64 Q

9th - 12th

30 Q

9th - 12th

11 Q

9th - 12th

40 Q

9th - 12th

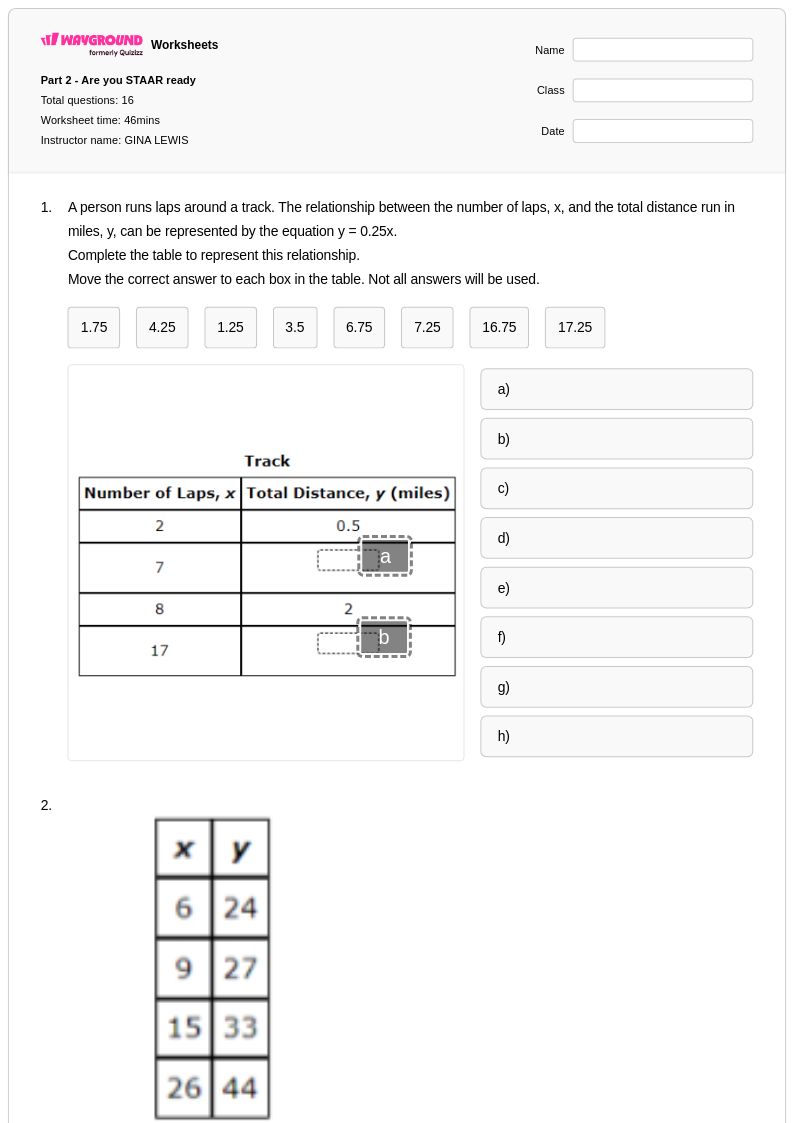

16 Q

5th - Uni

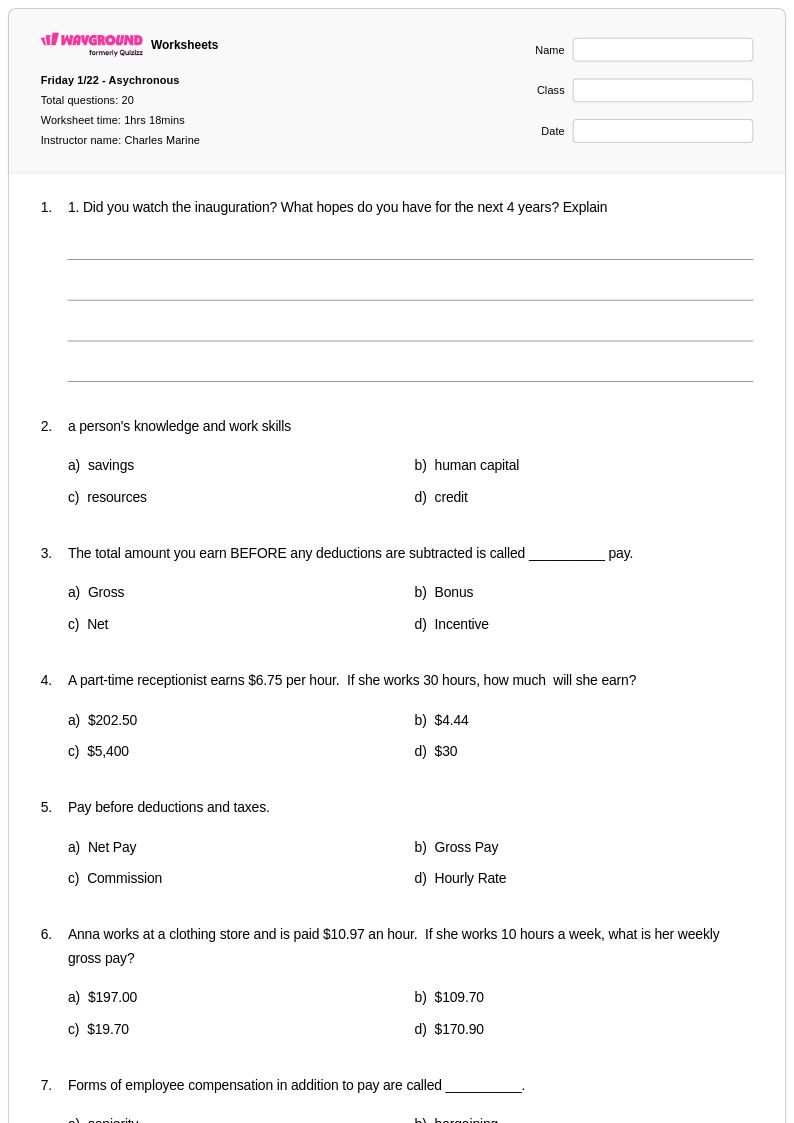

20 Q

9th - 11th

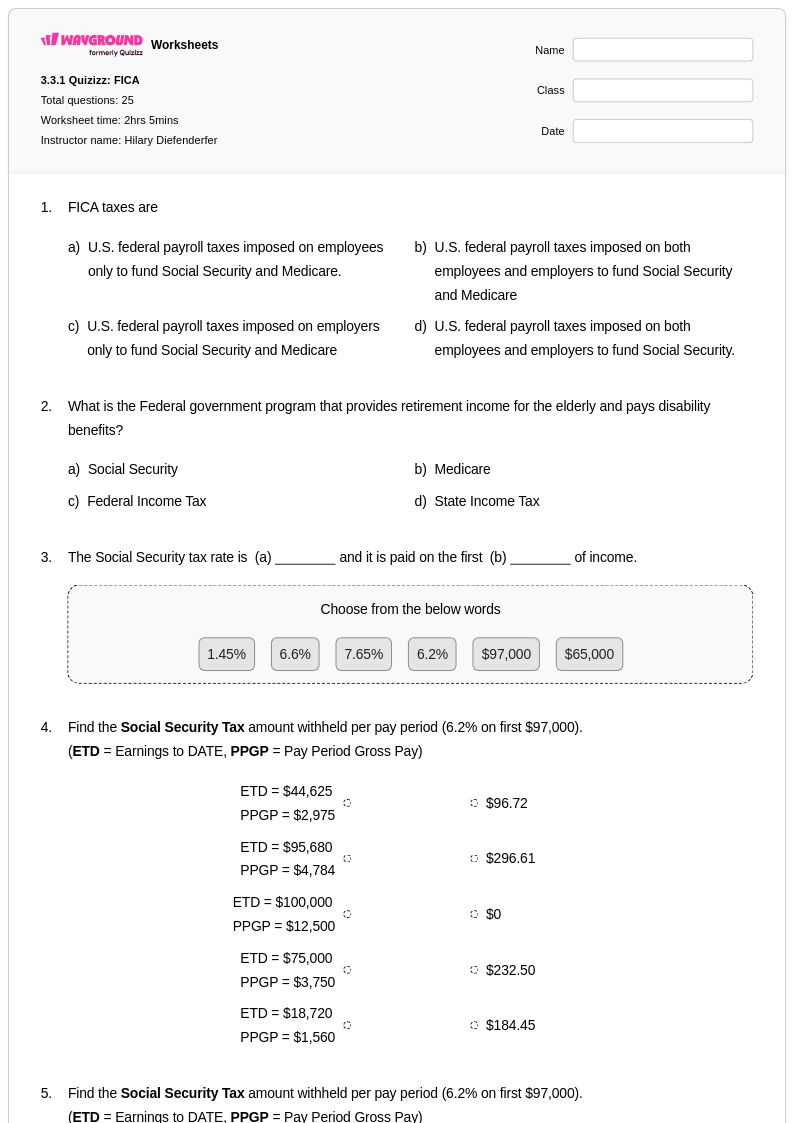

25 Q

9th - 12th

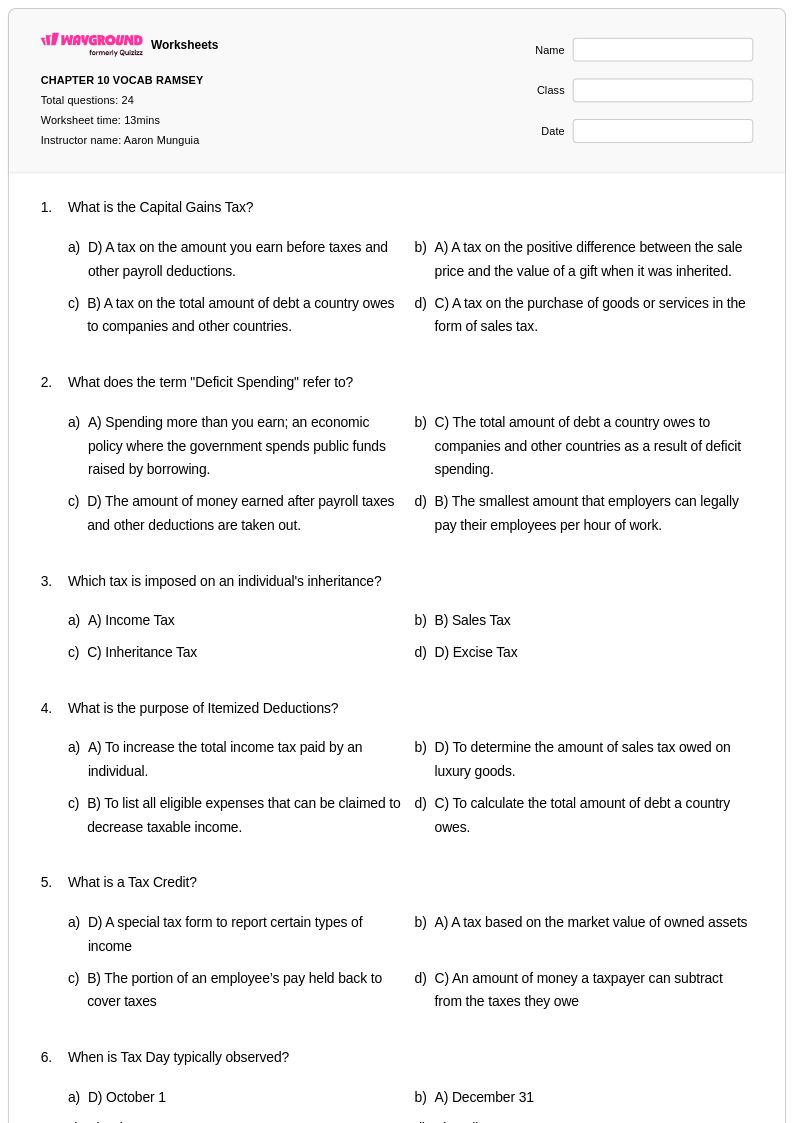

24 Q

9th

10 Q

9th - 12th

17 Q

9th - 12th

44 Q

9th - 12th

33 Q

9th - 12th

