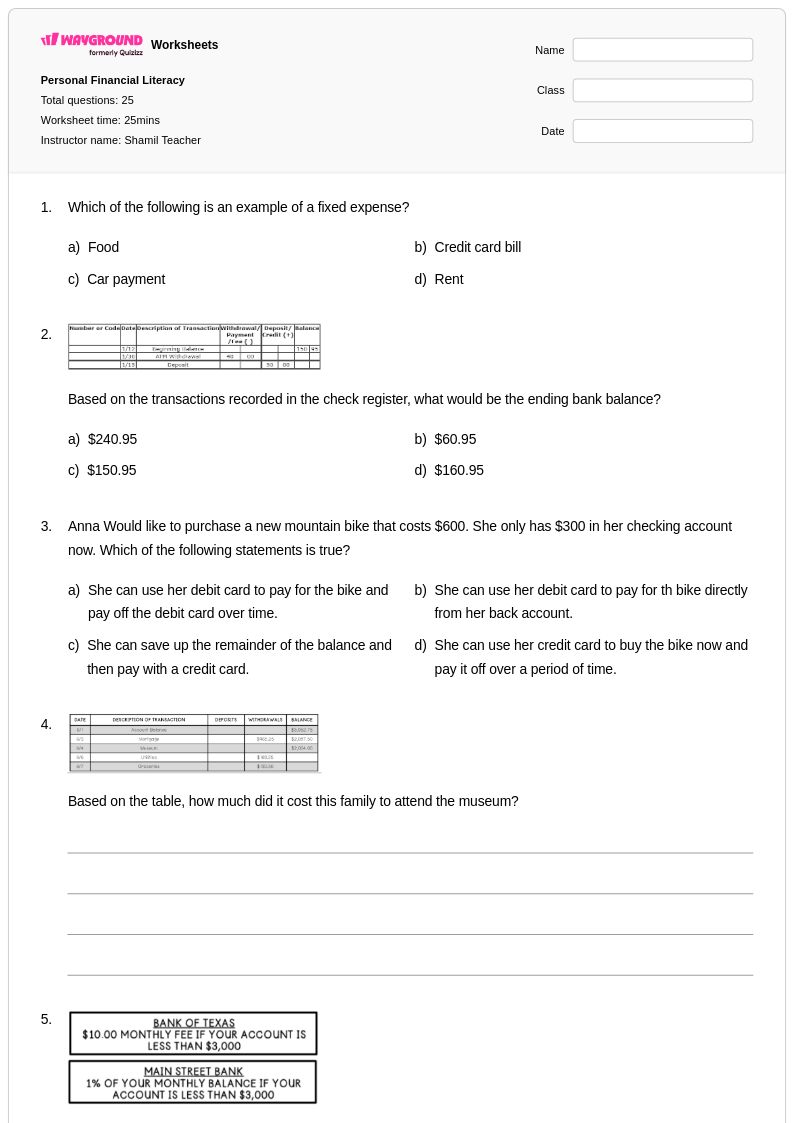

25 Q

7th - Uni

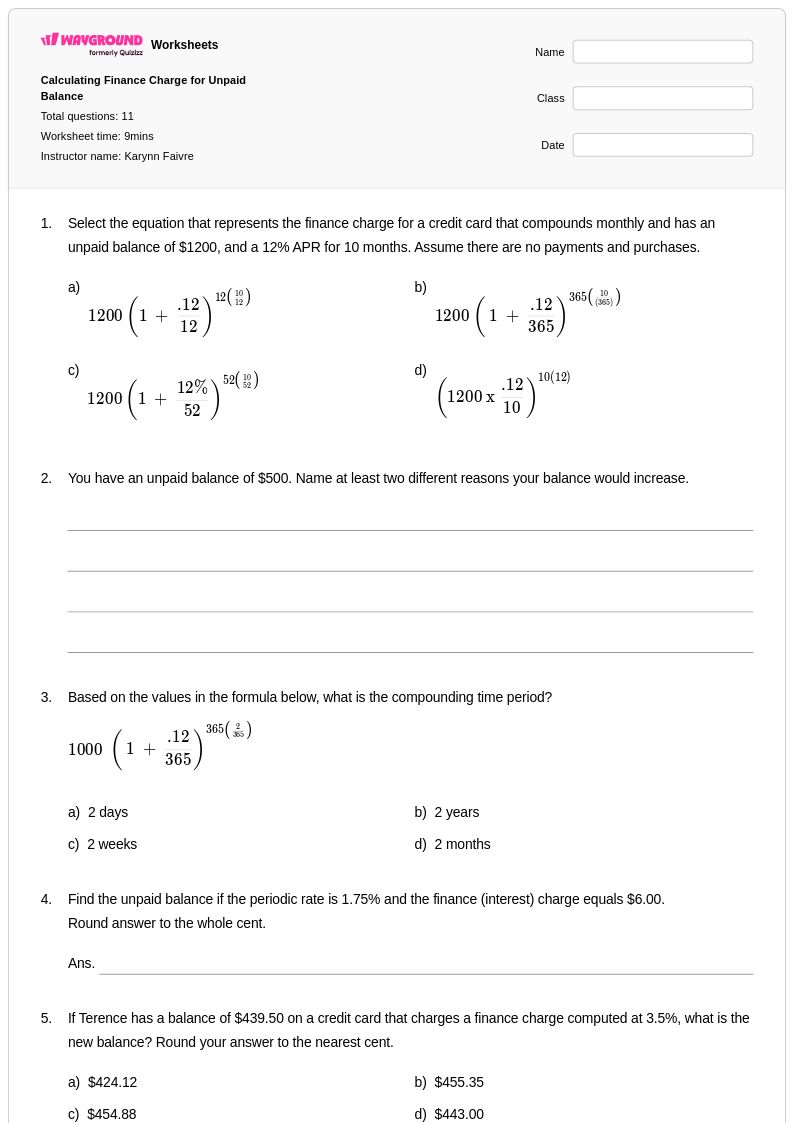

11 Q

12th

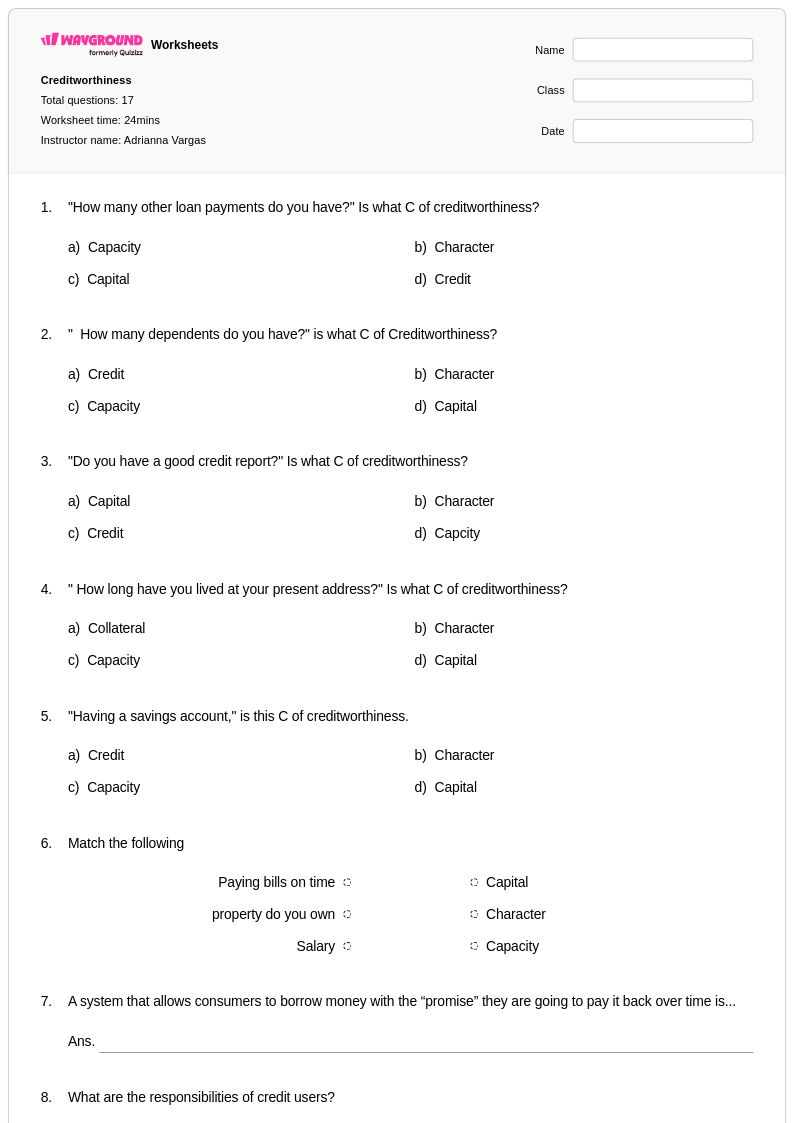

17 Q

11th - 12th

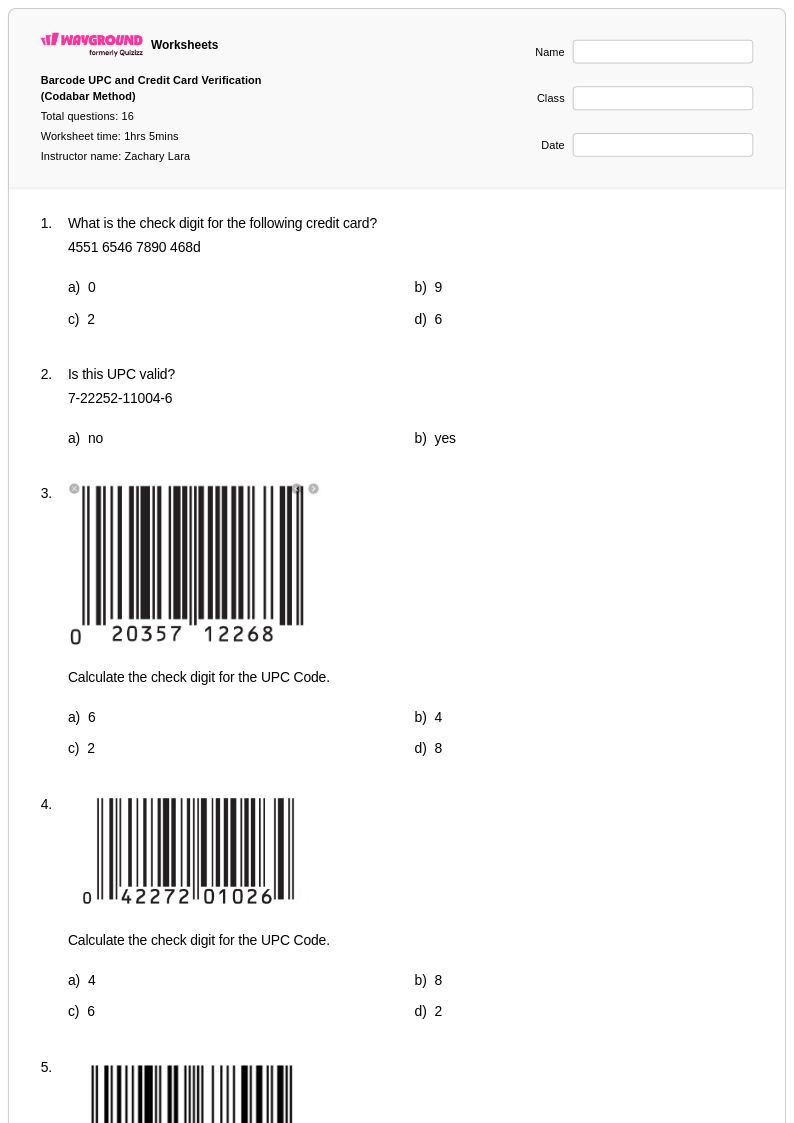

16 Q

12th

61 Q

9th - 12th

9 Q

12th

8 Q

9th - 12th

24 Q

12th

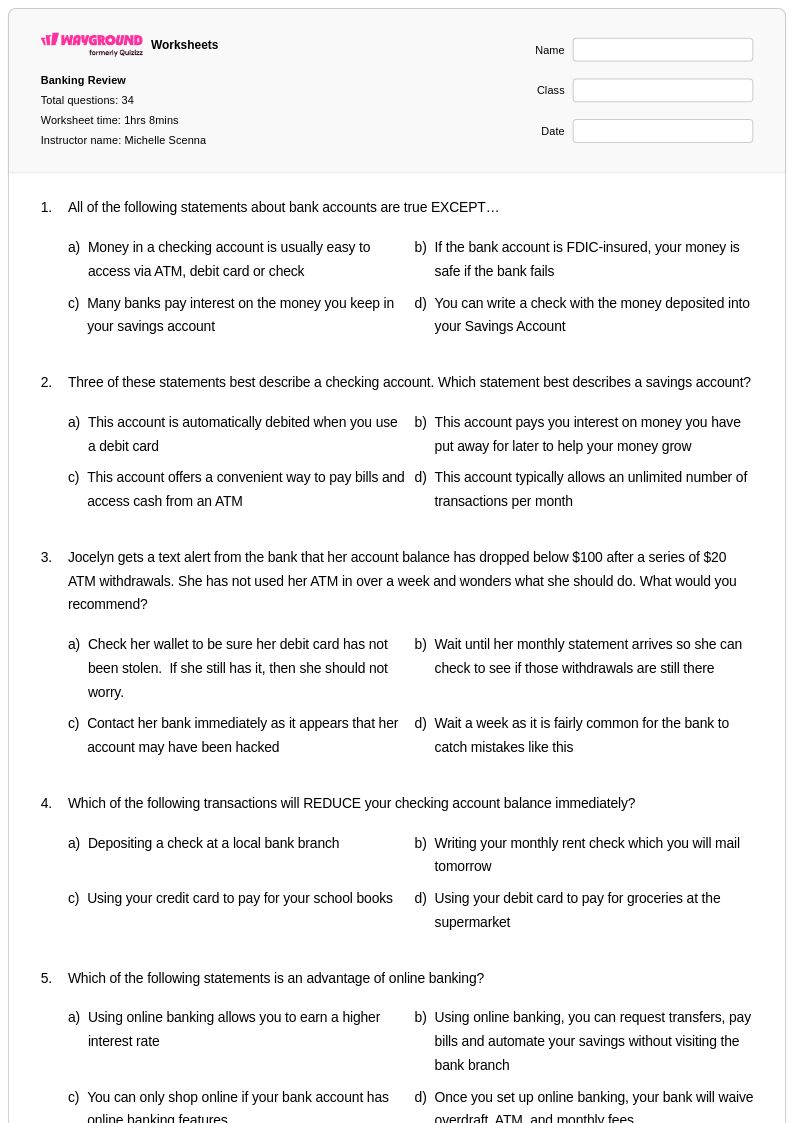

34 Q

11th - Uni

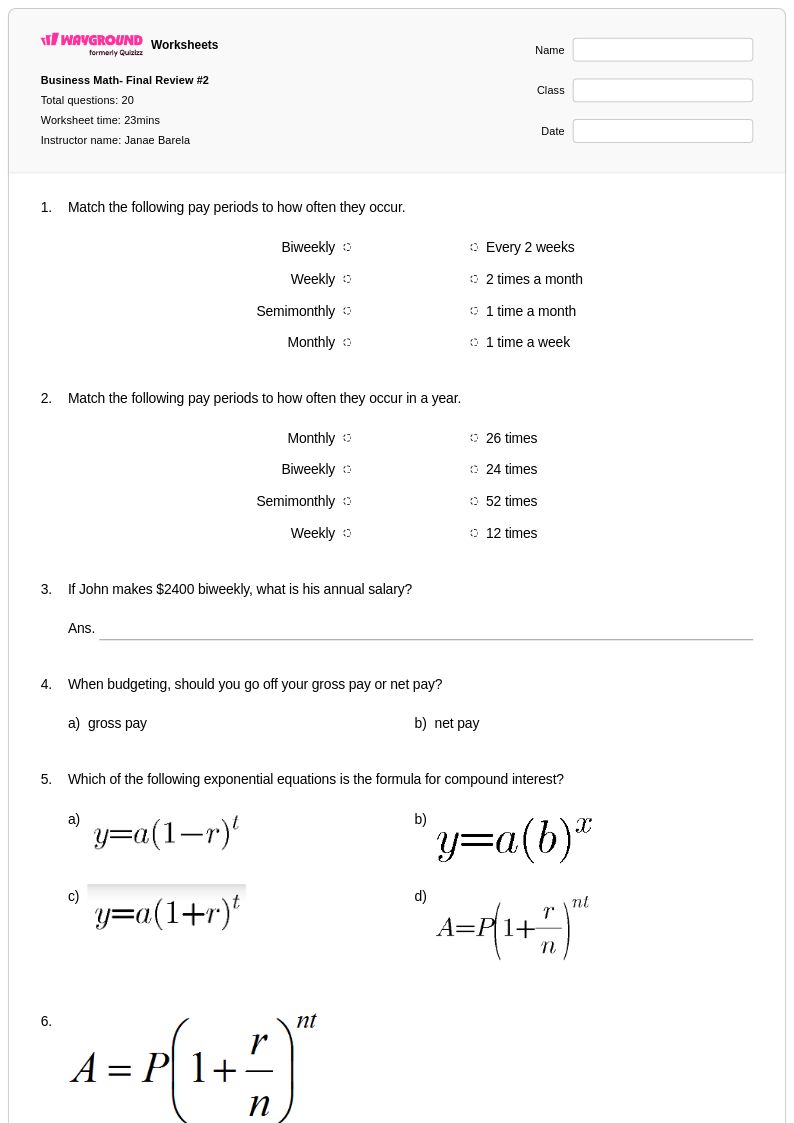

20 Q

