11Q

9th - 12th

19Q

8th

19Q

4th

17Q

8th

21Q

9th

24Q

4th

15Q

4th

10Q

12th

13Q

4th - Uni

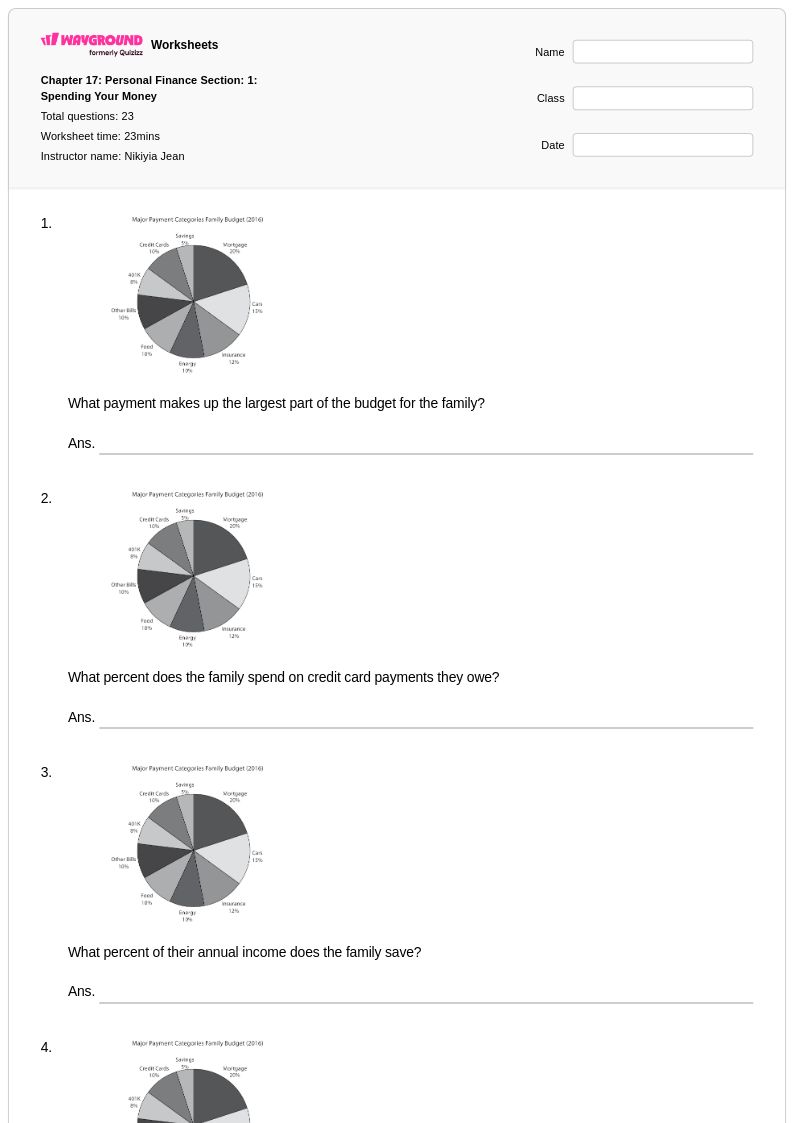

23Q

7th

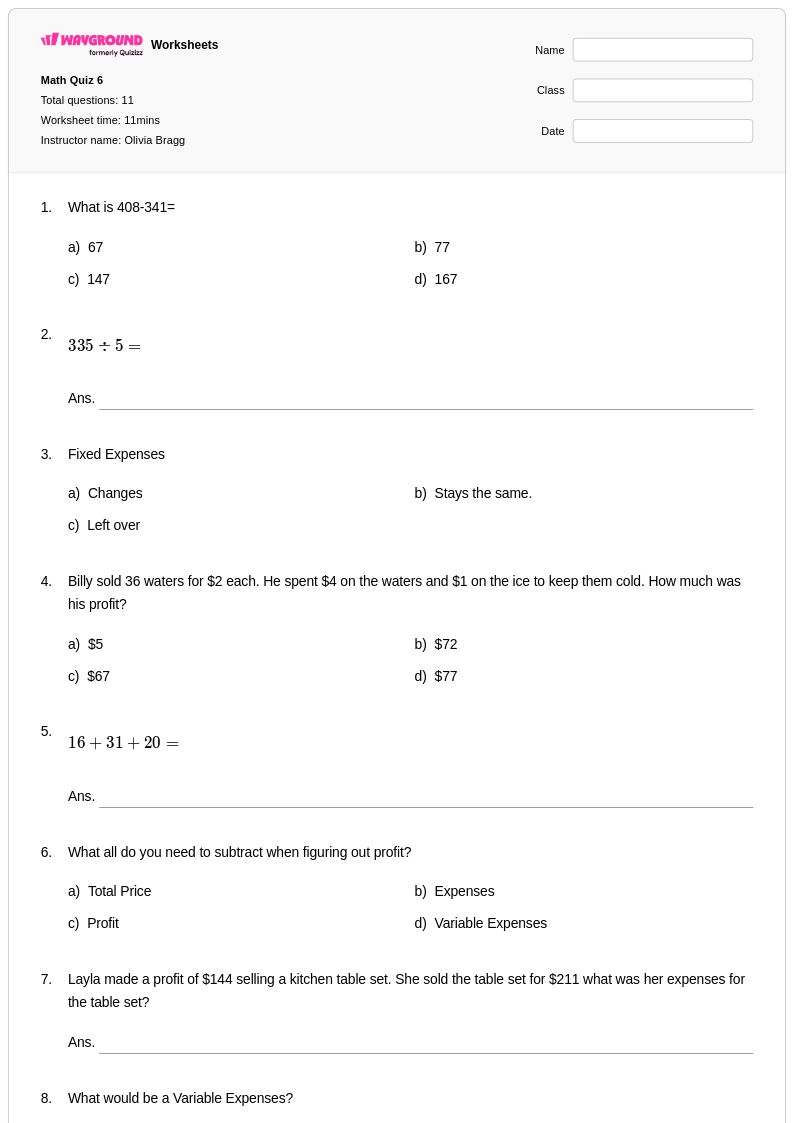

11Q

1st - 5th

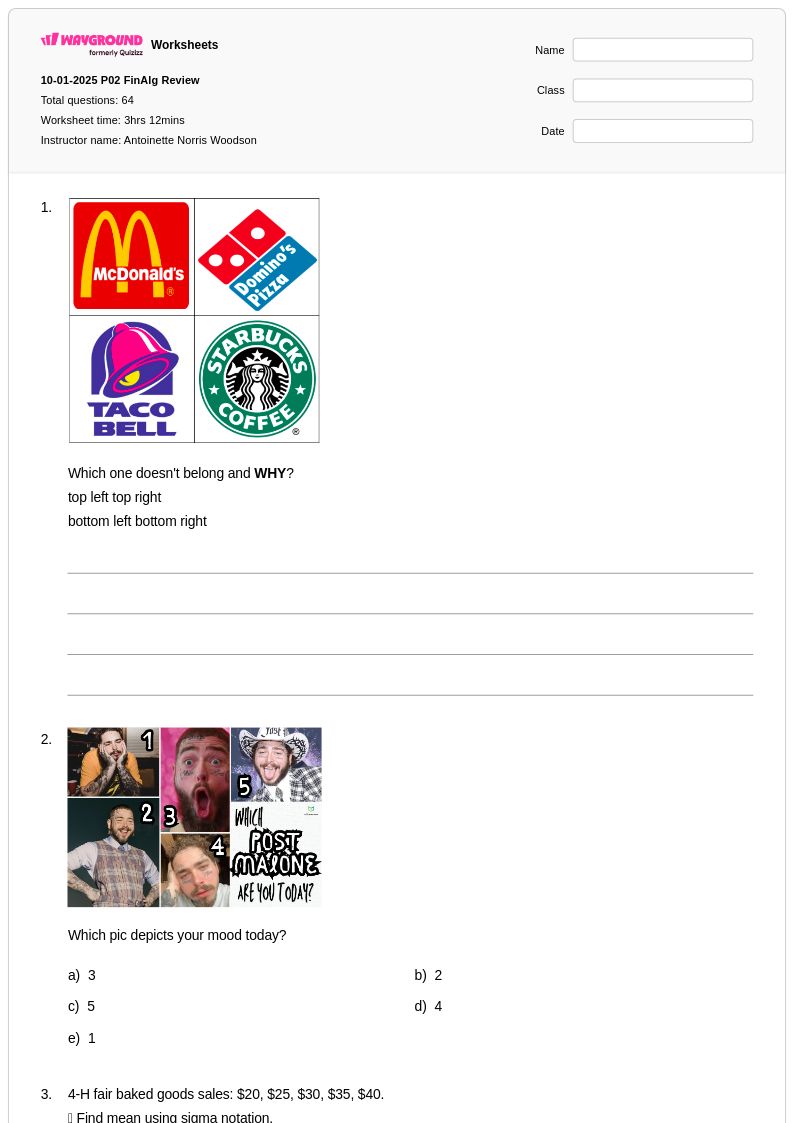

64Q

9th - 12th

14Q

12th

19Q

4th

9Q

5th

12Q

4th

20Q

12th

10Q

11th - 12th

13Q

4th

10Q

4th

7Q

4th

14Q

5th

12Q

