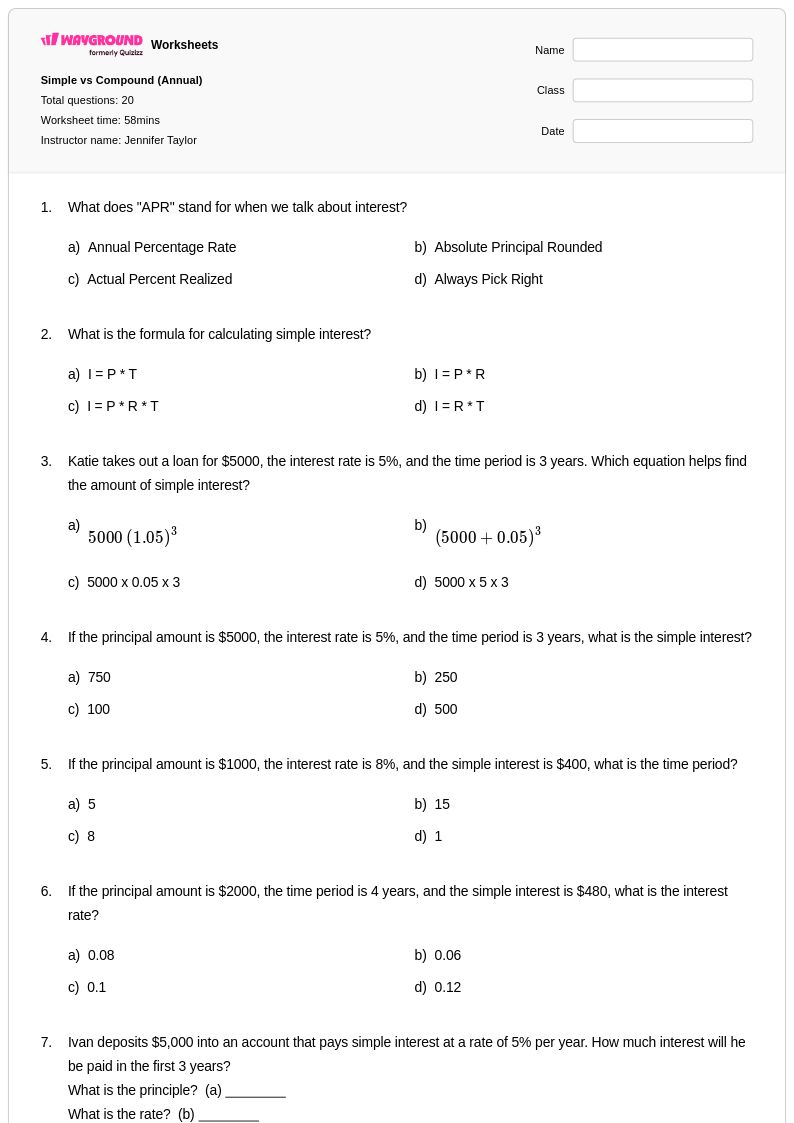

20 Q

9th - 12th

14 Q

12th

7 Q

8th

18 Q

9th

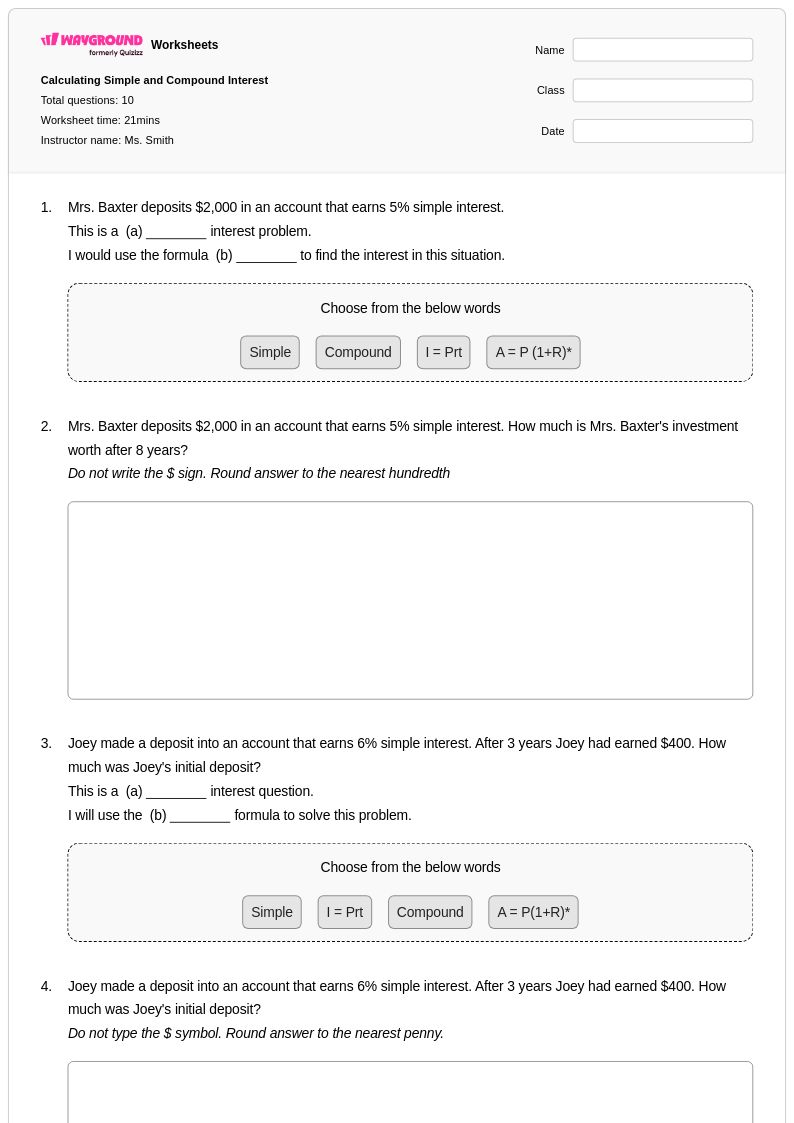

10 Q

9th - 12th

17 Q

9th - 12th

17 Q

12th

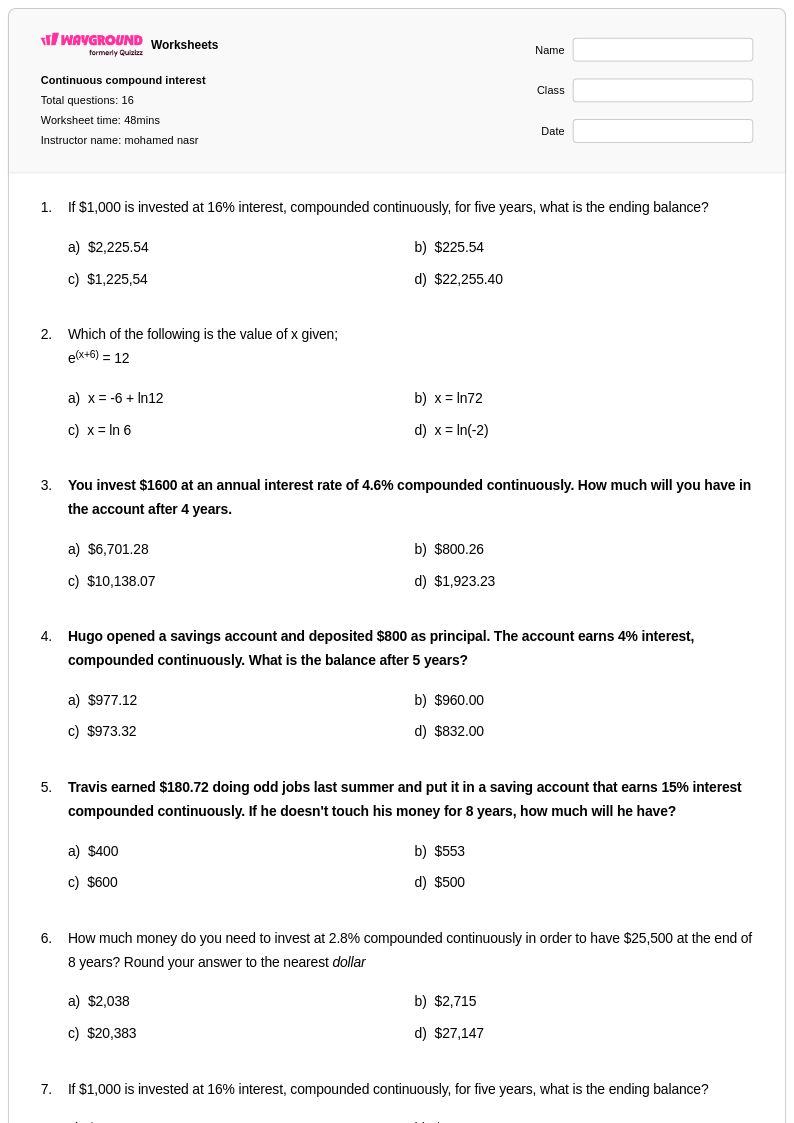

16 Q

8th

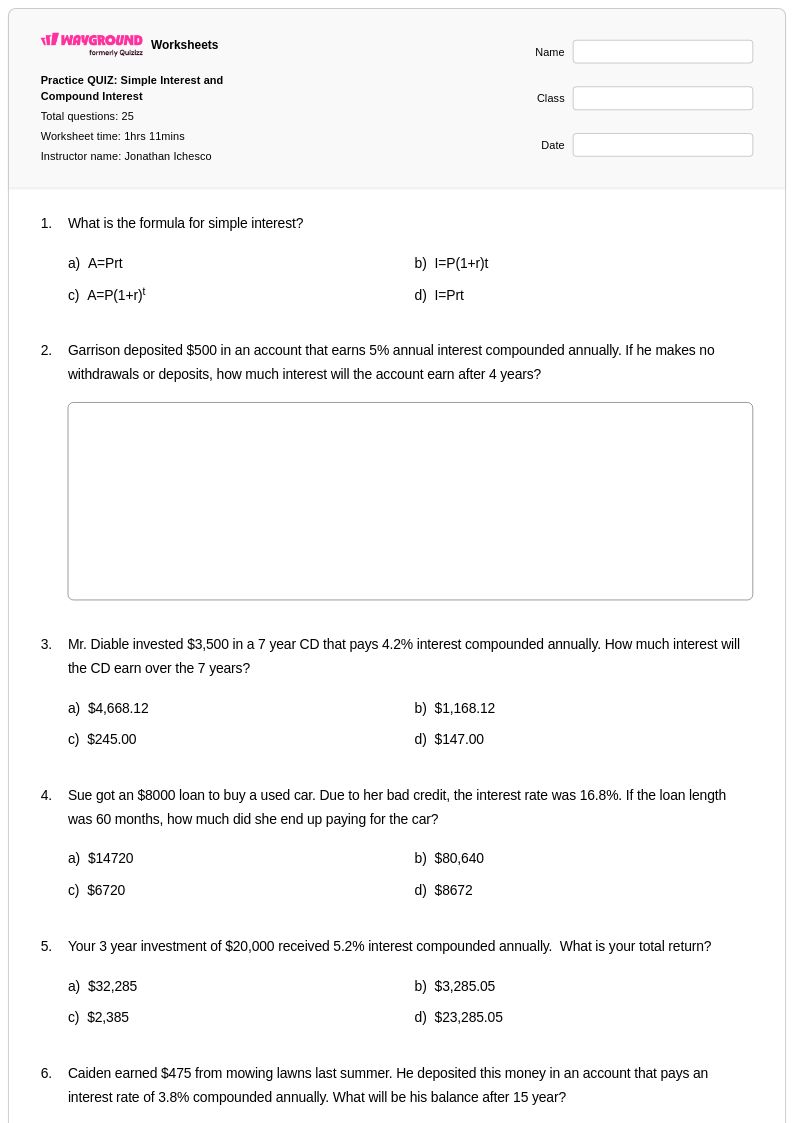

25 Q

9th

20 Q

12th

16 Q

11th

10 Q

7th

20 Q

11th - Uni

20 Q

8th

10 Q

