35Q

12th

20Q

9th - 12th

15Q

9th - 12th

14Q

12th

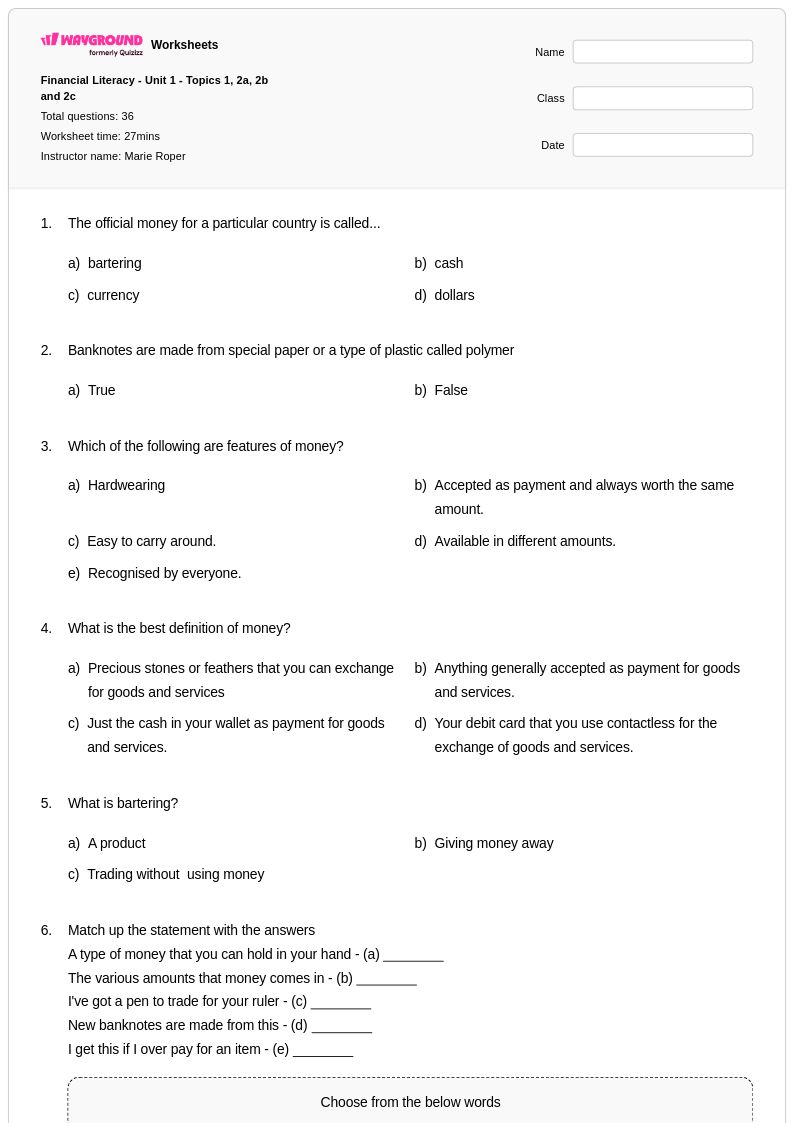

36Q

9th - Uni

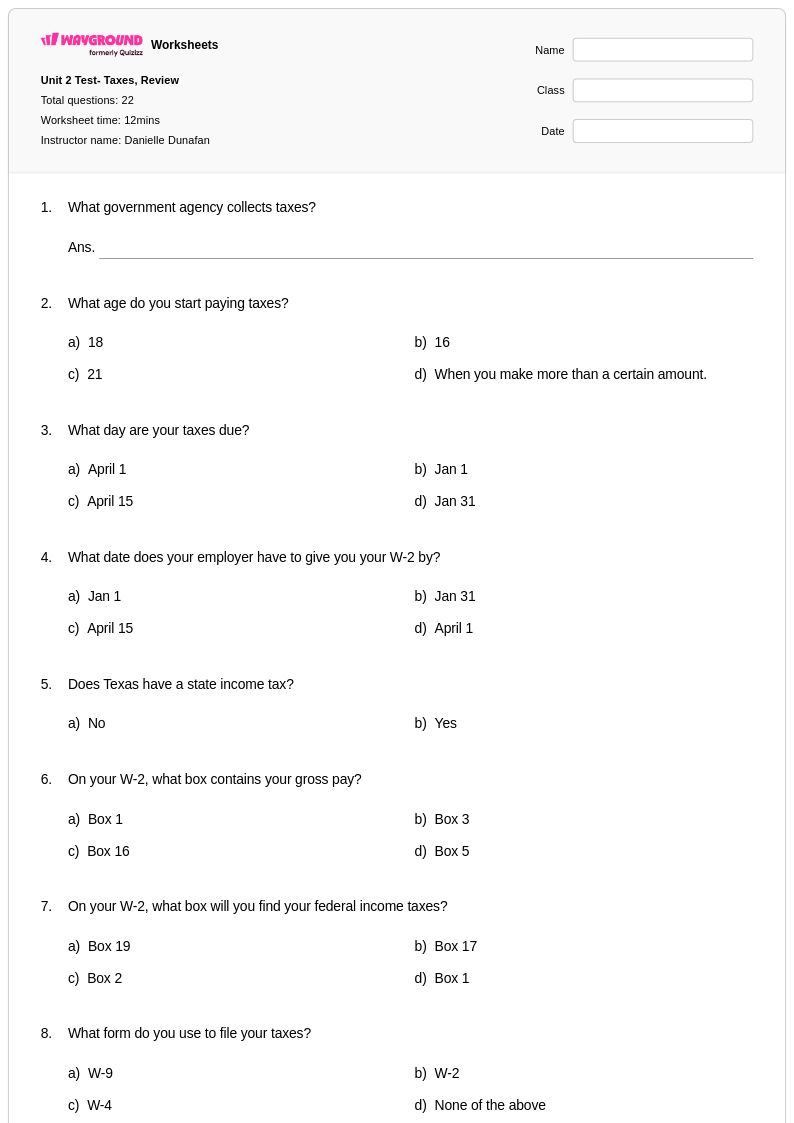

22Q

9th - 12th

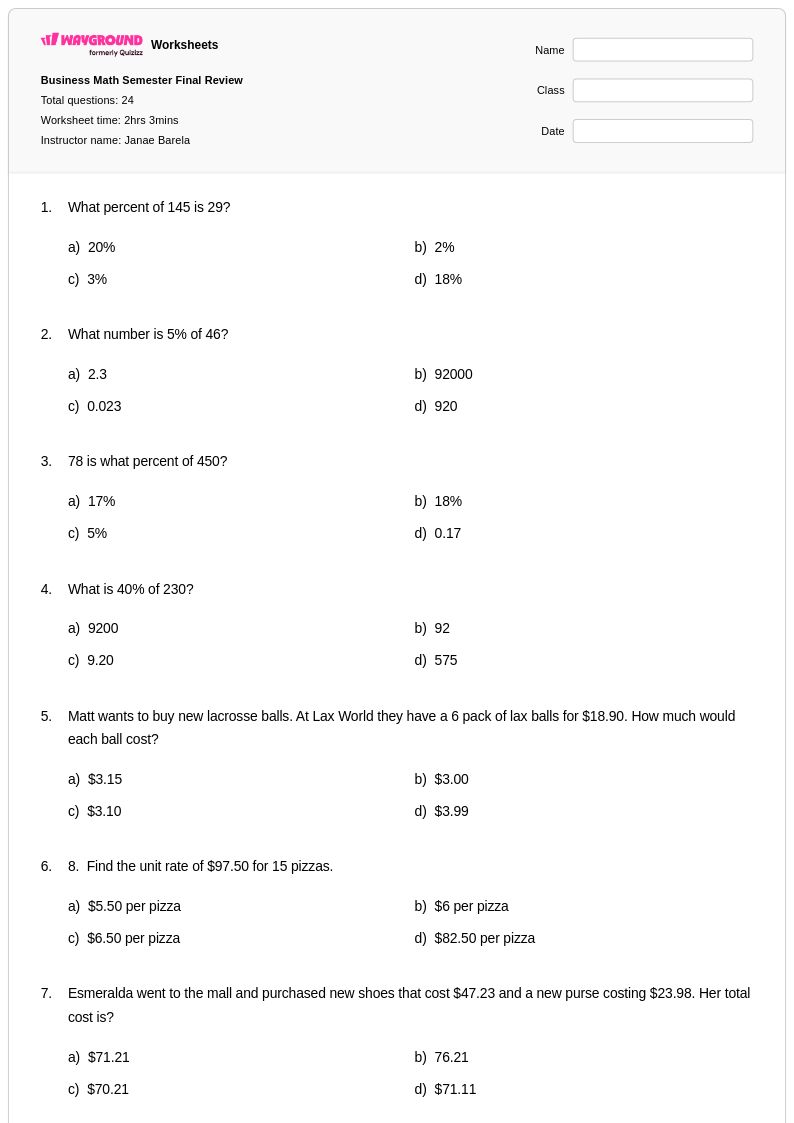

24Q

12th

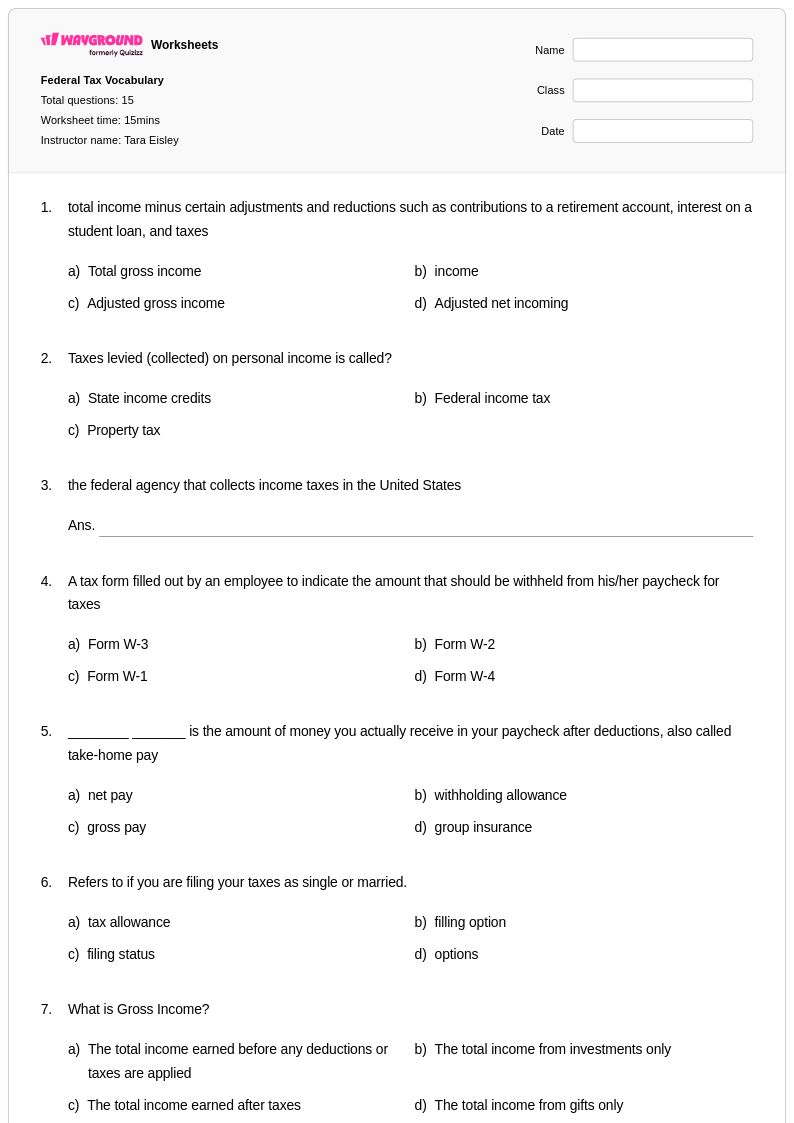

15Q

9th - 12th

24Q

12th

18Q

9th - 12th

7Q

9th - 12th

35Q

9th - 12th

