10Q

Uni

6Q

9th - 12th

20Q

9th

5Q

12th

6Q

9th - 12th

15Q

9th

8Q

9th

6Q

11th - 12th

16Q

9th

11Q

11th - Uni

10Q

12th

6Q

7th - 9th

12Q

10th

11Q

7th - 9th

16Q

12th

18Q

12th

13Q

9th - 12th

14Q

12th

12Q

9th - 12th

26Q

9th

11Q

9th - Uni

15Q

12th

16Q

9th

52Q

11th - 12th

Explore planilhas por assuntos

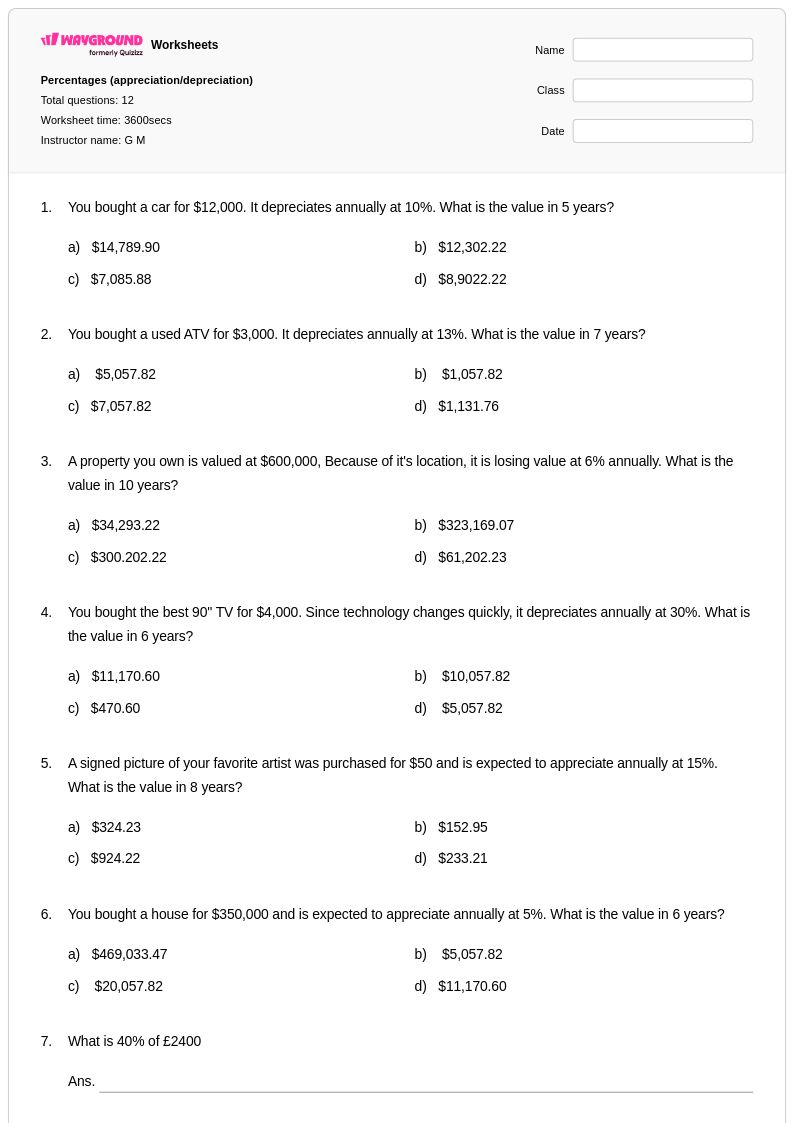

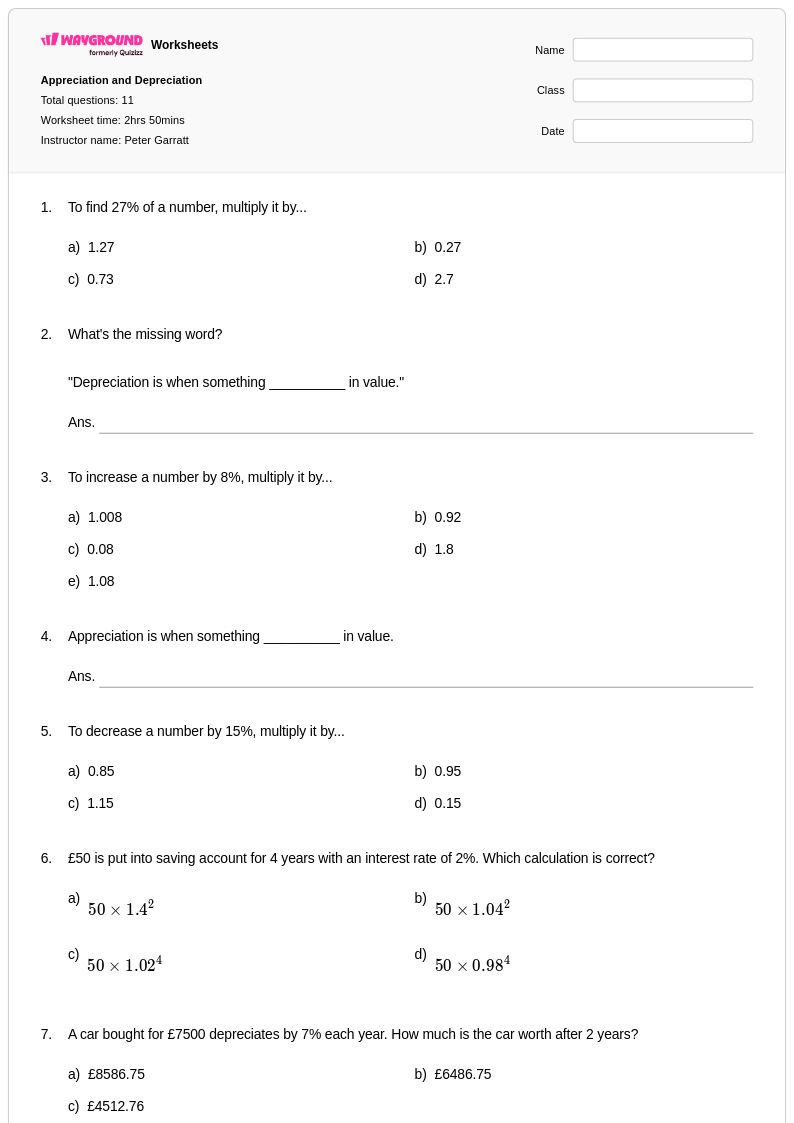

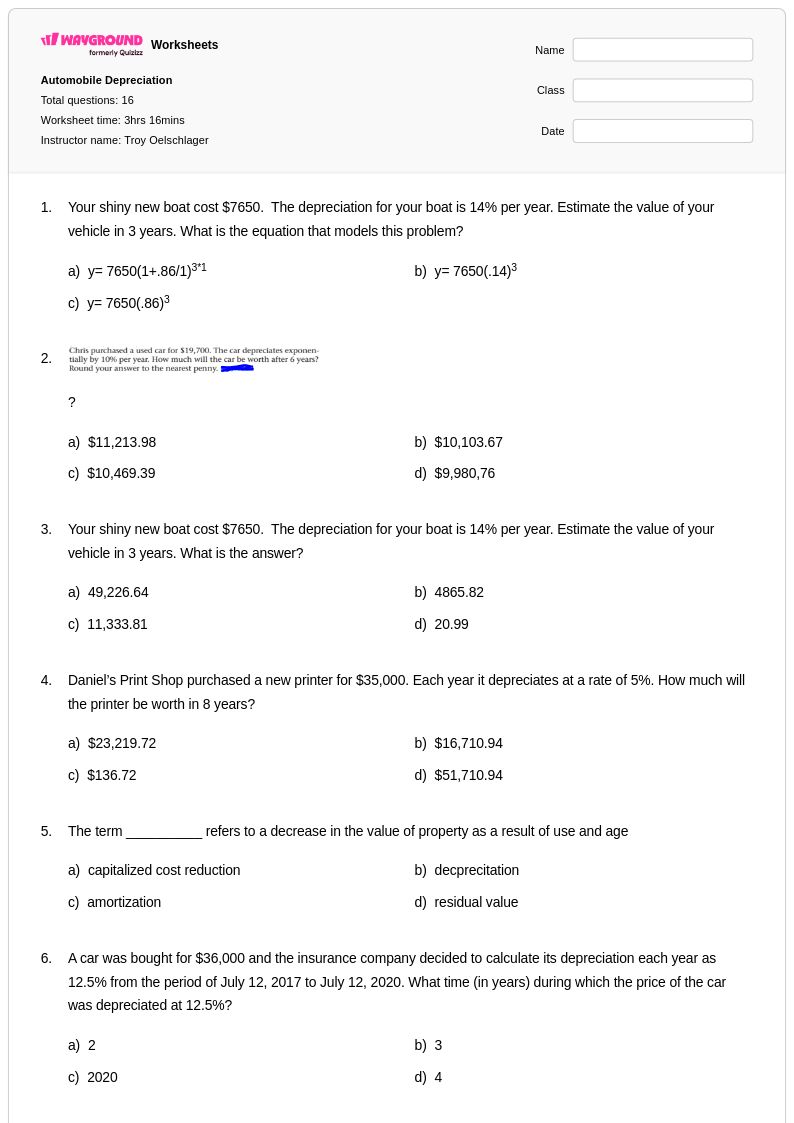

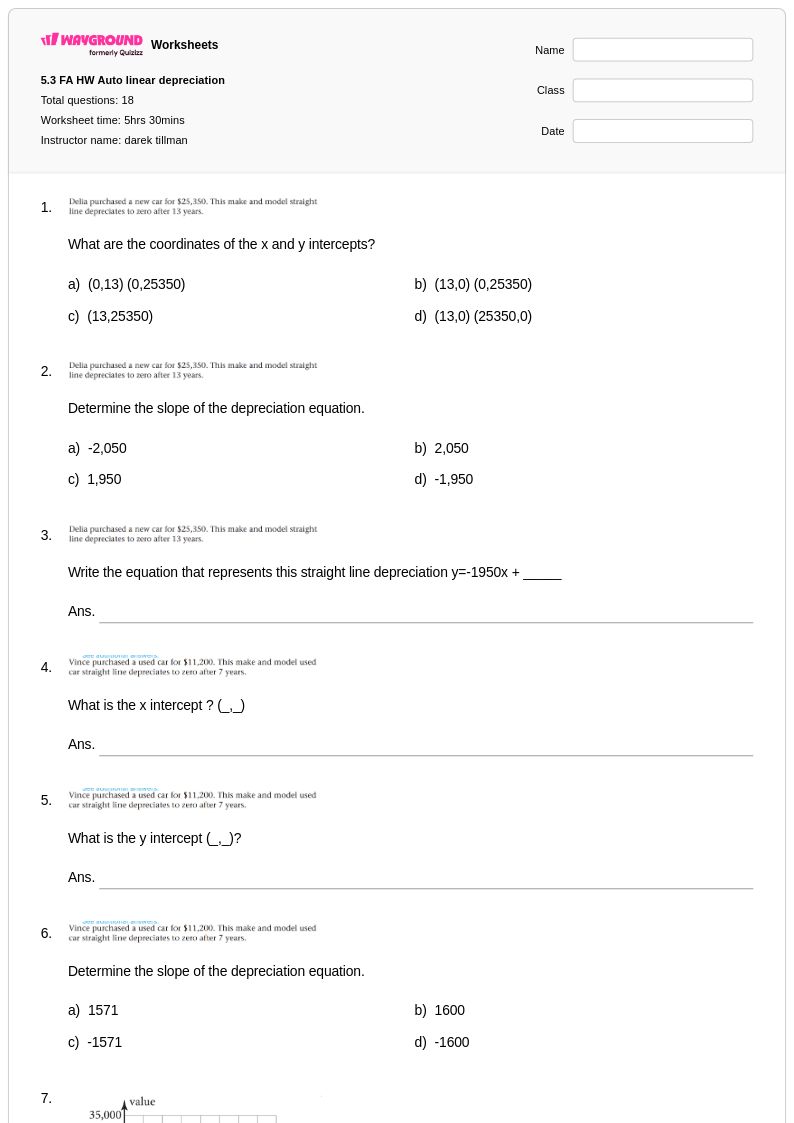

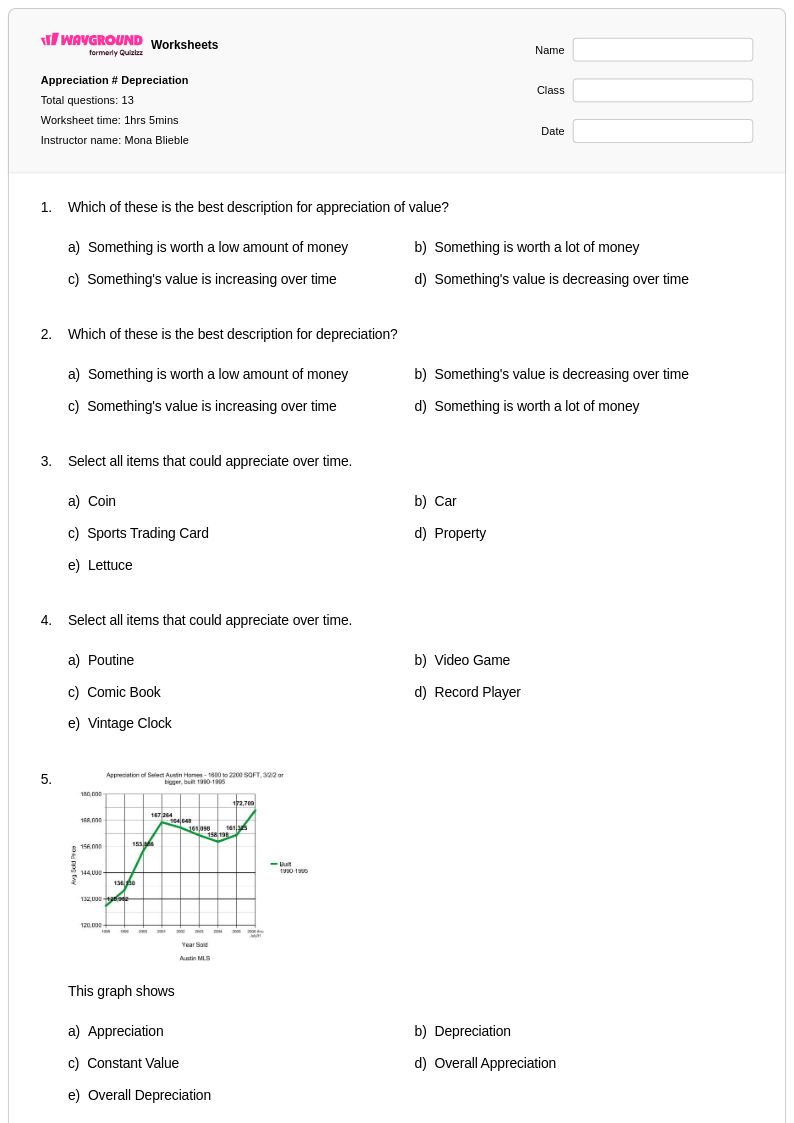

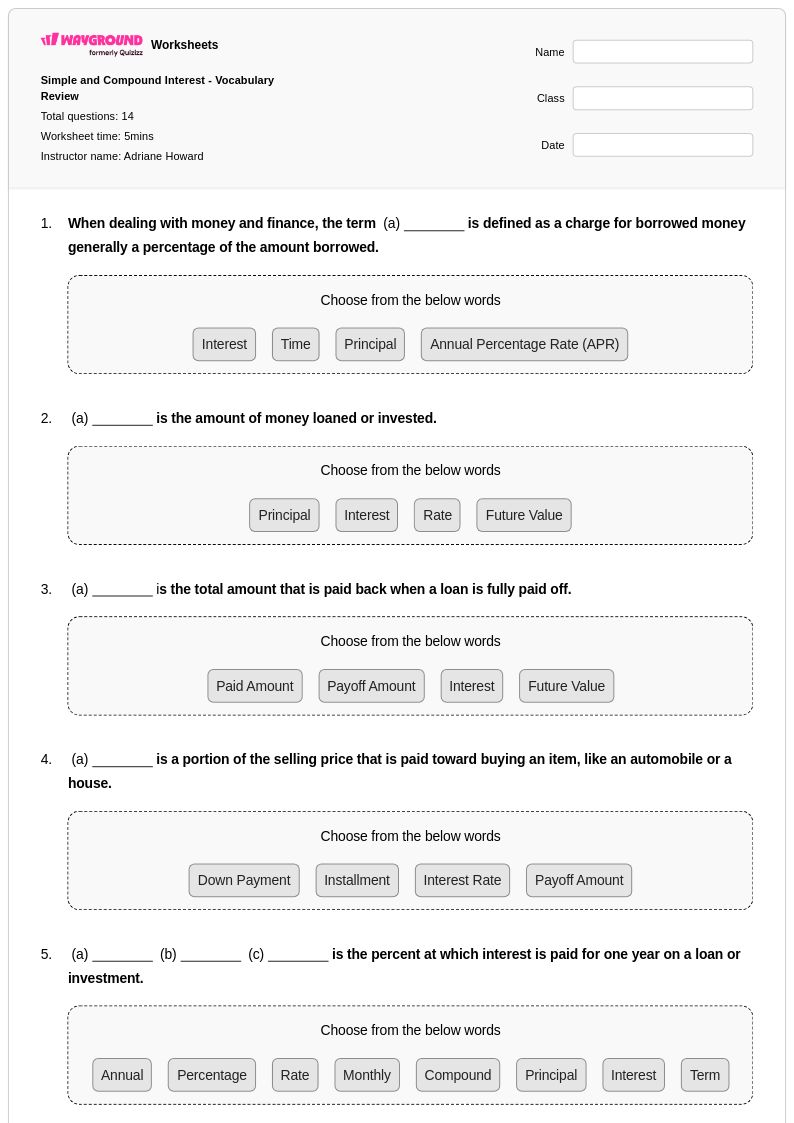

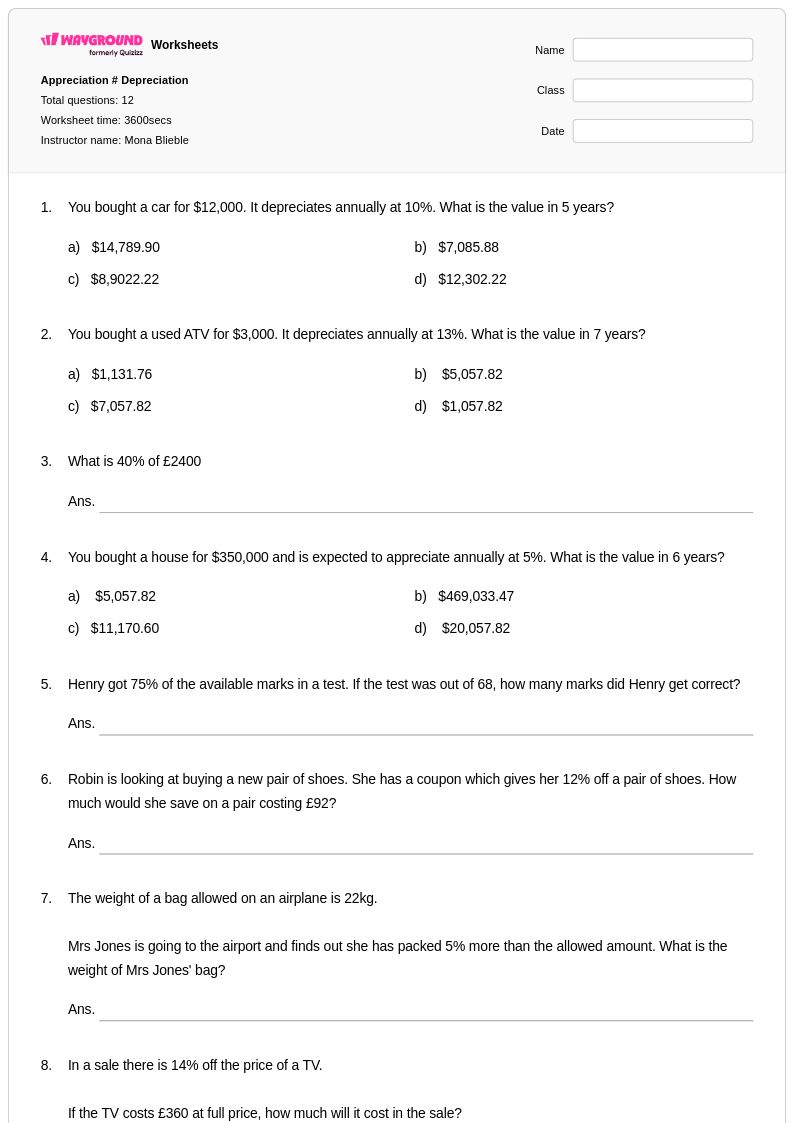

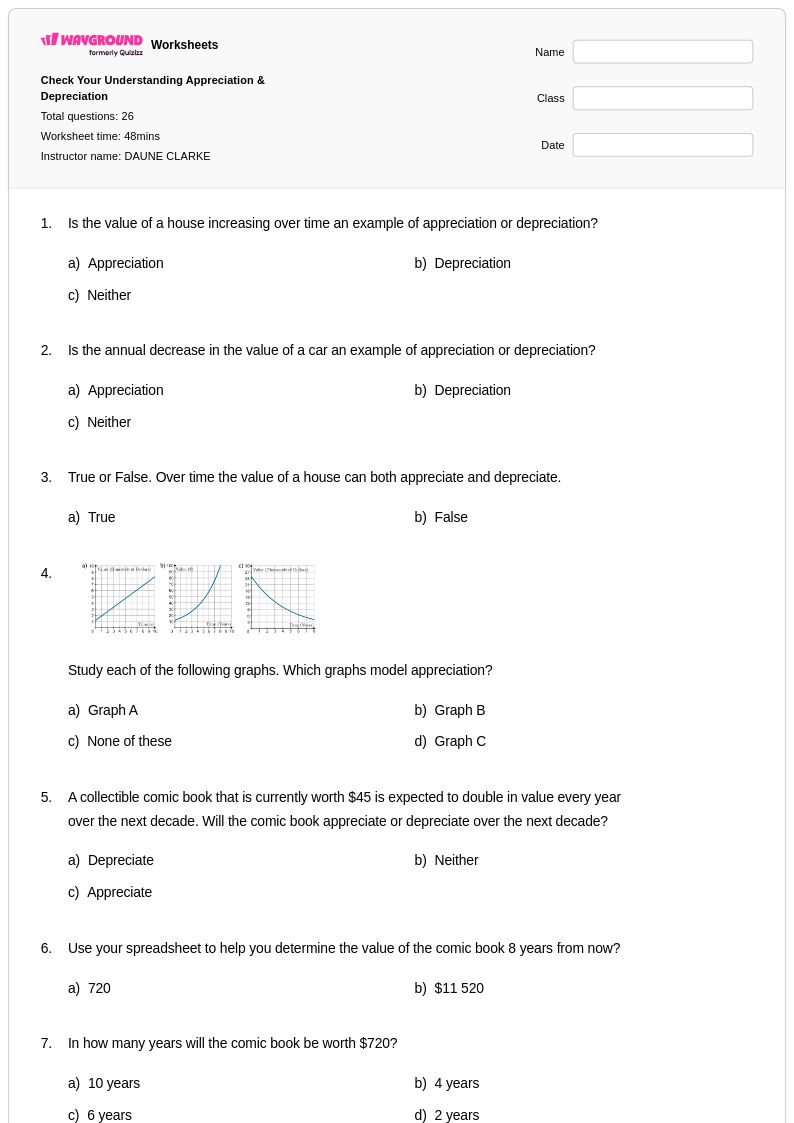

Explore printable Depreciation worksheets

