8 Q

5th

10 Q

3rd

8 Q

5th

13 Q

5th

12 Q

7th

17 Q

5th

18 Q

7th

25 Q

4th

23 Q

9th - 12th

11 Q

5th

15 Q

9th - 12th

21 Q

9th - 12th

22 Q

9th - 12th

19 Q

4th

22 Q

9th - 12th

10 Q

5th

23 Q

7th

22 Q

5th

65 Q

Uni

26 Q

5th

21 Q

7th

80 Q

5th

23 Q

9th - 12th

17 Q

8th

Explore Worksheets by Grade

Explore Worksheets by Subjects

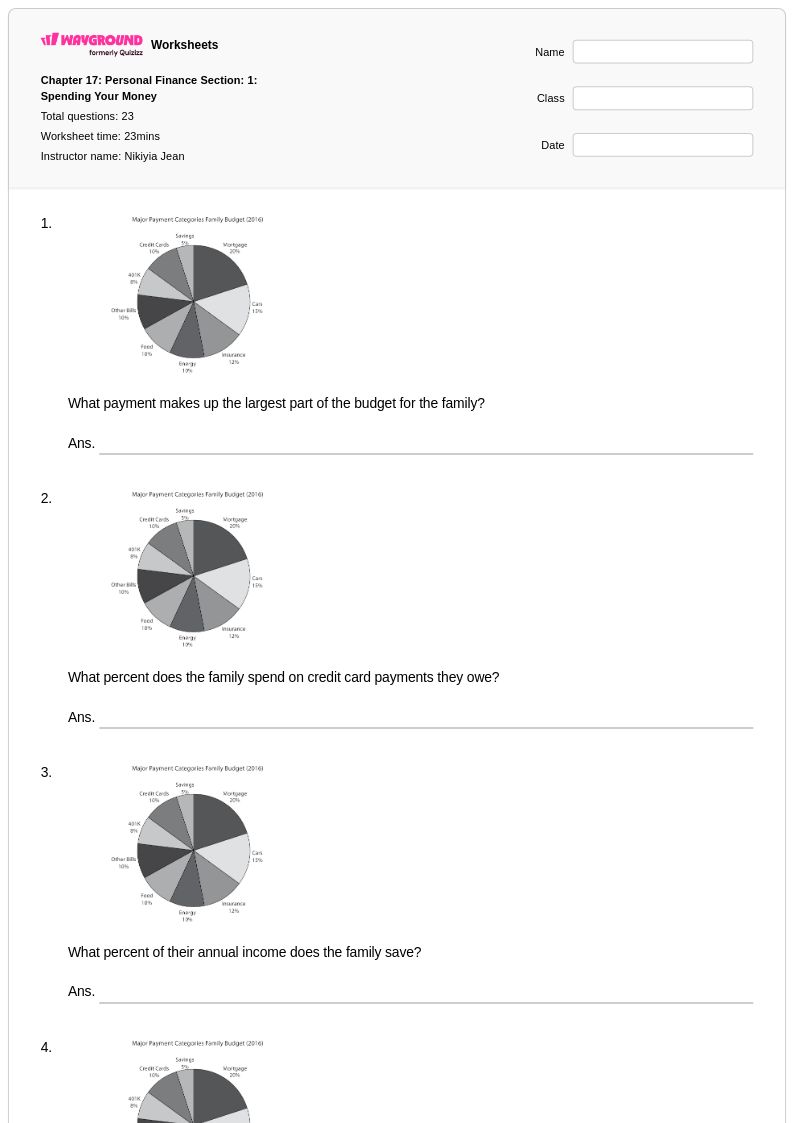

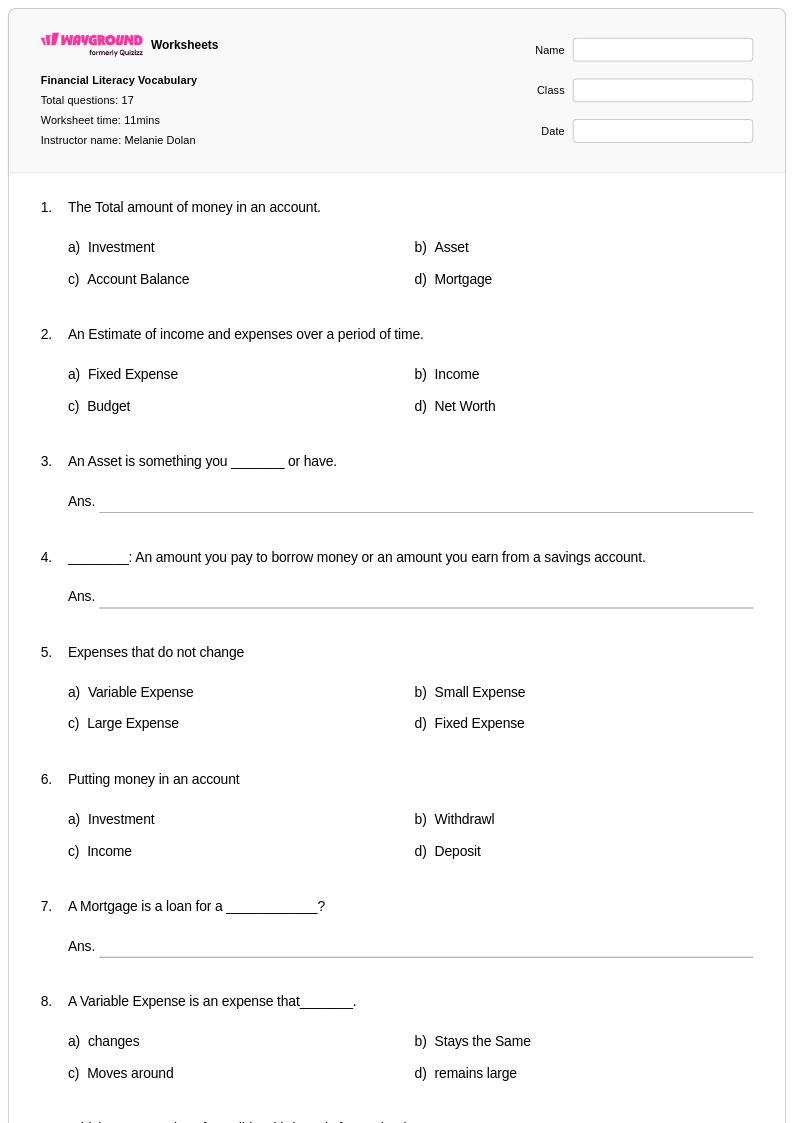

Explore printable Income and Expenses worksheets

Income and expenses worksheets available through Wayground (formerly Quizizz) provide students with essential practice in understanding personal financial management fundamentals. These comprehensive resources help learners develop critical skills in categorizing different types of income sources, tracking various expense categories, and analyzing spending patterns to make informed financial decisions. The worksheets feature realistic scenarios that challenge students to distinguish between needs and wants, calculate monthly budgets, and identify areas for potential savings. Each worksheet collection includes detailed answer keys that allow students to verify their calculations and understanding, while the free printable format makes these resources accessible for classroom use, homework assignments, or independent study sessions.

Wayground (formerly Quizizz) empowers educators with millions of teacher-created resources specifically designed to support income and expenses instruction across diverse learning environments. The platform's robust search and filtering capabilities enable teachers to quickly locate worksheets that align with their curriculum standards and match their students' skill levels, while differentiation tools allow for seamless customization to accommodate various learning needs within the same classroom. These flexible resources are available in both printable PDF format for traditional paper-based activities and digital formats for interactive online learning, making them ideal for remediation work with struggling students, enrichment activities for advanced learners, and regular skill practice sessions. Teachers can efficiently plan comprehensive financial literacy units by accessing worksheets that progress from basic income identification to complex budget analysis, ensuring students build a solid foundation in personal finance management.