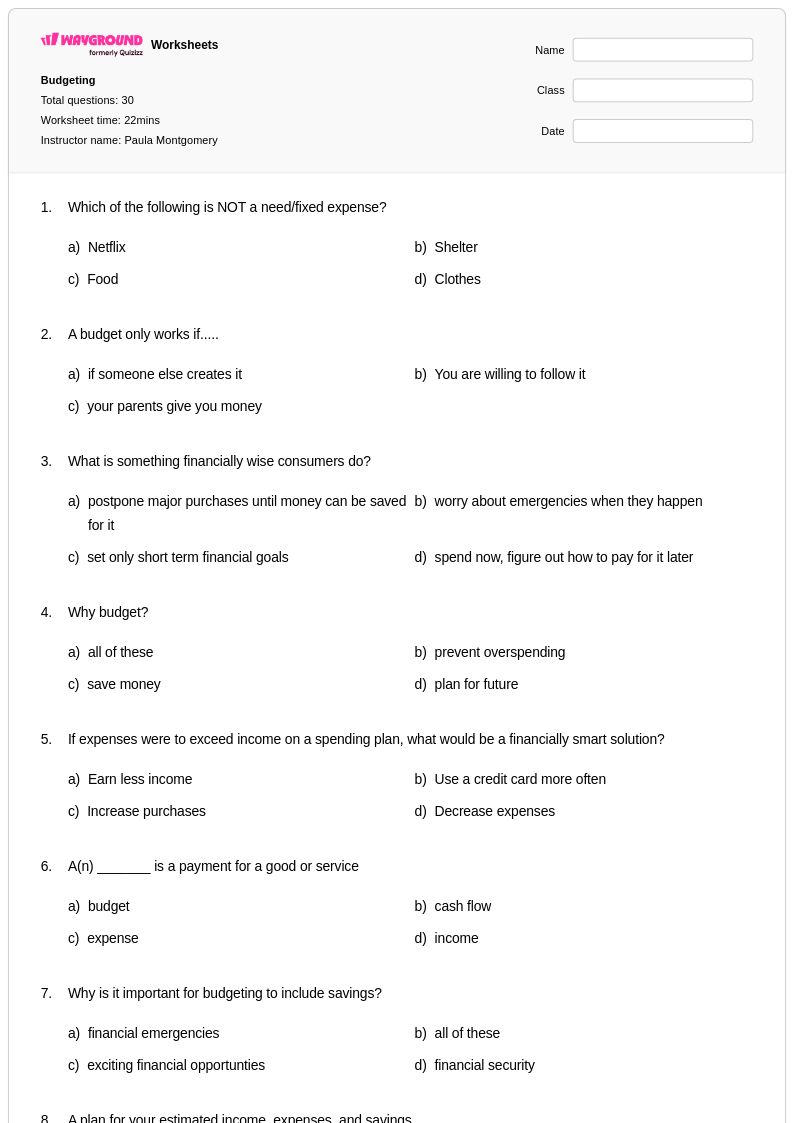

30 Hỏi

8th

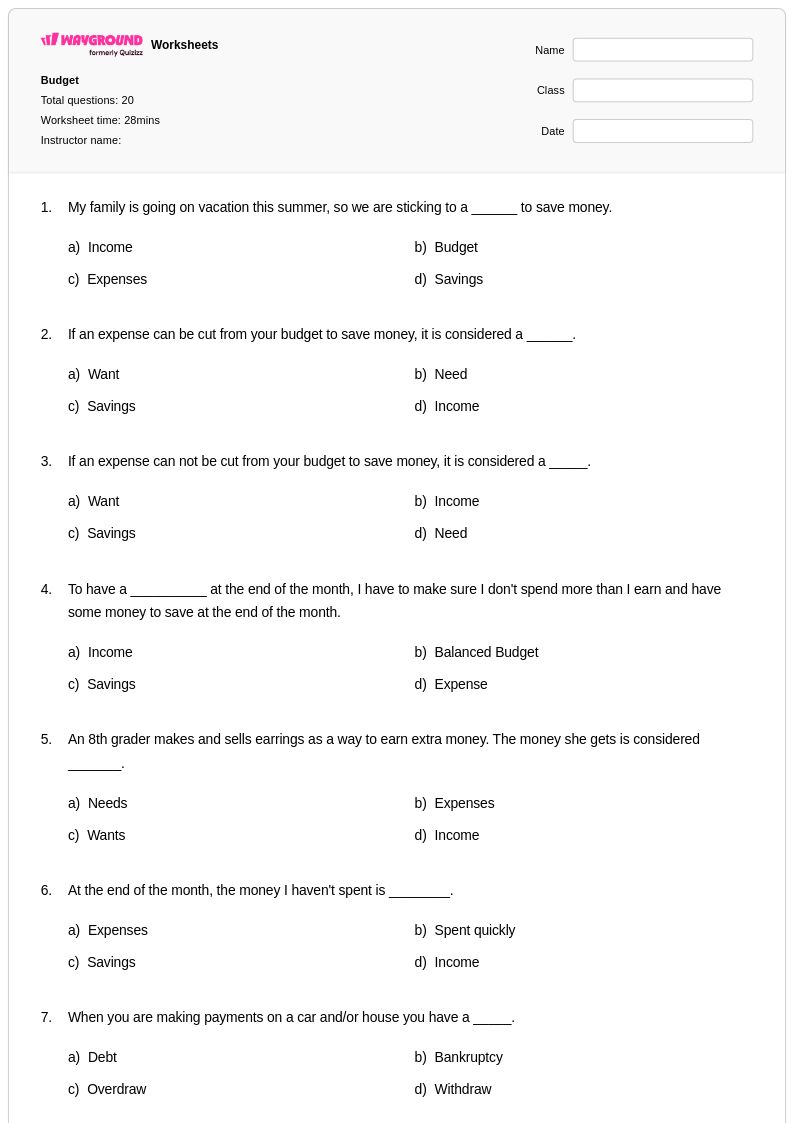

20 Hỏi

7th - 8th

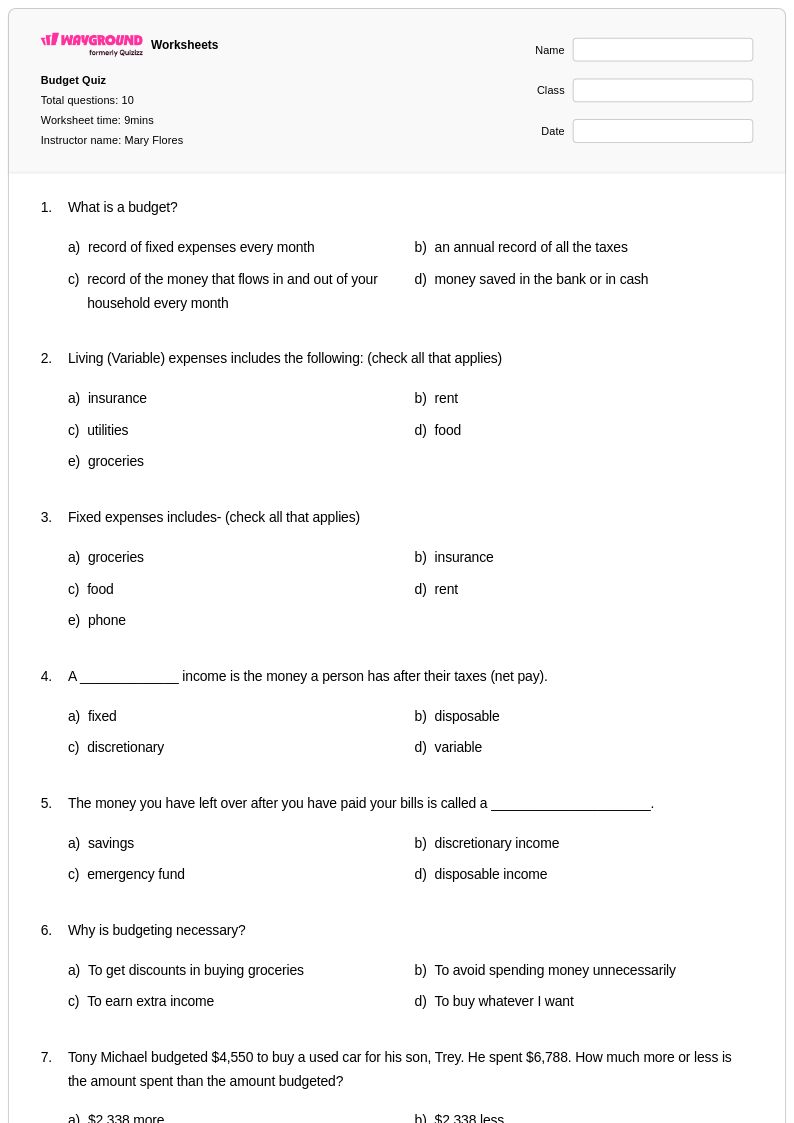

10 Hỏi

8th - 12th

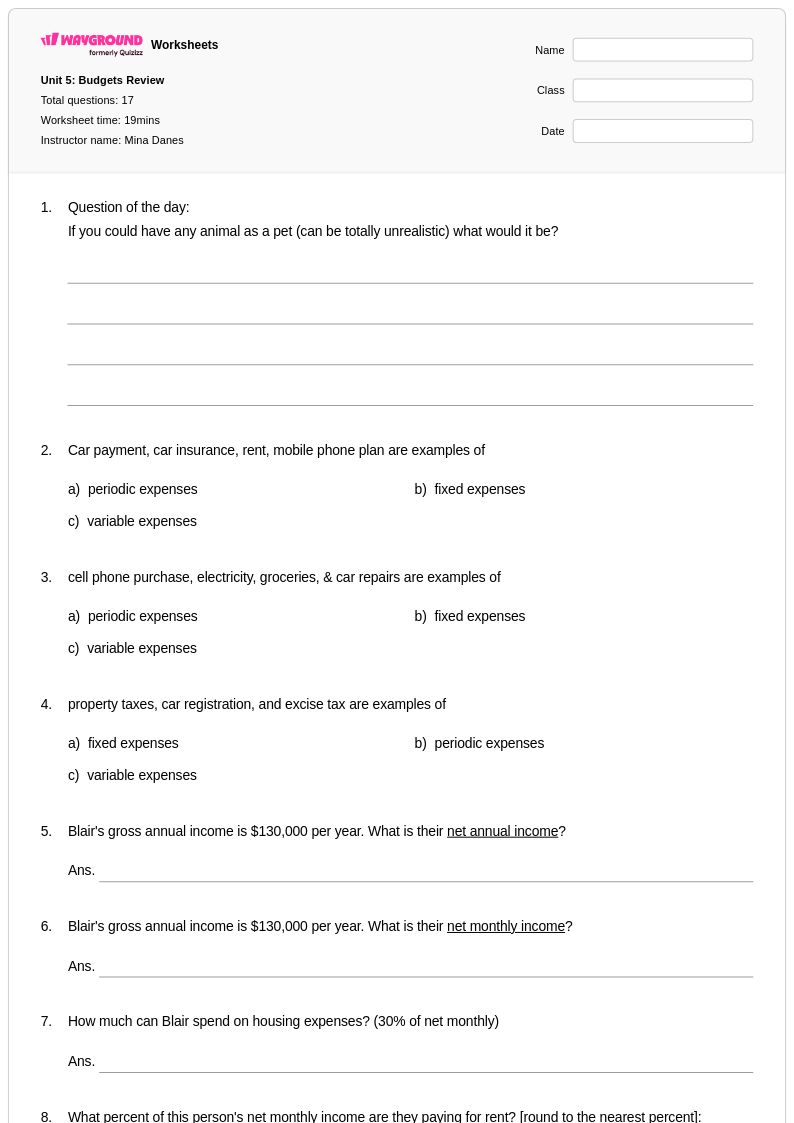

17 Hỏi

6th - PD

23 Hỏi

7th - Uni

10 Hỏi

6th - 12th

20 Hỏi

8th

10 Hỏi

6th - 8th

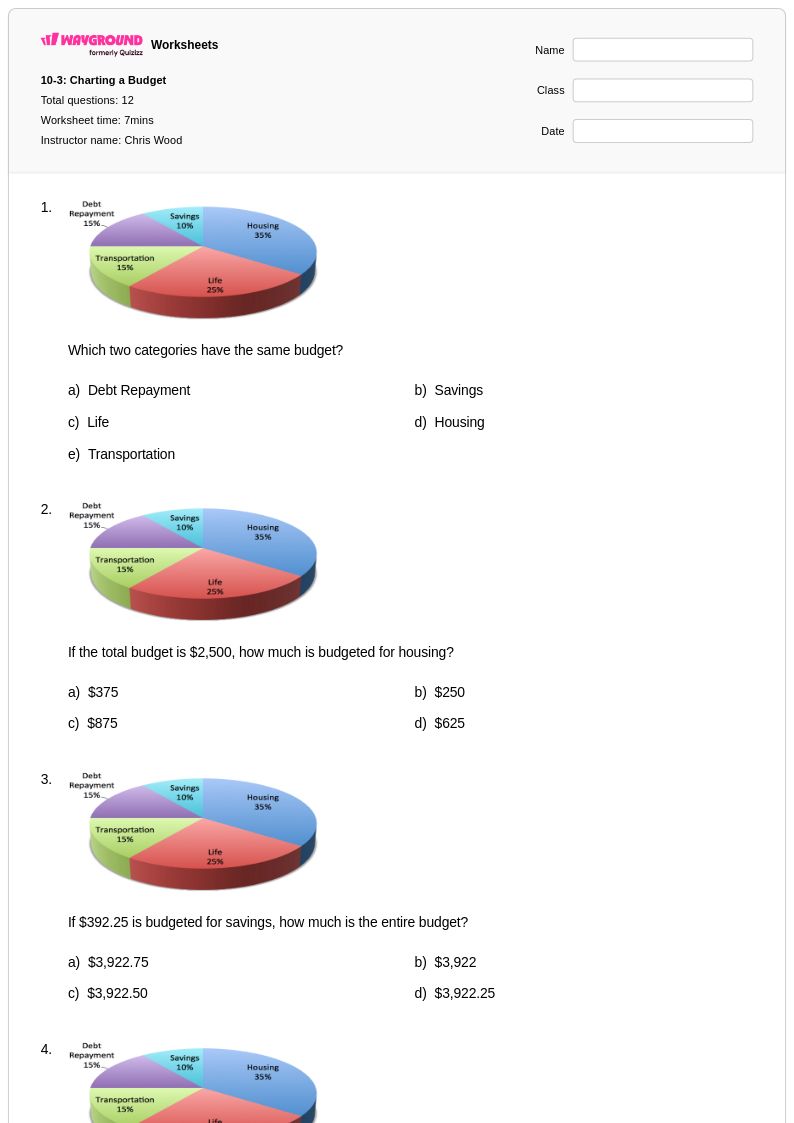

12 Hỏi

7th - 12th

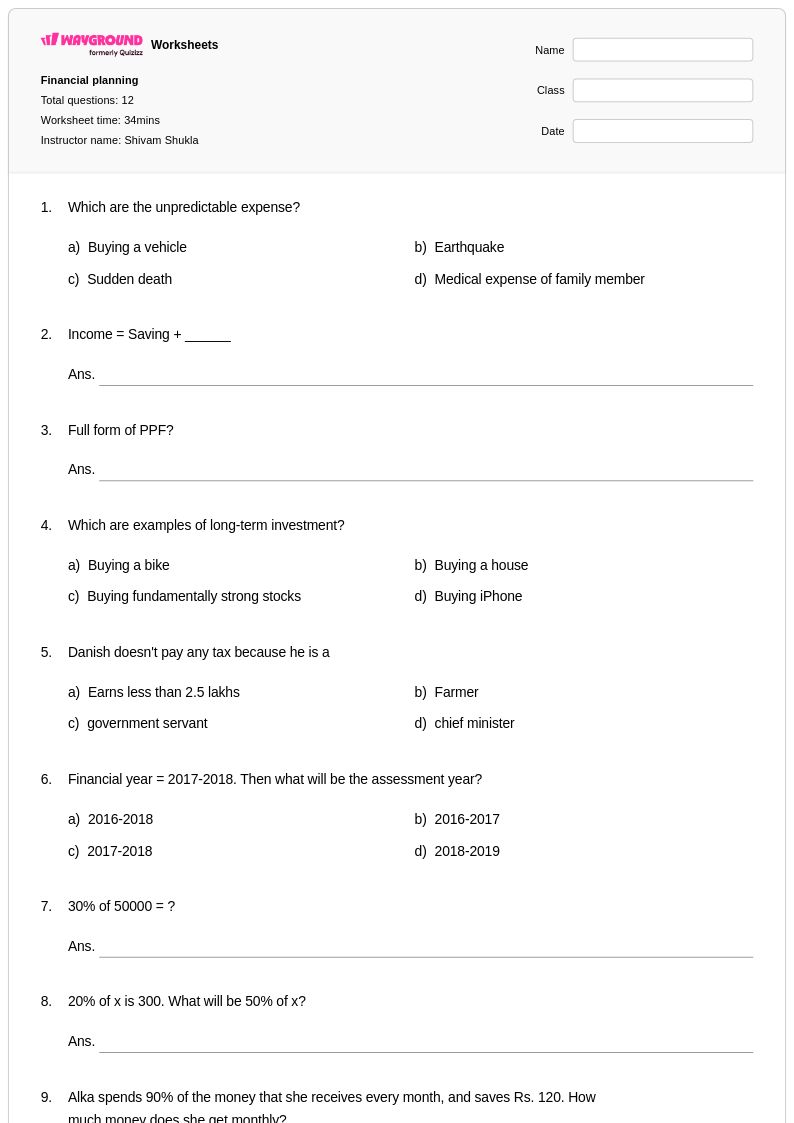