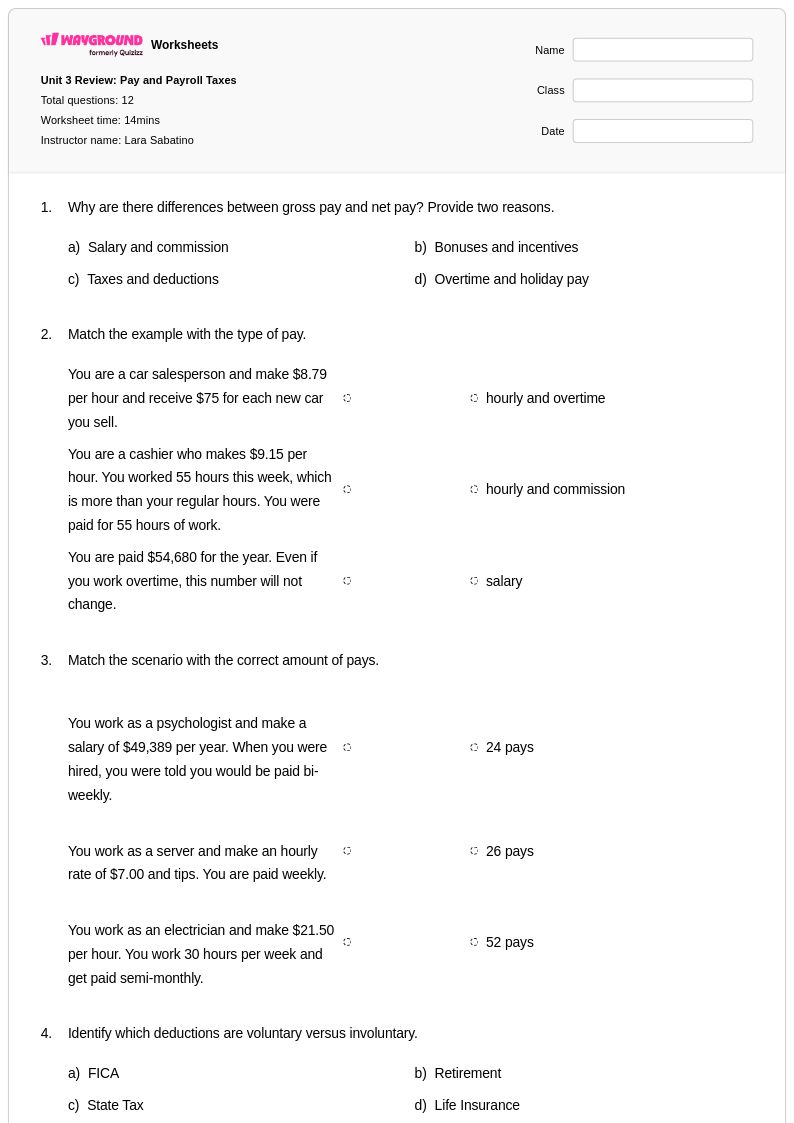

12Q

12th

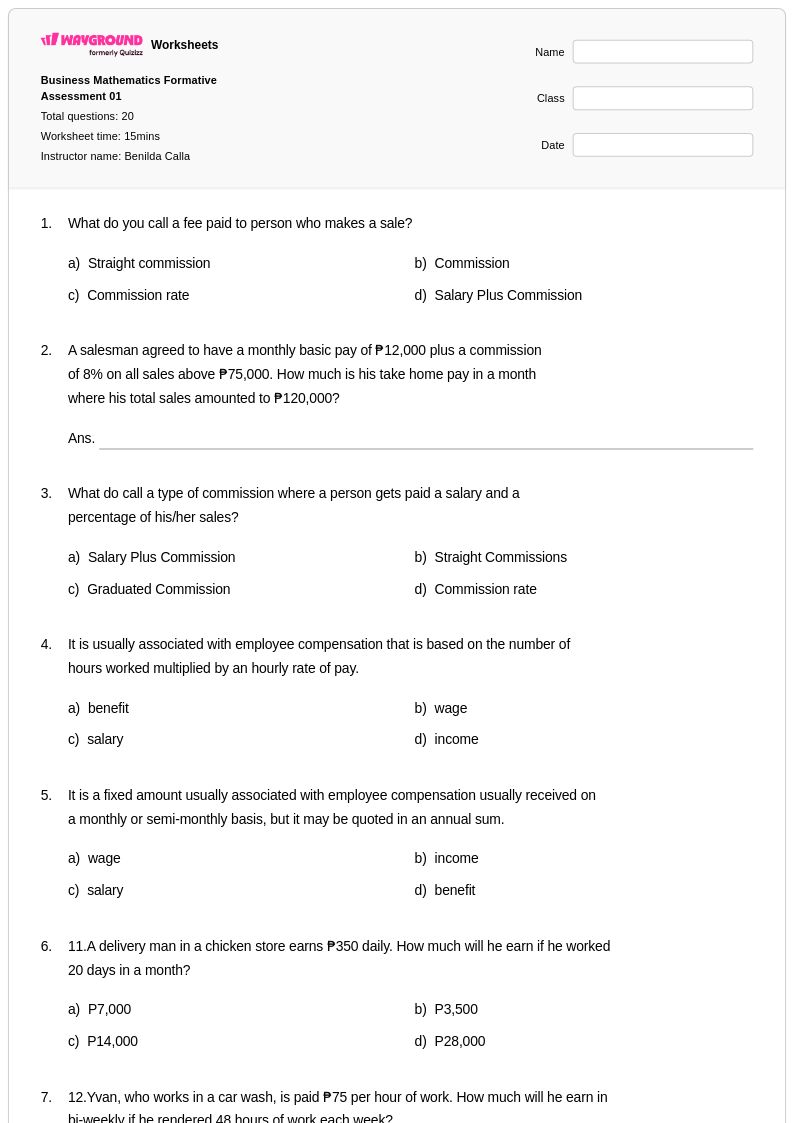

20Q

11th - 12th

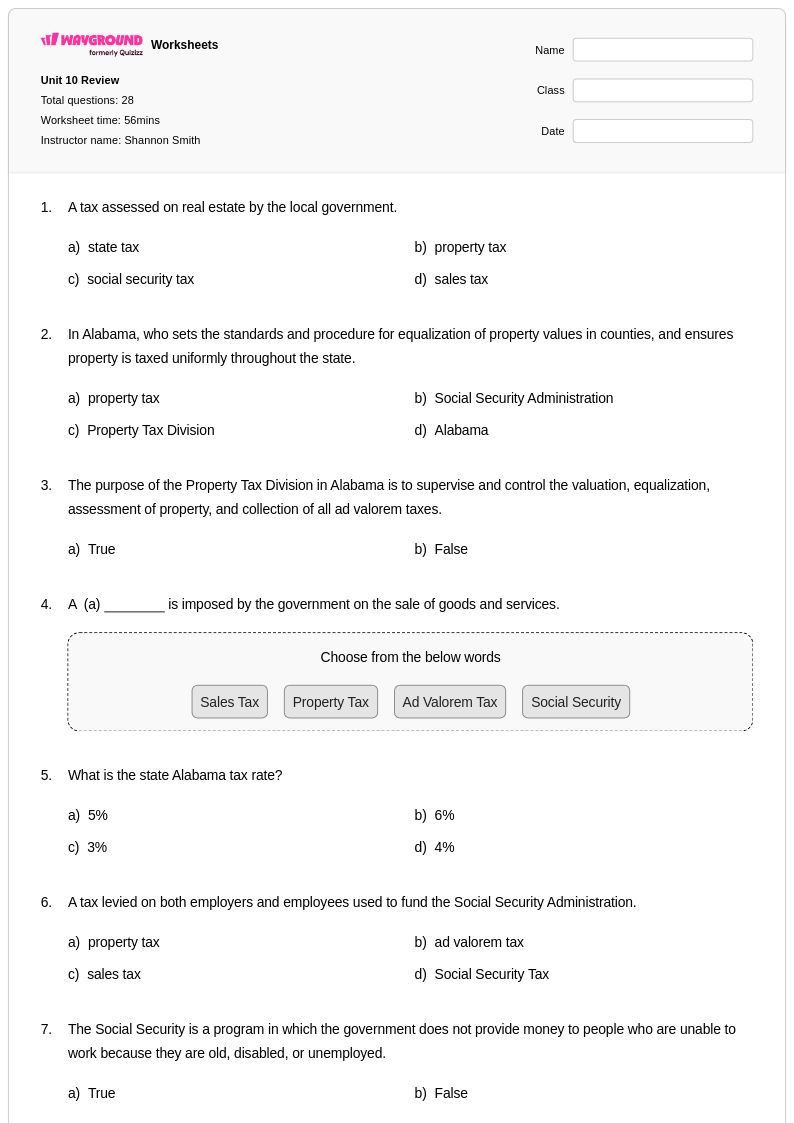

28Q

12th

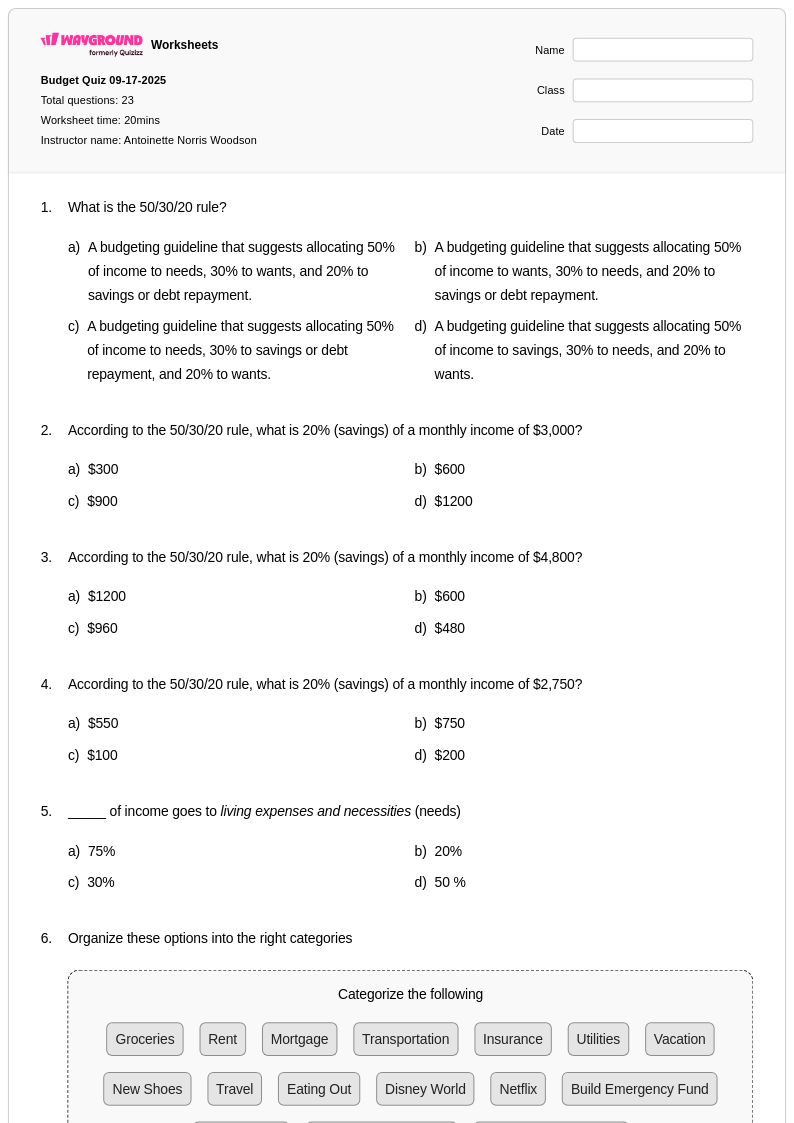

23Q

9th - 12th

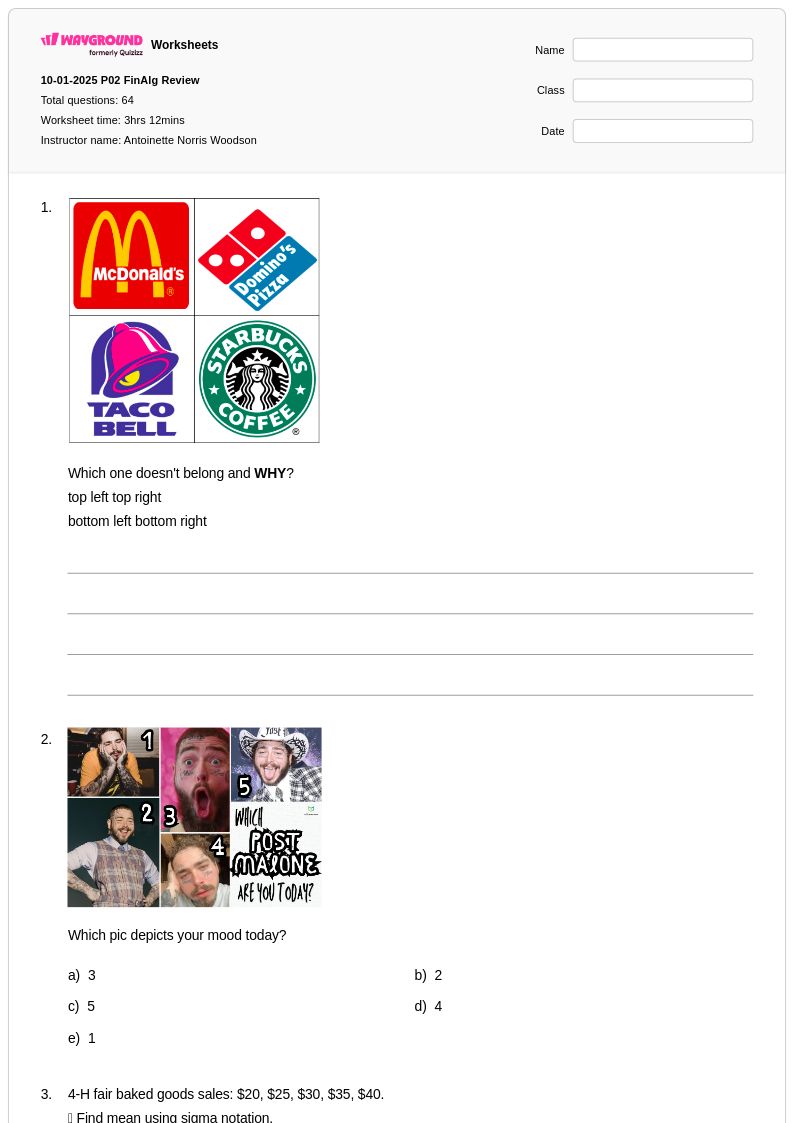

64Q

9th - 12th

8Q

12th

30Q

9th - 12th

40Q

12th

11Q

9th - 12th

40Q

9th - 12th

