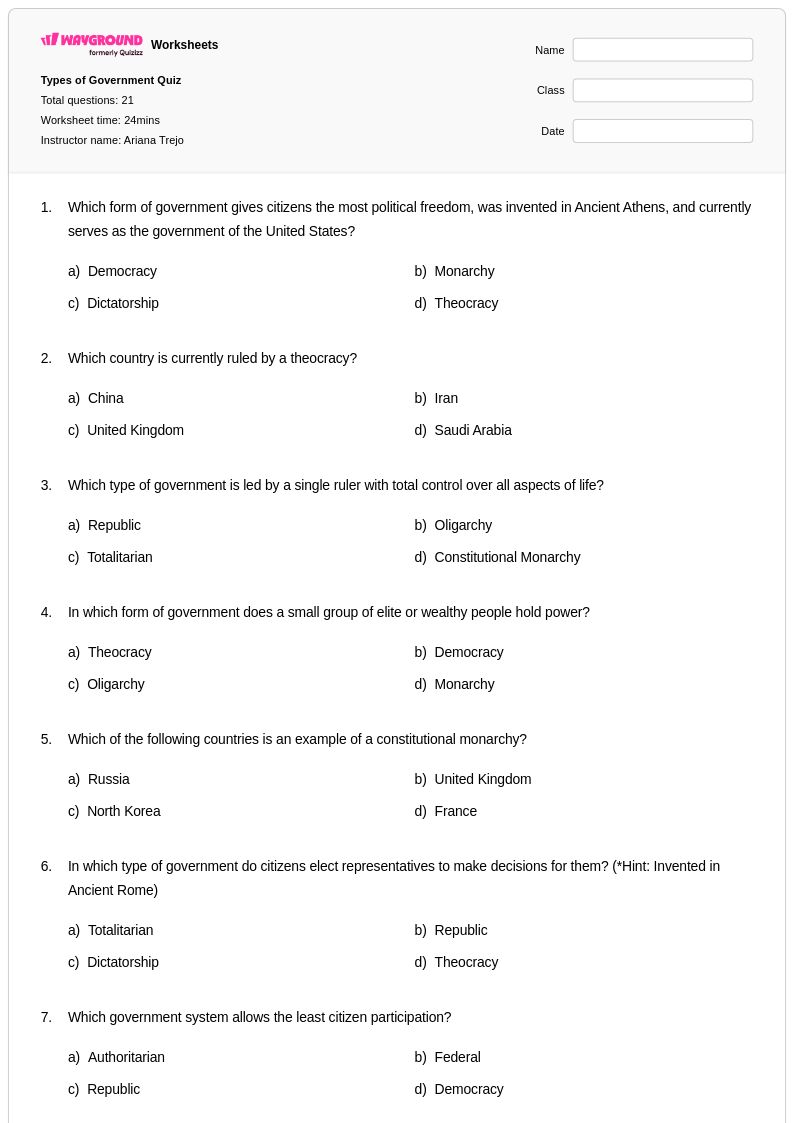

21 Q

10th

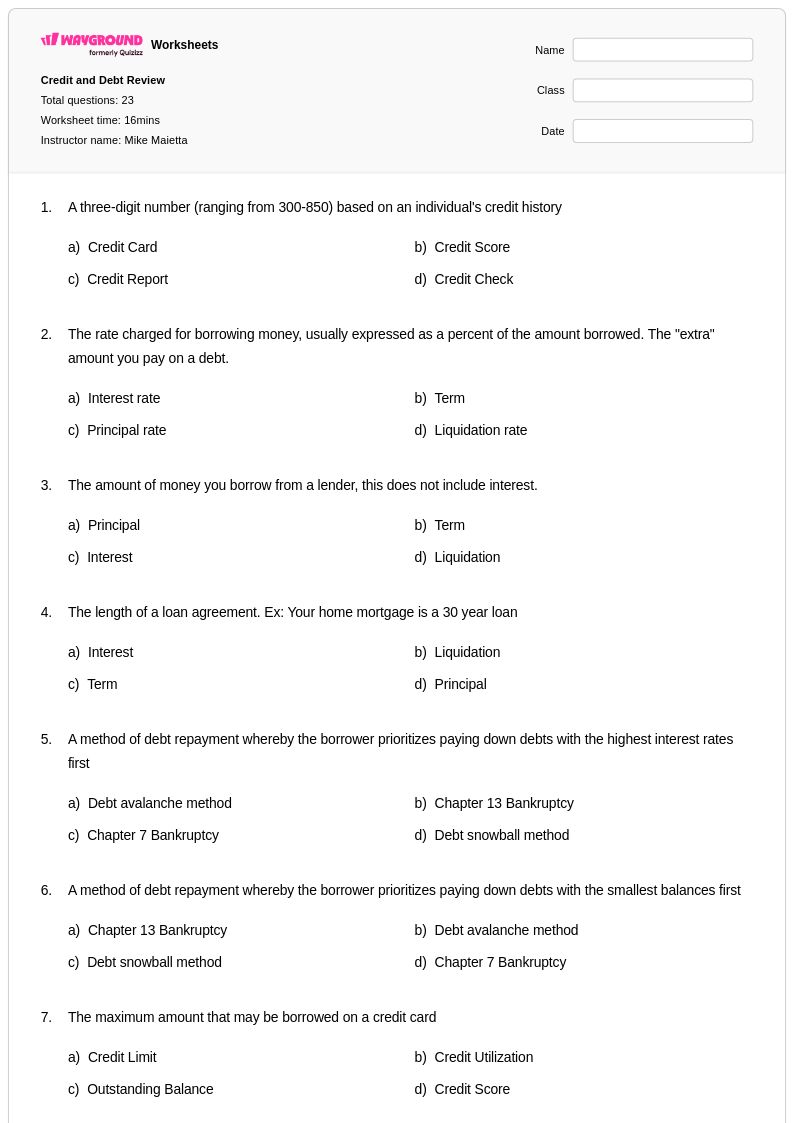

23 Q

9th - 12th

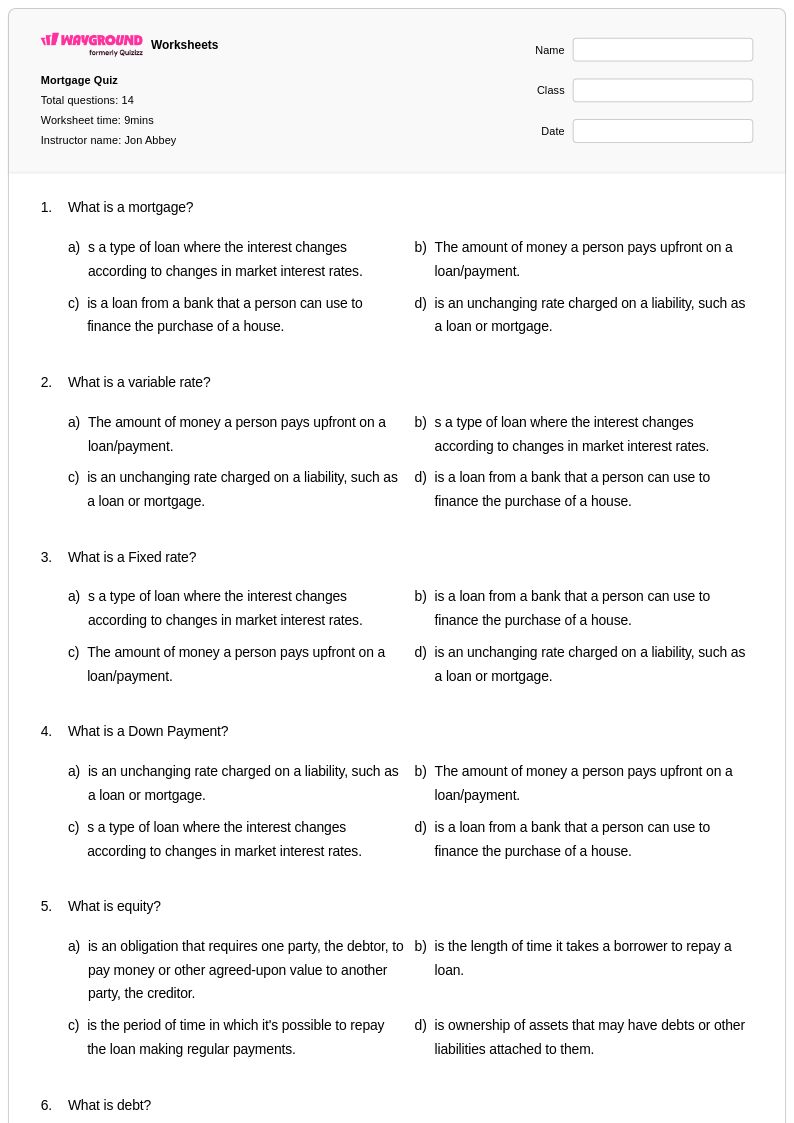

14 Q

10th

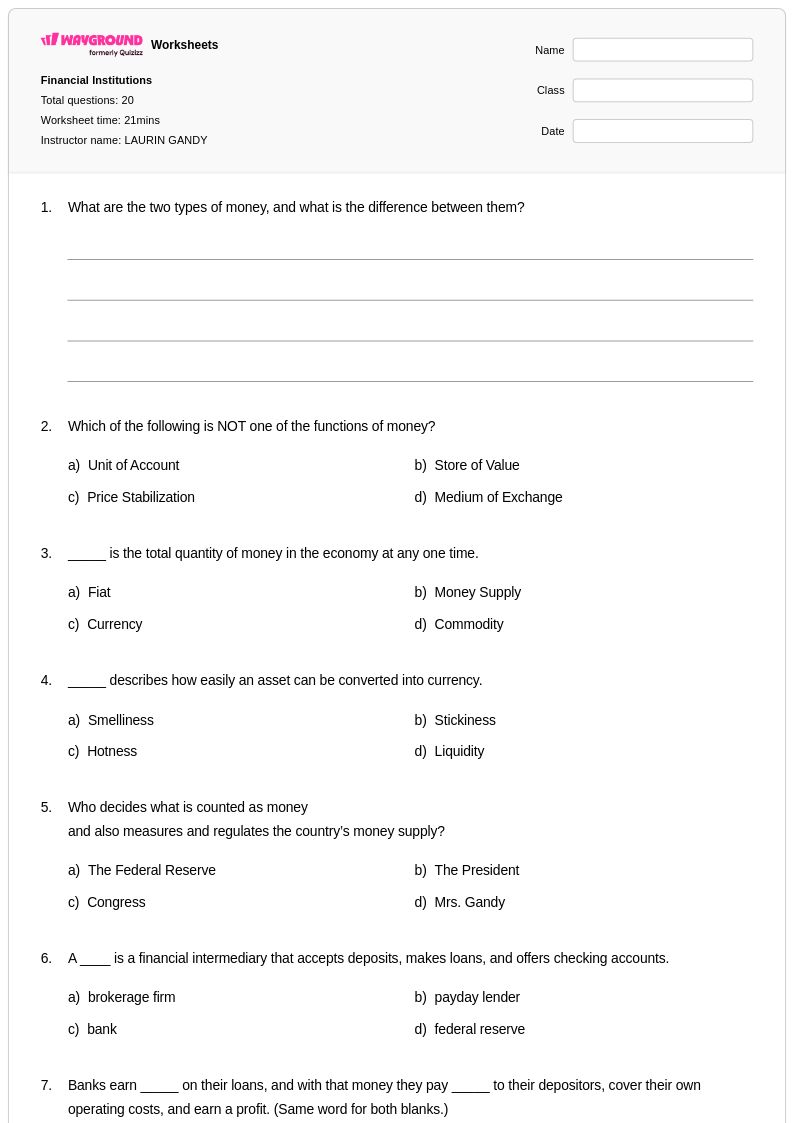

20 Q

9th - 12th

20 Q

9th - 12th

22 Q

9th - 12th

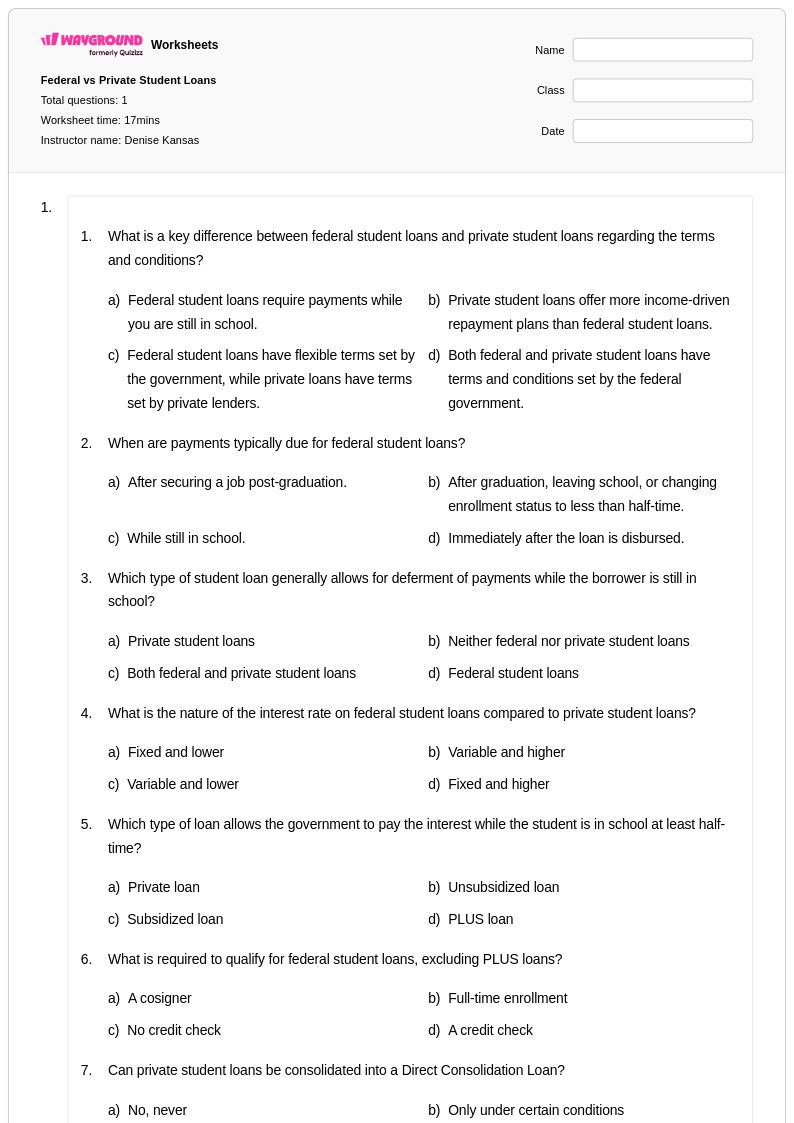

17 Q

9th - 12th

18 Q

10th

10 Q

9th - 12th

25 Q

9th - 12th

20 Q

8th - 12th

10 Q

9th - 12th

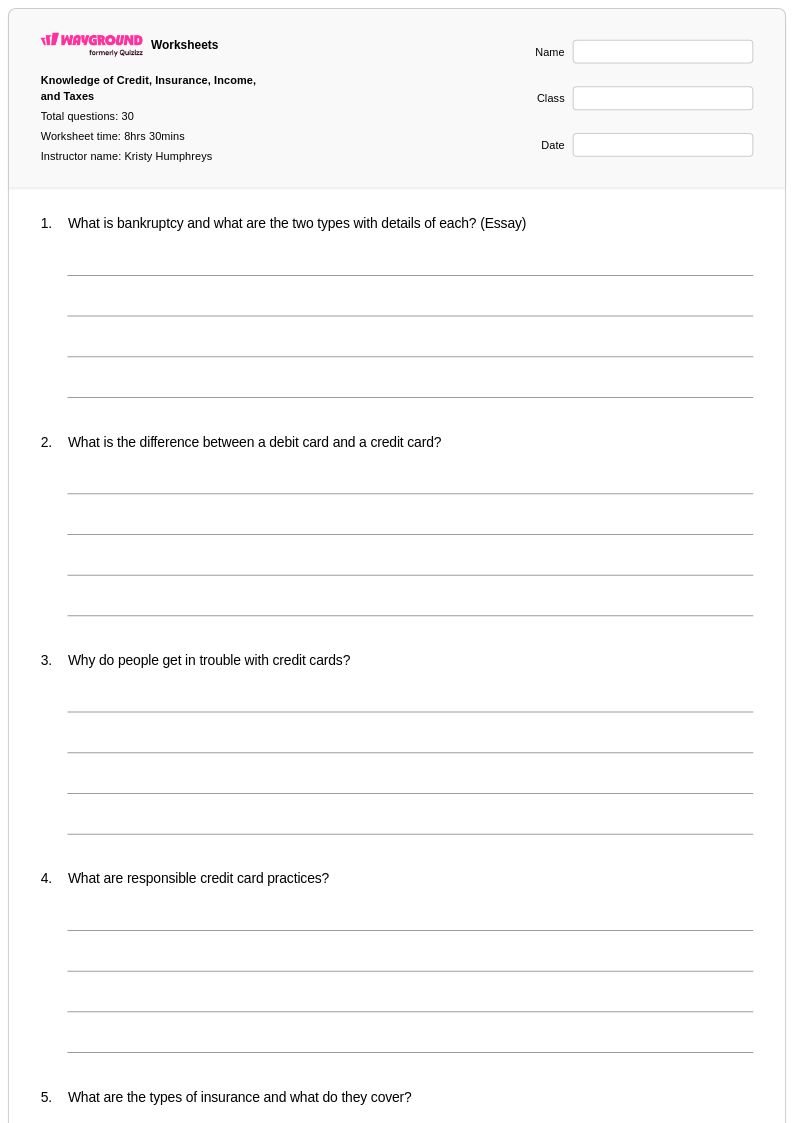

30 Q

10th

26 Q

9th - 12th

18 Q