7th

20 Q

7th

18 Q

9th - 12th

15 Q

8th

10 Q

9th - 12th

17 Q

7th

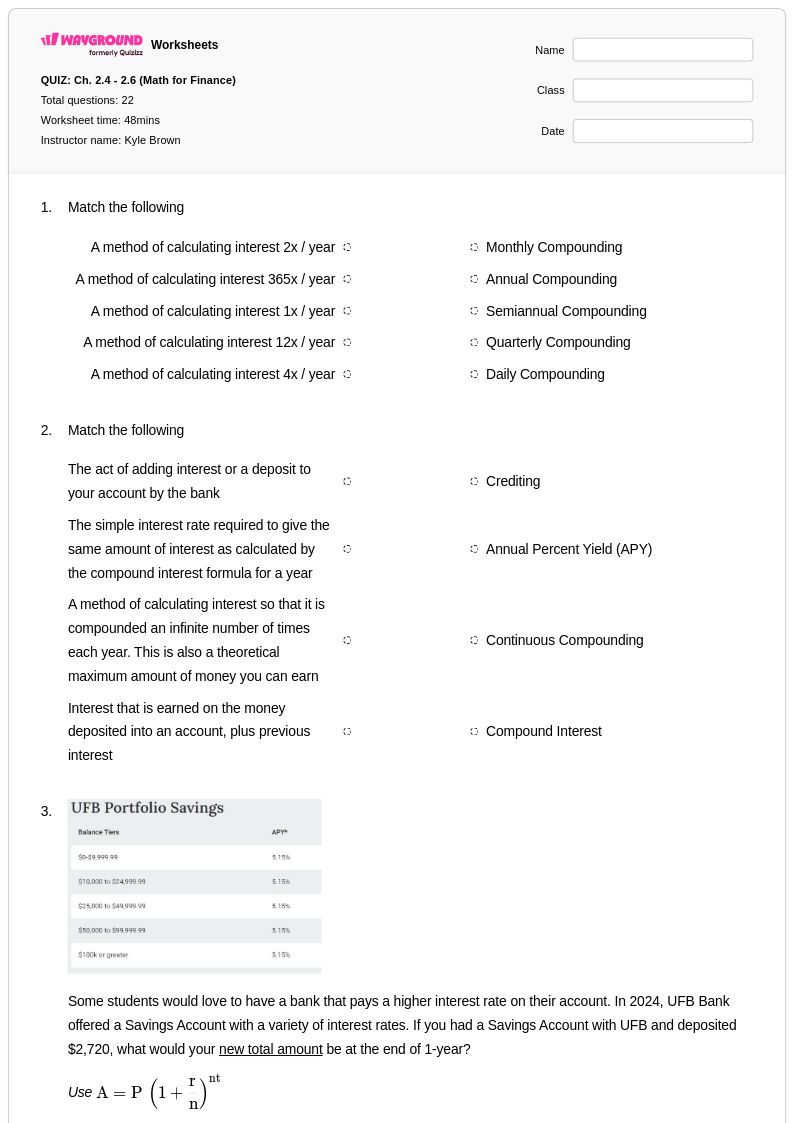

22 Q

9th - 12th

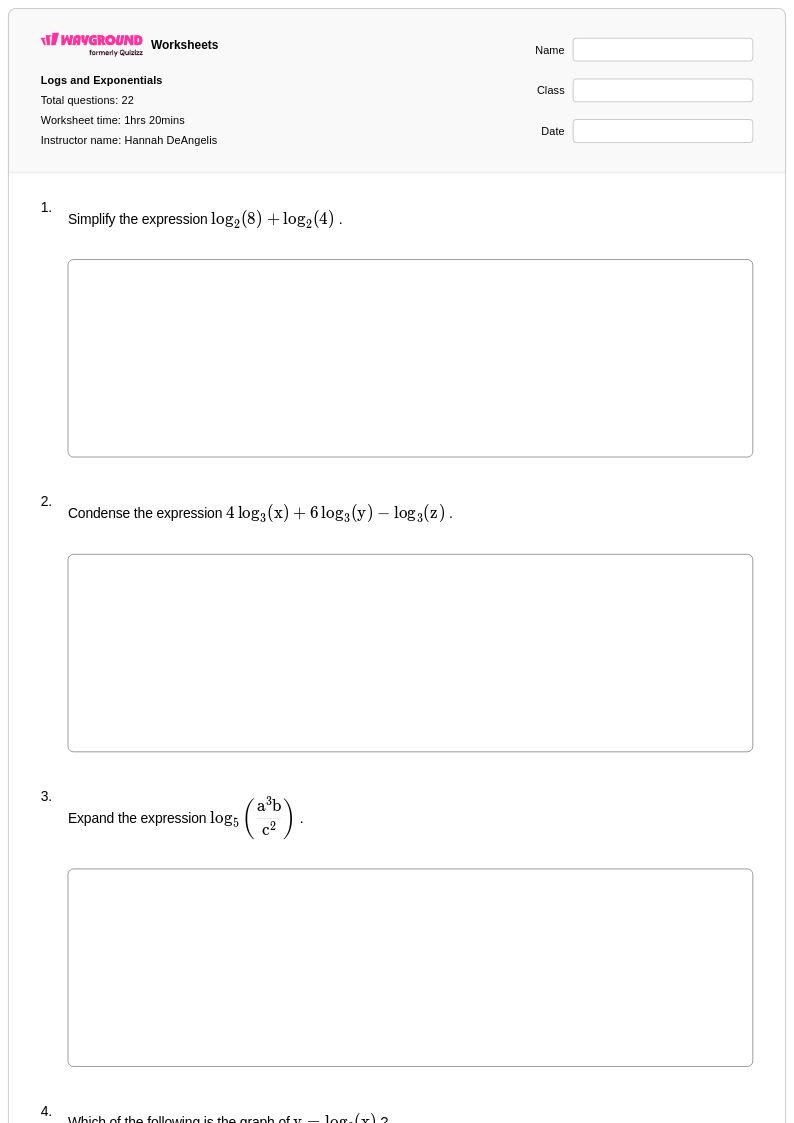

22 Q

11th

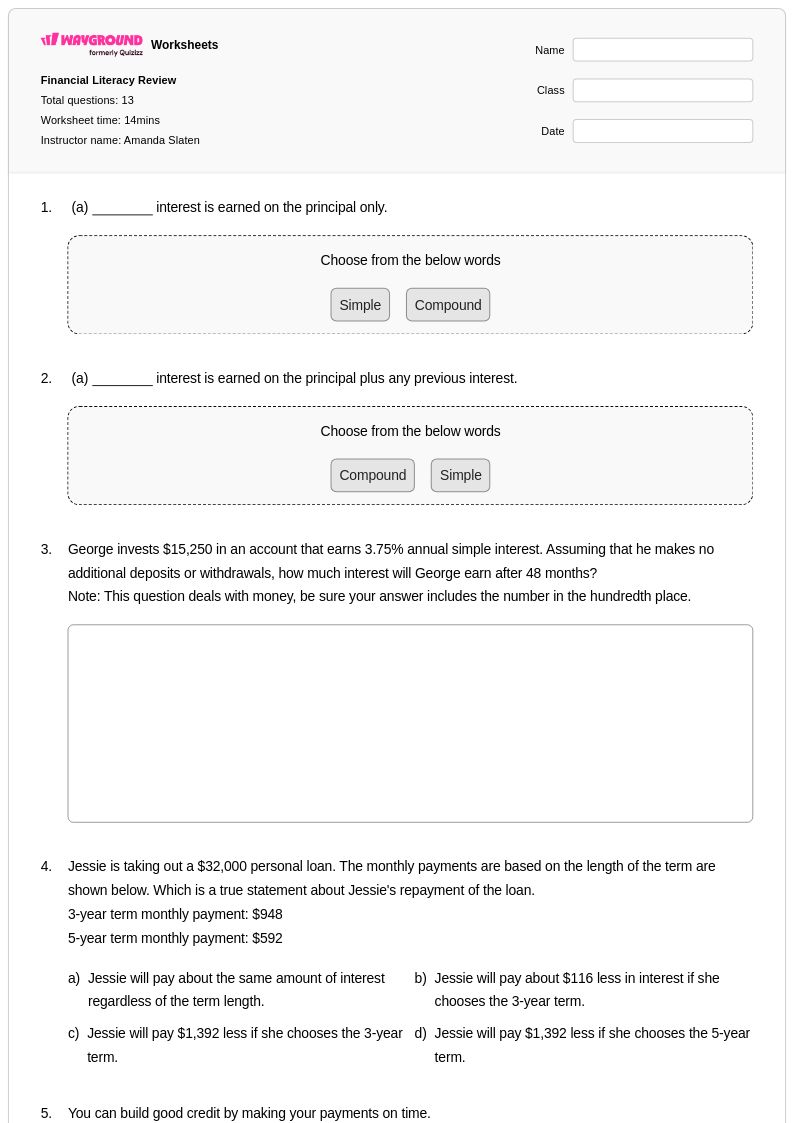

13 Q

8th

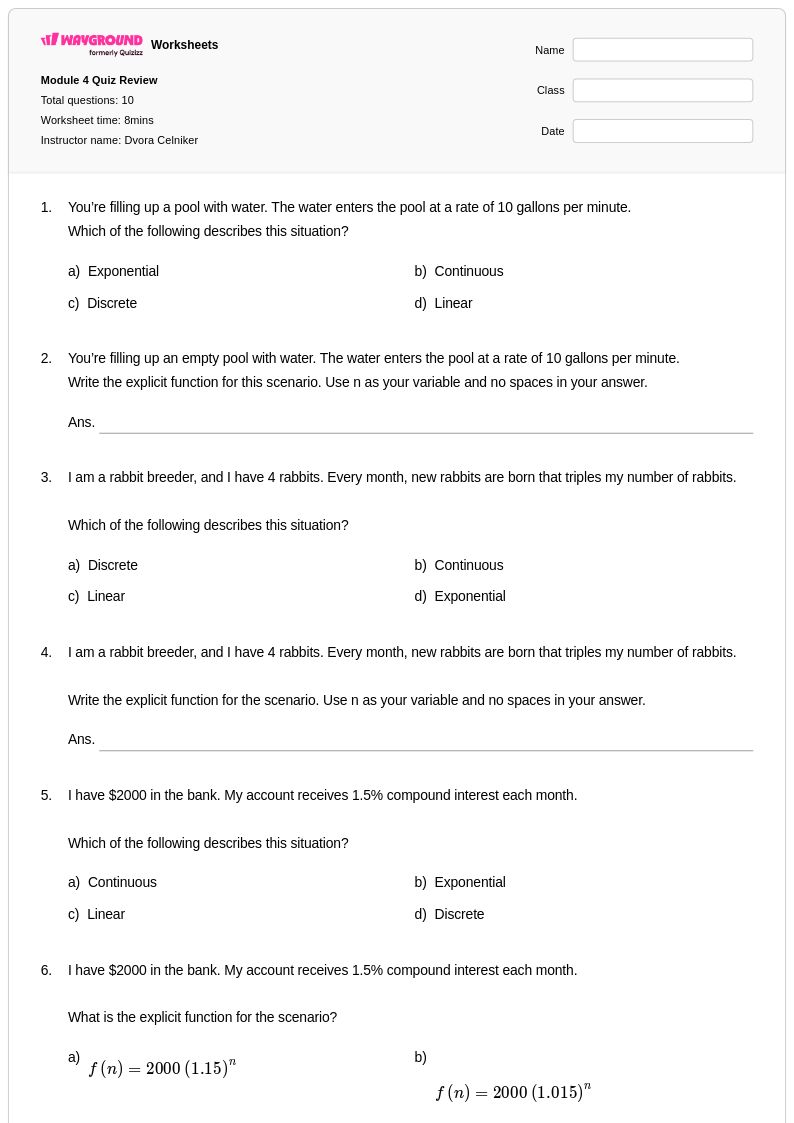

10 Q

9th - 12th

Explore Worksheets by Subjects