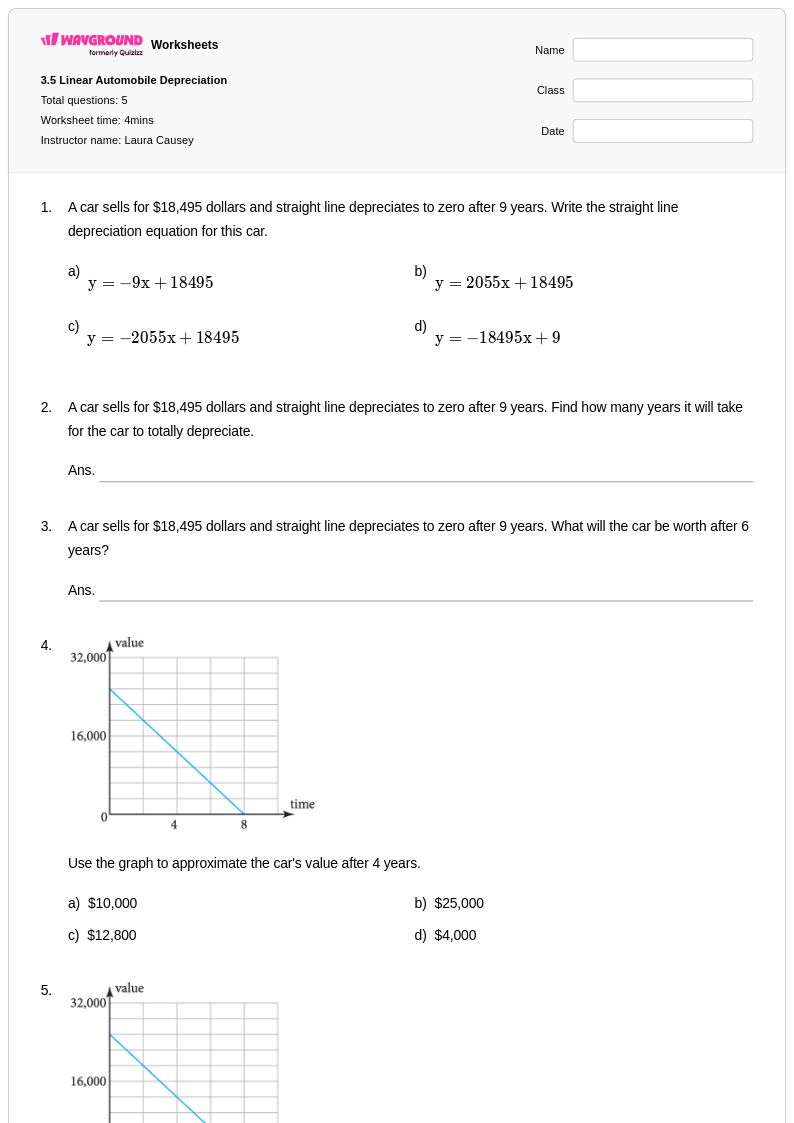

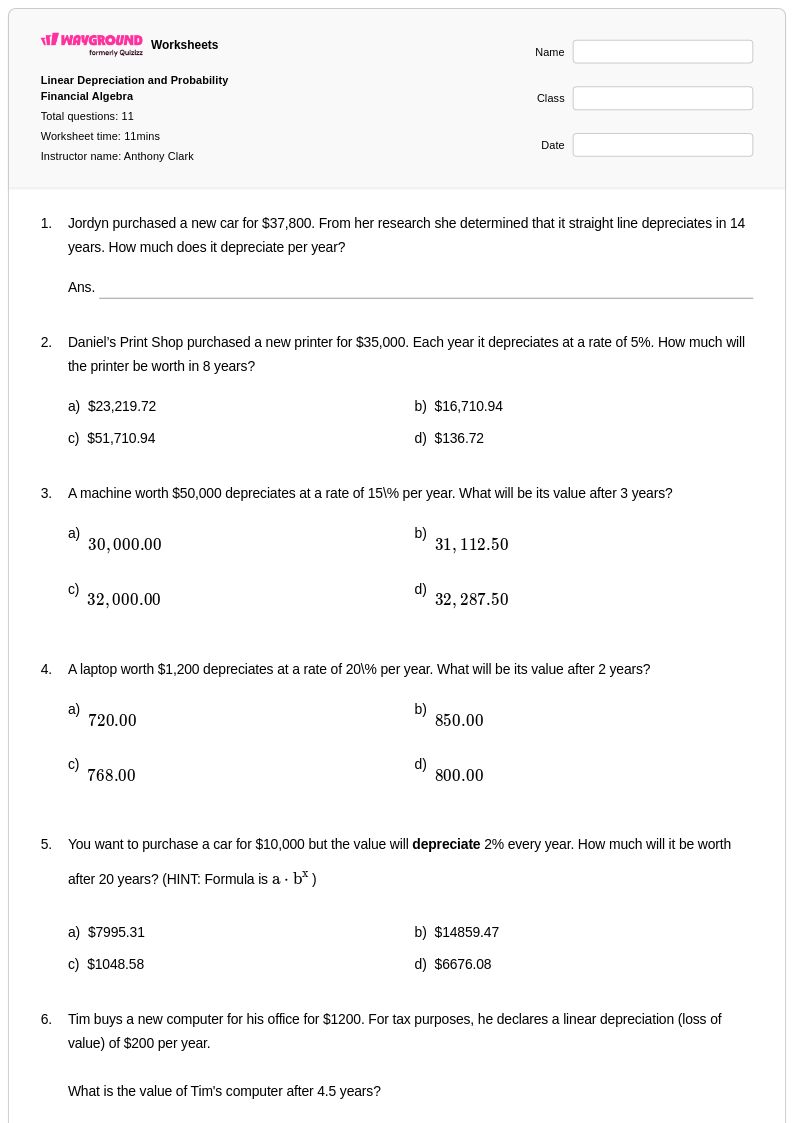

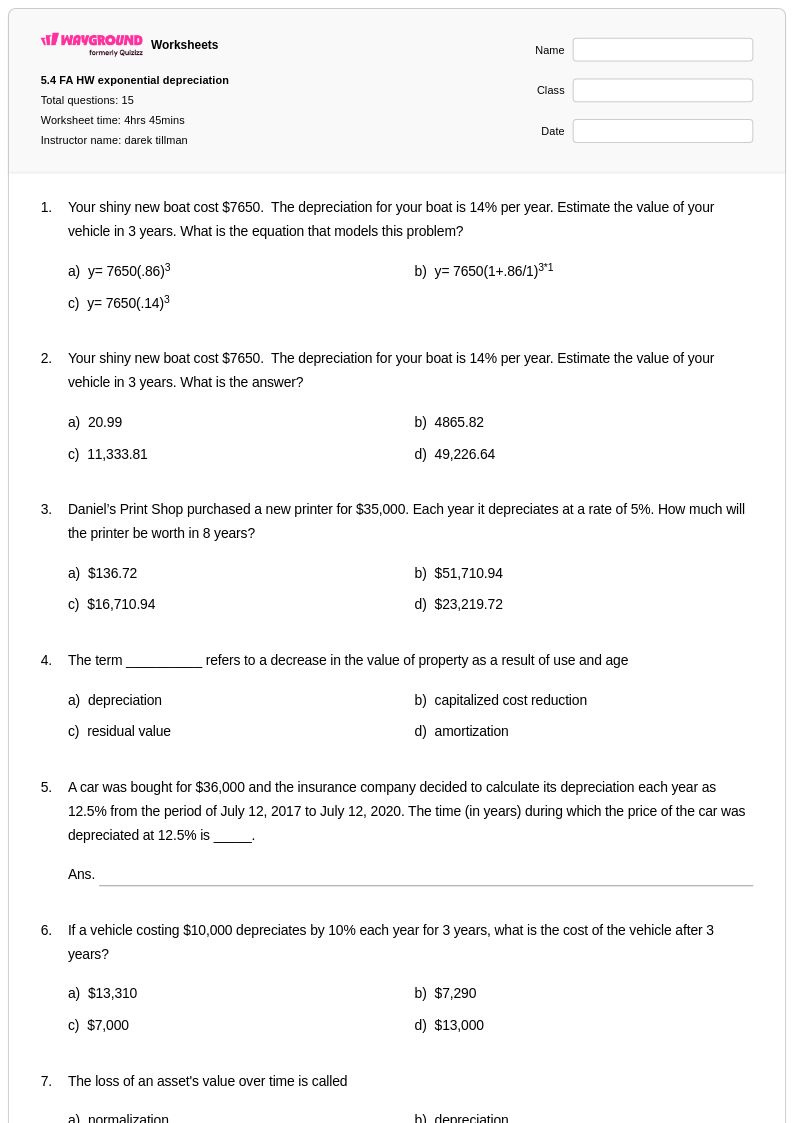

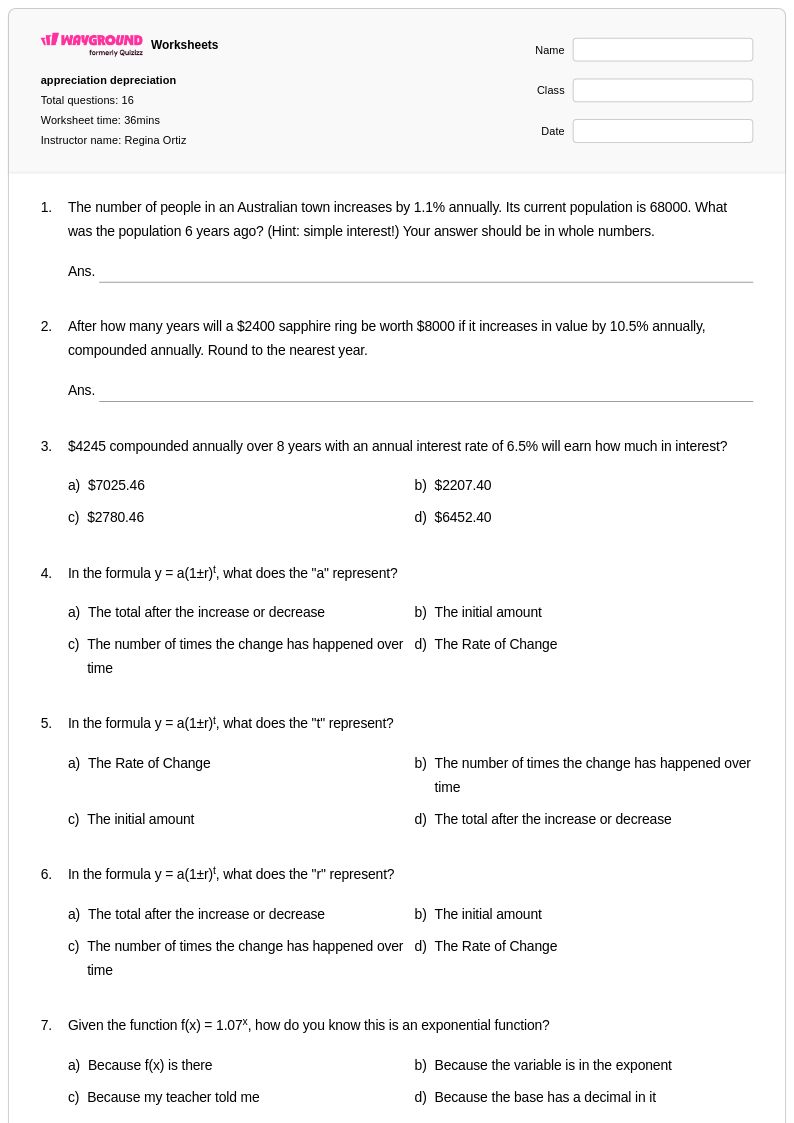

Depreciation worksheets available through Wayground (formerly Quizizz) provide comprehensive practice with this essential financial literacy concept that demonstrates how assets lose value over time. These carefully designed mathematical resources strengthen students' understanding of straight-line depreciation, declining balance methods, and sum-of-years digits calculations while building critical analytical skills needed for real-world financial decision making. Each worksheet collection includes detailed answer keys and step-by-step solutions that help students master the formulas and processes used to calculate asset depreciation across various scenarios, from vehicle purchases to business equipment investments. The free printable materials offer extensive practice problems that progress from basic depreciation calculations to complex multi-year scenarios, ensuring students develop both computational accuracy and conceptual understanding of how depreciation impacts personal and business finances.

Wayground (formerly Quizizz) empowers educators with access to millions of teacher-created depreciation resources that support diverse classroom needs and learning objectives. The platform's robust search and filtering capabilities allow teachers to quickly locate worksheets aligned with specific financial literacy standards while offering differentiation tools that accommodate various skill levels and learning styles. Teachers can seamlessly customize existing materials or create original content, with all resources available in both printable pdf format for traditional classroom use and interactive digital versions for technology-enhanced learning environments. These flexible features streamline lesson planning while providing targeted options for remediation, enrichment, and ongoing skill practice, enabling educators to effectively guide students through the complexities of depreciation calculations and their practical applications in personal finance and business contexts.