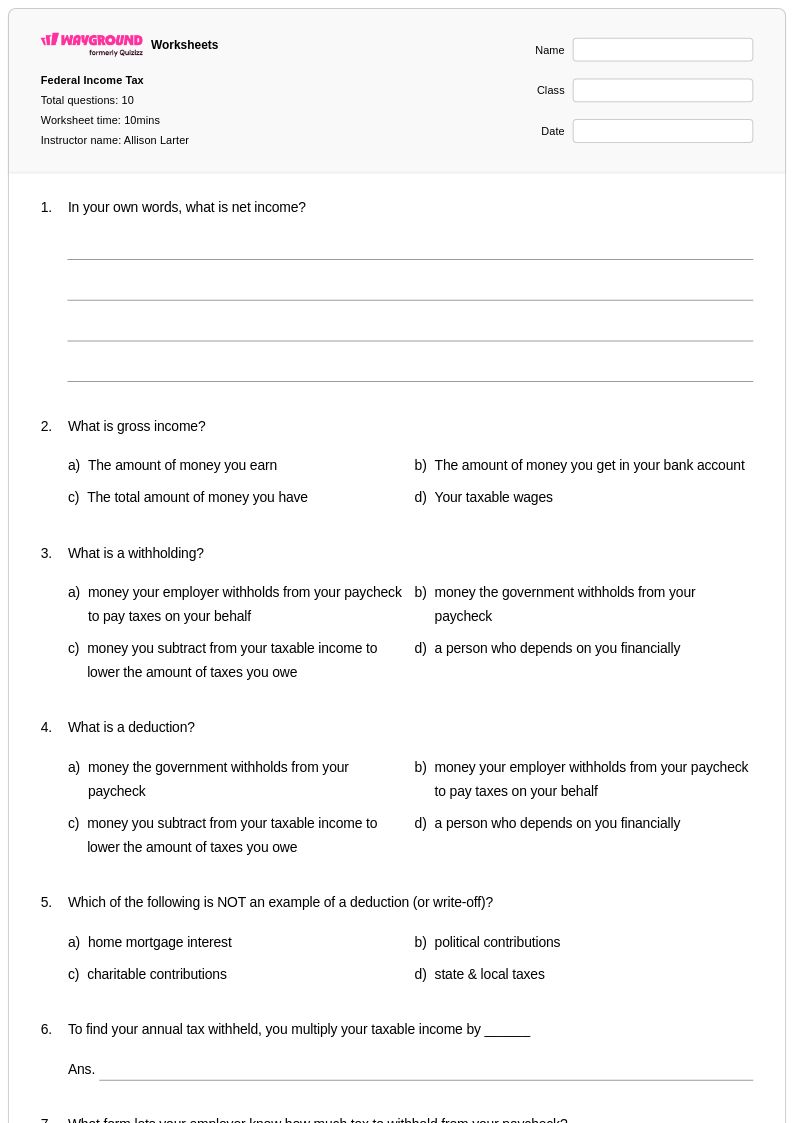

10 Q

9th - 12th

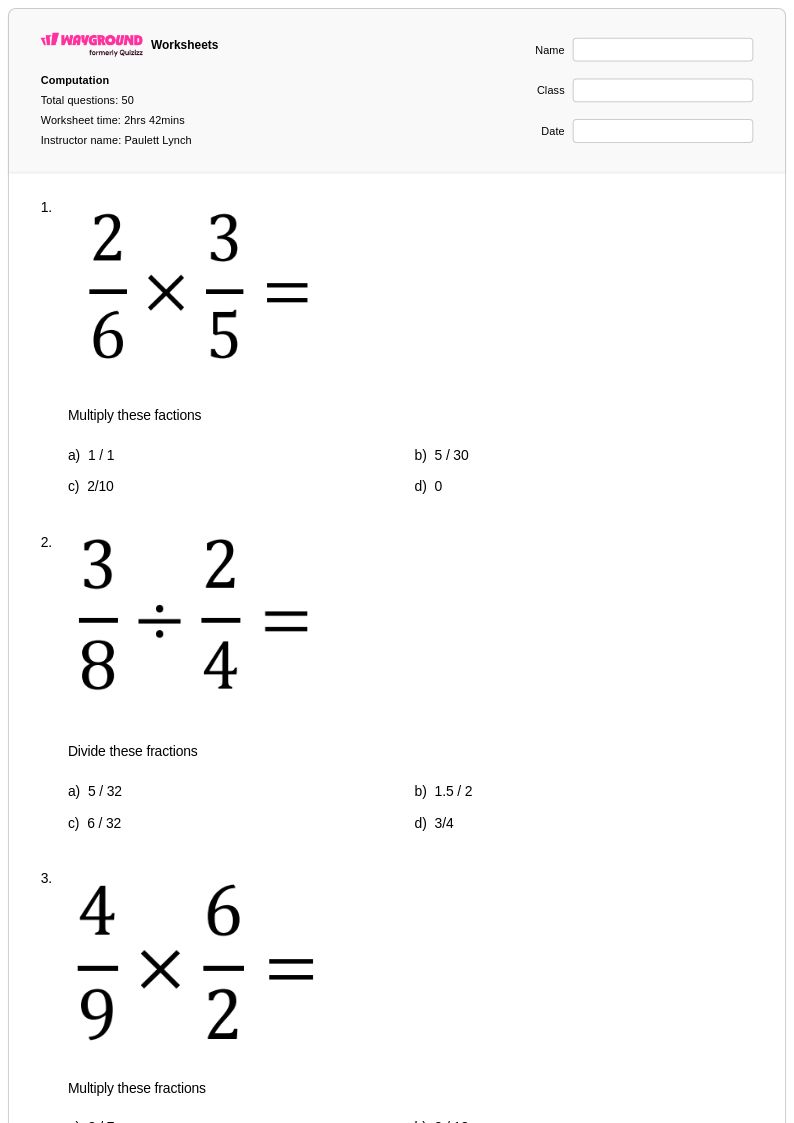

50 Q

7th - 11th

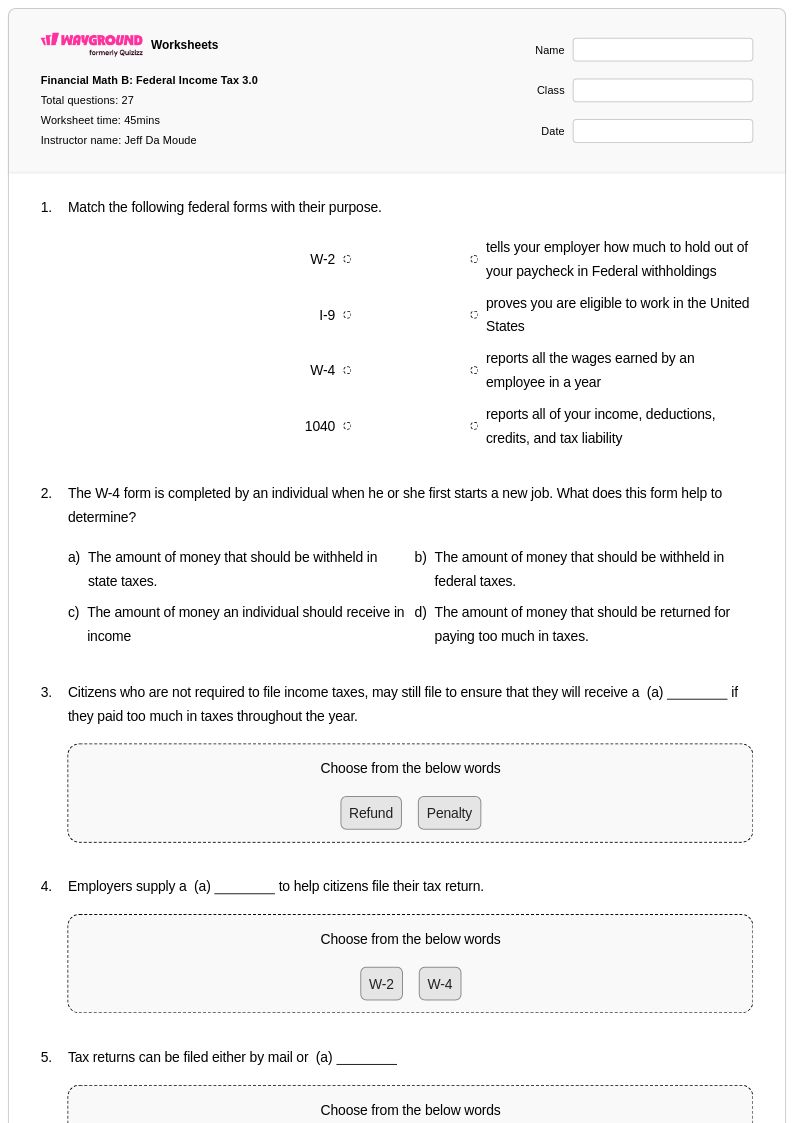

37 Q

9th - 12th

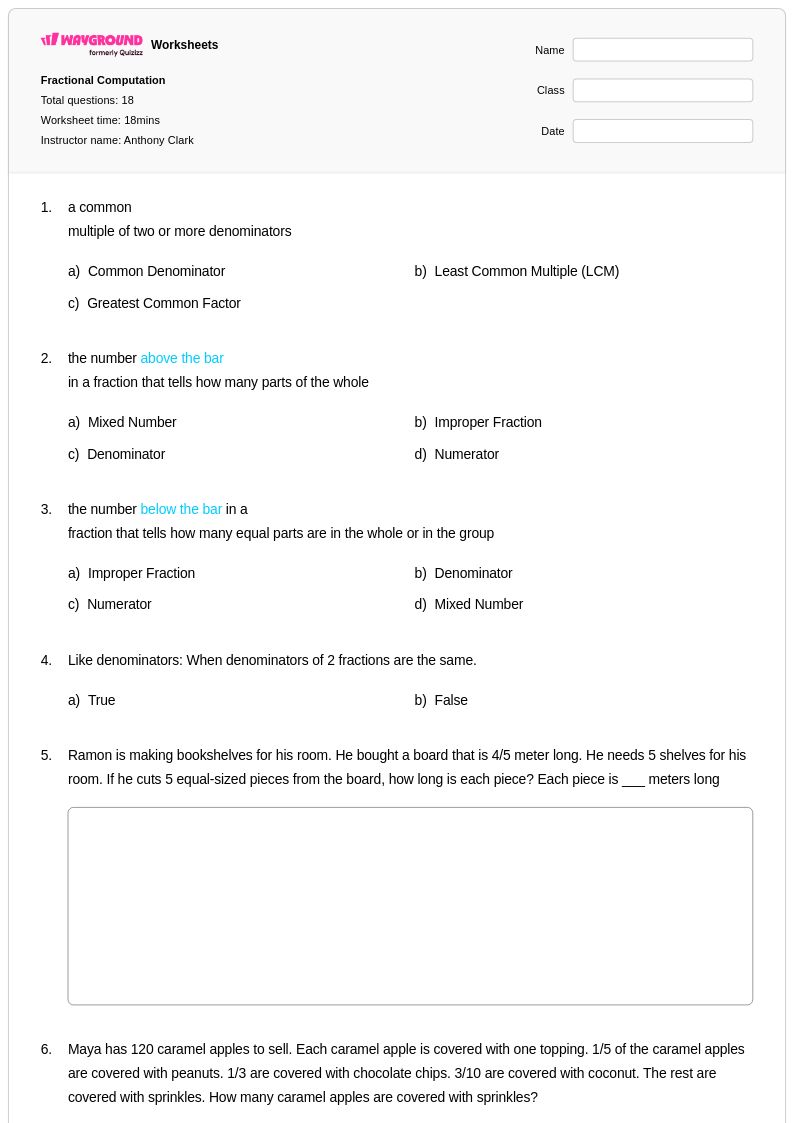

18 Q

5th - Uni

15 Q

11th

10 Q

11th

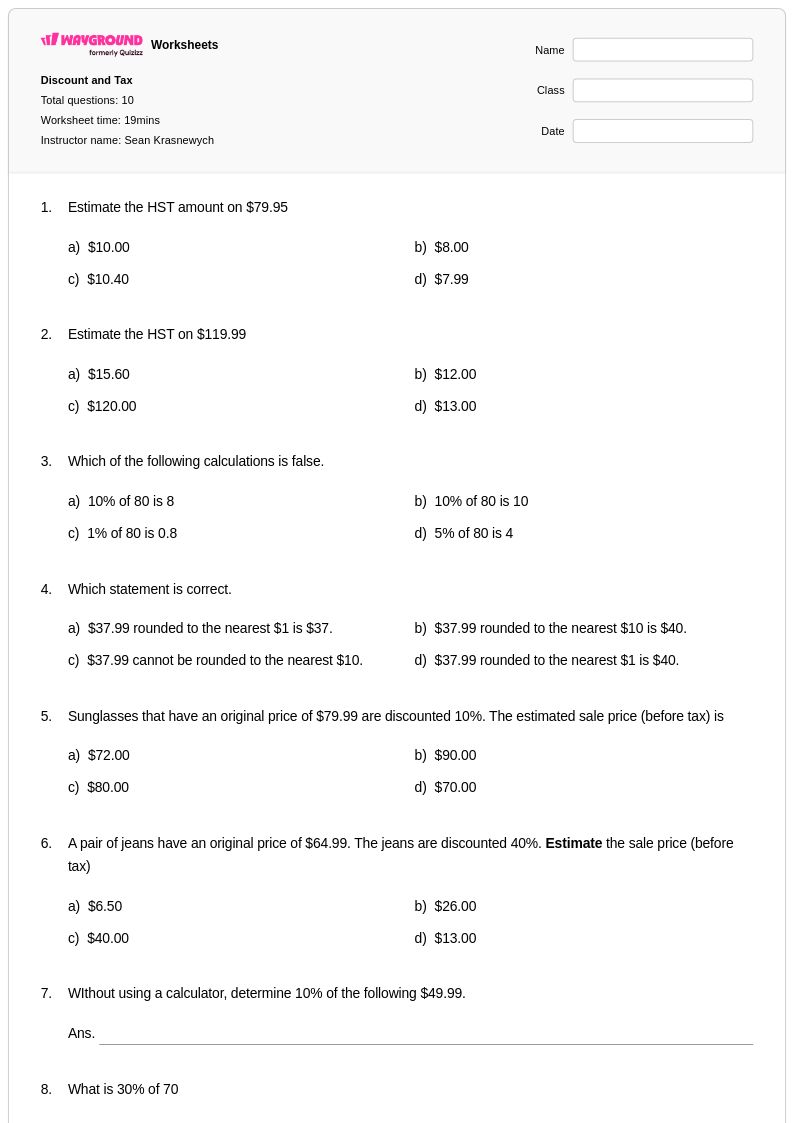

19 Q

4th - Uni

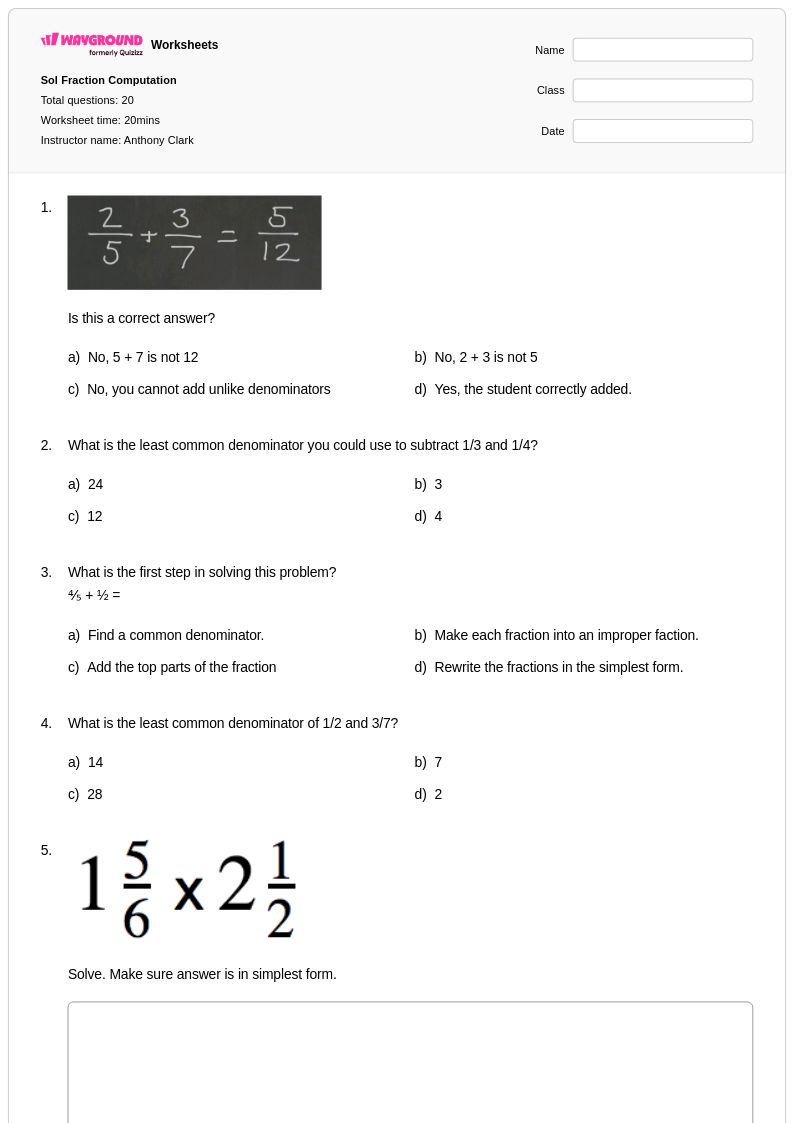

20 Q

4th - Uni

50 Q

9th - 12th

16 Q

4th - 12th

