15Q

10th

10Q

9th - 12th

19Q

9th - 12th

20Q

9th - 12th

38Q

9th - 12th

50Q

9th - 12th

10Q

9th - 12th

44Q

7th - 12th

10Q

9th - 12th

12Q

9th - 11th

17Q

9th - 12th

20Q

9th - 12th

102Q

9th - 12th

30Q

10th - 12th

12Q

9th - 12th

28Q

10th

17Q

9th - 12th

10Q

9th - 12th

21Q

9th - 12th

20Q

9th - 12th

27Q

10th

50Q

9th - 12th

40Q

9th - 12th

6Q

9th - 12th

Explore planilhas Personal Financial Literacy por notas

Explore outras planilhas de assuntos para class 10

Explore printable Personal Financial Literacy worksheets for Class 10

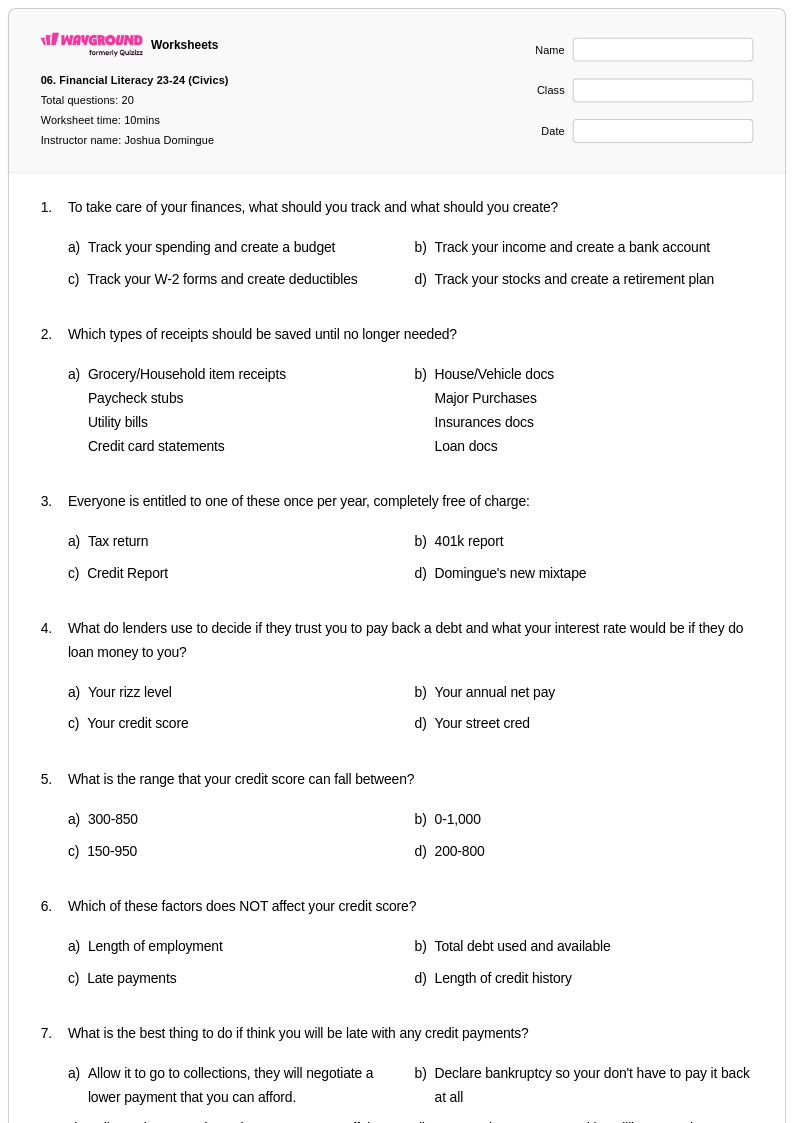

Personal Financial Literacy worksheets for Class 10 students available through Wayground (formerly Quizizz) provide comprehensive coverage of essential money management skills that high school students need to develop before entering adulthood. These expertly crafted resources focus on critical concepts including budgeting, banking basics, credit and debt management, investment fundamentals, insurance principles, and consumer decision-making strategies. Students engage with real-world scenarios through practice problems that simulate authentic financial situations, from calculating compound interest to analyzing loan terms and creating personal spending plans. Each worksheet collection includes detailed answer keys that enable both independent learning and instructor-guided review, while the free printable pdf format ensures accessibility for diverse classroom environments and home study sessions.

Wayground (formerly Quizizz) empowers educators with an extensive library of millions of teacher-created Personal Financial Literacy resources specifically designed for Class 10 Social Studies curricula. The platform's robust search and filtering capabilities allow instructors to quickly locate materials aligned with state and national economics standards, while built-in differentiation tools enable customization for varying student ability levels and learning styles. Teachers can seamlessly adapt worksheet content for remediation support, enrichment activities, or targeted skill practice, with resources available in both digital interactive formats and traditional printable pdf versions. This flexibility streamlines lesson planning while providing multiple pathways for students to master complex financial concepts, from understanding credit scores and loan applications to evaluating investment options and developing long-term financial goals.