26 Q

5th

20 Q

11th

10 Q

5th

13 Q

5th

14 Q

12th

30 Q

5th

20 Q

9th - 12th

24 Q

12th

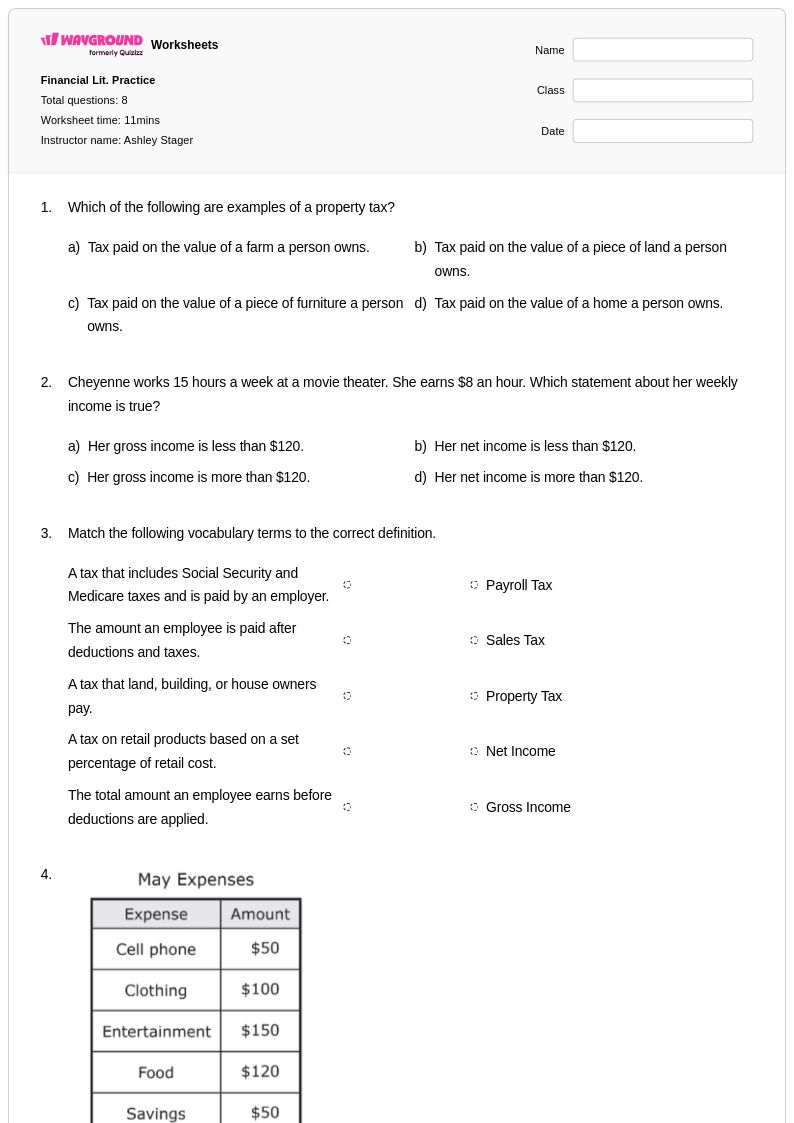

8 Q

5th

14 Q

5th

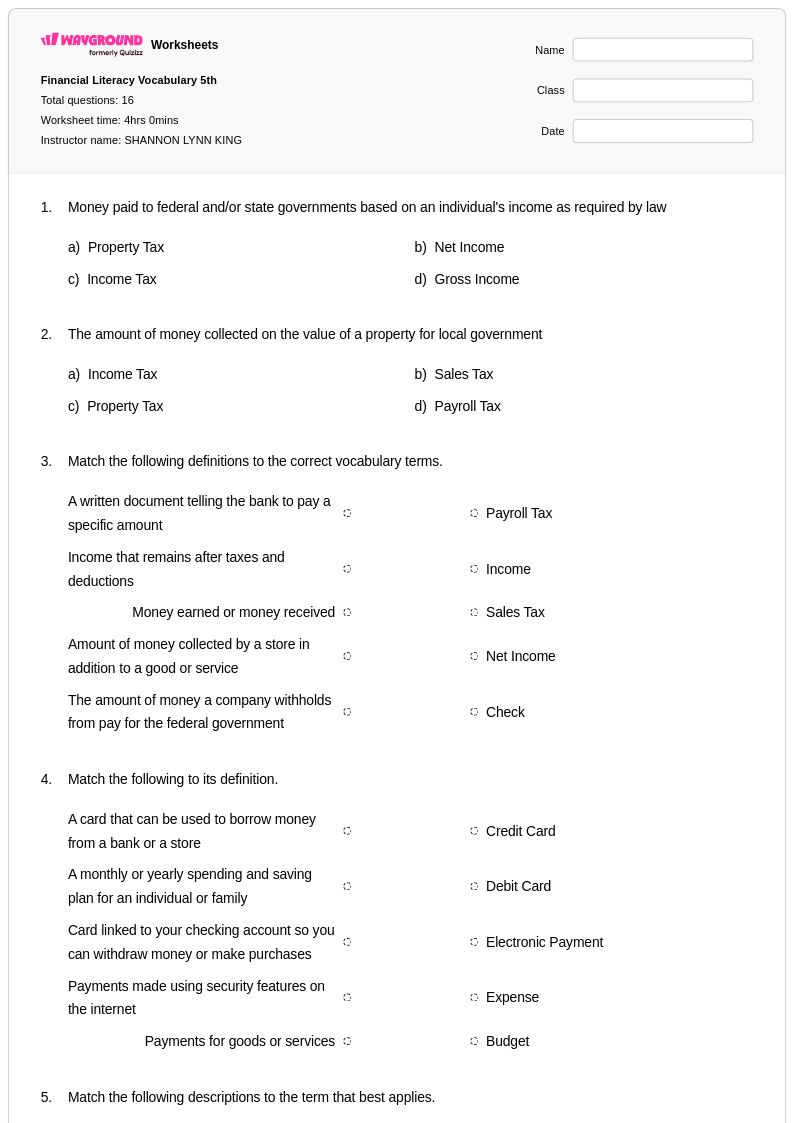

16 Q

5th

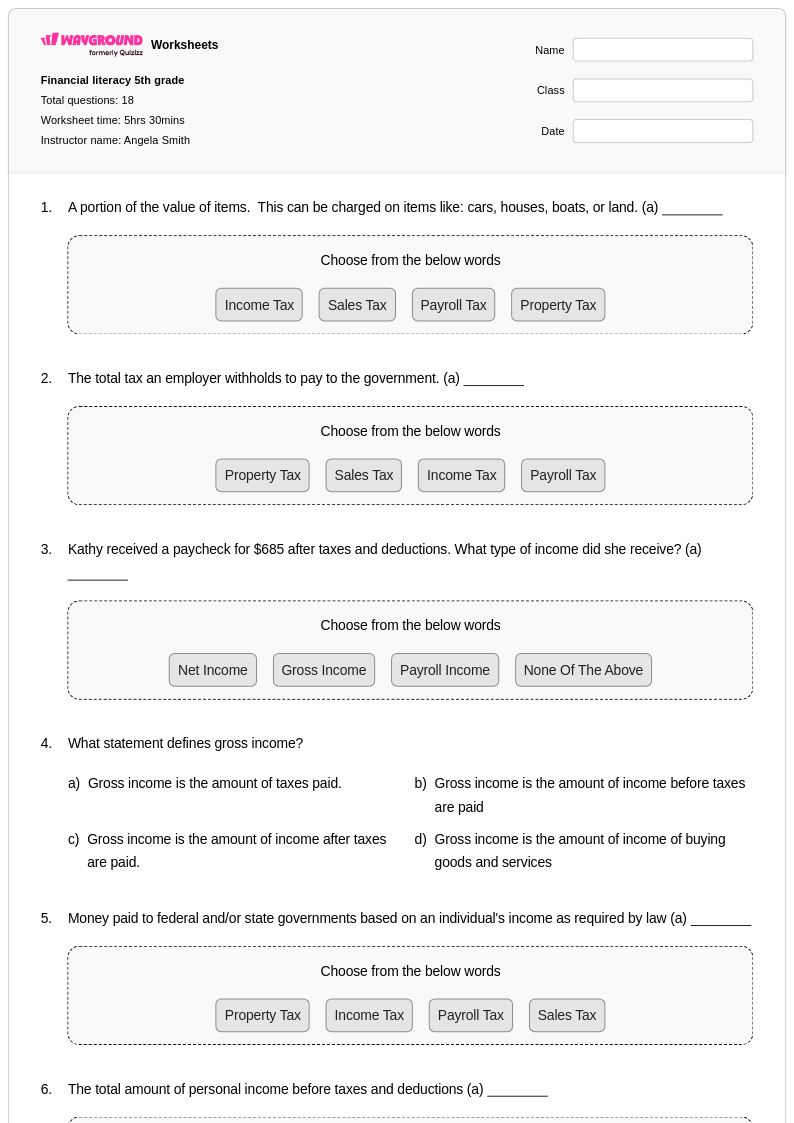

18 Q

5th

60 Q

9th

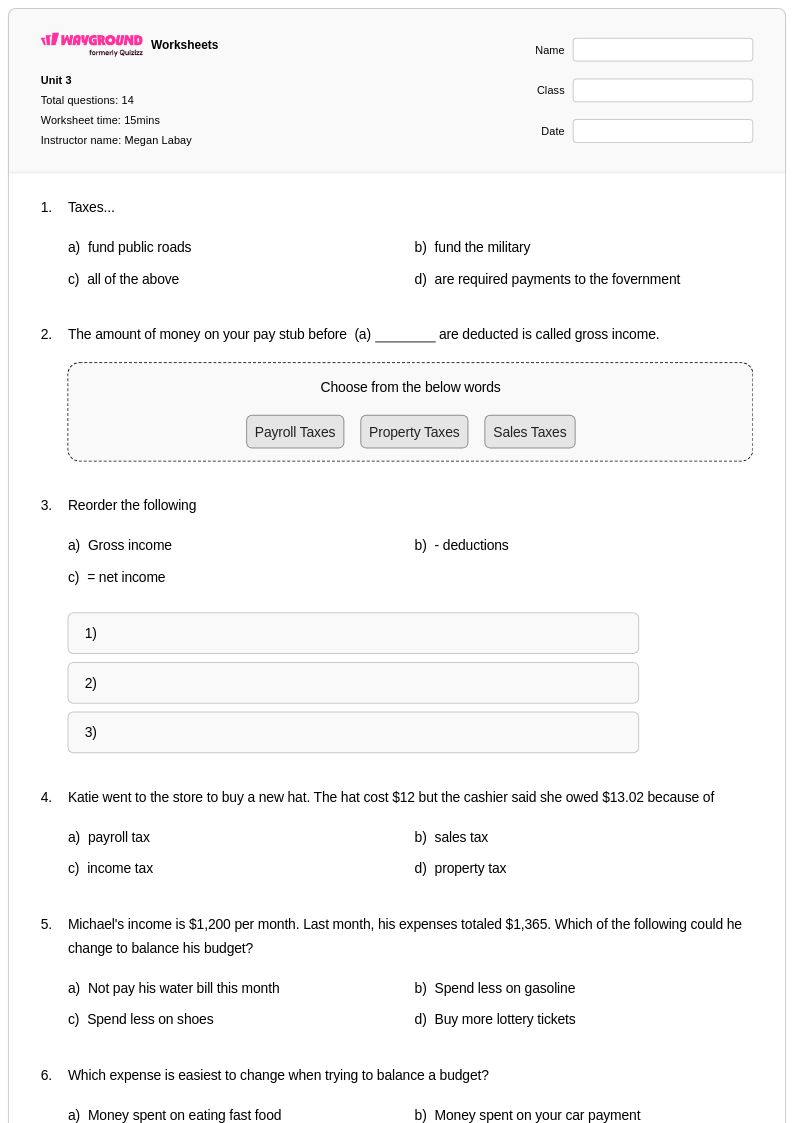

15 Q

9th

22 Q

9th - 12th

12 Q

7th

24 Q

12th

6 Q

5th

20 Q

12th

15 Q

5th

20 Q

5th

15 Q

9th - 12th

18 Q

9th - 12th

7 Q

9th - 12th

Explore Worksheets by Subjects

Explore printable Deductions worksheets

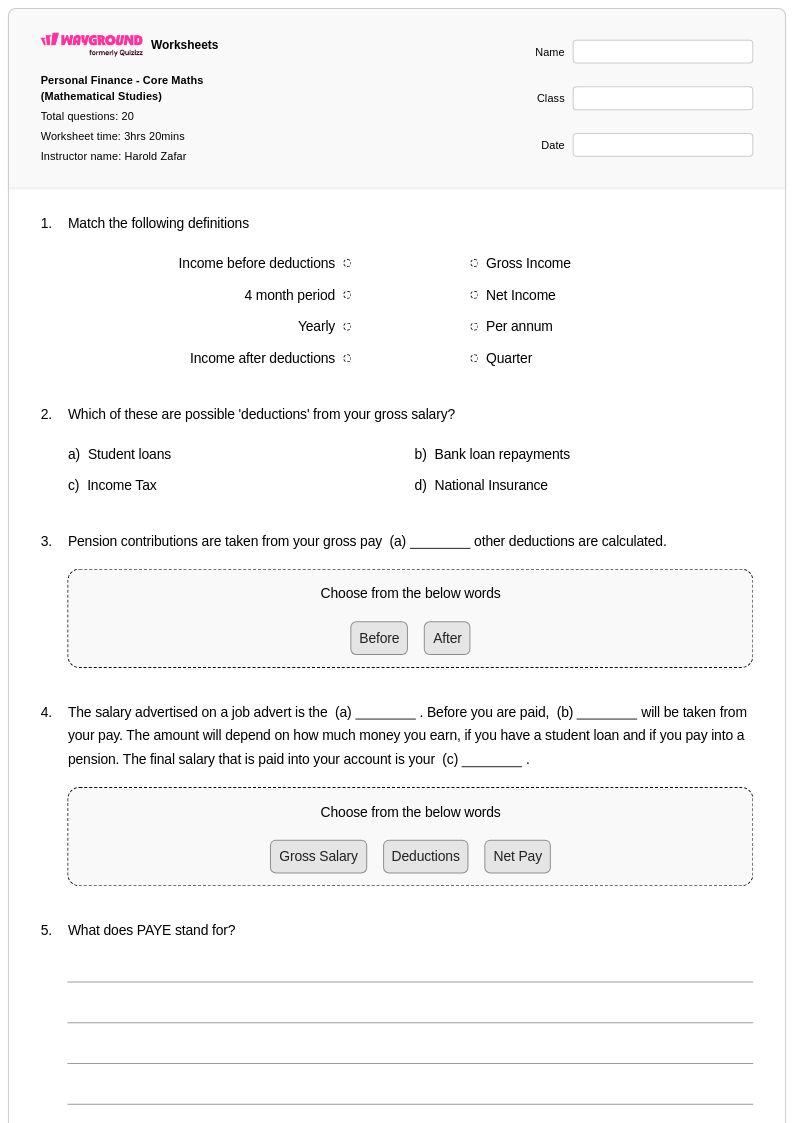