4th

23Q

4th

Explore planilhas por assuntos

Explore printable Fixed and Variable Expenses worksheets

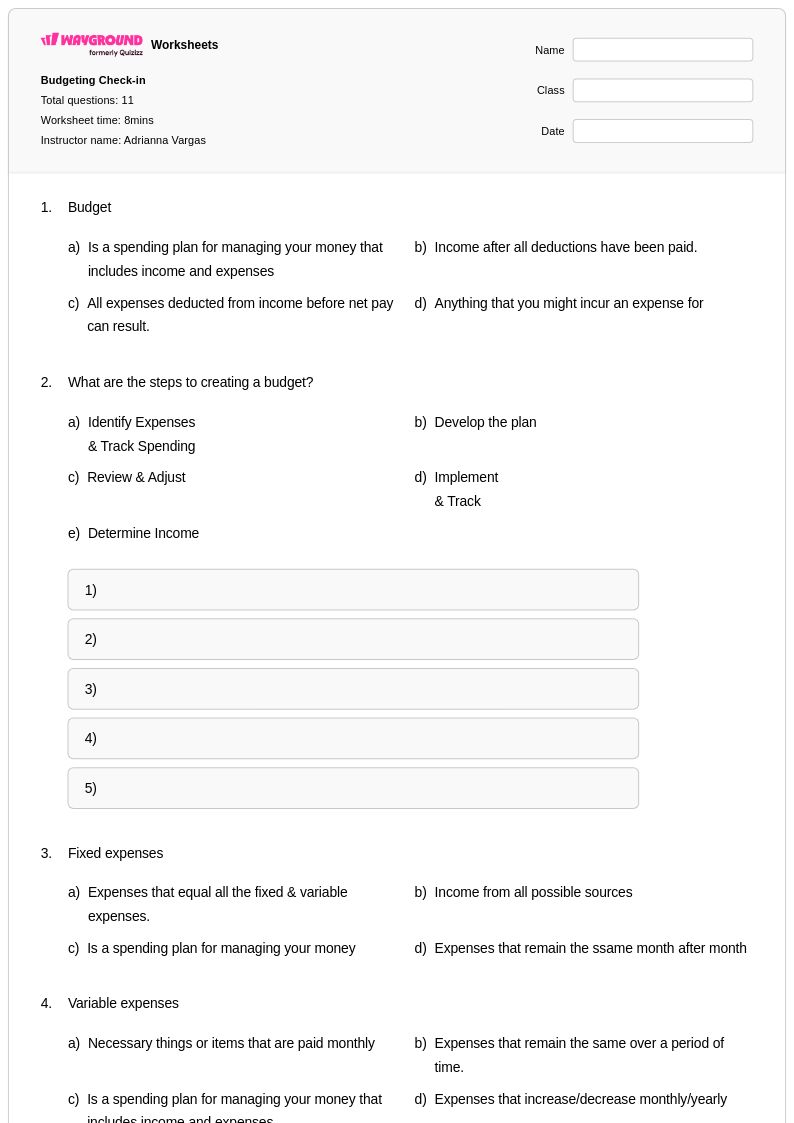

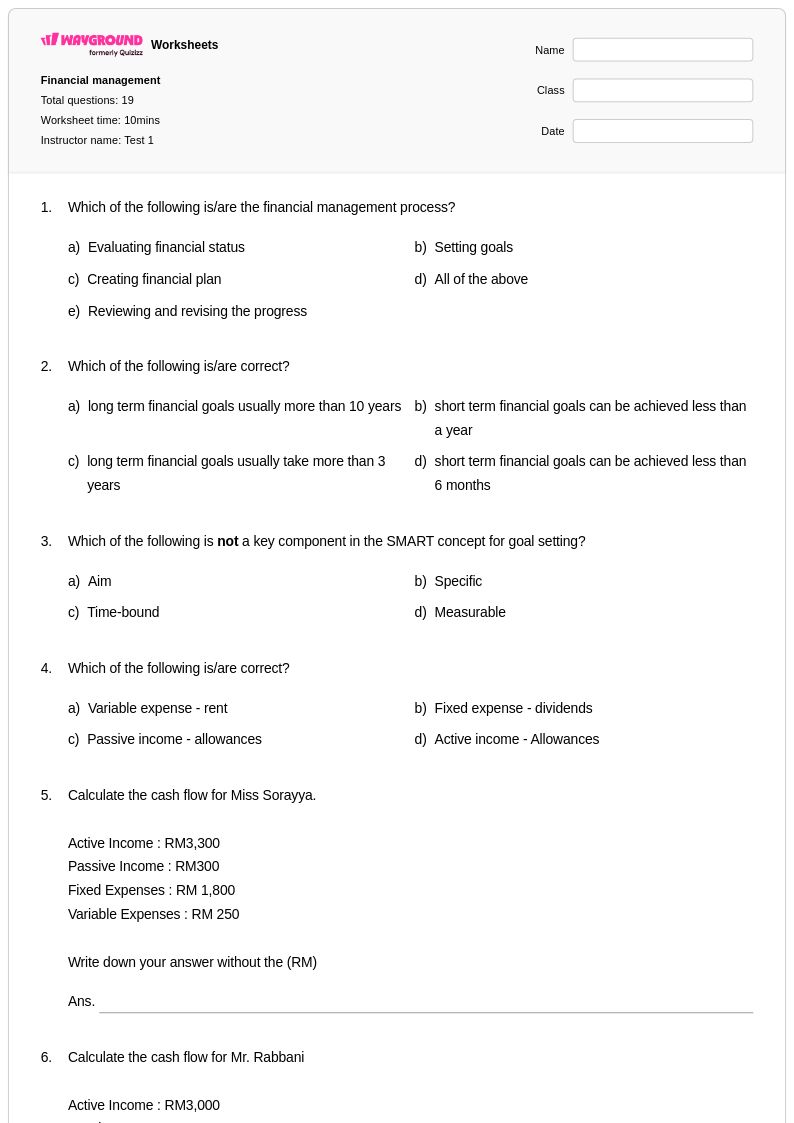

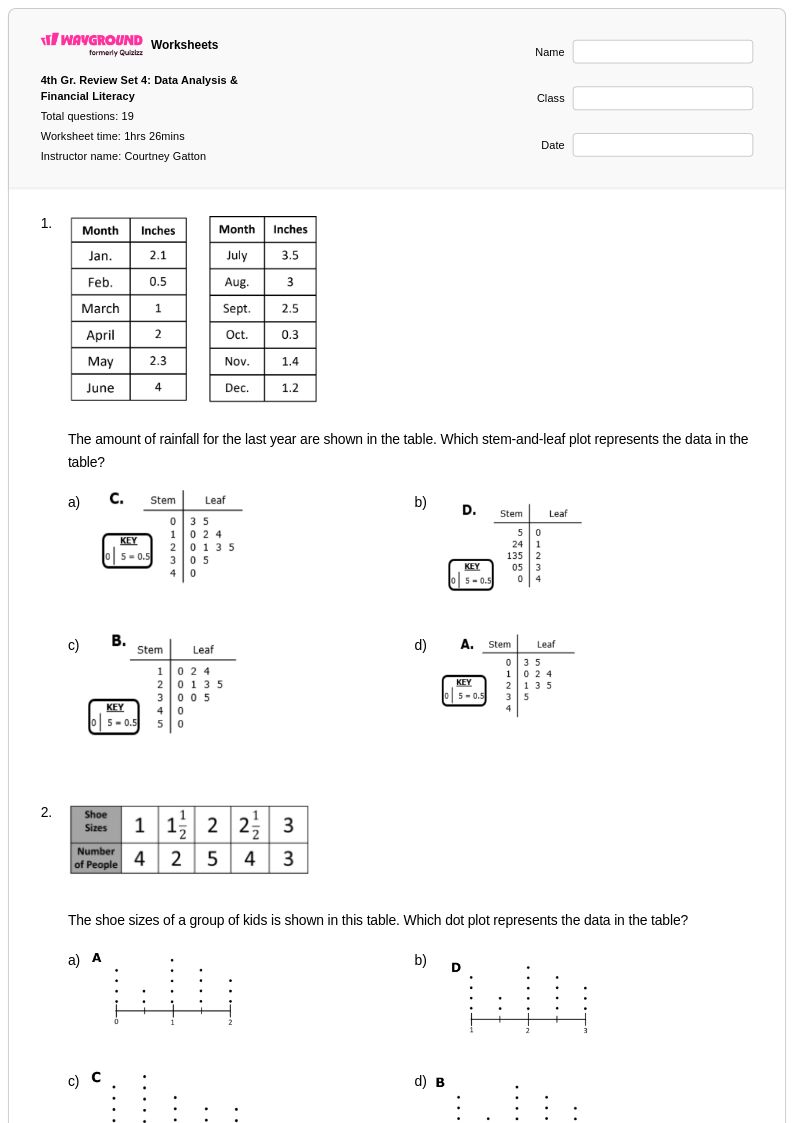

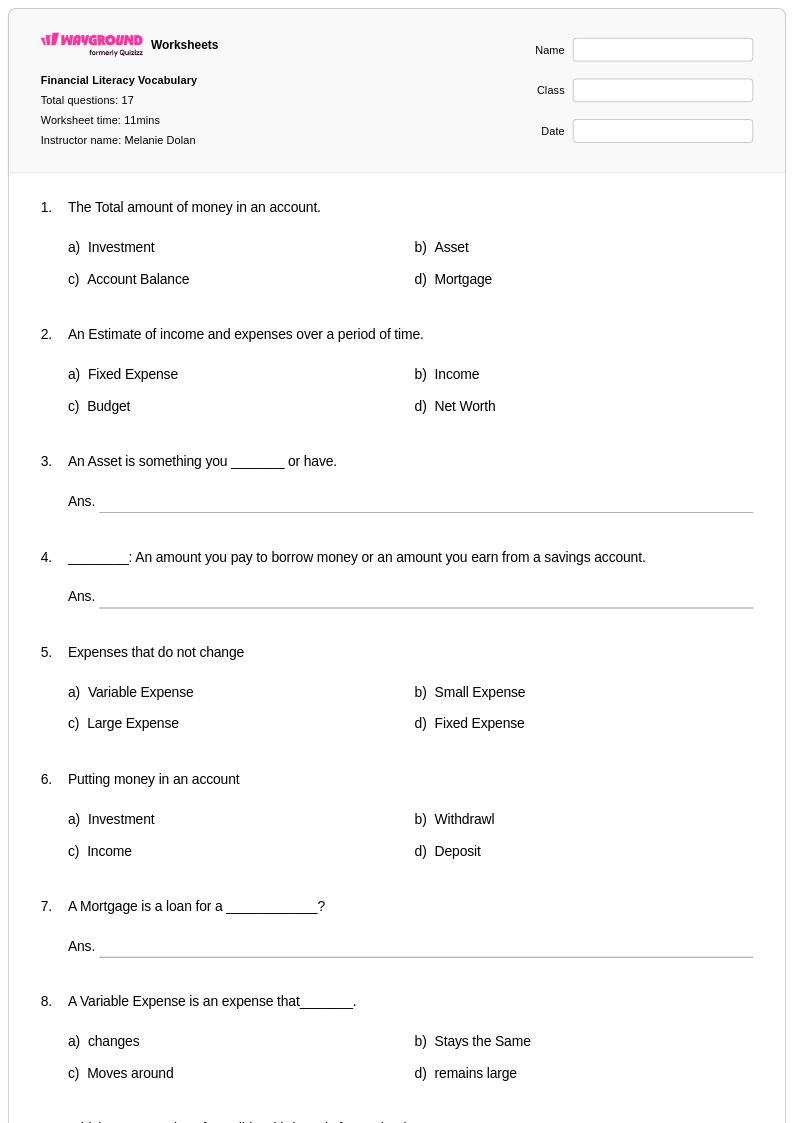

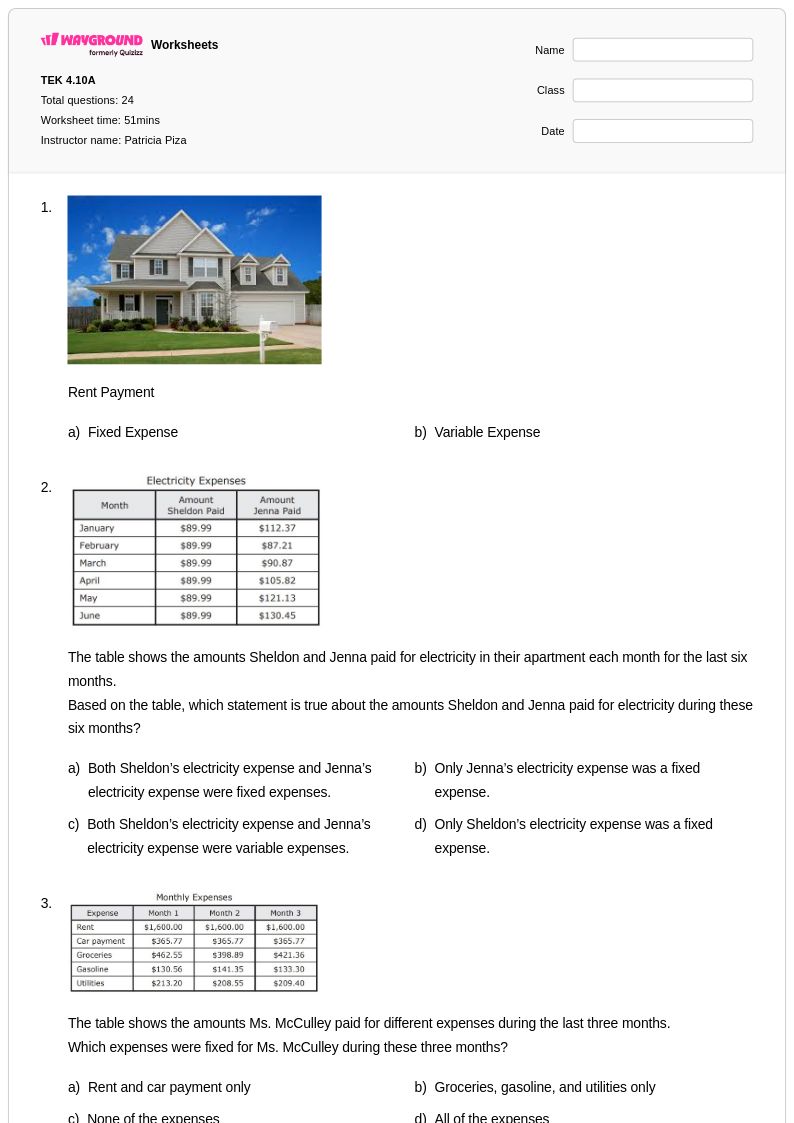

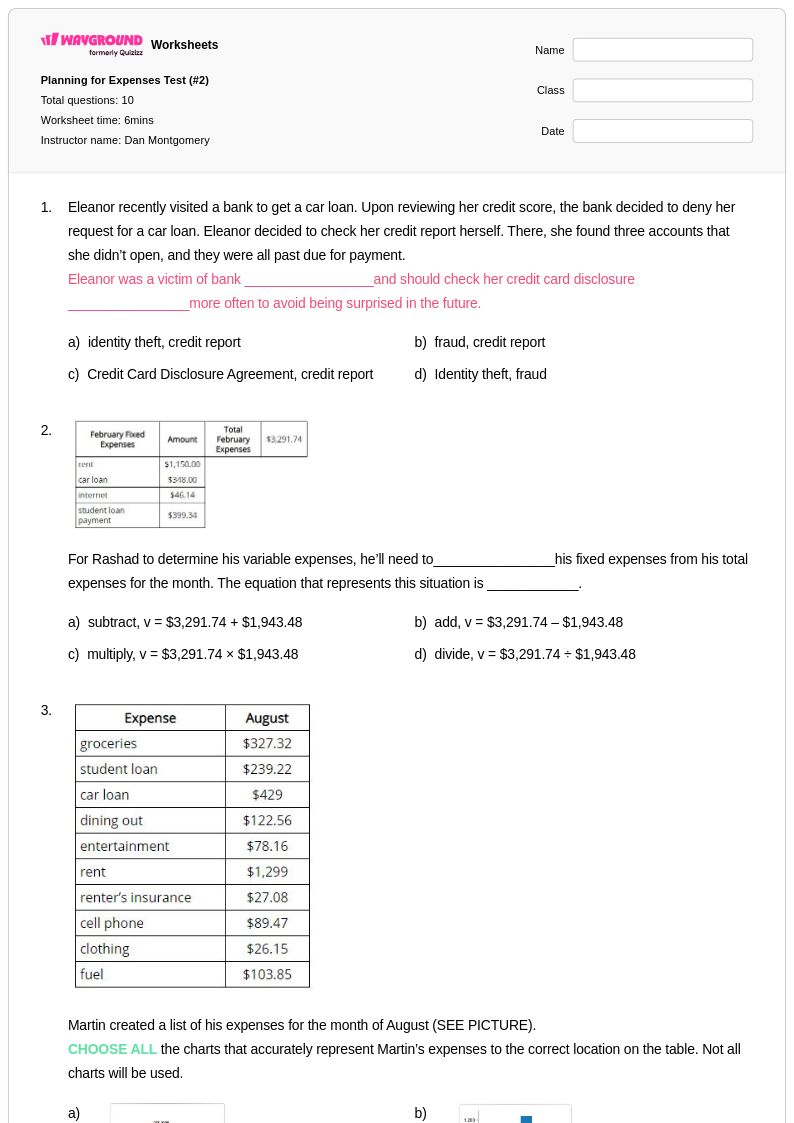

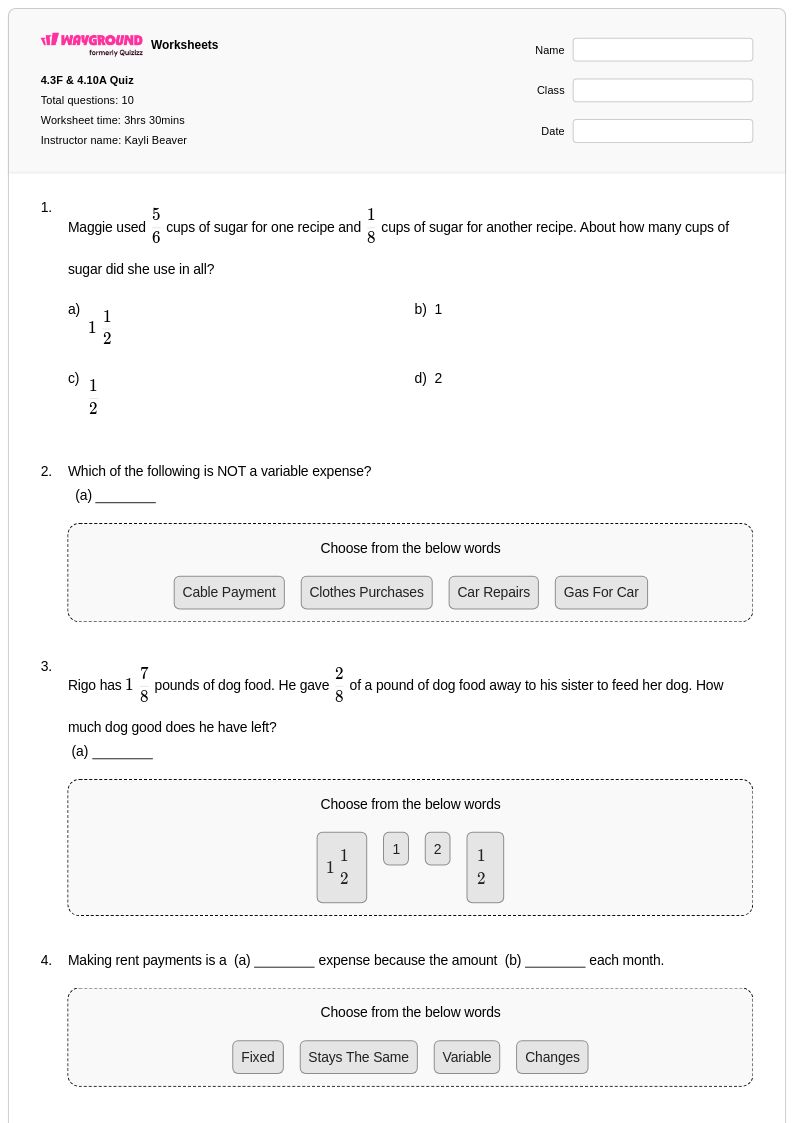