12 Hỏi

8th - 10th

10 Hỏi

7th - 8th

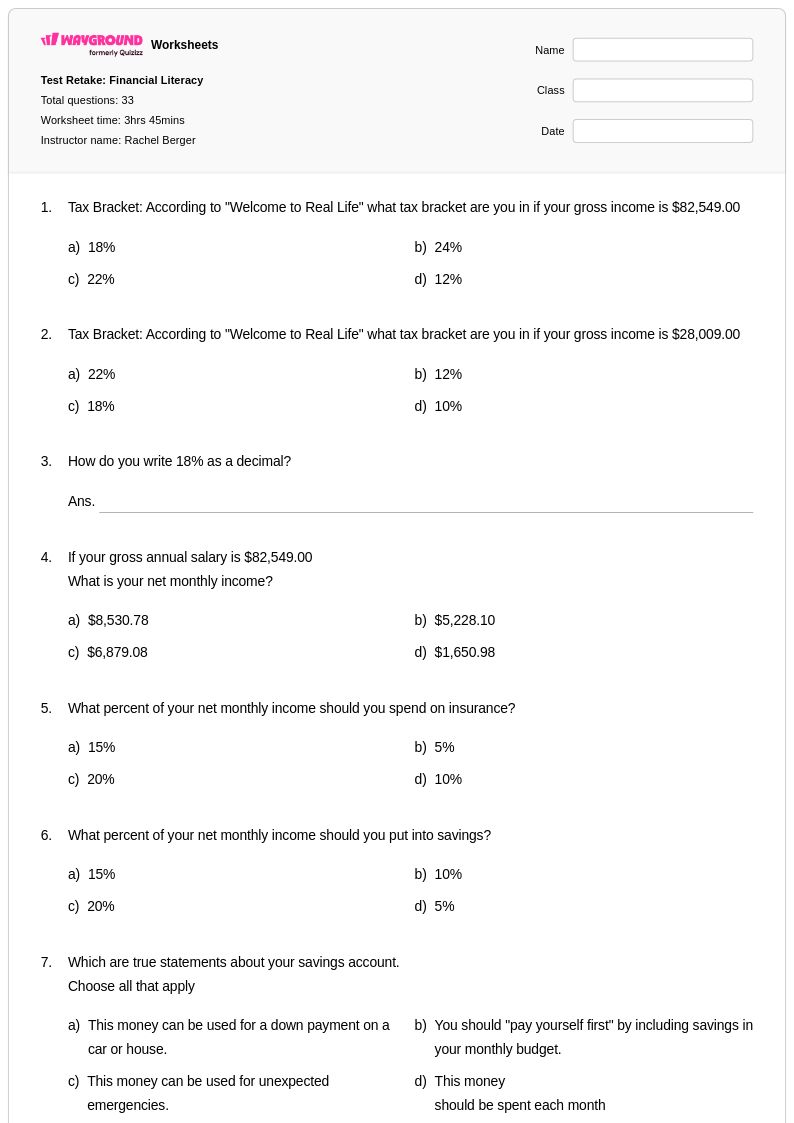

33 Hỏi

8th

10 Hỏi

8th

10 Hỏi

5th - 12th

15 Hỏi

8th

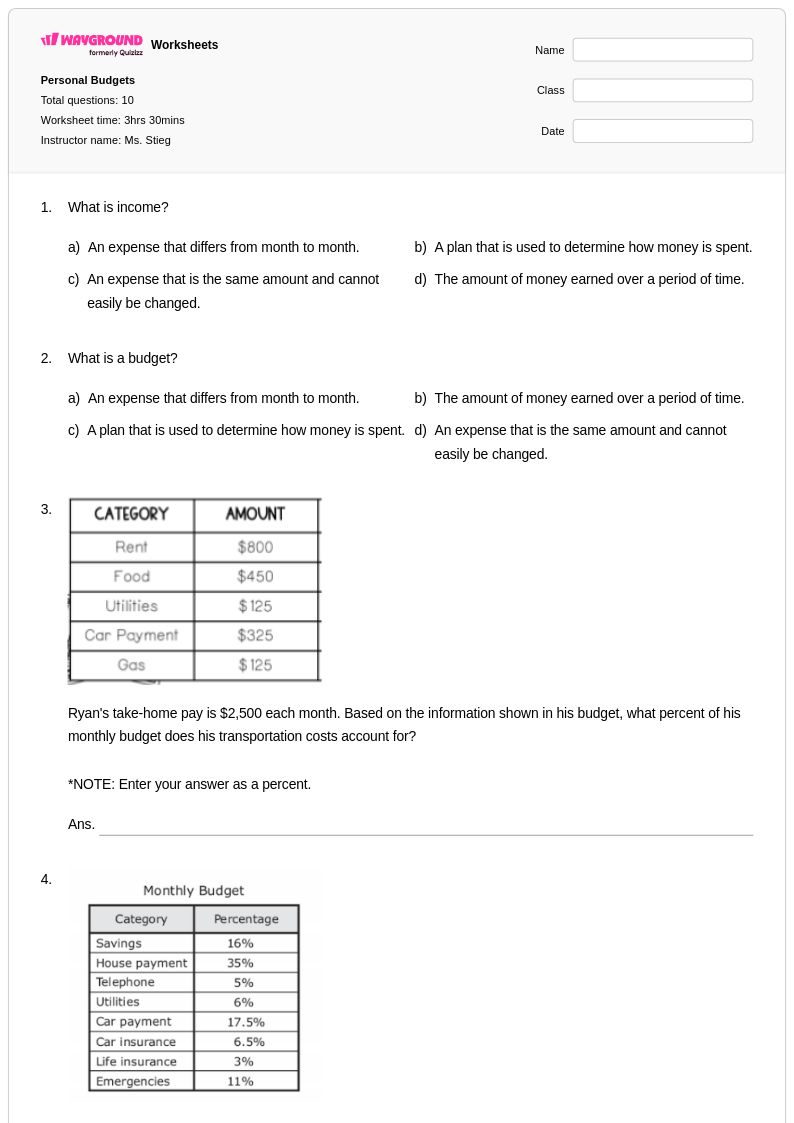

12 Hỏi

6th - 12th

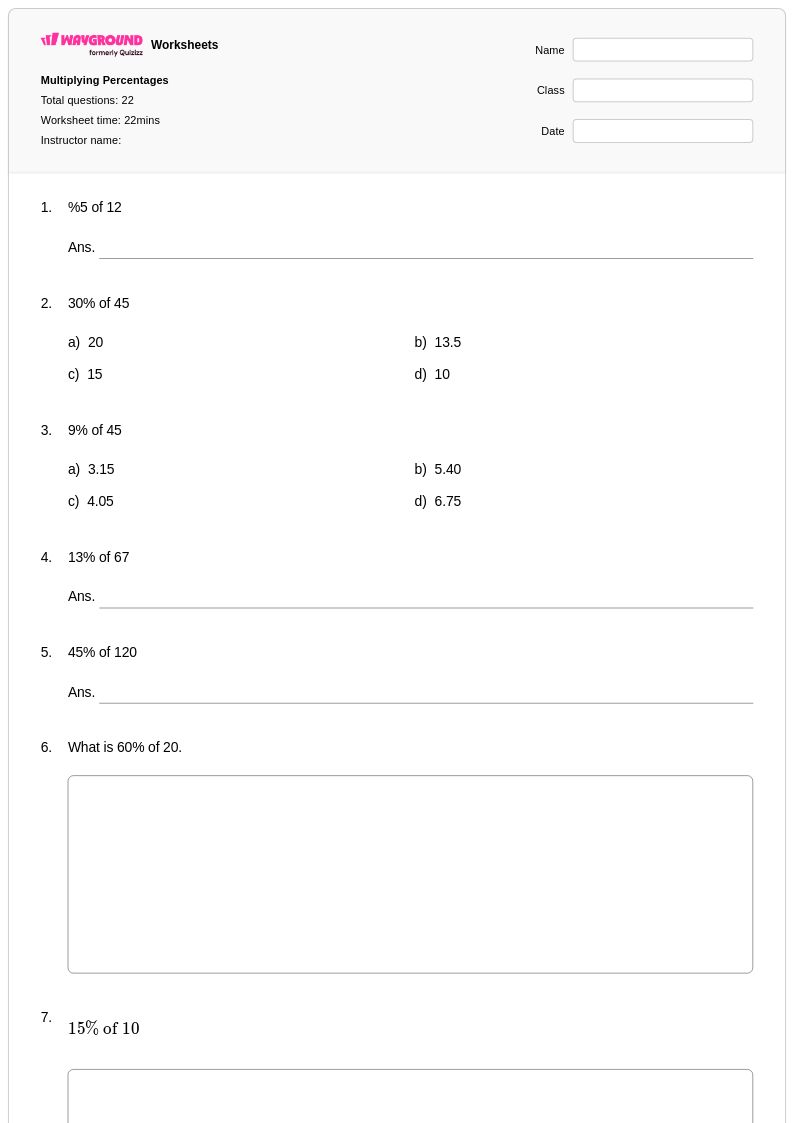

22 Hỏi

6th - 8th

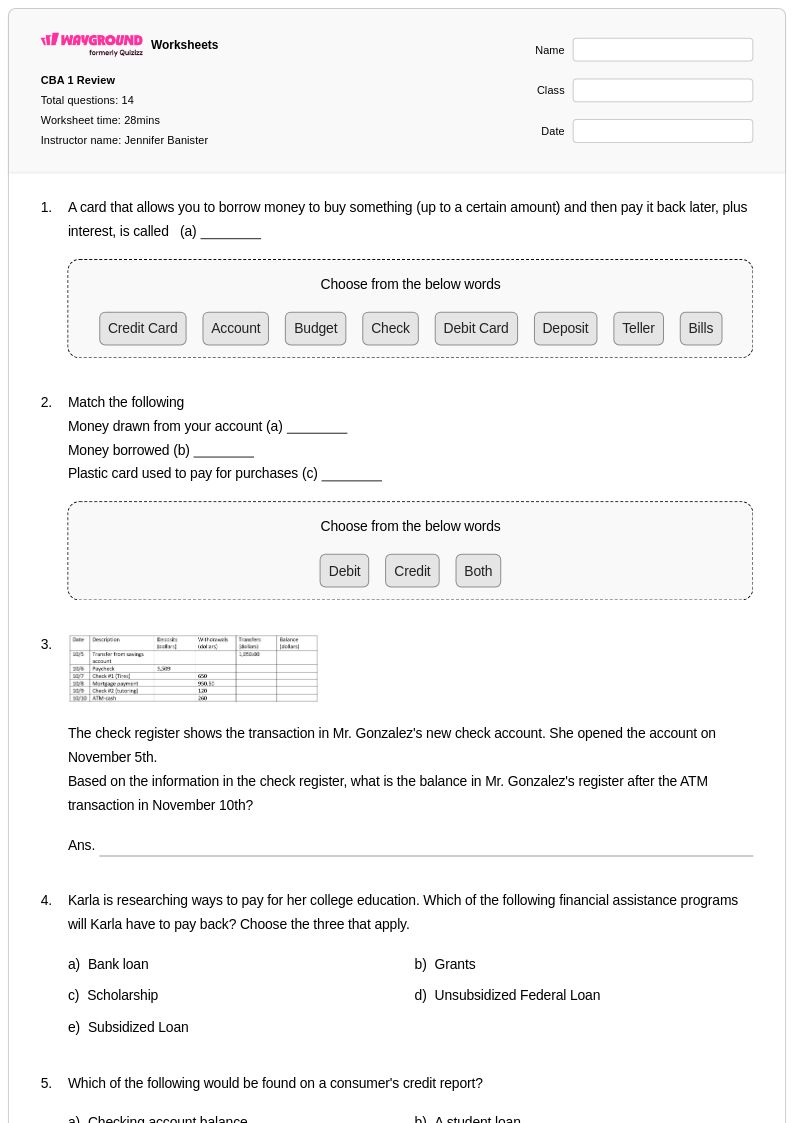

14 Hỏi

6th - 8th

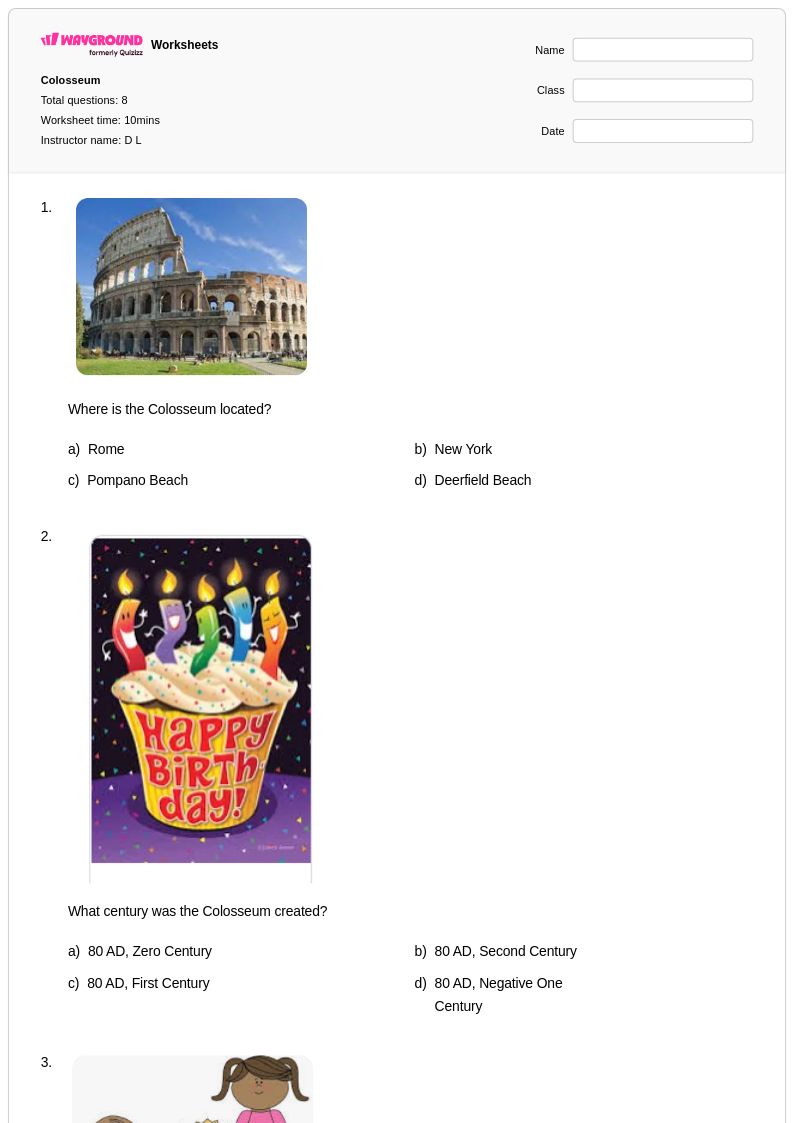

8 Hỏi

6th - 8th

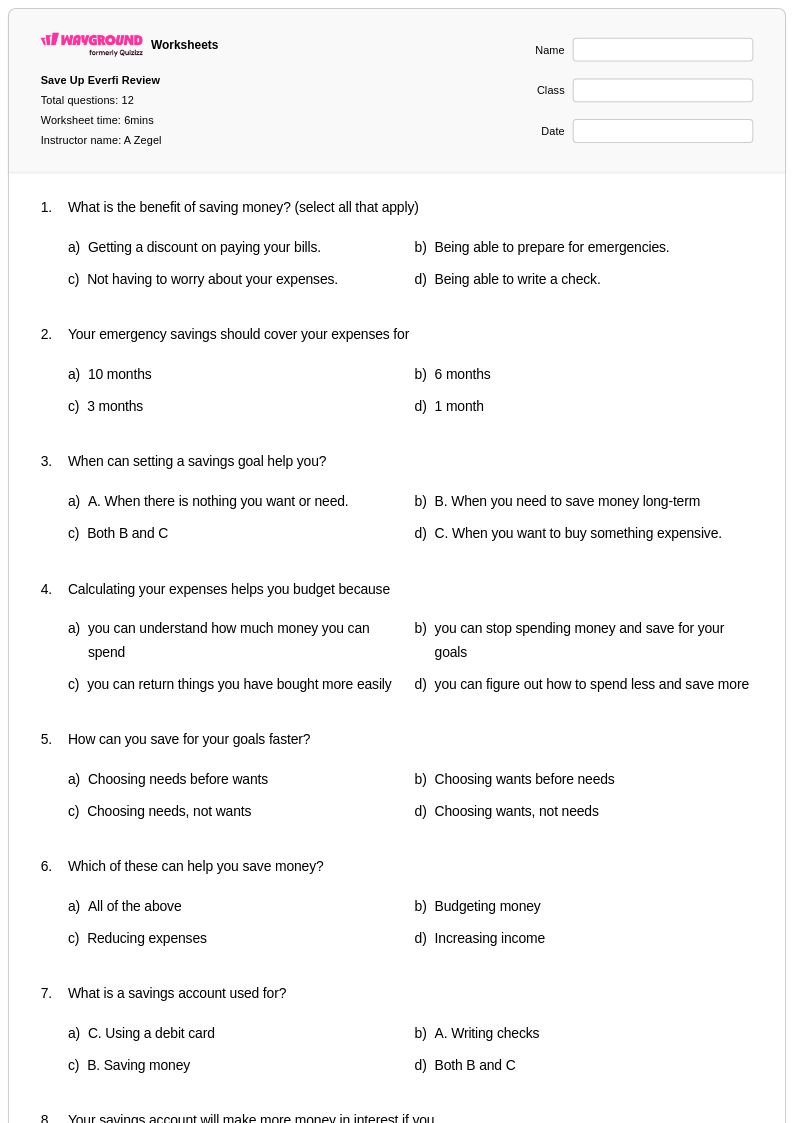

