38 T

9th - 12th

18 T

8th - 12th

12 T

9th - 12th

10 T

9th - 12th

16 T

9th - 12th

17 T

10th

56 T

9th - 12th

16 T

9th - 12th

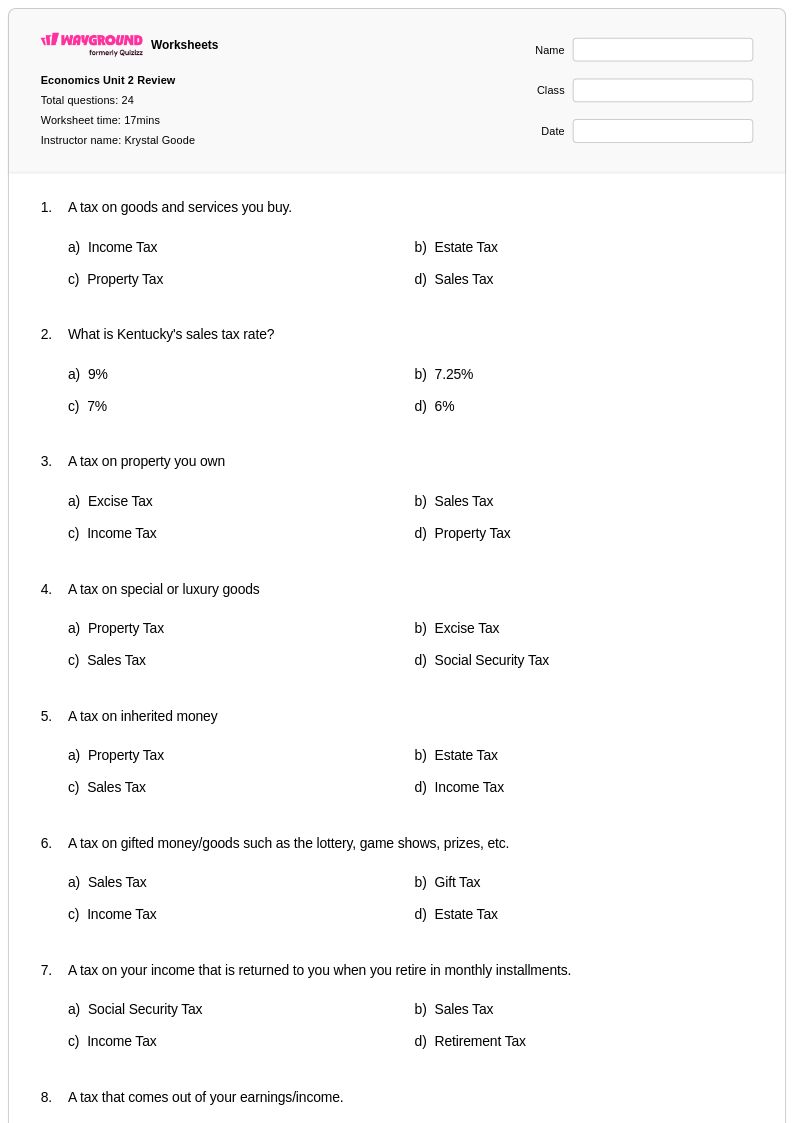

24 T

9th - 12th

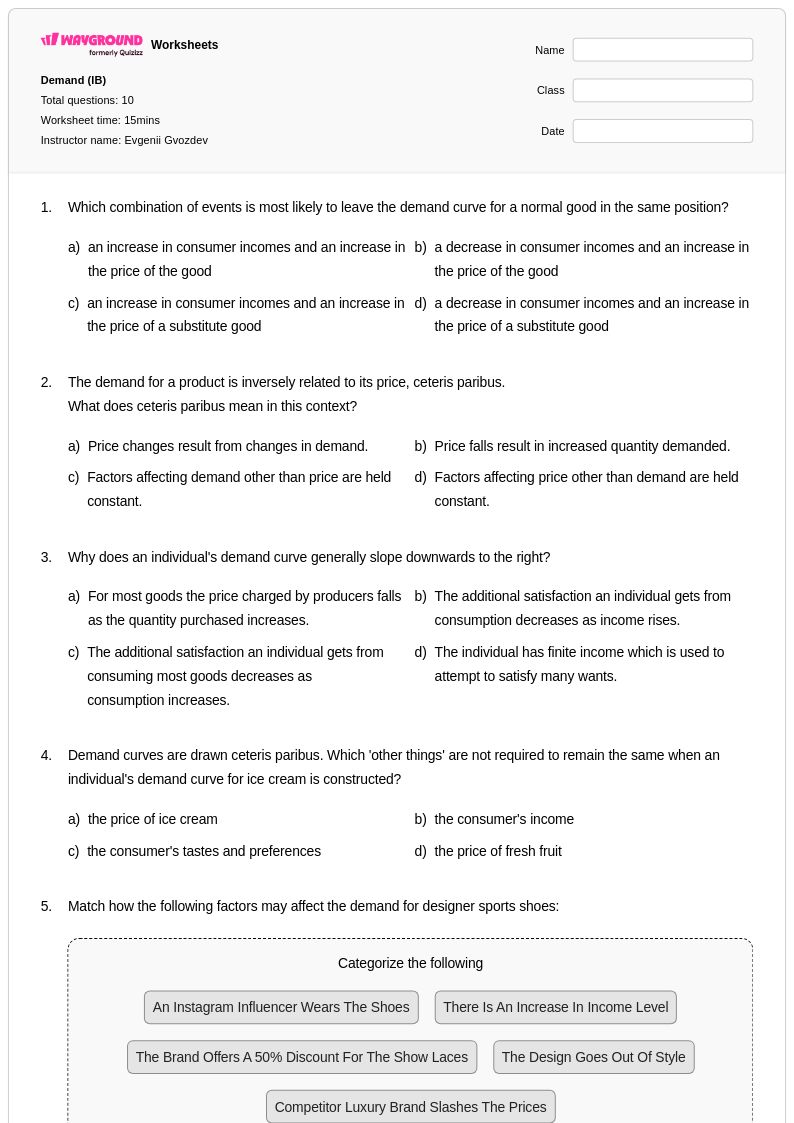

10 T

10th

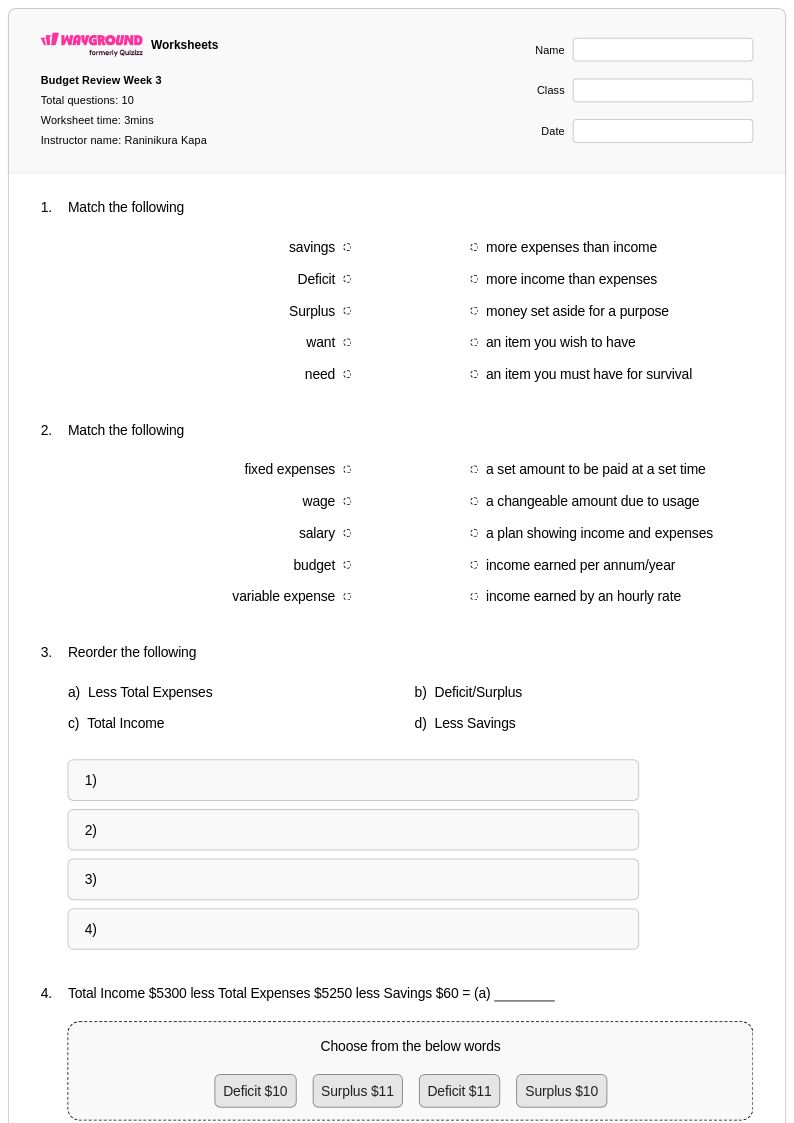

10 T

10th

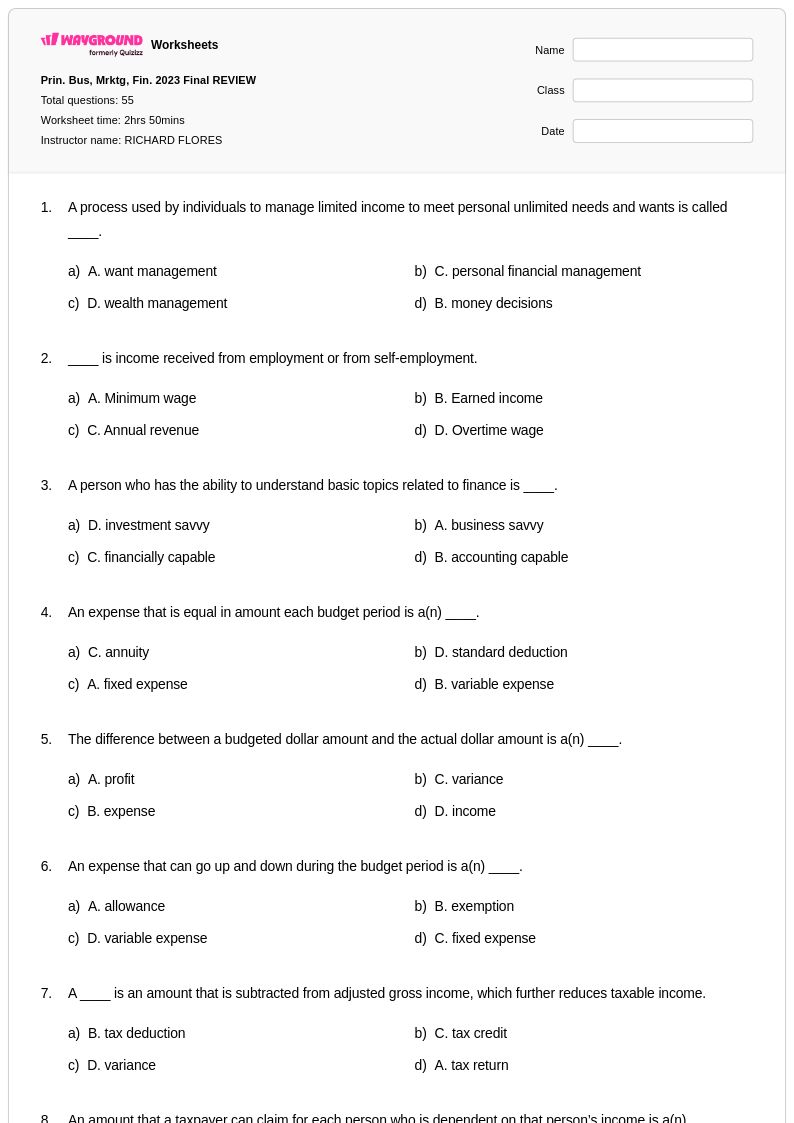

55 T

9th - 12th

16 T

10th - 12th

20 T

9th - 12th

13 T

10th

34 T

9th - 12th

5 T