10th

10 Q

10th - 12th

Explore Other Subject Worksheets for class 10

Explore printable Types of Loans worksheets for Class 10

Types of loans worksheets for Class 10 students available through Wayground provide comprehensive exploration of consumer credit, mortgages, student loans, and business financing options. These educational resources strengthen critical financial literacy skills by guiding students through the analysis of interest rates, repayment terms, collateral requirements, and the long-term economic impact of different borrowing decisions. The practice problems incorporated within these worksheets challenge students to calculate loan payments, compare annual percentage rates, and evaluate the total cost of credit across various loan products. Each printable resource includes detailed answer keys that support both independent study and classroom instruction, while the free pdf format ensures accessibility for diverse learning environments and budget constraints.

Wayground's extensive collection of teacher-created resources supports educators with millions of carefully curated worksheets that align with social studies and economics standards for secondary education. The platform's advanced search and filtering capabilities enable teachers to locate age-appropriate materials that match specific curriculum requirements and learning objectives related to personal finance and economic decision-making. These differentiation tools allow instructors to customize content complexity, modify problem sets, and adapt worksheets for students with varying skill levels, making lesson planning more efficient and targeted. Whether used for initial instruction, skill remediation, or enrichment activities, these digital and printable resources provide flexible solutions that enhance student understanding of credit markets, lending institutions, and responsible borrowing practices essential for financial success.