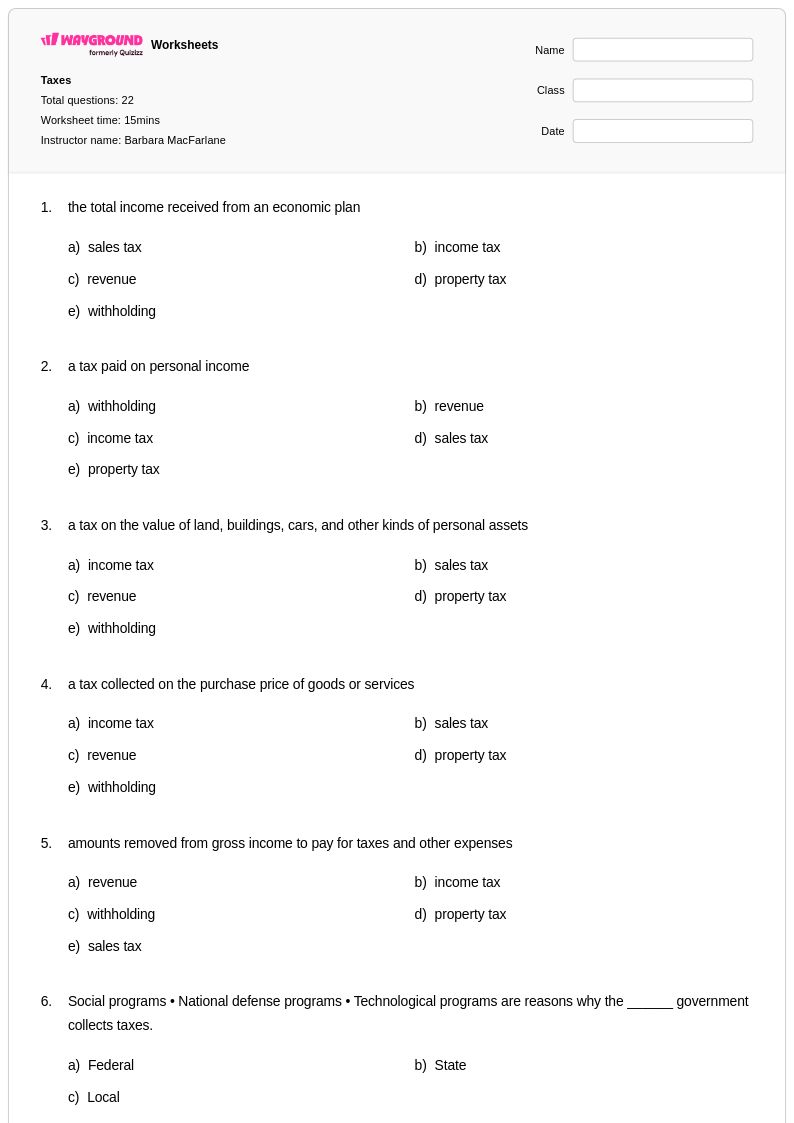

22 Q

12th

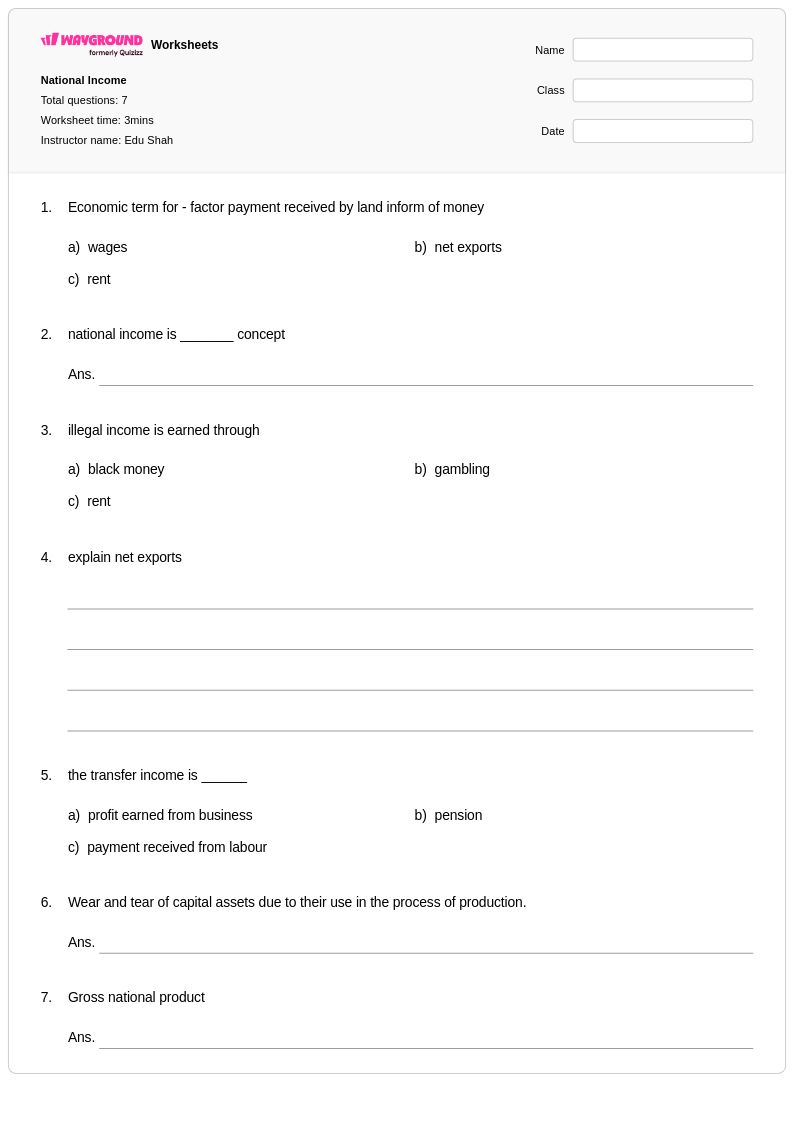

7 Q

12th

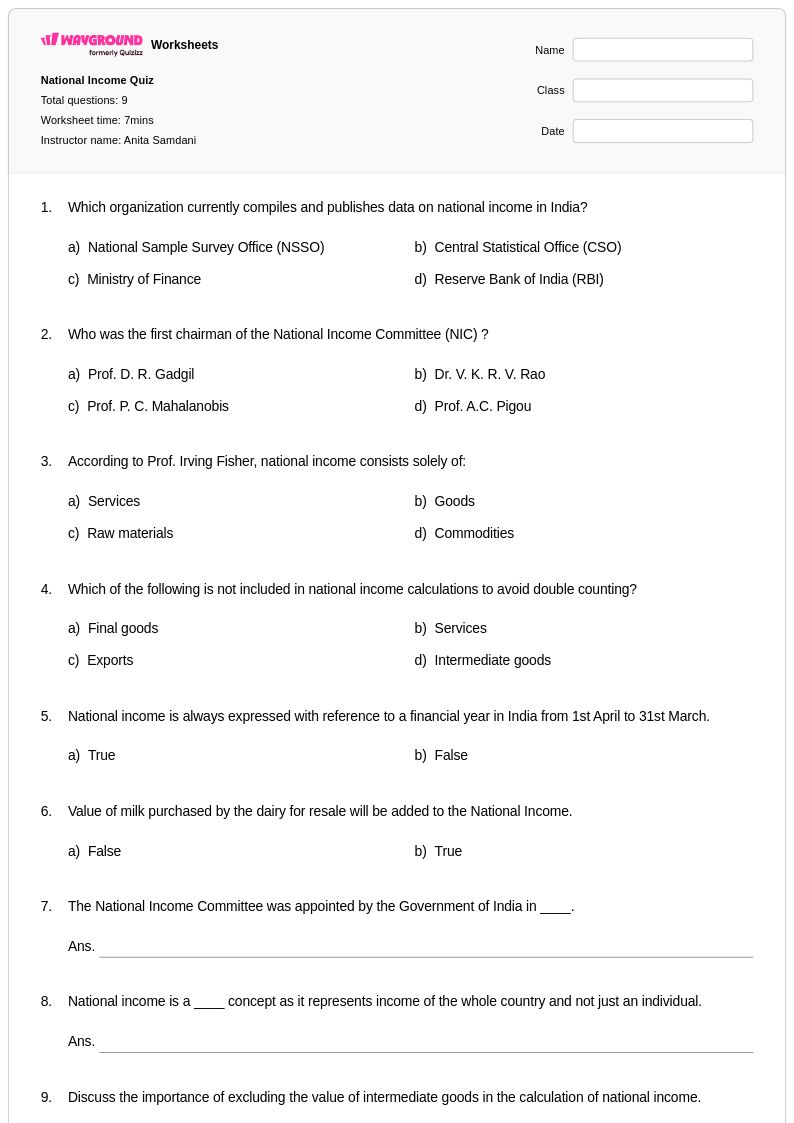

9 Q

12th

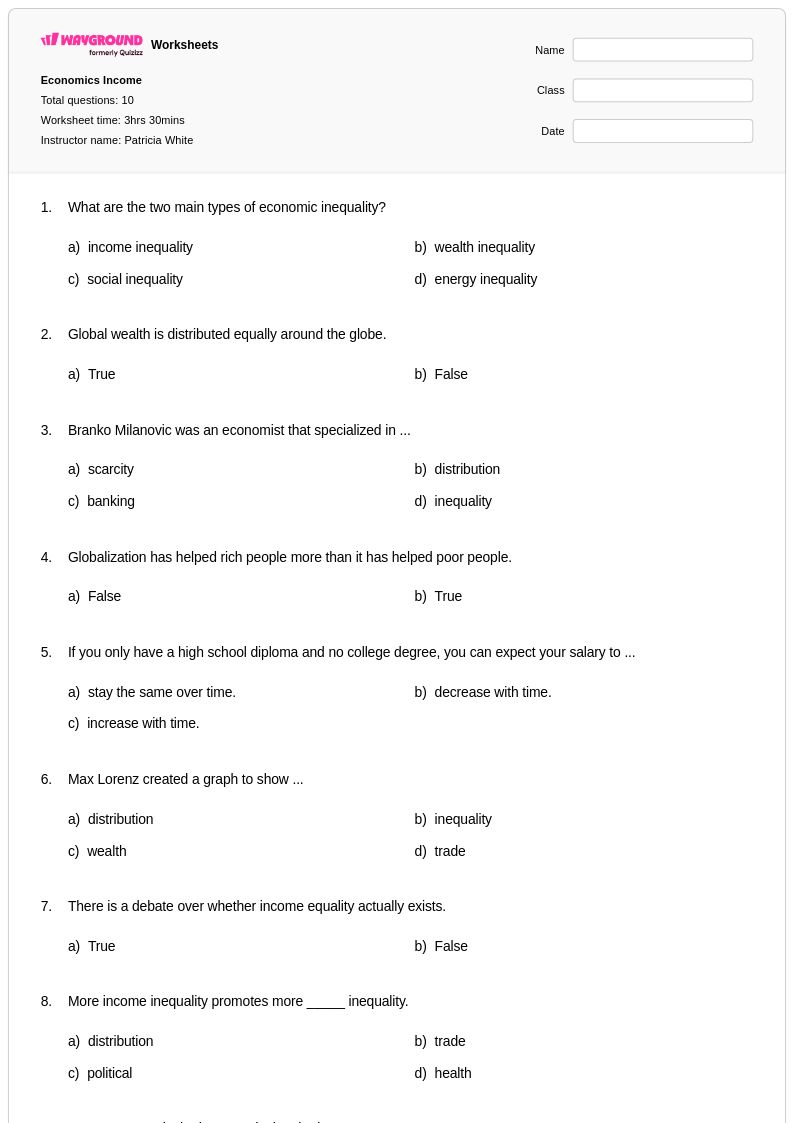

10 Q

9th - 12th

10 Q

12th

25 Q

12th - Uni

10 Q

12th

13 Q

8th

25 Q

12th - Uni

25 Q

11th

110 Q

12th

26 Q

11th

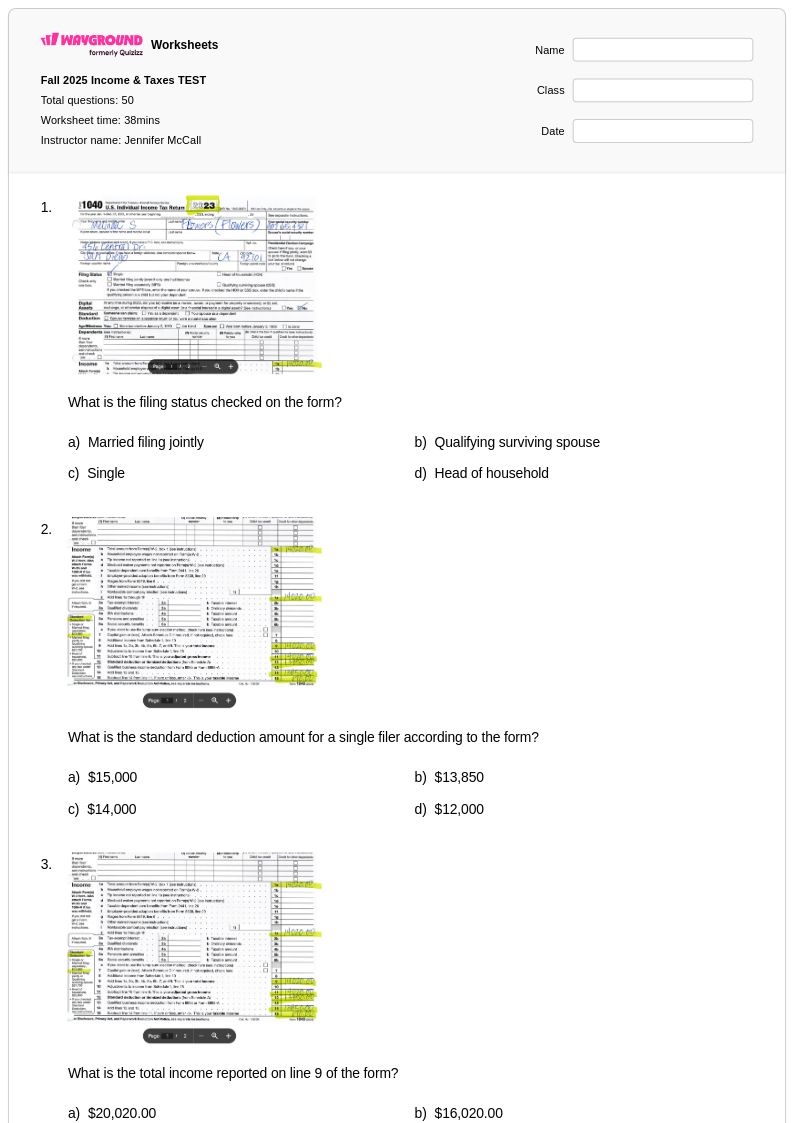

50 Q

11th - Uni

10 Q

9th - 12th

25 Q

12th - Uni

37 Q

12th - Uni

15 Q

12th

10 Q

9th - 12th

10 Q

9th - 12th

11 Q

12th

36 Q

11th

15 Q

12th

15 Q

12th - Uni

15 Q

12th - Uni

Explore Worksheets by Subjects

Explore printable Taxable Income worksheets