9th - 12th

12 T

10th

30 T

9th - 12th

15 T

10th

30 T

7th - 12th

21 T

9th - 10th

18 T

9th - 12th

11 T

9th - 12th

Jelajahi Lembar Kerja Mata Pelajaran Lainnya untuk year 10

Explore printable Taxable Income worksheets for Year 10

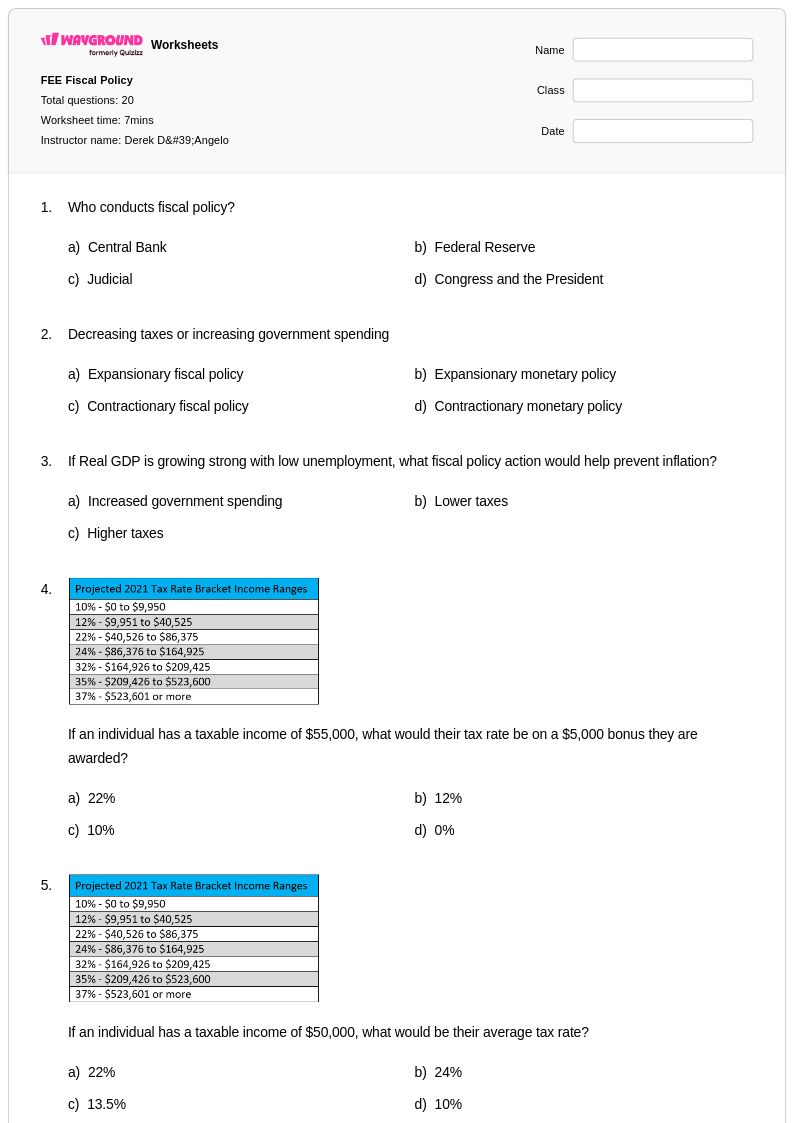

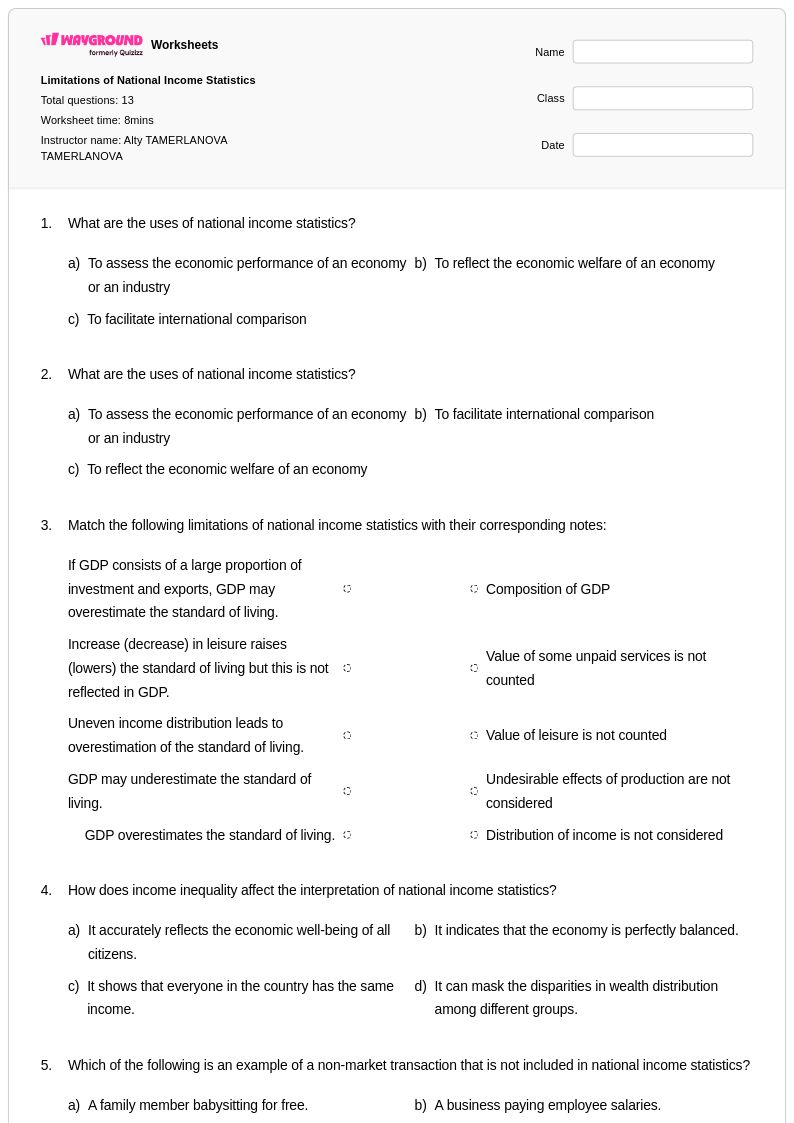

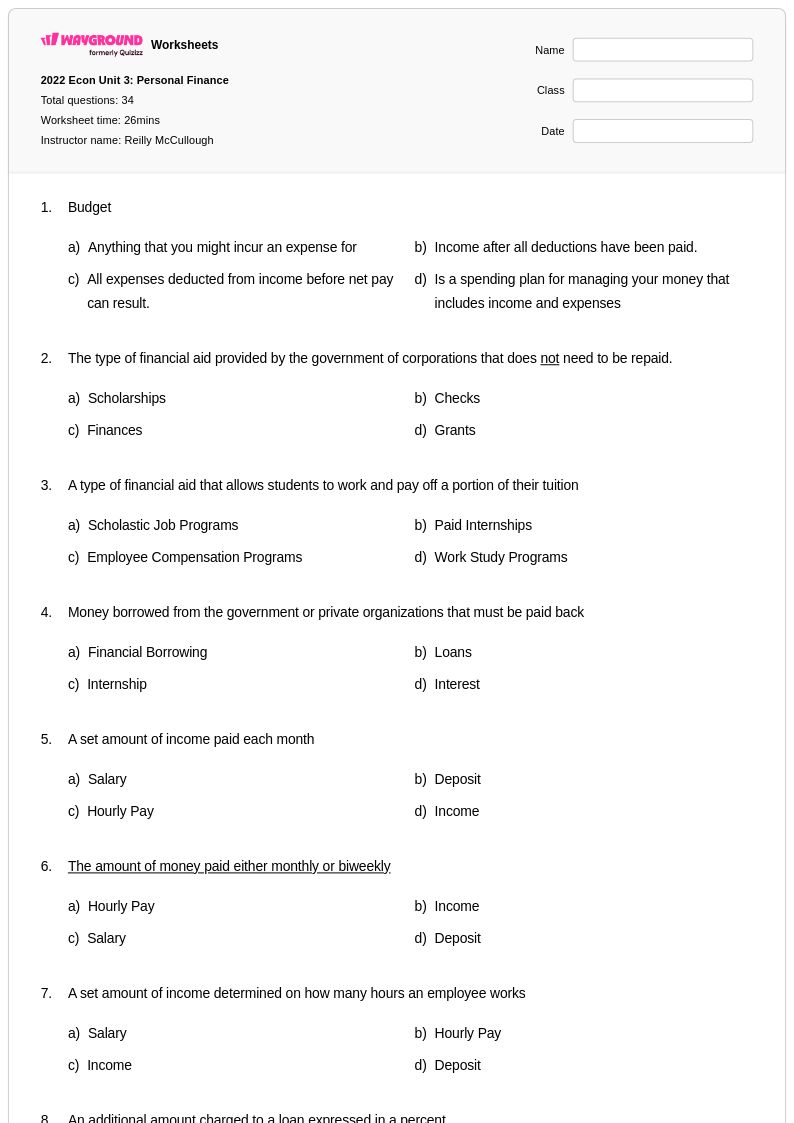

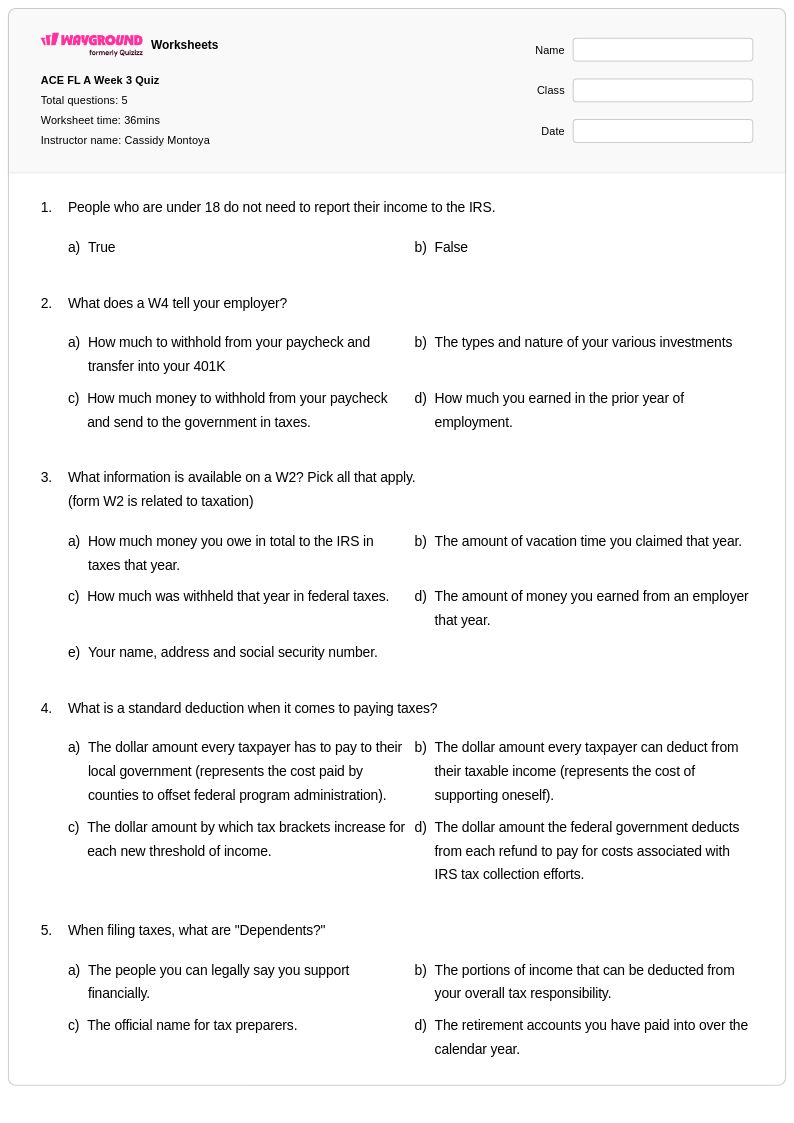

Year 10 taxable income worksheets available through Wayground (formerly Quizizz) provide comprehensive practice materials designed to strengthen students' understanding of personal finance and tax fundamentals within economics education. These educational resources focus on essential concepts including gross versus net income, various deduction types, tax bracket calculations, and the practical application of federal and state tax systems. Students develop critical analytical skills through practice problems that simulate real-world scenarios involving W-2 forms, 1099 documents, and standard versus itemized deductions. The worksheets include detailed answer keys that enable independent learning and self-assessment, while the free printable format ensures accessibility for diverse classroom environments and homework assignments.

Wayground (formerly Quizizz) supports educators with millions of teacher-created taxable income worksheet collections that feature robust search and filtering capabilities aligned to economics standards and Year 10 learning objectives. Teachers can easily locate age-appropriate materials covering specific tax concepts, from basic income calculation to complex deduction scenarios, with built-in differentiation tools that accommodate varying skill levels within the classroom. The platform's flexible customization options allow instructors to modify existing worksheets or combine multiple resources to create targeted practice sessions for remediation or enrichment purposes. Available in both printable pdf format and interactive digital versions, these comprehensive worksheet collections streamline lesson planning while providing students with meaningful skill practice that connects classroom economics theory to practical financial literacy applications.