12 Q

3rd

9 Q

3rd

14 Q

3rd

20 Q

3rd

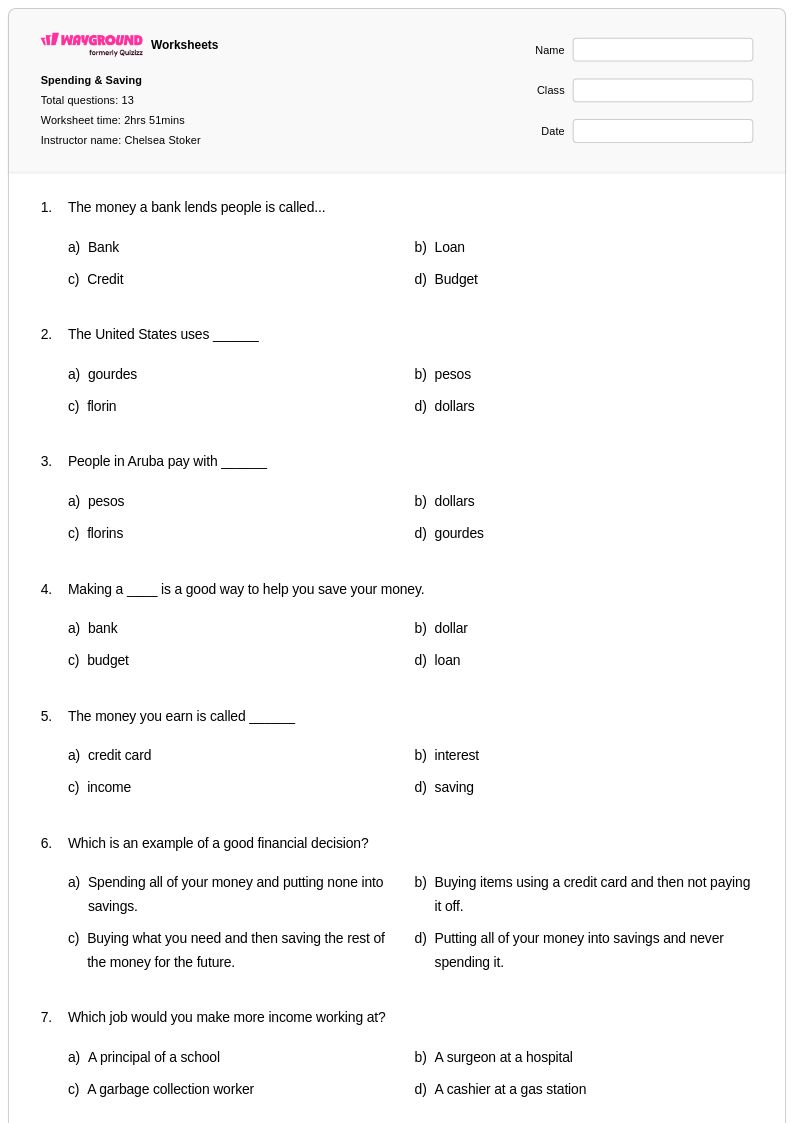

13 Q

3rd

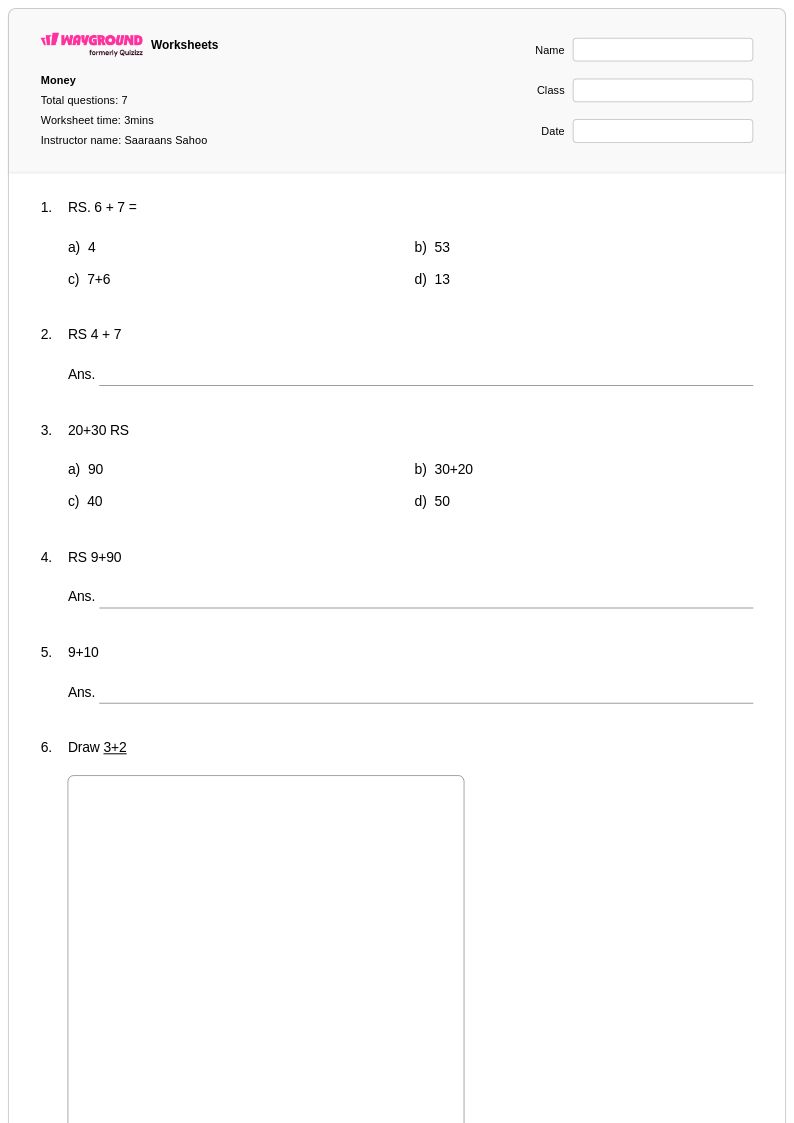

7 Q

3rd

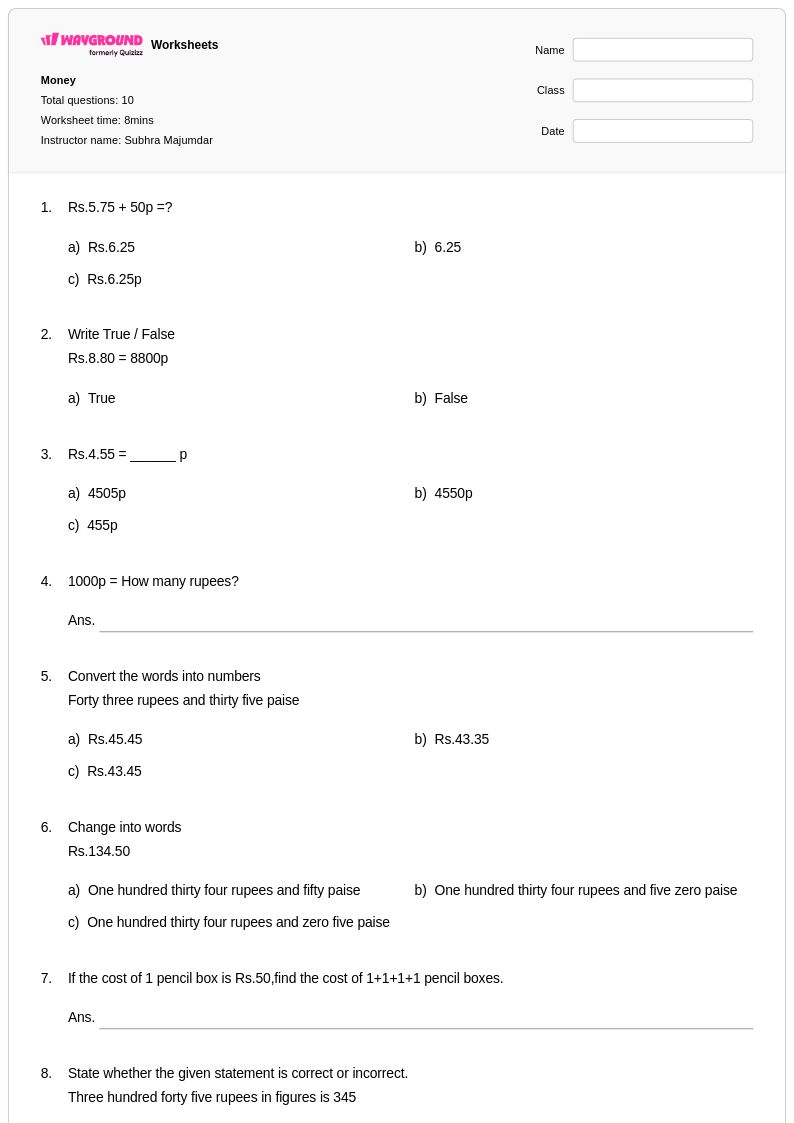

10 Q

3rd

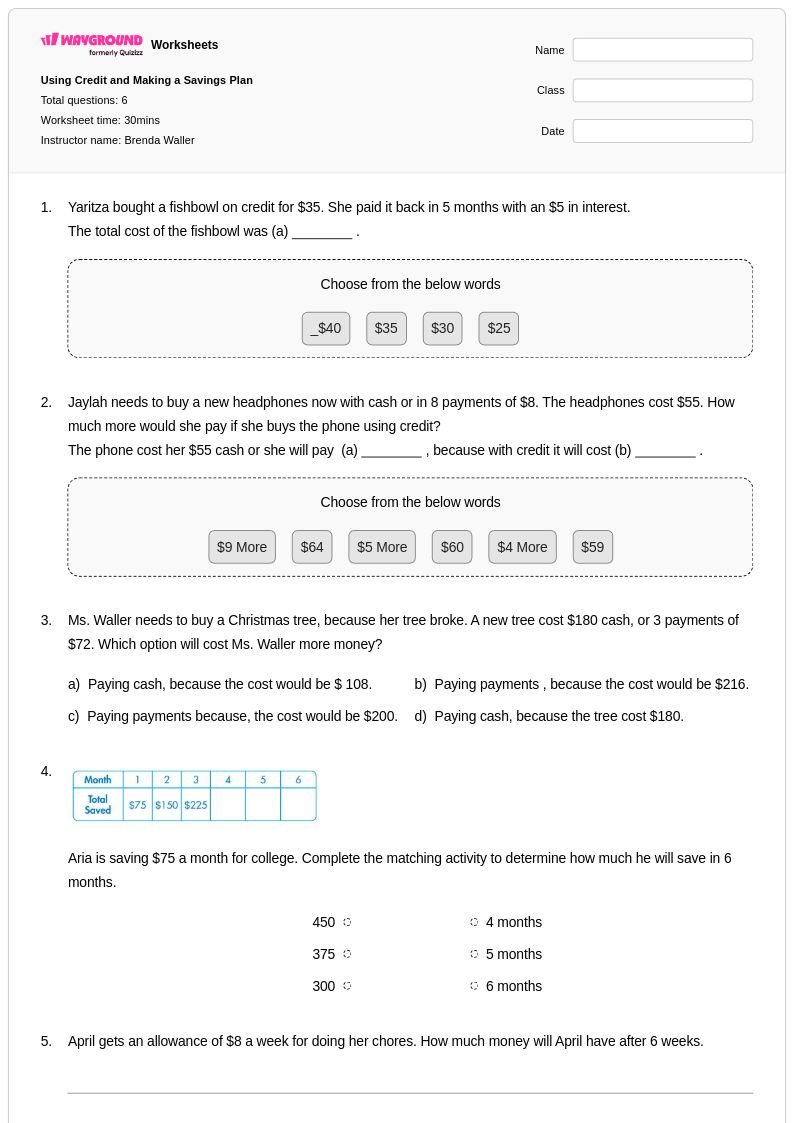

6 Q

3rd

6 Q

2nd - 3rd

10 Q

1st - 3rd

15 Q

3rd

18 Q

1st - 12th

20 Q

2nd - Uni

11 Q

3rd

11 Q

3rd - 4th

10 Q

3rd

10 Q

3rd

10 Q