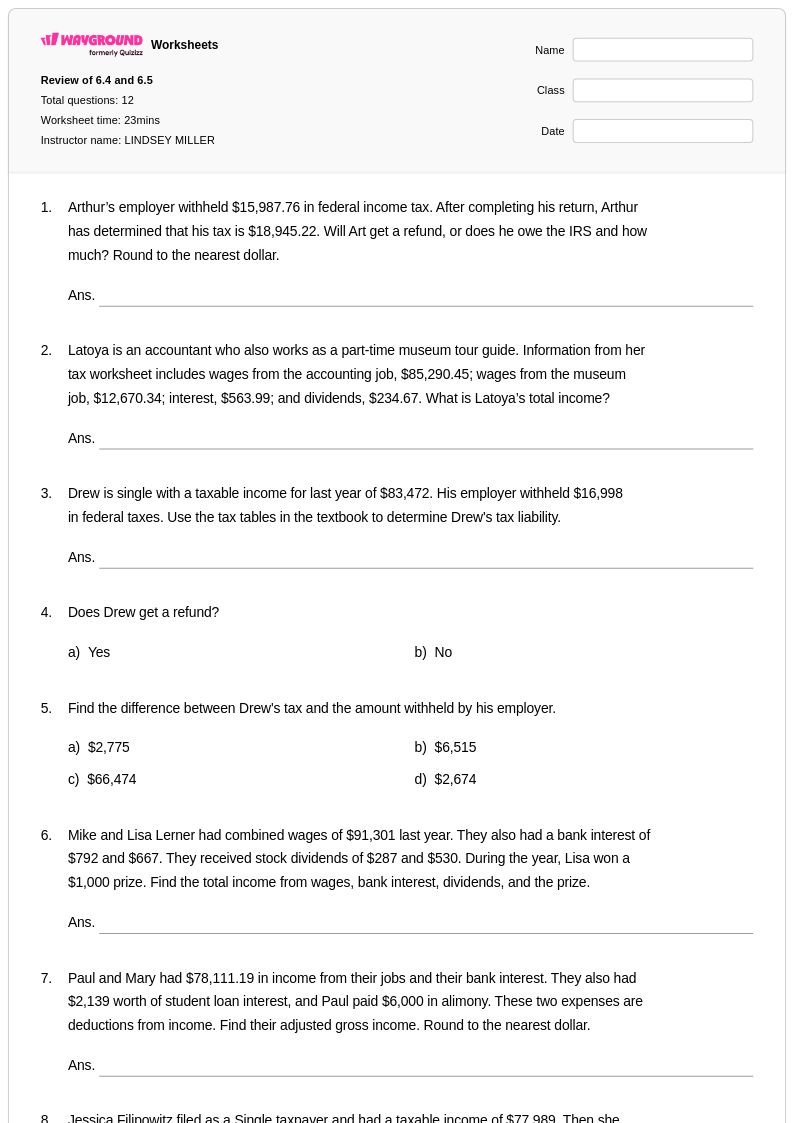

12 Q

9th - 12th

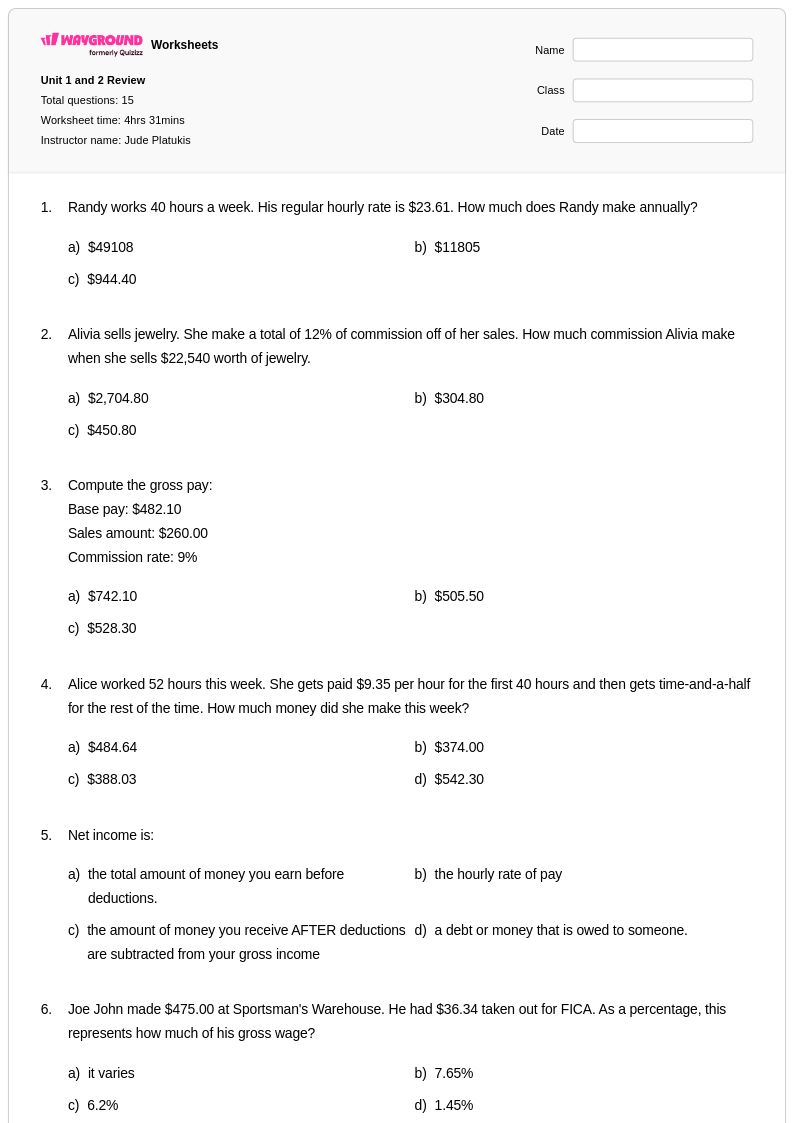

15 Q

9th - 12th

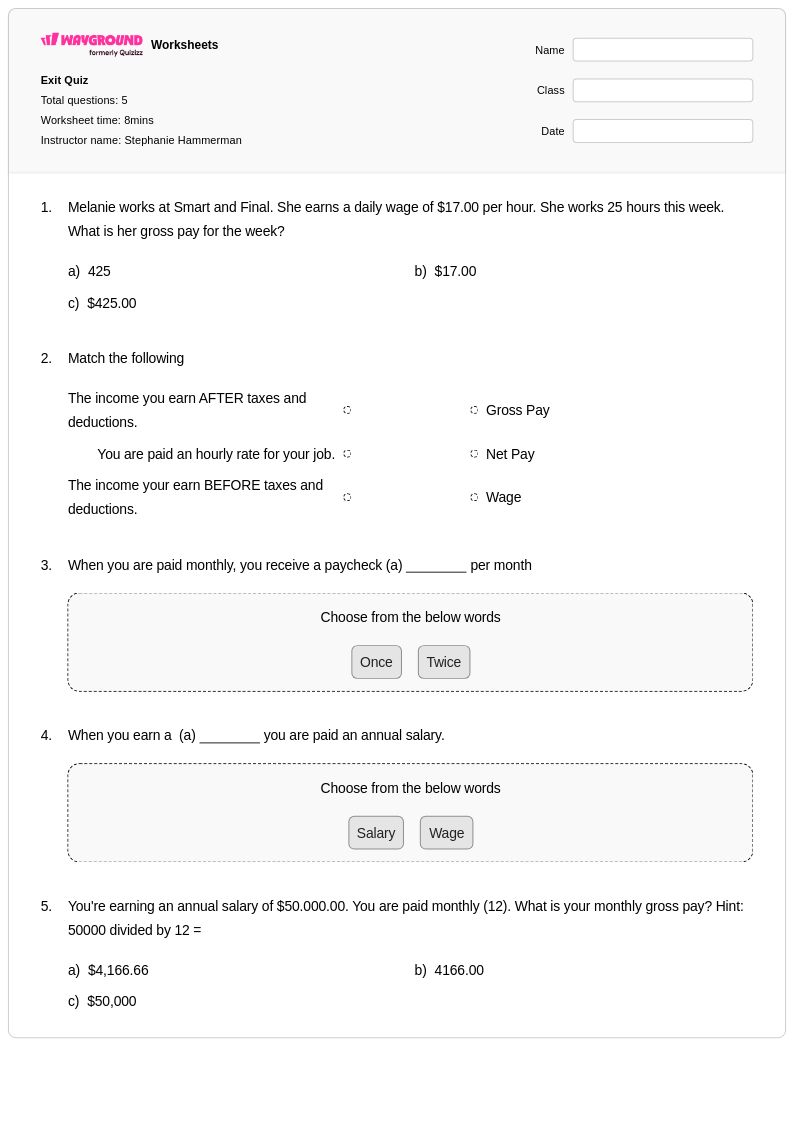

5 Q

9th - 12th

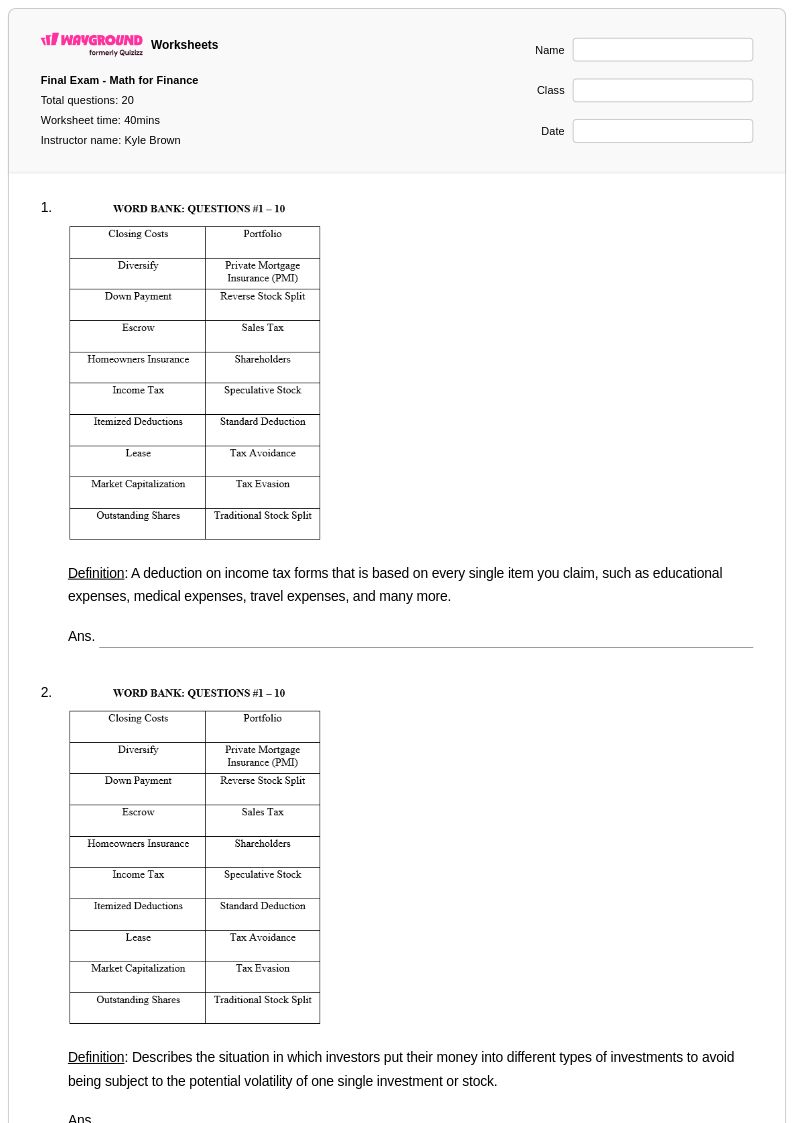

20 Q

9th - 12th

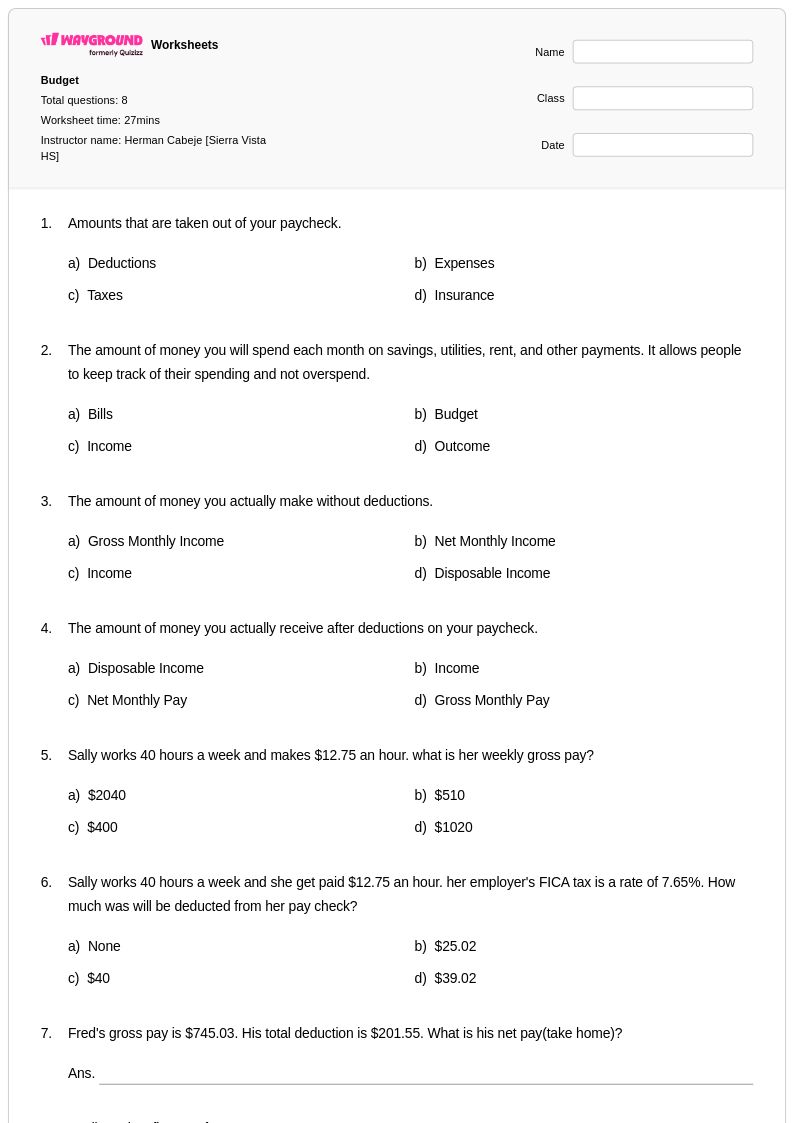

8 Q

9th - 12th

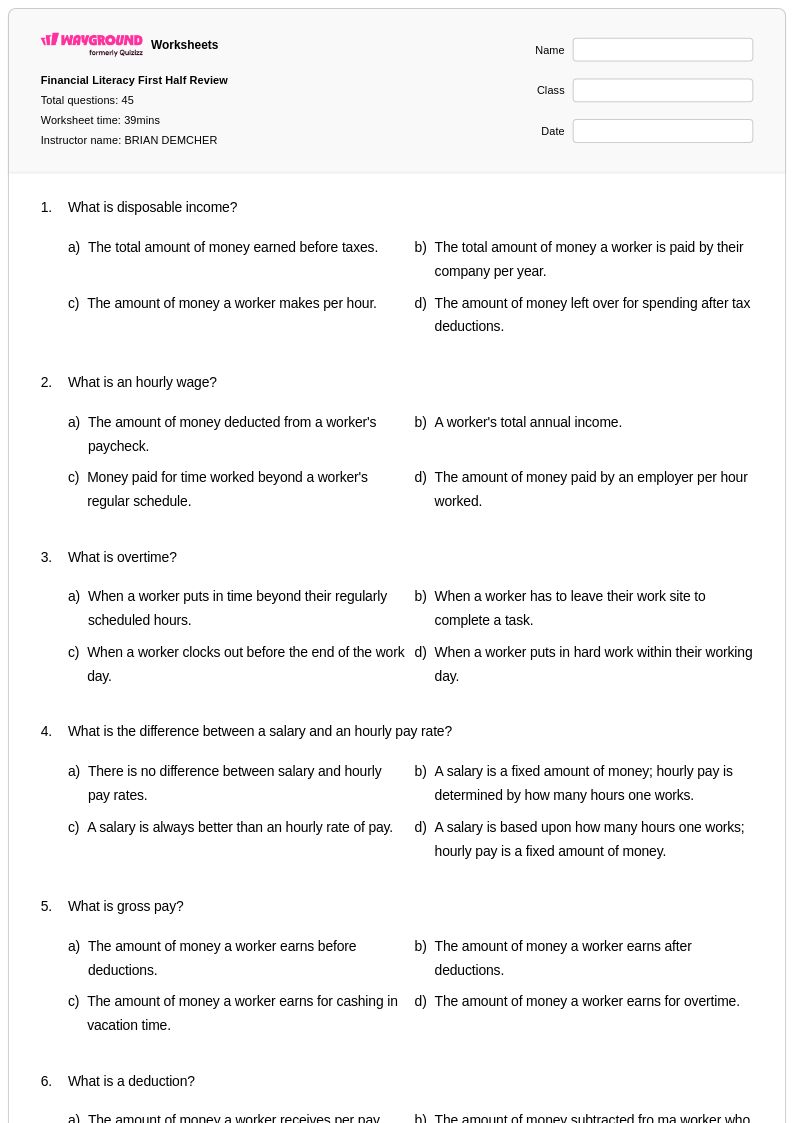

45 Q

9th - 12th

