15 Q

8th - Uni

25 Q

6th - Uni

25 Q

8th - Uni

10 Q

3rd - Uni

20 Q

5th - Uni

20 Q

10th

20 Q

10th

22 Q

9th - 12th

15 Q

8th - Uni

80 Q

10th

19 Q

6th - 12th

25 Q

6th - Uni

25 Q

8th - Uni

16 Q

10th

15 Q

10th

15 Q

4th - Uni

21 Q

9th - 12th

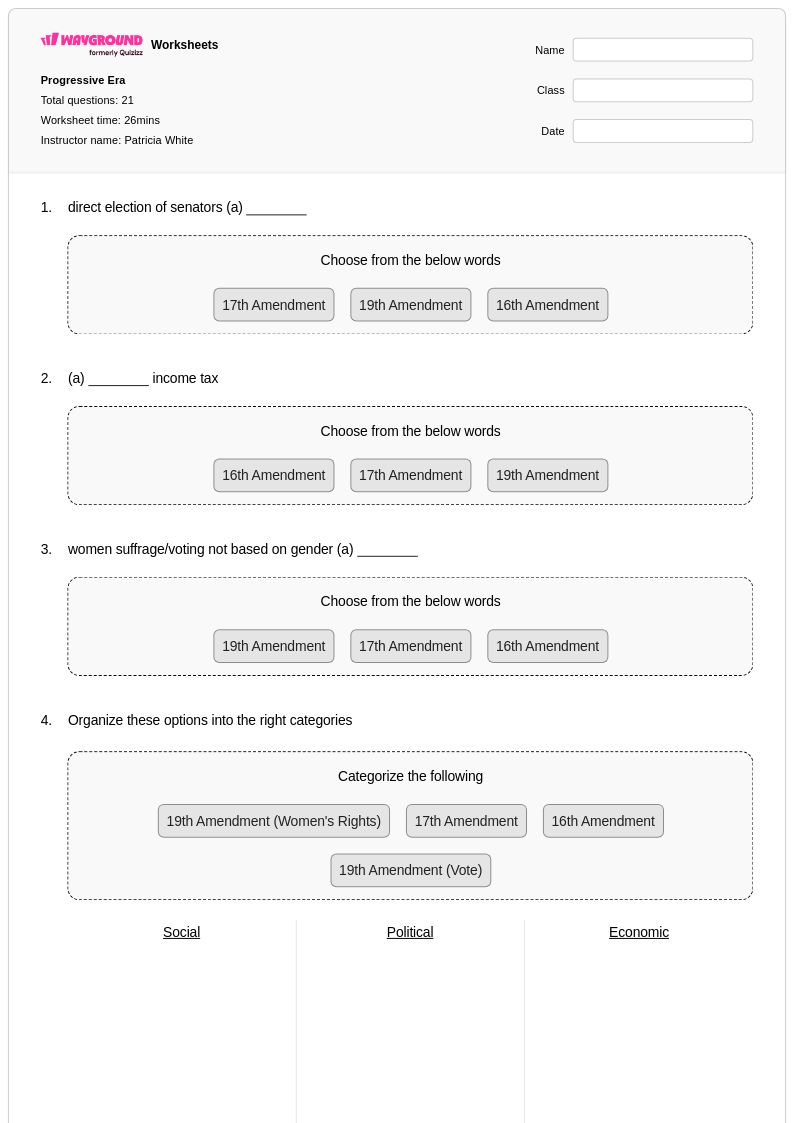

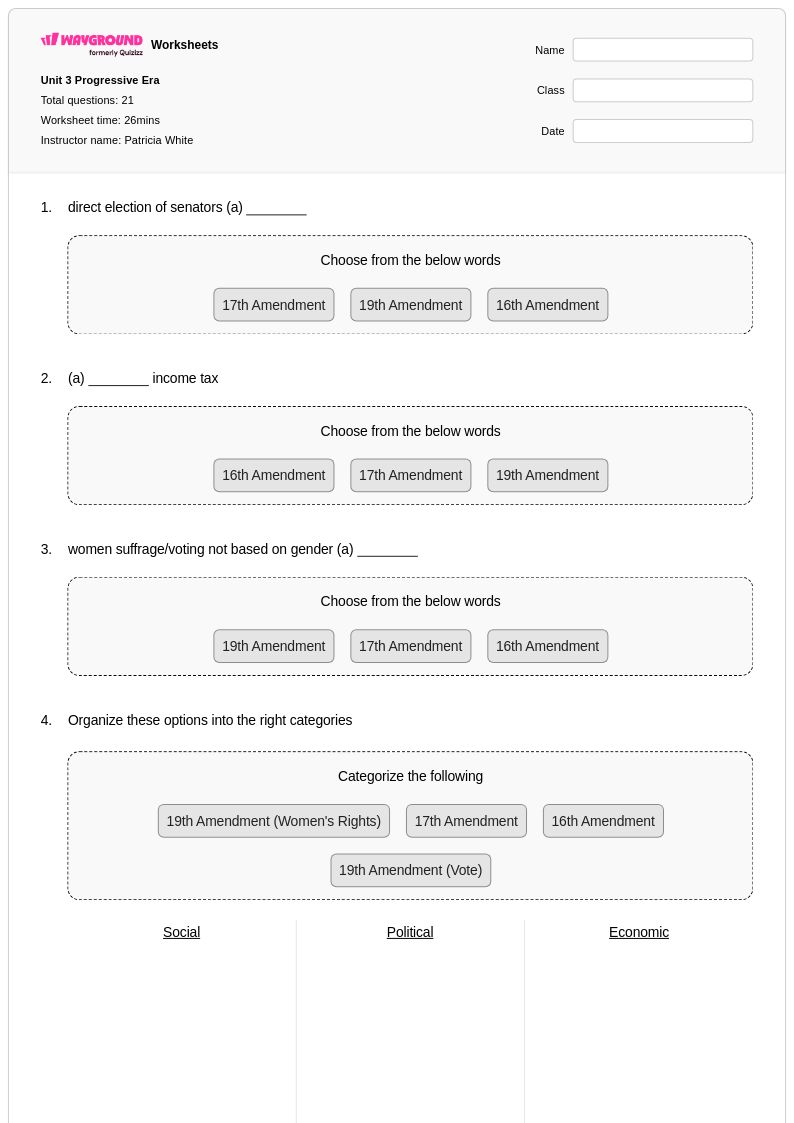

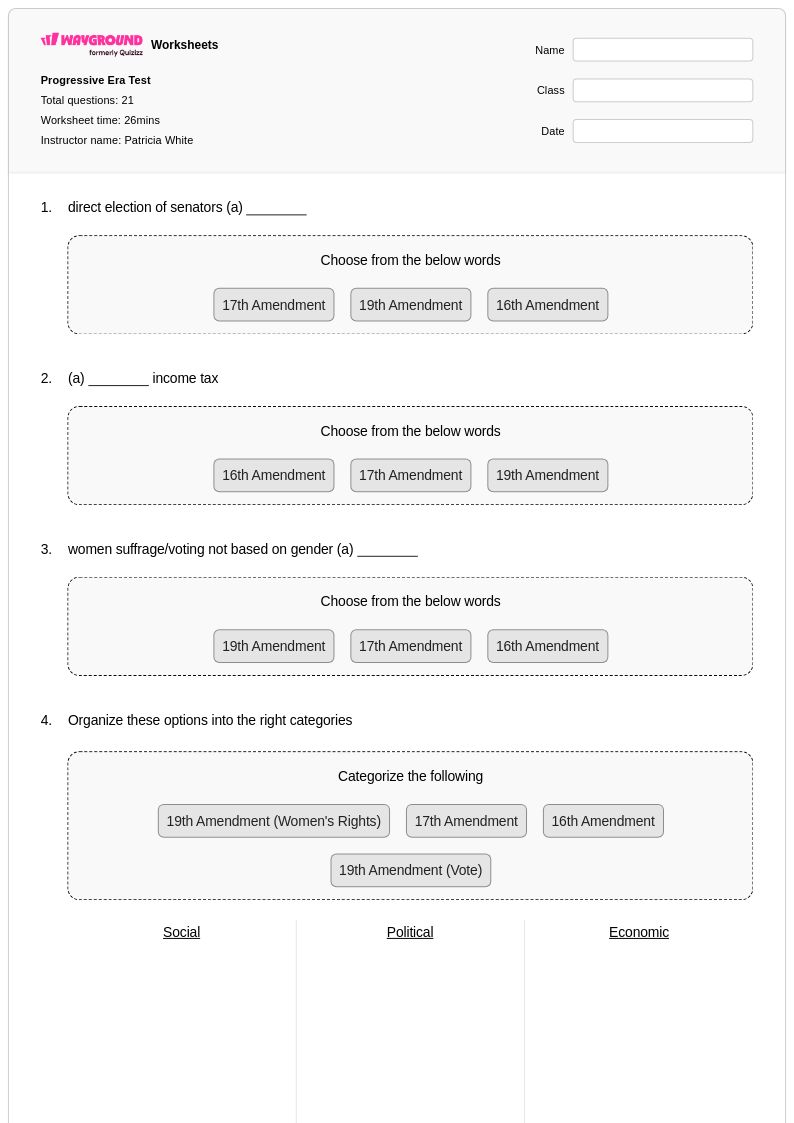

21 Q

9th - 12th

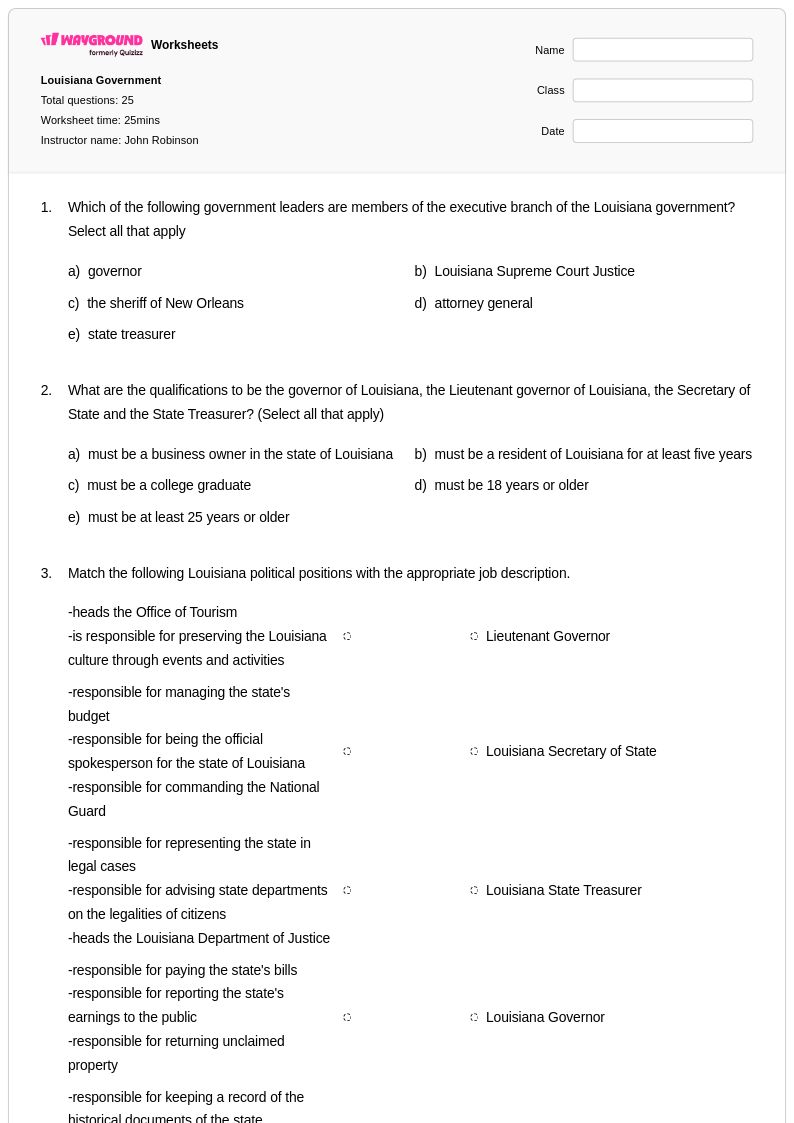

25 Q

8th - Uni

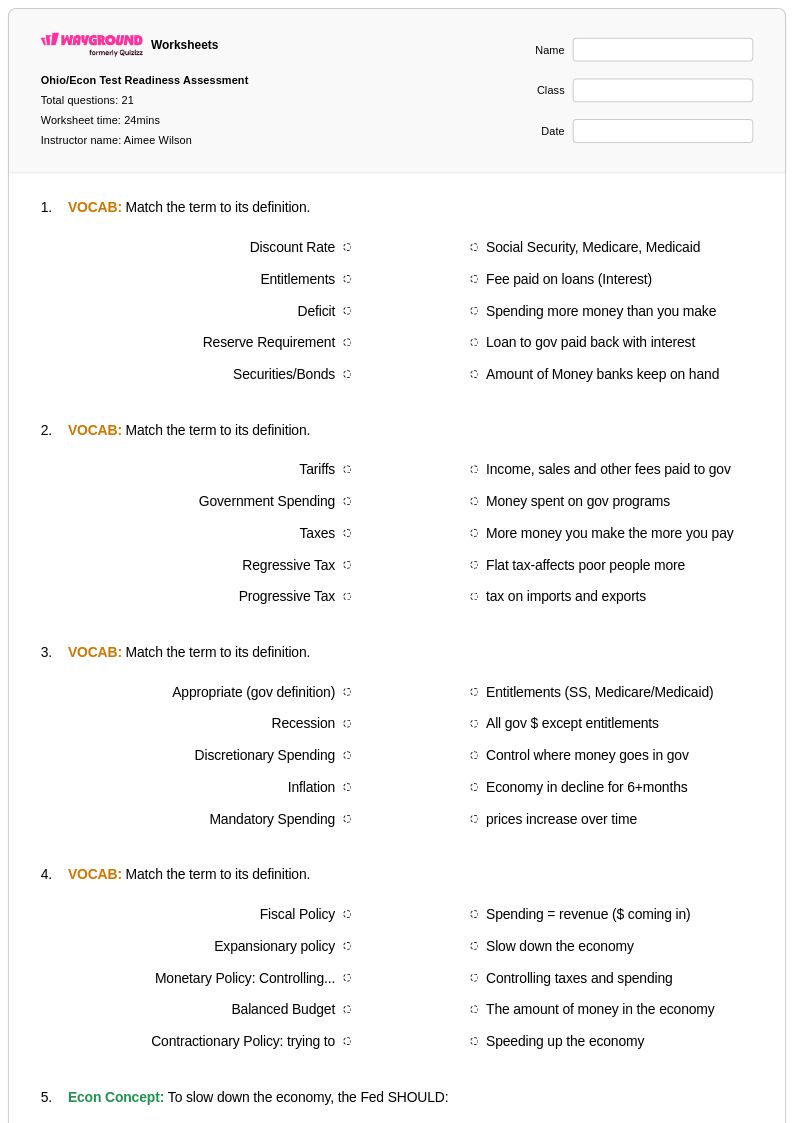

21 Q

9th - 12th

21 Q

9th - 12th

Explore Other Subject Worksheets for class 10

Explore printable Taxes worksheets for Class 10