3rd

10 Q

3rd

10 Q

3rd

10 Q

3rd

18 Q

2nd - Uni

6 Q

2nd - PD

11 Q

3rd - 9th

Explore Saving Money Worksheets by Grades

Explore Other Subject Worksheets for class 3

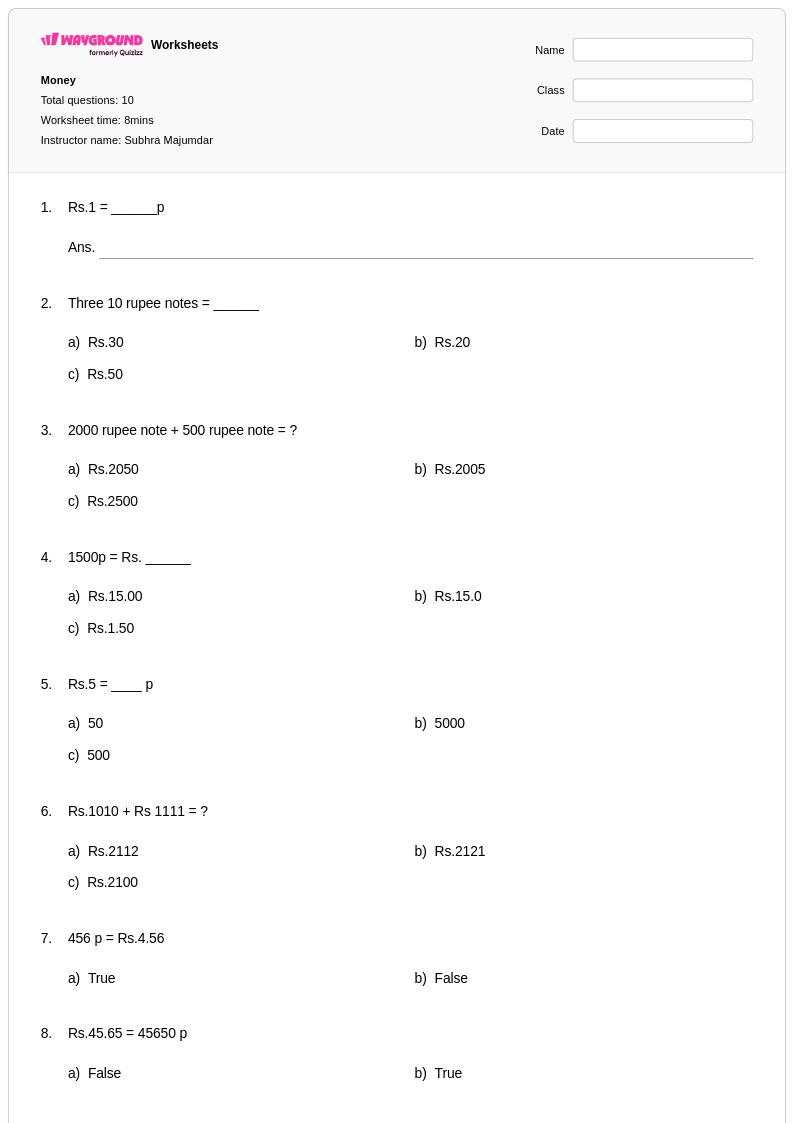

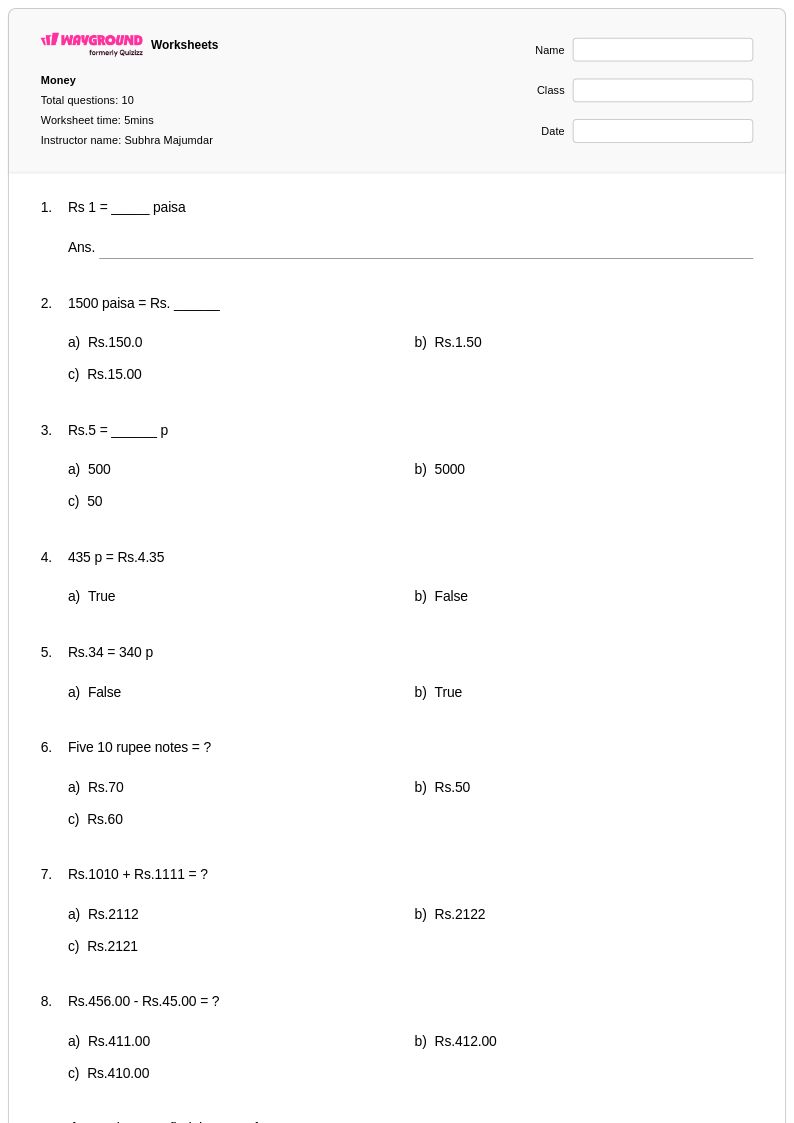

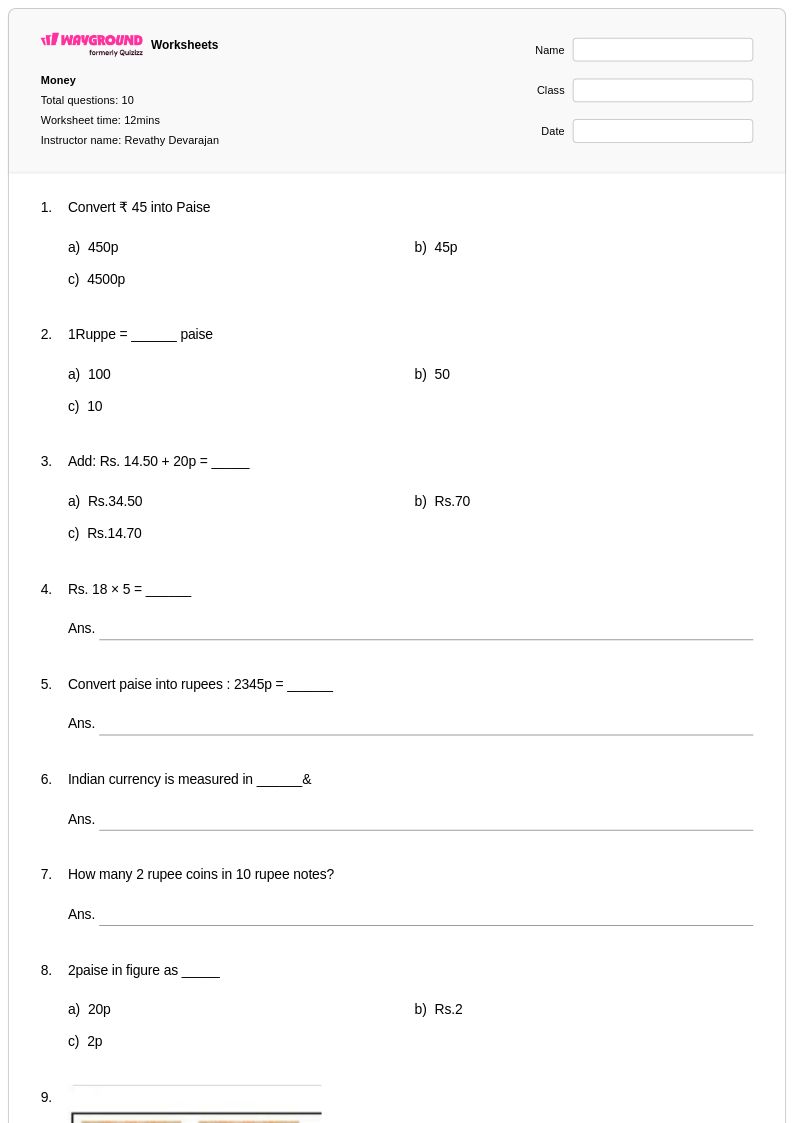

Explore printable Saving Money worksheets for Class 3

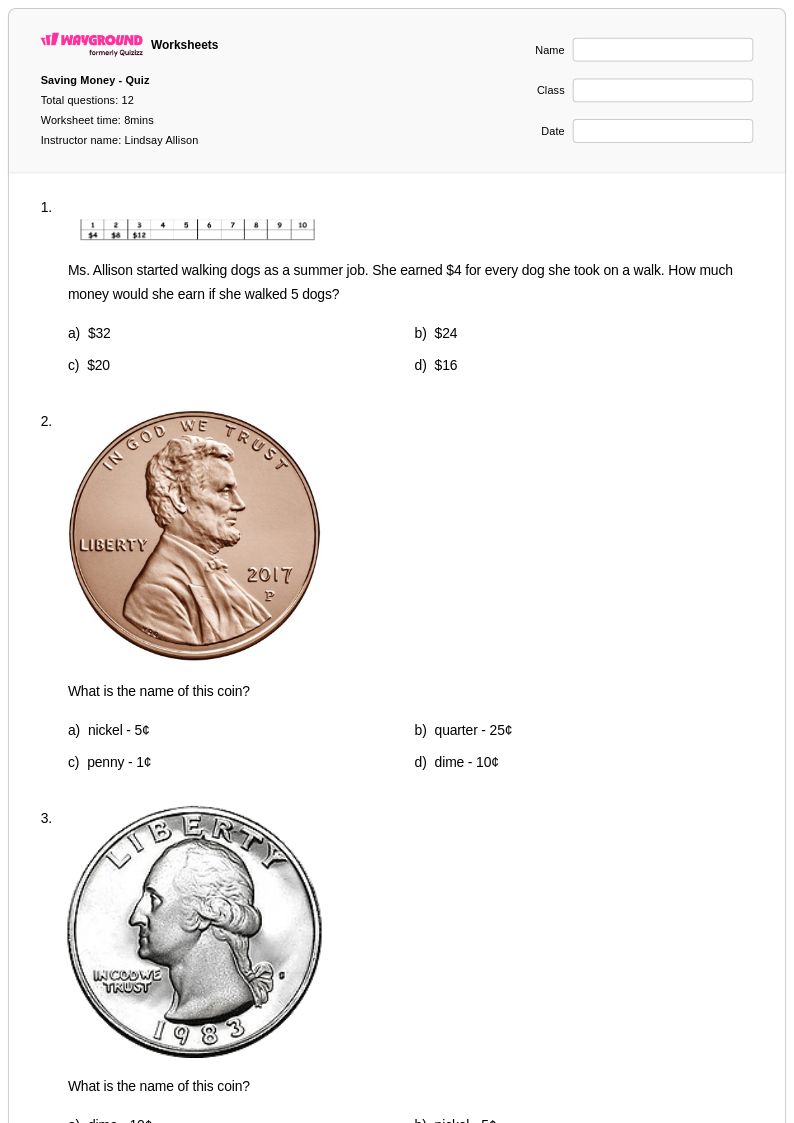