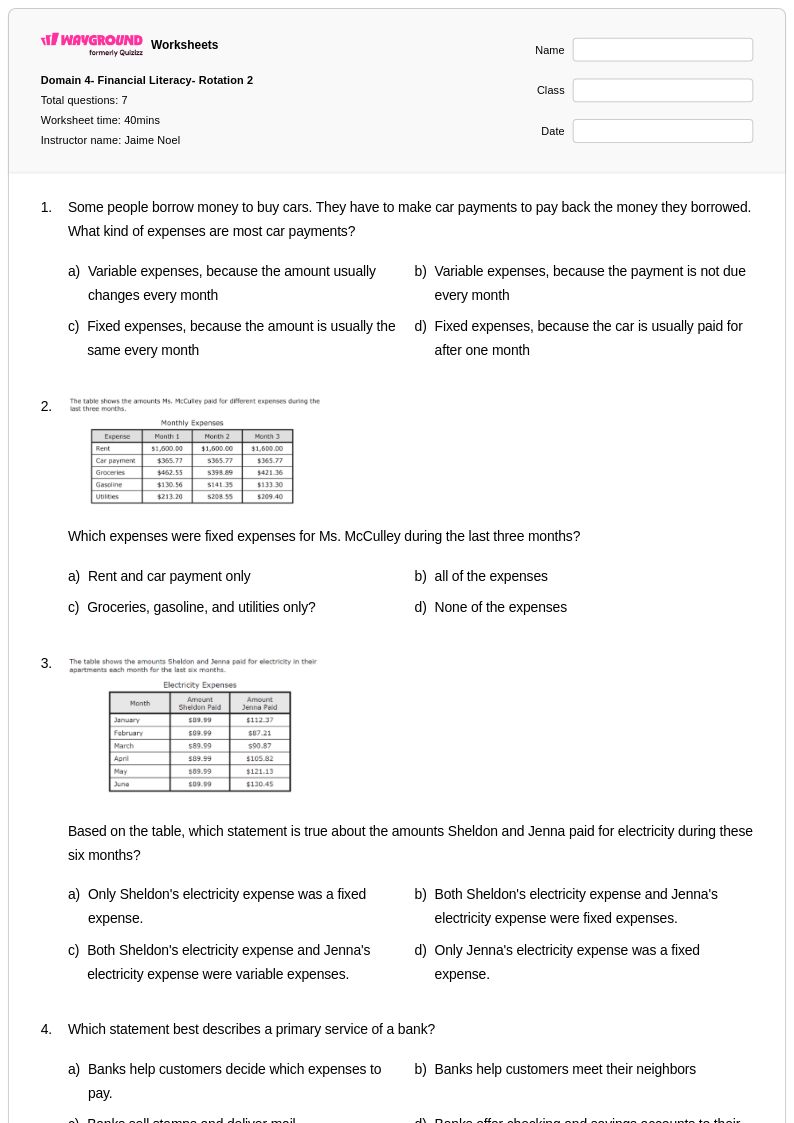

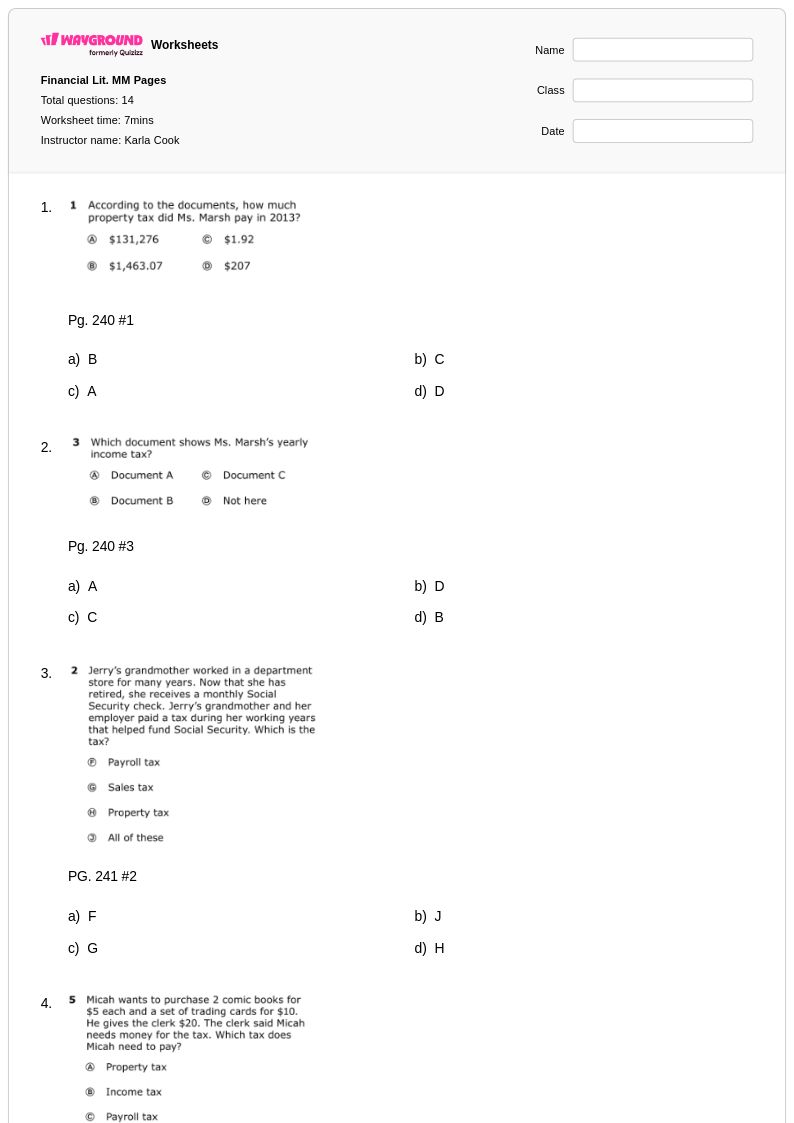

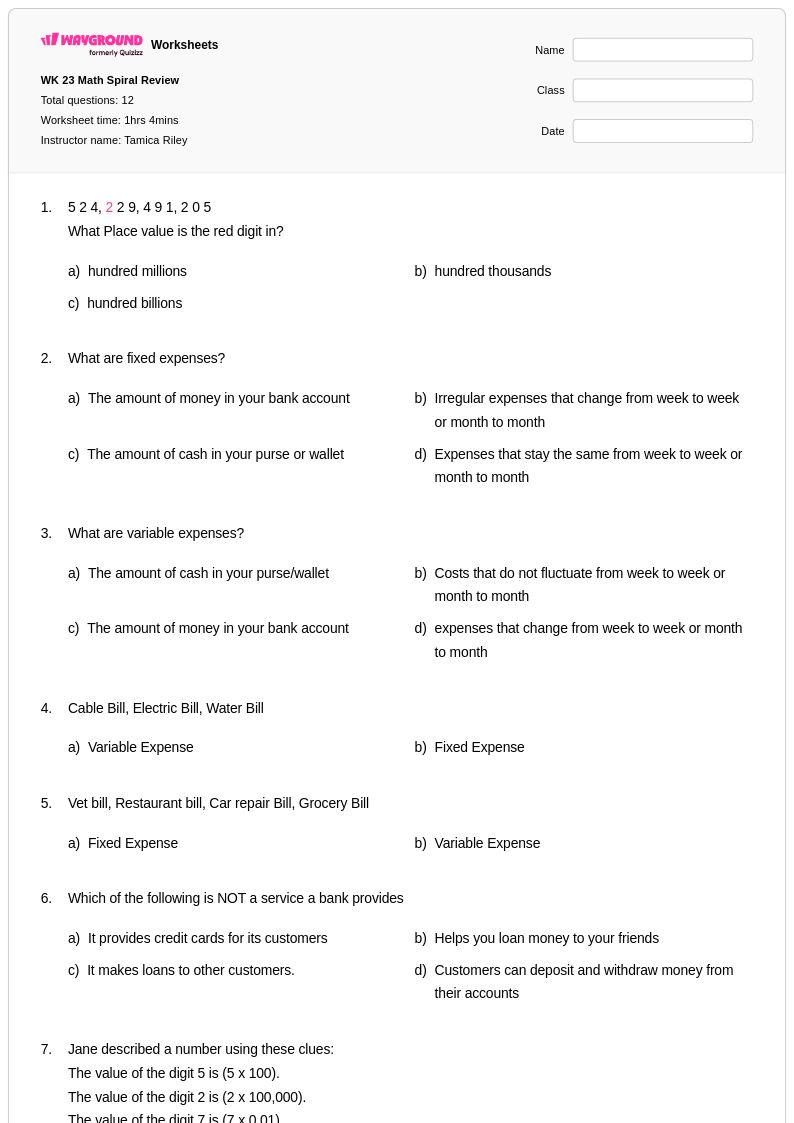

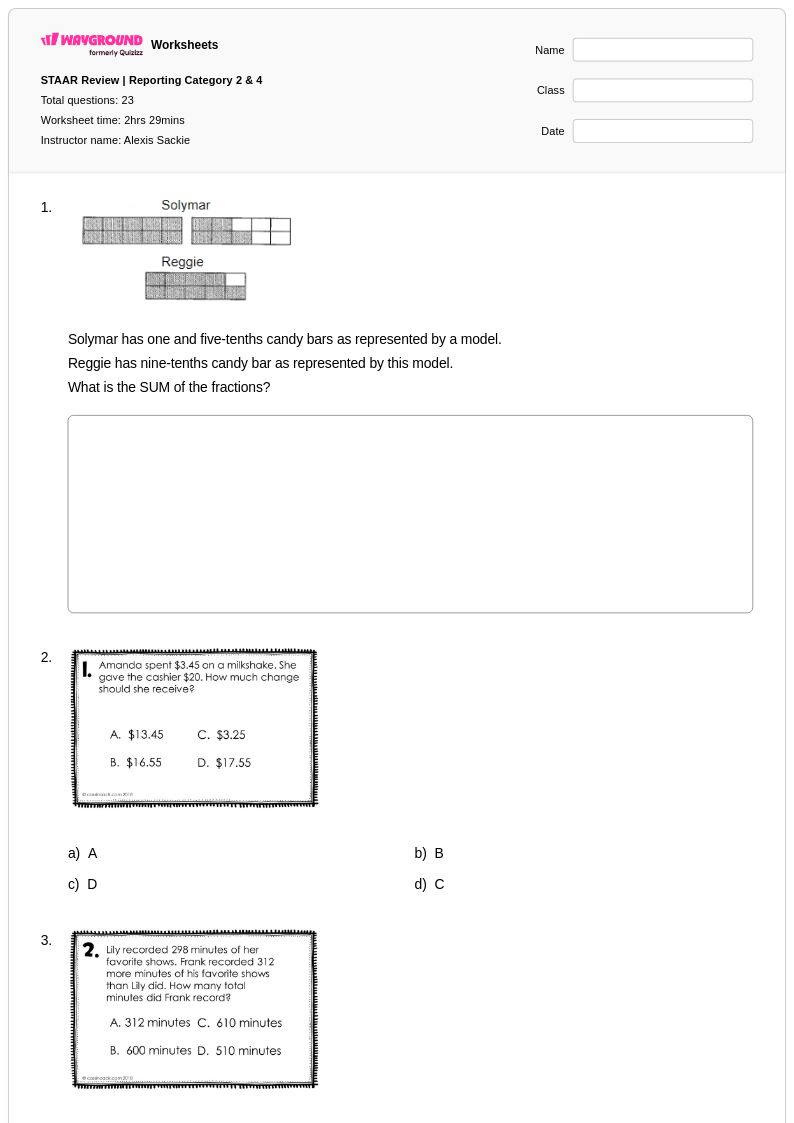

Fixed and variable expenses worksheets available through Wayground (formerly Quizizz) provide students with essential practice in distinguishing between consistent monthly costs and fluctuating expenditures that