25 Q

12th - Uni

19 Q

12th

10 Q

12th

10 Q

12th

10 Q

12th

10 Q

12th

15 Q

12th - Uni

20 Q

12th

110 Q

12th

10 Q

12th

20 Q

12th

15 Q

8th - Uni

20 Q

12th

10 Q

12th

15 Q

11th - 12th

20 Q

5th - Uni

8 Q

11th - 12th

46 Q

7th - Uni

9 Q

8th - Uni

15 Q

8th - Uni

15 Q

8th - Uni

10 Q

9th - 12th

25 Q

4th - Uni

Explore Other Subject Worksheets for class 12

Explore printable Taxation worksheets for Class 12

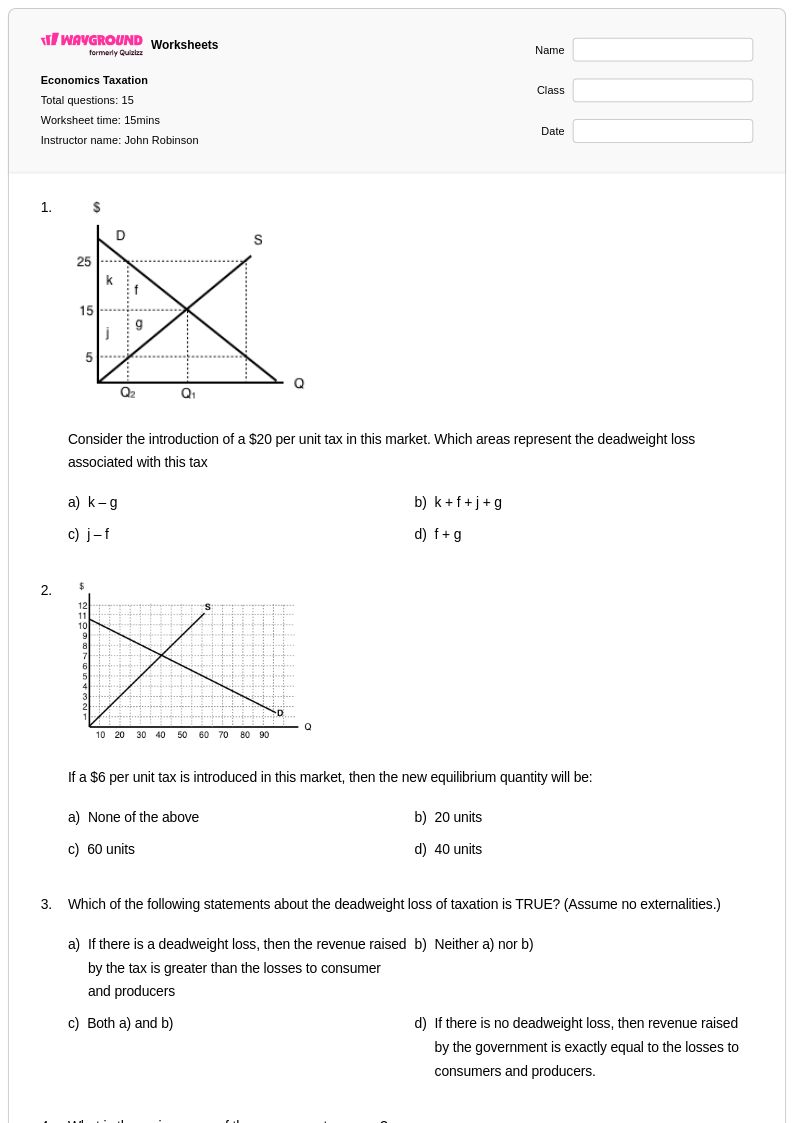

Taxation worksheets for Class 12 students available through Wayground (formerly Quizizz) provide comprehensive coverage of advanced tax concepts essential for understanding modern economic systems. These expertly crafted resources explore complex topics including progressive, regressive, and proportional tax structures, tax incidence and burden distribution, fiscal policy implications, and the economic effects of taxation on market behavior and income distribution. Students engage with practice problems that challenge them to analyze real-world tax scenarios, calculate tax liabilities using various methods, and evaluate the efficiency and equity trade-offs inherent in different taxation approaches. The worksheets strengthen critical thinking skills by requiring students to examine how taxation influences economic decision-making, labor supply, investment patterns, and overall economic growth, while answer keys and detailed explanations support independent learning and self-assessment.

Wayground (formerly Quizizz) empowers educators with an extensive library of millions of teacher-created taxation resources specifically designed for Class 12 economics instruction. The platform's robust search and filtering capabilities enable teachers to quickly locate materials aligned with specific curriculum standards and learning objectives, whether focusing on corporate taxation, international tax policy, or public finance theory. These differentiation tools allow instructors to customize worksheets based on individual student needs, providing additional scaffolding for struggling learners while offering enrichment opportunities for advanced students. Available in both printable pdf format and interactive digital versions, these resources seamlessly integrate into diverse classroom environments and support flexible instructional approaches. Teachers can efficiently plan comprehensive taxation units, implement targeted remediation strategies, and provide meaningful skill practice that prepares students for advanced economic analysis and informed civic participation.