9th - 12th

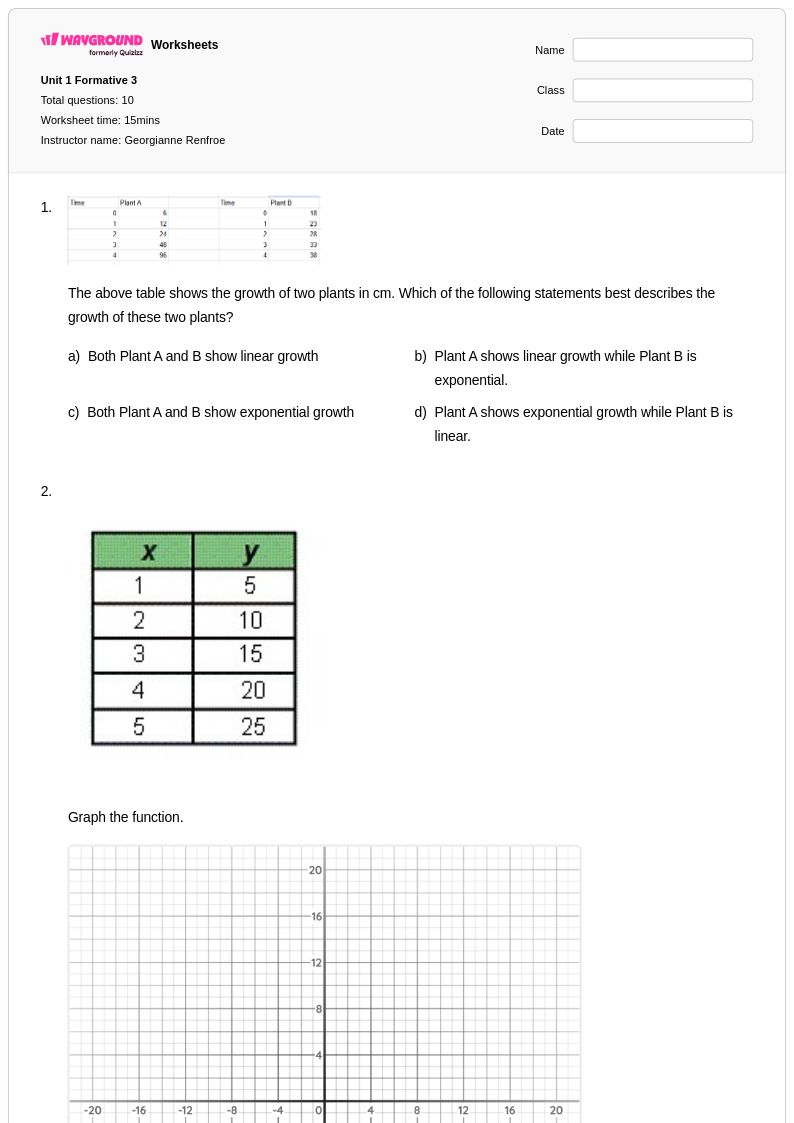

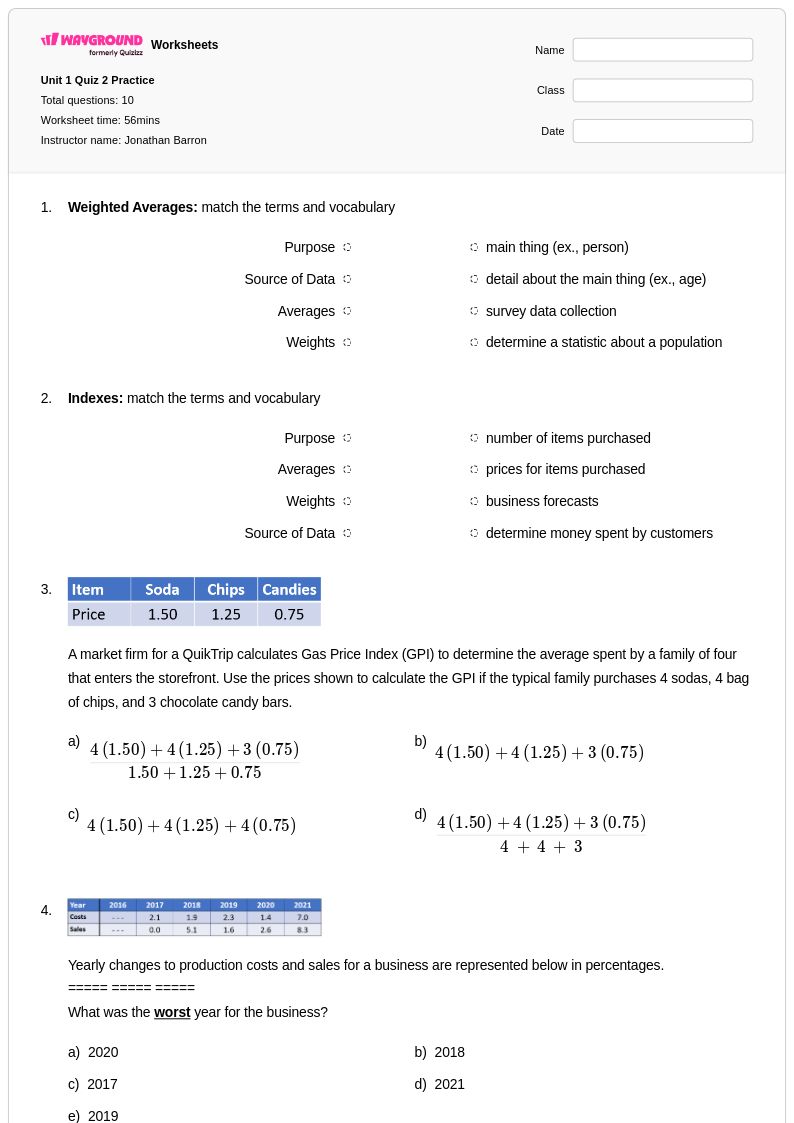

10 Q

12th

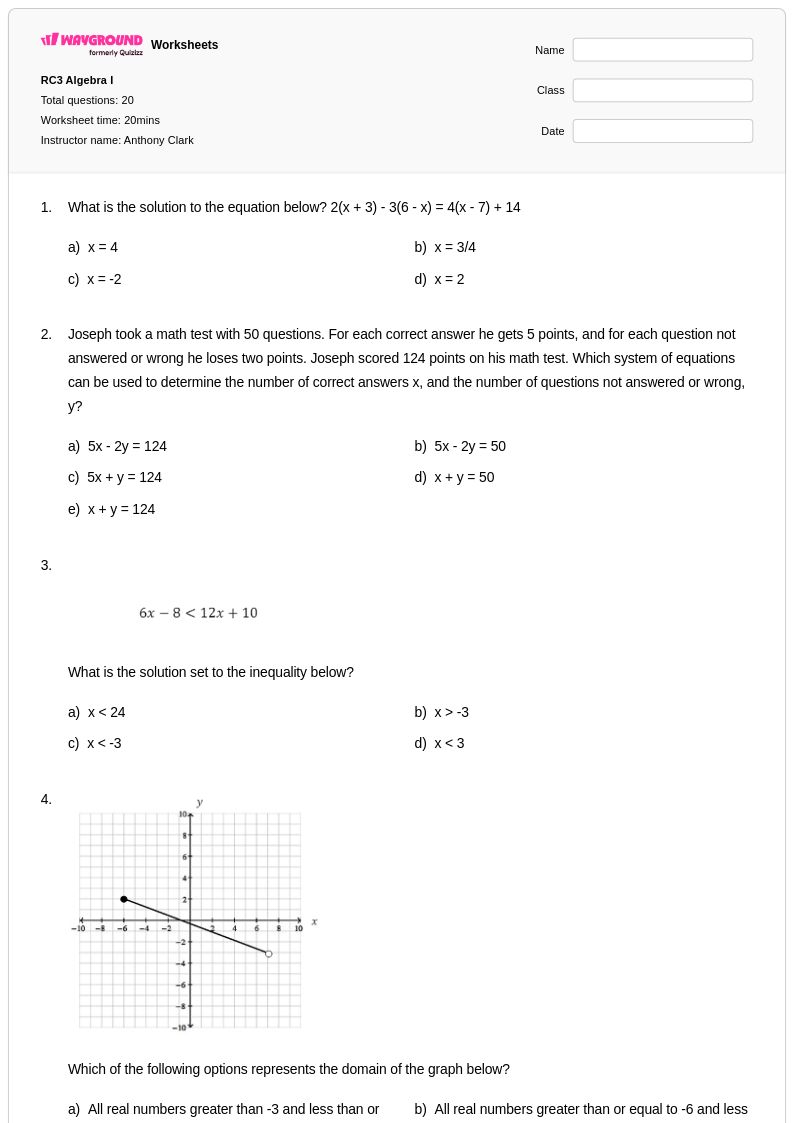

20 Q

8th - Uni

20 Q

9th - 12th

10 Q

9th - 12th

20 Q

9th - 12th

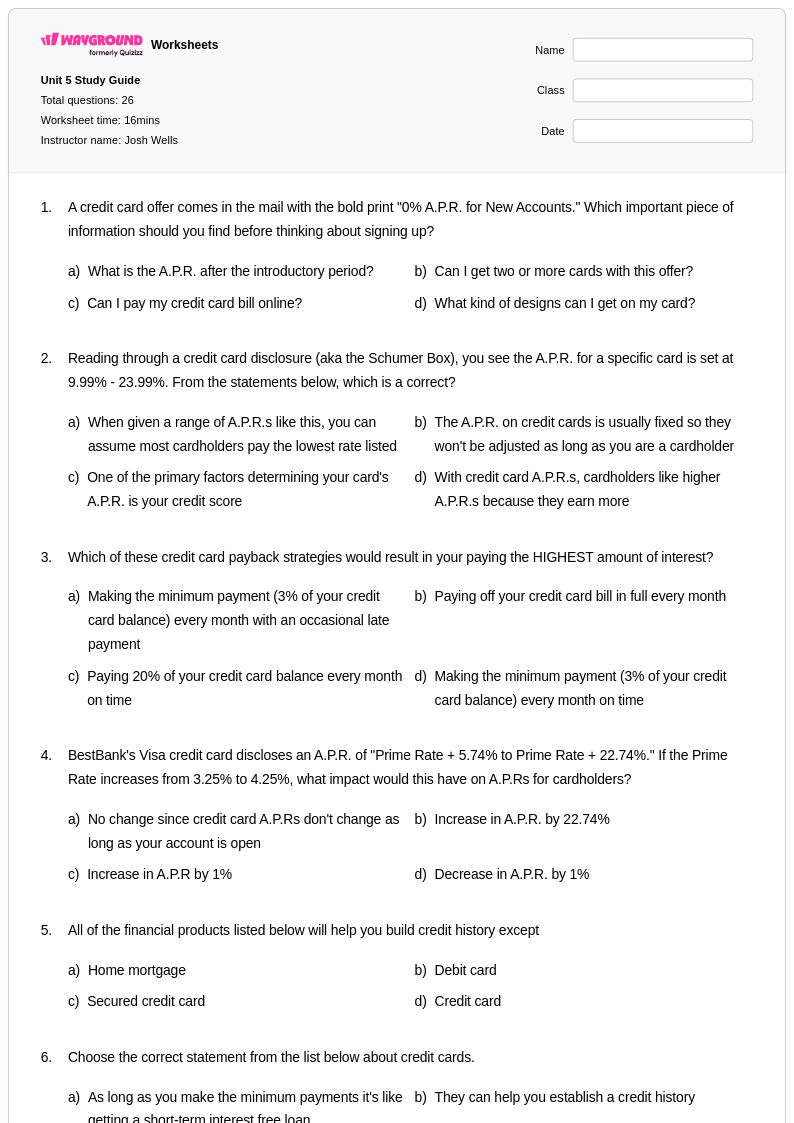

26 Q

12th

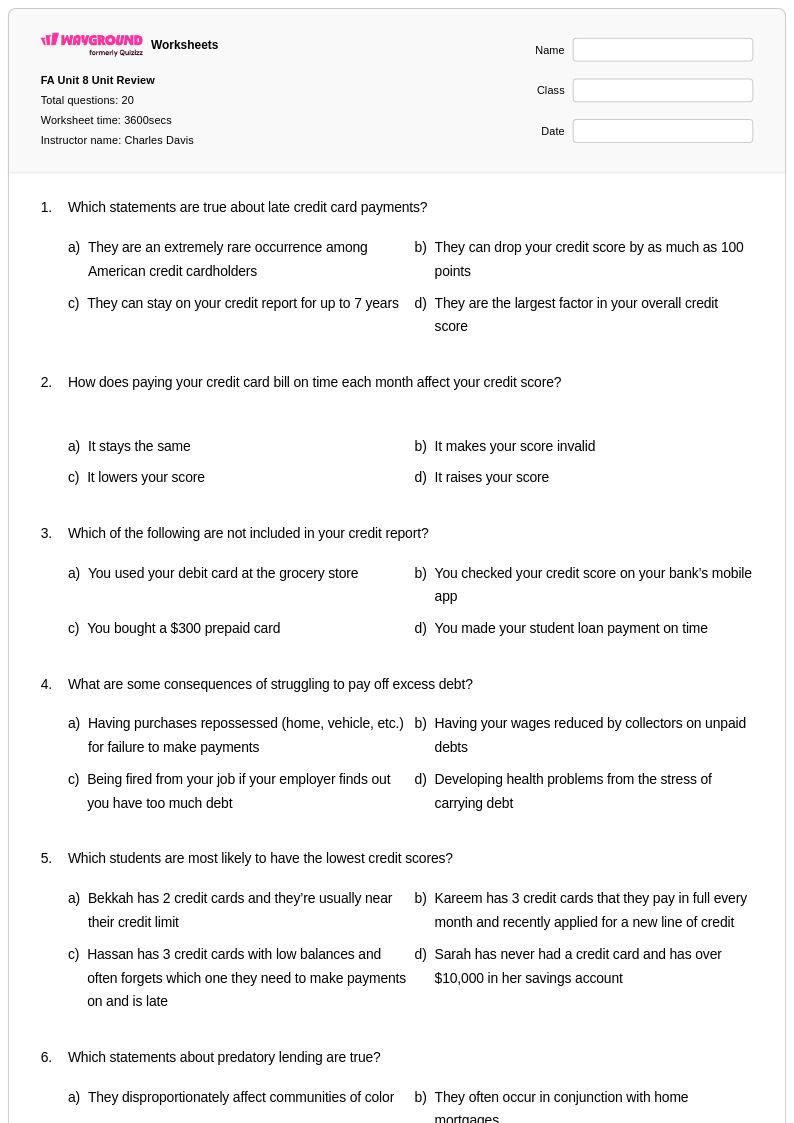

20 Q

12th

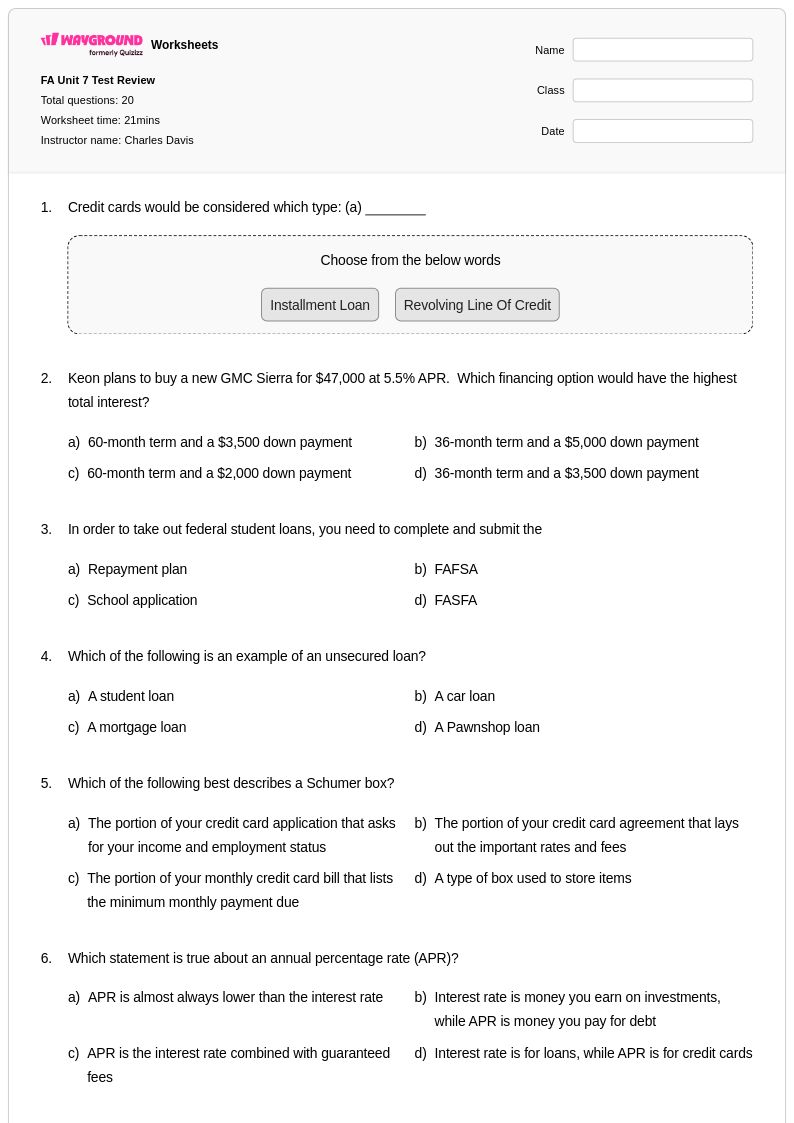

21 Q

12th

30 Q

12th

