10Q

12th

10Q

9th - 12th

8Q

5th

16Q

7th

22Q

12th

15Q

7th

37Q

9th - 12th

20Q

12th

10Q

5th

15Q

7th

7Q

12th

18Q

12th

15Q

12th - Uni

10Q

12th

14Q

12th

9Q

4th

20Q

7th

13Q

7th

12Q

4th

15Q

9th

21Q

7th

8Q

5th

17Q

5th

Explorar hojas de trabajo por materias

Explore printable Tax Computation worksheets

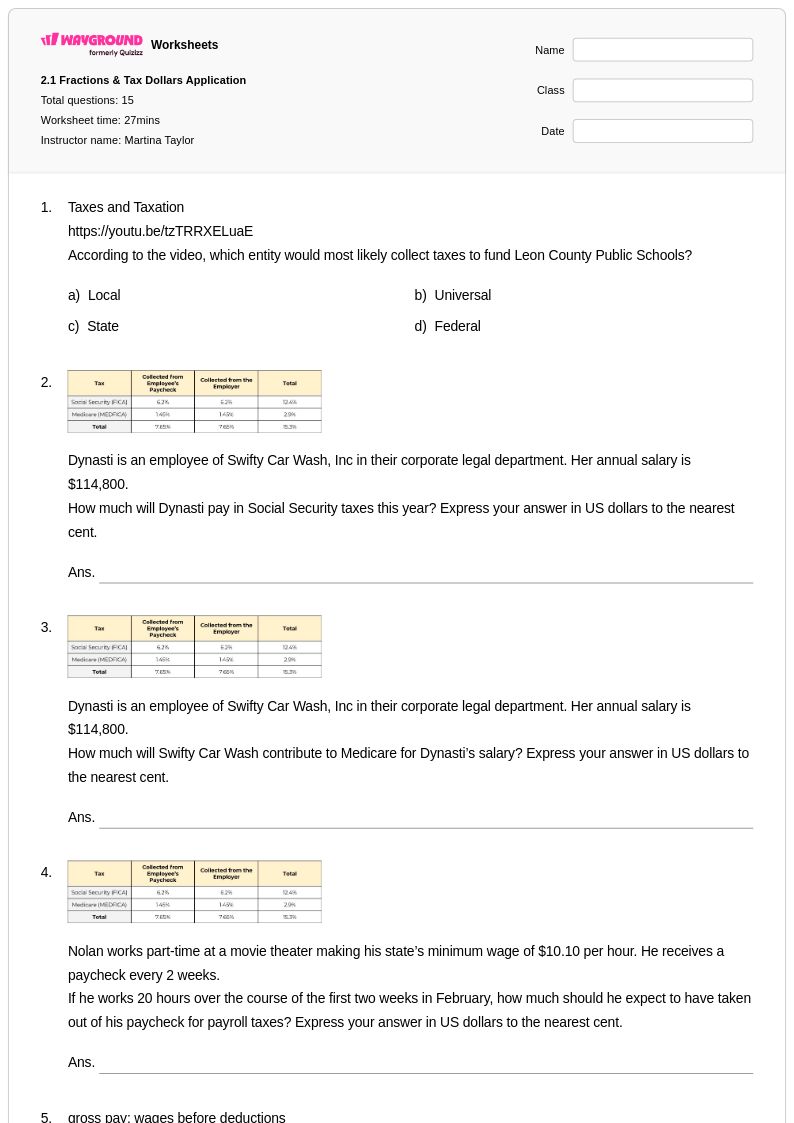

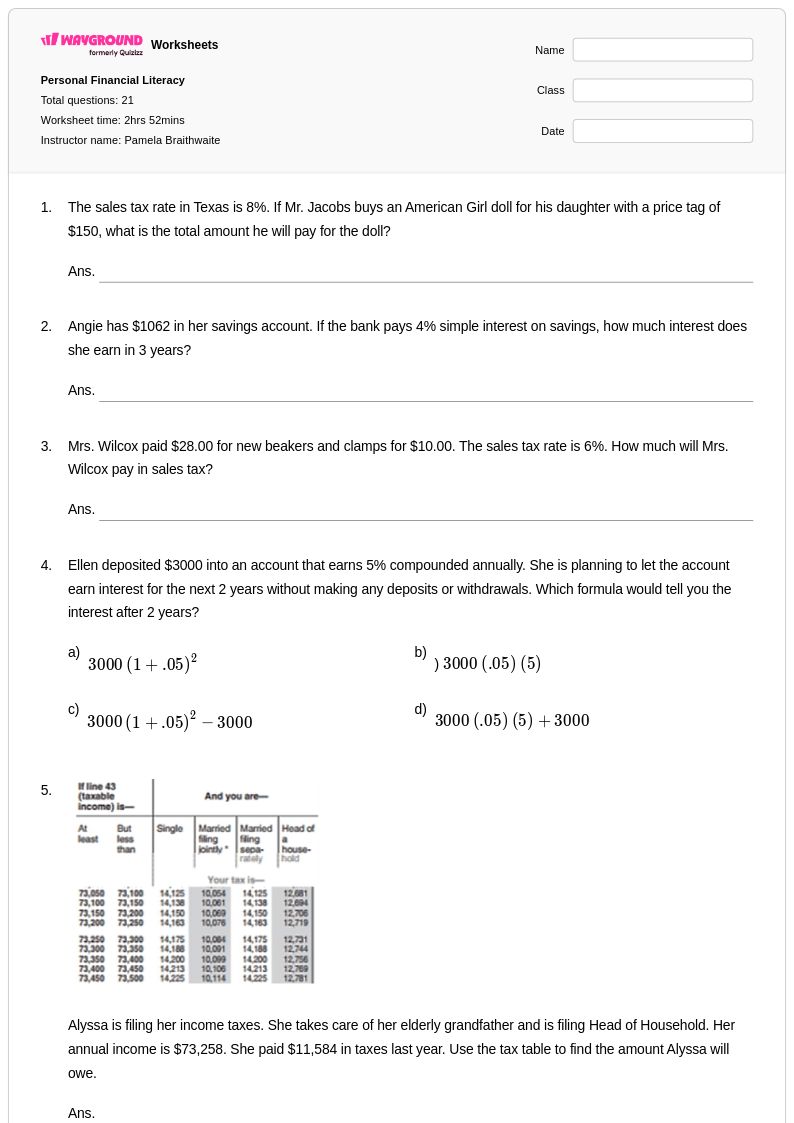

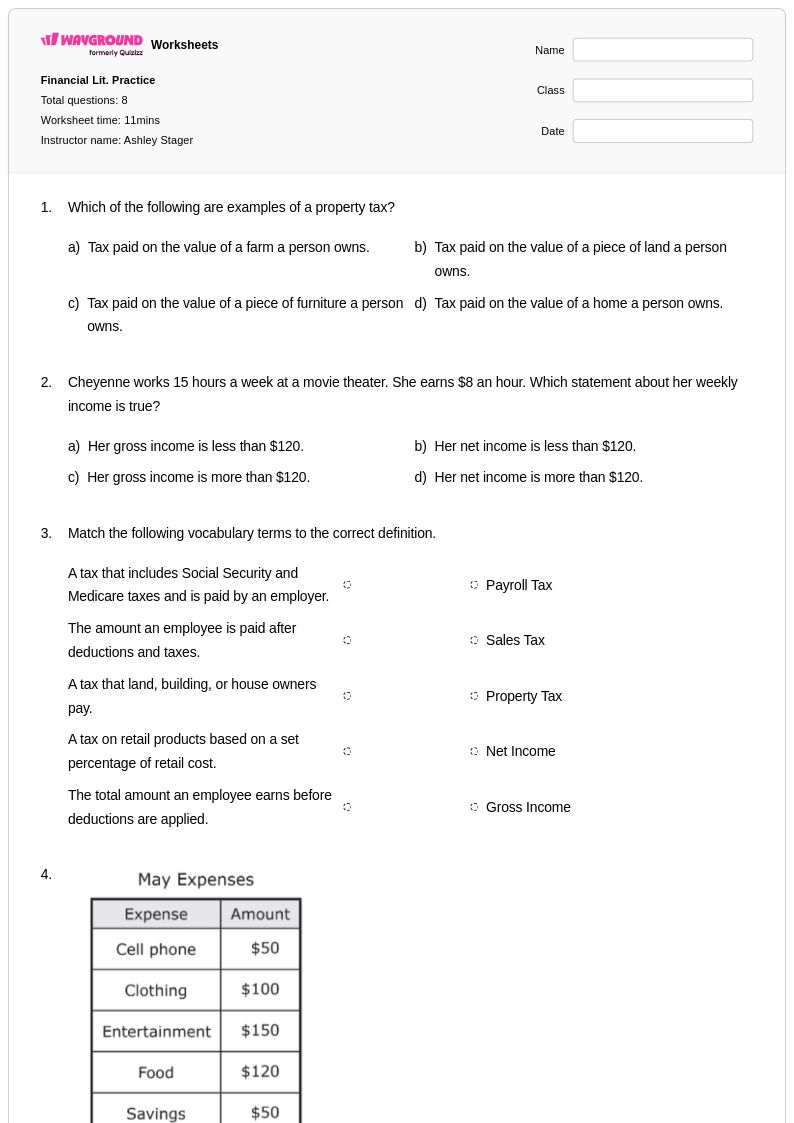

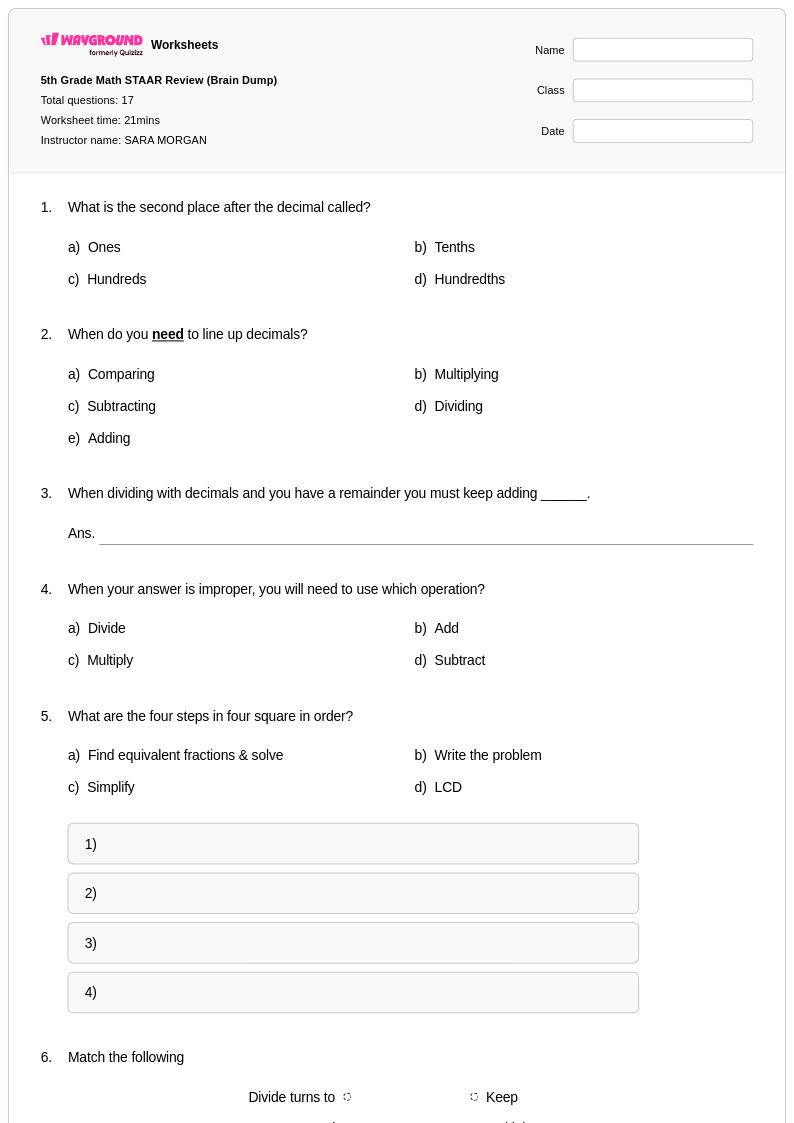

Tax computation worksheets available through Wayground (formerly Quizizz) provide comprehensive practice opportunities for students to master the essential mathematical skills required for understanding and calculating various types of taxes. These expertly designed resources focus on developing proficiency in computing income tax, sales tax, property tax, and payroll deductions through systematic problem-solving approaches that mirror real-world scenarios. Students work through carefully structured practice problems that build their confidence in applying percentage calculations, understanding tax brackets, interpreting tax tables, and performing multi-step computations involving deductions and credits. Each worksheet collection includes detailed answer keys that enable self-assessment and independent learning, while the free printables offer flexibility for both classroom instruction and homework assignments, ensuring students gain the mathematical foundation necessary for personal financial responsibility.

Wayground (formerly Quizizz) empowers educators with an extensive library of millions of teacher-created tax computation resources that streamline lesson planning and support differentiated instruction across diverse learning needs. The platform's robust search and filtering capabilities allow teachers to quickly locate worksheets that align with specific curriculum standards and target particular aspects of tax calculation, from basic percentage applications to complex scenarios involving multiple tax types and deductions. These versatile materials are available in both printable pdf formats for traditional paper-and-pencil practice and digital formats that facilitate interactive learning experiences. Teachers can seamlessly customize existing worksheets or create entirely new assessments to address individual student requirements, making these resources invaluable for remediation support, enrichment activities, and ongoing skill practice that ensures students develop mathematical competency in tax computation throughout their financial literacy education.