16 Q

9th - 12th

12 Q

9th - 12th

16 Q

9th - 12th

18 Q

8th - 12th

56 Q

9th - 12th

16 Q

9th - 12th

38 Q

9th

38 Q

9th

24 Q

9th - 12th

21 Q

9th

55 Q

9th - 12th

17 Q

9th

10 Q

9th

20 Q

9th

20 Q

9th - 12th

25 Q

8th - Uni

34 Q

9th - 12th

5 Q

9th - 12th

10 Q

9th

30 Q

9th - 12th

30 Q

7th - 12th

21 Q

9th - 10th

18 Q

9th - 12th

Explore Other Subject Worksheets for class 9

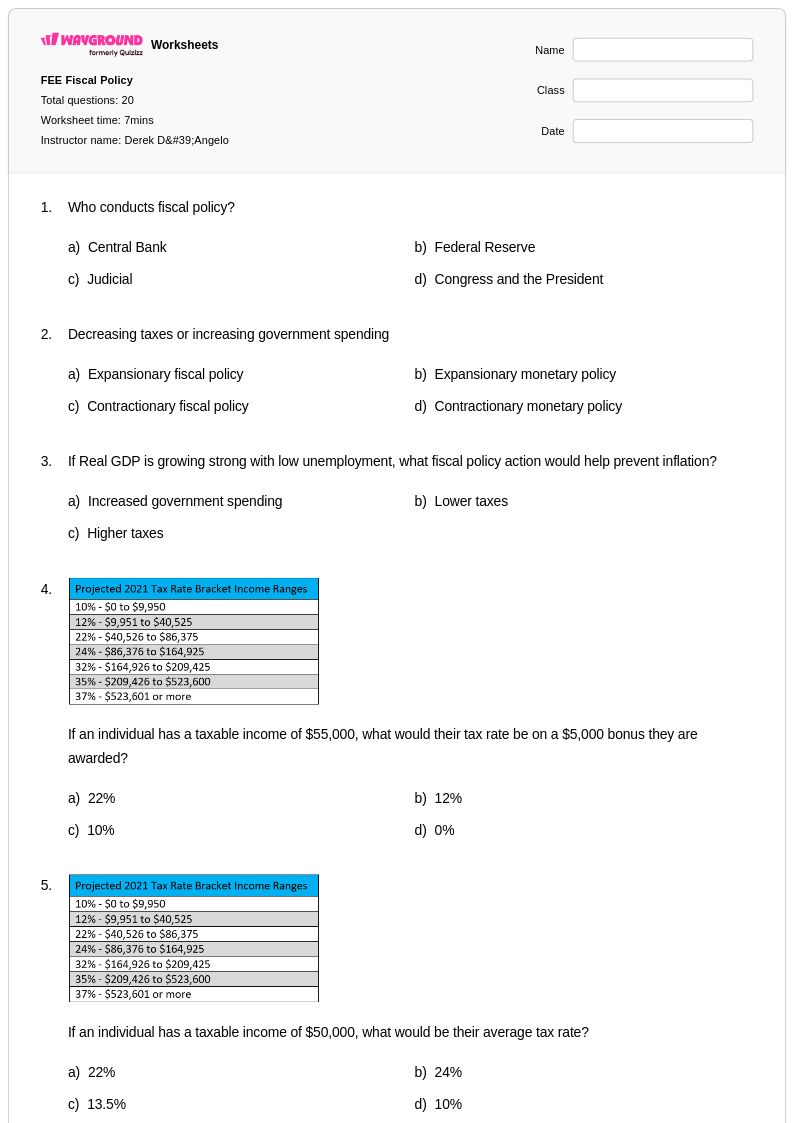

Explore printable Taxable Income worksheets for Class 9

Class 9 taxable income worksheets available through Wayground (formerly Quizizz) provide comprehensive practice for students learning to calculate and understand various forms of taxable income in economics coursework. These educational resources strengthen critical financial literacy skills by guiding students through the complexities of identifying taxable versus non-taxable income sources, calculating gross and adjusted gross income, and understanding deductions and exemptions. The practice problems within these worksheets systematically build students' ability to work with tax brackets, withholdings, and basic tax preparation concepts that form the foundation of personal financial management. Each free worksheet includes detailed answer keys that enable students to verify their calculations and understand the reasoning behind tax computations, while printable pdf formats ensure easy distribution and completion both in classroom settings and for homework assignments.

Wayground (formerly Quizizz) supports educators with an extensive collection of teacher-created taxable income worksheet resources, drawing from millions of high-quality materials developed by experienced social studies and economics instructors. The platform's robust search and filtering capabilities allow teachers to quickly locate worksheets that align with specific curriculum standards and match their students' skill levels, while differentiation tools enable customization of difficulty levels to meet diverse learning needs. These versatile resources are available in both printable and digital formats, including downloadable pdf versions, giving teachers the flexibility to adapt materials for various instructional approaches. The comprehensive worksheet collections facilitate targeted skill practice, support remediation for struggling learners, provide enrichment opportunities for advanced students, and streamline lesson planning by offering ready-to-use materials that can be seamlessly integrated into existing economics curriculum frameworks.