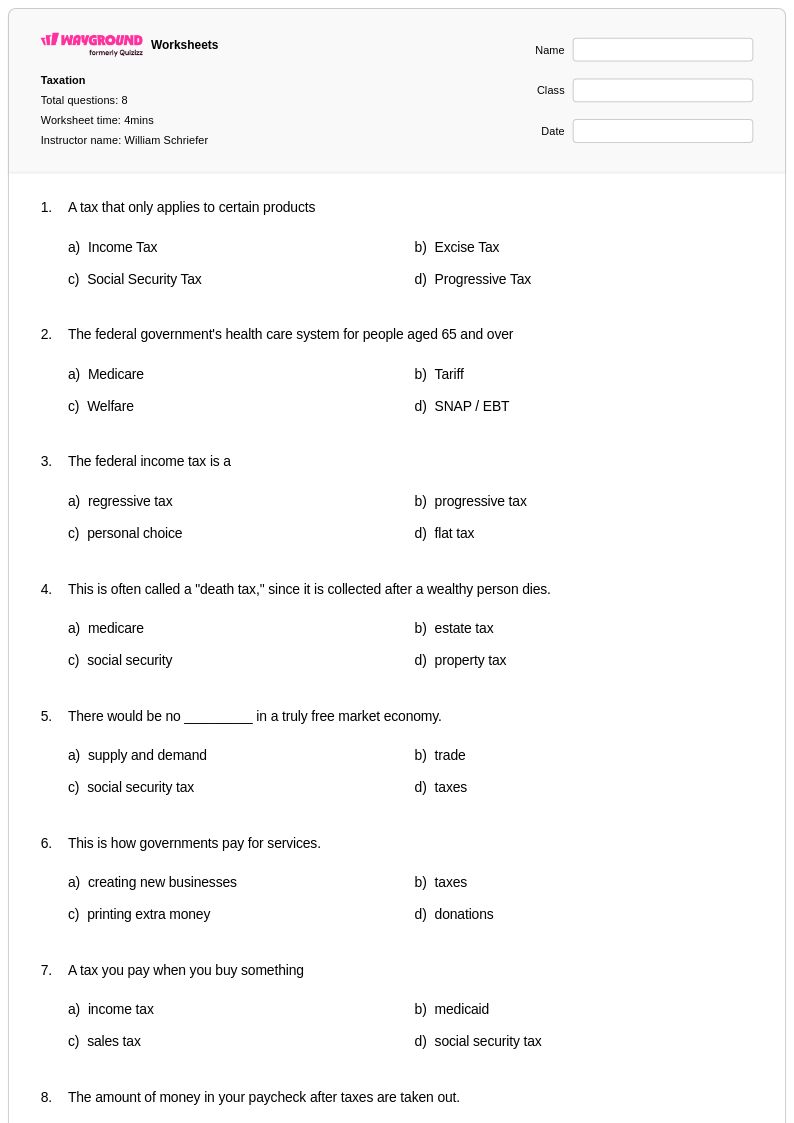

8 Q

9th

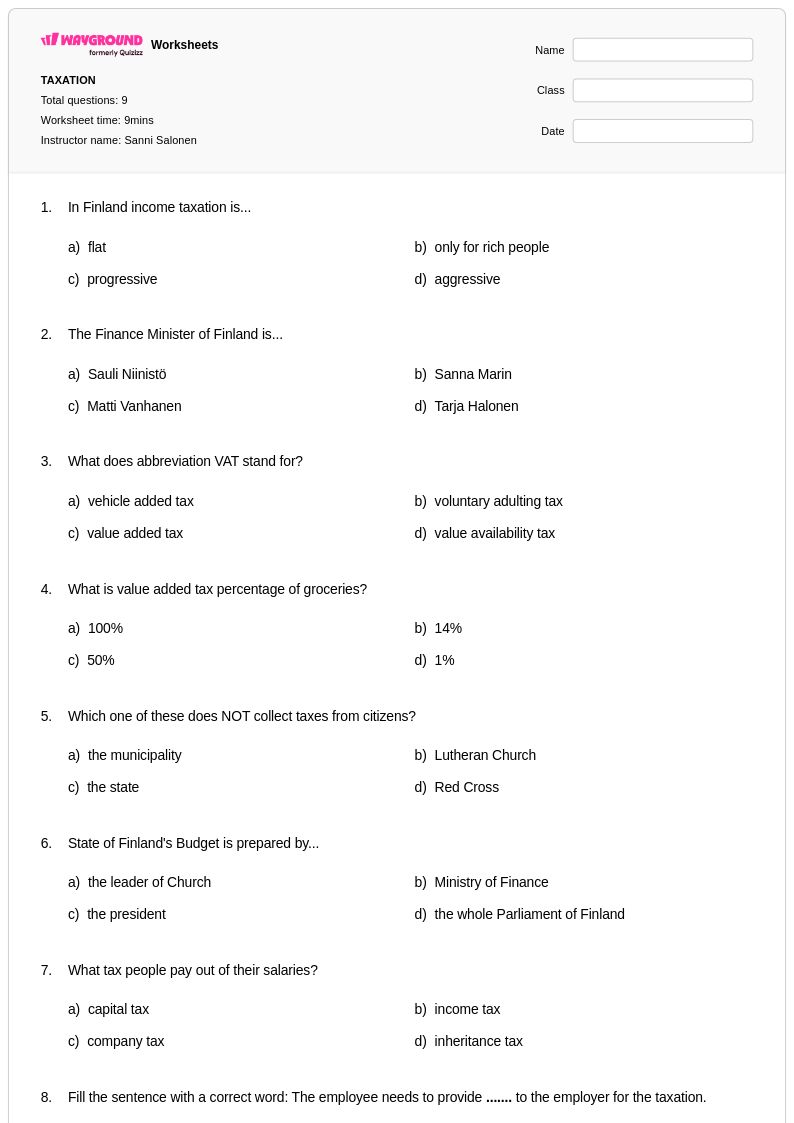

9 Q

9th

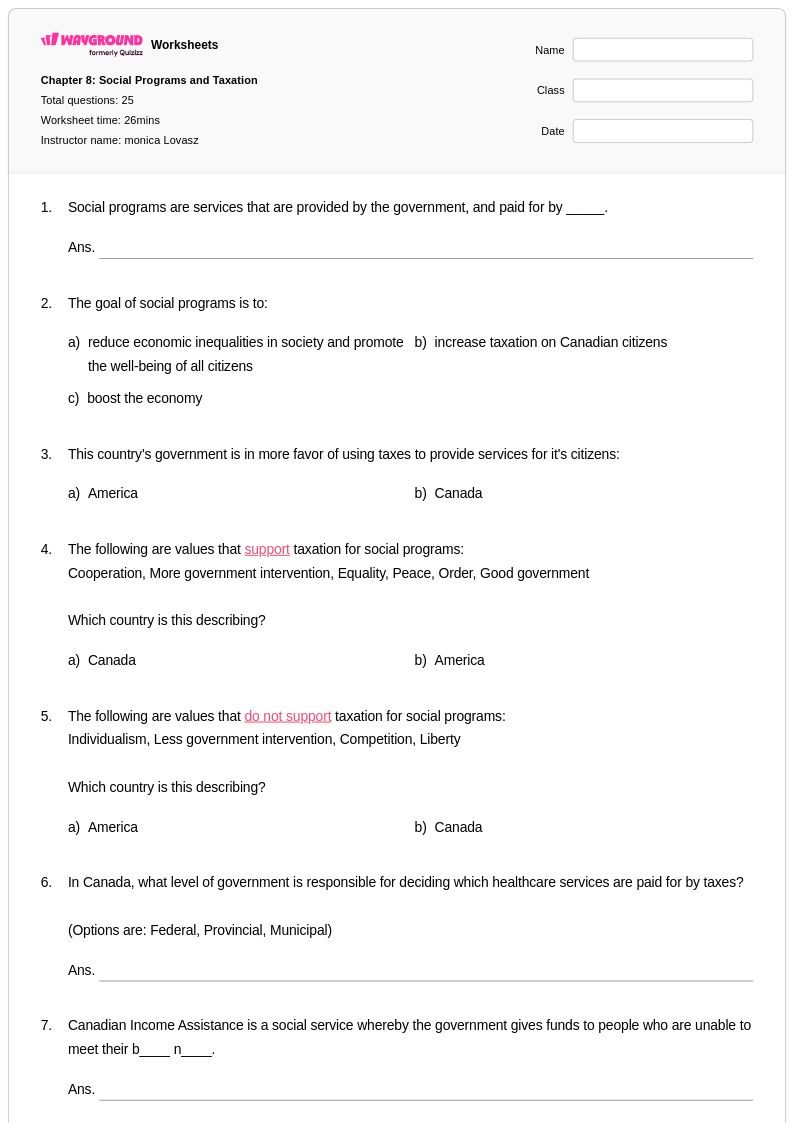

25 Q

9th

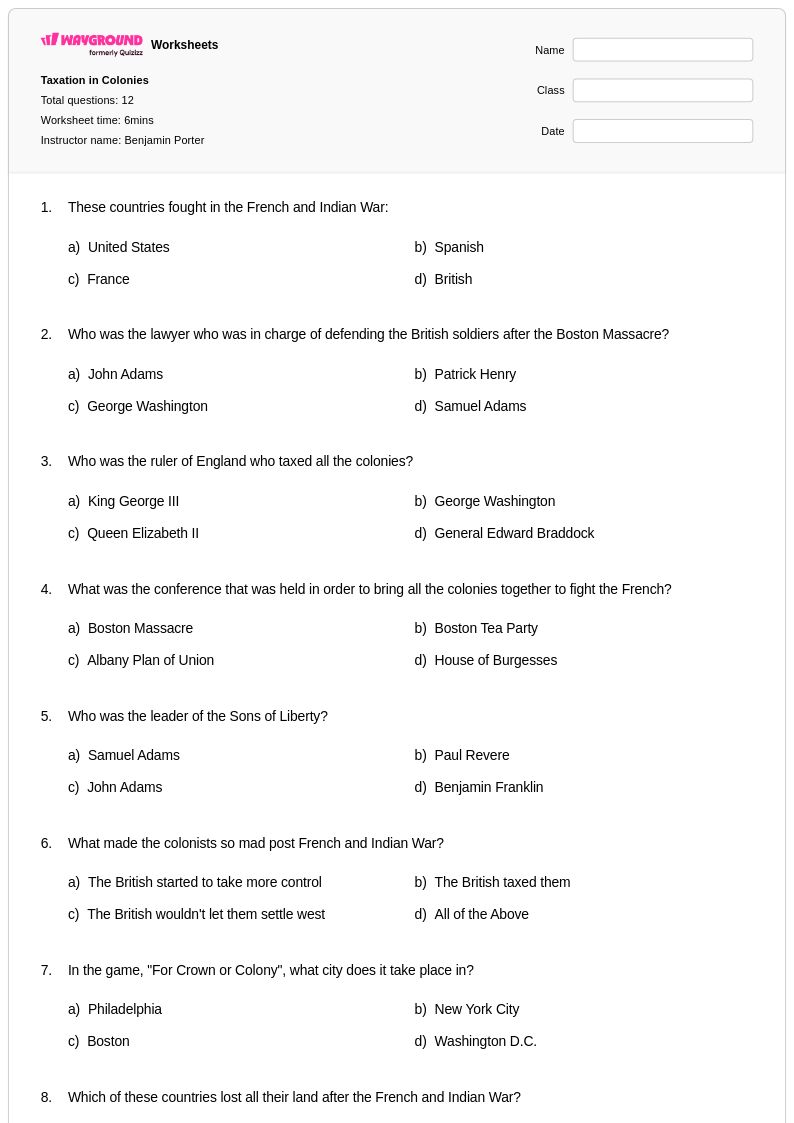

12 Q

6th - 10th

35 Q

5th - 12th

15 Q

9th - 12th

20 Q

9th - 12th

14 Q

9th

8 Q

7th - 11th

15 Q

8th - Uni

15 Q

9th - 11th

10 Q

9th

20 Q

5th - Uni

6 Q

9th

46 Q

7th - Uni

10 Q

9th

9 Q

8th - Uni

24 Q

9th - 12th

24 Q

9th - 12th

25 Q

5th - 10th

10 Q

9th - 12th

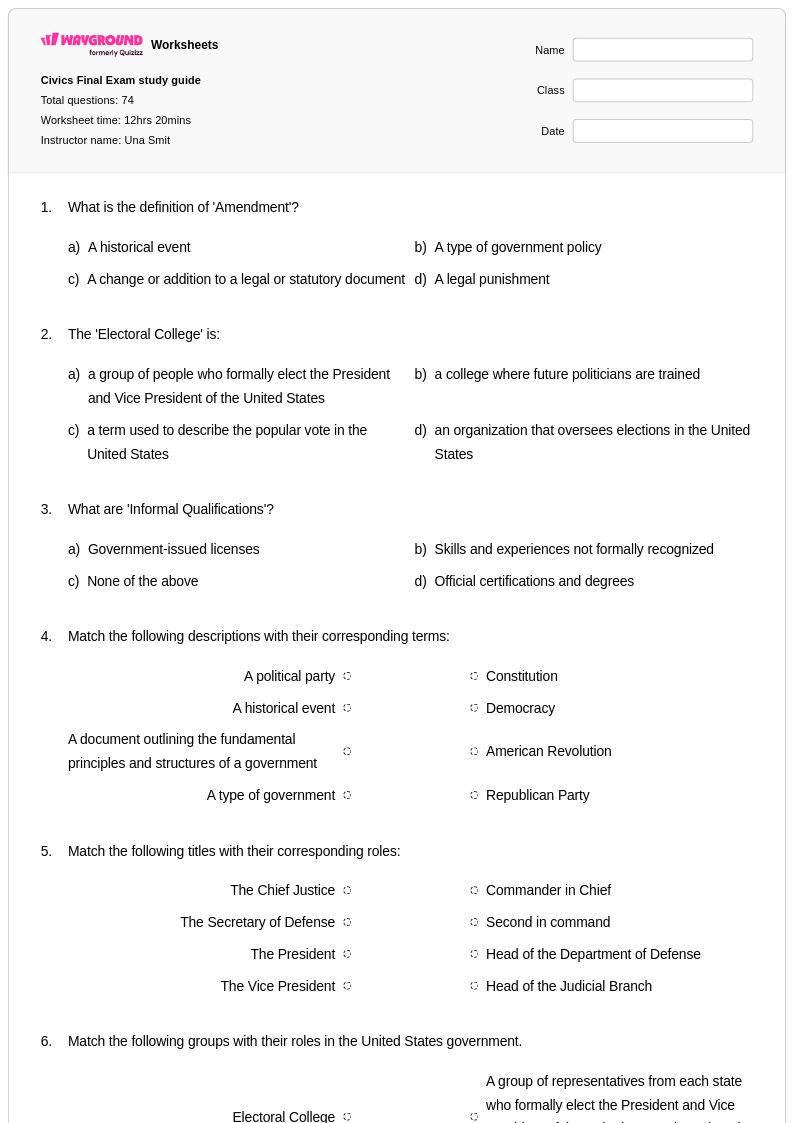