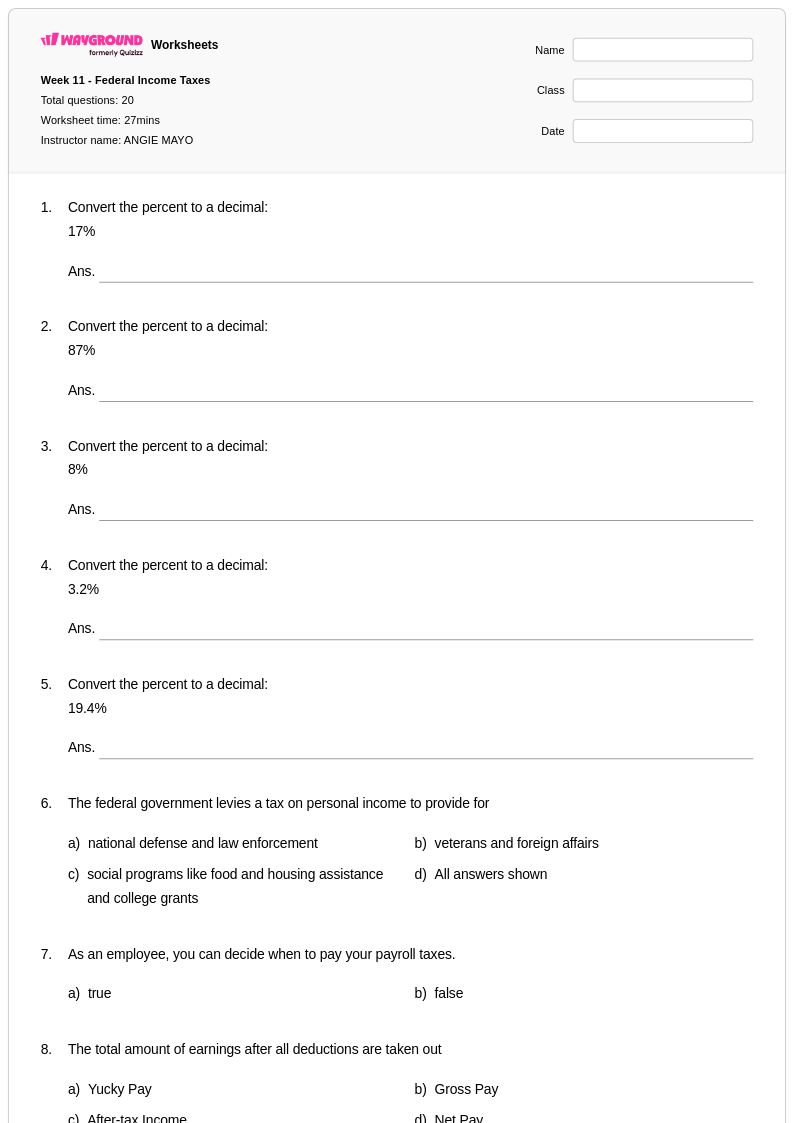

20 Q

9th - 12th

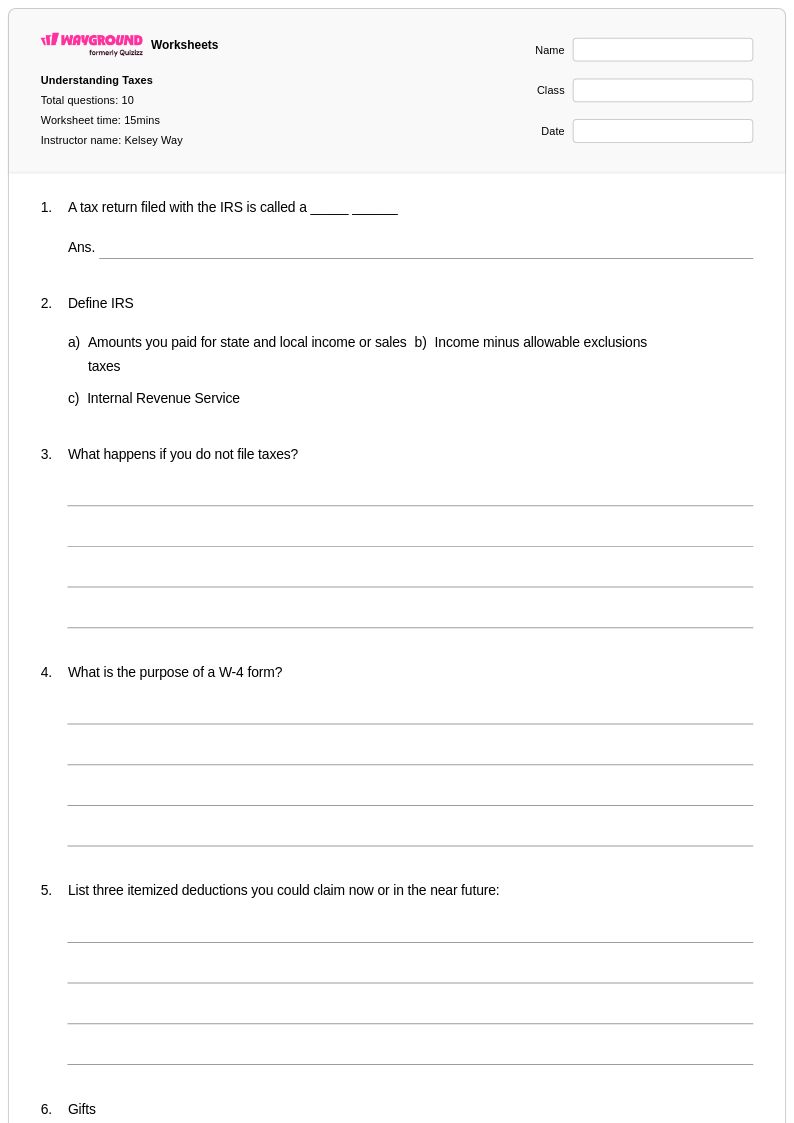

10 Q

9th - 12th

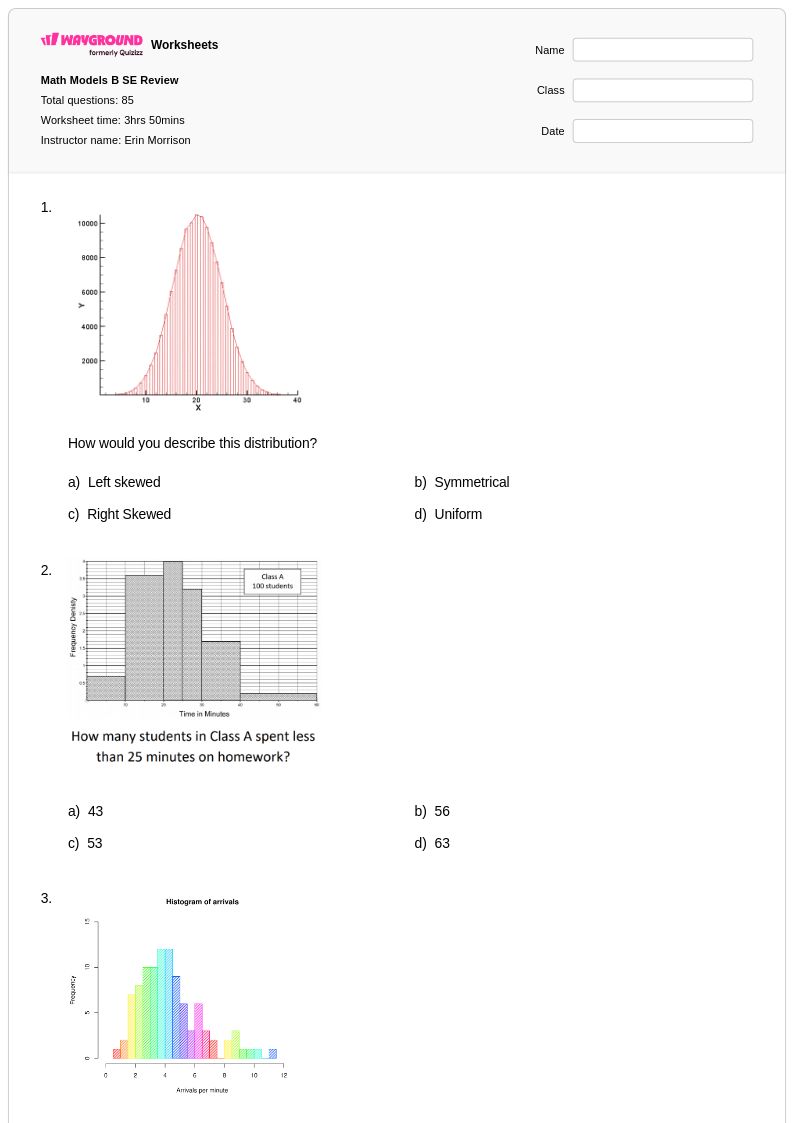

85 Q

9th - 12th

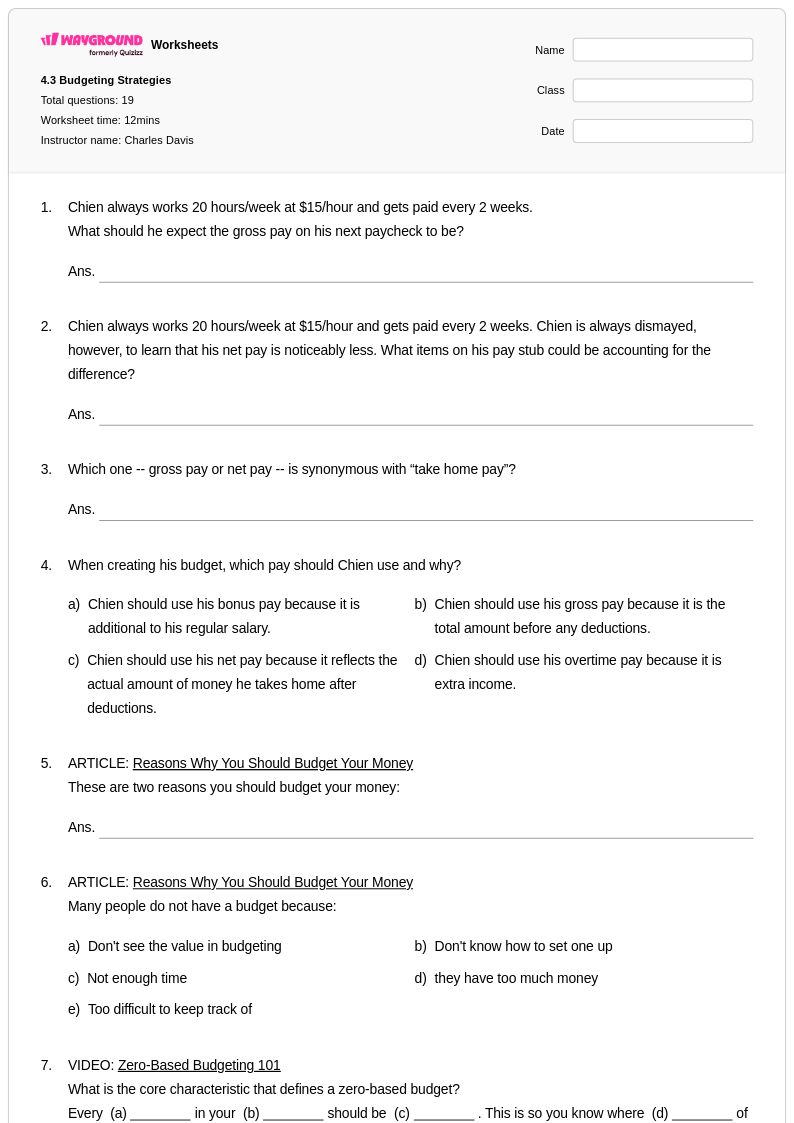

19 Q

9th

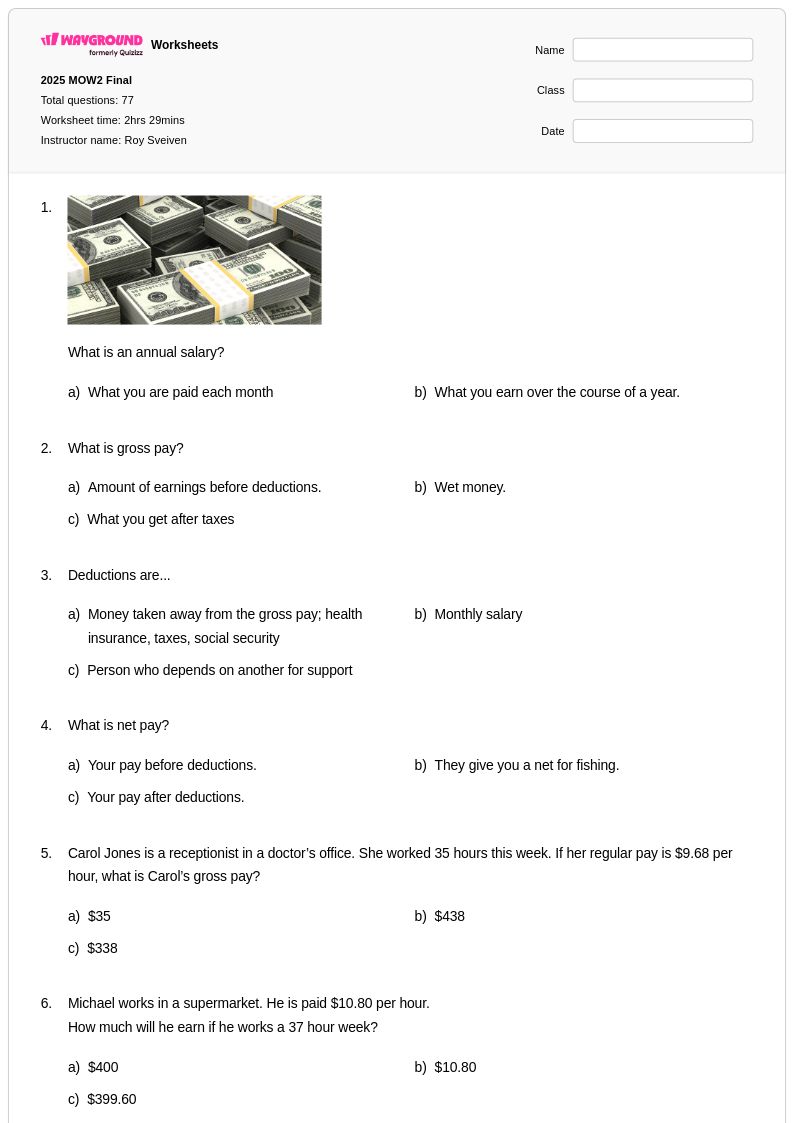

77 Q

9th

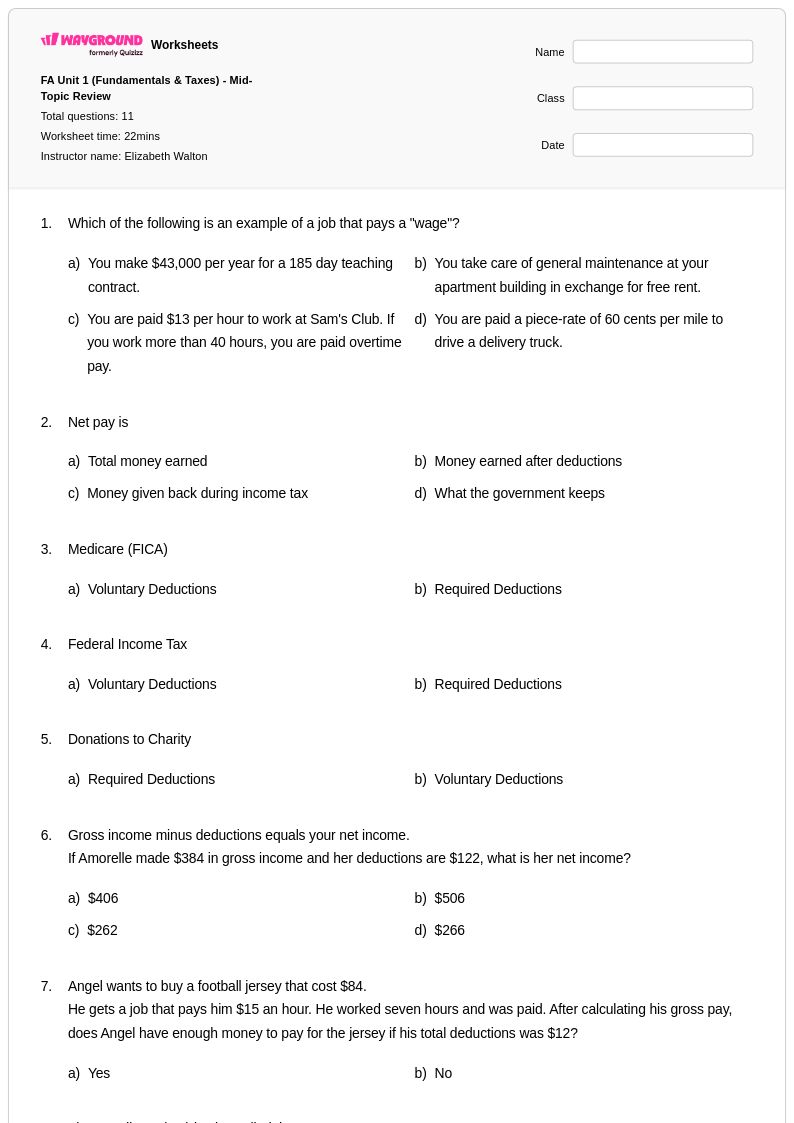

11 Q

9th - 12th

Explore Other Subject Worksheets for class 9