12 Hỏi

8th

25 Hỏi

4th - 8th

35 Hỏi

8th - Uni

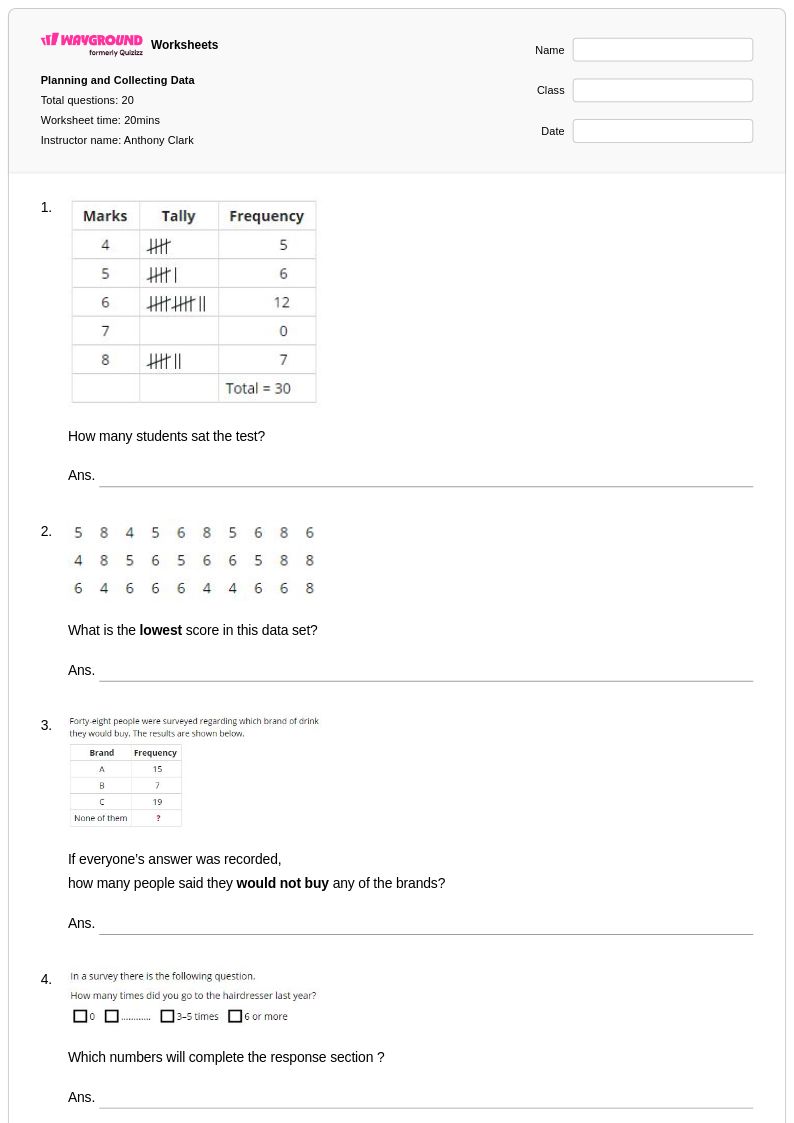

20 Hỏi

7th - Uni

15 Hỏi

8th - Uni

Khám phá các bảng tính chủ đề khác cho grade 8

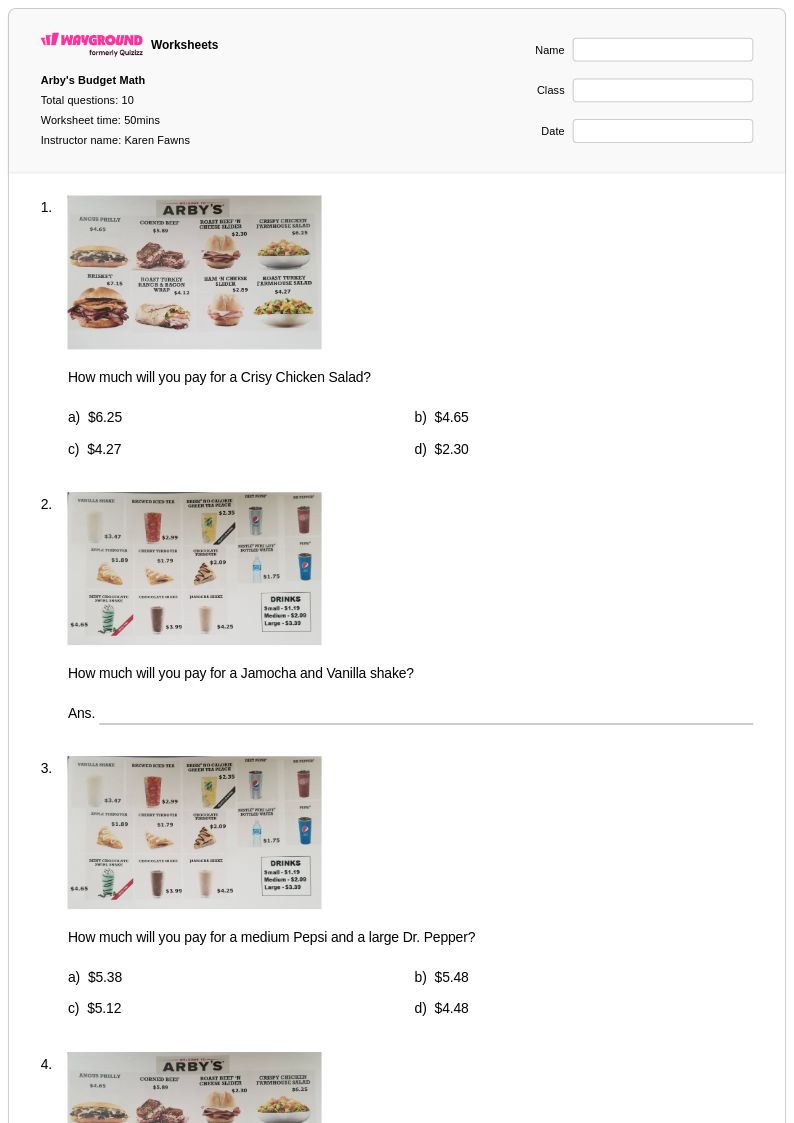

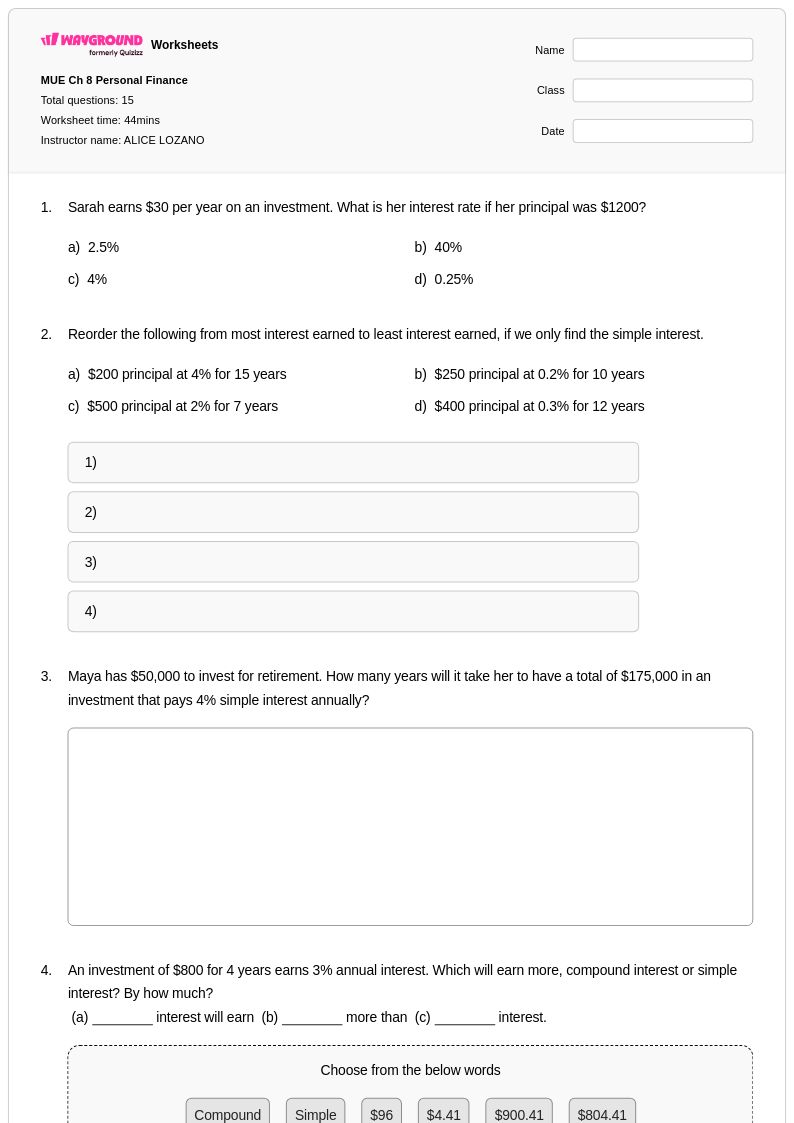

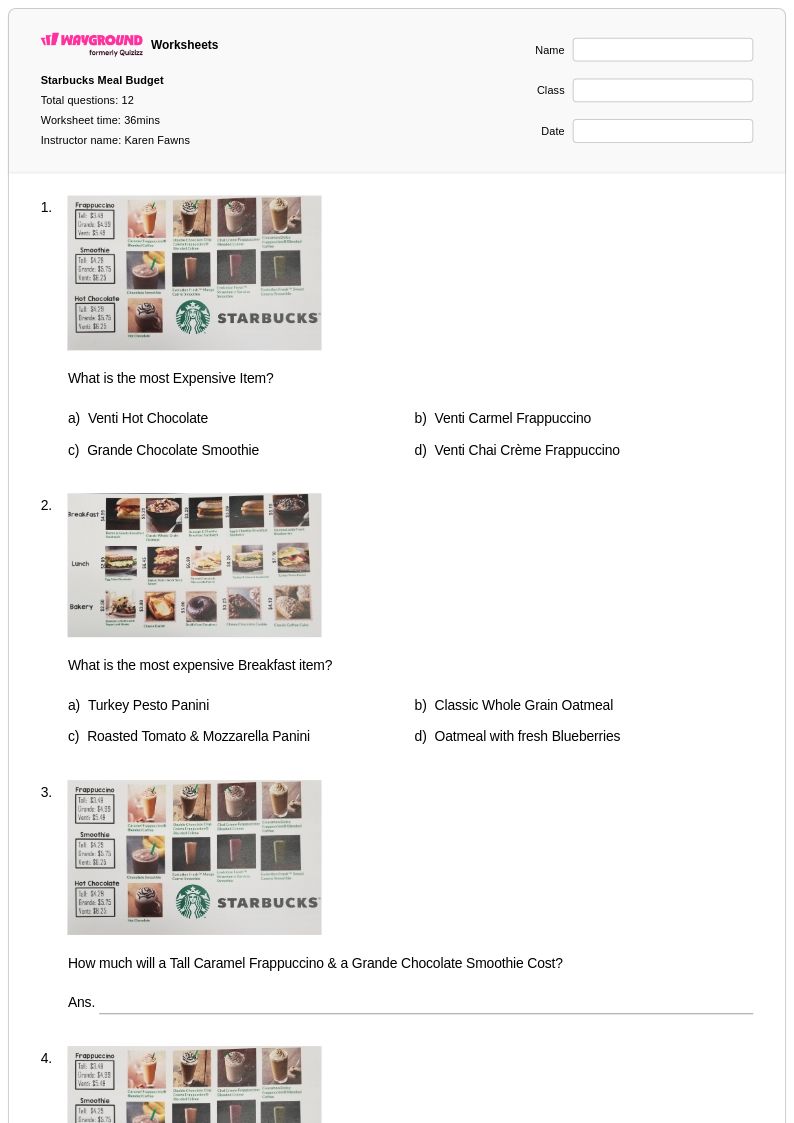

Explore printable Budget Planning worksheets for Grade 8

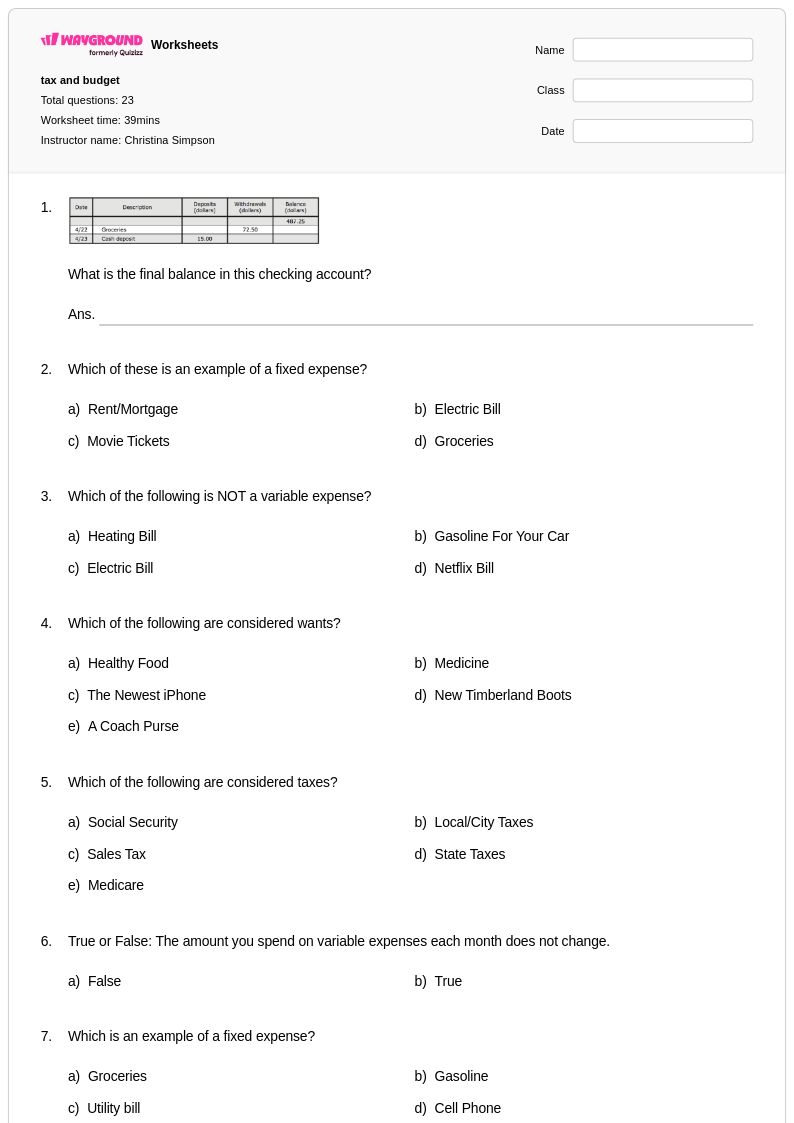