23 Q

12th

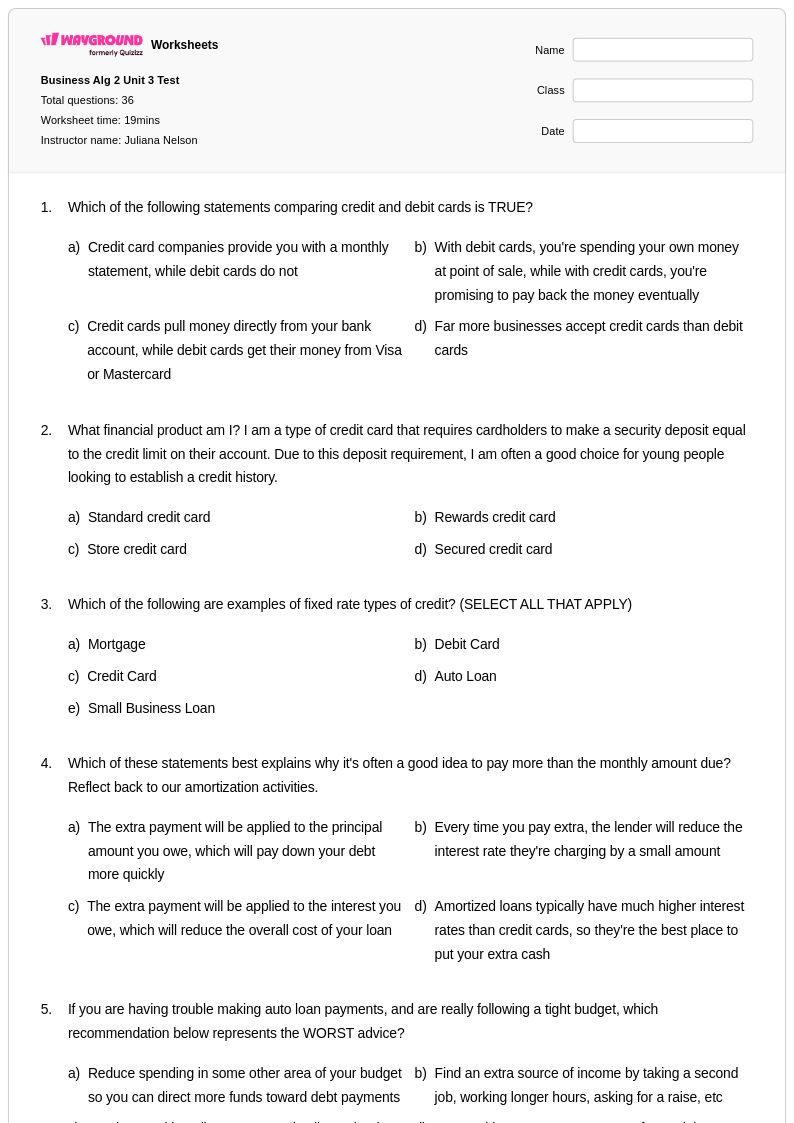

36 Q

12th

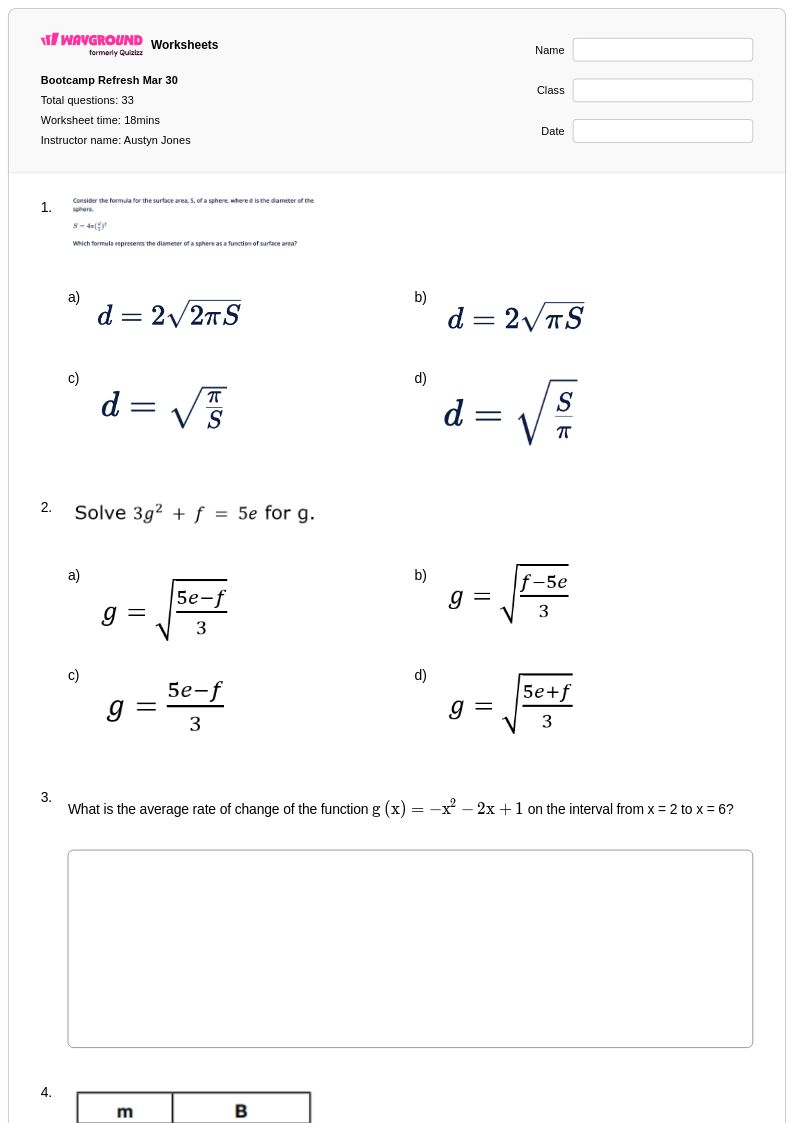

33 Q

12th

11 Q

12th

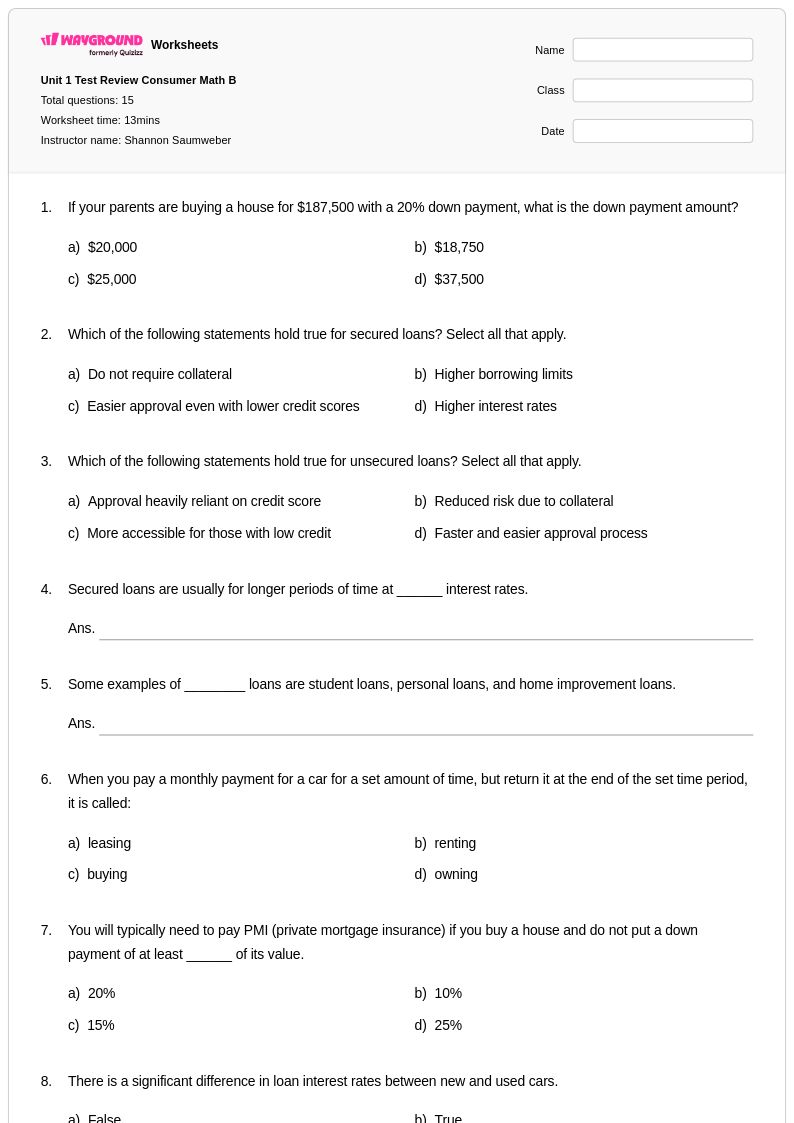

15 Q

11th - Uni

Explore Credit Card Statements Worksheets by Grades

Explore Other Subject Worksheets for class 12

Explore printable Credit Card Statements worksheets for Class 12