15Q

12th - Uni

20Q

12th

Explore otras hojas de trabajo de materias para year 12

Explore printable Deductions worksheets for Year 12

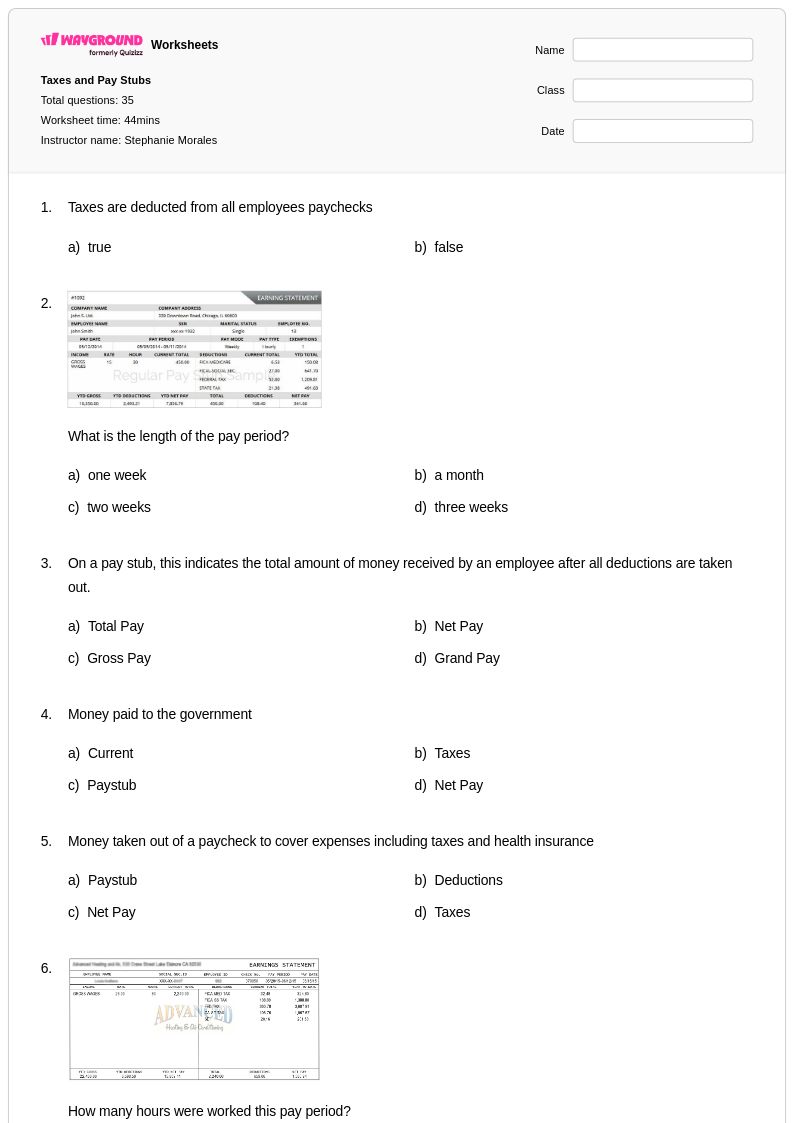

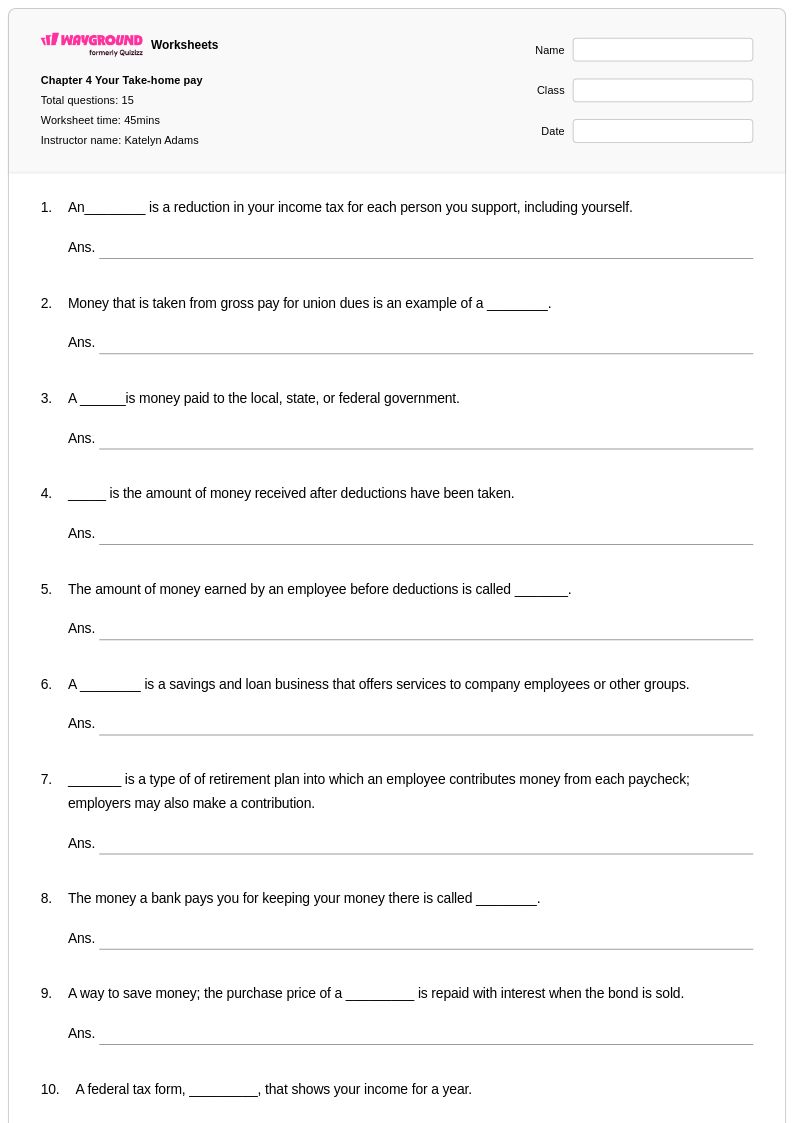

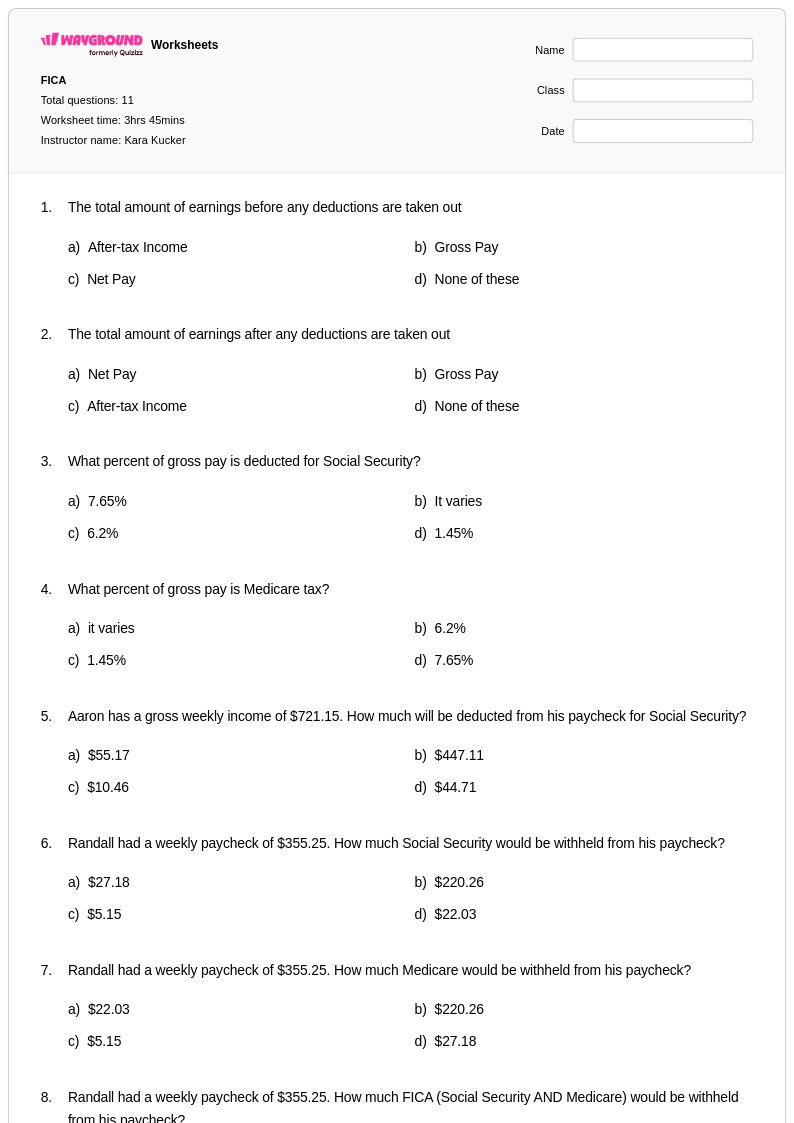

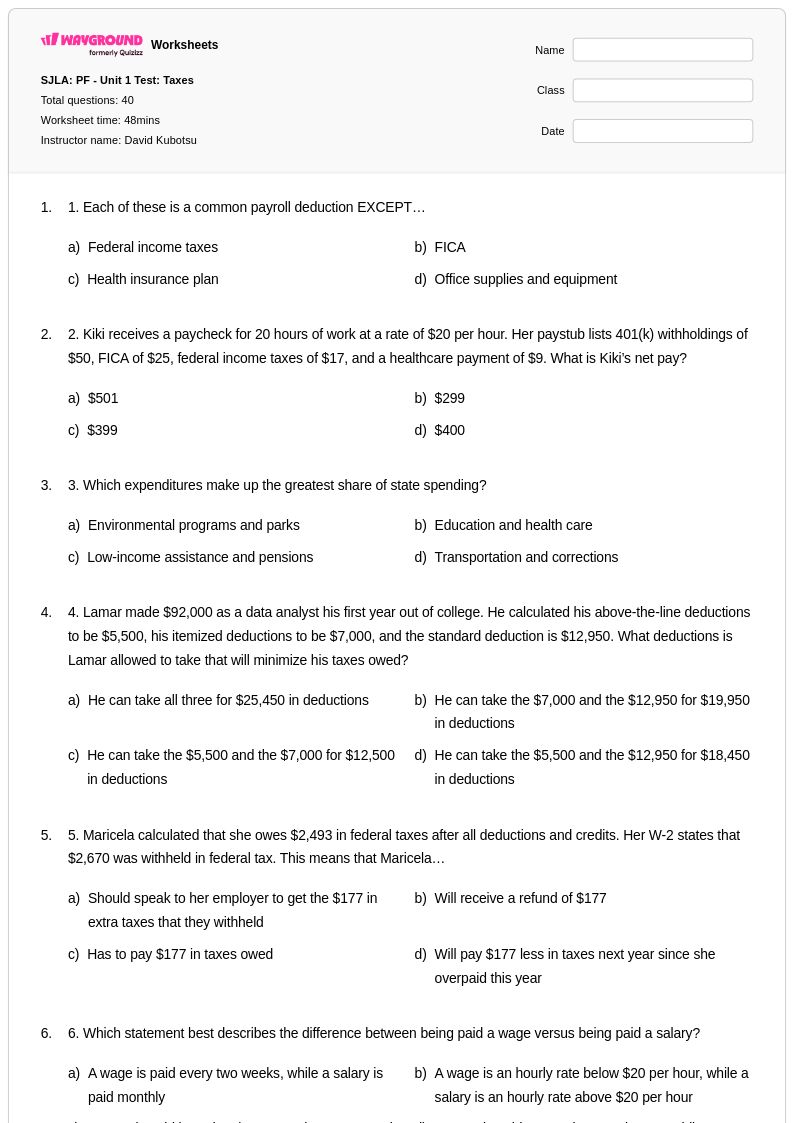

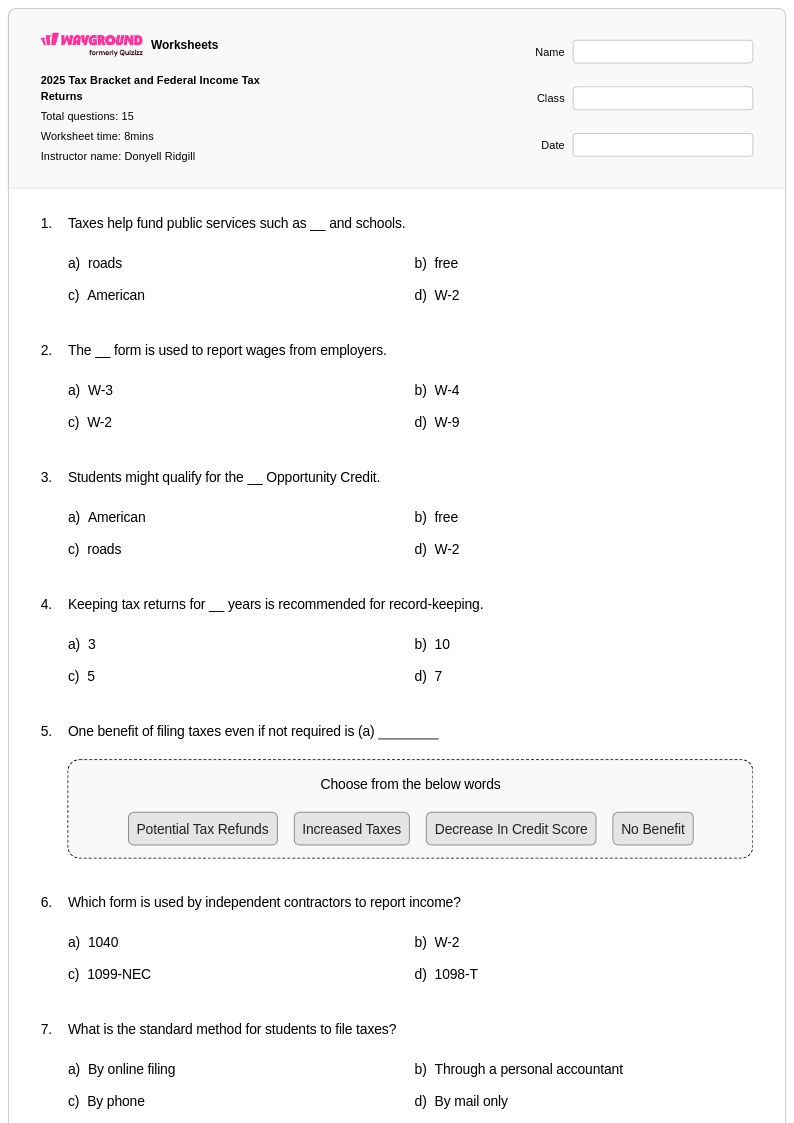

