10 Q

12th

50 Q

11th - Uni

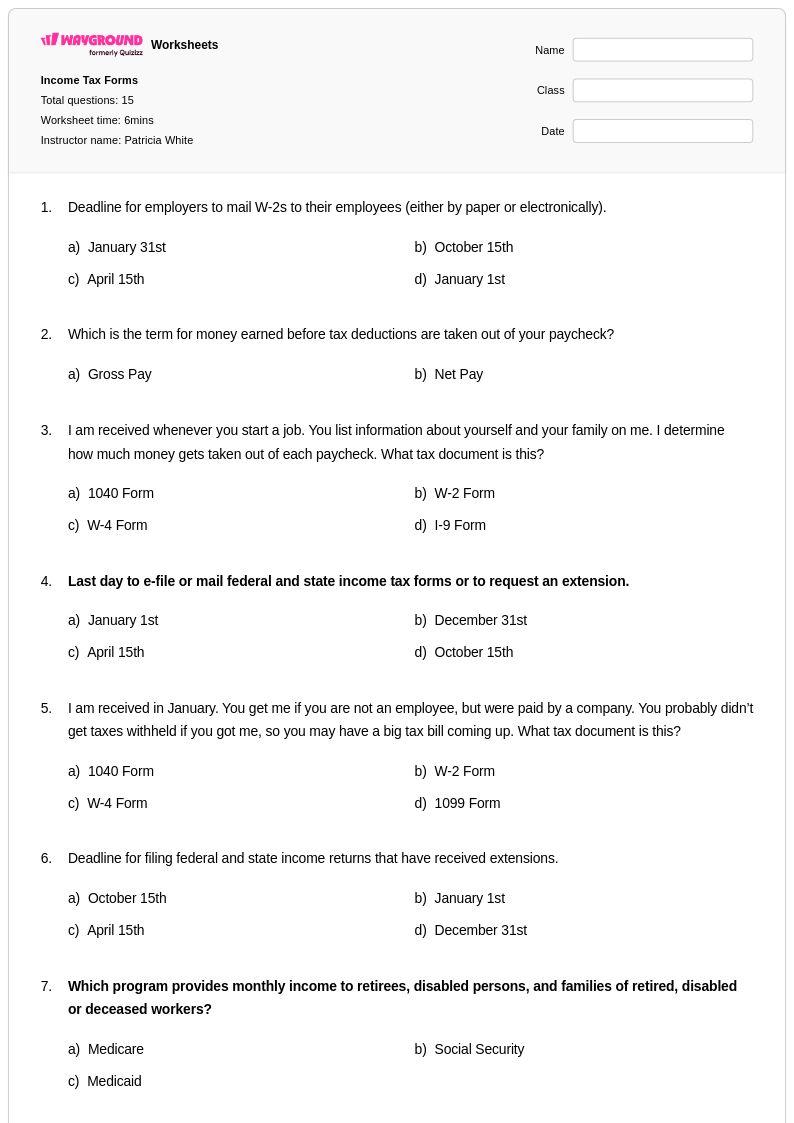

15 Q

12th

15 Q

12th

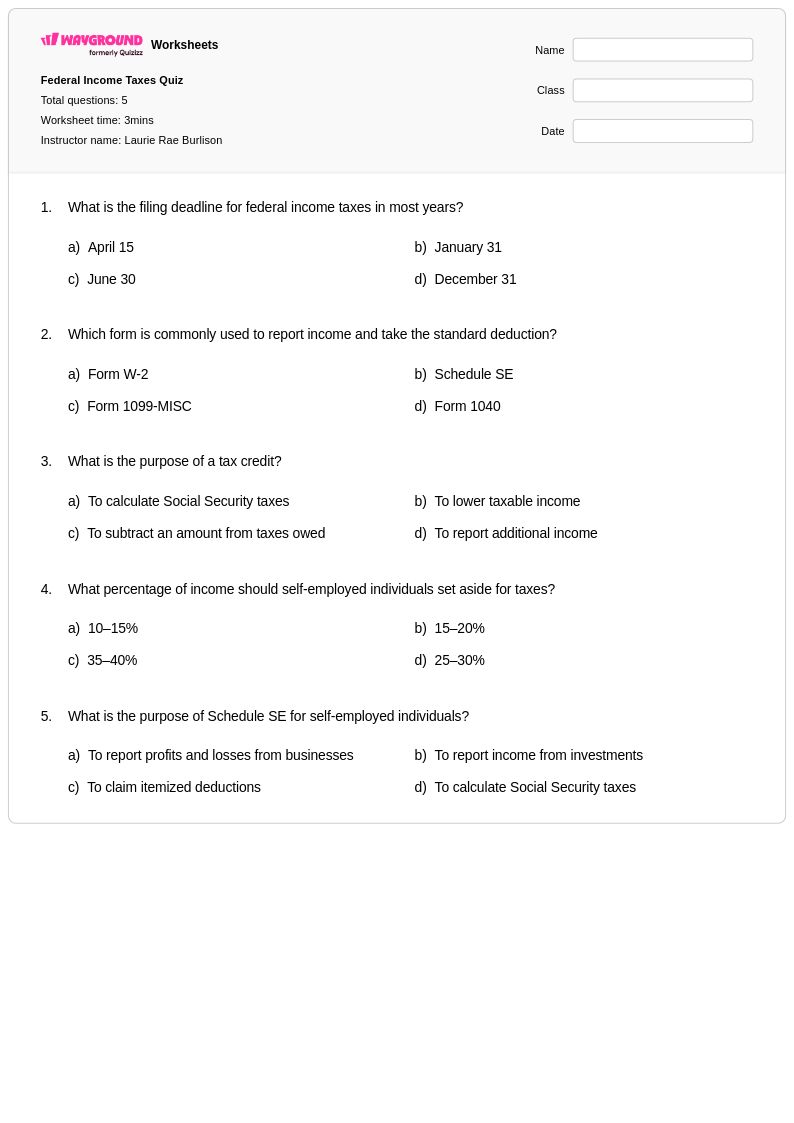

5 Q

12th - Uni

25 Q

12th - Uni

15 Q

12th - Uni

15 Q

12th - Uni

15 Q

11th - Uni

15 Q

12th - Uni

25 Q

12th - Uni

25 Q

11th - Uni

15 Q

12th - Uni

15 Q

12th - Uni

13 Q

9th - 12th

40 Q

12th

10 Q

12th

25 Q

12th - Uni

31 Q

12th

10 Q

12th

15 Q

9th - 12th

5 Q

12th

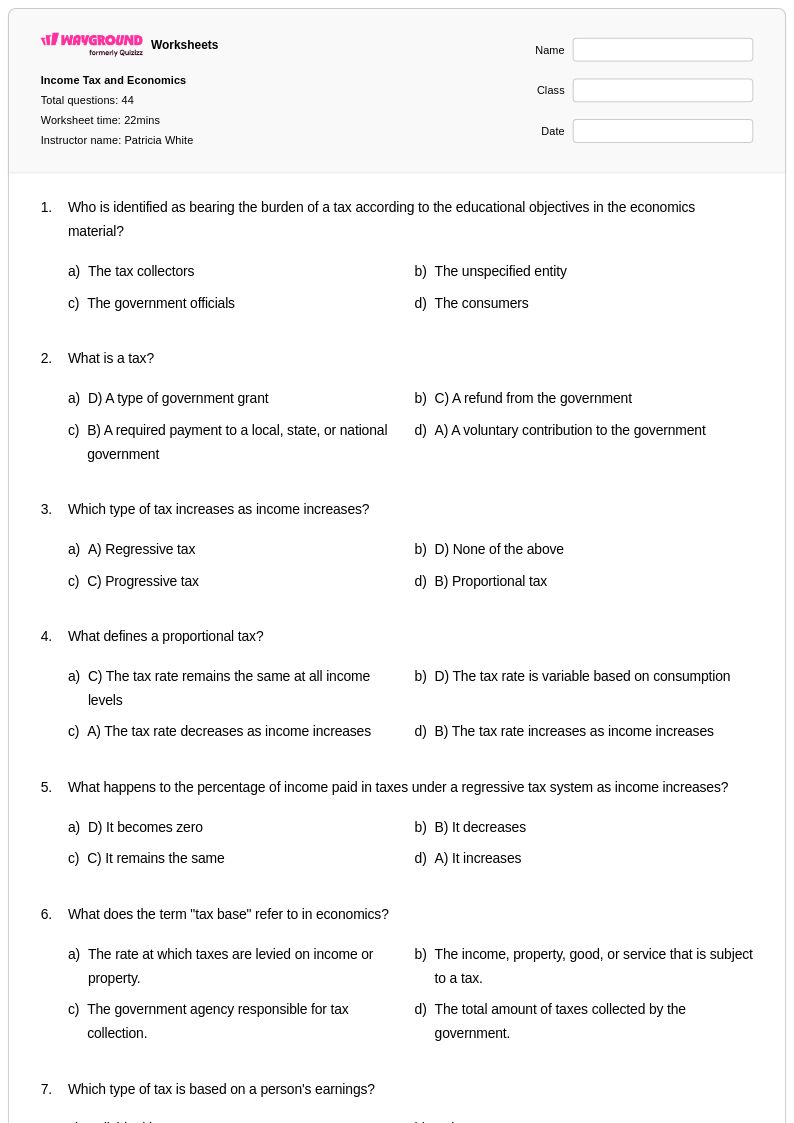

44 Q

12th

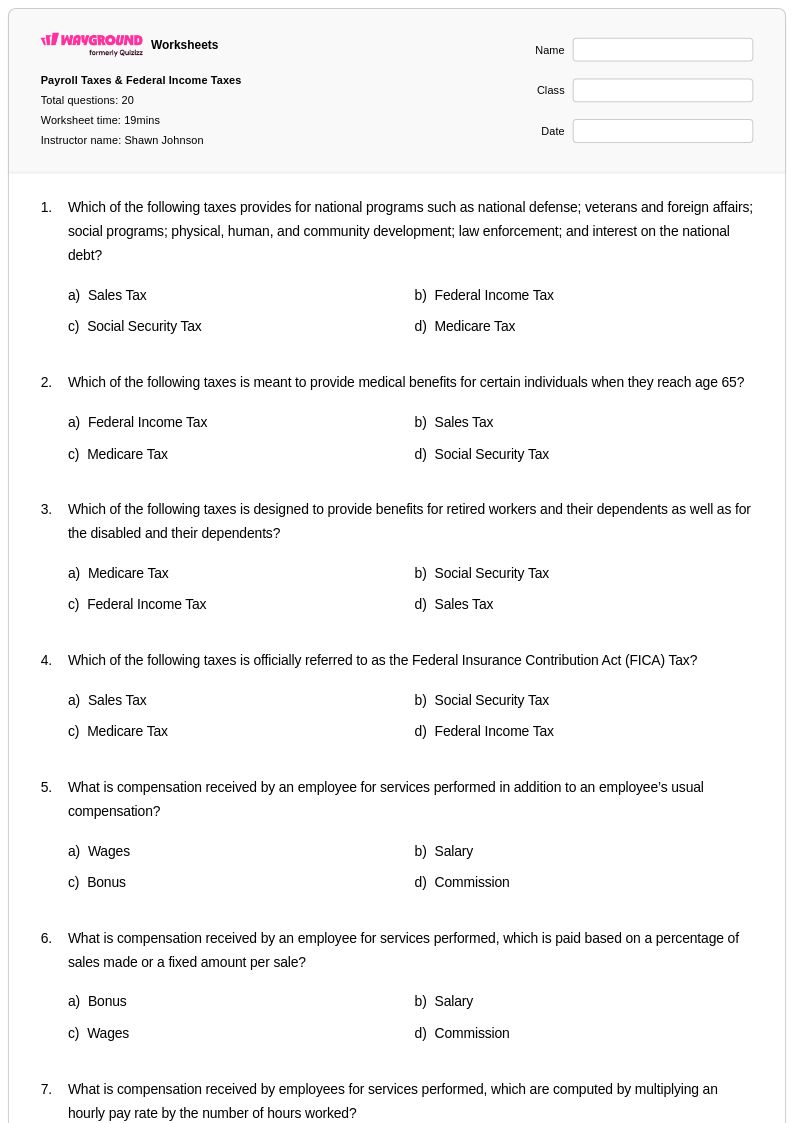

20 Q

11th - 12th

Explore Other Subject Worksheets for class 12