20 Q

7th - Uni

10 Q

9th - 12th

10 Q

6th - 11th

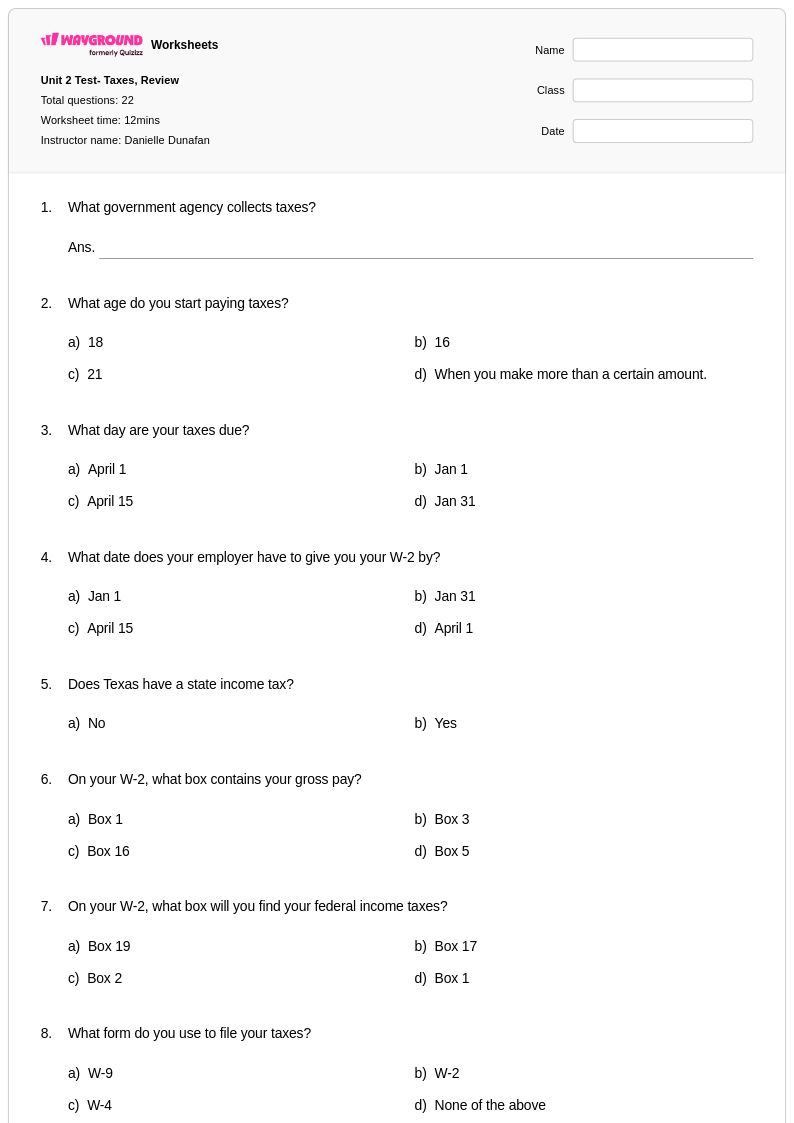

22 Q

9th - 12th

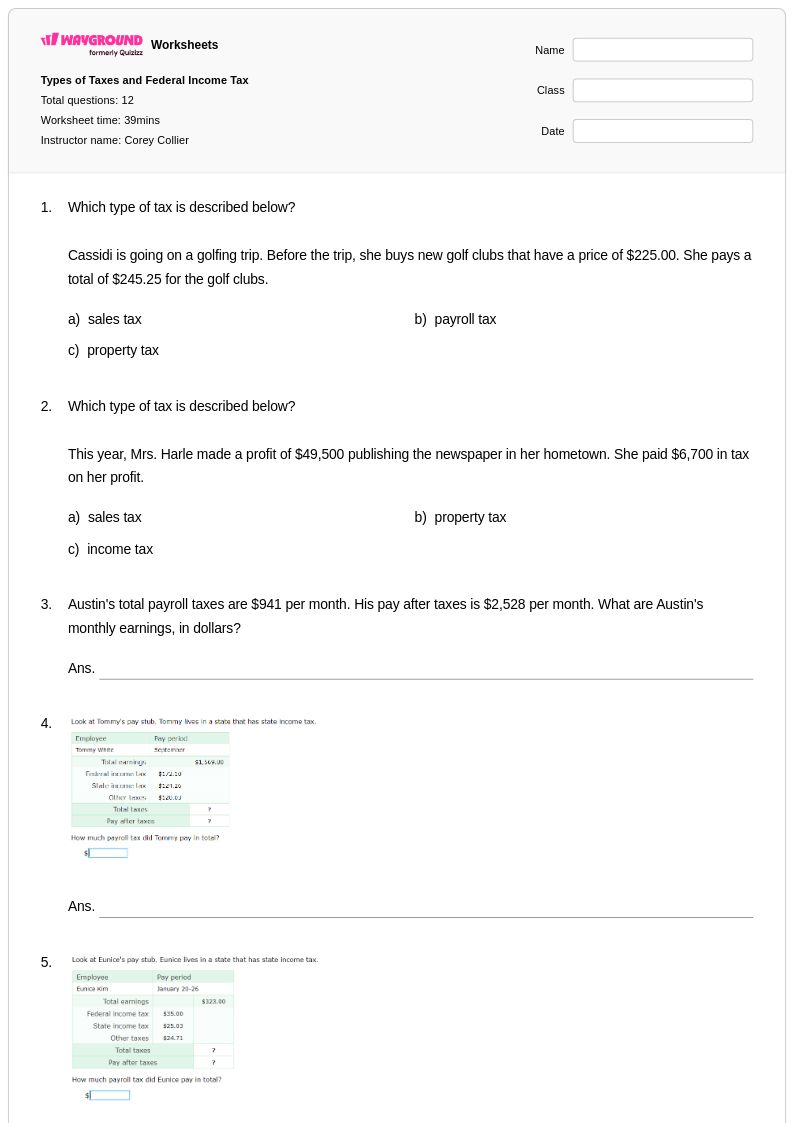

12 Q

9th - 12th

10 Q

9th - 12th

10 Q

9th - 12th

10 Q

9th - 12th

25 Q

4th - Uni

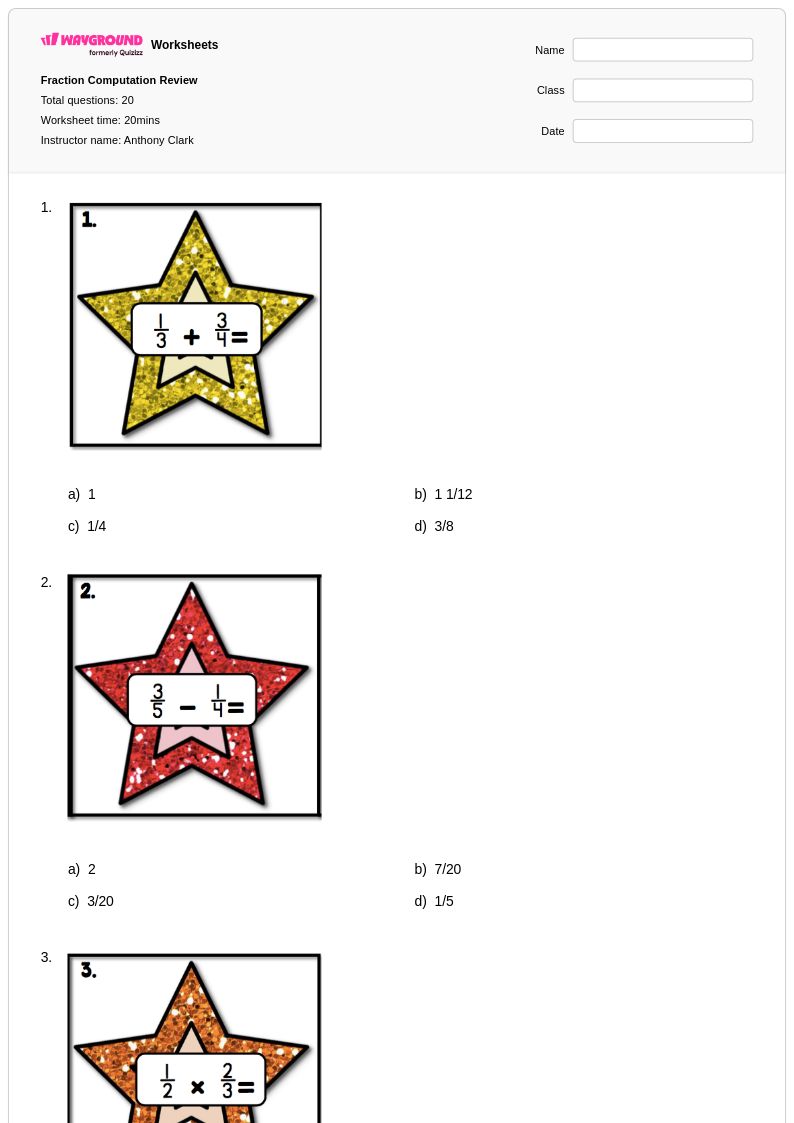

20 Q

7th - Uni

12 Q

5th - Uni

15 Q

5th - Uni

15 Q

11th - 12th

15 Q

9th - 12th

Explore Other Subject Worksheets for class 11