74 Q

9th - 12th

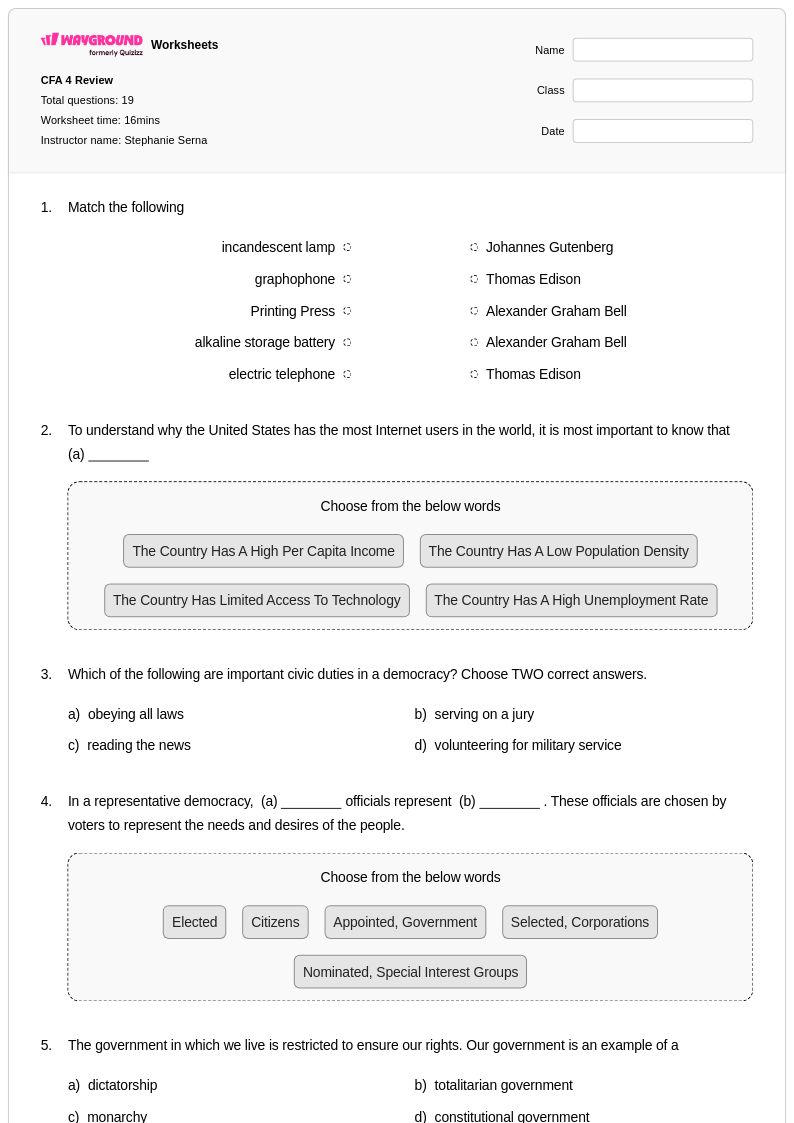

19 Q

6th - Uni

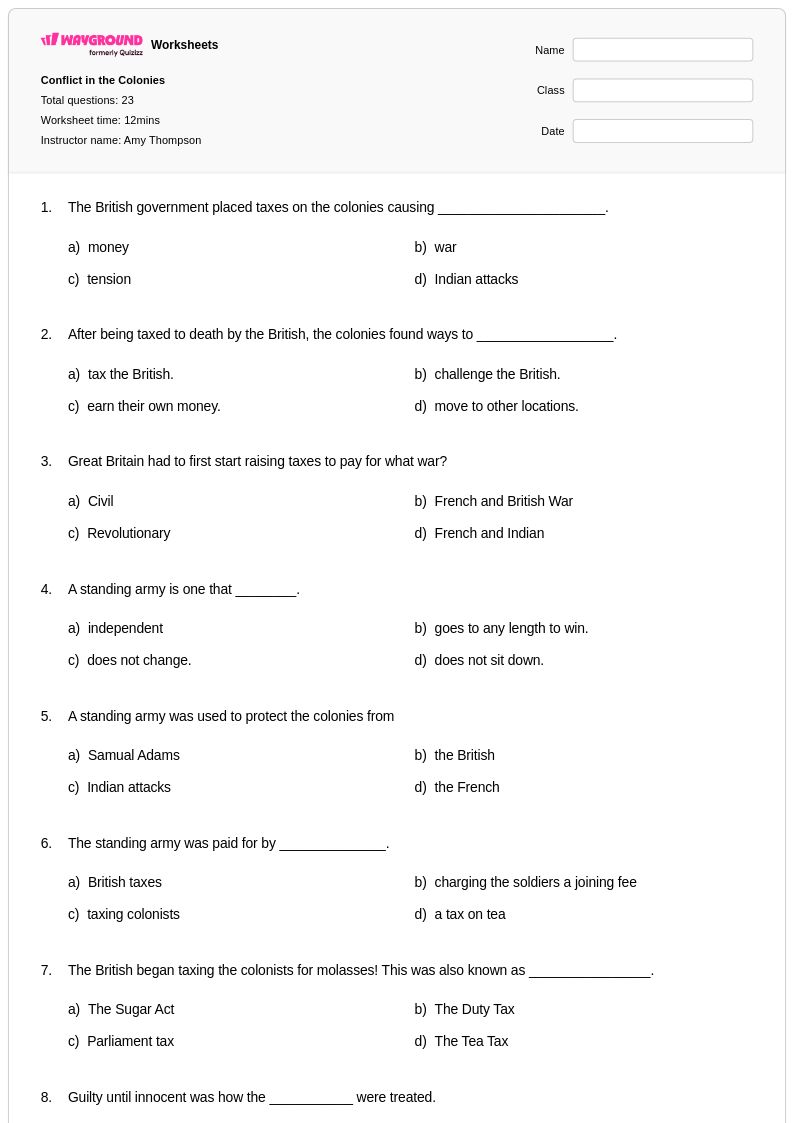

23 Q

8th - 10th

Explore Other Subject Worksheets for year 9

Explore printable Taxation worksheets for Year 9

Year 9 taxation worksheets available through Wayground (formerly Quizizz) provide comprehensive coverage of fundamental tax concepts that form the cornerstone of economic literacy for high school students. These educational resources strengthen critical thinking skills by exploring various types of taxes including income, sales, property, and corporate taxes, while examining their impact on individuals, businesses, and government revenue generation. Students engage with practice problems that demonstrate tax calculation methods, analyze progressive versus regressive tax structures, and evaluate the relationship between taxation and public services. The collection includes detailed answer keys and free printable materials that guide learners through complex scenarios involving tax brackets, deductions, and the broader economic implications of fiscal policy decisions.

Wayground (formerly Quizizz) empowers educators with access to millions of teacher-created taxation resources that support diverse instructional needs and learning objectives. The platform's robust search and filtering capabilities enable teachers to locate materials aligned with specific academic standards while offering differentiation tools that accommodate varying skill levels within Year 9 classrooms. These customizable worksheet collections are available in both printable PDF formats and interactive digital versions, providing flexibility for traditional classroom instruction, remote learning environments, and hybrid educational models. Teachers utilize these comprehensive resources for targeted skill practice, remediation of challenging concepts, enrichment activities for advanced learners, and systematic lesson planning that builds student understanding of taxation's role in modern economic systems.