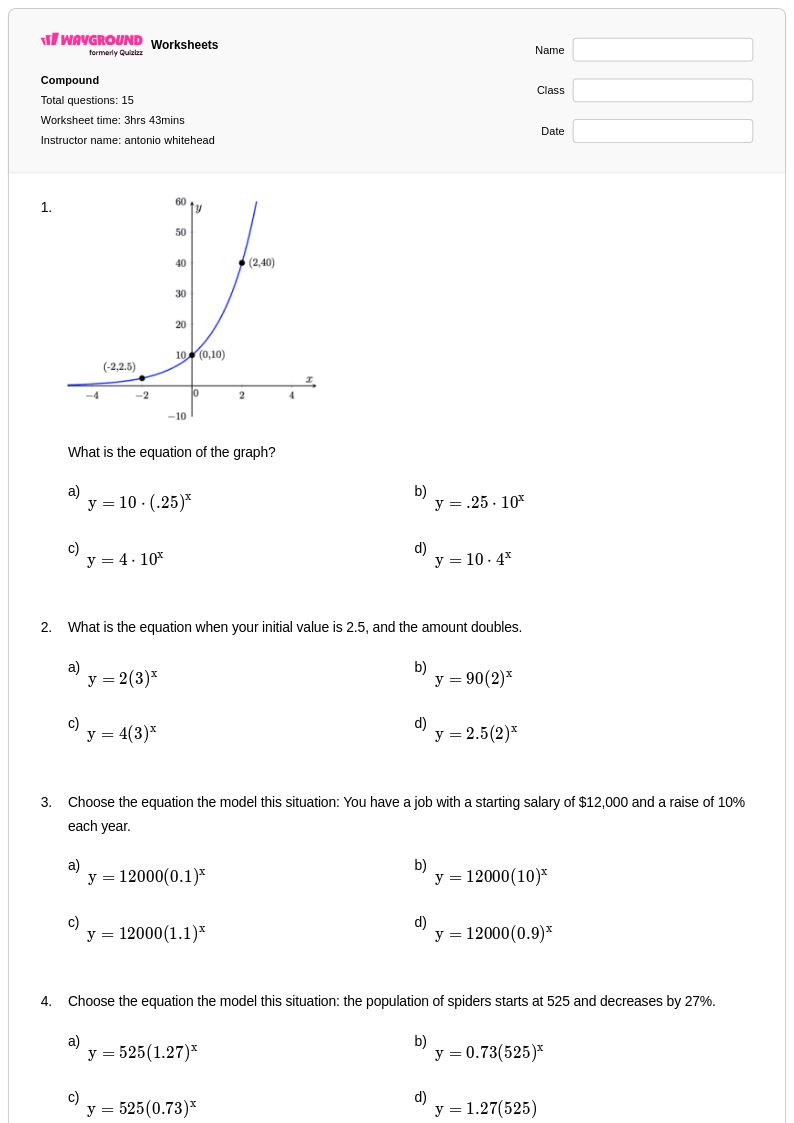

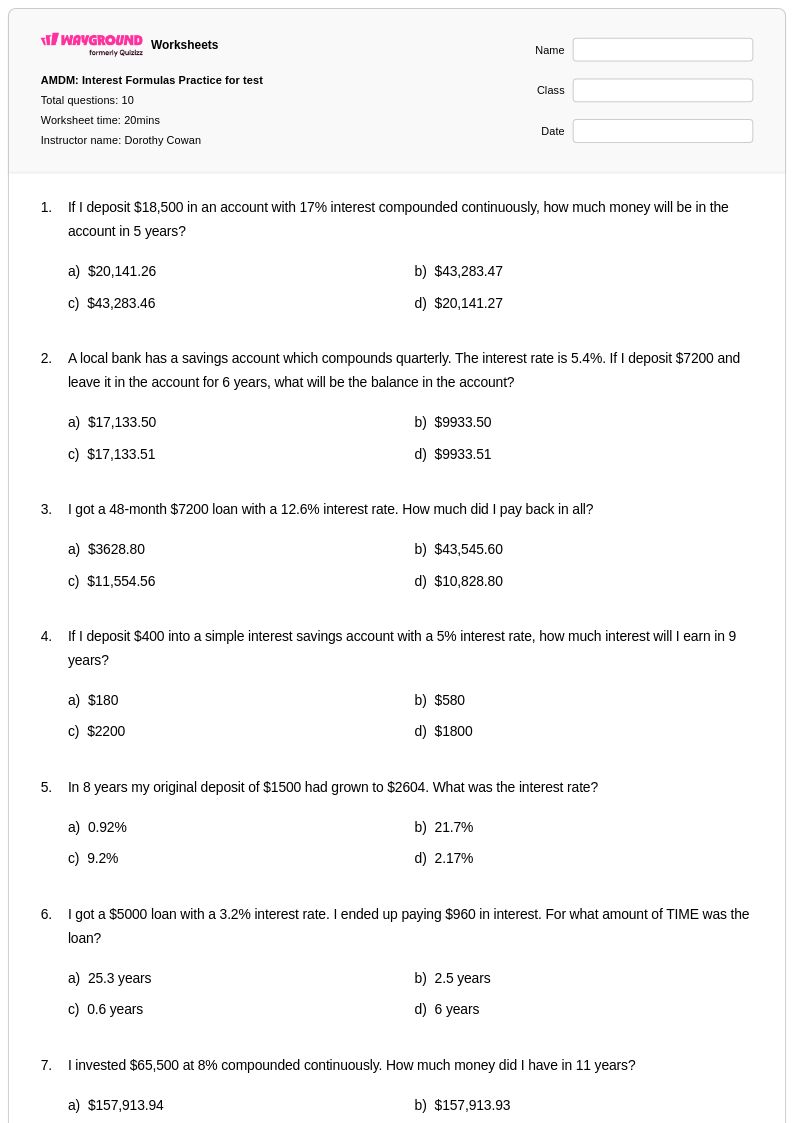

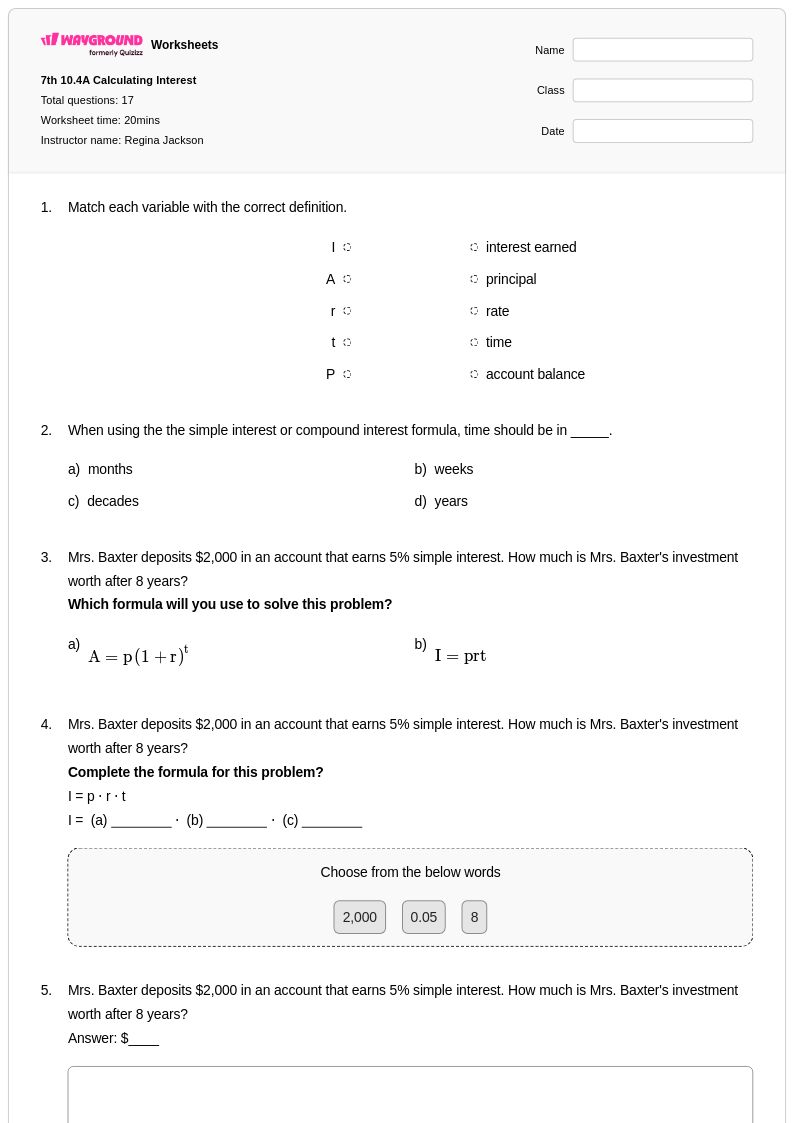

Explore printable Compound and Continuous Interest worksheets

Compound and continuous interest worksheets available through Wayground (formerly Quizizz) provide comprehensive practice opportunities for students to master these fundamental financial mathematics concepts. These expertly designed resources focus on developing critical skills in calculating compound interest using various compounding periods, understanding the mathematical relationship between nominal and effective interest rates, and applying continuous interest formulas in real-world scenarios. Students work through practice problems that reinforce exponential growth patterns, compare different investment strategies, and analyze the long-term impact of compounding frequency on financial outcomes. Each worksheet collection includes detailed answer keys and step-by-step solutions, with materials available as free printables and downloadable pdf resources that support both classroom instruction and independent study.

Wayground (formerly Quizizz) empowers educators with access to millions of teacher-created compound and continuous interest worksheet collections that streamline lesson planning and enhance mathematical instruction. The platform's robust search and filtering capabilities enable teachers to quickly locate resources aligned with specific curriculum standards, while built-in differentiation tools allow for seamless customization based on individual student needs and skill levels. These comprehensive worksheet libraries are available in both printable and digital formats, including convenient pdf downloads, making them ideal for targeted remediation sessions, enrichment activities, and regular skill practice. Teachers can efficiently modify existing materials or combine multiple resources to create cohesive learning experiences that address diverse learning styles and academic goals, ensuring students develop strong foundational understanding of compound and continuous interest calculations essential for financial literacy.