Explore printable Deductions worksheets for Class 9

Deductions worksheets for Class 9 students available through Wayground (formerly Quizizz) provide comprehensive practice with understanding how various deductions impact personal finances and mathematical calculations. These worksheets strengthen essential skills including calculating gross versus net income, understanding tax withholdings, identifying common payroll deductions like health insurance and retirement contributions, and analyzing how deductions affect take-home pay. Students work through practice problems that mirror real-world scenarios, learning to interpret pay stubs, calculate percentage-based deductions, and determine the financial impact of voluntary versus mandatory deductions. Each worksheet comes with a detailed answer key and is available as a free printable pdf, allowing students to develop critical financial literacy skills through hands-on mathematical applications.

Wayground (formerly Quizizz) supports mathematics teachers with an extensive collection of deductions worksheets drawn from millions of teacher-created resources that address Class 9 financial literacy standards. The platform's advanced search and filtering capabilities enable educators to quickly locate worksheets that match specific learning objectives, whether focusing on payroll deductions, tax calculations, or benefits analysis. Teachers can customize these resources to meet diverse student needs, creating differentiated assignments for remediation or enrichment while maintaining alignment with mathematical problem-solving standards. Available in both printable pdf format and interactive digital versions, these worksheets facilitate flexible lesson planning and provide targeted skill practice that helps students master the mathematical concepts underlying personal financial management and deduction calculations.