Explore printable Tax Computation worksheets for Class 11

Tax computation worksheets for Class 11 students available through Wayground (formerly Quizizz) provide comprehensive practice in calculating various types of taxes that high school students encounter in advanced financial literacy curricula. These expertly designed worksheets strengthen essential mathematical skills including percentage calculations, progressive tax bracket computations, payroll deduction analysis, and property tax assessments. Students work through realistic practice problems that mirror actual tax scenarios, developing proficiency in computing federal and state income taxes, Social Security and Medicare withholdings, and understanding tax liability versus tax refunds. Each worksheet collection includes detailed answer keys and step-by-step solutions, with free printable pdf formats that allow students to practice complex tax calculations both in classroom settings and independently at home.

Wayground (formerly Quizizz) supports mathematics educators with millions of teacher-created tax computation resources specifically aligned with Class 11 financial literacy standards and learning objectives. The platform's robust search and filtering capabilities enable teachers to quickly locate worksheets that match specific tax computation concepts, from basic percentage-based calculations to complex multi-step problems involving standard deductions, exemptions, and tax credits. Advanced differentiation tools allow educators to customize worksheet difficulty levels and problem types to meet diverse student needs, while the availability of both digital and printable pdf formats provides flexibility for various instructional approaches. These comprehensive worksheet collections facilitate targeted skill practice, support remediation for struggling learners, and offer enrichment opportunities for advanced students, making lesson planning more efficient while ensuring students develop the quantitative reasoning skills necessary for real-world tax literacy.