Class 10 taxes worksheets available through Wayground (formerly Quizizz) provide comprehensive coverage of fundamental taxation concepts that students need to master in their economics coursework. These expertly crafted resources focus on building critical analytical skills as students explore income taxes, sales taxes, property taxes, and the progressive nature of tax systems. The worksheets strengthen students' ability to calculate tax obligations, analyze tax brackets, and understand the relationship between taxation and government revenue. Each printable resource includes detailed answer keys and practice problems that guide students through complex scenarios involving tax computations, deductions, and the economic impact of various tax policies. These free educational materials serve as essential tools for reinforcing classroom instruction while developing students' quantitative reasoning skills in real-world economic contexts.

Wayground (formerly Quizizz) empowers educators with millions of teacher-created taxation worksheets that can be easily searched, filtered, and customized to meet diverse classroom needs. The platform's robust collection allows teachers to differentiate instruction by selecting materials that align with specific learning standards and accommodate varying skill levels within their Class 10 economics classes. These versatile resources are available in both printable pdf formats and interactive digital versions, providing flexibility for in-class activities, homework assignments, and assessment preparation. Teachers can seamlessly integrate these taxation worksheets into their lesson planning for targeted skill practice, remediation sessions for struggling learners, and enrichment opportunities for advanced students, ensuring that all learners develop a solid foundation in understanding how taxes function within economic systems.