Credit card statement worksheets for Class 12 students provide essential practice in analyzing real-world financial documents that students will encounter as they transition to independent financial management. These comprehensive worksheets available through Wayground guide students through the critical process of interpreting monthly credit card statements, calculating interest charges, understanding minimum payment requirements, and identifying fees that can significantly impact their financial health. Students develop vital mathematical skills by working through practice problems that involve computing annual percentage rates, determining payoff timelines under different payment scenarios, and analyzing how compound interest affects outstanding balances. These free printable resources include detailed answer keys that enable self-assessment and reinforce learning, while the pdf format ensures accessibility for both classroom instruction and independent study.

Wayground, formerly Quizizz, empowers educators with millions of teacher-created resources specifically designed to strengthen financial literacy instruction through diverse credit card statement analysis activities. The platform's robust search and filtering capabilities allow teachers to quickly locate worksheets that align with specific curriculum standards and match their students' skill levels, while differentiation tools enable customization for varying mathematical abilities within Class 12 classrooms. Teachers can seamlessly integrate these resources into their lesson planning, utilizing both printable and digital formats to accommodate different learning environments and preferences. The extensive collection supports targeted remediation for students struggling with percentage calculations or compound interest concepts, while also providing enrichment opportunities for advanced learners to explore complex scenarios involving multiple credit cards, balance transfers, and strategic debt management approaches.