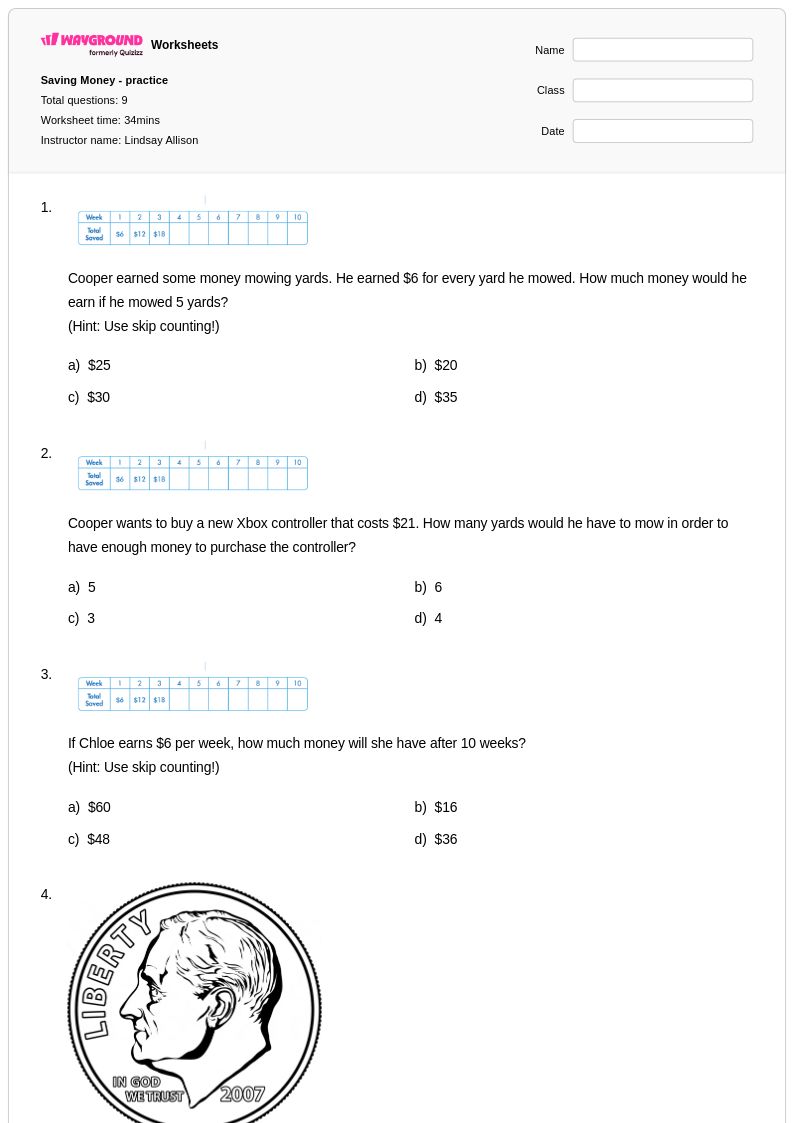

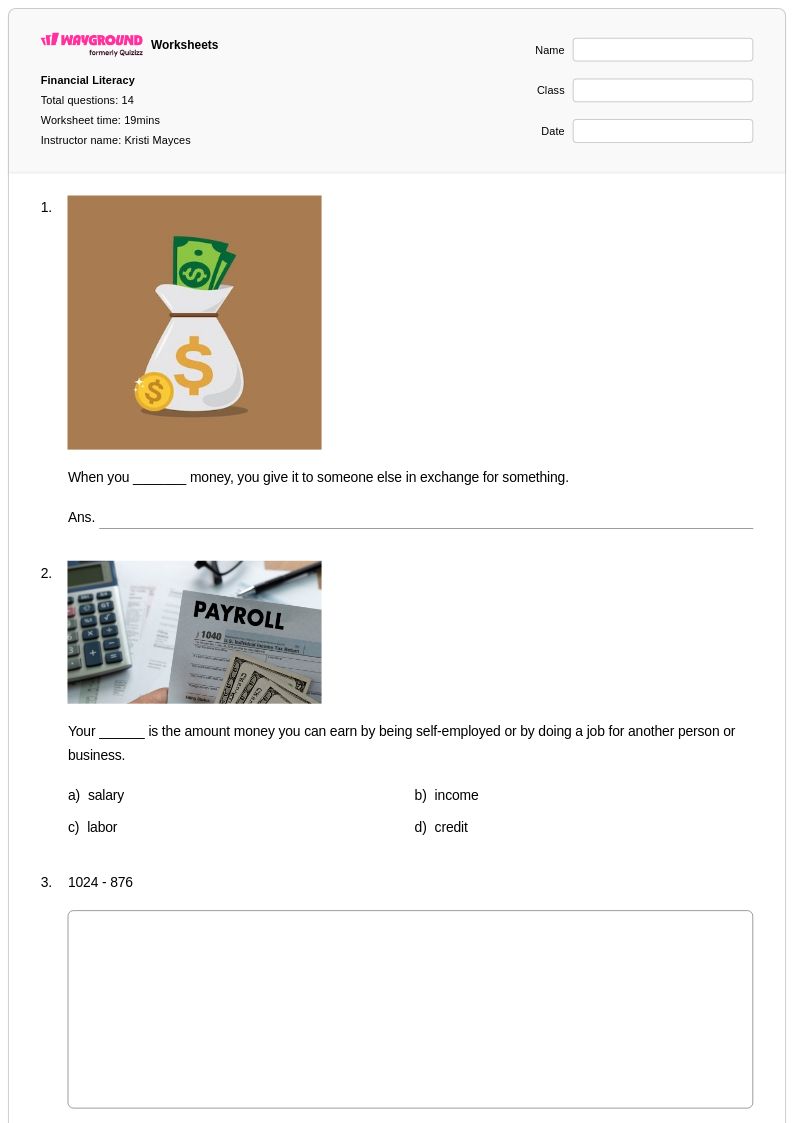

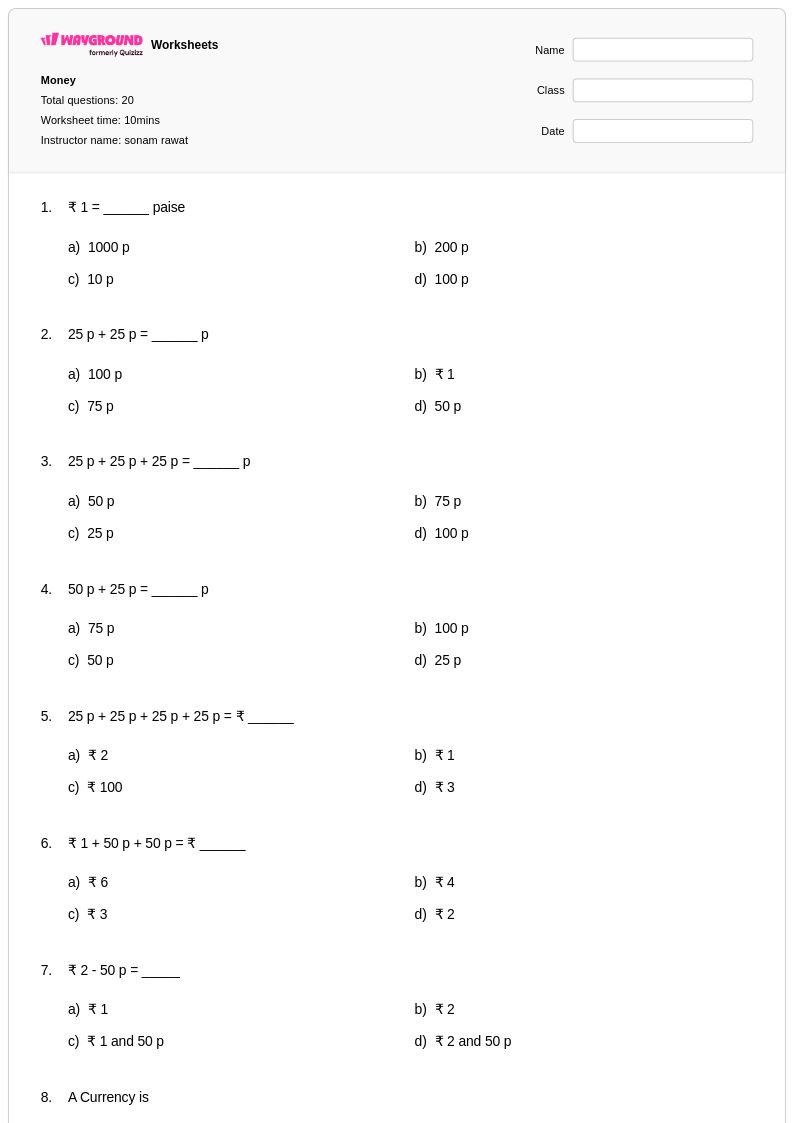

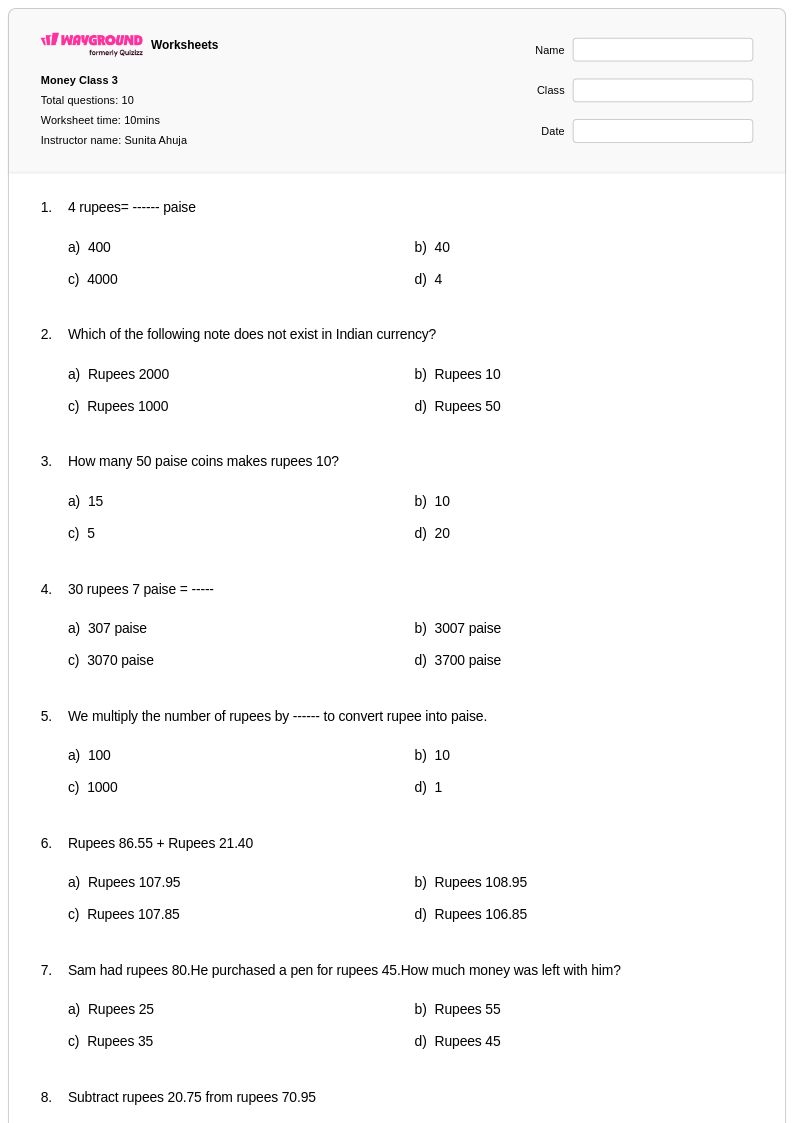

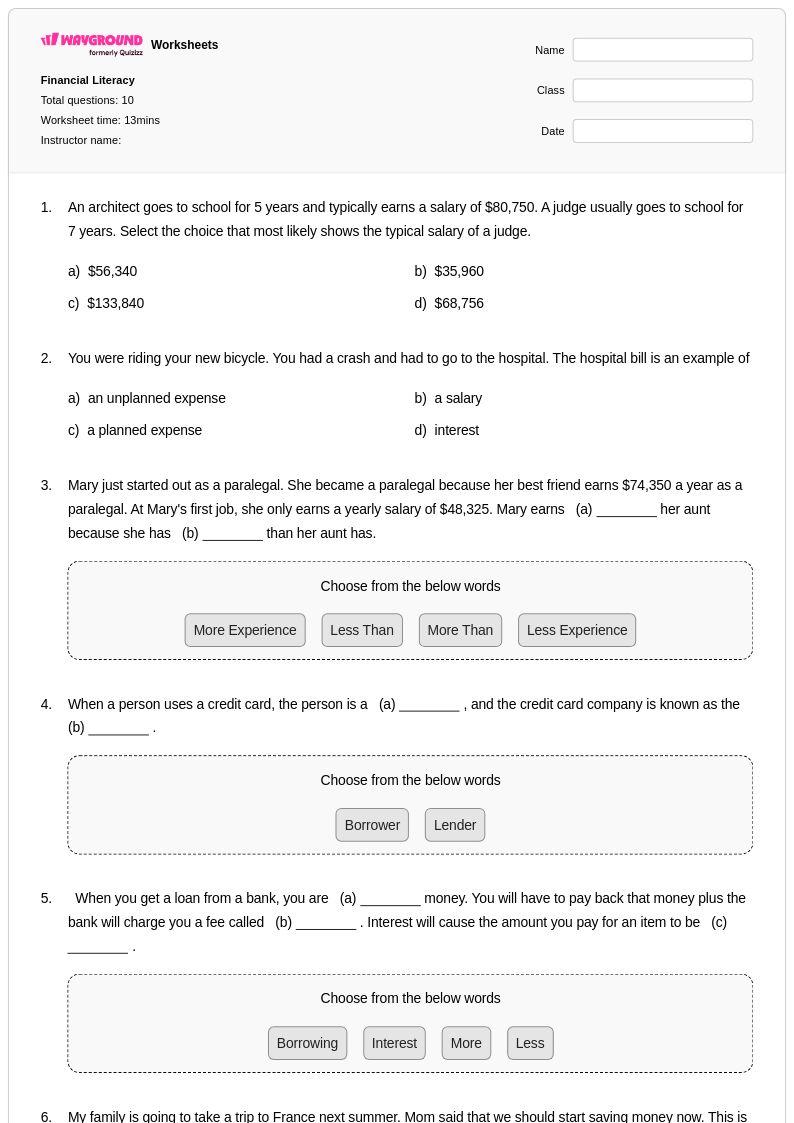

Saving money worksheets for Class 3 students available through Wayground (formerly Quizizz) provide essential foundational practice in personal financial management and