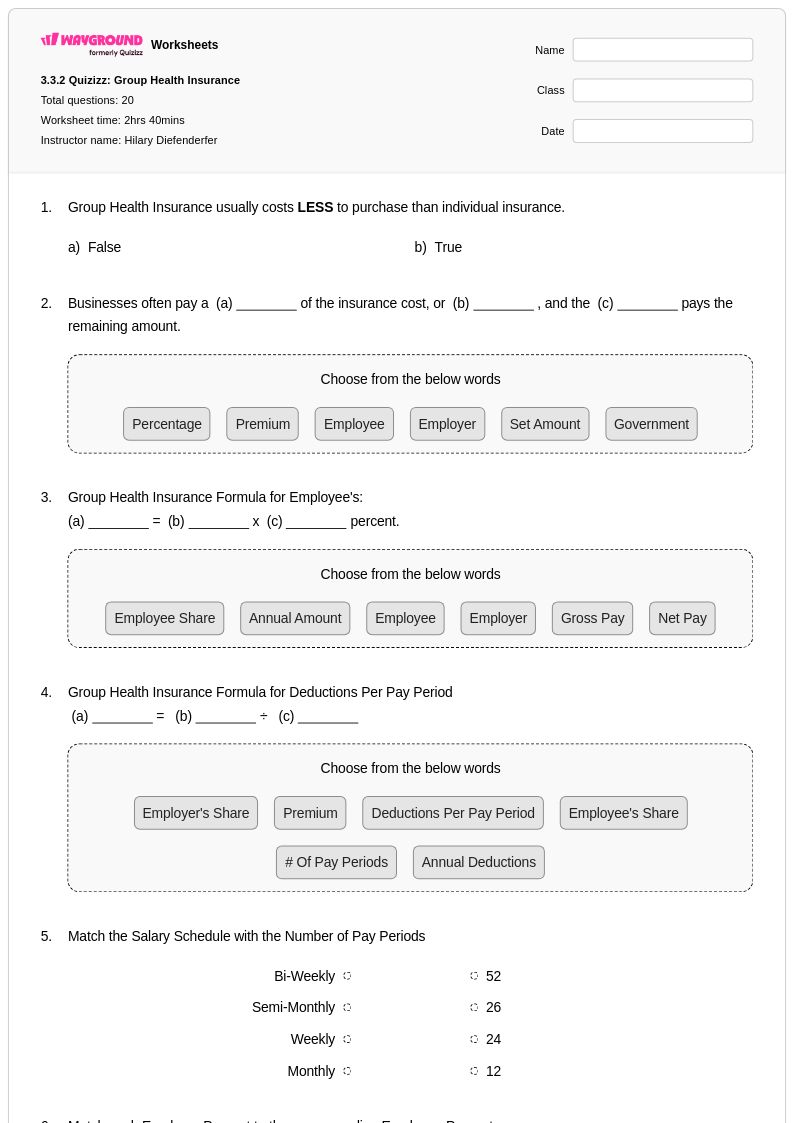

Deductions worksheets for Year 12 students through Wayground (formerly Quizizz) provide comprehensive practice with understanding and calculating various types of income deductions, including federal and state taxes, Social Security, Medicare, health insurance premiums, and retirement contributions. These expertly crafted resources strengthen students' ability to analyze pay stubs, calculate net income from gross pay, and understand the impact of different deduction types on take-home earnings. The collection includes practice problems that mirror real-world scenarios, complete answer keys for immediate feedback, and free printable materials in convenient pdf format that allow students to develop essential financial literacy skills needed for post-graduation financial independence.

Wayground (formerly Quizizz) empowers educators with millions of teacher-created deduction worksheets that can be easily searched and filtered to match specific curriculum standards and student proficiency levels. The platform's robust differentiation tools enable teachers to customize worksheet difficulty, modify problem sets for diverse learning needs, and provide targeted remediation or enrichment opportunities. Available in both printable pdf and interactive digital formats, these resources streamline lesson planning while offering flexible implementation options for classroom instruction, homework assignments, or independent study sessions. Teachers can efficiently track student progress through built-in assessment features and use the comprehensive worksheet collections to reinforce mathematical concepts essential for students' financial preparedness as they transition to adult responsibilities.