Explore printable Income Tax worksheets for Class 12

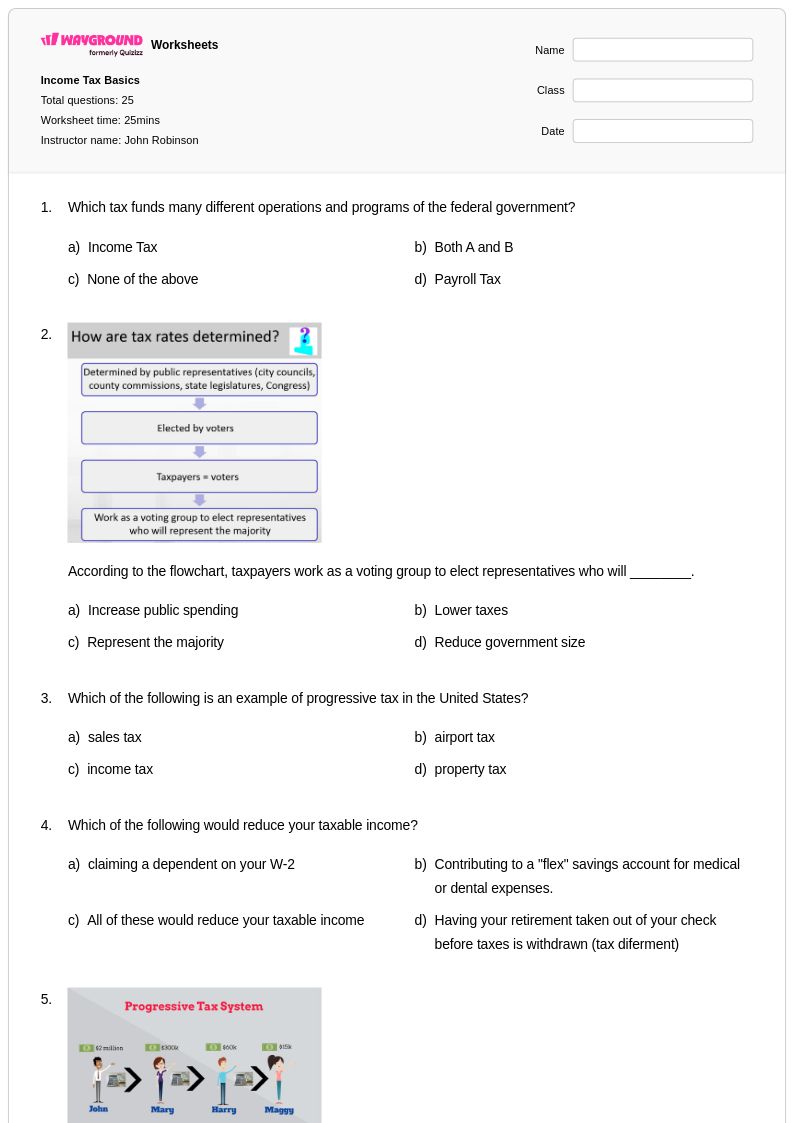

Income tax worksheets for Class 12 students available through Wayground (formerly Quizizz) provide comprehensive practice with the complexities of personal taxation systems and their economic implications. These carefully designed resources help students master essential skills including calculating gross and net income, understanding progressive tax brackets, determining deductions and exemptions, and analyzing the relationship between taxation and government revenue. Students work through realistic practice problems that mirror actual tax scenarios, developing proficiency with tax forms, percentage calculations, and economic reasoning. Each worksheet collection includes detailed answer keys and explanations, making these free printables valuable for both guided instruction and independent study as students prepare for adult financial responsibilities.

Wayground (formerly Quizizz) empowers educators with millions of teacher-created income tax resources that streamline lesson planning and accommodate diverse learning needs in Class 12 economics courses. The platform's robust search and filtering capabilities allow teachers to quickly locate worksheets aligned with specific curriculum standards, while differentiation tools enable customization for students at varying skill levels. These comprehensive collections are available in both printable pdf formats for traditional classroom use and digital formats for technology-integrated learning environments. Teachers can efficiently modify existing worksheets or combine multiple resources to create targeted practice sessions, whether for initial skill development, remediation of challenging tax concepts, or enrichment activities that explore advanced topics like tax policy analysis and economic impact assessment.