mathematical reasoning. These carefully designed worksheets help young learners develop critical money-saving concepts through age-appropriate scenarios, visual representations of piggy banks and savings goals, and practical problem-solving activities that connect mathematics to real-world financial decisions. Students strengthen their understanding of coin and bill values, practice addition and subtraction with money amounts, and explore the relationship between earning, spending, and saving through engaging practice problems. Each worksheet includes comprehensive answer keys and is available as free printables in convenient pdf format, making it easy for educators to incorporate meaningful financial literacy instruction into their mathematics curriculum while building students' computational fluency and critical thinking skills.

Wayground (formerly Quizizz) empowers teachers with millions of educator-created saving money resources specifically designed for Class 3 mathematics instruction, featuring robust search and filtering capabilities that allow quick access to standards-aligned materials. The platform's differentiation tools enable teachers to customize worksheets based on individual student needs, offering both printable pdf versions for traditional classroom use and digital formats for interactive learning experiences. These comprehensive collections support diverse instructional approaches, from whole-class lessons introducing saving concepts to targeted remediation for students needing additional practice with money calculations, while also providing enrichment opportunities for advanced learners ready to explore more complex financial scenarios. Teachers can seamlessly integrate these resources into lesson planning, homework assignments, and assessment preparation, ensuring students receive consistent practice with saving money concepts that build both mathematical proficiency and essential life skills.