43Q

6th - 8th

20Q

6th - 8th

12Q

6th - 8th

21Q

6th - 8th

6Q

6th - 8th

10Q

7th

15Q

6th - 8th

15Q

7th

44Q

7th - 12th

10Q

7th

14Q

7th

11Q

6th - 8th

46Q

7th - Uni

13Q

7th

10Q

3rd - Uni

17Q

7th

20Q

5th - Uni

19Q

7th

19Q

7th

23Q

6th - 8th

19Q

7th

15Q

7th

22Q

7th

20Q

5th - 8th

Explore otras hojas de trabajo de materias para grade 7

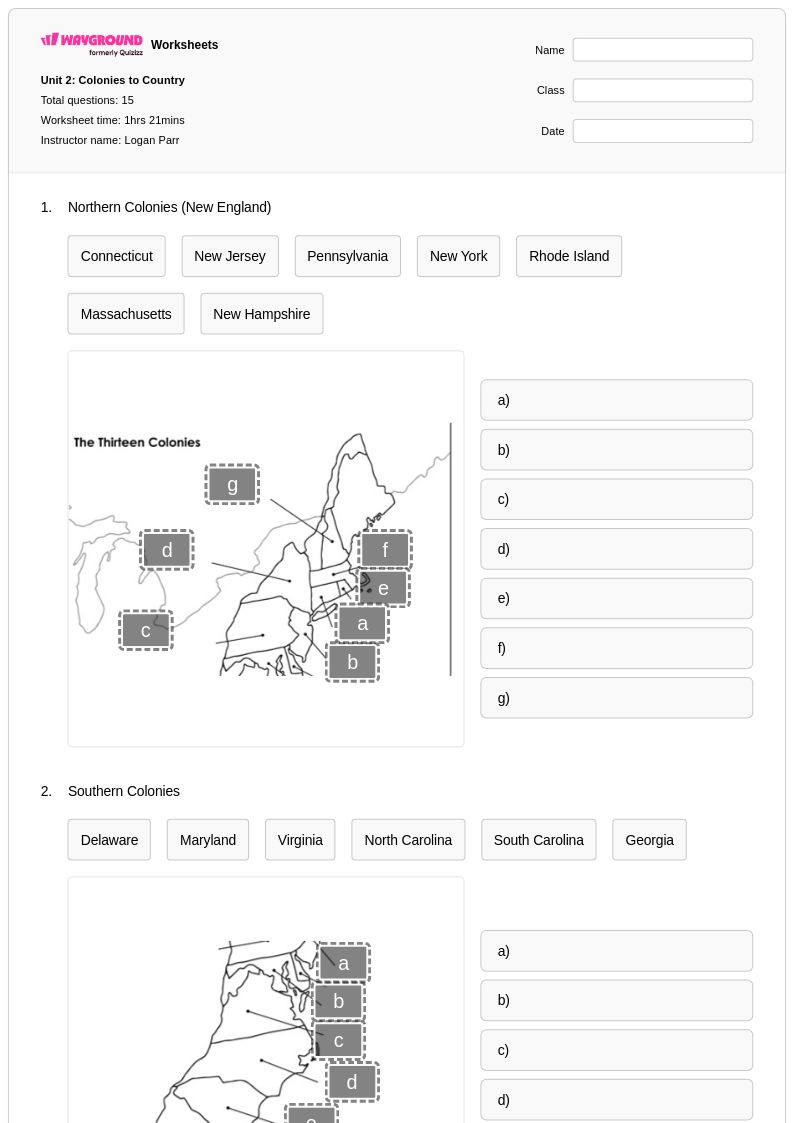

Explore printable Taxes worksheets for Grade 7

Grade 7 taxes worksheets available through Wayground (formerly Quizizz) provide comprehensive coverage of fundamental taxation concepts that seventh-grade students need to understand as part of their economics education. These carefully designed practice problems help students explore different types of taxes including income tax, sales tax, and property tax, while developing essential skills in calculating tax amounts, understanding tax brackets, and analyzing the role of taxation in government funding. The worksheet collection strengthens mathematical application skills as students work through real-world scenarios involving tax computation, and each resource includes detailed answer keys that support both independent learning and teacher-guided instruction. Available as free printables in convenient pdf format, these worksheets enable students to practice complex economic concepts through structured exercises that build confidence in understanding how taxation systems function in modern society.

Wayground (formerly Quizizz) supports educators with an extensive collection of teacher-created resources specifically designed for Grade 7 taxation instruction, featuring millions of worksheets that can be easily accessed through robust search and filtering capabilities. Teachers benefit from standards-aligned materials that connect directly to economics curriculum requirements, along with differentiation tools that allow customization based on individual student needs and varying skill levels. The platform's flexible format options include both printable worksheets and digital versions in pdf format, enabling seamless integration into diverse classroom environments and teaching approaches. These comprehensive resources facilitate effective lesson planning while providing targeted materials for remediation support, enrichment activities, and ongoing skill practice, ensuring that educators have the tools necessary to help students master complex taxation concepts through varied and engaging worksheet exercises.