10 Q

9th - 12th

20 Q

9th - 12th

10 Q

9th - 12th

122 Q

9th - 12th

20 Q

9th - 12th

6 Q

9th - 12th

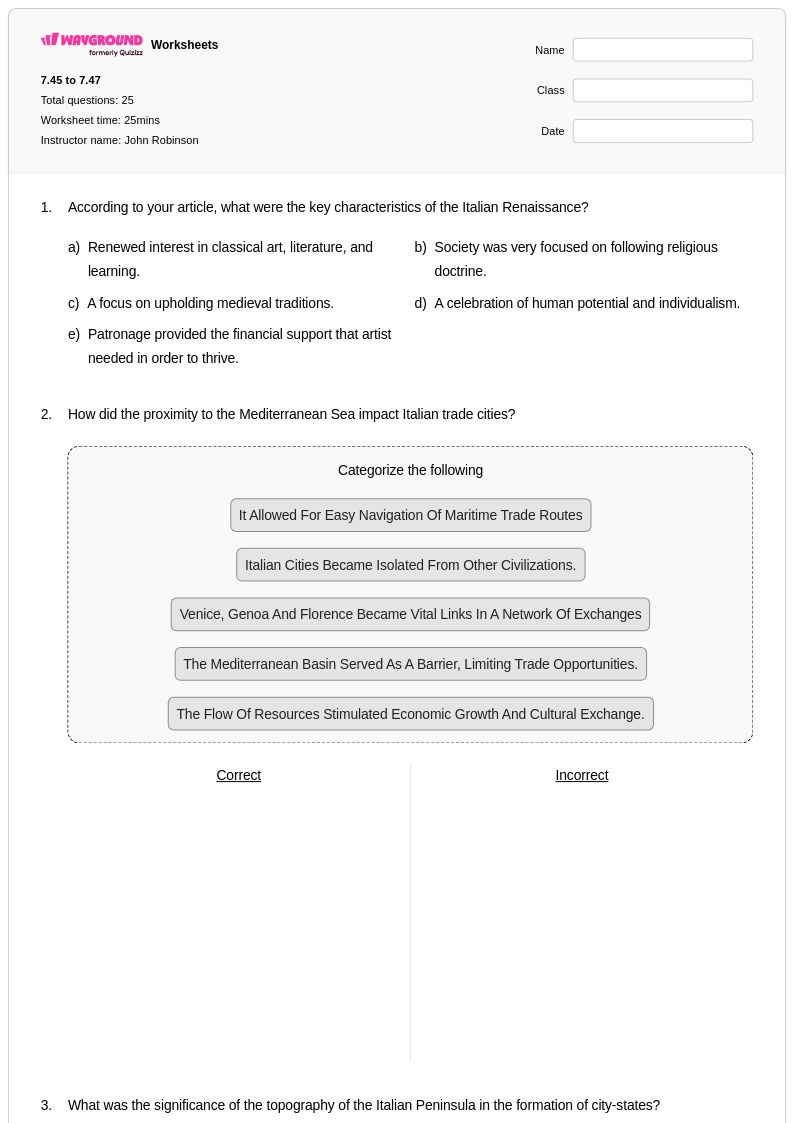

25 Q

6th - Uni

10 Q

9th - 12th

25 Q

7th - Uni

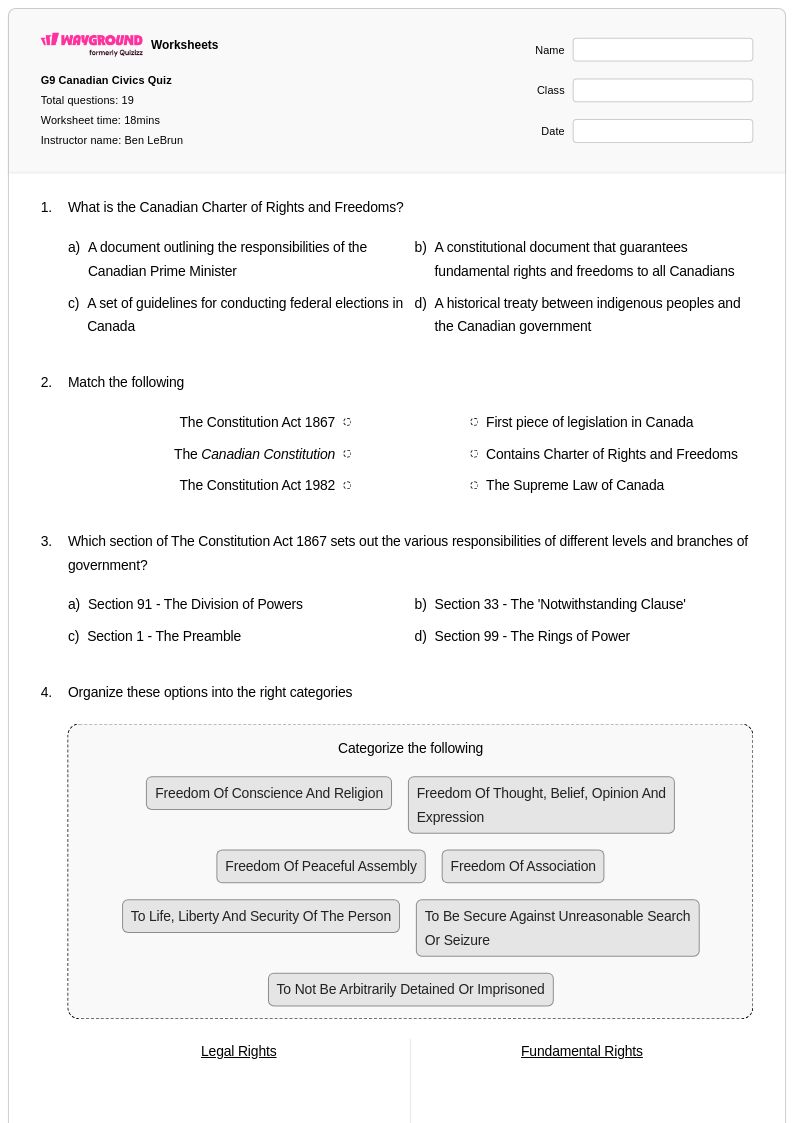

19 Q

9th

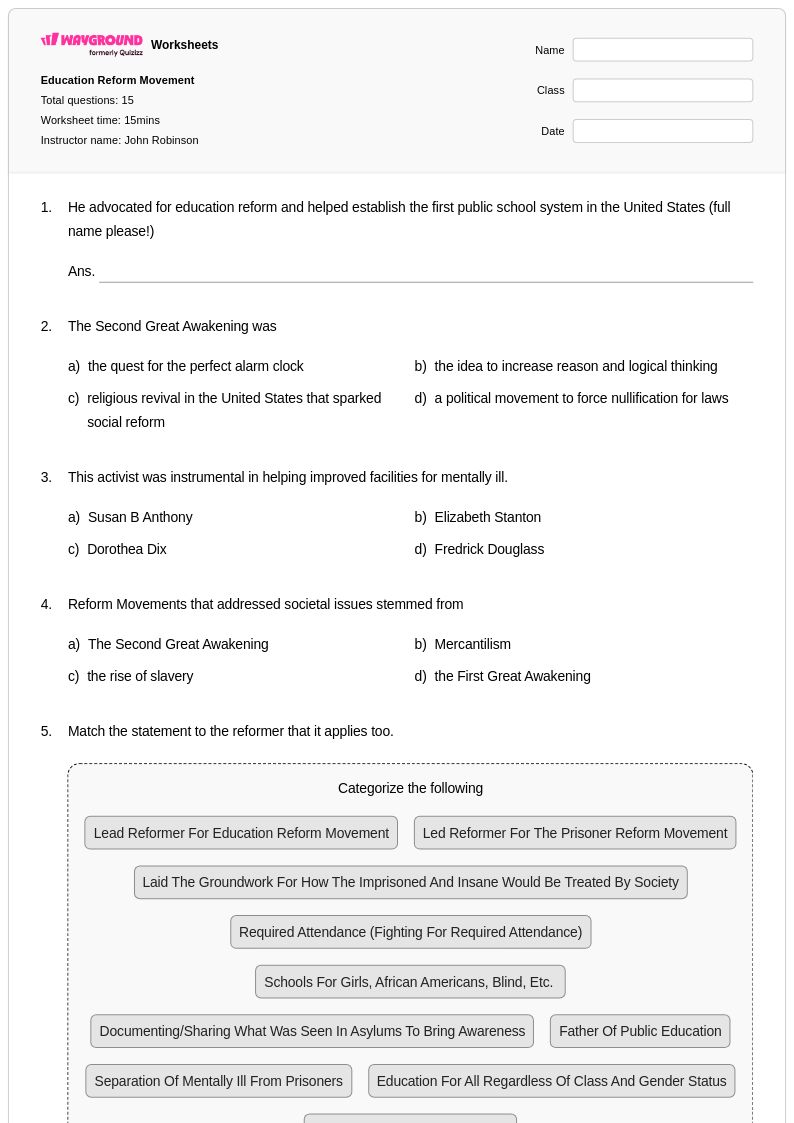

15 Q

8th - Uni

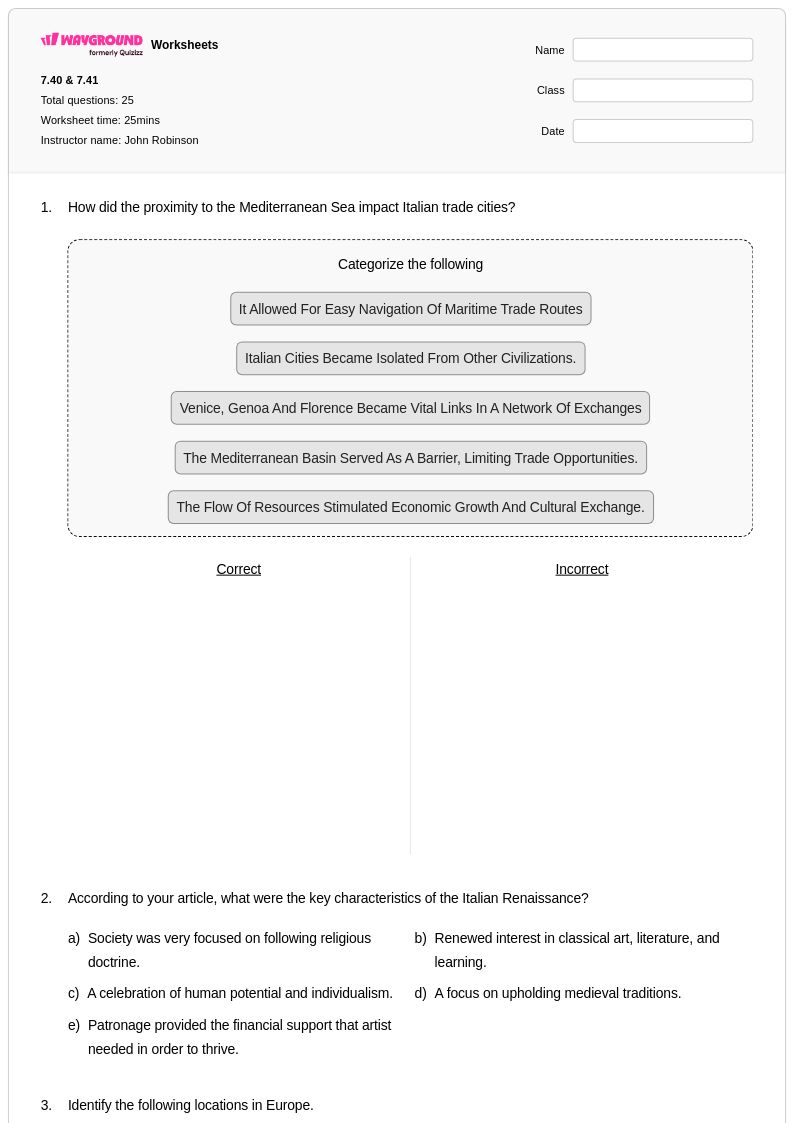

25 Q

7th - Uni

18 Q

9th - 12th

12 Q

9th - 10th

15 Q

6th - Uni

25 Q

7th - Uni

13 Q

9th - 11th

16 Q

9th - 12th

16 Q

9th - 12th

16 Q

9th - 12th

25 Q

8th - Uni

Explore Other Subject Worksheets for year 9

Explore printable Financial Education worksheets for Year 9

Financial education worksheets for Year 9 students available through Wayground (formerly Quizizz) provide comprehensive coverage of essential economic literacy concepts that prepare students for real-world financial decision making. These expertly designed resources focus on fundamental skills including budgeting, understanding credit and debt, analyzing investment options, calculating compound interest, and evaluating insurance needs. Each worksheet collection includes detailed answer keys that enable both independent study and instructor-guided review, while the free printable format ensures accessibility for diverse classroom environments. The practice problems range from basic financial calculations to complex scenario-based applications that challenge students to apply economic principles to authentic situations they will encounter as adults.

Wayground's extensive library contains millions of teacher-created financial education resources that support educators in delivering standards-aligned instruction tailored to Year 9 learning objectives. The platform's robust search and filtering capabilities allow teachers to quickly locate worksheets that match specific curriculum requirements, skill levels, and learning goals, while built-in differentiation tools enable seamless adaptation for diverse student needs. These customizable materials are available in both digital and printable PDF formats, providing flexibility for traditional classroom instruction, remote learning, or hybrid educational models. Teachers can efficiently plan comprehensive financial literacy units, provide targeted remediation for struggling learners, offer enrichment opportunities for advanced students, and create focused skill practice sessions that build the economic reasoning abilities essential for informed citizenship and personal financial success.