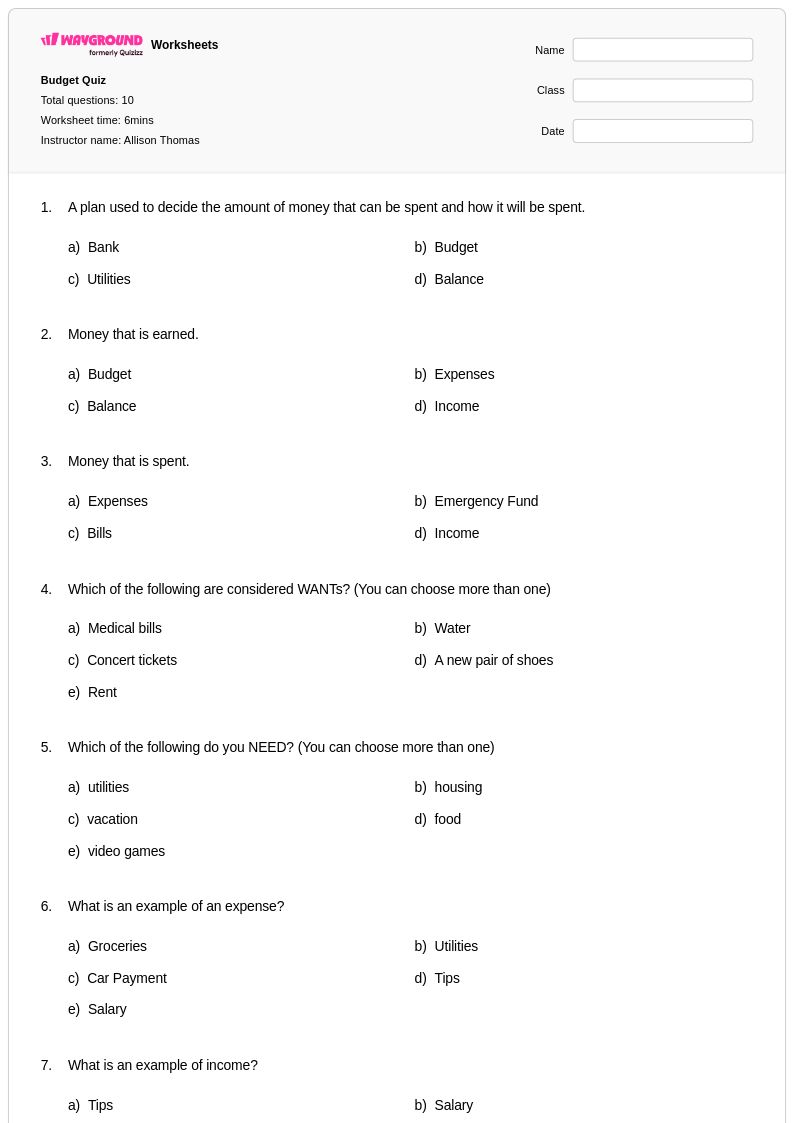

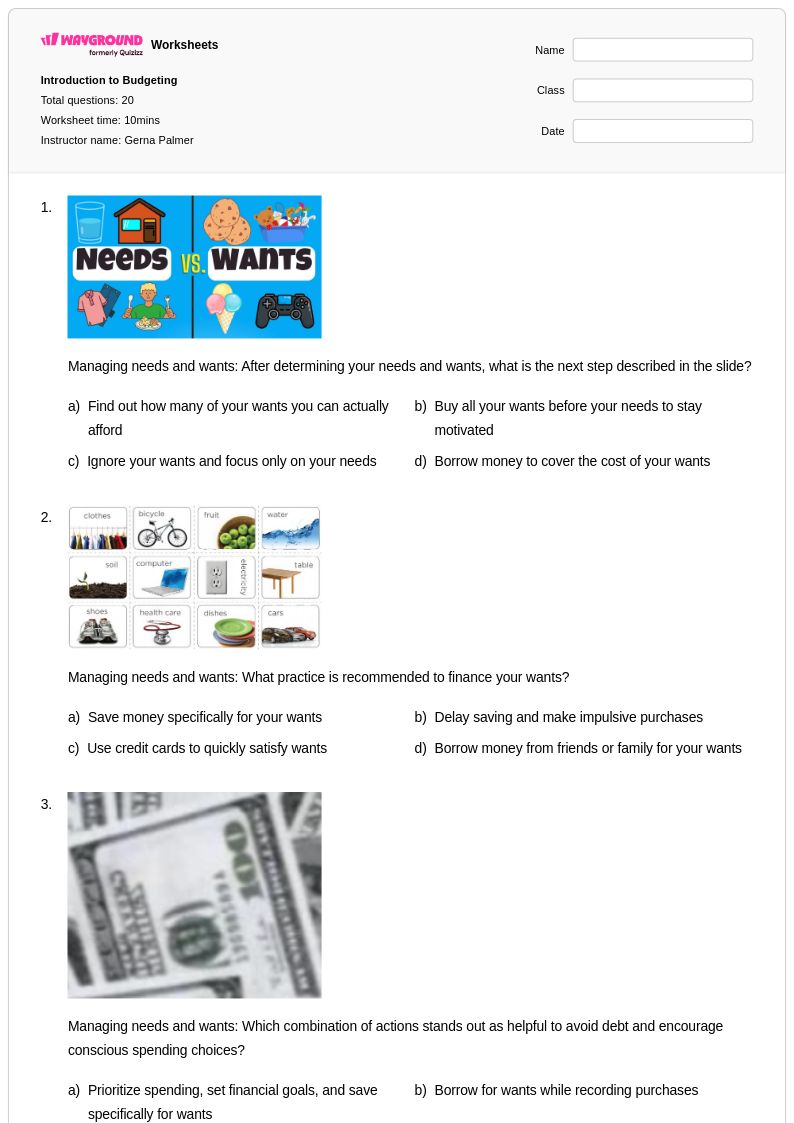

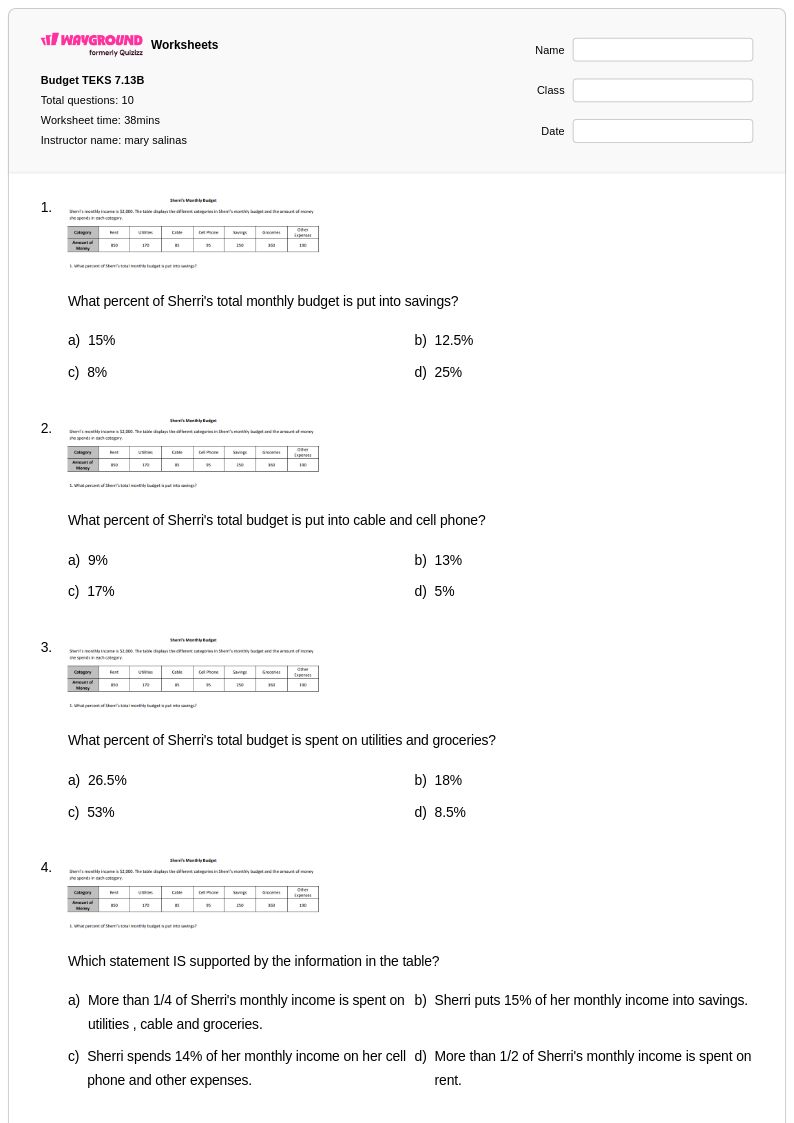

Budget planning worksheets for Grade 8 students available through Wayground (formerly Quizizz) provide comprehensive practice in essential personal finance skills that form the foundation of lifelong financial literacy. These carefully designed resources guide eighth-grade learners through the fundamental concepts of creating, analyzing, and managing personal budgets, including income tracking, expense categorization, and spending prioritization. Students develop critical mathematical reasoning skills as they work through practice problems involving percentage calculations, ratio comparisons, and real-world scenarios that require balancing wants versus needs. Each worksheet collection includes detailed answer keys that enable independent learning and self-assessment, while the free printable format ensures accessibility for diverse classroom environments and home study situations.

Wayground (formerly Quizizz) empowers educators with millions of teacher-created budget planning resources specifically aligned with Grade 8 mathematics and financial literacy standards, offering robust search and filtering capabilities that streamline lesson planning and curriculum integration. Teachers can easily differentiate instruction by selecting from worksheets that range from basic budget creation exercises to complex financial decision-making scenarios, with flexible customization tools that allow modifications to meet individual student needs. The platform's comprehensive collection is available in both printable pdf formats and interactive digital versions, supporting varied teaching approaches and enabling seamless transitions between classroom instruction, independent practice, and homework assignments. These versatile resources prove invaluable for targeted skill remediation, enrichment activities for advanced learners, and ongoing assessment of student progress in financial literacy concepts.