21 Q

9th - 12th

21 Q

9th - 12th

15 Q

7th - Uni

10 Q

10th

6 Q

10th

15 Q

7th - Uni

10 Q

9th - 12th

10 Q

10th - 12th

25 Q

8th - Uni

21 Q

9th - 12th

25 Q

8th - Uni

12 Q

9th - 12th

20 Q

9th - 10th

25 Q

8th - Uni

25 Q

6th - Uni

14 Q

9th - 12th

17 Q

9th - 12th

15 Q

3rd - 12th

15 Q

9th - 12th

15 Q

9th - 12th

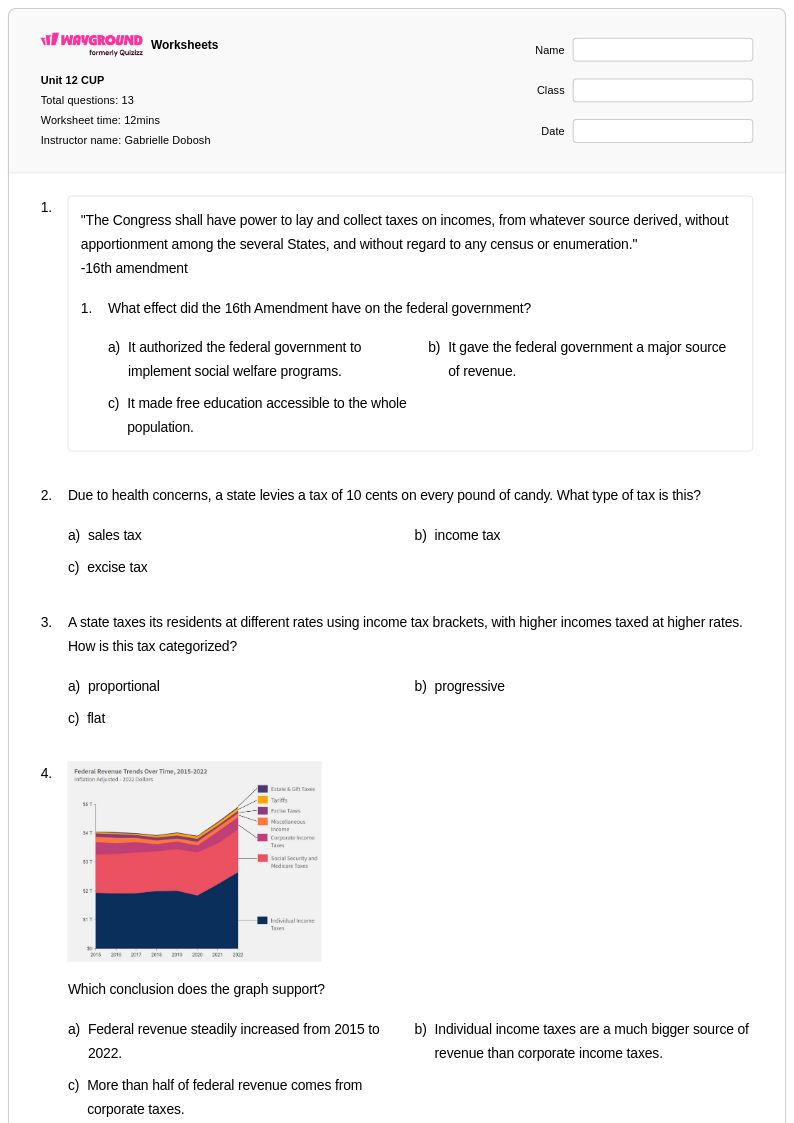

13 Q

9th - 12th

14 Q

10th

11 Q

10th

20 Q

10th

Explore Other Subject Worksheets for class 10

Explore printable Income Tax worksheets for Class 10

Income tax worksheets for Class 10 students available through Wayground (formerly Quizizz) provide comprehensive practice in understanding one of the most fundamental aspects of personal finance and civic responsibility. These carefully designed resources help students master essential skills including calculating gross and net income, understanding tax brackets and progressive taxation systems, completing basic tax forms, and analyzing the relationship between income levels and tax obligations. The collection features detailed practice problems that guide students through real-world scenarios involving W-2 forms, standard deductions, and filing status considerations, while accompanying answer keys enable both independent study and teacher-guided instruction. These free printable materials strengthen critical thinking skills as students explore how income tax systems function within broader economic frameworks and examine the role of taxation in funding government services and public programs.

Wayground's extensive library of teacher-created income tax resources supports educators with millions of high-quality materials specifically designed for Class 10 social studies instruction. The platform's robust search and filtering capabilities allow teachers to quickly locate worksheets aligned with curriculum standards and differentiate instruction based on individual student needs and learning objectives. These customizable resources are available in both printable pdf formats for traditional classroom use and digital formats for technology-enhanced learning environments, providing flexibility for diverse teaching situations. Teachers can effectively utilize these materials for lesson planning, targeted remediation of challenging tax concepts, enrichment activities for advanced learners, and ongoing skill practice that reinforces students' understanding of income tax principles throughout their economic education journey.