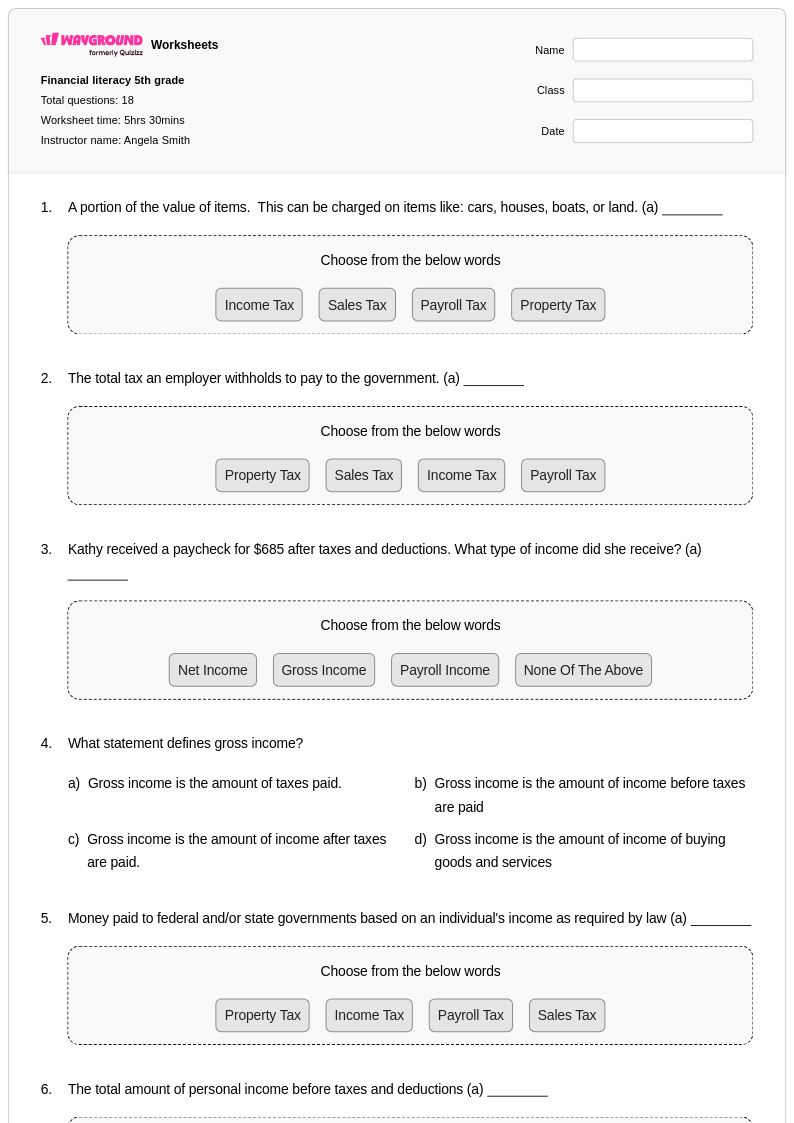

18 Q

5th

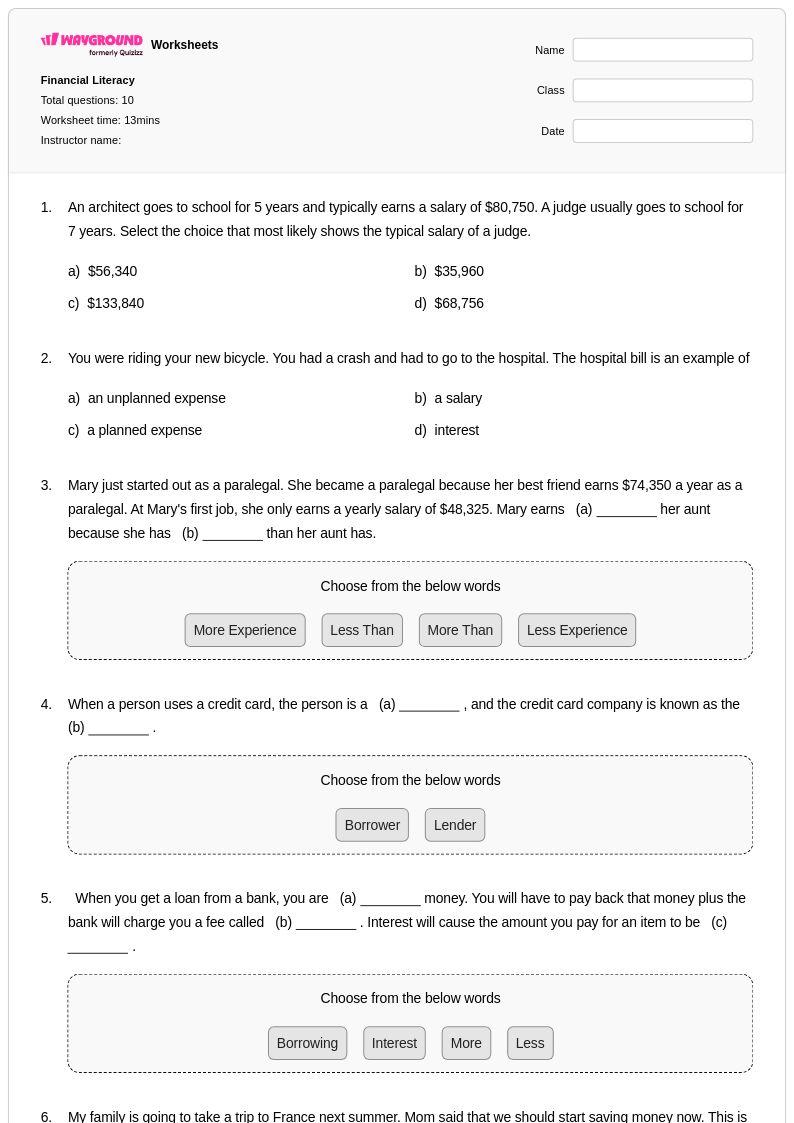

10 Q

3rd

24 Q

6th - 8th

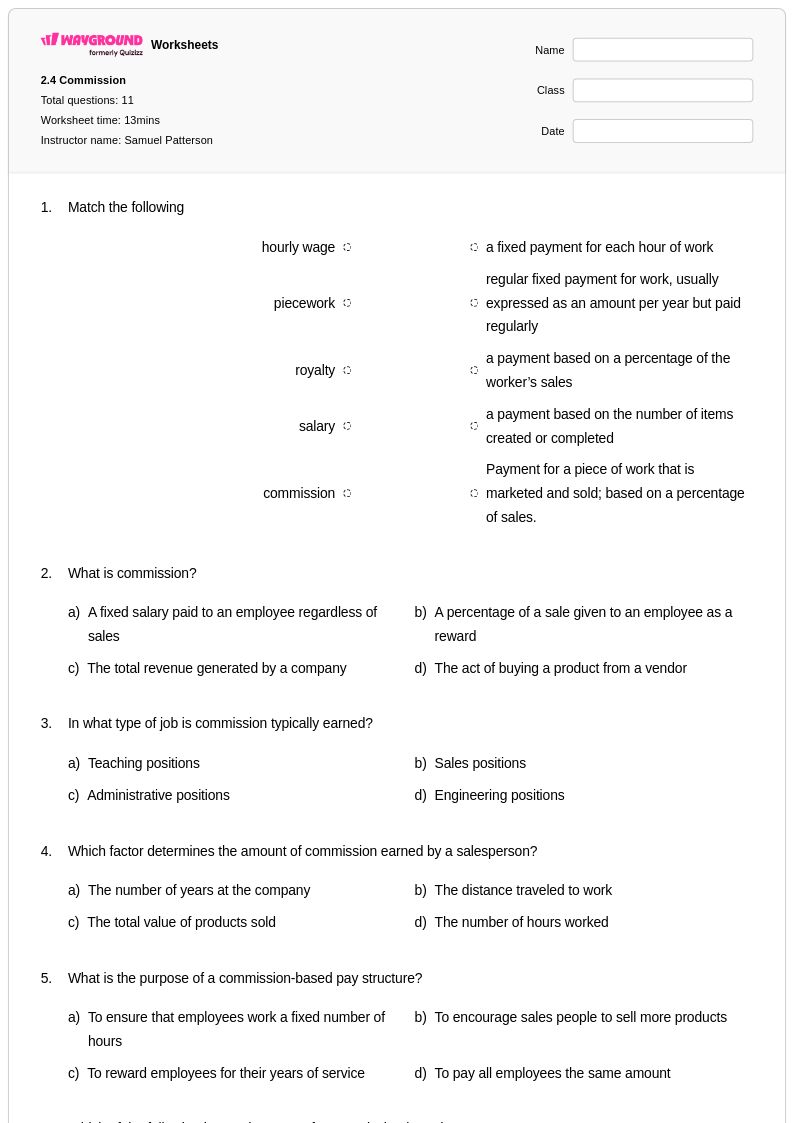

11 Q

10th

24 Q

12th

7 Q

5th

5 Q

4th

15 Q

PD

20 Q

7th

10 Q

11th

20 Q

12th

25 Q

9th - 12th

16 Q

9th - 12th

23 Q

9th - 12th

17 Q

5th

14 Q

12th

20 Q

10th

20 Q

4th

15 Q

9th

21 Q

7th

20 Q

6th - Uni

20 Q

4th

8 Q

9th - 12th

17 Q

7th

Explore Worksheets by Subjects

Explore printable Income Calculation worksheets

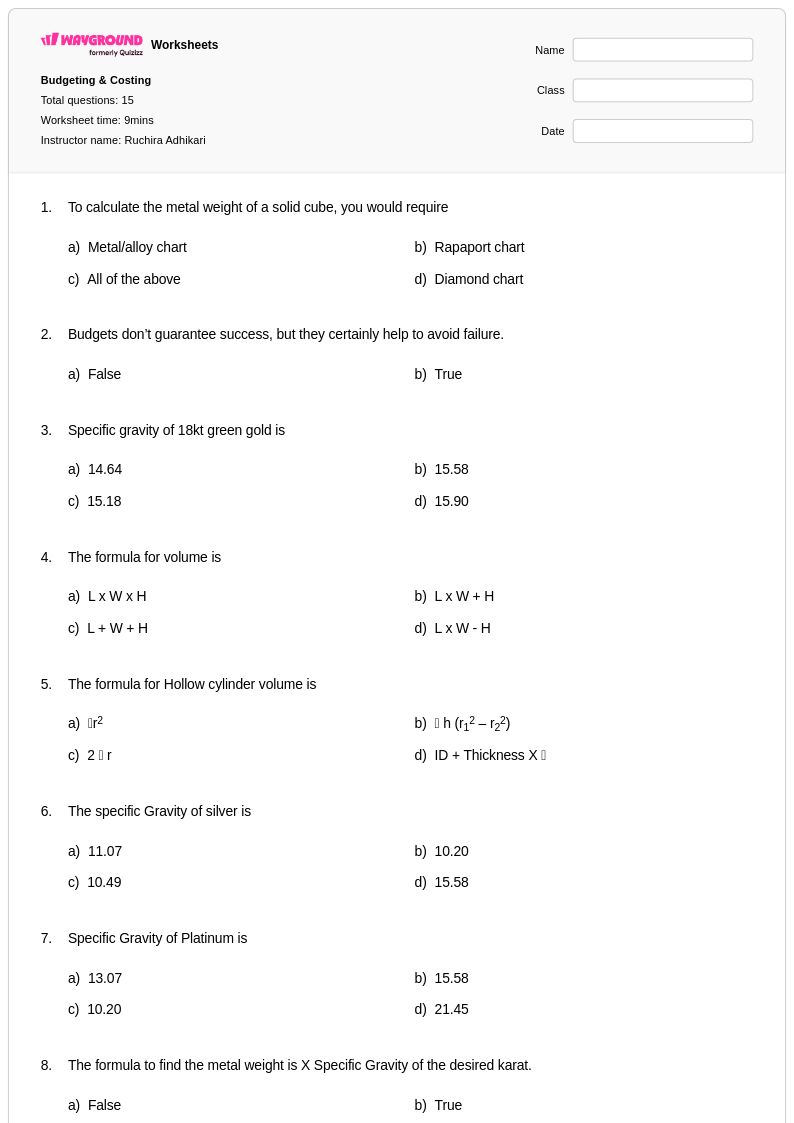

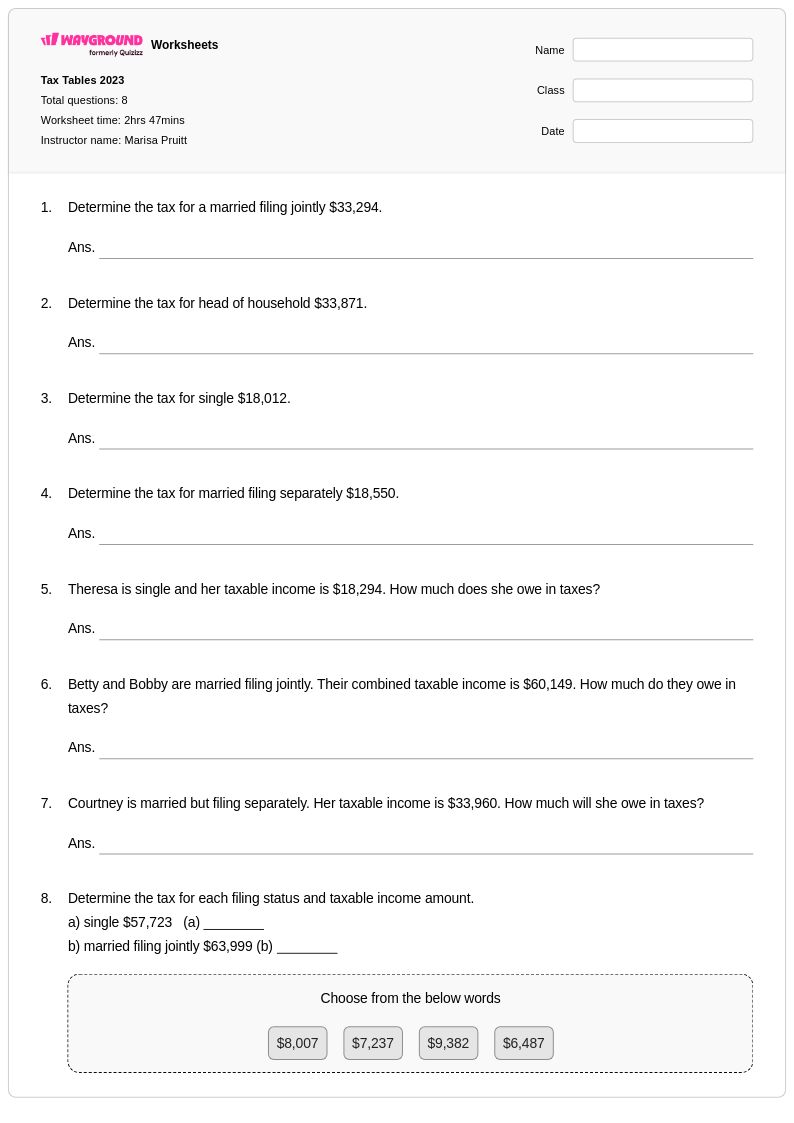

