10 Q

9th - 12th

30 Q

6th - 8th

11 Q

9th - 12th

8 Q

9th - 12th

12 Q

12th

20 Q

9th - Uni

20 Q

10th

10 Q

6th

15 Q

9th - 12th

14 Q

6th

19 Q

9th - Uni

16 Q

1st

10 Q

2nd

13 Q

3rd

20 Q

9th - 12th

14 Q

7th

10 Q

6th

10 Q

1st - Uni

13 Q

2nd

20 Q

6th

10 Q

6th

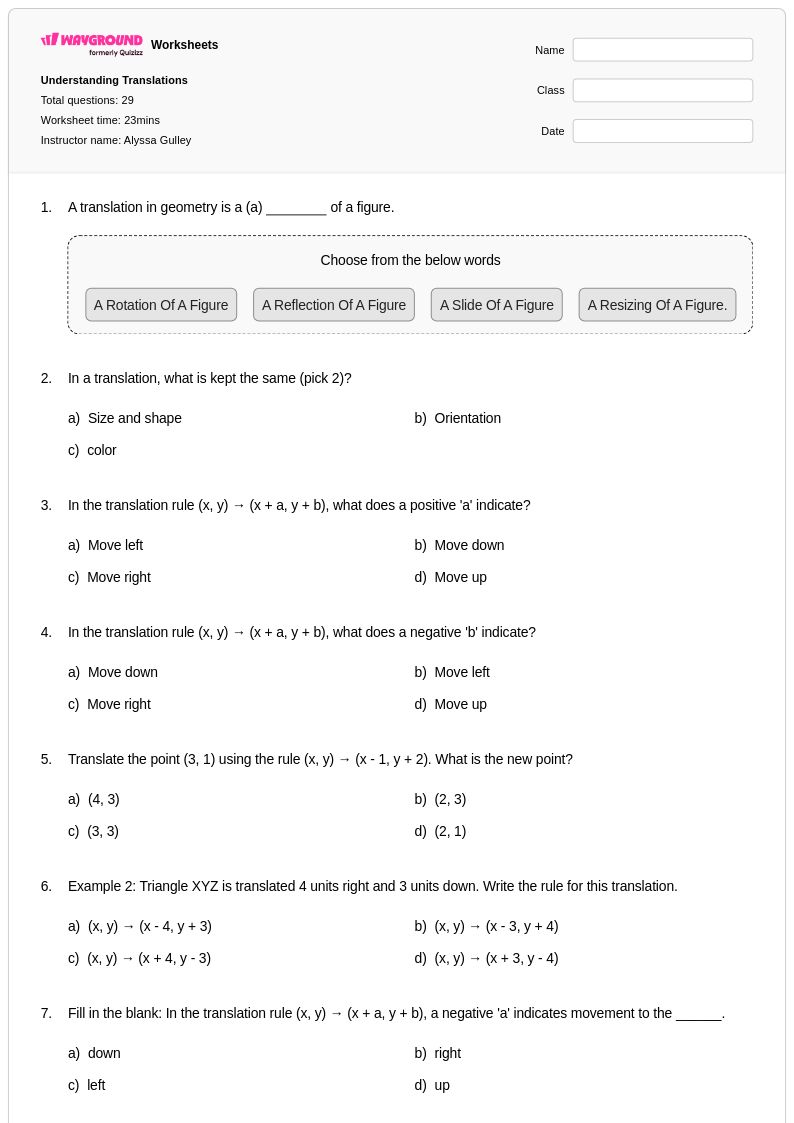

29 Q

8th

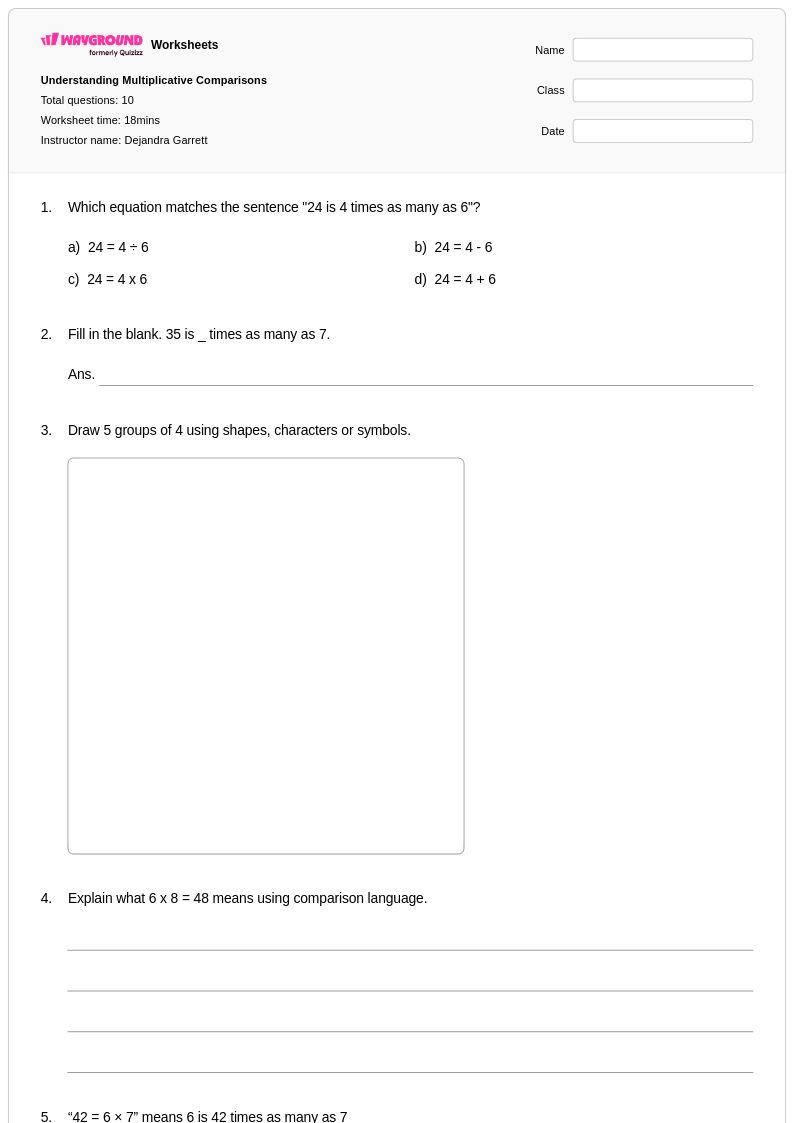

10 Q

4th

11 Q

6th

Explore Worksheets by Subjects

Explore printable Understanding Paychecks worksheets

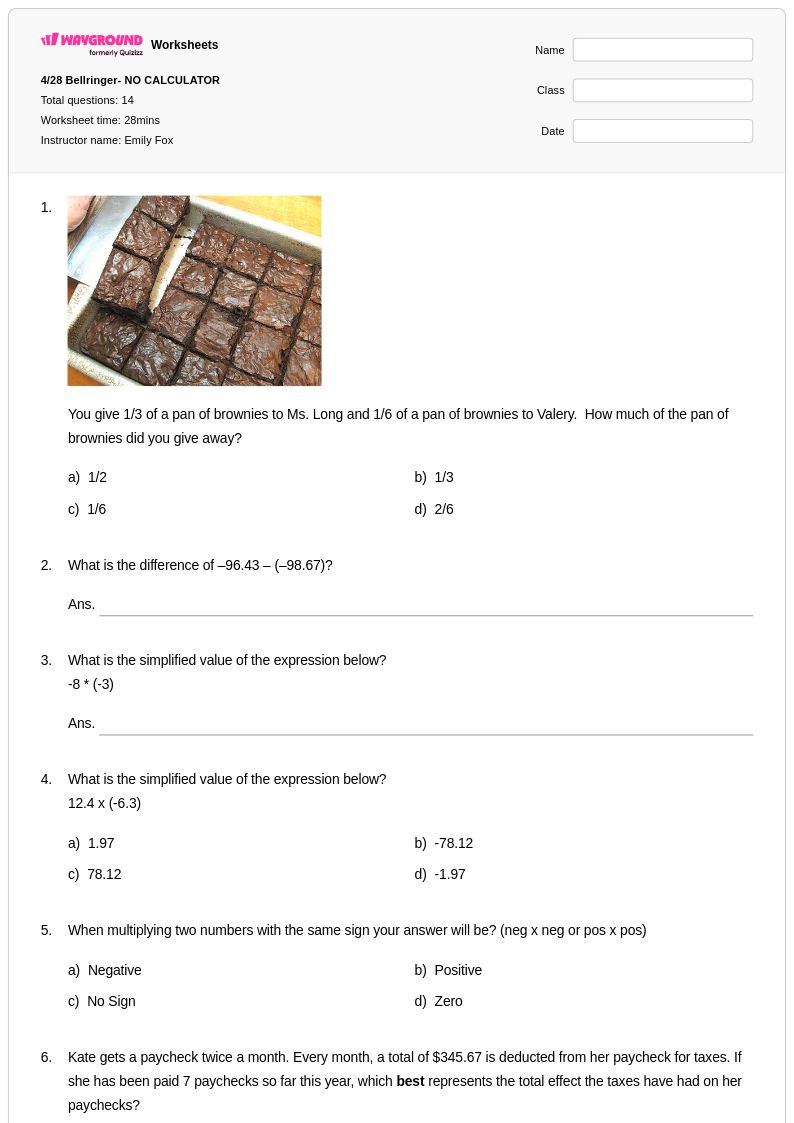

Understanding paychecks represents a crucial financial literacy skill that bridges mathematical concepts with real-world applications, and Wayground's comprehensive worksheet collection provides educators with expertly designed resources to teach this essential topic. These worksheets guide students through the complexities of paycheck analysis, including gross pay calculations, deduction breakdowns, net pay determination, and tax withholding interpretations. Students develop critical mathematical reasoning skills while working through practice problems that mirror authentic paycheck scenarios, from hourly wage computations to salary-based earnings with benefits deductions. Each worksheet includes a detailed answer key to support independent learning and self-assessment, with free printables available in convenient PDF format for seamless classroom integration and homework assignments.

Wayground, formerly Quizizz, empowers educators with millions of teacher-created resources specifically designed for financial literacy instruction, featuring robust search and filtering capabilities that help instructors quickly locate materials aligned with curriculum standards and learning objectives. The platform's differentiation tools enable teachers to customize worksheets based on individual student needs, supporting both remediation for struggling learners and enrichment opportunities for advanced students. These resources are available in both printable and digital formats, including downloadable PDFs, allowing for flexible implementation whether in traditional classroom settings or remote learning environments. Teachers can efficiently plan comprehensive lessons, target specific skill gaps, and provide meaningful practice opportunities that prepare students for real-world financial decision-making and workplace readiness.