Deductions worksheets available through Wayground (formerly Quizizz) provide comprehensive practice materials that help students master the critical financial literacy skill of understanding various types of income reductions. These educational resources focus on teaching learners how to calculate and analyze different deductions including taxes, insurance premiums, retirement contributions, and other workplace withholdings from gross income. Students develop essential mathematical reasoning abilities while working through practice problems that mirror real-world payroll scenarios, building confidence in interpreting pay stubs and understanding net versus gross income calculations. The worksheets include detailed answer keys and are available as free printables in pdf format, making them accessible resources for reinforcing deduction concepts through structured problem-solving activities.

Wayground (formerly Quizizz) supports mathematics educators with an extensive collection of teacher-created deductions worksheets drawn from millions of available resources that can be easily located through robust search and filtering capabilities. Teachers benefit from standards-aligned materials that accommodate diverse learning needs through built-in differentiation tools and flexible customization options, allowing instructors to modify content difficulty and focus areas to match specific classroom requirements. These versatile resources are available in both printable and digital formats, including downloadable pdf versions, enabling seamless integration into various instructional settings whether for in-class practice, homework assignments, or assessment preparation. The comprehensive worksheet collection supports effective lesson planning while providing targeted materials for remediation, enrichment, and ongoing skill development in financial literacy concepts.