Taxable income worksheets available through Wayground (formerly Quizizz) provide students with comprehensive practice in understanding how various forms of income are subject to taxation under federal and state tax systems. These carefully designed educational resources help students develop critical financial literacy skills by working through realistic scenarios involving wages, salaries, tips, investment income, and other taxable earnings. Students engage with practice problems that require them to calculate adjusted gross income, identify tax-exempt versus taxable sources of revenue, and apply current tax brackets to determine liability. Each worksheet includes detailed answer keys that guide students through complex calculations, while the free printable format ensures accessibility for diverse learning environments and homework assignments.

Wayground's extensive collection draws from millions of teacher-created resources specifically focused on economics and personal finance education, offering educators powerful search and filtering capabilities to locate materials perfectly suited to their curriculum needs. The platform's standards alignment features ensure that taxable income worksheets meet state and national economics standards, while built-in differentiation tools allow teachers to modify content complexity for varied skill levels within their classrooms. These versatile resources support comprehensive lesson planning by providing both printable pdf versions for traditional assignments and digital formats for interactive learning experiences. Teachers can seamlessly integrate these worksheets into remediation programs for students struggling with tax concepts, enrichment activities for advanced learners exploring complex financial scenarios, and regular skill practice sessions that build confidence in real-world economic applications.