Income calculation worksheets available through Wayground (formerly Quizizz) provide comprehensive practice opportunities for students to master essential financial literacy skills related to understanding and computing various forms of earnings. These carefully designed resources strengthen critical mathematical abilities including calculating gross and net income, determining hourly wages versus salary compensation, understanding deductions and taxes, and analyzing different payment structures such as commission-based earnings. The worksheets feature diverse practice problems that guide students through real-world scenarios, from computing overtime pay to understanding benefit packages, while accompanying answer keys enable both independent learning and instructor assessment. These free printables serve as invaluable educational tools that bridge mathematical concepts with practical financial knowledge students will use throughout their lives.

Wayground (formerly Quizizz) empowers educators with millions of teacher-created resources specifically focused on income calculation and broader financial literacy concepts, complete with robust search and filtering capabilities that allow instructors to quickly locate materials aligned with their curriculum standards and student needs. The platform's differentiation tools enable teachers to customize worksheets for various skill levels, ensuring both struggling learners receive appropriate remediation support and advanced students access enrichment opportunities that deepen their understanding of complex income scenarios. Available in both printable and digital formats including convenient pdf downloads, these resources streamline lesson planning while providing flexible options for classroom instruction, homework assignments, and targeted skill practice sessions that prepare students for real-world financial decision-making.