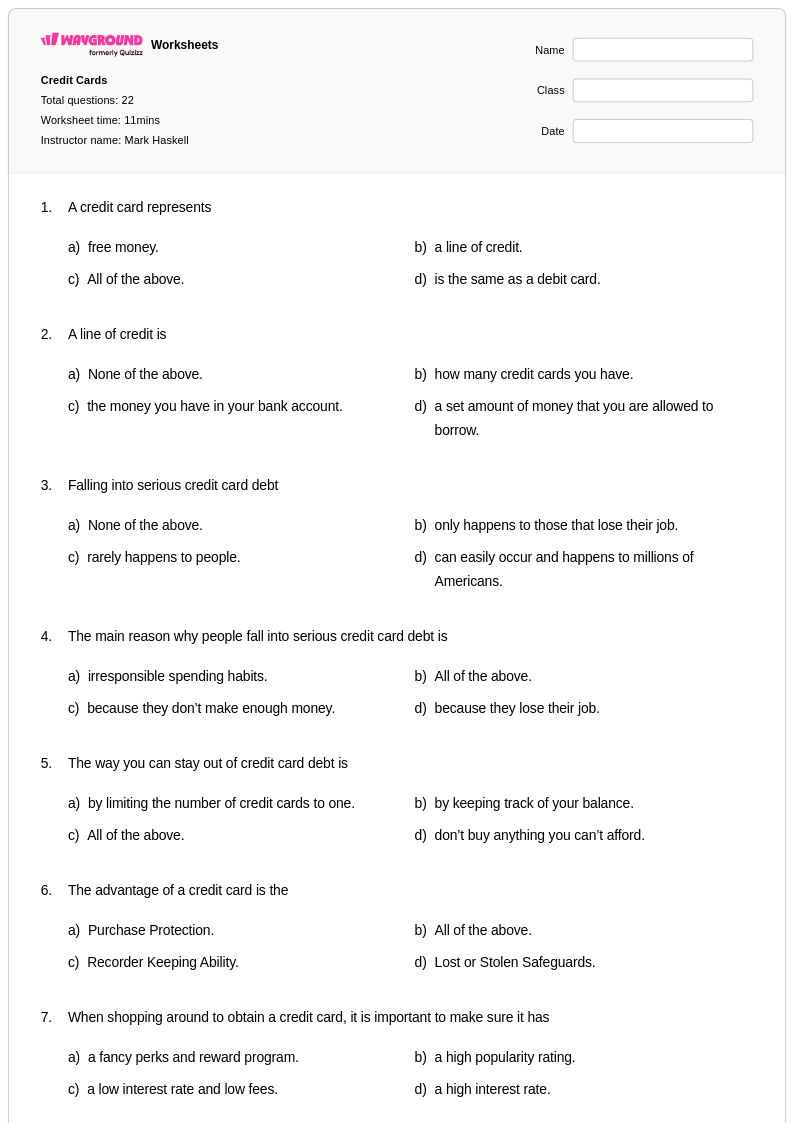

22 Q

5th - Uni

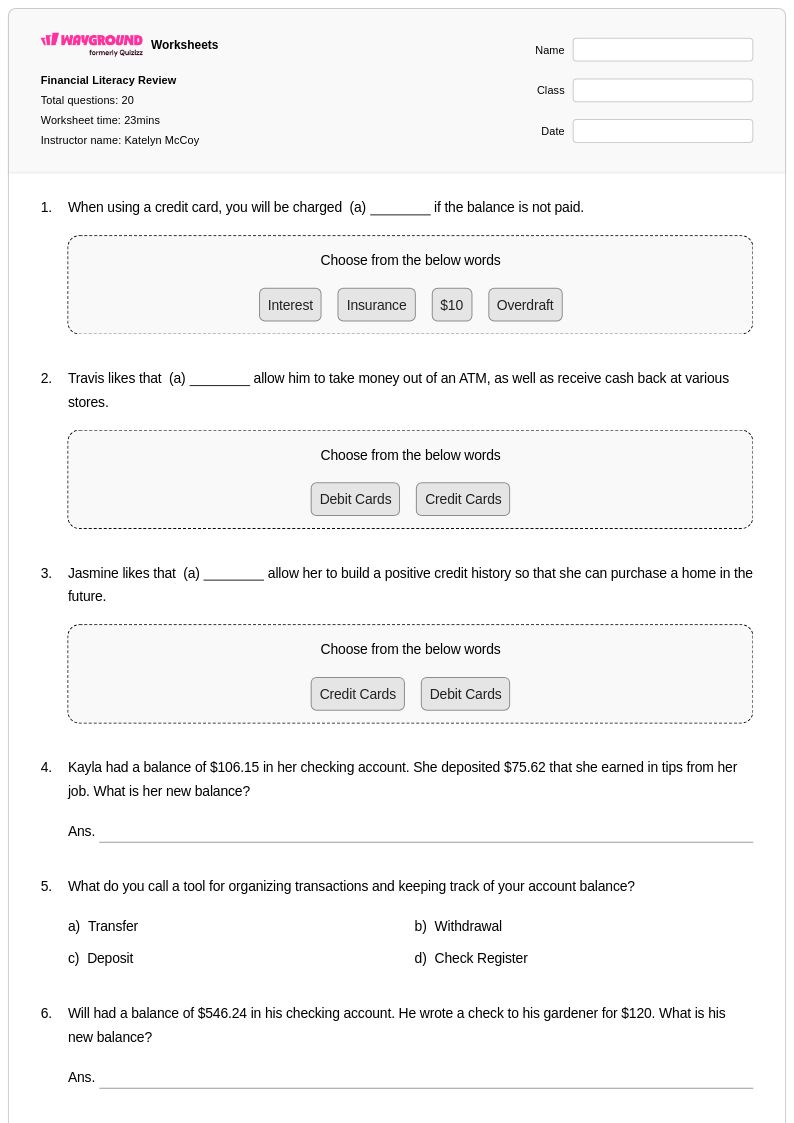

20 Q

6th

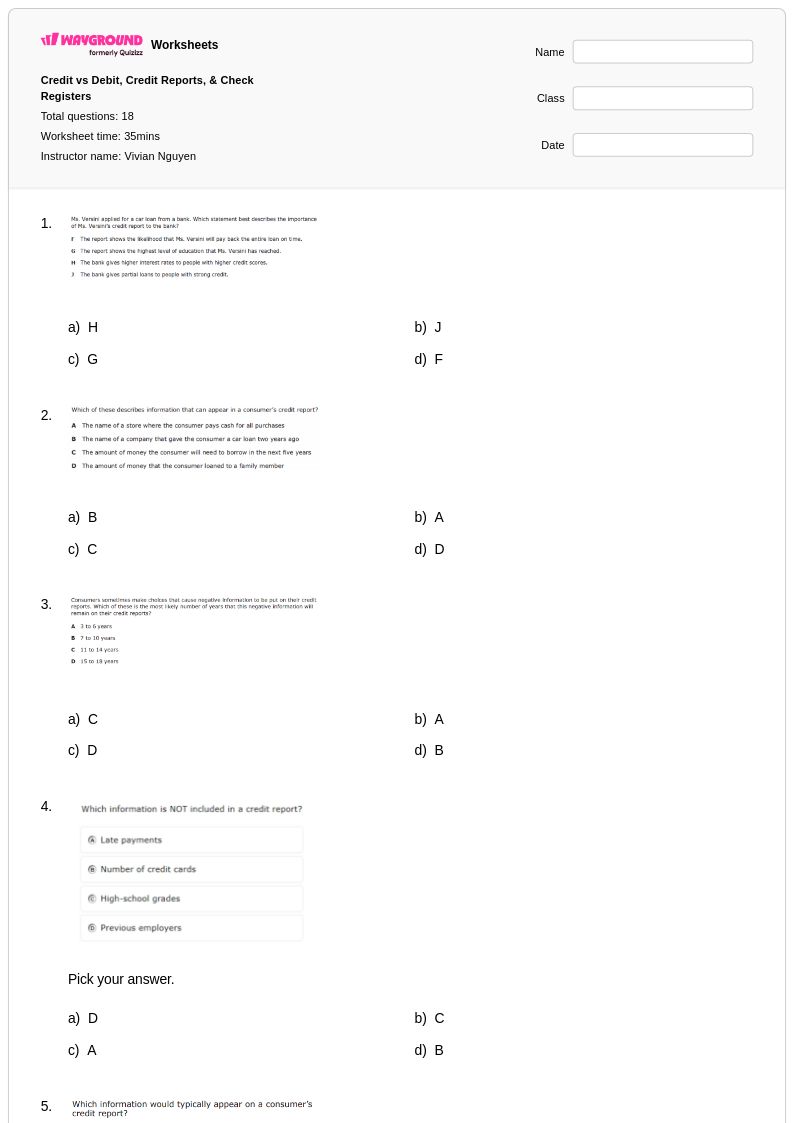

18 Q

6th - 8th

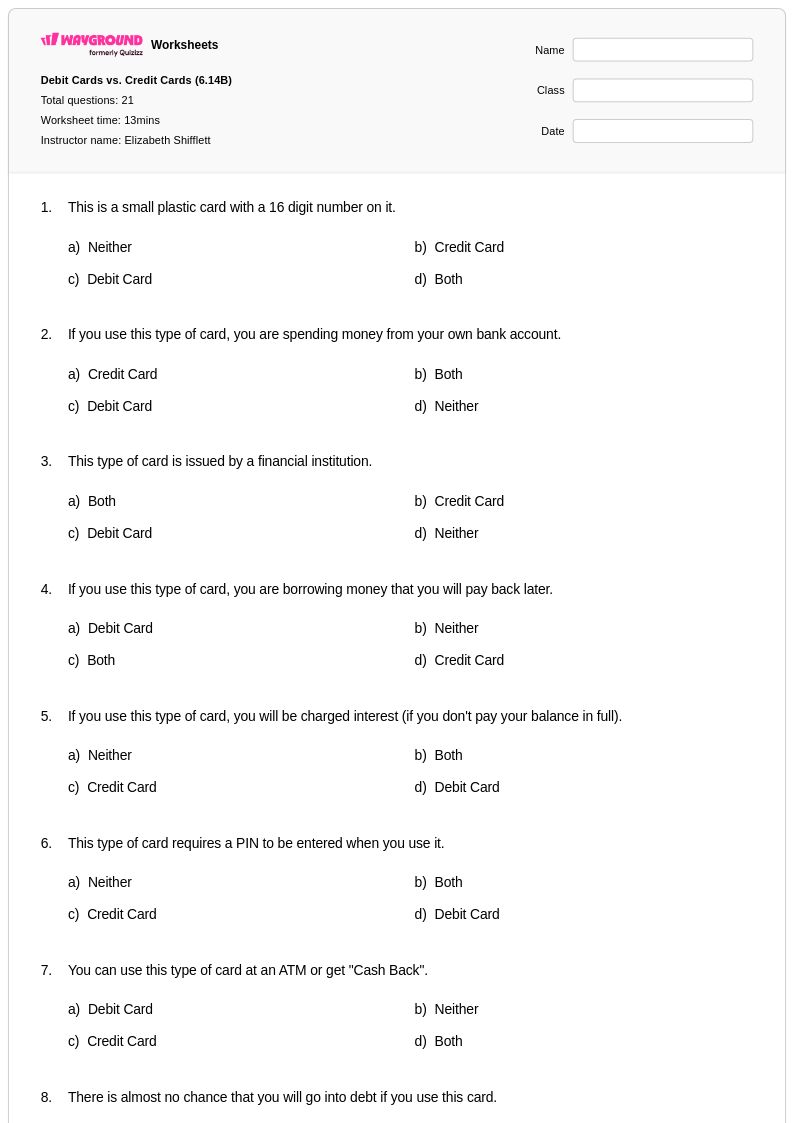

21 Q

6th

14 Q

6th

24 Q

6th

13 Q

6th - 8th

14 Q

6th

12 Q

6th

10 Q

6th

20 Q

6th

20 Q

6th

18 Q

6th

34 Q

6th

10 Q

6th - 8th

18 Q

6th

10 Q

6th - 7th

13 Q

6th

19 Q

6th

40 Q

6th

10 Q

6th

9 Q

6th

18 Q

6th

14 Q

6th

Explore Credit Card Statements Worksheets by Grades

Explore Other Subject Worksheets for grade 6

Explore printable Credit Card Statements worksheets for Grade 6

Credit card statements provide Grade 6 students with essential real-world financial literacy skills through carefully structured mathematics worksheets available on Wayground (formerly Quizizz). These comprehensive printables focus on developing students' ability to analyze monthly credit card statements, calculate interest charges, understand minimum payment requirements, and identify various fees and charges. The practice problems guide students through interpreting statement components such as previous balances, new purchases, payment due dates, and available credit limits. Each worksheet includes detailed answer keys that help students verify their calculations while building confidence in financial mathematics concepts. The free pdf resources emphasize critical thinking skills as students learn to evaluate spending patterns, calculate annual percentage rates, and understand the long-term financial impact of carrying credit card balances.

Wayground (formerly Quizizz) empowers educators with millions of teacher-created credit card statement worksheets designed specifically for Grade 6 financial literacy instruction. The platform's robust search and filtering capabilities allow teachers to quickly locate resources that align with state mathematics standards and match their specific classroom needs. Differentiation tools enable educators to modify worksheets for varying skill levels, while the flexible customization features support both remediation for struggling learners and enrichment activities for advanced students. Teachers can access these materials in both printable and digital formats, including downloadable pdfs, making lesson planning more efficient and adaptable to different learning environments. The extensive collection supports targeted skill practice through varied problem types, helping educators address individual student needs while building essential financial literacy competencies that prepare students for responsible money management.