15 Q

12th - Uni

15 Q

12th - Uni

25 Q

12th - Uni

17 Q

6th - 8th

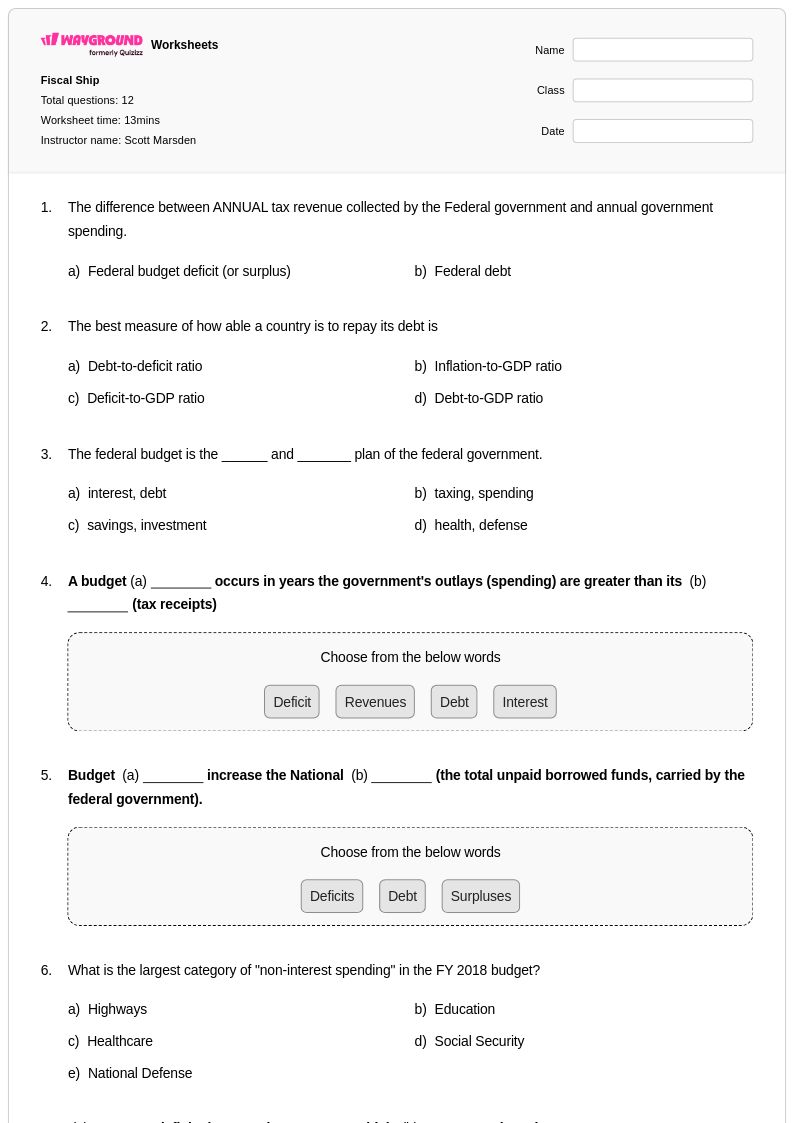

12 Q

12th

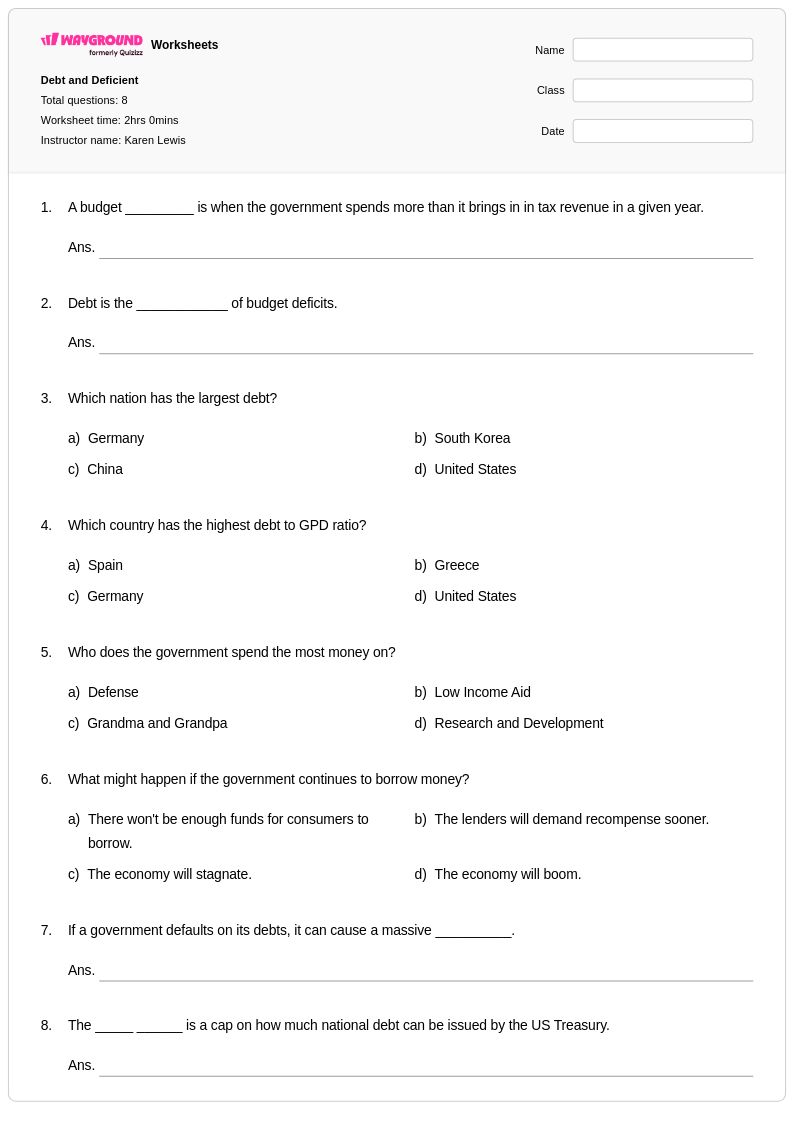

8 Q

9th - 12th

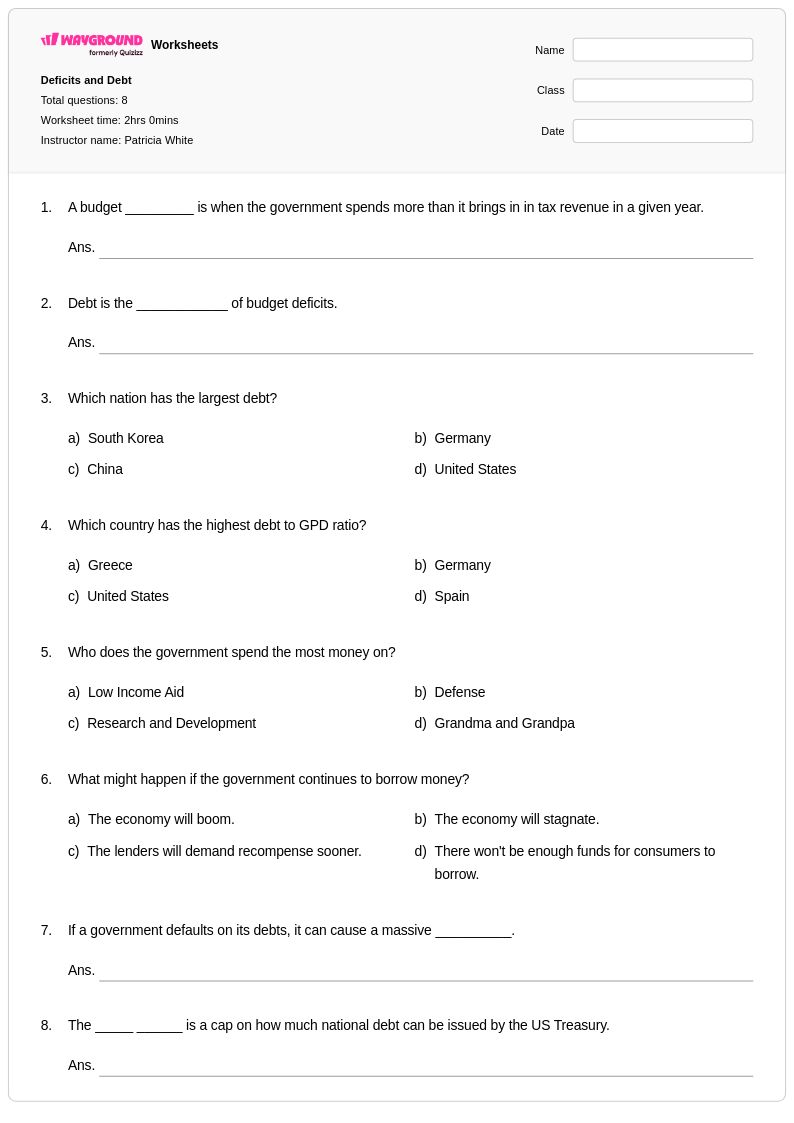

8 Q

9th - 12th

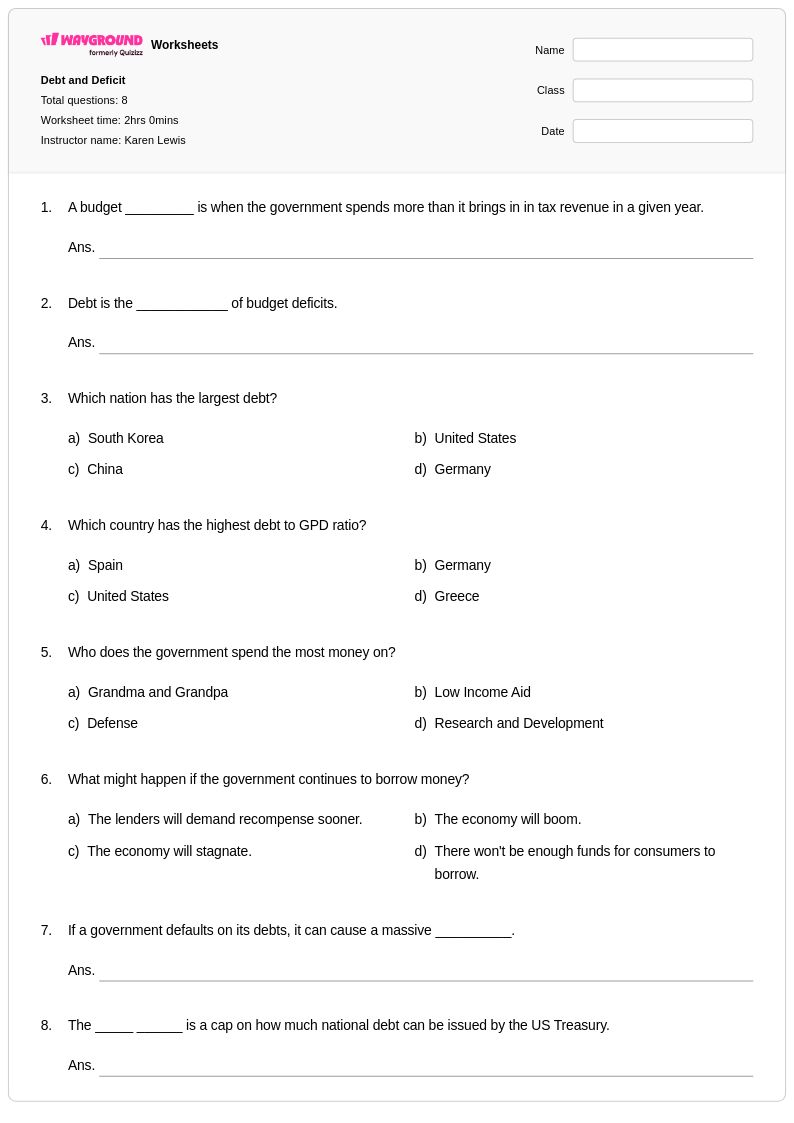

8 Q

9th - 12th

15 Q

12th - Uni

25 Q

12th

15 Q

12th - Uni

15 Q

10th - Uni

25 Q

5th - Uni

19 Q

12th

23 Q

9th - 12th

15 Q

10th - Uni

15 Q

8th

17 Q

6th - 8th

14 Q

10th

15 Q

12th

39 Q

12th

69 Q

9th

17 Q

8th

10 Q

9th - 12th

Explore Worksheets by Subjects

Explore printable Debt to Income Ratio worksheets

Debt to income ratio worksheets available through Wayground (formerly Quizizz) provide students with essential practice in understanding one of the most critical financial literacy concepts in personal economics. These comprehensive worksheets guide learners through calculating debt to income ratios, interpreting what these percentages mean for financial health, and applying this knowledge to real-world scenarios involving mortgage applications, credit decisions, and budget planning. Students work through practice problems that demonstrate how lenders use this metric to assess borrowing risk, while developing skills in percentage calculations, financial analysis, and critical thinking about personal finance management. Each worksheet includes detailed answer keys and step-by-step solutions, making them valuable resources for both classroom instruction and independent study, with free printable pdf formats ensuring accessibility for all learning environments.

Wayground (formerly Quizizz) supports educators with millions of teacher-created debt to income ratio worksheets that feature robust search and filtering capabilities, allowing instructors to quickly locate materials that align with specific learning objectives and educational standards. The platform's differentiation tools enable teachers to customize worksheets based on student skill levels, while flexible formatting options provide both printable and digital versions including downloadable pdfs for seamless integration into any teaching environment. These comprehensive worksheet collections facilitate targeted skill practice, support remediation efforts for students struggling with financial calculations, and offer enrichment opportunities for advanced learners ready to explore complex economic scenarios. Teachers can efficiently plan lessons knowing they have access to professionally designed resources that scaffold learning from basic ratio calculations to sophisticated analysis of financial decision-making processes.