form the foundation of personal budgeting skills. These comprehensive worksheets strengthen critical financial literacy competencies by guiding learners through real-world scenarios involving rent, insurance, and loan payments as fixed expenses, while exploring variable costs like groceries, entertainment, and utility bills that change from month to month. Students develop analytical thinking as they categorize different types of expenses, calculate monthly budget allocations, and understand how both expense types impact overall financial planning. The practice problems included in these free printables challenge learners to create realistic budgets, analyze spending patterns, and make informed financial decisions, while accompanying answer keys enable self-assessment and reinforce correct categorization techniques through immediate feedback.

Wayground (formerly Quizizz) empowers educators with an extensive collection of teacher-created fixed and variable expenses resources drawn from millions of contributions that span diverse learning objectives and skill levels. The platform's robust search and filtering capabilities allow instructors to quickly locate worksheets that align with specific financial literacy standards and accommodate different student needs through built-in differentiation tools. Teachers can seamlessly customize existing materials or create original content that addresses their classroom's unique requirements, with all resources available in both printable pdf format for traditional instruction and digital formats for technology-integrated learning environments. This flexibility supports comprehensive lesson planning by providing targeted practice for skill development, focused remediation for students struggling with expense categorization concepts, and enrichment opportunities for advanced learners ready to explore complex budgeting scenarios and financial decision-making processes.